UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 30, 2015

FIRST SOLAR, INC.

(Exact name of registrant as specified in its charter)

|

| | | | |

Delaware (State or other jurisdiction of incorporation) | | 001-33156 (Commission File Number) | | 20-4623678 (I.R.S. Employer Identification No.) |

350 West Washington Street

Suite 600

Tempe, Arizona 85281

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code: (602) 414-9300

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

TABLE OF CONTENTS

|

|

|

|

|

EX-99.1: Press Release of First Solar, Inc. dated April 30, 2015 |

Item 2.02 Results of Operations and Financial Condition.

On April 30, 2015, First Solar, Inc. is issuing a press release and holding a conference call regarding its financial results for the first quarter ended March 31, 2015. A copy of the press release is furnished as Exhibit 99.1 to this Form 8-K.

The information in this Form 8-K and in Exhibit 99.1 attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liability of that Section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

|

| | | |

(d) Exhibits. | | |

| | |

99.1 |

| | Press Release of First Solar, Inc. dated April 30, 2015 |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

| FIRST SOLAR, INC. |

| (Registrant) |

| | | |

Dated: April 30, 2015 | By: | | /s/ PAUL KALETA |

| Name: | | Paul Kaleta |

| Title: | | Executive Vice President and General Counsel |

EXHIBIT 99.1

First Solar, Inc. Announces First Quarter 2015 Financial Results

| |

• | Net sales of $469 million |

| |

• | GAAP loss per fully diluted share of ($0.62) |

| |

• | Cash and marketable securities of $1.5 billion, net cash of $1.2 billion |

| |

• | 593MWdc of new bookings. Year to date bookings of 905MWdc |

| |

• | 16.3% lead line efficiency at end of April. 15.6% average lead line efficiency for Q1 |

TEMPE, Ariz., Apr 30, 2015 - First Solar, Inc. (Nasdaq: FSLR) today announced financial results for the first quarter of 2015. Net sales were $469 million in the quarter, a decrease of $539 million from the fourth quarter of 2014. The sequential decrease in net sales resulted from retaining projects which would otherwise have generated revenue in anticipation of the Company’s announced plans to pursue a YieldCo. In addition, delays on multiple projects in the current quarter, a higher mix of module only sales and the sale of the SolarGen 2 project in the prior quarter contributed to the lower revenue.

The Company reported a first quarter GAAP loss per fully diluted share of ($0.62), compared to earnings of $1.89 in the prior quarter. The decrease in net income compared to the prior quarter was due to lower revenue, the mix of systems projects under construction and a higher proportion of module only and module plus sales.

Cash and marketable securities at the end of the first quarter were approximately $1.5 billion, a decrease of approximately $507 million compared to the prior quarter. Cash flows used in operations were $418 million in the first quarter. The decrease in cash and marketable securities during the quarter was due also to the increase in project construction on balance sheet in preparation for a YieldCo launch.

“As anticipated, the first quarter was a transitional period as we executed on our plans to form 8point3 Energy Partners” said Jim Hughes, CEO of First Solar. “We continue to enhance the overall strength of our business with our lead line now running at 16.3% efficiency and our announced strategic alliance with Caterpillar”.

The Company also provided guidance for the second quarter of 2015 as follows:

| |

• | Net Sales of $750 to $850 million |

| |

• | Earnings of $0.45 to $0.55 per fully diluted share, including a non-recurring tax benefit of approximately $0.40 |

| |

• | Cash flow used in operating activities of ($250) to ($350) million |

*Earnings per share guidance excludes impact related to potential 8point3 Energy Partners IPO transaction occurring in Q2

First Solar has scheduled a conference call for today, April 30, 2015 at 5:00 p.m. ET to discuss this announcement. A live webcast of this conference call is available at http://investor.firstsolar.com/events.cfm.

An audio replay of the conference call will also be available approximately two hours after the conclusion of the call. The audio replay will remain available until Wednesday, May 6, 2015 at 7:30 p.m. ET and can be accessed by dialing 888-203-1112 if you are calling from within the United States or 719-457-0820 if you are calling from outside the United States and entering the replay pass code 3108257. A replay of the webcast will be available on the Investors section of the Company’s website approximately two hours after the conclusion of the call and remain available for approximately 90 calendar days.

About First Solar, Inc.

First Solar is a leading global provider of comprehensive photovoltaic (PV) solar systems which use its advanced module and system technology. The Company's integrated power plant solutions deliver an economically attractive alternative to fossil-fuel electricity generation today. From raw material sourcing through end-of-life module recycling, First Solar's renewable energy systems protect and enhance the environment. For more information about First Solar, please visit www.firstsolar.com.

For First Solar Investors

This release contains forward-looking statements which are made pursuant to safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include statements, among other things, concerning: our business strategy, including anticipated trends and developments in and management plans for our business and the markets in which we operate; future financial results, operating results, revenues, gross margin, operating expenses, products, projected costs, warranties, solar module efficiency and balance of systems cost reduction roadmaps, product reliability and capital expenditures; our ability to continue to reduce the cost per watt of our solar modules; our ability to reduce the costs to construct PV solar power systems; research and development programs and our ability to improve the conversion efficiency of our solar modules; sales and marketing initiatives; and competition. These forward-looking statements are often characterized by the use of words such as "estimate," "expect," "anticipate," "project," "plan," "intend," "believe," "forecast," "foresee," "likely," "may," "should," "goal," "target," "might," "will," "could," "predict," "continue" and the negative or plural of these words and other comparable terminology. Forward-looking statements are only predictions based on our current expectations and our projections about future events. You should not place undue reliance on these forward-looking statements. We undertake no obligation to update any of these forward-looking statements for any reason. These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to differ materially from those expressed or implied by these statements. These factors include, but are not limited to, the matters discussed in Item 1A: "Risk Factors," of our most recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other reports filed with the SEC.

Contacts

First Solar Investors

David Brady

+1 602 414-9315

dbrady@firstsolar.com

or

Steve Haymore

+1 602 414-9315

stephen.haymore@firstsolar.com

First Solar Media

Steve Krum

+1 602-427-3359

steve.krum@firstsolar.com

FIRST SOLAR, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except share data)

(Unaudited)

|

| | | | | | | | |

| | March 31, 2015 | | December 31, 2014 |

ASSETS | | | | |

Current assets: | | | | |

Cash and cash equivalents | | $ | 779,908 |

| | $ | 1,482,054 |

|

Marketable securities | | 704,674 |

| | 509,032 |

|

Accounts receivable trade, net | | 254,217 |

| | 135,434 |

|

Accounts receivable, unbilled and retainage | | 81,587 |

| | 76,971 |

|

Inventories | | 496,599 |

| | 505,088 |

|

Balance of systems parts | | 119,959 |

| | 125,083 |

|

Deferred project costs | | 311,118 |

| | 29,354 |

|

Deferred tax assets, net | | 73,419 |

| | 91,565 |

|

Assets held for sale | | 20,728 |

| | 20,728 |

|

Notes receivable, affiliate | | 44,210 |

| | 12,487 |

|

Prepaid expenses and other current assets | | 263,284 |

| | 202,670 |

|

Total current assets | | 3,149,703 |

| | 3,190,466 |

|

Property, plant and equipment, net | | 1,368,443 |

| | 1,402,304 |

|

PV solar power systems, net | | 45,723 |

| | 46,393 |

|

Project assets and deferred project costs | | 833,154 |

| | 810,348 |

|

Deferred tax assets, net | | 210,536 |

| | 222,326 |

|

Restricted cash and investments | | 421,875 |

| | 407,053 |

|

Investments in unconsolidated affiliates and joint ventures | | 257,321 |

| | 255,029 |

|

Goodwill | | 84,985 |

| | 84,985 |

|

Other intangibles, net | | 118,364 |

| | 119,236 |

|

Inventories | | 115,578 |

| | 115,617 |

|

Note receivable, affiliate | | 9,127 |

| | 9,127 |

|

Other assets | | 59,865 |

| | 61,555 |

|

Total assets | | $ | 6,674,674 |

| | $ | 6,724,439 |

|

LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | |

Current liabilities: | | | | |

Accounts payable | | $ | 202,755 |

| | $ | 214,656 |

|

Income taxes payable | | 2,882 |

| | 1,727 |

|

Accrued expenses | | 436,913 |

| | 388,156 |

|

Current portion of long-term debt | | 42,123 |

| | 51,918 |

|

Billings in excess of costs and estimated earnings | | 171,331 |

| | 195,346 |

|

Payments and billings for deferred project costs | | 71,639 |

| | 60,591 |

|

Other current liabilities | | 57,263 |

| | 88,702 |

|

Total current liabilities | | 984,906 |

| | 1,001,096 |

|

Accrued solar module collection and recycling liability | | 236,155 |

| | 246,307 |

|

Long-term debt | | 200,386 |

| | 165,003 |

|

Other liabilities | | 266,121 |

| | 284,546 |

|

Total liabilities | | 1,687,568 |

| | 1,696,952 |

|

Commitments and contingencies | | | | |

Stockholders’ equity: | | | | |

Common stock, $0.001 par value per share; 500,000,000 shares authorized; 100,791,414 and 100,288,942 shares issued and outstanding at March 31, 2015 and December 31, 2014, respectively | | 101 |

| | 100 |

|

Additional paid-in capital | | 2,698,134 |

| | 2,697,558 |

|

Accumulated earnings | | 2,217,397 |

| | 2,279,689 |

|

Accumulated other comprehensive income | | 71,474 |

| | 50,140 |

|

Total stockholders’ equity | | 4,987,106 |

| | 5,027,487 |

|

Total liabilities and stockholders’ equity | | $ | 6,674,674 |

| | $ | 6,724,439 |

|

FIRST SOLAR, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share amounts)

(Unaudited)

|

| | | | | | | | |

| | Three Months Ended March 31, |

| | 2015 | | 2014 |

Net sales | | $ | 469,209 |

| | $ | 950,158 |

|

Cost of sales | | 430,228 |

| | 713,447 |

|

Gross profit | | 38,981 |

| | 236,711 |

|

Operating expenses: | | | | |

Research and development | | 34,756 |

| | 38,773 |

|

Selling, general and administrative | | 67,688 |

| | 58,664 |

|

Production start-up | | 6,650 |

| | — |

|

Total operating expenses | | 109,094 |

| | 97,437 |

|

Operating (loss) income | | (70,113 | ) | | 139,274 |

|

Foreign currency loss, net | | (1,596 | ) | | (579 | ) |

Interest income | | 5,064 |

| | 4,321 |

|

Interest expense, net | | (194 | ) | | (410 | ) |

Other expense, net | | (1,259 | ) | | (1,774 | ) |

(Loss) income before taxes and equity in earnings of unconsolidated affiliates | | (68,098 | ) | | 140,832 |

|

Income tax benefit (expense) | | 5,980 |

| | (28,853 | ) |

Equity in earnings of unconsolidated affiliates, net of tax | | (174 | ) | | 28 |

|

Net (loss) income | | $ | (62,292 | ) | | $ | 112,007 |

|

Net (loss) income per share: | | | | |

Basic | | $ | (0.62 | ) | | $ | 1.12 |

|

Diluted | | $ | (0.62 | ) | | $ | 1.10 |

|

Weighted-average number of shares used in per share calculations: | | | | |

Basic | | 100,375 |

| | 99,591 |

|

Diluted | | 100,375 |

| | 101,822 |

|

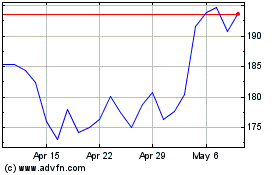

First Solar (NASDAQ:FSLR)

Historical Stock Chart

From Mar 2024 to Apr 2024

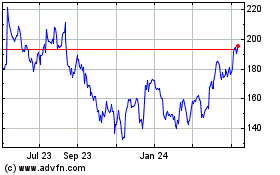

First Solar (NASDAQ:FSLR)

Historical Stock Chart

From Apr 2023 to Apr 2024