Filed pursuant to Rule 424(b)(5)

Registration Statement No. 333-190505

Prospectus Supplement

(To the Prospectus Dated August 26, 2013)

1,200,000 Shares

Common Stock

We are offering

1,200,000 shares of our common stock, $0.10 par value per share, pursuant to this prospectus supplement and the accompanying prospectus.

Our common stock is listed and traded on The NASDAQ Capital Market, or “NASDAQ,” under the symbol “FLIC.” On May 4, 2016, the last reported price of our common stock on NASDAQ was

$29.52 per share.

Investing in our common stock involves risks. Please carefully read the “

Risk

Factors

” beginning on page S-10 of this prospectus supplement, and the documents incorporated by reference in this prospectus supplement, including the risk factors contained therein, for a discussion of certain factors that you should

consider before making your investment decision.

|

|

|

|

|

|

|

|

|

|

|

|

|

Per Share

|

|

|

Total

|

|

|

Public offering price

|

|

$

|

29.00

|

|

|

$

|

34,800,000

|

|

|

Underwriting discount

|

|

$

|

1.55875

|

|

|

$

|

1,870,500

|

|

|

Proceeds, before expenses, to The First of Long Island Corporation

|

|

$

|

27.44125

|

|

|

$

|

32,929,500

|

|

The shares of common stock are being offered through the underwriter on a firm commitment basis. We have

granted the underwriter a 30-day option to purchase 180,000 additional shares of our common stock at the same price and on the same terms.

None of the Securities and Exchange Commission, any state securities commission, the Board of Governors of the Federal Reserve System or any other regulatory body has approved or disapproved of these

securities or passed upon the adequacy, completeness or accuracy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

These securities are not deposits, savings accounts, or other obligations of a bank or savings association and are not insured by the

Federal Deposit Insurance Corporation or any other governmental agency.

The underwriter expects to deliver the common

stock through the facilities of The Depository Trust Company against payment on or about May 10, 2016.

S

ANDLER

O’N

EILL

+ P

ARTNERS

, L.P.

The date of this prospectus supplement is May 4, 2016.

TABLE OF CONTENTS

Prospectus Supplement

Prospectus

You should rely only on the information contained or incorporated by reference in this prospectus

supplement and the accompanying prospectus. We have not, and Sandler O’Neill & Partners, L.P. (“Sandler O’Neill”) has not, authorized any other person to provide you with different or additional information. If anyone

provides you with different or additional information, you should not rely on it. We are not, and Sandler O’Neill is not, making an offer to sell our securities in any jurisdiction where the offer or sale is not permitted.

You should assume that the information appearing in this prospectus supplement, the accompanying prospectus and any documents incorporated

by reference herein, is accurate as of their respective dates. However, our business, financial condition, liquidity, results of operations, and prospects may have changed since those dates. This prospectus supplement supersedes the accompanying

prospectus to the extent it contains information that is different from or in addition to the information in that prospectus.

S-i

ABOUT THIS PROSPECTUS SUPPLEMENT

This document consists of two parts. The first part is this prospectus supplement, which describes the specific terms of this offering and

certain other matters, and also updates and adds to the information contained in the accompanying prospectus and the documents incorporated by reference into this prospectus supplement and the accompanying prospectus. The second part is the

accompanying prospectus, which provides more general information about us, our common stock and other securities that we may offer from time to time, some of which may not apply to this offering. You should read this prospectus supplement and the

accompanying prospectus with the additional information described below under the headings “Where You Can Find More Information” and “Incorporation of Certain Documents by Reference.” Generally, when we refer to this

“prospectus” we mean this prospectus supplement together with the accompanying prospectus.

If the information set forth in this

prospectus supplement differs in any way from the information set forth in the accompanying prospectus, you should rely on the information set forth in this prospectus supplement.

Unless we specifically state otherwise, the information in this prospectus supplement assumes no exercise of Sandler O’Neill’s

option to purchase additional shares of our common stock.

We are offering to sell shares of our common stock only in jurisdictions where

offers and sales are permitted. The distribution of this prospectus and the offering of the common stock in certain jurisdictions may be restricted by law. This prospectus does not constitute, and may not be used in connection with, an offer to

sell, or a solicitation of an offer to buy, any common stock offered by this prospectus by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

In this prospectus supplement, unless otherwise expressly stated or the context otherwise requires, the terms “we,” “us,”

the “Company,” and “our” refer to The First of Long Island Corporation and our subsidiaries on a consolidated basis. References to the “Bank” refer to The First National Bank of Long Island, our wholly-owned subsidiary

through which we conduct all of our business, and its subsidiaries.

Currency amounts in this prospectus supplement and the accompanying

prospectus are stated in U.S. dollars.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

We make statements in this prospectus and the documents incorporated into it by reference that are considered “forward-looking

statements” as defined in the Private Securities Litigation Reform Act of 1995 (the “PSLRA”). These forward-looking statements include statements of goals; intentions and expectations; estimates of risks and of future costs and

benefits; assessments of probable loan losses; assessments of market risk; and statements of the ability to achieve financial and other goals. Forward-looking statements are typically identified by words such as “would,”

“should,” “could,” “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project” and other similar words and expressions.

Forward-looking statements are subject to numerous assumptions, risks and uncertainties which may change over time. Forward-looking statements speak only as of the date they are made. We do not assume any duty and do not undertake to update our

forward-looking statements. Because forward-looking statements are subject to assumptions and uncertainties, actual results or future events could differ, possibly materially, from those that we anticipated in our forward-looking statements and

future results could differ materially from historical performance.

Our forward-looking statements are subject to the following principal

risks and uncertainties: general economic conditions and trends, either nationally or locally; conditions in the securities markets; fluctuations in the market price of our common stock; changes in interest rates; changes in deposit flows and in the

demand for deposit and loan products and other financial services; changes in real estate values; changes in the quality or

S-1

composition of our loan or investment portfolios; changes in competitive pressures among financial institutions or from non-financial institutions; our ability to retain key members of

management; changes in legislation, regulation, and policies; and a variety of other matters which, by their nature, are subject to significant uncertainties. We provide greater detail regarding some of these factors in the “Risk Factors”

section of this prospectus supplement and the accompanying prospectus, and in our Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q, including the section captioned “Risk Factors” of those reports. Our forward-looking

statements may also be subject to other risks and uncertainties, including those that we may discuss elsewhere in other documents we file with the Securities and Exchange Commission (“SEC”) from time to time.

You should not place undue reliance on these forward-looking statements, which reflect our expectations only as of the date of this prospectus

supplement. Except as required by applicable laws or regulations, we do not assume any duty and do not undertake any obligation to update or revise our forward-looking statements. Because forward-looking statements are subject to assumptions and

uncertainties, actual results or future events could differ, possibly materially, from those that we anticipated in our forward-looking statements and future results could differ materially from historical performance.

S-2

PROSPECTUS SUPPLEMENT SUMMARY

This summary is not complete and does not contain all of the information you should consider before making a decision to invest in the

securities offered by this prospectus. You should read this summary together with the entire prospectus supplement, including the section entitled “Risk Factors” on page S-10, the accompanying prospectus, and the other documents that are

incorporated by reference in this prospectus supplement, including our financial statements and the notes thereto and management’s discussion and analysis thereof, before making an investment decision.

General

The First of Long Island

Corporation, a one-bank holding company, was incorporated on February 7, 1984, for the purpose of providing financial services through its wholly-owned subsidiary, The First National Bank of Long Island.

The Bank was organized in 1927 as a national banking association under the laws of the United States of America.

The Bank has two wholly owned subsidiaries: The First of Long Island Agency, Inc., a licensed insurance agency under the laws of the State of

New York; and FNY Service Corp., an investment company. The Bank and FNY Service Corp. jointly own another subsidiary, The First of Long Island REIT, Inc., a real estate investment trust.

We have historically served the financial needs of privately owned businesses, professionals, consumers, public bodies and other organizations

primarily in Nassau and Suffolk Counties, Long Island, New York and the boroughs of New York City. Our principal business consists of attracting business and consumer checking deposits, money market deposits, time deposits and savings deposits and

investing those funds in commercial and residential mortgage loans, commercial loans, home equity loans, and investment securities. Our loan portfolio is primarily comprised of loans to borrowers on Long Island and in the boroughs of New York City,

and our real estate loans are principally secured by properties located in those geographic areas. Our investment securities portfolio is primarily comprised of direct obligations of the U.S. government and its agencies and highly rated obligations

of states and political subdivisions. We have an Investment Management Division that provides investment management, pension trust, personal trust, estate and custody services.

The Bank’s revenues are derived principally from interest on loans and investment securities, service charges and fees on deposit

accounts and income from investment management and trust services. At March 31, 2016, we had total assets of $3.2 billion, total deposits of $2.6 billion and total stockholders’ equity of $260.4 million.

Our principal executive offices are located at 10 Glen Head Road, Glen Head, New York 11545, and our telephone number is (516) 671-4900.

Our Internet address is https://www.fnbli.com. The information contained on our website should not be considered part of this prospectus supplement or the accompanying prospectus, and the reference to our website does not constitute incorporation by

reference of the information contained on the website. Additional information about us and our subsidiaries is included in documents incorporated by reference in this prospectus. See “Where You Can Find More Information” on page S-17 of

this prospectus supplement.

Key Initiatives and Strategy

Loan Growth.

Total loans grew at a compounded annual growth rate (“CAGR”) of 20.0% during the five-year period ended

December 31, 2015 and totaled $2.3 billion at March 31, 2016. The loan growth occurred largely in commercial mortgages, residential mortgages and commercial and industrial loans, which grew at CAGRs of 19.9%, 24.3% and 19.0%, respectively.

One of our key strategic initiatives has been to increase

S-3

earnings by making loans a larger portion of the overall balance sheet and securities a smaller portion. This strategy has resulted in our net loan to deposit ratio more closely resembling that

of our national bank holding company peer group (as published by the Federal Reserve System). Our ratio was 89.3% at March 31, 2016 and 97.2% and 89.8% at December 31, 2015 and 2014, respectively. The ratio for our national peer group,

which consists of all bank holding companies having assets between $3 billion and $10 billion, was 89.9% and 87.9% at year-end 2015 and 2014, respectively.

In addition to improving earnings through loan growth, we are also seeking to improve earnings and manage concentration risk through

diversification within our real estate loan portfolio and through diversification into loans that are not secured by real estate. Approximately one-third of the growth in our commercial and industrial portfolio during 2015 resulted from our recent

small business credit scored loan initiative. These loans are originated using the most conservative score card and are generally made to small businesses that have less than $2 million in annual sales at the time of application. Most are in the

form of revolving credit lines and, depending on the type of business, the maximum loan amount generally ranges from $150,000 to $400,000. We are also using credit scoring to issue small business credit cards. Other loan diversification initiatives

include originating or purchasing equipment financing loans and, during 2016, we intend to begin originating loans under the Small Business Administration’s 7(a) and Express loan programs.

We expect that loan growth will continue to come from the marketing efforts of our personnel and, with respect to commercial and residential

real estate loans, the strong relationships we have developed and continue to develop with brokers and correspondents. All loans originated through brokers and correspondents are underwritten by our personnel. In growing and diversifying the loan

portfolio, we will continue to target loans we believe to be of lower risk within the categories of loans we have chosen to emphasize.

We

intend to fund our loan growth with a combination of deposit growth and term borrowings. We believe that term borrowings will mitigate the earnings impact if interest rates increase.

Deposit Growth.

Total deposits grew at a CAGR of 12.1% during the five-year period ended December 31, 2015. The growth of

nonmaturity deposits, particularly checking deposits, remains a key strategic initiative. In addition to checking deposits, nonmaturity deposits include savings, NOW and money market deposits. As in the past, we expect that future deposit growth

will come largely from our continued expansion of the Bank’s branch distribution system and new and expanded business and municipal banking relationships. These factors are further described under “Prospectus Supplement

Summary—Financial Strength and Stability—Branch Distribution” and “ —Municipal Banking Relationships” in this prospectus supplement.

Recruiting and Retaining Superior Talent.

We continue to focus on recruiting talented executive management, lending, commercial

banking, marketing, branch, and back-office teams. Our recruiting efforts target individuals who have significant relevant experience in their discipline, a loyal customer following and strong references. We believe that our good reputation in our

marketplace and successful track record in terms of profitability and growth have worked to our advantage in this regard.

Noninterest Income.

Our noninterest income comes largely from our Investment Management Division, service charges on deposit

accounts, merchant services, debit, credit and ATM cards and a variety of other services we perform including, but not limited to, the sale of mutual funds and annuities. One of our strategic objectives is to grow noninterest income by expanding

existing services, adding new products and services and potentially acquiring fee-based businesses. In this regard we have worked to develop a sales culture to take advantage of cross-sell opportunities with our existing customers. In addition, we

have considered and will continue to consider the acquisition of businesses that could complement our banking business and add to noninterest income. Over the five-year period ended December 31, 2015, our aggregate fees from merchant services,

debit cards and ATM transactions, three of our key noninterest income initiatives, have grown at a CAGR of 16.6%, or from $386,000 in 2010 to $834,000 in 2015.

S-4

Financial Strength and Stability

Loan Quality.

Our management team places strong emphasis on credit quality. At March 31, 2016, our nonaccrual loans totaled

$1.3 million, or 0.06% of total loans, and loans past due 30 to 89 days totaled $265,000, or 0.01% of total loans. In addition, our net chargeoffs have not exceeded 0.16% of average total loans in any of the last five calendar years. We attribute

the lack of significant delinquencies and chargeoffs to conservative underwriting standards, strong credit administration practices, comprehensive loan review, the categories of loans within which we lend, the affluent nature of the geographic areas

we serve and our diligent ongoing efforts to identify and address problems early. In recent years, we enhanced our credit risk management by building a more robust credit department and strengthening our written underwriting policies and loan review

function. In approving new loans, we generally require a loan to value ratio of 75% or less, a FICO score of 700 or better, a debt service coverage ratio of 1.25X or better and a stressed debt service coverage ratio of 1.0X or better.

Investment Securities Portfolio.

Our management team also places strong emphasis on the credit quality of our securities

portfolio. Our investment securities portfolio is comprised almost exclusively of residential mortgage-backed securities and municipal securities. The mortgage securities in our portfolio are backed by mortgages underwritten on conventional terms,

with 69% of these securities at December 31, 2015 being full faith and credit obligations of the U.S. government and the balance being obligations of U.S. government sponsored entities. The municipal securities in our portfolio principally

consist of high quality, general obligation securities rated AA or better by major rating agencies. In selecting municipal securities for purchase, we use credit agency ratings for screening purposes only and then perform our own credit analysis. On

an ongoing basis, we periodically assess the credit strength of the municipal securities in our portfolio and make decisions to hold or sell based on such assessments. We have no trust preferred securities in our portfolio or subordinated debt

instruments of other financial institutions. We have not had nor do we currently have any impaired securities.

Branch

Distribution.

Our Bank is one of the largest commercial banks headquartered on Long Island, where we generally operate in densely populated areas with a mix of personal, business and municipal banking customers. The physical size of our

branches and our typical staff count are relatively small compared to many of our competitors in recognition of the fact that branch foot traffic has declined dramatically as an ever increasing number of electronic banking channels have been

introduced and developed. Although electronic banking channels have given us the ability to service customers with small branches, we believe that branch presence is necessary to acquire customers in our target market segments, which include small

businesses with annual sales of $500,000 to $10 million, middle market businesses with annual sales of $10 million to $100 million, professionals (i.e. doctors, lawyers, dentists, CPAs), municipalities and service conscious retail customers. The

rightsizing of our branches has enabled us to maximize revenue and minimize the initial investment and ongoing costs associated with providing our various products and services.

In addition to rightsizing our branches, we have avoided a one-size-fits-all strategy with respect to the types of branches we offer. We

generally utilize conventional full service offices in areas on Long Island and the borough of Queens where there is a traditional mix of personal and business banking customers. We have commercial banking offices in markets where there is a high

concentration of professional practices and other commercial businesses. These branches, which generally have shorter hours and even smaller footprints than our full service branches, provide the equivalent of private banking to our business

customers. As a result of lower personnel and overhead costs, these offices can be profitable providing personalized service to a limited number of business customers. Additionally, we employ two select service banking centers to provide a private

banking atmosphere in markets where there is a high concentration of retail customers.

We have been opening two to four new branches per

year, and now have 44 branches located in Nassau and Suffolk Counties, Long Island and the boroughs of Queens and Manhattan. As we move forward, we plan to continue opening branches at the same pace as we have in the past. In addition to filling

voids in our Nassau and Suffolk County branch distribution system, Queens and Brooklyn will be geographies of focus. We opened two

S-5

branches in Queens in the latter part of 2015 and will open a branch in Bay Ridge, Brooklyn later this year. Both of these boroughs of New York City have high concentrations of customers in our

targeted market segments.

Municipal Banking Relationships.

In addition to expanding our branch distribution system, in

recent years we have also focused on growing our municipal deposit business. We generally seek to establish municipal deposit relationships consisting of 15% to 20% noninterest-bearing checking balances, with the remainder being stable

interest-bearing balances. One significant factor that has contributed to our success in growing this business is that many larger banks are reducing their municipal deposit relationships because of concerns over liquidity. As of March 31,

2016, we do business with more than 125 municipalities accounting for approximately $471.4 million, or 18.4%, of our total deposits.

Customer Service and Branding.

We believe that we differentiate ourselves from our competition by providing superior,

personalized service. We continue to make significant investments in our technology platform in order to provide our employees with the tools necessary to better serve our customers and enable us to cross-sell the various products and services we

offer. In addition, we have worked on a branding campaign to become commonly known as the Bank “Where Everyone Knows Your Name

®

.”

S-6

THE OFFERING

|

Issuer

|

The First of Long Island Corporation, a New York corporation.

|

|

Common Stock Offered

|

1,200,000 shares of common stock, $0.10 par value per share.(1)

|

|

Common Stock Outstanding after this Offering

|

15,476,877 shares, based on 14,276,877 shares outstanding as of May 4, 2016.(2)

|

|

Net Proceeds to us

|

We estimate that our net proceeds from this offering will be approximately $32.5 million (or $37.5 million if Sandler O’Neill exercises in full its option to purchase additional shares), after deducting the underwriting discount and

estimated offering expenses payable by us.

|

|

Use of Proceeds

|

We intend to use the net proceeds from this offering for general corporate purposes, including support for organic growth and financing possible acquisitions of branches or fee-based businesses. See “Use of Proceeds” on page S-12 of

this prospectus supplement.

|

|

Market and Trading Symbol for the Common Stock

|

Our common stock is listed and traded on NASDAQ under the symbol “FLIC.”

|

|

Risk Factors

|

Investing in our common stock involves risks. You should carefully consider the information contained in, or incorporated by reference into, this prospectus supplement and the accompanying prospectus. In particular, we urge you to consider

carefully the factors set forth under “Risk Factors” beginning on page S-10 of this prospectus supplement and in the documents incorporated by reference in this prospectus supplement before making a decision to invest in our common stock.

|

|

(1)

|

Excludes Sandler O’Neill’s option to purchase 180,000 additional shares of our common stock.

|

|

(2)

|

Excludes 210,378 shares subject to outstanding compensatory stock options having a weighted average exercise price of $16.00 per share, 173,607 shares issuable pursuant to performance and service-based restricted stock

units issued and outstanding, 186,917 shares reserved for issuance pursuant to our dividend reinvestment and stock purchase plan and 180,000 shares subject to Sandler O’Neill’s purchase option granted in this offering.

|

S-7

SUMMARY OF SELECTED FINANCIAL DATA

The following table(s) sets forth selected consolidated financial information for the Company as of and for each of the five years ended

December 31, 2015 (which, other than our financial ratios, has been derived from our audited consolidated financial statements), and as of March 31, 2016 and for the three month periods ended March 31, 2016 and 2015. You should read

this table together with the consolidated financial information contained in our consolidated financial statements and related notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included

in our Annual Report on Form 10-K for the year ended December 31, 2015 and our Quarterly Report on Form 10-Q for the quarter ended March 31, 2016 that have been filed with the SEC and are incorporated by reference in this prospectus

supplement. Information as of March 31, 2016 and for the three-month periods ended March 31, 2016 and 2015, other than our financial ratios, has been derived from our unaudited interim consolidated financial statements and includes, in the

opinion of management, all adjustments, consisting of only normal recurring adjustments, necessary to present fairly the information therein. The results of operations for the three months ended March 31, 2016 are not necessarily indicative of

the results that may be expected for the full 2016 year or any future period.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At March 31,

2016

|

|

|

At December 31,

|

|

|

|

|

|

2015

|

|

|

2014

|

|

|

2013

|

|

|

2012

|

|

|

2011

|

|

|

|

|

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(In thousands)

|

|

|

Balance Sheet Data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets

|

|

$

|

3,234,376

|

|

|

$

|

3,130,343

|

|

|

$

|

2,721,494

|

|

|

$

|

2,399,892

|

|

|

$

|

2,108,290

|

|

|

$

|

2,022,407

|

|

|

Loans

|

|

|

2,309,152

|

|

|

|

2,248,183

|

|

|

|

1,804,819

|

|

|

|

1,477,937

|

|

|

|

1,147,384

|

|

|

|

985,859

|

|

|

Allowance for loan losses

|

|

|

27,524

|

|

|

|

27,256

|

|

|

|

23,221

|

|

|

|

20,848

|

|

|

|

18,624

|

|

|

|

16,572

|

|

|

Deposits

|

|

|

2,556,003

|

|

|

|

2,284,675

|

|

|

|

1,985,025

|

|

|

|

1,782,128

|

|

|

|

1,633,076

|

|

|

|

1,502,868

|

|

|

Borrowed funds

|

|

|

401,022

|

|

|

|

557,214

|

|

|

|

481,486

|

|

|

|

395,463

|

|

|

|

248,634

|

|

|

|

309,727

|

|

|

Stockholders’ equity

|

|

|

260,436

|

|

|

|

250,936

|

|

|

|

233,303

|

|

|

|

206,556

|

|

|

|

205,370

|

|

|

|

189,347

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At or For the

Three Months

Ended March 31,

|

|

|

At or For the Year Ended December 31,

|

|

|

|

|

2016

|

|

|

2015

|

|

|

2015

|

|

|

2014

|

|

|

2013

|

|

|

2012

|

|

|

2011

|

|

|

|

|

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Dollars in thousands, except per share amounts)

|

|

|

Income Statement Data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income

|

|

$

|

25,107

|

|

|

$

|

22,058

|

|

|

$

|

92,135

|

|

|

$

|

81,976

|

|

|

$

|

74,851

|

|

|

$

|

76,229

|

|

|

$

|

76,312

|

|

|

Interest expense

|

|

|

4,406

|

|

|

|

4,252

|

|

|

|

16,529

|

|

|

|

15,048

|

|

|

|

12,364

|

|

|

|

16,127

|

|

|

|

17,567

|

|

|

Net interest income

|

|

|

20,701

|

|

|

|

17,806

|

|

|

|

75,606

|

|

|

|

66,928

|

|

|

|

62,487

|

|

|

|

60,102

|

|

|

|

58,745

|

|

|

Provision for loan losses

|

|

|

253

|

|

|

|

411

|

|

|

|

4,317

|

|

|

|

3,189

|

|

|

|

2,997

|

|

|

|

3,628

|

|

|

|

4,061

|

|

|

Net income

|

|

|

7,430

|

|

|

|

6,485

|

|

|

|

25,890

|

|

|

|

23,014

|

|

|

|

21,300

|

|

|

|

20,393

|

|

|

|

19,457

|

|

|

|

|

|

|

|

|

|

Per Share Data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings

|

|

$

|

0.52

|

|

|

$

|

0.47

|

|

|

$

|

1.85

|

|

|

$

|

1.67

|

|

|

$

|

1.56

|

|

|

$

|

1.52

|

|

|

$

|

1.48

|

|

|

Diluted earnings

|

|

|

0.52

|

|

|

|

0.46

|

|

|

|

1.83

|

|

|

|

1.65

|

|

|

|

1.55

|

|

|

|

1.51

|

|

|

|

1.46

|

|

|

Cash Dividends Declared

|

|

|

0.20

|

|

|

|

0.19

|

|

|

|

0.78

|

|

|

|

0.72

|

|

|

|

0.68

|

|

|

|

0.64

|

|

|

|

0.60

|

|

|

Dividend Payout Ratio

|

|

|

38.46

|

%

|

|

|

41.30

|

%

|

|

|

42.62

|

%

|

|

|

43.64

|

%

|

|

|

43.87

|

%

|

|

|

42.38

|

%

|

|

|

41.10

|

%

|

|

Book Value

|

|

$

|

18.32

|

|

|

$

|

17.19

|

|

|

$

|

17.78

|

|

|

$

|

16.80

|

|

|

$

|

15.06

|

|

|

$

|

15.21

|

|

|

$

|

14.35

|

|

|

Tangible Book Value

|

|

|

18.31

|

|

|

|

17.17

|

|

|

|

17.76

|

|

|

|

16.78

|

|

|

|

15.05

|

|

|

|

15.19

|

|

|

|

14.34

|

|

S-8

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At or For the

Three Months

Ended March 31,

|

|

|

At or For the Year Ended December 31,

|

|

|

|

|

2016

|

|

|

2015

|

|

|

2015

|

|

|

2014

|

|

|

2013

|

|

|

2012

|

|

|

2011

|

|

|

|

|

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Dollars in thousands)

|

|

|

Average Balance Sheet Data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets

|

|

$

|

3,168,991

|

|

|

$

|

2,765,341

|

|

|

$

|

2,897,548

|

|

|

$

|

2,515,103

|

|

|

$

|

2,240,139

|

|

|

$

|

2,057,608

|

|

|

$

|

1,852,611

|

|

|

Loans

|

|

|

2,268,449

|

|

|

|

1,845,809

|

|

|

|

1,990,823

|

|

|

|

1,584,198

|

|

|

|

1,286,227

|

|

|

|

1,073,046

|

|

|

|

947,309

|

|

|

Allowance for loan losses

|

|

|

27,703

|

|

|

|

23,518

|

|

|

|

24,531

|

|

|

|

21,554

|

|

|

|

19,847

|

|

|

|

18,098

|

|

|

|

15,013

|

|

|

Deposits

|

|

|

2,420,476

|

|

|

|

2,028,684

|

|

|

|

2,215,883

|

|

|

|

1,922,172

|

|

|

|

1,747,888

|

|

|

|

1,578,233

|

|

|

|

1,439,647

|

|

|

Borrowed Funds

|

|

|

474,678

|

|

|

|

477,564

|

|

|

|

419,372

|

|

|

|

347,946

|

|

|

|

272,737

|

|

|

|

257,392

|

|

|

|

226,382

|

|

|

Stockholders’ equity

|

|

|

257,096

|

|

|

|

235,979

|

|

|

|

243,330

|

|

|

|

224,585

|

|

|

|

203,125

|

|

|

|

200,137

|

|

|

|

174,458

|

|

|

|

|

|

|

|

|

|

|

|

Financial Ratios(1):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Return on average assets

|

|

|

0.94

|

%

|

|

|

0.95

|

%

|

|

|

0.89

|

%

|

|

|

0.92

|

%

|

|

|

0.95

|

%

|

|

|

0.99

|

%

|

|

|

1.05

|

%

|

|

Return on average stockholders’ equity

|

|

|

11.62

|

%

|

|

|

11.15

|

%

|

|

|

10.64

|

%

|

|

|

10.25

|

%

|

|

|

10.49

|

%

|

|

|

10.19

|

%

|

|

|

11.15

|

%

|

|

Average stockholders’ equity to average assets

|

|

|

8.11

|

%

|

|

|

8.53

|

%

|

|

|

8.40

|

%

|

|

|

8.93

|

%

|

|

|

9.07

|

%

|

|

|

9.73

|

%

|

|

|

9.42

|

%

|

|

|

|

|

|

|

|

|

|

|

Asset Quality Ratios:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nonaccrual Loans

|

|

$

|

1,313

|

|

|

$

|

1,588

|

|

|

$

|

1,435

|

|

|

$

|

1,704

|

|

|

$

|

4,496

|

|

|

$

|

4,098

|

|

|

$

|

3,211

|

|

|

Nonaccrual Loans/Loans

|

|

|

0.06

|

%

|

|

|

0.08

|

%

|

|

|

0.06

|

%

|

|

|

0.09

|

%

|

|

|

0.30

|

%

|

|

|

0.36

|

%

|

|

|

0.33

|

%

|

|

Net Chargeoffs / Average Loans

|

|

|

0.00

|

%

|

|

|

0.01

|

%

|

|

|

0.01

|

%

|

|

|

0.05

|

%

|

|

|

0.06

|

%

|

|

|

0.15

|

%

|

|

|

0.16

|

%

|

|

Allowance for Loan Losses as a Percentage of Total Loans

|

|

|

1.19

|

%

|

|

|

1.25

|

%

|

|

|

1.21

|

%

|

|

|

1.29

|

%

|

|

|

1.41

|

%

|

|

|

1.62

|

%

|

|

|

1.68

|

%

|

|

Allowance for Loan Losses as a Multiple of Nonaccrual Loans

|

|

|

21.0

|

x

|

|

|

14.9

|

x

|

|

|

19.0

|

x

|

|

|

13.6

|

x

|

|

|

4.6

|

x

|

|

|

4.5

|

x

|

|

|

5.2

|

x

|

S-9

RISK FACTORS

Investing in our common stock involves risks. Before you decide to invest in our common stock, you should carefully consider all of the

information contained or incorporated by reference in this prospectus supplement and the accompanying prospectus, including the risk factors described below and those incorporated by reference from our most recent Annual Report on Form 10-K for the

fiscal year ended December 31, 2015, as updated by our Quarterly Reports on Form 10-Q and other filings we make with the SEC. Please refer to “Incorporation of Certain Documents by Reference” and “Where You Can Find More

Information” in this prospectus supplement for discussions of these other filings. In addition to the material risks and uncertainties described in those documents and in this prospectus supplement, there may be additional risks and

uncertainties of which management is not aware or focused on or that management deems immaterial. If any of these risks and uncertainties actually occur, our business, financial condition, liquidity, results of operations and prospects could be

materially and adversely affected. This could cause the market price of our common stock to decline, and you could lose all or part of your investment. This prospectus supplement and the accompanying prospectus are qualified in their entirety by

those risk factors.

Risks Related to this Offering and Ownership of Our Common Stock

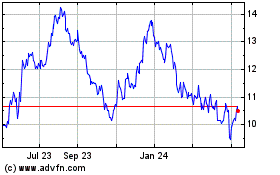

Historically, the price of our common stock has fluctuated significantly, which may make it difficult for you to resell shares of common

stock at prices you find attractive.

Historically, our stock price has fluctuated significantly. For example, in 2015, the high

sales price per share of our common stock on NASDAQ was $31.92 and the low sales price per share was $22.81. We expect that the market price of our common stock will continue to fluctuate and there can be no assurances about the market prices for

our common stock, which may make it difficult for you to resell shares of common stock at prices you find attractive.

Our stock price may

fluctuate as a result of a variety of factors, many of which are beyond our control. In addition to matters discussed in other risk factors contained or incorporated by reference herein, these factors include:

|

|

•

|

|

Actual or anticipated quarterly fluctuations in our results of operations, cash flows and financial condition;

|

|

|

•

|

|

Changes in expectations as to our future financial performance or buy/sell recommendations of securities analysts;

|

|

|

•

|

|

Speculation in the press or investment community regarding stock prices generally or relating to our reputation or the financial services industry;

|

|

|

•

|

|

Strategic actions by us or our competitors, such as acquisitions, restructurings, dispositions, financings and operating business practices;

|

|

|

•

|

|

Fluctuations in the stock price and operating results of our competitors;

|

|

|

•

|

|

Sales of our equity or equity-related securities;

|

|

|

•

|

|

Proposed or adopted regulatory changes or developments;

|

|

|

•

|

|

Anticipated or pending investigations, proceedings or litigation that involve or affect us;

|

|

|

•

|

|

Changes in global financial markets and global economies and general market conditions, such as interest or foreign exchange rates, stock, commodity or real estate valuations or volatility and other geopolitical,

regulatory or judicial events; and

|

|

|

•

|

|

General market conditions and, in particular, developments related to market conditions for the financial services industry.

|

S-10

We may issue additional equity or equity-related securities, or engage in other

transactions which dilute our book value or affect the priority of the common stock, which may adversely affect the market price of our common stock.

Our board of directors may determine from time to time to issue additional shares of our common stock or other equity or equity-related

securities. Except as described under “Underwriting,” we are not restricted from issuing additional shares of common stock, including securities that are convertible into or exchangeable for, or that represent the right to receive, common

stock. Because our decision to issue equity or equity-related securities in the future will depend on market conditions and other factors beyond our control, we cannot predict or estimate the amount, timing or nature of any future issuances, or the

prices, if any, at which any such issuances may be effected. Such issuances could be dilutive to common stockholders and could reduce the market price of our common stock. Holders of our common stock are not entitled to preemptive rights or other

protections against dilution. New investors also may have rights, preferences and privileges that are senior to, and that adversely affect, our then current common stockholders. If we raise additional capital by selling debt or preferred equity

securities, upon liquidation, holders of our debt securities and shares of preferred stock, and lenders with respect to other borrowings, will receive distributions of our available assets prior to the holders of our common stock.

We may reduce or eliminate the cash dividend on our common stock.

Holders of our common stock are only entitled to receive such cash dividends as our board of directors, in its sole and absolute discretion,

may declare out of funds legally available for such payments. Although we have historically declared cash dividends on our common stock and currently have no plans or intentions to reduce or eliminate our cash dividends, we are not required to

declare cash dividends and could reduce or eliminate our common stock cash dividends in the future. This could adversely affect the market price of our common stock. Our ability to pay dividends on our common stock may also be subject to our

compliance with covenants in any future debt agreements. Moreover, the issuance of any preferred stock or debt in the future may affect our ability to pay dividends on our common stock unless all interest on such debt or dividends on any such

preferred stock have been paid in full. Also, as a bank holding company, our ability to declare and pay dividends is dependent on certain federal regulatory considerations including the guidelines of the Federal Reserve Board regarding capital

adequacy and dividends. See “Market for Our Common Stock and Our Dividend Policy” for more information.

An investment in

our common stock is not an insured deposit and is not guaranteed by the Federal Deposit Insurance Corporation, so you could lose some or all of your investment.

Our common stock is not a bank deposit and, therefore, is not insured against loss by the Federal Deposit Insurance Corporation

(“FDIC”) or any other public or private entity. Investment in our common stock is inherently risky for the reasons described in this “Risk Factors” section, elsewhere in this prospectus supplement and the accompanying prospectus,

and the documents incorporated by reference in this prospectus, and is also subject to the same market forces that affect the common stock in any company. As a result, if you acquire our common stock, you may lose some or all of your investment.

Substantial regulatory limitations on changes of control and anti-takeover provisions in our certificate of incorporation and

bylaws may make it more difficult for you to receive a change in control premium.

With certain limited exceptions, federal

regulations prohibit a person or company or a group of persons deemed to be “acting in concert” from, directly or indirectly, acquiring more than 10% (5% if the acquiror is a bank holding company) of any class of our voting stock or

obtaining the ability to control in any manner the election of a majority of our directors or otherwise direct the management or policies of our company without prior notice or application to and the approval of the Federal Reserve Board.

In addition, our certificate of incorporation and bylaws contain a number of provisions relating to corporate governance and rights of

stockholders that might discourage future takeover attempts, including our Shareholder Protection Rights Plan. See “Description of the Securities—Description of Common Stock—Anti-Takeover

S-11

Effects of Certain Provisions of Our Certificate of Incorporation Our Bylaws and Federal and State Law” in the accompanying prospectus.

Risks Relating to Our Business

For risks

associated with our business and industry, see the section entitled “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2015, and our Quarterly Report on Form 10-Q for the period ended March 31, 2016,

which are incorporated in this prospectus supplement by reference, as the same may be updated from time to time prior to the completion of this offering by our future filings under the Securities Exchange Act of 1934 (the “Exchange Act”).

USE OF PROCEEDS

We expect to receive net proceeds from this offering of approximately $32.5 million (or $37.5 million if Sandler O’Neill exercises its

option to purchase additional shares in full) after deducting the underwriting discount and estimated expenses payable by us. We intend to use the net proceeds from this offering for general corporate purposes, including support for organic growth

and financing possible acquisitions of branches or fee-based businesses.

CAPITALIZATION

The following table shows our capitalization as of March 31, 2016 on an actual basis and on an as adjusted basis to give effect to the

receipt of the net proceeds from this offering.

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31, 2016

|

|

|

|

|

Actual

|

|

|

As

Adjusted(1)

|

|

|

|

|

(Dollars in thousands,

except per share data)

|

|

|

Stockholders’ Equity

|

|

|

|

|

|

|

|

|

|

Common stock ($0.10 par value; 40,000,000 shares authorized; 14,212,354 shares issued and

outstanding at March 31, 2016; 15,412,354 shares issued and outstanding, as adjusted(1)

|

|

$

|

1,421

|

|

|

$

|

1,541

|

|

|

Surplus

|

|

|

58,914

|

|

|

|

91,339

|

|

|

Retained earnings

|

|

|

189,646

|

|

|

|

189,646

|

|

|

Accumulated other comprehensive income

|

|

|

10,455

|

|

|

|

10,455

|

|

|

Total stockholders’ equity

|

|

|

260,436

|

|

|

|

292,981

|

|

|

|

|

|

|

The First of Long Island Corporation Capital Ratios

|

|

|

|

|

|

|

|

|

|

Total capital to risk weighted assets

|

|

|

14.21%

|

|

|

|

15.89

|

%

|

|

Tier I capital to risk weighted assets

|

|

|

12.95%

|

|

|

|

14.64

|

%

|

|

Common equity Tier 1 capital to risk weighted assets

|

|

|

12.95%

|

|

|

|

14.64

|

%

|

|

Tier I capital to average assets

|

|

|

7.92%

|

|

|

|

8.96

|

%

|

|

(1)

|

The number of common shares to be outstanding after the offering is based on actual shares outstanding as of March 31, 2016, and assumes that 1,200,000 shares of common stock are sold in the offering and that the

underwriter’s option to purchase additional shares is not exercised. In addition, the number of common shares to be outstanding on an as adjusted basis excludes, as of March 31, 2016, 213,862 shares subject to outstanding compensatory

stock options having a weighted average exercise price of $15.97 per share, 180,599 shares issuable pursuant to performance and service-based restricted stock units issued and outstanding, and 240,964 shares reserved for issuance pursuant to our

dividend reinvestment and stock purchase plan.

|

S-12

MARKET FOR OUR COMMON STOCK AND OUR DIVIDEND POLICY

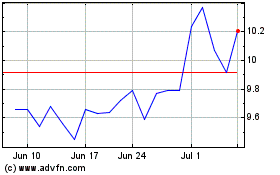

Our common stock is listed on NASDAQ under the symbol “FLIC.” As of May 4, 2016, we had 14,276,877 shares of common stock

outstanding, held of record by approximately 676 stockholders of record. The number of stockholders of record includes banks and brokers who act as nominees, each of whom may represent more than one shareholder. On May 4, 2016, the closing price of

our common stock was $29.52 per share.

The following table sets forth, for the periods indicated, the high and low sales prices per share

for the common stock as reported on NASDAQ and the cash dividends declared per common share, for the periods shown.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

High

|

|

|

Low

|

|

|

Dividend

Declared

|

|

|

Quarter Ended:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, 2016 (through May 4, 2016)

|

|

$

|

31.94

|

|

|

$

|

27.09

|

|

|

|

—

|

|

|

March 31, 2016

|

|

$

|

30.50

|

|

|

$

|

26.14

|

|

|

$

|

0.20

|

|

|

|

|

|

|

|

December 31, 2015

|

|

$

|

31.92

|

|

|

$

|

26.04

|

|

|

$

|

0.20

|

|

|

September 30, 2015

|

|

$

|

28.74

|

|

|

$

|

22.81

|

|

|

$

|

0.20

|

|

|

June 30, 2015

|

|

$

|

28.94

|

|

|

$

|

23.98

|

|

|

$

|

0.19

|

|

|

March 31, 2015

|

|

$

|

28.37

|

|

|

$

|

23.25

|

|

|

$

|

0.19

|

|

|

|

|

|

|

|

December 31, 2014

|

|

$

|

29.28

|

|

|

$

|

22.32

|

|

|

$

|

0.19

|

|

|

September 30, 2014

|

|

$

|

26.77

|

|

|

$

|

22.22

|

|

|

$

|

0.19

|

|

|

June 30, 2014

|

|

$

|

28.15

|

|

|

$

|

22.48

|

|

|

$

|

0.17

|

|

|

March 31, 2014

|

|

$

|

28.58

|

|

|

$

|

24.47

|

|

|

$

|

0.17

|

|

The amount of future dividends, if any, will be determined by our board of directors in its sole and absolute

discretion and will depend on our historical and anticipated earnings, liquidity and financial condition, regulatory capital levels, applicable law and regulation and other factors considered by the board of directors to be relevant. In addition,

the payment of cash dividends on the common stock will depend upon the ability of the Bank to declare and pay dividends to us. The Bank’s ability to pay dividends will depend primarily upon its earnings, liquidity and financial condition,

regulatory capital levels and need for funds, as well as applicable governmental policies. Even if we have earnings in an amount sufficient to pay dividends, the Bank’s board of directors may determine to retain earnings for the purpose of

funding growth or increasing capital levels.

There are various legal limitations with respect to the Bank’s ability to pay dividends

to us and our ability to pay dividends to stockholders. Under the New York Business Corporation Law, we may pay dividends on our outstanding shares except if we are insolvent or would be made insolvent by the dividend. Under federal banking law, the

prior approval of the Federal Reserve Board and the Office Comptroller of the Currency (the “OCC”) may be required in certain circumstances prior to the payment of dividends by us or the Bank. A national bank may generally declare a

dividend, without approval from the OCC, in an amount equal to its year-to-date net income plus the prior two years’ net income that is still available for dividends. The OCC has the authority to prohibit a national bank from paying dividends

if such payment is deemed to be an unsafe or unsound practice. In addition, as a depository institution the deposits of which are insured by the FDIC, the Bank may not pay dividends or distribute any of its capital assets while it remains in default

on any assessment due to the FDIC. The Bank currently is not (and never has been) in default under any of its obligations to the FDIC.

The Federal Reserve Board has issued a policy statement regarding the payment of dividends by bank holding companies. In general, the Federal

Reserve Board’s policy provides that dividends should be paid only out of current earnings and only if the prospective rate of earnings retention by the bank holding company appears consistent with the organization’s capital needs, asset

quality and overall financial condition. The Federal Reserve Board has the authority to prohibit us from paying dividends if such payment is deemed to be an unsafe or unsound practice.

S-13

DESCRIPTION OF OUR COMMON STOCK

Please refer to “Description of the Securities—Description of Common Stock” in the accompanying prospectus for a summary

description of our common stock being offered hereby, including the following: dividends, voting rights, events of liquidation, no preemptive rights, redemption and anti-takeover effects of certain provisions of our certificate of incorporation, our

bylaws and federal and state laws.

We are authorized to issue 40,000,000 shares of common stock, par value $0.10 per share. As of May 4,

2016, we had 14,276,877 shares of common stock outstanding. As of May 4, 2016, there were also 210,378 shares of common stock subject to outstanding compensatory stock options having a weighted average exercise price of $16.00 per share, 173,607

shares of common stock issuable pursuant to performance and service-based restricted stock units issued and outstanding, and 186,917 shares of common stock reserved for issuance pursuant to our dividend reinvestment and stock purchase plan.

UNDERWRITING

We are offering the shares of our common stock described in this prospectus supplement in an underwritten offering through Sandler

O’Neill. We have entered into an underwriting agreement with Sandler O’Neill with respect to the common stock being offered. Subject to the terms and conditions contained in the underwriting agreement, Sandler O’Neill has agreed to

purchase, at the public offering price less the underwriting discount set forth on the cover page of this prospectus supplement, all of the shares of common stock being offered by this prospectus supplement.

The underwriting agreement provides that Sandler O’Neill’s obligations to purchase shares of our common stock depends on the

satisfaction of the conditions contained in the underwriting agreement, including:

|

|

•

|

|

the representations and warranties made by us are true and our agreements have been performed;

|

|

|

•

|

|

there is no material adverse change in or affecting our business, financial condition, stockholders’ equity, liquidity, results of operations or prospects; and

|

|

|

•

|

|

we deliver customary closing documents.

|

Subject to these conditions, Sandler O’Neill is

committed to purchase and pay for all shares of our common stock offered by this prospectus supplement, if any such shares are taken. However, Sandler O’Neill is not obligated to take or pay for the shares of our common stock covered by its

purchase option described below, unless and until such option is exercised.

Purchase Option.

We have granted Sandler

O’Neill an option, exercisable no later than 30 days after the date of the underwriting agreement, to purchase up to an aggregate of 180,000 additional shares of common stock at the public offering price less the underwriting discount set forth

on the cover page of this prospectus supplement. We will be obligated to sell these shares of common stock to Sandler O’Neill to the extent such option is exercised.

Commissions and Expenses.

Sandler O’Neill proposes to offer our common stock directly to the public at the public offering

price set forth on the cover page of this prospectus supplement and to dealers at the public offering price less a concession not in excess of $0.93525 per share. After the public offering of our common stock, Sandler O’Neill may change the

offering price, concessions and other selling terms.

S-14

The following table shows the per share and total underwriting discount that we will pay to

Sandler O’Neill and the proceeds we will receive before expenses. These amounts are shown assuming both no exercise and full exercise of the underwriter’s option to purchase additional shares of our common stock.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Per Share

|

|

|

Total Without

Exercise

of Purchase

Option

|

|

|

Total With

Exercise of

Purchase

Option

|

|

|

Public offering price

|

|

$

|

29.00

|

|

|

$

|

34,800,000

|

|

|

$

|

40,020,000

|

|

|

Underwriting discount

|

|

$

|

1.55875

|

|

|

$

|

1,870,500

|

|

|

$

|

2,151,075

|

|

|

Proceeds to us before expenses

|

|

$

|

27.44125

|

|

|

$

|

32,929,500

|

|

|

$

|

37,868,925

|

|

We estimate that the total expenses of this offering, exclusive of the underwriting discount, will be

approximately $385,000, and are payable by us.

Indemnity.

We have agreed to indemnify Sandler O’Neill, and persons who

control Sandler O’Neill, against certain liabilities, including liabilities under the Securities Act of 1933, and to contribute to payments that Sandler O’Neill may be required to make in respect of these liabilities.

Lock-Up Agreement.

We, and each of our directors and executive officers, have agreed, for a period of 90 days after the date of

this prospectus supplement, not to, without the prior written consent of Sandler O’Neill, directly or indirectly offer, pledge, sell, grant any option, right or warrant to purchase or otherwise transfer or dispose of any shares of our common

stock or any securities convertible into or exercisable or exchangeable for our common stock, file, or cause to be filed, any registration statement under the Securities Act of 1933 with respect to any of the foregoing or enter into any swap or any

other agreement or any transaction that transfers, in whole or in part, directly or indirectly, the economic consequence of ownership of our common stock, whether such transaction would be settled by delivery of common stock or other securities, in

cash or otherwise.

Stabilization.

In connection with this offering, Sandler O’Neill may engage in stabilizing

transactions, over-allotment transactions and syndicate covering transactions.

|

|

•

|

|

Stabilizing transactions permit bids to purchase shares of common stock so long as the stabilizing bids do not exceed a specified maximum, and are engaged in for the purpose of preventing or retarding a decline in the

market price of the common stock while this offering is in progress.

|

|

|

•

|

|

Over-allotment transactions involve sales by Sandler O’Neill of shares of common stock in excess of the number of shares Sandler O’Neill is obligated to purchase. This creates a syndicate short position which

may be either a covered short position or a naked short position. In a covered short position, the number of shares of common stock over-allotted by Sandler O’Neill is not greater than the number of shares that it may purchase in its purchase

option. In a naked short position, the number of shares involved is greater than the number of shares in its purchase option. Sandler O’Neill may close out any short position by exercising its purchase option and/or by purchasing shares in the

open market.

|

|

|

•

|

|

Syndicate covering transactions involve purchases of common stock in the open market after this offering has been completed in order to cover syndicate short positions. In determining the source of shares to close out

the short position, Sandler O’Neill will consider, among other things, the price of shares available for purchase in the open market as compared with the price at which it may purchase shares through exercise of its purchase option. If Sandler

O’Neill sells more shares than could be covered by exercise of its purchase option and, therefore, has a naked short position, the position can be closed out only by buying shares in the open market. A naked short position is more likely to be

created if Sandler O’Neill is concerned that after pricing there could be downward pressure on the price of the shares in the open market that could adversely affect investors who purchase in this offering.

|

S-15

These stabilizing transactions and syndicate covering transactions may have the effect of raising

or maintaining the market price of our common stock or preventing or retarding a decline in the market price of our common stock. As a result, the price of our common stock in the open market may be higher than it would otherwise be in the absence

of these transactions. Neither we nor Sandler O’Neill make any representation or prediction as to the effect that the transactions described above may have on the market price of our common stock. These transactions may be effected on the

NASDAQ, in the over-the-counter market or otherwise and, if commenced, may be discontinued at any time.

Passive Market Making.

In connection with this offering, Sandler O’Neill and selected dealers, if any, who are qualified market makers on the NASDAQ, may engage in passive market making transactions in our common stock on the NASDAQ in accordance with Rule

103 of Regulation M under the Exchange Act. Rule 103 permits passive market making activity by the participants in this offering. Passive market making may occur before the pricing of this offering or before the commencement of offers or sales of

our common stock. Each passive market maker must comply with applicable volume and price limitations and must be identified as a passive market maker. In general, a passive market maker must display its bid at a price not in excess of the highest

independent bid for the security. If all independent bids are lowered below the bid of the passive market maker, however, the bid must then be lowered when purchase limits are exceeded. Net purchases by a passive market maker on each day are limited

to a specified percentage of the passive market maker’s average daily trading volume in the common stock during a specified period and must be discontinued when that limit is reached. Sandler O’Neill and other dealers are not required to

engage in passive market making and may end passive market making activities at any time.

Our Relationship with the

Underwriter.

Sandler O’Neill and some of its affiliates have performed and expect to continue to perform financial advisory and investment banking services for us in the ordinary course of their respective businesses, and may have

received, and may continue to receive, compensation for such services.

Our common stock is being offered by Sandler O’Neill, subject

to prior sale, when, as and if issued to and accepted by them, subject to approval of certain legal matters by counsel for Sandler O’Neill and other conditions.

TRANSFER AGENT

The Transfer Agent for our common stock is Continental Stock Transfer & Trust Company.

LEGAL MATTERS

The validity of the shares of common stock offered hereby and selected other legal matters in connection with the offering will be passed upon

for us by the law firm of Luse Gorman, PC, Washington, DC. Sidley Austin LLP, New York, New York, will act as counsel to the underwriter.

EXPERTS

The consolidated financial statements of The First of Long Island Corporation as of December 31, 2015 and 2014, and for each of the years

in the three-year period ended December 31, 2015, and the effectiveness of The First of Long Island Corporation’s internal control over financial reporting as of December 31, 2015 have been audited by Crowe Horwath LLP, an independent

registered public accounting firm, as set forth in its report, which is incorporated herein by reference. Such consolidated financial statements have been so incorporated in reliance upon the report of such firm given upon their authority as experts

in accounting and auditing.

S-16

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and other documents with the SEC. You may read and copy any document we file

at the SEC’s public reference room at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. Please call 1-800-SEC-0330 for further information on the operation of the public reference room. Our SEC filings are also available to you on the

SEC’s Internet site at http://www.sec.gov and on our website at https://www.fnbli.com. Information contained on our website or any other website is not incorporated by reference into and does not constitute part of this prospectus.

We have filed with the SEC a registration statement on Form S-3 relating to the securities covered by this prospectus supplement. This

prospectus summarizes material provisions of contracts and other documents that we refer you to. As permitted by the rules and regulations of the SEC, the registration statement that contains this prospectus includes additional information not

contained in this prospectus. Because this prospectus may not contain all the information that you may find important, you should review the full text of these documents. We have included copies of these documents as exhibits to our registration

statement of which this prospectus is a part.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

In this prospectus supplement, as permitted by law, we “incorporate by reference” information from other documents that we file with