Fifth Third Bank Extends More Than $12 Billion in Credit to Business Customers

April 27 2016 - 9:42AM

Business Wire

In the first quarter of 2016, Fifth Third Bank (NASDAQ: FITB)

extended more than $12 billion in new and renewed credit to

business customers. During calendar year 2015, Fifth Third Bank

loaned more than $48 billion to businesses.

Companies that received loans from Fifth Third Bank during this

time period include:

Digital Insurance, the nation’s largest benefits-only

insurance broker, specializing in insurance distribution and

benefits management for small to mid-sized companies. The Atlanta,

Georgia based insurance broker received a line of credit to support

their acquisition strategy.

Dry County Brewing Company, a craft microbrewery in

Kennesaw, Georgia. Fifth Third Bank helped the company secure an

SBA loan for capital equipment purchases and leasehold

improvements. The funds were used to secure the equipment needed to

move their craft beer production from a third party manufacturer to

in-house production.

Superior Uniform Group, manufacturer and seller of a wide

range of uniforms, career apparel and accessories for healthcare,

hospitality, public safety, industrial and commercial markets.

Fifth Third Bank provided the Seminole, Florida based company a

revolving line of credit and term loan to acquire BAMBKO to expand

and complement their product lines.

Web.com, provider of a full range of internet services to

small businesses to help them compete and succeed online. Fifth

Third Bank helped the Jacksonville, Florida based firm secure

acquisition financing to expand services to include cloud-based

marketing automation for clients with online, mobile and social

presence.

About Fifth Third Bank

Fifth Third Bancorp is a diversified financial services company

headquartered in Cincinnati, Ohio. The Company has $142 billion in

assets and operates 1,241 full-service Banking Centers, including

95 Bank Mart® locations, most open seven days a week, inside select

grocery stores and over 2,500 ATMs in Ohio, Kentucky, Indiana,

Michigan, Illinois, Florida, Tennessee, West Virginia,

Pennsylvania, Georgia and North Carolina. Fifth Third operates four

main businesses: Commercial Banking, Branch Banking, Consumer

Lending, and Investment Advisors. Fifth Third also has an 18.3%

interest in Vantiv Holding, LLC. Fifth Third is among the largest

money managers in the Midwest and, as of March 31, 2016, had $303

billion in assets under care, of which it managed $26 billion for

individuals, corporations and not-for-profit organizations.

Investor information and press releases can be viewed at

www.53.com. Fifth Third’s common stock is traded on the Nasdaq®

Global Select Market under the symbol “FITB.” Fifth Third Bank was

established in 1858. Member FDIC, Equal Housing Lender

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160427006013/en/

Fifth Third BankSean Parker, 513-534-6791

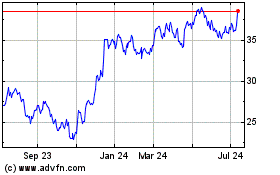

Fifth Third Bancorp (NASDAQ:FITB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Fifth Third Bancorp (NASDAQ:FITB)

Historical Stock Chart

From Apr 2023 to Apr 2024