UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

_______________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported) - February 1, 2016

|

The First of Long Island Corporation |

(Exact Name of Registrant as Specified in Charter)

|

New York |

001-32964 |

11-2672906 |

|

(State or Other Jurisdiction of Incorporation) |

(Commission File

Number) |

(IRS Employer Identification No.) |

|

10 Glen Head Road, Glen Head, New York |

|

11545 |

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant's telephone number, including area code - (516) 671-4900

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02. Results of Operations and Financial Condition

On February 1, 2016, The First of Long Island Corporation issued a press release disclosing material non-public information regarding the Corporation's financial condition as of December 31, 2015 and its results of operations for the twelve and three month periods then ended. The press release is furnished as Exhibit 99.1 to this Form 8-K filing.

Item 9.01. Financial Statements and Exhibits

Exhibit 99.1 - Press release dated February 1, 2016 regarding the Corporation's financial condition as of December 31, 2015 and its results of operations for the twelve and three month periods then ended.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

The First of Long Island Corporation |

|

|

(Registrant) |

|

|

|

|

Date: February 1, 2016 |

By: /s/ William Aprigliano |

|

|

William Aprigliano |

|

|

Senior Vice President & Chief Accounting Officer |

|

|

(principal accounting officer) |

1

Exhibit 99.1

|

February 1, 2016 |

|

For More Information Contact: |

| For Immediate Release |

|

Mark D. Curtis, EVP, CFO and Treasurer |

| |

|

(516) 671-4900, Ext. 585 |

THE FIRST OF LONG ISLAND CORPORATION

ANNOUNCES INCREASES IN NET INCOME AND EPS

FOR THE YEAR AND THREE MONTHS ENDED DECEMBER 31, 2015

Glen Head, New York, February 1, 2016 (GLOBE NEWSWIRE) – The First of Long Island Corporation (Nasdaq: FLIC), the parent company of The First National Bank of Long Island, reported increases in net income and earnings per share for the year and three months ended December 31, 2015. In the highlights that follow, all comparisons are of the current year or three month period to the same period last year.

FULL YEAR 2015 HIGHLIGHTS

| |

● |

Net Income increased 12.5% to $25.9 million from $23.0 million |

| |

|

|

| |

● |

EPS increased 10.9% to $1.83 from $1.65 |

| |

|

|

| |

● |

Cash Dividends Per Share increased 8.3% to $.78 from $.72 |

| |

|

|

| |

● |

Total Assets exceeded $3.1 billion at year end |

| |

|

|

| |

● |

25.7% growth in the average balance of Loans |

| |

|

|

| |

● |

15.5% growth in the average balance of Noninterest-Bearing Checking Deposits |

| |

|

|

| |

● |

15.3% growth in the average balance of Total Deposits |

FOURTH QUARTER HIGHLIGHTS

| |

● |

Net Income increased 21.2% to $6.6 million from $5.5 million |

| |

|

|

| |

● |

EPS increased 17.9% to $.46 from $.39 |

| |

|

|

| |

● |

Cash Dividends Per Share increased 5.3% to $.20 from $.19 |

| |

|

|

| |

● |

The Mortgage Loan Pipeline remained strong at $117 million at quarter end |

| |

|

|

| |

● |

The Credit Quality of the Bank’s loan and securities portfolios remains excellent |

Analysis of 2015 Earnings

Net income for 2015 increased $2.9 million over 2014. The increase is attributable to increases in net interest income of $8.7 million, or 13.0%, and noninterest income, before securities gains, of $174,000, or 2.4%. The positive impact of these items on earnings was partially offset by an increase in noninterest expense, before debt extinguishment costs, of $3.6 million, or 8.5%, and increases in the provision for loan losses and income tax expense of $1.1 million and $1.4 million, respectively.

The increase in net interest income was driven by growth in average interest-earning assets of $365.6 million, or 15.0%, which is primarily comprised of growth in the average balances of loans of $406.6 million, or 25.7%, and nontaxable securities of $23.9 million, or 5.8%, partially offset by a decrease in the average balance of taxable securities of $68.8 million, or 16.2%. The growth in the average balance of loans includes growth in commercial and industrial loans of $11.3 million, or 14.8%, a large portion of which resulted from the Bank’s small business credit scored loan initiative. The shift from taxable securities to better yielding loans and nontaxable securities partially mitigated the negative impact on net interest income of a low interest rate environment. The growth in loans and nontaxable securities of $406.6 million and $23.9 million, respectively, to the extent not funded by the decline in taxable securities of $68.8 million, was funded by growth in the average balances of noninterest-bearing checking deposits of $99.0 million, or 15.5%, interest-bearing deposits of $194.7 million, or 15.1%, and long-term debt of $64.5 million, or 21.5%. The increase in long-term debt resulted from management’s desire to reduce the impact that an eventual increase in interest rates could have on the Bank’s earnings.

Intermediate and long-term interest rates remain low and volatile. In a low interest rate environment: (1) loans are sometimes originated and investments are sometimes made at yields lower than existing portfolio yields; (2) some loans prepay in full resulting in the immediate writeoff of deferred costs while the rates on other loans are modified downward; (3) prepayment speeds on mortgage securities are elevated resulting in the faster amortization of purchase premiums; (4) the benefit of no cost funding in the form of noninterest-bearing checking deposits and capital is suppressed; and (5) the Bank’s ability to reduce deposit rates diminishes. These factors are primarily responsible for a 9 basis point decline in net interest margin and a 6 basis point decline in net interest spread when comparing 2015 to 2014. These factors also explain why strong growth in the average balance of loans of 25.7% was accompanied by lesser growth of 13.0% in net interest income. Although net interest margin declined when comparing 2015 to 2014, it was relatively stable throughout 2015 amounting to 2.91% in quarter one, 2.94% in quarters two and three and 2.98% in quarter four.

The $174,000 increase in noninterest income before securities gains is primarily attributable to real estate and sales tax refunds of $204,000 and $91,000, respectively, an increase in cash value accretion on bank-owned life insurance of $359,000 and an increase in merchant services income of $76,000. The positive impact of these items was partially offset by a decrease in service charges on deposit accounts of $397,000 resulting largely from a decrease in deposit account overdraft activity and a net gain of $165,000 during 2014 on the sale of loans held-for-sale. Cash value accretion increased primarily because of a fourth quarter 2014 purchase of bank-owned life insurance with an initial cash value of $16.9 million. Also contributing to the increase in noninterest income was the successful deployment in recent years of a variety of noninterest income initiatives including debit cards, ATM banking and merchant services as noted above. Total income from these initiatives grew to $834,000 in 2015 compared to $715,000 in 2014.

The increase in noninterest expense, before debt extinguishment costs, of $3.6 million is primarily attributable to an increase in salaries of $1.8 million, or 9.5%, an increase in employee benefits expense of $1.2 million, or 24.6%, a growth-related increase in the combined amount of FDIC insurance expense and the Bank’s OCC assessment of $250,000 and a one-time charge of $77,000 resulting from the termination of certain network and communication-related contracts. The impact of these items was partially offset by a decrease in occupancy and equipment expense of $82,000. The increase in salaries is primarily due to new branch openings, additions to staff in the back office and normal annual salary adjustments, partially offset by lower stock-based compensation expense. The decrease in stock-based compensation expense is mainly attributable to stock awards granted in the fourth quarter of 2014 with a value of $358,000 that vested immediately. The increase in employee benefits expense is largely due to an increase in incentive compensation cost, an increase in payroll tax expense resulting from additions to staff, an increase in group health insurance expense resulting from increases in staff count and the rates being paid for group health insurance and an increase in supplemental executive retirement expense. The decrease in occupancy and equipment expense is primarily attributable to a decrease in maintenance and repairs expense, mostly offset by increases in rent, real estate taxes and depreciation of newly-opened branches and expanded back-office space. Over the last two years, the Bank opened six new branches, relocated an existing branch to a larger facility and significantly expanded its loan operations department.

During the second quarter of 2015 the Bank completed a deleveraging transaction that involved the sale of $61.8 million of available-for-sale securities at a gain of $995,000 and utilization of the resulting proceeds to prepay $63.5 million of long-term debt at a cost of $1,084,000. The primary purpose of the transaction was to reduce the size of the Corporation’s balance sheet by eliminating inefficient leverage and thereby provide capital to accommodate future growth.

The $1.4 million increase in income tax expense is attributable to an increase in pretax earnings and changes in New York City income tax law effective January 1, 2015, partially offset by changes in New York State tax law also effective January 1, 2015. The changes in New York City income tax law resulted in a one-time charge of $402,000 to establish a New York City deferred income tax liability as of the effective date of the legislation and an increase in income tax expense of $41,000 for the period.

Analysis of Earnings – Fourth Quarter 2015 Versus Fourth Quarter 2014

Net income for the fourth quarter of 2015 was $6.6 million, an increase of 21.2% over $5.5 million earned in the same quarter last year. The increase is primarily attributable to an increase in net interest income of $3.1 million, or 18.2%, net gains on sales of securities of $191,000 and a decrease in occupancy and equipment expense of $274,000. The positive impact on earnings of these items was partially offset by increases in salaries of $143,000, employee benefits expense of $395,000, other noninterest expense of $257,000, the provision for loan losses of $870,000 and income tax expense of $751,000. The increases in net interest income, salaries, employee benefits expense, other noninterest expense and income tax expense and the decrease in occupancy and equipment expense occurred for substantially the same reasons discussed above with respect to the full year periods. The increase in the provision for loan losses was primarily attributable to the fact that the fourth quarter of 2014 included a decline in average annualized historical losses and an improvement in economic conditions.

Asset Quality

The Bank’s allowance for loan losses to total loans (reserve coverage ratio) decreased by 8 basis points from 1.29% at year-end 2014 to 1.21% at December 31, 2015. The decrease in the reserve coverage ratio is primarily due to a continued improvement in economic conditions, partially offset by an increase in specific reserves on loans individually deemed to be impaired.

The $4.3 million provision for loan losses for 2015 is primarily attributable to loan growth, a $368,000 increase in specific reserves on loans individually deemed to be impaired and $282,000 of net chargeoffs, partially offset by a continued improvement in economic conditions. The $3.2 million provision for loan losses for 2014 was primarily attributable to loan growth and net chargeoffs, partially offset by an improvement in economic conditions, a reduction in watch, special mention and substandard loans and a decrease in specific reserves on loans individually deemed to be impaired.

The credit quality of the Bank’s loan portfolio remains excellent. Nonaccrual loans amounted to $1.4 million, or .06% of total loans outstanding, at December 31, 2015, compared to $1.7 million, or .09%, at December 31, 2014. The decrease in nonaccrual loans is primarily attributable to paydowns and loan sales. Troubled debt restructurings increased during 2015 to $4.5 million at year end. Of this amount, $3.6 million are performing in accordance with their modified terms and $900,000 are nonaccrual and included in the aforementioned amount of nonaccrual loans. Loans past due 30 through 89 days amounted to $1.0 million, or .04% of total loans outstanding, at December 31, 2015, compared to $2.2 million, or .12%, at December 31, 2014. Management does not believe that the increase in troubled debt restructurings is indicative of deterioration in the overall credit quality of the Bank’s loan portfolio as the increase was attributed to one lending relationship.

The credit quality of the Bank’s securities portfolio also remains excellent. The Bank’s mortgage securities are backed by mortgages underwritten on conventional terms, with 69% of these securities being full faith and credit obligations of the U.S. government and the balance being obligations of U.S. government sponsored entities. The remainder of the Bank’s securities portfolio principally consists of high quality, general obligation municipal securities rated AA or better by major rating agencies. In selecting municipal securities for purchase, the Bank uses credit agency ratings for screening purposes only and then performs its own credit analysis. On an ongoing basis, the Bank periodically assesses the credit strength of the municipal securities in its portfolio and makes decisions to hold or sell based on such assessments.

Capital

The Corporation’s Tier 1 leverage, Common Equity Tier 1 risk-based, Tier 1 risk-based and Total risk-based capital ratios were approximately 8.0%, 12.9%, 12.9% and 14.2%, respectively, at December 31, 2015. The strength of the Corporation’s balance sheet positions the Corporation for continued growth in a measured and disciplined fashion.

Key Strategic Initiatives

Key strategic initiatives will continue to include loan and deposit growth through effective relationship management, targeted solicitation efforts, new product offerings and continued expansion of the Bank’s branch distribution system. With respect to loan growth, the Bank plans to continue to prudently manage concentration risk and further develop its broker and correspondent relationships. All loans originated through such relationships are underwritten by Bank personnel. The Bank’s branch distribution system currently consists of 43 branches located in Nassau and Suffolk Counties, Long Island, the borough of Queens and Manhattan. The Bank anticipates opening two new branches during 2016 and on an ongoing basis continues to evaluate sites for further branch expansion. In addition to loan and deposit growth, management will also continue to focus on growing noninterest income from existing and potential new sources.

Challenges We Face

The federal funds target rate increased by twenty-five basis points in December. Further increases could exert upward pressure on non-maturity deposit rates. Intermediate and long-term interest rates are low and volatile and impacted by both national and global forces. Such rates could remain low for the foreseeable future and thereby cause both investing and lending rates to be suboptimal. There is significant price competition for loans in the Bank’s marketplace and little room for the Bank to further reduce its deposit rates. Higher yielding loans continue to prepay and are replaced with lower yielding loans and there is an ongoing need, from an interest rate risk perspective, to term-fund a portion of the Bank’s loan growth with time deposits and wholesale borrowings. In the current interest rate environment, the spread between lending rates and term-funding rates is relatively small. These factors will make it difficult to improve net interest margin and could result in a decline in net interest margin from its current level and inhibit earnings growth for the foreseeable future.

The banking industry continues to be faced with new and complex regulatory requirements and enhanced supervisory oversight. These factors are exerting downward pressure on revenues and upward pressure on required capital levels and the cost of doing business.

CONSOLIDATED BALANCE SHEETS

(Unaudited)

| |

|

12/31/15 |

|

|

12/31/14 |

|

| |

|

(in thousands) |

|

| |

|

|

|

|

|

|

|

|

|

Assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

39,635 |

|

|

$ |

32,944 |

|

| |

|

|

|

|

|

|

|

|

|

Investment securities: |

|

|

|

|

|

|

|

|

|

Held-to-maturity, at amortized cost (fair value of $14,910 and $22,870) |

|

|

14,371 |

|

|

|

21,833 |

|

|

Available-for-sale, at fair value |

|

|

737,700 |

|

|

|

774,145 |

|

| |

|

|

752,071 |

|

|

|

795,978 |

|

| |

|

|

|

|

|

|

|

|

|

Loans held-for-sale |

|

|

105 |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

Loans: |

|

|

|

|

|

|

|

|

|

Commercial and industrial |

|

|

93,056 |

|

|

|

77,140 |

|

|

Secured by real estate: |

|

|

|

|

|

|

|

|

|

Commercial mortgages |

|

|

1,036,331 |

|

|

|

858,975 |

|

|

Residential mortgages |

|

|

1,025,215 |

|

|

|

779,994 |

|

|

Home equity lines |

|

|

87,848 |

|

|

|

83,109 |

|

|

Consumer and other |

|

|

5,733 |

|

|

|

5,601 |

|

| |

|

|

2,248,183 |

|

|

|

1,804,819 |

|

|

Allowance for loan losses |

|

|

(27,256 |

) |

|

|

(23,221 |

) |

| |

|

|

2,220,927 |

|

|

|

1,781,598 |

|

| |

|

|

|

|

|

|

|

|

|

Restricted stock, at cost |

|

|

28,435 |

|

|

|

23,304 |

|

|

Bank premises and equipment, net |

|

|

30,330 |

|

|

|

27,854 |

|

|

Bank-owned life insurance |

|

|

32,447 |

|

|

|

31,568 |

|

|

Pension plan assets, net |

|

|

14,337 |

|

|

|

16,421 |

|

|

Other assets |

|

|

12,056 |

|

|

|

11,827 |

|

| |

|

$ |

3,130,343 |

|

|

$ |

2,721,494 |

|

|

Liabilities: |

|

|

|

|

|

|

|

|

|

Deposits: |

|

|

|

|

|

|

|

|

|

Checking |

|

$ |

777,994 |

|

|

$ |

655,753 |

|

|

Savings, NOW and money market |

|

|

1,195,968 |

|

|

|

1,000,325 |

|

|

Time, $100,000 and over |

|

|

198,147 |

|

|

|

208,745 |

|

|

Time, other |

|

|

112,566 |

|

|

|

120,202 |

|

| |

|

|

2,284,675 |

|

|

|

1,985,025 |

|

| |

|

|

|

|

|

|

|

|

|

Short-term borrowings |

|

|

211,502 |

|

|

|

136,486 |

|

|

Long-term debt |

|

|

365,712 |

|

|

|

345,000 |

|

|

Accrued expenses and other liabilities |

|

|

12,313 |

|

|

|

13,247 |

|

|

Deferred income taxes payable |

|

|

5,205 |

|

|

|

8,433 |

|

| |

|

|

2,879,407 |

|

|

|

2,488,191 |

|

|

Stockholders' Equity: |

|

|

|

|

|

|

|

|

|

Common stock, par value $.10 per share: |

|

|

|

|

|

|

|

|

|

Authorized, 40,000,000 shares |

|

|

|

|

|

|

|

|

|

Issued and outstanding, 14,116,677 and 13,887,134 shares |

|

|

1,412 |

|

|

|

1,389 |

|

|

Surplus |

|

|

56,931 |

|

|

|

51,009 |

|

|

Retained earnings |

|

|

185,069 |

|

|

|

170,120 |

|

| |

|

|

243,412 |

|

|

|

222,518 |

|

|

Accumulated other comprehensive income, net of tax |

|

|

7,524 |

|

|

|

10,785 |

|

| |

|

|

250,936 |

|

|

|

233,303 |

|

| |

|

$ |

3,130,343 |

|

|

$ |

2,721,494 |

|

CONSOLIDATED STATEMENTS OF INCOME

(Unaudited)

| |

|

Twelve Months Ended |

|

|

Three Months Ended |

|

| |

|

12/31/15 |

|

|

12/31/14 |

|

|

12/31/15 |

|

|

12/31/14 |

|

| |

|

(dollars in thousands) |

|

|

Interest and dividend income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans |

|

$ |

70,558 |

|

|

$ |

59,209 |

|

|

$ |

19,230 |

|

|

$ |

15,588 |

|

|

Investment securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxable |

|

|

7,991 |

|

|

|

9,359 |

|

|

|

1,875 |

|

|

|

2,214 |

|

|

Nontaxable |

|

|

13,586 |

|

|

|

13,408 |

|

|

|

3,402 |

|

|

|

3,405 |

|

| |

|

|

92,135 |

|

|

|

81,976 |

|

|

|

24,507 |

|

|

|

21,207 |

|

|

Interest expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Savings, NOW and money market deposits |

|

|

2,564 |

|

|

|

1,955 |

|

|

|

724 |

|

|

|

523 |

|

|

Time deposits |

|

|

5,987 |

|

|

|

6,171 |

|

|

|

1,422 |

|

|

|

1,632 |

|

|

Short-term borrowings |

|

|

183 |

|

|

|

148 |

|

|

|

70 |

|

|

|

24 |

|

|

Long-term debt |

|

|

7,795 |

|

|

|

6,774 |

|

|

|

1,918 |

|

|

|

1,785 |

|

| |

|

|

16,529 |

|

|

|

15,048 |

|

|

|

4,134 |

|

|

|

3,964 |

|

|

Net interest income |

|

|

75,606 |

|

|

|

66,928 |

|

|

|

20,373 |

|

|

|

17,243 |

|

|

Provision for loan losses |

|

|

4,317 |

|

|

|

3,189 |

|

|

|

1,915 |

|

|

|

1,045 |

|

|

Net interest income after provision for loan losses |

|

|

71,289 |

|

|

|

63,739 |

|

|

|

18,458 |

|

|

|

16,198 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Noninterest income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment Management Division income |

|

|

2,044 |

|

|

|

2,058 |

|

|

|

496 |

|

|

|

501 |

|

|

Service charges on deposit accounts |

|

|

2,577 |

|

|

|

2,974 |

|

|

|

596 |

|

|

|

671 |

|

|

Net gains on sales of securities |

|

|

1,324 |

|

|

|

141 |

|

|

|

191 |

|

|

|

- |

|

|

Other |

|

|

2,813 |

|

|

|

2,228 |

|

|

|

617 |

|

|

|

557 |

|

| |

|

|

8,758 |

|

|

|

7,401 |

|

|

|

1,900 |

|

|

|

1,729 |

|

|

Noninterest expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Salaries |

|

|

20,680 |

|

|

|

18,885 |

|

|

|

5,546 |

|

|

|

5,403 |

|

|

Employee benefits |

|

|

6,021 |

|

|

|

4,833 |

|

|

|

1,674 |

|

|

|

1,279 |

|

|

Occupancy and equipment |

|

|

8,798 |

|

|

|

8,880 |

|

|

|

2,159 |

|

|

|

2,433 |

|

|

Debt extinguishment |

|

|

1,084 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Other |

|

|

10,108 |

|

|

|

9,433 |

|

|

|

2,741 |

|

|

|

2,484 |

|

| |

|

|

46,691 |

|

|

|

42,031 |

|

|

|

12,120 |

|

|

|

11,599 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before income taxes |

|

|

33,356 |

|

|

|

29,109 |

|

|

|

8,238 |

|

|

|

6,328 |

|

|

Income tax expense |

|

|

7,466 |

|

|

|

6,095 |

|

|

|

1,620 |

|

|

|

869 |

|

|

Net Income |

|

$ |

25,890 |

|

|

$ |

23,014 |

|

|

$ |

6,618 |

|

|

$ |

5,459 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Share and Per Share Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted Average Common & |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Equivalent Shares |

|

|

14,174,840 |

|

|

|

13,954,587 |

|

|

|

14,278,302 |

|

|

|

14,019,735 |

|

|

Basic EPS |

|

$ |

1.85 |

|

|

$ |

1.67 |

|

|

$ |

.47 |

|

|

$ |

.39 |

|

|

Diluted EPS |

|

$ |

1.83 |

|

|

$ |

1.65 |

|

|

$ |

.46 |

|

|

$ |

.39 |

|

|

Cash Dividends Declared |

|

$ |

.78 |

|

|

$ |

.72 |

|

|

$ |

.20 |

|

|

$ |

.19 |

|

FINANCIAL RATIOS

(Unaudited)

|

ROA |

|

|

.89 |

% |

|

|

.92 |

% |

|

|

.86 |

% |

|

|

.82 |

% |

|

ROE |

|

|

10.64 |

% |

|

|

10.25 |

% |

|

|

10.22 |

% |

|

|

9.27 |

% |

|

Net Interest Margin |

|

|

2.94 |

% |

|

|

3.03 |

% |

|

|

2.98 |

% |

|

|

2.97 |

% |

|

Dividend Payout Ratio |

|

|

42.62 |

% |

|

|

43.64 |

% |

|

|

43.48 |

% |

|

|

48.72 |

% |

PROBLEM AND POTENTIAL PROBLEM LOANS AND ASSETS

(Unaudited)

| |

|

12/31/15 |

|

|

12/31/14 |

|

| |

|

(in thousands) |

|

| |

|

|

|

|

|

|

|

|

|

Loans, excluding troubled debt restructurings: |

|

|

|

|

|

|

|

|

|

Past due 30 through 89 days |

|

$ |

1,003 |

|

|

$ |

2,186 |

|

|

Past due 90 days or more and still accruing |

|

|

- |

|

|

|

- |

|

|

Nonaccrual (includes $105,000 in loans held-for-sale at 12/31/15) |

|

|

535 |

|

|

|

424 |

|

| |

|

|

1,538 |

|

|

|

2,610 |

|

|

Troubled debt restructurings: |

|

|

|

|

|

|

|

|

|

Performing according to their modified terms |

|

|

3,581 |

|

|

|

704 |

|

|

Past due 30 through 89 days |

|

|

- |

|

|

|

- |

|

|

Past due 90 days or more and still accruing |

|

|

- |

|

|

|

- |

|

|

Nonaccrual |

|

|

900 |

|

|

|

1,280 |

|

| |

|

|

4,481 |

|

|

|

1,984 |

|

|

Total past due, nonaccrual and restructured loans: |

|

|

|

|

|

|

|

|

|

Restructured and performing according to their modified terms |

|

|

3,581 |

|

|

|

704 |

|

|

Past due 30 through 89 days |

|

|

1,003 |

|

|

|

2,186 |

|

|

Past due 90 days or more and still accruing |

|

|

- |

|

|

|

- |

|

|

Nonaccrual |

|

|

1,435 |

|

|

|

1,704 |

|

| |

|

|

6,019 |

|

|

|

4,594 |

|

|

Other real estate owned |

|

|

- |

|

|

|

- |

|

| |

|

$ |

6,019 |

|

|

$ |

4,594 |

|

| |

|

|

|

|

|

|

|

|

|

Allowance for loan losses |

|

$ |

27,256 |

|

|

$ |

23,221 |

|

|

Allowance for loan losses as a percentage of total loans |

|

|

1.21 |

% |

|

|

1.29 |

% |

|

Allowance for loan losses as a multiple of nonaccrual loans |

|

19.0x |

|

|

13.6x |

|

AVERAGE BALANCE SHEET, INTEREST RATES AND INTEREST DIFFERENTIAL

(Unaudited)

| |

|

Twelve Months Ended December 31, |

|

| |

|

2015 |

|

|

2014 |

|

| |

|

Average

Balance |

|

|

Interest/

Dividends |

|

|

Average

Rate |

|

|

Average

Balance |

|

|

Interest/

Dividends |

|

|

Average

Rate |

|

|

Assets: |

|

(in thousands) |

|

|

Interest-bearing bank balances |

|

$ |

20,568 |

|

|

$ |

52 |

|

|

|

.25 |

% |

|

$ |

16,675 |

|

|

$ |

36 |

|

|

|

.22 |

% |

|

Investment securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxable |

|

|

355,177 |

|

|

|

7,939 |

|

|

|

2.24 |

|

|

|

423,929 |

|

|

|

9,323 |

|

|

|

2.20 |

|

|

Nontaxable (1) |

|

|

438,835 |

|

|

|

20,585 |

|

|

|

4.69 |

|

|

|

414,972 |

|

|

|

20,315 |

|

|

|

4.90 |

|

|

Loans (1) |

|

|

1,990,823 |

|

|

|

70,572 |

|

|

|

3.54 |

|

|

|

1,584,198 |

|

|

|

59,224 |

|

|

|

3.74 |

|

|

Total interest-earning assets |

|

|

2,805,403 |

|

|

|

99,148 |

|

|

|

3.53 |

|

|

|

2,439,774 |

|

|

|

88,898 |

|

|

|

3.64 |

|

|

Allowance for loan losses |

|

|

(24,531 |

) |

|

|

|

|

|

|

|

|

|

|

(21,554 |

) |

|

|

|

|

|

|

|

|

|

Net interest-earning assets |

|

|

2,780,872 |

|

|

|

|

|

|

|

|

|

|

|

2,418,220 |

|

|

|

|

|

|

|

|

|

|

Cash and due from banks |

|

|

28,665 |

|

|

|

|

|

|

|

|

|

|

|

26,608 |

|

|

|

|

|

|

|

|

|

|

Premises and equipment, net |

|

|

29,011 |

|

|

|

|

|

|

|

|

|

|

|

26,429 |

|

|

|

|

|

|

|

|

|

|

Other assets |

|

|

59,000 |

|

|

|

|

|

|

|

|

|

|

|

43,846 |

|

|

|

|

|

|

|

|

|

| |

|

$ |

2,897,548 |

|

|

|

|

|

|

|

|

|

|

$ |

2,515,103 |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders' Equity: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Savings, NOW & money market deposits |

|

$ |

1,159,573 |

|

|

|

2,564 |

|

|

|

.22 |

|

|

$ |

972,136 |

|

|

|

1,955 |

|

|

|

.20 |

|

|

Time deposits |

|

|

320,626 |

|

|

|

5,987 |

|

|

|

1.87 |

|

|

|

313,318 |

|

|

|

6,171 |

|

|

|

1.97 |

|

|

Total interest-bearing deposits |

|

|

1,480,199 |

|

|

|

8,551 |

|

|

|

.58 |

|

|

|

1,285,454 |

|

|

|

8,126 |

|

|

|

.63 |

|

|

Short-term borrowings |

|

|

55,134 |

|

|

|

183 |

|

|

|

.33 |

|

|

|

48,220 |

|

|

|

148 |

|

|

|

.31 |

|

|

Long-term debt |

|

|

364,238 |

|

|

|

7,795 |

|

|

|

2.14 |

|

|

|

299,726 |

|

|

|

6,774 |

|

|

|

2.26 |

|

|

Total interest-bearing liabilities |

|

|

1,899,571 |

|

|

|

16,529 |

|

|

|

.87 |

|

|

|

1,633,400 |

|

|

|

15,048 |

|

|

|

.92 |

|

|

Checking deposits |

|

|

735,684 |

|

|

|

|

|

|

|

|

|

|

|

636,718 |

|

|

|

|

|

|

|

|

|

|

Other liabilities |

|

|

18,963 |

|

|

|

|

|

|

|

|

|

|

|

20,400 |

|

|

|

|

|

|

|

|

|

| |

|

|

2,654,218 |

|

|

|

|

|

|

|

|

|

|

|

2,290,518 |

|

|

|

|

|

|

|

|

|

|

Stockholders' equity |

|

|

243,330 |

|

|

|

|

|

|

|

|

|

|

|

224,585 |

|

|

|

|

|

|

|

|

|

| |

|

$ |

2,897,548 |

|

|

|

|

|

|

|

|

|

|

$ |

2,515,103 |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest income (1) |

|

|

|

|

|

$ |

82,619 |

|

|

|

|

|

|

|

|

|

|

$ |

73,850 |

|

|

|

|

|

|

Net interest spread (1) |

|

|

|

|

|

|

|

|

|

|

2.66 |

% |

|

|

|

|

|

|

|

|

|

|

2.72 |

% |

|

Net interest margin (1) |

|

|

|

|

|

|

|

|

|

|

2.94 |

% |

|

|

|

|

|

|

|

|

|

|

3.03 |

% |

(1) Tax-equivalent basis. Interest income on a tax-equivalent basis includes the additional amount of interest income that would have been earned if the Corporation's investment in tax-exempt loans and investment securities had been made in loans and investment securities subject to Federal income taxes yielding the same after-tax income. The tax-equivalent amount of $1.00 of nontaxable income was $1.52 in each period presented, based on a Federal income tax rate of 34%.

Forward Looking Information

This earnings release contains various “forward-looking statements” within the meaning of that term as set forth in Rule 175 of the Securities Act of 1933 and Rule 3b-6 of the Securities Exchange Act of 1934. Such statements are generally contained in sentences including the words “may” or “expect” or “could” or “should” or “would” or “believe”. The Corporation cautions that these forward-looking statements are subject to numerous assumptions, risks and uncertainties that could cause actual results to differ materially from those contemplated by the forward-looking statements. Factors that could cause future results to vary from current management expectations include, but are not limited to, changing economic conditions; legislative and regulatory changes; monetary and fiscal policies of the federal government; changes in interest rates; deposit flows and the cost of funds; demands for loan products; competition; changes in management’s business strategies; changes in accounting principles, policies or guidelines; changes in real estate values; and other factors discussed in the “risk factors” section of the Corporation’s filings with the Securities and Exchange Commission. The forward-looking statements are made as of the date of this report, and the Corporation assumes no obligation to update the forward-looking statements or to update the reasons why actual results could differ from those projected in the forward-looking statements.

For more detailed financial information please see the Corporation’s annual report on Form 10-K for the year ended December 31, 2015. The Form 10-K will be available through the Bank’s website at www.fnbli.com on or about March 15, 2016, after it is electronically filed with the Securities and Exchange Commission (“SEC”). Our SEC filings are also available on the SEC’s website at www.sec.gov. You may also read and copy any document we file with the SEC at the SEC’s public reference room at 100 F Street, N.E., Room 1580, Washington, DC 20549. You should call 1-800-SEC-0330 for more information on the public reference room.

9

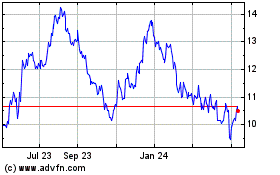

First of Long Island (NASDAQ:FLIC)

Historical Stock Chart

From Mar 2024 to Apr 2024

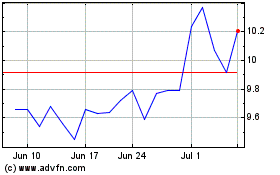

First of Long Island (NASDAQ:FLIC)

Historical Stock Chart

From Apr 2023 to Apr 2024