Report of Foreign Issuer (6-k)

October 22 2014 - 3:27PM

Edgar (US Regulatory)

FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

REPORT OF

FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of October, 2014

Commission File Number: 0-30852

GRUPO

FINANCIERO GALICIA S.A.

(the “Registrant”)

Galicia Financial Group S.A.

(translation of Registrant’s name into English)

Tte. Gral. Juan D. Perón 430, 25th Floor

(CP1038AAJ) Buenos Aires, Argentina

(address of principal executive offices)

Indicate by check mark whether

the Registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark whether by furnishing the information contained in this form, the Registrant is also thereby furnishing the information to the

Securities and Exchange Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ¨ No x

If “Yes” is marked, indicate below the file number assigned to the Registrant in connection with Rule 12g3-2(b): 82-

FORM 6-K

Commission File No. 0-30852

|

|

|

|

|

| Month Filed |

|

Event and Summary |

|

Exhibit No. |

|

|

|

| October, 2014 |

|

Notice of Material Event, dated October 21, 2014 regarding the placement results for the Class VI Notes. |

|

99.1 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

GRUPO FINANCIERO GALICIA S.A.

(Registrant) |

|

|

|

| Date: October 22, 2014 |

|

By: |

|

/s/ Pedro Alberto Richards |

|

|

Name: |

|

Pedro Alberto Richards |

|

|

Title: |

|

Chief Executive Officer |

Exhibit 99.1

Grupo Financiero Galicia S.A.

Cuit 30-70496280-7

October 21, 2014

Buenos Aires

To: Comisión Nacional de Valores (National Securities Exchange Commission)

Re.: Grupo Financiero Galicia S.A. – Class VI Notes for up to $200,000,000 (extendible up to $250,000,000)

To whom it may concern,

We are writing to you

in relation to the Class VI Notes for up to US$200,000,000 (extendible up to US$250,000,000) to be issued in two series, Series I (“Series I Notes”) and Series II (“Series II Notes”), under the Global Program of simple, short,

mid- and/or long-term Notes, non-convertible into shares for a maximum outstanding face value of up to US$100,000,000 or the equivalent thereof in another currency (the “Program”).

Please note that after the close of the Subscription Period, it has been determined that the issuance of Series I Notes and Series II Notes

will amount to a global face value of up to US$250,000,000.

The notes were issued with the following detail:

Series I Notes:

| |

1. |

Principal Amount: $140,155,155 |

| |

2. |

Date of issuance: October 23, 2014. |

| |

3. |

Interest Rate: 3.25 % of face value. |

| |

4. |

Maturity Date: April 23, 2016. |

| |

5. |

Payment of Principal: The aggregate principal amount of Series I Notes shall be paid in one lump sum on April 23, 2016. |

| |

6. |

Payment of Interest: Interest on Series I Notes shall be payable on January 23, 2015; April 23, 2015; July 23, 2015; October 23, 2015; January 23, 2016 and

April 23, 2016. |

| |

8. |

Apportionment factor: 77.71% |

This document constitutes an unofficial translation into

English of the original document in Spanish, which

document shall govern in all respects, including with respect to any matters of

interpretation.

Grupo Financiero Galicia S.A.

Cuit 30-70496280-7

Series II Notes:

| |

1. |

Principal Amount: $109,844,845 |

| |

2. |

Date of issuance: October 23, 2014. |

| |

3. |

Interest Rate: 4.25 % of face value. |

| |

4. |

Maturity Date: October 23, 2017. |

| |

5. |

Payment of Principal: The aggregate principal amount of Series II Notes shall be paid in one lump sum on October 23, 2017. |

| |

6. |

Payment of Interest: Interest on Series II Notes shall be payable on January 23, 2015; April 23, 2015; July 23, 2015; October 23, 2015; January 23,

2016; April 23, 2016; July 23, 2016; October 23, 2016; January 23, 2017; April 23, 2017; July 23, 2017 and October 23, 2017. |

| |

8. |

Apportionment factor: None. |

Sincerely,

A. Enrique Pedemonte

Authorized

– Attorney-in-law

Grupo Financiero Galicia

This document

constitutes an unofficial translation into English of the original document in Spanish, which

document shall govern in all respects,

including with respect to any matters of interpretation.

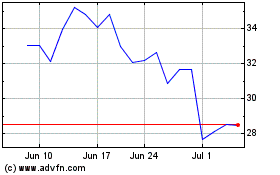

Grupo Financiero Galicia (NASDAQ:GGAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

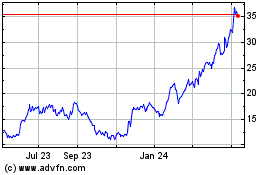

Grupo Financiero Galicia (NASDAQ:GGAL)

Historical Stock Chart

From Apr 2023 to Apr 2024