Citizens Profit Rises in First Quarter; Fifth Third, KeyCorp Post Declines

April 21 2016 - 2:33PM

Dow Jones News

By Joshua Jamerson

Citizens Financial Group Inc. on Thursday posted a

better-than-expected increase in first-quarter profit, pushing the

bank to boost its dividend, though two other regional banks posted

declines in their bottom lines.

Citizens raised its quarterly dividend by 20% to 12 cents as

revenue also beat expectations.

Citizens reported net income of $216 million, or 41 cents a

share, up from $209 million, or 38 cents a share, a year earlier.

Revenue rose to $1.23 billion from $1.18 billion a year ago.

Analysts polled by Thomson Reuters had anticipated a profit 39

cents a share on $1.23 billion in revenue.

Meanwhile, Fifth Third Bancorp said its profit and revenue fell

-- although by less than analysts had expected -- despite an

increase in the value of its remaining stake in payment-processing

firm Vantiv Inc. The Cincinnati-based regional bank said it

received a $47 million positive valuation adjustment on its

remaining Vantiv warrant.

Fifth-Third reported a first-quarter profit of $327 million, or

40 cents a share, down from $361 million, or 42 cents a share, a

year earlier. Revenue, a combination of net interest income and

noninterest income, declined 26% to $1.55 billion. Analysts had

estimated earnings of 34 cents a share and $1.47 billion in

revenue, according to Thomson Reuters.

Cleveland-based KeyCorp, meanwhile, reported a first-quarter

profit that missed Wall Street views, even as revenue rose amid

what the company's chief executive called a weak environment.

"While the operating environment remains challenging, our

results reflect continued momentum in our core businesses," said

CEO Beth Mooney.

The Cleveland bank said it earned $188 million, or 22 cents a

share, down from $233 million, or 26 cents a share, in the year-ago

quarter. Revenue rose 2.9% to $1.04 billion, though that was down

4.7% from the fourth quarter. Analysts, on average, had projected

earnings of 25 cents a share on $1.04 billion in revenue.

Write to Joshua Jamerson at joshua.jamerson@wsj.com

(END) Dow Jones Newswires

April 21, 2016 14:18 ET (18:18 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

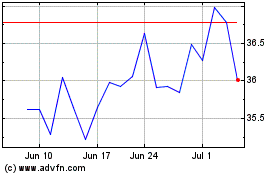

Fifth Third Bancorp (NASDAQ:FITB)

Historical Stock Chart

From Mar 2024 to Apr 2024

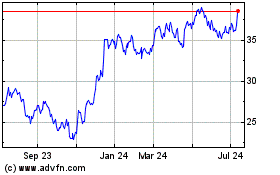

Fifth Third Bancorp (NASDAQ:FITB)

Historical Stock Chart

From Apr 2023 to Apr 2024