FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

REPORT OF

FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of November, 2015

Commission File Number: 0-30852

GRUPO

FINANCIERO GALICIA S.A.

(the “Registrant”)

Galicia Financial Group S.A.

(translation of Registrant’s name into English)

Tte. Gral. Juan D. Perón 430, 25th Floor

(CP1038AAJ) Buenos Aires, Argentina

(address of principal executive offices)

Indicate by check mark whether

the Registrant files or will file annual reports under cover of Form 20-F ¨ or Form 40-F ¨.

Form

20-F x Form

40-F ¨

Indicate by

check mark whether by furnishing the information contained in this form, the Registrant is also thereby furnishing the information to the Securities and Exchange Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ¨

No x

If “Yes” is marked, indicate below the file number assigned

to the Registrant in connection with Rule 12g3-2(b): 82-

FORM 6-K

Commission File No. 0-30852

|

|

|

|

|

| Month Filed |

|

Event and Summary |

|

Exhibit

No. |

|

|

|

| November, 2015 |

|

Financial results of the Registrant for the third quarter ended September 30, 2015. |

|

99.1 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

GRUPO FINANCIERO GALICIA S.A.

(Registrant) |

|

|

|

| Date: November 10, 2015 |

|

By: |

|

/s/ Pedro Alberto Richards |

|

|

Name: |

|

Pedro Alberto Richards |

|

|

Title: |

|

Chief Executive Officer |

Exhibit 99.1

FOR IMMEDIATE RELEASE

For more information contact:

Pedro A. Richards

Chief Executive Officer

Telefax: (5411) 4343-7528

investors@gfgsa.com

www.gfgsa.com

GRUPO FINANCIERO GALICIA S.A. REPORTS FINANCIAL RESULTS FOR THE

QUARTER ENDED ON SEPTEMBER 30, 2015

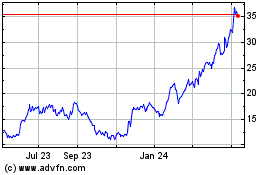

Buenos Aires, Argentina, November 10, 2015 - Grupo Financiero Galicia S.A. (“Grupo Financiero Galicia”; Buenos Aires Stock Exchange: GGAL

/NASDAQ: GGAL) announced its financial results for the quarter ended on September 30, 2015.

HIGHLIGHTS

| |

• |

|

Net income for the quarter ended September 30, 2015, amounted to Ps.1,187 million, a 27.5% increase from the Ps.931 million profit recorded in the third quarter of fiscal year 2014. The profit per share for the

quarter amounted to Ps.0.91, compared to Ps.0.72 per share for the same quarter of fiscal year 2014. |

| |

• |

|

The result of the quarter was mainly attributable to the income derived from the interest in Banco de Galicia y Buenos Aires S.A. (“Banco Galicia” or the “Bank”) (Ps.1,107 million), in Sudamericana

Holding S.A., (Ps.80 million), and in Galicia Administradora de Fondos S.A. (Ps.27 million), and partially offset by administrative and financial expenses (Ps.37 million). |

| |

• |

|

As of September 30, 2015, Grupo Financiero Galicia and its subsidiaries had a staff of 12,153 employees, had a network of 651 branches and other points of contact with clients, and managed 3.4 million deposit

accounts and 13.1 million credit cards. |

CONFERENCE CALL

On Tuesday, November 10, 2015 at 11:00 A.M.

Eastern Standard Time (01:00 PM Buenos Aires Time), GFG will host a conference call to review these results. The call-in number is: 719-457-2697 – Conference ID: 4111022.

GRUPO FINANCIERO GALICIA S.A.

RESULTS FOR THE THIRD QUARTER

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

In millions of pesos, except percentages |

|

| Table I: |

|

FY2015 |

|

|

FY2014 |

|

|

Variation (%) |

|

| Net Income by Business |

|

3rd Q |

|

|

2nd Q |

|

|

3rd Q |

|

|

3Q15 vs

2Q15 |

|

|

3Q15 vs

3Q14 |

|

| Income from Equity Investments in: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Banco de Galicia y Buenos Aires S.A. |

|

|

1,107 |

|

|

|

878 |

|

|

|

877 |

|

|

|

26.1 |

|

|

|

26.2 |

|

| Sudamericana Holding S.A. |

|

|

80 |

|

|

|

67 |

|

|

|

52 |

|

|

|

19.4 |

|

|

|

53.8 |

|

| Galicia Administradora de Fondos S.A. |

|

|

27 |

|

|

|

23 |

|

|

|

13 |

|

|

|

17.4 |

|

|

|

107.7 |

|

| Other companies (1) |

|

|

17 |

|

|

|

6 |

|

|

|

5 |

|

|

|

183.3 |

|

|

|

240.0 |

|

| Deferred tax adjustment (2) |

|

|

(4 |

) |

|

|

8 |

|

|

|

14 |

|

|

|

(150.0 |

) |

|

|

(128.6 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Administrative Expenses |

|

|

(10 |

) |

|

|

(7 |

) |

|

|

(6 |

) |

|

|

42.9 |

|

|

|

66.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Financial Results |

|

|

(27 |

) |

|

|

(23 |

) |

|

|

(22 |

) |

|

|

17.4 |

|

|

|

22.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income and expenses |

|

|

(3 |

) |

|

|

(3 |

) |

|

|

(2 |

) |

|

|

— |

|

|

|

50.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income |

|

|

1,187 |

|

|

|

949 |

|

|

|

931 |

|

|

|

25.1 |

|

|

|

27.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) |

Includes the results from our interests in Compañía Financiera Argentina S.A. (3%), Galicia Warrants S.A. (87.5%) and Net Investment S.A. (87.5%). |

| (2) |

Income tax charge determined by Banco Galicia´s subsidiaries in accordance with the deferred tax method. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

In pesos, except stated otherwise and percentages |

|

| Table II: |

|

FY2015 |

|

|

FY2014 |

|

|

Nine Months Ended |

|

| Principal Indicators |

|

3rd Q |

|

|

3rd Q |

|

|

09/30/15 |

|

|

09/30/14 |

|

| Earnings per Share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average Shares Outstanding (in thousands) |

|

|

1,300,265 |

|

|

|

1,300,265 |

|

|

|

1,300,265 |

|

|

|

1,300,265 |

|

| Earnings per Share (1) |

|

|

0.91 |

|

|

|

0.72 |

|

|

|

2.38 |

|

|

|

1.89 |

|

| Book Value per Share(1) |

|

|

10.18 |

|

|

|

7.20 |

|

|

|

10.18 |

|

|

|

7.20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

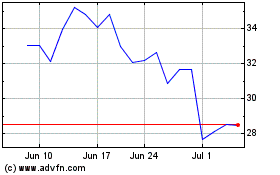

| Closing Price |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Shares - Buenos Aires Stock Exchange |

|

|

24.85 |

|

|

|

21.00 |

|

|

|

|

|

|

|

|

|

| ADS - Nasdaq (in dollars) |

|

|

17.82 |

|

|

|

14.21 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Price/Book Value |

|

|

2.44 |

|

|

|

2.92 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average Daily Volume (amounts in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Buenos Aires Stock Exchange |

|

|

713 |

|

|

|

1,401 |

|

|

|

767 |

|

|

|

1,306 |

|

| Nasdaq (2) |

|

|

3,848 |

|

|

|

7,343 |

|

|

|

4,324 |

|

|

|

5,969 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Profitability (%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Return on Average Assets (3) |

|

|

4.12 |

|

|

|

4.25 |

|

|

|

3.82 |

|

|

|

3.88 |

|

| Return on Average Shareholders’ Equity (3) |

|

|

37.61 |

|

|

|

41.78 |

|

|

|

35.34 |

|

|

|

40.19 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) |

10 ordinary shares = 1 ADS. |

| (2) |

Expressed in equivalent shares. |

In the third quarter of fiscal year 2015 Grupo Financiero Galicia recorded a Ps.1,187

million profit, which represented a 4.12% annualized return on average assets and a 37.61% return on average shareholder’s equity.

This result was

mainly due to profits from its interest in Banco Galicia (Ps.1,107 million) which accounts for 93.3% of Grupo Financiero Galicia’s net income.

|

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Grupo Financiero Galicia S.A. – Selected Financial Information – Consolidated Data |

|

In millions of pesos |

|

| |

|

FY2015 |

|

|

FY2014 |

|

| |

|

3rd Q |

|

|

2nd Q |

|

|

1st Q |

|

|

4th Q |

|

|

3rd Q |

|

| Consolidated Balance Sheet |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and due from Banks |

|

|

17,472 |

|

|

|

10,876 |

|

|

|

11,590 |

|

|

|

16,959 |

|

|

|

14,478 |

|

| Government and Corporate Securities |

|

|

17,064 |

|

|

|

19,661 |

|

|

|

15,128 |

|

|

|

10,010 |

|

|

|

10,974 |

|

| Net Loans |

|

|

82,838 |

|

|

|

79,663 |

|

|

|

72,139 |

|

|

|

66,608 |

|

|

|

61,579 |

|

| Other Receivables Resulting from Financial Brokerage |

|

|

10,834 |

|

|

|

13,987 |

|

|

|

9,802 |

|

|

|

6,798 |

|

|

|

6,970 |

|

| Equity Investments in other Companies |

|

|

52 |

|

|

|

51 |

|

|

|

52 |

|

|

|

52 |

|

|

|

51 |

|

| Bank Premises and Equipment. Miscellaneous and Intangible Assets |

|

|

4,727 |

|

|

|

4,069 |

|

|

|

3,904 |

|

|

|

3,759 |

|

|

|

3,464 |

|

| Other Assets |

|

|

3,555 |

|

|

|

3,676 |

|

|

|

3,698 |

|

|

|

3,128 |

|

|

|

3,129 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Assets |

|

|

136,542 |

|

|

|

131,983 |

|

|

|

116,313 |

|

|

|

107,314 |

|

|

|

100,645 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Deposits |

|

|

82,421 |

|

|

|

77,242 |

|

|

|

68,600 |

|

|

|

64,666 |

|

|

|

59,931 |

|

| Other Liabilities Resulting from Financial Brokerage |

|

|

32,672 |

|

|

|

35,153 |

|

|

|

28,899 |

|

|

|

25,401 |

|

|

|

24,650 |

|

| Subordinated Notes |

|

|

2,302 |

|

|

|

2,250 |

|

|

|

2,103 |

|

|

|

2,066 |

|

|

|

1,969 |

|

| Other Liabilities |

|

|

4,915 |

|

|

|

4,394 |

|

|

|

4,643 |

|

|

|

4,154 |

|

|

|

4,002 |

|

| Minority Interest |

|

|

992 |

|

|

|

891 |

|

|

|

863 |

|

|

|

781 |

|

|

|

729 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Liabilities |

|

|

123,302 |

|

|

|

119,930 |

|

|

|

105,108 |

|

|

|

97,068 |

|

|

|

91,281 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Shareholders’ Equity |

|

|

13,240 |

|

|

|

12,053 |

|

|

|

11,205 |

|

|

|

10,246 |

|

|

|

9,364 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consolidated Income Statement |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Financial Income |

|

|

6,446 |

|

|

|

5,820 |

|

|

|

5,569 |

|

|

|

4,976 |

|

|

|

4,884 |

|

| Financial Expenses |

|

|

(3,343 |

) |

|

|

(3,171 |

) |

|

|

(2,796 |

) |

|

|

(2,763 |

) |

|

|

(2,344 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross Brokerage Margin |

|

|

3,103 |

|

|

|

2,649 |

|

|

|

2,773 |

|

|

|

2,213 |

|

|

|

2,540 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Provisions for Loan Losses |

|

|

(448 |

) |

|

|

(484 |

) |

|

|

(591 |

) |

|

|

(517 |

) |

|

|

(646 |

) |

| Income from Services. Net |

|

|

2,036 |

|

|

|

1,851 |

|

|

|

1,780 |

|

|

|

1,600 |

|

|

|

1,575 |

|

| Income from Insurance Activities |

|

|

447 |

|

|

|

429 |

|

|

|

392 |

|

|

|

369 |

|

|

|

302 |

|

| Administrative Expenses |

|

|

(3,317 |

) |

|

|

(3,079 |

) |

|

|

(2,768 |

) |

|

|

(2,522 |

) |

|

|

(2,356 |

) |

| Minority Interest |

|

|

(101 |

) |

|

|

(66 |

) |

|

|

(82 |

) |

|

|

(77 |

) |

|

|

(70 |

) |

| Income from Equity Investments |

|

|

47 |

|

|

|

26 |

|

|

|

26 |

|

|

|

50 |

|

|

|

112 |

|

| Net Other Income |

|

|

156 |

|

|

|

166 |

|

|

|

94 |

|

|

|

176 |

|

|

|

95 |

|

| Income Tax |

|

|

(736 |

) |

|

|

(543 |

) |

|

|

(666 |

) |

|

|

(409 |

) |

|

|

(621 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income |

|

|

1,187 |

|

|

|

949 |

|

|

|

958 |

|

|

|

883 |

|

|

|

931 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Grupo Financiero Galicia S.A. – Additional Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

FY2015 |

|

|

FY2014 |

|

| |

|

3rd Q |

|

|

2nd Q |

|

|

1st Q |

|

|

4th Q |

|

|

3rd Q |

|

| Physical Data (Number of) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Employees |

|

|

12,153 |

|

|

|

12,048 |

|

|

|

12,080 |

|

|

|

12,012 |

|

|

|

11,971 |

|

| Banco Galicia |

|

|

5,522 |

|

|

|

5,479 |

|

|

|

5,485 |

|

|

|

5,374 |

|

|

|

5,317 |

|

| Regional Credit-Card Companies |

|

|

5,072 |

|

|

|

5,098 |

|

|

|

5,174 |

|

|

|

5,232 |

|

|

|

5,346 |

|

| Compañía Financiera Argentina |

|

|

1,205 |

|

|

|

1,147 |

|

|

|

1,119 |

|

|

|

1,112 |

|

|

|

1,026 |

|

| Sudamericana Holding |

|

|

303 |

|

|

|

273 |

|

|

|

252 |

|

|

|

242 |

|

|

|

229 |

|

| Galicia Administradora de Fondos |

|

|

17 |

|

|

|

17 |

|

|

|

16 |

|

|

|

16 |

|

|

|

16 |

|

| Other companies |

|

|

34 |

|

|

|

34 |

|

|

|

34 |

|

|

|

36 |

|

|

|

37 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Branches |

|

|

525 |

|

|

|

525 |

|

|

|

528 |

|

|

|

527 |

|

|

|

526 |

|

| Bank Branches |

|

|

260 |

|

|

|

260 |

|

|

|

260 |

|

|

|

261 |

|

|

|

261 |

|

| Regional Credit-Card Companies |

|

|

207 |

|

|

|

207 |

|

|

|

209 |

|

|

|

207 |

|

|

|

206 |

|

| Compañía Financiera Argentina |

|

|

58 |

|

|

|

58 |

|

|

|

59 |

|

|

|

59 |

|

|

|

59 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other Points of Sale |

|

|

126 |

|

|

|

126 |

|

|

|

126 |

|

|

|

126 |

|

|

|

126 |

|

| Regional Credit-Card Companies |

|

|

90 |

|

|

|

90 |

|

|

|

90 |

|

|

|

90 |

|

|

|

90 |

|

| Compañía Financiera Argentina |

|

|

36 |

|

|

|

36 |

|

|

|

36 |

|

|

|

36 |

|

|

|

36 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Deposit Accounts (in thousands) |

|

|

3,394 |

|

|

|

3,193 |

|

|

|

3,028 |

|

|

|

3,006 |

|

|

|

2,948 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Credit Cards (in thousands) |

|

|

13,097 |

|

|

|

12,569 |

|

|

|

12,181 |

|

|

|

11,933 |

|

|

|

11,635 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Banco Galicia |

|

|

3,232 |

|

|

|

3,089 |

|

|

|

2,970 |

|

|

|

2,882 |

|

|

|

2,804 |

|

| Regional Credit-Card Companies |

|

|

9,717 |

|

|

|

9,348 |

|

|

|

9,045 |

|

|

|

8,880 |

|

|

|

8,676 |

|

| Compañía Financiera Argentina |

|

|

148 |

|

|

|

132 |

|

|

|

166 |

|

|

|

171 |

|

|

|

155 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Inflation and Exchange Rates |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Retail Price Index (%) (1) |

|

|

3.73 |

|

|

|

3.17 |

|

|

|

3.42 |

|

|

|

3.40 |

|

|

|

4.19 |

|

| Wholesale Price Index (I.P.I.M.) (%) (1) |

|

|

4.27 |

|

|

|

3.58 |

|

|

|

1.44 |

|

|

|

3.12 |

|

|

|

4.64 |

|

| C.E.R. Coefficient (%) (1) |

|

|

3.49 |

|

|

|

3.51 |

|

|

|

3.13 |

|

|

|

3.83 |

|

|

|

4.13 |

|

| Exchange Rate (Pesos per US$) (2) |

|

|

9.4192 |

|

|

|

9.0865 |

|

|

|

8.8197 |

|

|

|

8.5520 |

|

|

|

8.4643 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Rates (quarterly averages(3)) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Badlar (4) |

|

|

20.97 |

|

|

|

20.52 |

|

|

|

20.59 |

|

|

|

19.95 |

|

|

|

21.17 |

|

| Reference Interest Rate |

|

|

25.97 |

|

|

|

26.30 |

|

|

|

26.83 |

|

|

|

26.66 |

|

|

|

26.81 |

|

| Minimum Interest Rate on 30 to 44 days Time Deposits (5) |

|

|

23.27 |

|

|

|

22.88 |

|

|

|

23.34 |

|

|

|

23.19 |

|

|

|

N/A |

|

| Maximum Interest Rate on Personal Loans: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Group I |

|

|

37.66 |

|

|

|

38.13 |

|

|

|

38.90 |

|

|

|

38.65 |

|

|

|

38.87 |

|

| Group II |

|

|

46.75 |

|

|

|

47.34 |

|

|

|

48.29 |

|

|

|

47.98 |

|

|

|

48.26 |

|

| Interest Rate on Credit Line for Investment Projects |

|

|

18.00 |

|

|

|

19.00 |

|

|

|

19.00 |

|

|

|

19.50 |

|

|

|

19.50 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) |

Variation within the quarter. |

| (2) |

Reference foreign currency exchange rate in accordance to Communiqué “A” 3500 from the Argentine Central Bank, as of the last working day of the quarter. |

| (3) |

Except for Credit Line for Investment Projects, which corresponds to the interest rate established by regulations for each period. |

| (4) |

Private banks’ 30-day time deposits rate for amounts over Ps.1 million. |

| (5) |

Minimum interest rate on time deposits for individuals for amounts up to Ps.350,000. Corresponds to the interest rate on time deposits for up to Ps.1 million for companies and individuals since July 27,

2015. |

|

|

|

|

|

|

|

|

|

4 |

BANCO DE GALICIA Y BUENOS AIRES S.A.

HIGHLIGHTS

| |

• |

|

Net income for the third quarter amounted to Ps.1,107 million, Ps.230 million (26.2%) higher than in the same quarter of fiscal year 2014, reaching Ps.2,866 million during the first nine months of fiscal year 2015,

Ps.542 million (23.3%) higher than in the same period of fiscal year 2014. |

| |

• |

|

The growth of results when compared to the third quarter of fiscal year 2014 was mainly due to the 24.9% growth in operating income(1) and a 30.7% decrease in

provisions for loan losses, partially offset by the 41.0% increase in administrative expenses. |

| |

• |

|

The credit exposure to the private sector reached Ps.96,027 million, up 32.1% during the last twelve months, and deposits reached Ps.82,584 million, up 37.5% during the same period. As of September 30, 2015, the

Bank’s estimated market share of loans to the private sector was 9.11% while its estimated market share of deposits from the private sector was 8.92%. |

| |

• |

|

In the framework of the Credit Line for Productive Investment Projects, the Bank continued to fulfill the placement of the quota established by regulations in force. As of the end of the quarter, the outstanding amount

of loans related to this credit line reached Ps.9,204 million. |

| |

• |

|

As of September 30, 2015, shareholders’ equity amounted to Ps.12,765 million, and the computable capital was Ps.12,674 million, representing a Ps.3,867 million excess capital (or 43.9%). The capital ratio was

15.8%. |

INFORMATION DISCLOSURE

The

data shown in the tables below and the consolidated financial statements correspond to Banco de Galicia y Buenos Aires S.A., consolidated with the subsidiaries under its direct or indirect control, except where otherwise noted.

The Bank’s consolidated financial statements and the figures included in the different tables of this report correspond to Banco de Galicia y Buenos

Aires S.A., Banco Galicia Uruguay S.A. (in liquidation), Galicia Cayman S.A. (until September 30, 2014, as on October 1 it was merged with Banco Galicia), Tarjetas Regionales S.A. and its subsidiaries, Tarjetas del Mar S.A., Galicia

Valores S.A. Sociedad de Bolsa, Compañía Financiera Argentina S.A. and Cobranzas y Servicios S.A.

| (1) |

Net financial income plus net income from services. |

|

|

|

|

|

|

|

|

|

5 |

RESULTS FOR THE THIRD QUARTER

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

In millions of pesos, except percentages |

|

| Table III |

|

|

|

|

FY2015 |

|

|

FY2014 |

|

|

Variation (%) |

|

| Evolution of Consolidated Results |

|

3rd Q |

|

|

2nd Q |

|

|

3rd Q |

|

|

3Q15 vs

2Q15 |

|

|

3Q15 vs

3Q14 |

|

| Net Financial Income |

|

|

3,075 |

|

|

|

2,628 |

|

|

|

2,521 |

|

|

|

17.0 |

|

|

|

22.0 |

|

| Net Income from Services |

|

|

2,227 |

|

|

|

2,055 |

|

|

|

1,723 |

|

|

|

8.4 |

|

|

|

29.3 |

|

| Provisions for Loan Losses |

|

|

(448 |

) |

|

|

(484 |

) |

|

|

(646 |

) |

|

|

(7.4 |

) |

|

|

(30.7 |

) |

| Administrative Expenses |

|

|

(3,204 |

) |

|

|

(2,967 |

) |

|

|

(2,273 |

) |

|

|

8.0 |

|

|

|

41.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating Income |

|

|

1,650 |

|

|

|

1,232 |

|

|

|

1,325 |

|

|

|

33.9 |

|

|

|

24.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Other Income / (Loss)(*) |

|

|

113 |

|

|

|

135 |

|

|

|

150 |

|

|

|

(16.3 |

) |

|

|

(24.7 |

) |

| Income Tax |

|

|

(656 |

) |

|

|

(489 |

) |

|

|

(598 |

) |

|

|

34.2 |

|

|

|

9.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income |

|

|

1,107 |

|

|

|

878 |

|

|

|

877 |

|

|

|

26.1 |

|

|

|

26.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (*) |

Includes income from equity investments and minority interest results. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Percentages |

|

| Table IV |

|

FY2015 |

|

|

FY2014 |

|

|

Nine Months Ended |

|

| Profitability and Efficiency |

|

3rd Q |

|

|

3rd Q |

|

|

09/30/15 |

|

|

09/30/14 |

|

| Return on Average Assets (*) |

|

|

3.88 |

|

|

|

4.03 |

|

|

|

3.59 |

|

|

|

3.68 |

|

| Return on Average Shareholders’ Equity (*) |

|

|

36.31 |

|

|

|

40.38 |

|

|

|

33.96 |

|

|

|

38.88 |

|

| Financial Margin (*) (1) |

|

|

12.50 |

|

|

|

14.08 |

|

|

|

12.43 |

|

|

|

14.10 |

|

| Net Income from Services as a % of Operating Income (2) |

|

|

42.00 |

|

|

|

40.60 |

|

|

|

42.50 |

|

|

|

38.64 |

|

| Net Income from Services as a % of Administrative Expenses |

|

|

69.51 |

|

|

|

75.80 |

|

|

|

70.71 |

|

|

|

70.44 |

|

| Administrative Expenses as a % of Operating Income (2) |

|

|

60.43 |

|

|

|

53.56 |

|

|

|

60.11 |

|

|

|

54.86 |

|

| (1) |

Financial Margin: Financial Income minus Financial Expenses, divided by Average Interest-earning Assets. |

| (2) |

Operating Income: Net Financial Income plus Net Income from Services. |

In the third quarter of fiscal

year 2015, the Bank recorded a Ps.1,107 million profit, Ps.230 million (or 26.2%) higher than the Ps.877 million profit for the same quarter of the previous year.

The variation in net income was a consequence of the Ps.1,058 million increase in operating income and lower provisions for loan losses, for Ps.198 million,

which were offset mainly by increases in administrative expenses, for Ps.931 million, and in income tax, for Ps.58 million.

The operating income for the

third quarter of fiscal year 2015 totaled Ps.5,302 million, up 24.9% from the Ps.4,244 million recorded in the same quarter of the prior year. This positive development was due both to a higher net income from services (up Ps.504 million or 29.3%)

and a higher net financial income (up Ps.554 million or 22.0%).

The net financial income for the quarter included a Ps.73 million gain from

foreign-currency quotation differences (including the results from foreign-currency forward transactions), compared to a Ps.1 million loss in the third quarter of the previous fiscal year. The quarter’s profit was composed of a Ps.75 million

gain from FX brokerage and of a Ps.2 million loss from the valuation of the foreign-currency net position and the results from foreign-currency forward transactions, compared to a Ps.64 million profit and a Ps.65 million loss, respectively, in the

third quarter of fiscal year 2014.

|

|

|

|

|

|

|

|

|

6 |

The quarter’s net financial income before foreign-currency quotation differences amounted to Ps.3,002

million, with a Ps.481 million (or 19.1%) increase as compared to the Ps.2,521 million of income of the same quarter of fiscal year 2014, as a consequence of the increase in the portfolio of loans to the private sector and of government securities,

offset by a decrease in the spread.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Average balances in millions of pesos. Yields and rates in annualized nominal % |

|

| Table V |

|

|

|

|

|

|

|

|

|

|

|

|

|

FY2015 |

|

|

|

|

|

|

|

|

FY2014 |

|

| Average Balances,

Yield and Rates(*) |

|

3rd Q |

|

|

2nd Q |

|

|

1st Q |

|

|

4th Q |

|

|

3rd Q |

|

| |

Av. B. |

|

|

Int. |

|

|

Av. B. |

|

|

Int. |

|

|

Av. B. |

|

|

Int. |

|

|

Av. B. |

|

|

Int. |

|

|

Av. B. |

|

|

Int. |

|

| Interest-Earning Assets |

|

|

98,417 |

|

|

|

25.15 |

|

|

|

91,904 |

|

|

|

24.42 |

|

|

|

81,902 |

|

|

|

26.40 |

|

|

|

76,184 |

|

|

|

25.30 |

|

|

|

71,639 |

|

|

|

27.25 |

|

| Government Securities |

|

|

16,375 |

|

|

|

25.68 |

|

|

|

15,870 |

|

|

|

19.23 |

|

|

|

11,351 |

|

|

|

26.25 |

|

|

|

9,697 |

|

|

|

13.00 |

|

|

|

10,000 |

|

|

|

29.45 |

|

| Loans |

|

|

79,835 |

|

|

|

24.99 |

|

|

|

73,546 |

|

|

|

25.80 |

|

|

|

68,469 |

|

|

|

26.48 |

|

|

|

64,269 |

|

|

|

27.16 |

|

|

|

59,056 |

|

|

|

27.28 |

|

| Financial Trusts Securities |

|

|

721 |

|

|

|

29.39 |

|

|

|

786 |

|

|

|

5.98 |

|

|

|

823 |

|

|

|

24.70 |

|

|

|

846 |

|

|

|

27.06 |

|

|

|

876 |

|

|

|

9.80 |

|

| Other Interest-Earning Assets |

|

|

1,486 |

|

|

|

26.00 |

|

|

|

1,702 |

|

|

|

21.95 |

|

|

|

1,259 |

|

|

|

24.62 |

|

|

|

1,372 |

|

|

|

24.47 |

|

|

|

1,707 |

|

|

|

22.27 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest-Bearing Liabilities |

|

|

67,840 |

|

|

|

16.52 |

|

|

|

63,548 |

|

|

|

16.45 |

|

|

|

57,275 |

|

|

|

15.94 |

|

|

|

54,388 |

|

|

|

15.40 |

|

|

|

52,497 |

|

|

|

15.72 |

|

| Saving Accounts |

|

|

14,960 |

|

|

|

0.20 |

|

|

|

12,786 |

|

|

|

0.19 |

|

|

|

12,690 |

|

|

|

0.18 |

|

|

|

11,298 |

|

|

|

0.21 |

|

|

|

10,670 |

|

|

|

0.18 |

|

| Time Deposits |

|

|

39,849 |

|

|

|

22.20 |

|

|

|

37,506 |

|

|

|

21.66 |

|

|

|

33,301 |

|

|

|

21.28 |

|

|

|

31,048 |

|

|

|

20.63 |

|

|

|

30,041 |

|

|

|

21.45 |

|

| Debt Securities |

|

|

10,343 |

|

|

|

17.75 |

|

|

|

9,704 |

|

|

|

17.12 |

|

|

|

9,368 |

|

|

|

16.43 |

|

|

|

9,334 |

|

|

|

15.93 |

|

|

|

8,729 |

|

|

|

16.18 |

|

| Other Interest-Bearing Liabilities |

|

|

2,688 |

|

|

|

18.44 |

|

|

|

3,552 |

|

|

|

18.14 |

|

|

|

1,916 |

|

|

|

25.24 |

|

|

|

2,708 |

|

|

|

16.95 |

|

|

|

3,057 |

|

|

|

12.43 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (*) |

Does not include foreign-currency quotation differences. Annual nominal interest rates were calculated using a 360-day denominator. |

The average interest-earning assets grew Ps.26,778 million (37.4%) as compared to the third quarter of the previous fiscal year, as a consequence of the

Ps.20,779 million increase in the average portfolio of loans to the private sector and of the Ps.6,375 million growth in the average balance of government securities, due to a higher position in peso-denominated securities (Bonac 2016 and provincial

debt securities) and in dollar-denominated securities (primarily Lebac). Interest-bearing liabilities increased Ps.15,343 million (29.3%) during the same period, mainly due to the increase of the average balances of interest-bearing deposits.

The average yield on interest-earning assets for the third quarter of fiscal year 2015 was 25.15%, with a 210 basis points (“b.p.”) decrease

compared to the same quarter of the prior year. This decrease was a consequence of the 377 b.p. decrease on the portfolio of government securities and the 229 b.p. decrease on the portfolio of loans to the private sector. Likewise, the average cost

of interest-bearing liabilities was 16.52%, with an 80 b.p. increase compared to the third quarter of the prior year, mainly due to the 75 b.p. increase of the average interest rate on time deposits.

|

|

|

|

|

|

|

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

In millions of pesos |

|

| Table VI |

|

|

|

|

|

|

|

FY2015 |

|

|

|

|

|

FY2014 |

|

| Income from Services, Net |

|

3rd Q |

|

|

2nd Q |

|

|

1st Q |

|

|

4th Q |

|

|

3rd Q |

|

| National Cards |

|

|

831 |

|

|

|

731 |

|

|

|

687 |

|

|

|

656 |

|

|

|

580 |

|

| Regional Credit Cards |

|

|

1,198 |

|

|

|

1,093 |

|

|

|

1,004 |

|

|

|

1,012 |

|

|

|

911 |

|

| CFA |

|

|

78 |

|

|

|

70 |

|

|

|

69 |

|

|

|

65 |

|

|

|

51 |

|

| Deposit Accounts |

|

|

511 |

|

|

|

465 |

|

|

|

447 |

|

|

|

383 |

|

|

|

372 |

|

| Insurance |

|

|

120 |

|

|

|

110 |

|

|

|

101 |

|

|

|

94 |

|

|

|

88 |

|

| Financial Fees |

|

|

35 |

|

|

|

33 |

|

|

|

35 |

|

|

|

26 |

|

|

|

29 |

|

| Credit-Related Fees |

|

|

75 |

|

|

|

76 |

|

|

|

80 |

|

|

|

67 |

|

|

|

61 |

|

| Foreign Trade |

|

|

55 |

|

|

|

50 |

|

|

|

46 |

|

|

|

48 |

|

|

|

49 |

|

| Collections |

|

|

69 |

|

|

|

72 |

|

|

|

64 |

|

|

|

52 |

|

|

|

51 |

|

| Utility-Bills Collection Services |

|

|

44 |

|

|

|

40 |

|

|

|

36 |

|

|

|

34 |

|

|

|

36 |

|

| Mutual Funds |

|

|

9 |

|

|

|

8 |

|

|

|

6 |

|

|

|

6 |

|

|

|

4 |

|

| Other |

|

|

154 |

|

|

|

132 |

|

|

|

131 |

|

|

|

131 |

|

|

|

126 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Income |

|

|

3,179 |

|

|

|

2,880 |

|

|

|

2,706 |

|

|

|

2,574 |

|

|

|

2,358 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Expenditures |

|

|

(952 |

) |

|

|

(825 |

) |

|

|

(735 |

) |

|

|

(797 |

) |

|

|

(635 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income from Services, Net |

|

|

2,227 |

|

|

|

2,055 |

|

|

|

1,971 |

|

|

|

1,777 |

|

|

|

1,723 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income from services amounted to Ps.2,227 million, up 29.3% from the Ps.1,723 million recorded in the third quarter of the

previous fiscal year. The increases of fees which stood out were those related to national and regional credit cards (36.1%), to deposit accounts (37.4%), to insurance (36.4%) and to collections (35.3%).

Provisions for loan losses for the third quarter of fiscal year 2015 amounted to Ps.448 million, Ps.198 million lower than in the same quarter of the prior

year, attributable both to the commercial and to the consumer loan portfolios.

Administrative expenses for the quarter totaled Ps.3,204 million, up 41.0%

from the same quarter of the previous year. Personnel expenses amounted to Ps.1,747 million, growing 35.1%, mainly due to salary increase agreements with the unions. The remaining administrative expenses, excluding the amortization of organization

and development expenses, amounted to Ps.1,299 million, with a Ps.402 million (44.8%) increase as compared to Ps.897 million from the third quarter of fiscal year 2014, mainly due to increases in maintenance, cash transportation, taxes, and

consultants fees due to the increase in the level of activity and of expenses related to services provided to the Bank. Likewise, the amortization of organization and development expenses amounted to Ps.158 million, with a 90.4% increase, as in

December 2014 the Bank began to amortize its investment in the SAP Core Banking System.

Income from equity investments amounted to Ps.61 million, Ps.58

million (or 48.7%) lower than in the third quarter of fiscal year 2014, when a profit related to the sale of the Bank’s interest in Banelco S.A. to Visa S.A. was recorded, within the framework of the integration project of said companies. In

addition, as of June 30, 2015, the amortization of the negative goodwill from the acquisition of CFA was completed.

Net other income for the third

quarter amounted to Ps.153 million, an increase of 57.7% as compared to the Ps.97 million profit for the same quarter of the prior year, mainly due to higher results related to security margins on repurchase agreement transactions and to credits

recovered, and to lower net charges from other provisions.

|

|

|

|

|

|

|

|

|

8 |

The income tax charge was Ps.656 million, Ps.58 million higher than in the third quarter of fiscal year 2014.

LEVEL OF ACTIVITY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

In millions of pesos |

|

| Table VII |

|

|

|

|

|

|

|

FY2015 |

|

|

|

|

|

FY2014 |

|

| Exposure to the Private Sector |

|

3rd Q |

|

|

2nd Q |

|

|

1st Q |

|

|

4th Q |

|

|

3rd Q |

|

| Loans |

|

|

86,238 |

|

|

|

83,051 |

|

|

|

75,119 |

|

|

|

69,208 |

|

|

|

64,218 |

|

| Financial Leases |

|

|

1,011 |

|

|

|

1,034 |

|

|

|

1,058 |

|

|

|

1,066 |

|

|

|

1,055 |

|

| Corporate Securities |

|

|

855 |

|

|

|

718 |

|

|

|

773 |

|

|

|

724 |

|

|

|

628 |

|

| Other Financing (*) |

|

|

7,923 |

|

|

|

7,454 |

|

|

|

7,149 |

|

|

|

7,877 |

|

|

|

6,626 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Subtotal |

|

|

96,027 |

|

|

|

92,257 |

|

|

|

84,099 |

|

|

|

78,875 |

|

|

|

72,527 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Securitized Assets (**) |

|

|

— |

|

|

|

40 |

|

|

|

102 |

|

|

|

141 |

|

|

|

164 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Credit |

|

|

96,027 |

|

|

|

92,297 |

|

|

|

84,201 |

|

|

|

79,016 |

|

|

|

72,691 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (*) |

Includes certain accounts under the balance sheet heading Other Receivables from Financial Brokerage, Guarantees Granted and Unused Balances of Loans Granted. |

| (**) |

Financial trust CFA Trust I. |

As of September 30, 2015, the Bank’s total exposure to the

private sector reached Ps.96,027 million, with an increase of 32.1% from a year before and of 4.0% during the quarter.

Total loans include Ps.19,074

million corresponding to the regional credit card companies, which registered a 31.9% increase during the last twelve months and a 5.6% increase in the quarter. They also include Ps.3,490 million from CFA, which were up 8.9% during the year and 3.8%

in the quarter.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Percentages |

|

| Table VIII |

|

|

|

|

|

|

|

FY2015 |

|

|

|

|

|

FY2014 |

|

| Market Share (*) |

|

3rd Q |

|

|

2nd Q |

|

|

1st Q |

|

|

4th Q |

|

|

3rd Q |

|

| Total Loans |

|

|

8.45 |

|

|

|

8.67 |

|

|

|

8.34 |

|

|

|

8.07 |

|

|

|

8.04 |

|

| Loans to the Private Sector |

|

|

9.11 |

|

|

|

9.15 |

|

|

|

9.06 |

|

|

|

8.76 |

|

|

|

8.74 |

|

| (*) |

Banco de Galicia and CFA, within the Argentine financial system, according to the daily information on loans published by the Argentine Central Bank. Loans include only principal. The regional credit-card

companies’ data is not included. |

The Bank’s market share of loans to the private sector as of September 30, 2015,

without considering those granted by the regional credit card companies, was 9.11%, compared to 9.15% from June 30, 2015, and to 8.74% from September 30, 2014.

|

|

|

|

|

|

|

|

|

9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

In millions of pesos |

|

| Table IX |

|

|

|

|

|

|

|

FY2015 |

|

|

|

|

|

FY2014 |

|

| Loans by Type of Borrower |

|

3rd Q |

|

|

2nd Q |

|

|

1st Q |

|

|

4th Q |

|

|

3rd Q |

|

| Large Corporations |

|

|

11,278 |

|

|

|

11,885 |

|

|

|

9,657 |

|

|

|

8,590 |

|

|

|

10,416 |

|

| SMEs |

|

|

24,518 |

|

|

|

22,854 |

|

|

|

22,171 |

|

|

|

20,514 |

|

|

|

18,414 |

|

| Individuals |

|

|

49,874 |

|

|

|

45,605 |

|

|

|

42,228 |

|

|

|

39,649 |

|

|

|

34,920 |

|

| Financial Sector |

|

|

568 |

|

|

|

2,707 |

|

|

|

1,063 |

|

|

|

455 |

|

|

|

468 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Loans |

|

|

86,238 |

|

|

|

83,051 |

|

|

|

75,119 |

|

|

|

69,208 |

|

|

|

64,218 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Allowances |

|

|

3,401 |

|

|

|

3,288 |

|

|

|

2,996 |

|

|

|

2,615 |

|

|

|

2,653 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Loans, Net |

|

|

82,837 |

|

|

|

79,763 |

|

|

|

72,123 |

|

|

|

66,593 |

|

|

|

61,565 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

In millions of pesos |

|

| Table X |

|

|

|

|

|

|

|

FY2015 |

|

|

|

|

|

FY2014 |

|

| Loans by Sector of Activity |

|

3rd Q |

|

|

2nd Q |

|

|

1st Q |

|

|

4th Q |

|

|

3rd Q |

|

| Financial Sector |

|

|

568 |

|

|

|

2,707 |

|

|

|

1,063 |

|

|

|

455 |

|

|

|

468 |

|

| Services |

|

|

5,398 |

|

|

|

4,761 |

|

|

|

3,821 |

|

|

|

3,468 |

|

|

|

3,716 |

|

| Agriculture and Livestock |

|

|

8,850 |

|

|

|

8,676 |

|

|

|

8,875 |

|

|

|

8,178 |

|

|

|

7,013 |

|

| Consumer |

|

|

50,160 |

|

|

|

45,864 |

|

|

|

42,481 |

|

|

|

39,747 |

|

|

|

34,865 |

|

| Retail and Wholesale Trade |

|

|

7,817 |

|

|

|

6,775 |

|

|

|

6,873 |

|

|

|

5,936 |

|

|

|

6,216 |

|

| Construction |

|

|

936 |

|

|

|

884 |

|

|

|

787 |

|

|

|

709 |

|

|

|

823 |

|

| Manufacturing |

|

|

10,610 |

|

|

|

11,297 |

|

|

|

9,246 |

|

|

|

9,256 |

|

|

|

9,861 |

|

| Other |

|

|

1,899 |

|

|

|

2,087 |

|

|

|

1,973 |

|

|

|

1,459 |

|

|

|

1,256 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Loans |

|

|

86,238 |

|

|

|

83,051 |

|

|

|

75,119 |

|

|

|

69,208 |

|

|

|

64,218 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Allowances |

|

|

3,401 |

|

|

|

3,288 |

|

|

|

2,996 |

|

|

|

2,615 |

|

|

|

2,653 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Loans, Net |

|

|

82,837 |

|

|

|

79,763 |

|

|

|

72,123 |

|

|

|

66,593 |

|

|

|

61,565 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

During the year, loans to the private sector registered growth, mainly in those granted to individuals (42.8%) and SMEs

(33.1%). By sector of activity, the higher growth was recorded in the consumer sector (43.9%) and in the agriculture and livestock sector (26.2%).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

In millions of pesos |

|

| Table XI |

|

|

|

|

|

|

|

FY2015 |

|

|

|

|

|

FY2014 |

|

| Exposure to the Argentine Public Sector (*) |

|

3rd Q |

|

|

2nd Q |

|

|

1st Q |

|

|

4th Q |

|

|

3rd Q |

|

| Government Securities’ Net Position |

|

|

14,758 |

|

|

|

18,200 |

|

|

|

14,682 |

|

|

|

10,101 |

|

|

|

11,225 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Held for Trading |

|

|

14,758 |

|

|

|

18,200 |

|

|

|

14,682 |

|

|

|

10,101 |

|

|

|

11,125 |

|

| Lebac / Nobac |

|

|

10,770 |

|

|

|

13,972 |

|

|

|

11,790 |

|

|

|

7,563 |

|

|

|

8,223 |

|

| Other |

|

|

3,988 |

|

|

|

4,228 |

|

|

|

2,892 |

|

|

|

2,538 |

|

|

|

2,902 |

|

| Bonar 2015 Bonds |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

100 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other Receivables Resulting from Financial Brokerage |

|

|

782 |

|

|

|

747 |

|

|

|

821 |

|

|

|

867 |

|

|

|

881 |

|

| Trust Certificates of Participation and Securities |

|

|

689 |

|

|

|

718 |

|

|

|

784 |

|

|

|

830 |

|

|

|

831 |

|

| Other |

|

|

93 |

|

|

|

29 |

|

|

|

37 |

|

|

|

37 |

|

|

|

50 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Exposure |

|

|

15,540 |

|

|

|

18,947 |

|

|

|

15,503 |

|

|

|

10,968 |

|

|

|

12,106 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (*) |

Excludes deposits with the Argentine Central Bank, which constitute one of the items by which the Bank complies with the Argentine Central Bank’s minimum cash requirement. |

|

|

|

|

|

|

|

|

|

10 |

As of September 30, 2015, the Bank’s exposure to the public sector amounted to Ps.15,540 million.

Excluding debt securities issued by the Argentine Central Bank said exposure reached Ps.4,770 million (3.5% of total assets), while as of September 30, 2014, it amounted to Ps.3,883 million (3.9% of total assets). This increase during the last

twelve months was due to the acquisition of government securities, mainly Bonac 2016.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

In millions of pesos |

|

| Table XII |

|

|

|

|

|

|

|

FY2015 |

|

|

|

|

|

FY2014 |

|

| Deposits (*) |

|

3rd Q |

|

|

2nd Q |

|

|

1st Q |

|

|

4th Q |

|

|

3rd Q |

|

| In Pesos |

|

|

75,955 |

|

|

|

72,304 |

|

|

|

64,105 |

|

|

|

60,091 |

|

|

|

55,789 |

|

| Current Accounts |

|

|

19,728 |

|

|

|

19,016 |

|

|

|

15,971 |

|

|

|

15,985 |

|

|

|

15,040 |

|

| Saving Accounts |

|

|

16,657 |

|

|

|

15,767 |

|

|

|

13,893 |

|

|

|

14,090 |

|

|

|

11,597 |

|

| Time Deposits |

|

|

38,389 |

|

|

|

36,446 |

|

|

|

33,122 |

|

|

|

29,081 |

|

|

|

28,181 |

|

| Other |

|

|

1,181 |

|

|

|

1,075 |

|

|

|

1,119 |

|

|

|

935 |

|

|

|

971 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| In Foreign Currency |

|

|

6,629 |

|

|

|

5,052 |

|

|

|

4,592 |

|

|

|

4,841 |

|

|

|

4,251 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Deposits |

|

|

82,584 |

|

|

|

77,356 |

|

|

|

68,697 |

|

|

|

64,932 |

|

|

|

60,040 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of September 30, 2015, the Bank’s deposits amounted to Ps.82,584 million,

representing a 37.5% increase during the last twelve months and a 6.8% increase during the quarter.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Percentages |

|

| Table XIII |

|

|

|

|

|

|

|

FY2015 |

|

|

|

|

|

FY2014 |

|

| Market Share (*) |

|

3rd Q |

|

|

2nd Q |

|

|

1st Q |

|

|

4th Q |

|

|

3rd Q |

|

| Total Deposits |

|

|

7.12 |

|

|

|

6.97 |

|

|

|

6.70 |

|

|

|

6.63 |

|

|

|

6.89 |

|

| Private Sector Deposits |

|

|

8.92 |

|

|

|

8.73 |

|

|

|

8.71 |

|

|

|

8.79 |

|

|

|

8.78 |

|

| (*) |

Banco Galicia and CFA, within the Argentine financial system, according to the daily information on deposits published by the Argentine Central Bank. Deposits and Loans include only principal. |

As of September 30, 2015, the Bank’s estimated market share of private sector deposits in the Argentine financial system was 8.92%, compared to

8.73% of the prior quarter and to 8.78% of a year before.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

In millions of pesos |

|

| Table XIV |

|

|

|

|

|

|

|

FY2015 |

|

|

|

|

|

FY2014 |

|