U.S. Hot Stocks: Hot Stocks to Watch

December 10 2015 - 9:50AM

Dow Jones News

Among the companies with shares expected to trade actively in

Thursday's session are Ciena Corp. (CIEN), Visteon Corp. (VC) and

LoJack Corp. (LOJN).

Telecom-equipment maker Ciena Corp. posted a downbeat revenue

forecast but narrowed its loss as the company continues to adapt to

cloud-based and mobile-based networking demands. Shares fell 11.86%

to $21.25 in premarket trading.

Visteon Corp. said Thursday its board declared a $1.75 billion

special cash distribution and authorized another $500 million of

stock buybacks. Shares rose 2.07% to $121.28 premarket.

CalAmp Corp. (CAMP) on Thursday went public with its $113

million offer for LoJack Corp., after unsuccessfully pursuing the

maker of car theft-recovery systems for nearly two years. Shares of

CalAmp rose 2.69% to $19.06 premarket. Shares of LoJack rose 47.34%

to $5.12 premarket.

ConocoPhillips (COP) estimated capital expenditures of $7.7

billion for next year, a 25% decline from the reduced levels the

oil major expects to spend for 2015. Shares fell 0.45% to $48.25

premarket.

Stryker Corp. (SYK) said Monday it would raise its quarterly

dividend to 38 cents a share from 34.5 cents a share.

Yum Brands Inc. (YUM) on Thursday offered up a few financial

targets for its business ahead of the split off of its struggling

China division next year.

Kite Pharma Inc. (KITE) said Thursday an underwritten public

offering of 3.6 million shares of its common stock will be priced

to the public at $69 a share.

American Superconductor Corp. (AMSC) raised its guidance for the

current quarter following better-than-expected revenue in its wind

business.

Athenahealth Inc. (ATHN) projected 2016 earnings that beat Wall

Street expectations and said it plans to scale its operations to

improve its margins.

Chevron Corp. (CVX) projected capital spending plans for 2016 of

$26.6 billion, which the oil giant said is 24% below expected

capital and exploratory spending this year.

First Solar Inc. (FSLR) on Wednesday gave lackluster projections

for the upcoming fiscal year.

Men's Wearhouse Inc. (MW) warned on Wednesday it may miss its

profit projection for the year if Jos. A. Bank sales don't pick up

during the holiday season. The company swung to a third-quarter

loss as it booked a $90.1 million charge to adjust the trademark

value of the struggling chain.

Write to Chris Wack at chris.wack@wsj.com and Maria Armental at

maria.armental@wsj.com

-0-

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

December 10, 2015 09:35 ET (14:35 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

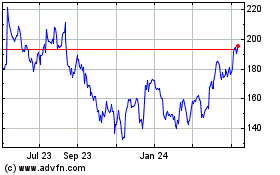

First Solar (NASDAQ:FSLR)

Historical Stock Chart

From Mar 2024 to Apr 2024

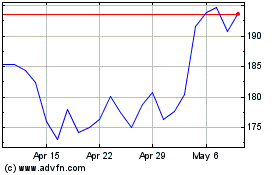

First Solar (NASDAQ:FSLR)

Historical Stock Chart

From Apr 2023 to Apr 2024