- 1Q16 net income available to common

shareholders of $312 million, or $0.40 per diluted common share

- Includes a $47 million pre-tax (~$31

million after-tax) positive valuation adjustment on the remaining

warrant in Vantiv, a $14 million pre-tax (~$9 million after-tax)

expense related to the voluntary early retirement program, and an

$8 million pre-tax (~$5 million after-tax) gain on the previously

announced sale of certain branches in St. Louis. These items

resulted in a net $0.03 impact on earnings per share

- 1Q16 return on average assets (ROA) of

0.93%; return on average common equity of 8.3%; return on average

tangible common equity** of 9.9%

- Pre-provision net revenue (PPNR)** of

$554 million in 1Q16

- Net interest income (FTE) of $909

million, up 1 percent sequentially and up 7 percent from 1Q15; net

interest margin of 2.91%, up 6 bps sequentially

- Average portfolio loans of $93.3

billion, down $319 million sequentially and up $2.8 billion from

1Q15; Period end portfolio loans and leases of $93.6 billion

increased $1.0 billion, or 1 percent sequentially and $2.4 billion,

or 3 percent, from 1Q15; the sequential and year over year

increases were primarily driven by increases in C&I,

residential mortgage, and commercial construction loans

- Non-interest income of $637 million

compared with $1.1 billion in the prior quarter; primarily driven

by the Vantiv-related items in the prior quarter; Capital markets

fees within Corporate banking revenue increased 20% from 4Q15,

driven primarily by M&A advisory work

- Non-interest expense of $986 million,

up 2 percent from prior quarter, primarily driven by seasonally

higher compensation-related expenses and $14 million in expense

related to the voluntary early retirement program

- Credit trends

- 1Q16 net charge-offs of $96 million

(0.42% of loans and leases) increased from 4Q15 NCOs of $80 million

(0.34% of loans and leases)

- Portfolio NPA ratio of 0.88% up 18 bps

from 4Q15, NPL ratio of 0.75% up 20 bps from 4Q15; total

nonperforming assets (NPAs) of $830 million, including loans

held-for-sale (HFS), increased $171 million sequentially

- 1Q16 provision expense of $119 million;

$91 million in 4Q15 and $69 million in 1Q15

- Strong capital ratios*

- Common equity Tier 1 (CET1) ratio

9.81%; fully phased-in CET1 ratio of 9.72%

- Tier 1 risk-based capital ratio 10.91%,

Total risk-based capital ratio 14.66%, Leverage ratio 9.57%

- Tangible common equity ratio** of

8.97%; 8.55% excluding securities portfolio unrealized

gains/losses

- 15 million reduction in common shares

outstanding during the quarter

- Book value per share of $19.46 up 5%

from 4Q15 and up 9% from 1Q15; tangible book value per share** of

$16.32

* Capital ratios estimated; presented under current U.S. capital

regulations.

** Non-GAAP measure; see Reg. G reconciliation on page 32.

Fifth Third Bancorp (Nasdaq:FITB) today reported first quarter

2016 net income of $327 million versus net income of $657 million

in the fourth quarter of 2015 and $361 million in the first quarter

of 2015. After preferred dividends, net income available to common

shareholders was $312 million, or $0.40 per diluted share, in the

first quarter of 2016, compared with $634 million, or $0.79 per

diluted share, in the fourth quarter of 2015, and $346 million, or

$0.42 per diluted share, in the first quarter of 2015.

First quarter 2016 included:

Income

- $47 million positive valuation

adjustment on the remaining Vantiv warrant

- $8 million gain on sale of certain St.

Louis branches as part of the previously announced branch

consolidation and sales plan

- $1 million benefit related to the

valuation of the Visa total return swap

Expense

- ($15 million) in severance expense,

primarily consisting of $14 million related to the voluntary early

retirement program

Fourth quarter 2015 included:

Income

- $331 million gain on the sale of Vantiv

shares

- $89 million gain on Vantiv warrant

actions taken during the quarter

- $49 million payment received from

Vantiv to terminate a portion of its tax receivable agreement

- $21 million positive valuation

adjustment on the remaining Vantiv warrant

- ($10 million) charge related to the

valuation of the Visa total return swap

Expense

- ($2 million) in severance expense

- ($10 million) contribution to Fifth

Third Foundation

Results also included a $31 million annual payment recognized

from Vantiv pursuant to the tax receivable agreement recorded in

other noninterest income.

First quarter 2015 included:

Income

- $70 million positive valuation

adjustment on the Vantiv warrant

- $37 million gain on the sale of

residential mortgage loans classified as troubled debt

restructurings

- ($17 million) charge related to the

valuation of the Visa total return swap

- ($30 million) impairment associated

with aircraft leases

Expense

- ($1 million) in severance expense

- ($2 million) in litigation reserve

charges

- ($4 million) contribution to Fifth

Third Foundation

Earnings Highlights

For the Three Months Ended

% Change March December September June

March 2016 2015 2015 2015

2015 Seq Yr/Yr

Earnings ($ in millions) Net

income attributable to Bancorp $ 327 $ 657 $ 381 $ 315 $ 361 (50%)

(9%) Net income available to common shareholders $ 312 $ 634 $ 366

$ 292 $ 346 (51%) (10%)

Common Share Data Earnings

per share, basic $ 0.40 $ 0.80 $ 0.46 $ 0.36 $ 0.42 (50%) (5%)

Earnings per share, diluted 0.40 0.79 0.45 0.36 0.42 (49%) (5%)

Cash dividends per common share 0.13 0.13 0.13 0.13 0.13 - -

Financial Ratios Return on average assets 0.93 % 1.83 % 1.07

% 0.90 % 1.06 % (49%) (12%) Return on average common equity 8.3

17.2 10.0 8.1 9.7 (52%) (14%) Return on average tangible common

equity(b) 9.9 20.6 12.0 9.7 11.7 (52%) (15%) CET1 capital(c) 9.81

9.82 9.40 9.42 9.52 - 3% Tier I risk-based capital(c) 10.91 10.93

10.49 10.51 10.62 - 3% CET1 capital (fully-phased in)(b)(c) 9.72

9.72 9.30 9.31 9.41 - 3% Net interest margin(a) 2.91 2.85 2.89 2.90

2.86 2% 2% Efficiency(a) 63.8 48.0 58.2 65.4 62.3 33% 2%

Common shares outstanding (in thousands) 770,471 785,080 795,439

810,054 815,190 (2%) (5%) Average common shares outstanding (in

thousands): Basic 773,564 784,855 795,793 803,965 810,210 (1%) (5%)

Diluted 778,392 794,481 805,023 812,843 818,672 (2%) (5%)

(a) Presented on a fully taxable

equivalent basis.

(b) These ratios have been included herein

to facilitate a greater understanding of the Bancorp's capital

structure and financial condition. See the Regulation G Non-GAAP

Reconciliation table for a reconciliation of these ratios to U.S.

GAAP.

(c) Under the banking agencies' Basel III

Final Rule, assets and credit equivalent amounts of off-balance

sheet exposures are calculated according to the standardized

approach for risk-weighted assets. The resulting values are added

together resulting in the Bancorp's total risk-weighted assets used

in the calculation of the tier I risk-based capital and common

equity tier 1 ratios. Current period regulatory capital ratios are

estimated.

NA: Not applicable.

“First quarter results were strong despite significant market

volatility,” said Greg D. Carmichael, President and CEO of Fifth

Third Bancorp. “Our net interest income increased from the fourth

quarter, reflecting the benefit of the Fed’s December rate hike on

loan yields. In addition, we had very strong results this quarter

in our fee generating businesses. At the same time the results also

highlight our focus on expense management. We remain cautious about

the economic outlook and are continuing to look to drive better

near term performance without relying on higher interest

rates.”

“The first quarter of 2016 represented a critical starting point

for the planned investments we discussed in January. During the

quarter we also executed other expense saving initiatives,

including our early retirement offer, which will positively impact

our operating leverage going forward. Despite the challenging

economic environment, we are making these investments now as they

will help drive revenue growth and efficiency improvements, while

enhancing the quality of customer service. We believe these

investments will help us generate attractive and more stable

returns through business cycles.”

“Economic conditions within our footprint remain relatively

unchanged, and activity levels are in line with customer sentiment.

Our customers continue to embrace the changes we have made to our

products, services, and delivery methods as we adapt to their

evolving preferences. Our focus on the customer remains at the core

of our efforts.”

Income Statement Highlights For the

Three Months Ended % Change March December

September June March 2016 2015 2015 2015

2015 Seq Yr/Yr

Condensed Statements of

Income ($ in millions) Net interest income (taxable equivalent)

$909 $904 $906 $892 $852 1 % 7 % Provision for loan and lease

losses 119 91 156 79 69 31 % 72 % Total non-interest income 637

1,104 713 556 630 (42 %) 1 % Total non-interest expense 986

963 943 947 923 2 %

7 % Income before income taxes (taxable equivalent) $

441 $ 954 $ 520 $ 422 $ 490

(54 %) (10 %) Taxable equivalent adjustment 6

5 5 5 5 20 % 20 % Applicable income tax expense 108

292 134 108 124 (63 %)

(13 %) Net income $ 327 $ 657 $ 381 $ 309 $ 361 (50 %) (9 %) Less:

Net income attributable to noncontrolling interests -

- - (6 ) - - - Net

income attributable to Bancorp $ 327 $ 657 $ 381 $ 315 $ 361 (50 %)

(9 %) Dividends on preferred stock 15 23 15

23 15 (35 %) - Net income

available to common shareholders $ 312 $ 634 $

366 $ 292 $ 346 (51 %) (10 %)

Earnings per share, diluted $0.40 $0.79 $0.45

$0.36 $0.42 (49 %) (5 %)

Net Interest

Income For the Three Months Ended % Change

March December September June March 2016 2015

2015 2015 2015 Seq Yr/Yr

Interest

Income ($ in millions) Total interest income (taxable

equivalent) $ 1,044 $ 1,035 $ 1,031 $ 1,008 $ 975 1 % 7 % Total

interest expense 135 131

125 116

123 3 % 10

% Net interest income (taxable equivalent) $ 909

$ 904 $ 906

$ 892 $ 852 1 % 7

%

Average Yield Yield on interest-earning assets

(taxable equivalent) 3.34 % 3.26 % 3.29 % 3.28 % 3.28 % 2 % 2 %

Rate paid on interest-bearing liabilities 0.64 %

0.61 % 0.58 %

0.56 % 0.60 % 5 %

7 % Net interest rate spread (taxable equivalent)

2.70 % 2.65 % 2.71

% 2.72 % 2.68 %

2 % 1 % Net interest margin (taxable equivalent) 2.91

% 2.85 % 2.89 % 2.90 % 2.86 % 2 % 2 %

Average Balances ($

in millions) Loans and leases, including held for sale $ 94,078

$ 94,587 $ 94,329 $ 92,739 $ 91,659 (1 %) 3 % Total securities and

other short-term investments 31,573 31,256 30,102 30,563 29,038 1 %

9 % Total interest-earning assets 125,651 125,843 124,431 123,302

120,697 - 4 % Total interest-bearing liabilities 85,450 85,381

85,171 83,480 83,305 - 3 % Bancorp shareholders' equity

16,376 15,982

15,815 15,841

15,820 2 % 4 %

Net interest income increased $5 million to $909 million on a

fully taxable equivalent basis from the fourth quarter, primarily

driven by improvement in loan yields due to the December Fed funds

rate increase. The increase was partially offset by continued loan

yield compression as a result of mix shift to lower yielding,

higher quality credits, as well as lower consumer loan balances, a

lower day count, and the reduction in the Fed stock dividend

rate.

The net interest margin was 2.91 percent, an increase of 6 bps

from the previous quarter. The increase was primarily driven by the

impact of the December Fed funds rate hike on loan yields and a

lower day count. This increase was partially offset by continued

loan yield compression as a result of a mix shift to lower

yielding, higher quality credits, as well as lower consumer loan

balances and the reduction in the Fed stock dividend rate.

Compared with the first quarter of 2015, net interest income

increased $57 million and the net interest margin increased 5 bps.

The increase in net interest income was driven by the impact of

higher investment securities and loan balances. The increase in the

net interest margin from the prior year was primarily driven by

lower cash balances held at the Fed.

Securities

Average securities and other short-term investments were $31.6

billion in the first quarter of 2016 compared with $31.3 billion in

the previous quarter and $29.0 billion in the first quarter of

2015. Other short-term investments average balances of $1.9 billion

decreased $377 million sequentially reflecting lower cash balances

held at the Federal Reserve.

Loans

For the Three Months Ended % Change

March December September June March 2016 2015 2015

2015 2015 Seq Yr/Yr

Average

Portfolio Loans and Leases ($ in millions) Commercial:

Commercial and industrial loans $ 43,089 $ 43,154 $ 43,149 $ 42,550

$ 41,426 - 4 % Commercial mortgage loans 6,886 7,032 7,023 7,148

7,241 (2 %) (5 %) Commercial construction loans 3,297 3,141 2,965

2,549 2,197 5 % 50 % Commercial leases 3,874

3,839 3,846

3,776 3,715 1 % 4 % Total

commercial loans and leases $ 57,146 $ 57,166

$ 56,983 $ 56,023 $

54,579 - 5 % Consumer: Residential

mortgage loans $ 13,788 $ 13,504 $ 13,144 $ 12,831 $ 12,433 2 % 11

% Home equity 8,217 8,360 8,479 8,654 8,802 (2 %) (7 %) Automobile

loans 11,283 11,670 11,877 11,902 11,933 (3 %) (5 %) Credit card

2,179 2,218 2,277 2,296 2,321 (2 %) (6 %) Other consumer loans and

leases 662 676

613 467 440

(2 %) 50 % Total consumer loans and leases $

36,129 $ 36,428 $ 36,390

$ 36,150 $ 35,929 (1 %) 1 %

Total average loans and leases (excluding held for sale) $ 93,275 $

93,594 $ 93,373 $ 92,173 $ 90,508 - 3 % Average loans held

for sale $ 803 $ 993 $ 956

$ 566 $ 1,151 (19 %)

(30 %)

Average loan and lease balances (excluding loans held-for-sale)

decreased $319 million sequentially and increased $2.8 billion, or

3 percent, from the first quarter of 2015. The year-over-year

increase in average loans and leases was driven by increased

commercial and industrial (C&I), residential mortgage and

commercial construction loans. Period end loans and leases

(excluding loans held-for-sale) of $93.6 billion increased $1.0

billion, or 1 percent, sequentially and increased $2.4 billion, or

3 percent, from a year ago.

Average commercial portfolio loan and lease balances were flat

sequentially and increased $2.6 billion, or 5 percent, from the

first quarter of 2015. Average C&I loans were flat from the

prior quarter and increased $1.7 billion, or 4 percent, from the

first quarter of 2015. Within commercial real estate, average

commercial mortgage balances decreased $146 million and average

commercial construction balances increased $156 million

sequentially. Commercial line usage, on an end of period basis,

increased 62 bps from the fourth quarter of 2015 and decreased 15

bps from the first quarter of 2015.

Average consumer portfolio loan and lease balances decreased

$299 million sequentially and increased $200 million from the first

quarter of 2015 primarily driven by average residential mortgage

loans which increased 2 percent sequentially and 11 percent from a

year ago. Average auto loans decreased 3 percent sequentially and 5

percent from the previous year. Average home equity loans declined

2 percent sequentially and 7 percent from the first quarter of

2015. Average credit card loans decreased 2 percent sequentially

and 6 percent from the first quarter of 2015.

Period end loans held-for-sale balances of $803 million

decreased $100 million sequentially and increased $79 million

compared with the prior year. During the quarter, we closed on the

previously announced sale of branches in St. Louis. The sale

included approximately $158 million of loans and consisted

primarily of residential mortgages. The sale had an impact of $51

million on average loans held for sale in the first quarter of

2016.

Deposits

For the Three Months Ended % Change

March December September June March 2016 2015 2015

2015 2015 Seq Yr/Yr

Average Deposits

($ in millions) Demand $ 35,201 $ 36,254 $ 35,231 $ 35,384 $

33,760 (3 %) 4 % Interest checking 25,740 25,296 25,590 26,894

26,885 2 % (4 %) Savings 14,601 14,615 14,868 15,156 15,174 - (4 %)

Money market 18,655 18,775 18,253 18,071 17,492 (1 %) 7 % Foreign

office(a) 483 736

718 955 861

(34 %) (44 %) Total transaction deposits $ 94,680 $

95,676 $ 94,660 $ 96,460 $ 94,172 (1 %) 1 % Other time

4,035 4,052 4,057

4,074 4,022

- - Total core deposits $ 98,715 $ 99,728 $

98,717 $ 100,534 $ 98,194 (1 %) 1 % Certificates - $100,000 and

over 2,815 3,305 2,924 2,558 2,683 (15 %) 5 % Other -

7 222

- - (100 %) -

Total average deposits $ 101,530 $

103,040 $ 101,863 $ 103,092

$ 100,877 (1 %) 1 %

(a) Includes commercial customer

Eurodollar sweep balances for which the Bancorp pays rates

comparable to other commercial deposit accounts.

Average core deposits decreased $1.0 billion, or 1 percent,

sequentially and increased $521 million, or 1 percent, from the

first quarter of 2015. Average transaction deposits decreased $996

million, or 1 percent, from the fourth quarter of 2015 and

increased $508 million, or 1 percent, from the first quarter of

2015. Sequential performance was primarily driven by lower demand

deposit and foreign office account balances, partially offset by

higher interest checking account balances. Year-over-year growth

reflected higher demand and money market account balances,

partially offset by lower interest checking, savings, and foreign

office account balances. Other time deposits were flat sequentially

and compared with the first quarter of 2015. Average deposit

balances were impacted by approximately $68 million due to the

previously noted sale of branches in St. Louis. This sale included

$219 million of primarily core consumer deposit balances.

Average commercial transaction deposits decreased 4 percent

sequentially and 1 percent from the previous year. Sequential

performance was primarily driven by seasonally lower demand deposit

balances and lower money market account balances. The

year-over-year decline reflected lower interest checking and

foreign office account balances, partially offset by higher demand

deposit and money market account balances.

Average consumer transaction deposits increased 2 percent both

sequentially and from the first quarter of 2015. The sequential

performance reflected higher interest checking, money market

account, and demand deposit account balances. Year-over-year growth

was driven by increased interest checking, money market account,

and demand deposit account balances, partially offset by lower

savings account balances.

Wholesale

Funding For the Three Months Ended

% Change March December September June March 2016

2015 2015 2015 2015 Seq Yr/Yr

Average Wholesale Funding ($ in millions) Certificates -

$100,000 and over $ 2,815 $ 3,305 $ 2,924 $ 2,558 $ 2,683 (15 %) 5

% Other deposits - 7 222 - - (100 %) - Federal funds purchased 608

1,182 1,978 326 172 (49 %) NM Other short-term borrowings 3,564

1,675 1,897 1,705 1,602 NM NM Long-term debt 14,949

15,738 14,664

13,741 14,414 (5

%) 4 % Total average wholesale funding $ 21,936

$ 21,907 $ 21,685 $

18,330 $ 18,871 - 16 %

Average wholesale funding of $21.9 billion was flat

sequentially, and increased $3.1 billion, or 16 percent, compared

with the first quarter of 2015. The year-over-year increase in

average wholesale funding was driven by higher securities balances

and the impact of reducing LCR punitive deposit balances through

targeted pricing changes.

Non-interest

Income For the Three Months Ended % Change March

December September June March 2016 2015 2015

2015 2015 Seq Yr/Yr

Non-interest Income ($

in millions) Service charges on deposits $ 137 $ 144 $ 145 $

139 $ 135 (5 %) 1 % Corporate banking revenue 102 104 104 113 63 (2

%) 62 % Mortgage banking net revenue 78 74 71 117 86 5 % (9 %)

Investment advisory revenue 102 102 103 105 108 - (6 %) Card and

processing revenue 79 77 77 77 71 3 % 11 % Other non-interest

income 136 602 213 1 163 (77 %) (17 %) Securities gains, net

3 1 - 4

4 NM (25 %) Total non-interest income $

637 $ 1,104 $ 713 $ 556 $ 630

(42 %) 1 %

Non-interest income of $637 million decreased $467 million

sequentially and increased $7 million compared with prior year

results. The sequential and year-over-year comparisons reflect the

impacts described below.

Non-interest Income excluding certain items

For the Three Months Ended % Change March

December March 2016

2015 2015 Seq Yr/Yr

Non-interest Income excluding certain items ($ in millions)

Non-interest income (U.S. GAAP) $ 637 $ 1,104 $ 630 Vantiv warrant

valuation (47 ) (21 ) (70 ) Gain on sale of certain branches (8 ) -

- Gain on sale of Vantiv shares - (331 ) - Gain on Vantiv warrant

actions - (89 ) - Vantiv TRA settlement payment - (49 ) - Gain on

sale of TDRs - - (37 ) Impairment associated with aircraft leases -

- 30 Valuation of Visa total return swap (1 ) 10 17 Securities

(gains) / losses (3 ) (1 )

(4 )

Non-interest income excluding certain items $ 578

$ 623 $ 566

(7 %) 2 %

Excluding the items in the table above, non-interest income of

$578 million decreased $45 million, or 7 percent, from the previous

quarter and increased $12 million, or 2 percent, from the first

quarter of 2015. The sequential decline was primarily due to the

$31 million annual Vantiv tax receivable payment recorded in the

fourth quarter of 2015. Year-over-year growth was driven by an

increase in corporate banking revenue and card and processing

revenue.

Service charges on deposits of $137 million decreased 5 percent

from the fourth quarter of 2015, reflecting normal seasonality, and

increased 1 percent compared with the same quarter last year. The

sequential decrease reflected an 11 percent decrease in retail

service charges due to seasonality. The increase from the first

quarter of 2015 was due to a 4 percent increase in commercial

service charges.

Corporate banking revenue of $102 million decreased $2 million

compared to the fourth quarter of 2015 and increased $39 million

from the first quarter of 2015. The sequential comparison reflects

lower lease remarketing fees and business lending fees, partially

offset by an increase in institutional sales revenue. The

year-over-year increase was primarily driven by the $30 million

impairment associated with aircraft leases in the first quarter of

2015 and higher loan syndications revenue, partially offset by

lower foreign exchange fees.

Mortgage banking net revenue was $78 million in the first

quarter of 2016, up $4 million from the fourth quarter of 2015 and

down $8 million from the first quarter of 2015. Originations were

stable at $1.8 billion in the current quarter, the previous quarter

and in the first quarter of 2015. First quarter 2016 originations

resulted in gains of $42 million on mortgages sold, compared with

gains of $37 million during the previous quarter and $44 million

during the first quarter of 2015. Mortgage servicing fees were $52

million this quarter, $53 million in the fourth quarter of 2015,

and $59 million in the first quarter of 2015. Mortgage banking net

revenue is also affected by net servicing asset valuation

adjustments, which include mortgage servicing rights (MSR)

amortization and MSR valuation adjustments (including

mark-to-market adjustments on free-standing derivatives used to

economically hedge the MSR portfolio). These net servicing asset

valuation adjustments were negative $16 million in the first

quarter of 2016 (reflecting MSR amortization of $27 million and MSR

valuation adjustments of positive $11 million); negative $16

million in the fourth quarter of 2015 (MSR amortization of $29

million and MSR valuation adjustments of positive $13 million); and

negative $17 million in the first quarter of 2015 (MSR amortization

of $34 million and MSR valuation adjustments of positive $17

million). The mortgage servicing asset, net of the valuation

reserve, was $685 million at quarter end on a servicing portfolio

of $58 billion.

Investment advisory revenue of $102 million was flat from the

fourth quarter of 2015 as seasonally higher tax related private

client service revenue was offset by lower securities and brokerage

fees. There was a decrease of 6 percent from the prior year

primarily due to lower securities and brokerage fees and personal

asset management fees due to the market decline during the

quarter.

Card and processing revenue of $79 million in the first quarter

of 2016 increased 3 percent sequentially and increased 11 percent

from the first quarter of 2015.

Other non-interest income totaled $136 million in the first

quarter of 2016, compared with $602 million in the previous quarter

and $163 million in the first quarter of 2015. As previously

described, the results included the adjustments in the table on

page 9 with the exception of securities gains in all comparable

periods. Excluding these items, other non-interest income of $80

million decreased approximately $42 million, or 34 percent, from

the fourth quarter of 2015 and increased approximately $7 million,

or 10 percent, from the first quarter of 2015. The sequential

decrease was primarily due to the payment from Vantiv pursuant to

the tax receivable agreement of $31 million recognized in the

fourth quarter of 2015.

Net gains on investment securities were $3 million in the first

quarter of 2016, compared with $1 million in the previous quarter

and $4 million in the first quarter of 2015.

Non-interest Expense For the Three

Months Ended % Change March December September June

March 2016 2015 2015 2015

2015 Seq Yr/Yr

Non-interest Expense

($ in millions) Salaries, wages and incentives $ 403 $ 386 $

387 $ 383 $ 369 4 % 9 % Employee benefits 100 74 72 78 99 35 % 1 %

Net occupancy expense 77 83 77 83 79 (7 %) (3 %) Technology and

communications 56 59 56 54 55 (5 %) 2 % Equipment expense 30 32 31

31 31 (6 %) (3 %) Card and processing expense 35 40 40 38 36 (13 %)

(3 %) Other non-interest expense 285

289 280 280

254 (1 %) 12 % Total

non-interest expense $ 986 $ 963

$ 943 $ 947 $ 923 2 %

7 %

Non-interest expense of $986 million increased 2 percent

compared with the fourth quarter of 2015 and increased 7 percent

compared with the first quarter of 2015. The sequential increase

was primarily due to a seasonal increase in FICA and unemployment

tax expense recorded in employee benefits and a $14 million expense

related to the voluntary early retirement program. The

year-over-year increase reflected higher compensation expense as a

result of additions primarily in risk and compliance and the

benefit from a settlement of a tax liability in the first quarter

of 2015 recorded in other non-interest expense.

Credit Quality For

the Three Months Ended March December September June March 2016

2015 2015 2015 2015

Total net losses

charged-off ($ in millions) Commercial and industrial loans

($46 ) ($30 ) ($128 ) ($34 ) ($38 ) Commercial mortgage loans (6 )

(3 ) (11 ) (11 ) (1 ) Commercial construction loans - - (3 ) - -

Commercial leases (2 ) (1 ) - - - Residential mortgage loans (2 )

(3 ) (3 ) (5 ) (6 ) Home equity (8 ) (9 ) (9 ) (9 ) (14 )

Automobile loans (9 ) (9 ) (7 ) (4 ) (8 ) Credit card (20 ) (19 )

(21 ) (21 ) (21 ) Other consumer loans and leases (3 )

(6 ) (6 ) (2 )

(3 ) Total net losses charged-off ($96 ) ($80 ) ($188 ) ($86

) ($91 ) Total losses charged-off ($116 ) ($105 ) ($209 )

($112 ) ($115 ) Total recoveries of losses previously charged-off

20 25 21

26 24 Total net losses

charged-off ($96 ) ($80 ) ($188 ) ($86 ) ($91 )

Ratios

(annualized)

Net losses charged-off as a percent of

average portfolio loans and leases (excluding held for sale)

0.42 % 0.34 % 0.80 % 0.37 % 0.41 % Commercial 0.38 % 0.24 % 0.99 %

0.32 % 0.29 % Consumer 0.48 % 0.49 %

0.51 % 0.46 % 0.59 %

Net charge-offs were $96 million, or 42 bps of average loans and

leases on an annualized basis, in the first quarter of 2016

compared with net charge-offs of $80 million, or 34 bps, in the

fourth quarter of 2015 and $91 million, or 41 bps, in the first

quarter of 2015.

Commercial net charge-offs were $54 million, or 38 bps, and were

up $20 million sequentially. The increase was primarily due to

higher charge-offs of C&I Loans, which increased by $16 million

from the fourth quarter of 2015. Of this increase, $9 million was

in the energy portfolio and related to oil field services loans.

Commercial real estate net charge-offs increased $3 million from

the previous quarter.

Consumer net charge-offs were $42 million, or 48 bps, and were

down $4 million sequentially. Compared with the previous quarter,

net charge-offs on residential mortgage loans in the portfolio and

home equity portfolio were each down $1 million. Net charge-offs in

the auto portfolio were flat and net charge-offs on credit card

loans were up $1 million from the fourth quarter of 2015. Net

charge-offs on other consumer loans were $3 million, down $3

million the previous quarter.

For the Three Months Ended March

December September June March 2016 2015

2015 2015 2015

Allowance for Credit Losses

($ in millions) Allowance for loan and lease losses, beginning

$ 1,272 $ 1,261 $ 1,293 $ 1,300 $ 1,322 Total net losses

charged-off (96 ) (80 ) (188 ) (86 ) (91 ) Provision for loan and

lease losses 119 91

156 79

69 Allowance for loan and lease

losses, ending $ 1,295 $ 1,272 $ 1,261 $ 1,293 $ 1,300

Reserve for unfunded commitments, beginning $ 138 $ 134 $ 132 $ 130

$ 135 Provision (benefit) for unfunded commitments 6 4 2 2 (4 )

Charge-offs - -

- -

(1 ) Reserve for unfunded commitments, ending $ 144 $

138 $ 134 $ 132 $ 130 Components of allowance for credit

losses: Allowance for loan and lease losses $ 1,295 $ 1,272 $ 1,261

$ 1,293 $ 1,300 Reserve for unfunded commitments 144

138 134

132 130

Total allowance for credit losses $ 1,439 $ 1,410 $ 1,395 $

1,425 $ 1,430

Allowance for loan and lease losses ratio As a

percent of portfolio loans and leases 1.38 % 1.37 % 1.35 % 1.39 %

1.42 % As a percent of nonperforming loans and leases(a) 185 % 252

% 275 % 272 % 247 % As a percent of nonperforming assets(a) 157 %

197 % 208 % 206 % 188 % (a) Excludes nonaccrual loans and

leases in loans held for sale.

Provision for loan and lease losses totaled $119 million in the

first quarter of 2016. The allowance represented 1.38 percent of

total portfolio loans and leases outstanding as of quarter end,

compared with 1.37 percent last quarter, and represented 185

percent of nonperforming loans and leases, and 157 percent of

nonperforming assets.

The provision increased $28 million from the fourth quarter of

2015 and increased $50 million from the first quarter of 2015. The

allowance for loan and lease losses increased $23 million

sequentially, primarily reflecting a higher reserve build for the

energy portfolio as a result of sustained low oil prices. As of

March 31, the reserve allocated to the energy portfolio was

approximately 6.20%, up from approximately 4.75% last quarter.

As of March December

September June March

Nonperforming Assets and

Delinquent Loans ($ in millions) 2016 2015 2015

2015 2015 Nonaccrual portfolio loans and leases:

Commercial and industrial loans $ 278 $ 82 $ 47 $ 61 $ 61

Commercial mortgage loans 51 56 60 49 57 Commercial construction

loans - - - - - Commercial leases 4 - 2 2 2 Residential mortgage

loans 25 28 31 35 40 Home equity 61

62 65 70

71 Total nonaccrual portfolio loans and leases

(excludes restructured loans) $ 419 $ 228 $ 205 $ 217 $ 231

Nonaccrual restructured portfolio commercial loans and leases(b)

210 203 177 175 205 Nonaccrual restructured portfolio consumer

loans and leases 72 75

76 83 90

Total nonaccrual portfolio loans and leases $ 701 $ 506 $

458 $ 475 $ 526 Repossessed property 17 18 17 16 20 OREO

107 123 131

135 145 Total

nonperforming portfolio assets(a) $ 825 $ 647 $ 606 $ 626 $ 691

Nonaccrual loans held for sale 3 1 1 1 2 Nonaccrual restructured

loans held for sale 2 11

1 - -

Total nonperforming assets $ 830 $ 659

$ 608 $ 627 $ 693

Restructured Portfolio Consumer loans and leases (accrual) $

998 $ 979 $ 973 $ 970 $ 943 Restructured Portfolio Commercial loans

and leases (accrual)(b) $ 461 $ 491 $ 571 $ 769 $ 774 Total

loans and leases 90 days past due $ 73 $ 75 $ 70 $ 70 $ 78

Nonperforming loans and leases as a

percent of portfolio loans, leases and other assets, including

OREO(a)

0.75 % 0.55 % 0.49 % 0.51 % 0.57 %

Nonperforming portfolio assets as a

percent of portfolio loans and leases and OREO(a)

0.88 % 0.70 % 0.65 % 0.67 % 0.76 % (a) Does not include

nonaccrual loans held for sale.

(b) Excludes $20 million of restructured

nonaccrual loans and $7 million of restructured accruing loans as

of March 31, 2016 and December 31, 2015. Excludes $21 million of

restructured nonaccrual loans and $7 million of restructured

accruing loans as of September 30, 2015, June 30, 2015 and March

31, 2015.

Total nonperforming assets, including loans held-for-sale,

increased $171 million, or 26 percent, from the previous quarter to

$830 million. Nonperforming loans (NPLs) at quarter-end increased

$195 million, or 39 percent, from the previous quarter to $701

million or 0.75 percent of total loans, leases and OREO.

Commercial NPAs increased $192 million, or 46 percent, from the

fourth quarter to $611 million, or 1.06 percent of commercial

loans, leases and OREO. Commercial NPLs increased $202 million from

last quarter to $543 million, or 0.94 percent of commercial loans

and leases. The increase in commercial NPAs was primarily due to an

increase in C&I NPAs. C&I NPAs increased $200 million from

the prior quarter to $472 million. This increase primarily

reflected a $168 million increase in NPLs associated with the RBL

(reserve based lending) energy portfolio and the impact of low oil

prices. This increase, coupled with the collateralized nature of

the RBL loans and the recognition of losses on previous

individually evaluated loans, resulted in a decline in the reserve

coverage of both NPLs and NPAs compared with those coverage levels

in the fourth quarter of 2015. Commercial mortgage NPAs decreased

$12 million from the previous quarter to $126 million. Commercial

construction NPAs were flat from the previous quarter at $8

million. Commercial lease NPAs were $5 million, up $4 million from

the previous quarter. Commercial NPAs included $210 million of

nonaccrual troubled debt restructurings (TDRs), compared with $203

million last quarter.

Consumer NPAs decreased $14 million from the fourth quarter to

$214 million, or 0.59 percent of consumer loans, leases and OREO.

Consumer NPLs decreased $7 million from last quarter to $158

million, or 0.44 percent of consumer loans and leases. Residential

mortgage NPAs decreased $9 million from the second quarter to $77

million. Home equity NPAs decreased $3 million, sequentially, to

$95 million. Consumer nonaccrual TDRs were $72 million in the first

quarter of 2016, compared with $75 million in the fourth quarter of

2015.

First quarter OREO balances included in NPA balances were down

$16 million from the fourth quarter to $107 million, and included

$60 million in commercial OREO and $47 million in consumer OREO.

Repossessed personal property decreased $1 million from the prior

quarter to $17 million.

Loans over 90 days past due and still accruing decreased $2

million from the fourth quarter of 2015 to $73 million. Commercial

balances over 90 days past due were $3 million compared with $7

million in the prior quarter, and consumer balances 90 days past

due increased $2 million from the previous quarter to $70 million.

Loans 30-89 days past due of $208 million were down $37 million

from the previous quarter. Commercial balances 30-89 days past due

decreased $1 million sequentially to $34 million and consumer

balances 30-89 days past due were down $36 million from the fourth

quarter at $174 million. The above delinquency figures exclude

nonaccruals described previously.

* Non-GAAP measure; see Reg. G reconciliation on page 32.

Capital Position For the Three Months

Ended March December September June

March 2016 2015 2015 2015 2015

Capital Position

Average total Bancorp shareholders' equity

to average assets

11.57% 11.26% 11.24% 11.32% 11.50% Tangible equity(a) 9.51% 9.55%

9.29% 9.29% 9.37%

Tangible common equity (excluding

unrealized gains/losses)(a)

8.55% 8.59% 8.33% 8.33% 8.40% Tangible common equity (including

unrealized gains/losses)(a) 8.97% 8.71% 8.65% 8.51% 8.77%

Tangible common equity as a percent of

risk-weighted assets (excluding unrealized gains/losses)(a)(b)

9.78% 9.80% 9.37% 9.39% 9.49%

Regulatory capital

ratios:

Basel III Transitional CET1 capital(b) 9.81% 9.82% 9.40% 9.42%

9.52% Tier I risk-based capital(b) 10.91% 10.93% 10.49% 10.51%

10.62% Total risk-based capital(b) 14.66% 14.13% 13.68% 13.69%

14.01% Tier I leverage 9.57% 9.54% 9.38% 9.44% 9.59% CET1

capital (fully phased-in)(a)(b) 9.72% 9.72% 9.30% 9.31% 9.41%

Book value per share $ 19.46 $ 18.48 $ 18.22 $ 17.62 $ 17.83

Tangible book value per share(a) $ 16.31 $ 15.39 $ 15.18 $ 14.62 $

14.85

(a) These ratios have been included herein

to facilitate a greater understanding of the Bancorp's capital

structure and financial condition. See the Regulation G Non-GAAP

Reconciliation table for a reconciliation of these ratios to U.S.

GAAP.

(b) Under the banking agencies Basel III

Final Rule, assets and credit equivalent amounts of off-balance

sheet exposures are calculated based upon the standardized approach

for risk-weighted assets. The resulting values are added together

resulting in the Bancorp's total risk-weighted assets.

(c) Current period regulatory capital

ratios are estimated.

Capital ratios remained strong during the quarter. The common

equity Tier 1 ratio was 9.81 percent, the tangible common equity to

tangible assets ratio* was 8.55 percent (excluding unrealized

gains/losses), and 8.97 percent (including unrealized

gains/losses). The Tier 1 risk-based capital ratio was 10.91

percent, the total risk-based capital ratio was 14.66 percent, and

the Leverage ratio was 9.57 percent.

Book value per share at March 31, 2016 was $19.46 and tangible

book value per share* was $16.32, compared with the December 31,

2015 book value per share of $18.48 and tangible book value per

share* of $15.39.

* Non-GAAP measure; see Reg. G reconciliation on page 32.

Fifth Third entered into or completed multiple share repurchases

during the quarter. Below is a summary of those share

repurchases.

- On January 14, 2016, Fifth Third

settled the forward contract related to the December 14, 2015 $215

million share repurchase agreement. An additional 1.78 million

shares were repurchased in connection with the completion of this

agreement.

- On March 4, 2016, Fifth Third entered

into a share repurchase agreement whereby Fifth Third would

purchase approximately $240 million of its outstanding stock, which

reduced the first quarter share count by 12.62 million shares.

- On April 11, 2016, Fifth Third settled

the forward contract related to the March 4, 2016 $240 million

share repurchase agreement. An additional 1.87 million shares were

repurchased in connection with the completion of this

agreement.

In total, common shares outstanding decreased by approximately

15 million shares in the first quarter of 2016 from the fourth

quarter of 2015.

Tax Rate

The effective tax rate was 25.0 percent in the first quarter of

2016 compared with 30.7 percent in the fourth quarter of 2015 and

25.6 percent in the first quarter of 2015. The sequential

comparison was primarily driven by the impact of Vantiv-related

transactions during the prior quarter.

Other

Fifth Third Bank owns approximately 35 million units

representing an 18.3 percent interest in Vantiv Holding, LLC,

convertible into shares of Vantiv, Inc., a publicly traded firm.

Based upon Vantiv’s closing price of $53.88 on March 31, 2016, our

interest in Vantiv was valued at approximately $1.9 billion. Next

month in our 10-Q, we will update our disclosure of the carrying

value of our interest in Vantiv stock, which was $360 million as of

December 31, 2015. The difference between the market value and the

book value of Fifth Third’s interest in Vantiv’s shares is not

recognized in Fifth Third’s equity or capital. Additionally, Fifth

Third has a remaining warrant to purchase approximately 7.8 million

additional shares in Vantiv which is carried as a derivative asset

at a fair value of $308 million as of March 31, 2016.

Conference Call

Fifth Third will host a conference call to discuss these

financial results at 9:00 a.m. (Eastern Time) today. This

conference call will be webcast live by Thomson Financial and may

be accessed through the Fifth Third Investor Relations website at

www.53.com (click on “About Fifth Third” then “Investor

Relations”). Institutional investors can access the call via

Thomson Financial’s password-protected event management site,

StreetEvents (www.streetevents.com).

Those unable to listen to the live webcast may access a webcast

replay through the Fifth Third Investor Relations website at the

same web address. Additionally, a telephone replay of the

conference call will be available beginning approximately two hours

after the conference call until Thursday, May 5, 2016 by dialing

800-585-8367 for domestic access or 404-537-3406 for international

access (passcode 75971680#).

Corporate Profile

Fifth Third Bancorp is a diversified financial services company

headquartered in Cincinnati, Ohio. As of March 31, 2016, the

Company had $142 billion in assets and operates 1,241 full-service

Banking Centers, including 95 Bank Mart® locations, most open seven

days a week, inside select grocery stores and 2,556 ATMs in Ohio,

Kentucky, Indiana, Michigan, Illinois, Florida, Tennessee, West

Virginia, Pennsylvania, Georgia and North Carolina. Fifth Third

operates four main businesses: Commercial Banking, Branch Banking,

Consumer Lending, and Investment Advisors. Fifth Third also has an

18.3% interest in Vantiv Holding, LLC. Fifth Third is among the

largest money managers in the Midwest and, as of March 31, 2016,

had $303 billion in assets under care, of which it managed $26

billion for individuals, corporations and not-for-profit

organizations. Investor information and press releases can be

viewed at www.53.com. Fifth Third’s common stock is traded on the

NASDAQ® Global Select Market under the symbol “FITB.”

FORWARD-LOOKING STATEMENTS

This release contains statements that we believe are

“forward-looking statements” within the meaning of Section 27A of

the Securities Act of 1933, as amended, and Rule 175 promulgated

thereunder, and Section 21E of the Securities Exchange Act of 1934,

as amended, and Rule 3b-6 promulgated thereunder. These statements

relate to our financial condition, results of operations, plans,

objectives, future performance or business. They usually can be

identified by the use of forward-looking language such as “will

likely result,” “may,” “are expected to,” “anticipates,”

“potential,” “estimate,” “forecast,” “projected,” “intends to,” or

may include other similar words or phrases such as “believes,”

“plans,” “trend,” “objective,” “continue,” “remain,” or similar

expressions, or future or conditional verbs such as “will,”

“would,” “should,” “could,” “might,” “can,” or similar verbs. You

should not place undue reliance on these statements, as they are

subject to risks and uncertainties, including but not limited to

the risk factors set forth in our most recent Annual Report on Form

10-K as updated from time to time by our Quarterly Reports on Form

10-Q. When considering these forward-looking statements, you should

keep in mind these risks and uncertainties, as well as any

cautionary statements we may make. Moreover, you should treat these

statements as speaking only as of the date they are made and based

only on information then actually known to us. There is a risk that

additional information may become known during the company’s

quarterly closing process or as a result of subsequent events that

could affect the accuracy of the statements and financial

information contained herein.

There are a number of important factors that could cause future

results to differ materially from historical performance and these

forward-looking statements. Factors that might cause such a

difference include, but are not limited to: (1) general economic

conditions and the economy weaken and become less favorable than

expected, particularly in the real estate market, either nationally

or in the states in which Fifth Third, one or more acquired

entities and/or the combined company do business; (2) deteriorating

credit quality; (3) political developments, wars or other

hostilities may disrupt or increase volatility in securities

markets or other economic conditions; (4) changes in the interest

rate environment reduce interest margins; (5) prepayment speeds,

loan origination and sale volumes, charge-offs and loan loss

provisions; (6) Fifth Third’s ability to maintain required capital

levels and adequate sources of funding and liquidity; (7)

maintaining capital requirements and adequate sources of funding

and liquidity may limit Fifth Third’s operations and potential

growth; (8) changes and trends in capital markets; (9) problems

encountered by larger or similar financial institutions may

adversely affect the banking industry and/or Fifth Third; (10)

competitive pressures among depository institutions increase

significantly; (11) effects of critical accounting policies and

judgments; (12) changes in accounting policies or procedures as may

be required by the Financial Accounting Standards Board (FASB) or

other regulatory agencies; (13) legislative or regulatory changes

or actions, or significant litigation, adversely affect Fifth

Third, one or more acquired entities and/or the combined company or

the businesses in which Fifth Third, one or more acquired entities

and/or the combined company are engaged, including the Dodd-Frank

Wall Street Reform and Consumer Protection Act; (14) ability to

maintain favorable ratings from rating agencies; (15) fluctuation

of Fifth Third’s stock price; (16) ability to attract and retain

key personnel; (17) ability to receive dividends from its

subsidiaries; (18) potentially dilutive effect of future

acquisitions on current shareholders’ ownership of Fifth Third;

(19) effects of accounting or financial results of one or more

acquired entities; (20) difficulties from Fifth Third’s investment

in, relationship with, and nature of the operations of Vantiv, LLC;

(21) loss of income from any sale or potential sale of businesses;

(22) difficulties in separating the operations of any branches or

other assets divested; (23) inability to achieve expected benefits

from branch consolidations and planned sales within desired

timeframes, if at all; (24) ability to secure confidential

information and deliver products and services through the use of

computer systems and telecommunications networks; and (25) the

impact of reputational risk created by these developments on such

matters as business generation and retention, funding and

liquidity.

You should refer to our periodic and current reports filed with

the Securities and Exchange Commission, or “SEC,” for further

information on other factors, which could cause actual results to

be significantly different from those expressed or implied by these

forward-looking statements.

Quarterly Financial Review for March

31, 2016Table of Contents

Financial Highlights 19-20 Consolidated Statements of

Income 21 Consolidated Statements of Income (Taxable Equivalent) 22

Consolidated Balance Sheets 23-24 Consolidated Statements of

Changes in Equity 25 Average Balance Sheet and Yield Analysis 26-27

Summary of Loans and Leases 28 Regulatory Capital 29 Summary of

Credit Loss Experience 30 Asset Quality 31 Regulation G Non-GAAP

Reconciliation 32 Segment Presentation 33

Fifth

Third Bancorp and Subsidiaries Financial Highlights $ in

millions, except per share data (unaudited) For the Three

Months Ended % Change March December March

2016 2015 2015 Seq

Yr/Yr

Income Statement Data Net interest income(a)

$909 $904 $852 1% 7% Non-interest income 637 1,104 630 (42%) 1%

Total revenue(a) 1,546 2,008 1,482 (23%) 4% Provision for loan and

lease losses 119 91 69 31% 72% Non-interest expense 986 963 923 2%

7% Net income attributable to Bancorp 327 657 361 (50%) (9%) Net

income available to common shareholders 312 634 346 (51%) (10%)

Common Share Data Earnings per share, basic $0.40

$0.80 $0.42 (50%) (5%) Earnings per share, diluted 0.40 0.79 0.42

(49%) (5%) Cash dividends per common share 0.13 0.13 0.13 - - Book

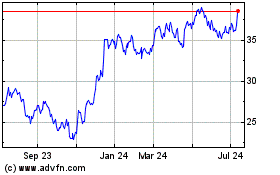

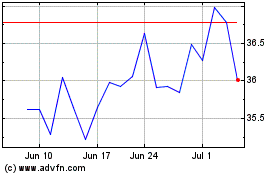

value per share 19.46 18.48 17.83 5% 9% Market price per share

16.69 20.10 18.85 (17%) (11%) Common shares outstanding (in

thousands) 770,471 785,080 815,190 (2%) (5%) Average common shares

outstanding (in thousands): Basic 773,564 784,855 810,210 (1%) (5%)

Diluted 778,392 794,481 818,672 (2%) (5%) Market capitalization

$12,859 $15,780 $15,366 (19%) (16%)

Financial Ratios

Return on average assets 0.93% 1.83% 1.06% (49%) (12%) Return on

average common equity 8.3% 17.2% 9.7% (52%) (14%) Return on average

tangible common equity(b)(d) 9.9% 20.6% 11.7% (52%) (15%)

Non-interest income as a percent of total revenue 41% 55% 43% (25%)

(5%) Dividend payout ratio 32.5% 16.3% 31.0% 101% 5% Average total

Bancorp shareholders' equity as a percent of average assets 11.57%

11.26% 11.50% 3% 1% Tangible common equity(c)(d)(j) 8.55% 8.59%

8.40% - 2% Net interest margin(a) 2.91% 2.85% 2.86% 2% 2%

Efficiency(a) 63.8% 48.0% 62.3% 33% 2% Effective tax rate 25.0%

30.7% 25.6% (19%) (2%)

Credit Quality Net losses

charged-off $96 $80 $91 22% 5% Net losses charged-off as a percent

of average portfolio loans and leases 0.42% 0.34% 0.41% 24% 2%

Allowance for loan and lease losses as a percent of portfolio loans

and leases 1.38% 1.37% 1.42% 1% (3%) Allowance for credit losses as

a percent of portfolio loans and leases 1.54% 1.52% 1.57% 1% (2%)

Nonperforming assets as a percent of

portfolio loans, leases and other assets, including OREO(e)

0.88% 0.70% 0.76% 26% 16%

Average Balances Loans and

leases, including held for sale $ 94,078 $ 94,587 $ 91,659 (1%) 3%

Total securities and other short-term investments 31,573 31,256

29,038 1% 9% Total assets 141,582 141,973 137,617 - 3% Transaction

deposits(f) 94,680 95,676 94,172 (1%) 1% Core deposits(g) 98,715

99,728 98,194 (1%) 1% Wholesale funding(h) 21,936 21,907 18,871 -

16% Bancorp shareholders' equity 16,376 15,982 15,820 2% 4%

Basel III Regulatory Capital Ratios(i)

Transitional CET1 capital(j) 9.81% 9.82% 9.52% - 3% Tier I

risk-based capital(j) 10.91% 10.93% 10.62% - 3% Total risk-based

capital(j) 14.66% 14.13% 14.01% 4% 5% Tier I leverage 9.57% 9.54%

9.59% - - CET1 capital (fully phased-in)(j) 9.72% 9.72% 9.41% - 3%

Operations Banking centers 1,241 1,254 1,303 (1%)

(4%) ATMs 2,556 2,593 2,637 (1%) (3%) Full-time equivalent

employees 18,200 18,261 18,471 -

(1%)

(a)

Presented on a fully taxable equivalent

basis.

(b)

The return on average tangible common

equity is calculated as tangible net income available to common

shareholders excluding tax effected amortization of intangibles)

divided by average tangible common equity (average common equity

less goodwill and intangible assets).

(c)

The tangible common equity ratio is

calculated as tangible common equity (shareholders' equity less

preferred stock, goodwill, intangible assets and accumulated other

comprehensive income divided by tangible assets (total assets less

goodwill, intangible assets and AOCI).

(d)

These ratios have been included herein to

facilitate a greater understanding of the Bancorp's capital

structure and financial condition. Non-GAAP measure; see Reg. G

reconciliation on page 32.

(e)

Excludes nonaccrual loans held for

sale.

(f)

Includes demand, interest checking,

savings, money market and foreign office deposits of commercial

customers.

(g)

Includes transaction deposits plus other

time deposits.

(h)

Includes certificates $100,000 and over,

other deposits, federal funds purchased, other short-term

borrowings and long-term debt.

(i)

Current period regulatory capital ratios

are estimates.

(j)

Under the banking agencies’ Basel III

Final Rule, assets and credit equivalent amounts of off-balance

sheet exposures are calculated based upon the standardized approach

for risk-weighted assets. The resulting values are added together

resulting in the Bancorp’s total risk-weighted assets.

Fifth Third Bancorp and Subsidiaries Financial

Highlights $ in millions, except per share data (unaudited)

For the Three Months Ended March December September

June March 2016 2015 2015

2015 2015

Income Statement Data Net interest

income(a) $909 $904 $906 $892 $852 Non-interest income 637 1,104

713 556 630 Total revenue(a) 1,546 2,008 1,619 1,448 1,482

Provision for loan and lease losses 119 91 156 79 69 Non-interest

expense 986 963 943 947 923 Net income attributable to Bancorp 327

657 381 315 361 Net income available to common shareholders 312 634

366 292 346

Common Share Data Earnings per share,

basic $0.40 $0.80 $0.46 $0.36 $0.42 Earnings per share, diluted

0.40 0.79 0.45 0.36 0.42 Cash dividends per common share 0.13 0.13

0.13 0.13 0.13 Book value per share 19.46 18.48 18.22 17.62 17.83

Market price per share 16.69 20.10 18.91 20.82 18.85 Common shares

outstanding (in thousands) 770,471 785,080 795,439 810,054 815,190

Average common shares outstanding (in thousands): Basic 773,564

784,855 795,793 803,965 810,210 Diluted 778,392 794,481 805,023

812,843 818,672 Market capitalization $12,859 $15,780 $15,042

$16,865 $15,366

Financial Ratios Return on average

assets 0.93% 1.83% 1.07% 0.90% 1.06% Return on average common

equity 8.3% 17.2% 10.0% 8.1% 9.7% Return on average tangible common

equity(b)(d) 9.9% 20.6% 12.0% 9.7% 11.7% Non-interest income as a

percent of total revenue 41% 55% 44% 38% 43% Dividend payout ratio

32.5% 16.3% 28.3% 36.1% 31.0% Average total Bancorp shareholders'

equity as a percent of average assets 11.57% 11.26% 11.24% 11.32%

11.50% Tangible common equity(c)(d) 8.55% 8.59% 8.33% 8.33% 8.40%

Net interest margin(a) 2.91% 2.85% 2.89% 2.90% 2.86% Efficiency(a)

63.8% 48.0% 58.2% 65.4% 62.3% Effective tax rate 25.0% 30.7% 26.0%

26.1% 25.6%

Credit Quality Net losses charged-off $96

$80 $188 $86 $91 Net losses charged-off as a percent of average

portfolio loans and leases 0.42% 0.34% 0.80% 0.37% 0.41% ALLL as a

percent of portfolio loans and leases 1.38% 1.37% 1.35% 1.39% 1.42%

Allowance for credit losses as a percent of portfolio loans and

leases 1.54% 1.52% 1.49% 1.54% 1.57%

Nonperforming assets as a percent of

portfolio loans, leases and other assets, including OREO(e)

0.88% 0.70% 0.65% 0.67% 0.76%

Average Balances Loans

and leases, including held for sale $94,078 $94,587 $94,329 $92,739

$91,659 Total securities and other short-term investments 31,573

31,256 30,102 30,563 29,038 Total assets 141,582 141,973 140,706

139,960 137,617 Transaction deposits(f) 94,680 95,676 94,660 96,460

94,172 Core deposits(g) 98,715 99,728 98,717 100,534 98,194

Wholesale funding(h) 21,936 21,907 21,685 18,330 18,871 Bancorp

shareholders' equity 16,376 15,982 15,815 15,841 15,820

Basel III Regulatory Capital Ratios(i)

Transitional CET1 capital(j) 9.81% 9.82% 9.40% 9.42% 9.52%

Tier I risk-based capital(j) 10.91% 10.93% 10.49% 10.51% 10.62%

Total risk-based capital(j) 14.66% 14.13% 13.68% 13.69% 14.01% Tier

I leverage 9.57% 9.54% 9.38% 9.44% 9.59% CET1 capital (fully

phased-in)(j) 9.72% 9.72% 9.30% 9.31% 9.41%

Operations Banking centers 1,241 1,254 1,295 1,299 1,303

ATMs 2,556 2,593 2,650 2,630 2,637 Full-time equivalent employees

18,200 18,261 18,311 18,527

18,471

(a)

Presented on a fully taxable equivalent

basis.

(b)

The return on average tangible common

equity is calculated as tangible net income available to common

shareholders excluding tax effected amortization of intangibles)

divided by average tangible common equity (average common equity

less goodwill and intangible assets).

(c)

The tangible common equity ratio is

calculated as tangible common equity (shareholders' equity less

preferred stock, goodwill, intangible assets and accumulated other

comprehensive income divided by tangible assets (total assets less

goodwill, intangible assets and AOCI).

(d)

The ratios have been included herein to

facilitate a greater understanding of the Bancorp's capital

structure and financial condition. Non-GAAP measure; see Reg. G

reconciliation on page 32.

(e)

Excludes nonaccrual loans held for

sale.

(f)

Includes demand, interest checking,

savings, money market and foreign office deposits of commercial

customers.

(g)

Includes transaction deposits plus other

time deposits.

(h)

Includes certificates $100,000 and over,

other deposits, federal funds purchased, other short-term

borrowings and long-term debt.

(i)

Current period regulatory capital ratios

are estimates.

(j)

Under the banking agencies’ Basel III

Final Rule, assets and credit equivalent amounts of off-balance

sheet exposures are calculated based upon the standardized approach

for risk-weighted assets. The resulting values are added together

resulting in the Bancorp’s total risk-weighted assets.

Fifth Third Bancorp

and Subsidiaries Consolidated Statements of Income $ in

millions (unaudited) For the Three Months Ended % Change

March December March 2016 2015 2015

Seq Yr/Yr

Interest Income Interest and fees on

loans and leases $804 $797 $778 1% 3% Interest on securities 232

231 188 - 23% Interest on other short-term investments 2

2 4 - (50%) Total interest income 1,038

1,030 970 1% 7%

Interest Expense Interest on deposits

49 46 50 7% (2%) Interest on federal funds purchased 1 - - 100%

100% Interest on short-term borrowings 3 1 - NM 100% Interest on

long-term debt 82 84 73 (2%) 12%

Total interest expense 135 131 123 3%

10%

Net Interest Income 903 899 847 - 7%

Provision for loan and lease losses 119 91

69 31% 72%

Net Interest Income After

Provision for Loan and Lease Losses 784 808 778 (3%) 1%

Non-interest Income Service charges on deposits 137 144 135

(5%) 1% Corporate banking revenue 102 104 63 (2%) 62% Mortgage

banking net revenue 78 74 86 5% (9%) Investment advisory revenue

102 102 108 - (6%) Card and processing revenue 79 77 71 3% 11%

Other non-interest income 136 602 163 (77%) (17%) Securities gains,

net 3 1 4 NM (25%) Total

non-interest income 637 1,104 630 (42%) 1%

Non-interest

Expense Salaries, wages and incentives 403 386 369 4% 9%

Employee benefits 100 74 99 35% 1% Net occupancy expense 77 83 79

(7%) (3%) Technology and communications 56 59 55 (5%) 2% Equipment

expense 30 32 31 (6%) (3%) Card and processing expense 35 40 36

(13%) (3%) Other non-interest expense 285 289

254 (1%) 12% Total non-interest expense 986 963 923

2% 7%

Income Before Income Taxes 435 949 485 (54%) (10%)

Applicable income tax expense 108 292 124

(63%) (13%)

Net Income 327 657 361 (50%) (9%)

Less: Net income attributable to noncontrolling interests -

- - - -

Net Income Attributable to

Bancorp 327 657 361 (50%) (9%) Dividends on preferred stock

15 23 15 (35%) -

Net Income

Available to Common Shareholders $312 $634

$346 (51%) (10%)

Fifth Third Bancorp and Subsidiaries Consolidated

Statements of Income (Taxable Equivalent) $ in millions (unaudited)

For the Three Months Ended March December September June March

2016 2015 2015 2015

2015

Interest Income Interest and fees on loans and

leases $804 $797 $795 $782 $778 Interest on securities 232 231 230

219 188 Interest on other short-term investments 2 2

1 2 4 Total interest income 1,038 1,030

1,026 1,003 970 Taxable equivalent adjustment 6 5

5 5 5 Total interest income (taxable

equivalent) 1,044 1,035 1,031 1,008 975

Interest

Expense Interest on deposits 49 46 44 46 50 Interest on federal

funds purchased 1 - - - - Interest on other short-term borrowings 3

1 1 1 - Interest on long-term debt 82 84 80

69 73 Total interest expense 135

131 125 116 123

Net Interest

Income (Taxable Equivalent) 909 904 906 892 852

Provision for loan and lease losses 119 91 156

79 69

Net Interest Income (Taxable

Equivalent) After Provision for Provision for Loan and Lease

Losses

790 813 750 813 783

Non-interest Income Service

charges on deposits 137 144 145 139 135 Corporate banking revenue

102 104 104 113 63 Mortgage banking net revenue 78 74 71 117 86

Investment advisory revenue 102 102 103 105 108 Card and processing

revenue 79 77 77 77 71 Other non-interest income 136 602 213 1 163

Securities gains, net 3 1 - 4

4 Total non-interest income 637 1,104 713 556 630

Non-interest Expense Salaries, wages and incentives 403 386

387 383 369 Employee benefits 100 74 72 78 99 Net occupancy expense

77 83 77 83 79 Technology and communications 56 59 56 54 55

Equipment expense 30 32 31 31 31 Card and processing expense 35 40

40 38 36 Other non-interest expense 285 289

280 280 254 Total non-interest expense

986 963 943 947 923

Income

Before Income Taxes (Taxable Equivalent) 441 954 520 422 490

Taxable equivalent adjustment 6 5 5 5

5

Income Before Income Taxes 435 949 515 417

485 Applicable income tax expense 108 292 134

108 124

Net Income 327 657 381 309 361

Less: Net Income attributable to noncontrolling interests -

- - (6 ) -

Net Income Attributable

to Bancorp 327 657 381 315 361 Dividends on preferred stock

15 23 15 23 15

Net

Income Available to Common Shareholders $312 $634

$366 $292 $346

Fifth

Third Bancorp and Subsidiaries Consolidated Balance Sheets $ in

millions, except per share data (unaudited) As of %

Change March December March

2016 2015 2015 Seq Yr/Yr

Assets Cash and due from banks $2,298 $2,540 $2,920 (10 %)

(21 %) Available-for-sale and other securities(a) 29,891 29,044

26,409 3 % 13 % Held-to-maturity securities(b) 64 70 177 (9 %) (64

%) Trading securities 405 386 392 5 % 3 % Other short-term

investments 1,778 2,671 4,919 (33 %) (64 %) Loans held for sale 803

903 724 (11 %) 11 % Portfolio loans and leases: Commercial and

industrial loans 43,433 42,131 42,052 3 % 3 % Commercial mortgage

loans 6,864 6,957 7,209 (1 %) (5 %) Commercial construction loans

3,428 3,214 2,302 7 % 49 % Commercial leases 3,956 3,854 3,786 3 %

4 % Residential mortgage loans 13,895 13,716 12,569 1 % 11 % Home

equity 8,112 8,301 8,714 (2 %) (7 %) Automobile loans 11,128 11,493

11,873 (3 %) (6 %) Credit card 2,138 2,259 2,291 (5 %) (7 %) Other

consumer loans and leases 651 657

448 (1 %) 45 % Portfolio loans and

leases 93,605 92,582 91,244 1 % 3 % Allowance for loan and lease

losses (1,295 ) (1,272 ) (1,300 ) 2 %

- Portfolio loans and leases, net 92,310 91,310

89,944 1 % 3 % Bank premises and equipment 2,185 2,239 2,433 (2 %)

(10 %) Operating lease equipment 738 707 695 4 % 6 % Goodwill 2,416

2,416 2,416 - - Intangible assets 11 12 14 (8 %) (21 %) Servicing

rights 685 785 789 (13 %) (13 %) Other assets 8,846

7,965 8,605 11 % 3 %

Total Assets $142,430 $141,048

$140,437 1 % 1 %

Liabilities Deposits: Demand $35,858 $36,267 $35,343 (1 %) 1

% Interest checking 25,182 26,768 27,191 (6 %) (7 %) Savings 14,738

14,601 15,355 1 % (4 %) Money market 19,377 18,494 18,105 5 % 7 %

Foreign office 441 464 811 (5 %) (46 %) Other time 4,049 4,019

4,044 1 % - Certificates $100,000 and over 2,830

2,592 2,566 9 % 10 %

Total deposits 102,475 103,205 103,415 (1 %) (1 %) Federal funds

purchased 134 151 200 (11 %) (33 %) Other short-term borrowings

3,523 1,507 1,413 NM NM Accrued taxes, interest and expenses 2,011

2,164 1,979 (7 %) 2 % Other liabilities 2,627 2,341 3,504 12 % (25

%) Long-term debt 15,305 15,810

14,022 (3 %) 9 %

Total Liabilities

126,075 125,178 124,533

1 % 1 %

Equity Common stock(c) 2,051 2,051

2,051 - - Preferred stock 1,331 1,331 1,331 - - Capital surplus

2,686 2,666 2,659 1 % 1 % Retained earnings 12,570 12,358 11,380 2

% 10 % Accumulated other comprehensive income 684 197 588 NM 16 %

Treasury stock (2,999 ) (2,764 ) (2,145 )

9 % 40 % Total Bancorp shareholders' equity 16,323

15,839 15,864 3 % 3 % Noncontrolling interests 32

31 40 3 % (20 %)

Total

Equity 16,355 15,870 15,904

3 % 3 %

Total Liabilities and Equity

$142,430 $141,048 $140,437

1 % 1 % (a) Amortized cost $28,838 $28,678

$25,475 1 % 13 % (b) Market values 64 70 177 (9 %) (64 %) (c)

Common shares, stated value $2.22 per share (in thousands):

Authorized 2,000,000 2,000,000 2,000,000 - - Outstanding, excluding

treasury 770,471 785,080 815,190 (2 %) (5 %) Treasury

153,422 138,812 108,702

11 % 41 %

Fifth

Third Bancorp and Subsidiaries Consolidated Balance Sheets $ in

millions, except per share data (unaudited) As of March December

September June March 2016 2015 2015

2015 2015

Assets Cash and due from banks

$2,298 $2,540 $2,455 $2,785 $2,920 Available-for-sale and other

securities(a) 29,891 29,044 28,799 27,987 26,409 Held-to-maturity

securities(b) 64 70 157 157 177 Trading securities 405 386 374 370

392 Other short-term investments 1,778 2,671 1,994 3,451 4,919

Loans held for sale 803 903 994 995 724 Portfolio loans and leases:

Commercial and industrial loans 43,433 42,131 42,948 42,800 42,052

Commercial mortgage loans 6,864 6,957 7,061 7,150 7,209 Commercial

construction loans 3,428 3,214 3,101 2,709 2,302 Commercial leases

3,956 3,854 3,898 3,881 3,786 Residential mortgage loans 13,895

13,716 13,392 12,933 12,569 Home equity 8,112 8,301 8,427 8,547

8,714 Automobile loans 11,128 11,493 11,826 11,909 11,873 Credit

card 2,138 2,259 2,229 2,278 2,291 Other consumer loans and leases

651 657 692 496

448 Portfolio loans and leases 93,605 92,582

93,574 92,703 91,244 Allowance for loan and lease losses

(1,295 ) (1,272 ) (1,261 ) (1,293 )

(1,300 ) Portfolio loans and leases, net 92,310 91,310 92,313

91,410 89,944 Bank premises and equipment 2,185 2,239 2,264 2,298

2,433 Operating lease equipment 738 707 680 670 695 Goodwill 2,416

2,416 2,416 2,416 2,416 Intangible assets 11 12 13 13 14 Servicing

rights 685 785 757 854 789 Other assets 8,846

7,965 8,667 8,222 8,605

Total Assets $142,430 $141,048

$141,883 $141,628

$140,437

Liabilities Deposits: Demand $35,858

$36,267 $34,832 $35,449 $35,343 Interest checking 25,182 26,768

24,832 27,074 27,191 Savings 14,738 14,601 14,632 14,976 15,355

Money market 19,377 18,494 18,887 17,900 18,105 Foreign office 441

464 754 728 811 Other time 4,049 4,019 4,041 4,050 4,044

Certificates $100,000 and over 2,830 2,592

2,915 2,846 2,566

Total deposits 102,475 103,205 100,893 103,023 103,415 Federal

funds purchased 134 151 132 126 200 Other short-term borrowings

3,523 1,507 4,904 4,136 1,413 Accrued taxes, interest and expenses

2,011 2,164 1,990 1,858 1,979 Other liabilities 2,627 2,341 2,614

3,356 3,504 Long-term debt 15,305 15,810

15,492 13,491 14,022

Total Liabilities 126,075

125,178 126,025 125,990

124,533

Equity Common stock(c) 2,051 2,051 2,051

2,051 2,051 Preferred stock 1,331 1,331 1,331 1,331 1,331 Capital

surplus 2,686 2,666 2,659 2,632 2,659 Retained earnings 12,570

12,358 11,826 11,564 11,380 Accumulated other comprehensive income

684 197 522 291 588 Treasury stock (2,999 ) (2,764 )

(2,563 ) (2,264 ) (2,145 ) Total Bancorp

shareholders' equity 16,323 15,839 15,826 15,605 15,864

Noncontrolling interests 32 31

32 33 40

Total Equity

16,355 15,870 15,858

15,638 15,904

Total Liabilities and

Equity $142,430 $141,048

$141,883 $141,628 $140,437 (a)

Amortized cost $28,838 $28,678 $27,986 $27,483 $25,475 (b) Market

values 64 70 157 157 177 (c) Common shares, stated value $2.22 per

share (in thousands): Authorized 2,000,000 2,000,000 2,000,000

2,000,000 2,000,000 Outstanding, excluding treasury 770,471 785,080

795,439 810,054 815,190 Treasury 153,422

138,812 128,453 113,838

108,702

Fifth Third Bancorp and

Subsidiaries Consolidated Statements of Changes in Equity $ in

millions (unaudited) For the Three Months Ended March March

2016 2015

Total equity,

beginning $15,870 $15,665 Net income attributable to Bancorp

327 361 Other comprehensive income, net of tax: Change in

unrealized gains: Available-for-sale securities 447 133 Qualifying

cash flow hedges 39 24

Change in accumulated other comprehensive

income related to employee benefit plans

1 2 Comprehensive income 814 520

Cash dividends declared: Common stock (100 ) (106 ) Preferred stock

(15 ) (15 ) Impact of stock transactions under stock compensation

plans, net 24 21 Shares acquired for treasury (240 ) (180 )

Noncontrolling interest 1 1 Other 1 (2 )

Total equity, ending $16,355 $15,904

Fifth Third

Bancorp and Subsidiaries Average Balance Sheet and Yield

Analysis $ in millions, except share data (unaudited) For the Three

Months Ended % Change March December March

2016 2015 2015 Seq Yr/Yr

Assets

Interest-earning assets: Commercial and industrial loans $43,127

$43,175 $41,462 - 4 % Commercial mortgage loans 6,908 7,053 7,248

(2 %) (5 %) Commercial construction loans 3,297 3,141 2,198 5 % 50

% Commercial leases 3,875 3,841 3,716 1 % 4 % Residential mortgage

loans 14,405 14,315 13,515 1 % 7 % Home equity 8,241 8,394 8,802 (2

%) (6 %) Automobile loans 11,285 11,674 11,933 (3 %) (5 %) Credit

card 2,277 2,320 2,321 (2 %) (2 %) Other consumer loans and leases

663 674 464 (2 %) 43 % Taxable securities 29,619 28,951 23,102 2 %

28 % Tax exempt securities 78 52 59 50 % 32 % Other short-term

investments 1,876 2,253 5,877

(17 %) (68 %) Total interest-earning assets

125,651 125,843 120,697 - 4 % Cash and due from banks 2,335 2,466

2,830 (5 %) (17 %) Other assets 14,869 14,925 15,412 - (4 %)

Allowance for loan and lease losses (1,273 ) (1,261 )

(1,322 ) 1 % (4 %)

Total Assets

$141,582 $141,973 $137,617

- 3 %

Liabilities

Interest-bearing liabilities: Interest checking deposits $25,740

$25,296 $26,885 2 % (4 %) Savings deposits 14,601 14,615 15,174 -

(4 %) Money market deposits 18,655 18,775 17,492 (1 %) 7 % Foreign

office deposits 483 736 861 (34 %) (44 %) Other time deposits 4,035

4,052 4,022 - - Certificates $100,000 and over 2,815 3,305 2,683

(15 %) 5 % Other deposits - 7 - (100 %) - Federal funds purchased

608 1,182 172 (49 %) NM Other short-term borrowings 3,564 1,675

1,602 NM NM Long-term debt 14,949 15,738

14,414 (5 %) 4 % Total

interest-bearing liabilities 85,450 85,381 83,305 - 3 % Demand

deposits 35,201 36,254 33,760 (3 %) 4 % Other liabilities

4,524 4,325 4,693 5 %

(4 %)

Total Liabilities 125,175 125,960 121,758 (1 %)

3 %

Total Equity 16,407 16,013

15,859 2 % 3 %

Total Liabilities and

Equity $141,582 $141,973

$137,617 - 3 %

Yield

Analysis Interest-earning assets: Commercial and industrial

loans(a) 3.23 % 3.12 % 3.16 % 4 % 2 % Commercial mortgage loans(a)

3.27 % 3.11 % 3.27 % 5 % - Commercial construction loans(a) 3.38 %

3.18 % 3.23 % 6 % 5 % Commercial leases(a) 2.77 % 2.68 % 2.90 % 3 %

(4 %) Residential mortgage loans 3.63 % 3.62 % 3.83 % - (5 %) Home

equity 3.80 % 3.57 % 3.66 % 6 % 4 % Automobile loans 2.65 % 2.67 %

2.68 % (1 %) (1 %) Credit card 10.64 % 10.17 % 10.22 % 5 % 4 %

Other consumer loans and leases 6.27 % 6.95 %

10.79 % (10 %) (42 %) Total loans and leases 3.46 %

3.36 % 3.46 % 3 % - Taxable securities 3.14 % 3.16 % 3.30 % (1 %)

(5 %) Tax exempt securities(a) 4.32 % 5.69 % 5.24 % (24 %) (18 %)

Other short-term investments 0.42 % 0.28 %

0.25 % 50 % 68 % Total interest-earning assets 3.34 %

3.26 % 3.28 % 2 % 2 % Interest-bearing liabilities: Interest

checking deposits 0.23 % 0.19 % 0.20 % 21 % 15 % Savings deposits