Fifth Third Securities Advises Par Mar Oil Co. on Sale to Croton Holding Company

April 07 2016 - 1:03PM

Business Wire

Fifth Third Securities, Inc. served as the exclusive financial

advisor to Par Mar Oil Company on their recent acquisition by

Croton Holding Company.

The closing of the transaction represents the second downstream

petroleum M&A success for Fifth Third Securities this year,

coming shortly after CST Brands’ $425 million acquisition of Flash

Foods, Inc. in February. Fifth Third represented the seller, Flash

Foods, in that transaction.

“This transaction highlights the continued strategic activity in

this industry and the value of partnering two organizations that

can grow by leveraging their complementary expertise,” said Rob

Bohn, Fifth Third Bank’s director of downstream petroleum

investment banking.

Based in Marietta, Ohio, Par Mar Oil Company operates 52

convenience stores and several car washes in West Virginia, Ohio

and Kentucky, which are branded with BP, Shell, Marathon and Exxon

fuel. The Company also includes 16 quick-service restaurants,

branded as A&W, Fazoli’s, Quiznos, Subway and Par Mar’s

proprietary food service.

Fifth Third Capital Markets provides value-added advice and

solutions aimed to support the growth and profitability of middle

market and mid-corporate clients. Fifth Third’s Capital Markets

services include investment banking++, debt capital markets+,

equity capital markets++, financial risk management+ and fixed

income sales and trading++. The group has offices in Atlanta,

Charlotte, Cincinnati, Chicago, Cleveland, Dallas and Memphis, and

provides industry specialization across many sectors including

consumer retail, diversified industrials, energy, food, beverage

and agribusiness, healthcare, real estate, surface transportation

and telecom, media and technology.

For additional information about how the capital markets

professionals at Fifth Third can help your business, please visit

our website.

+ Services and activities offered through Fifth Third Bank++

Services and activities offered through Fifth Third Securities,

Inc.

About Fifth Third Bancorp

Fifth Third Bancorp is a diversified financial services company

headquartered in Cincinnati, Ohio. The Company has $141 billion in

assets and operates 1,254 full-service Banking Centers, including

95 Bank Mart® locations, most open seven days a week, inside select

grocery stores and 2,593 ATMs in Ohio, Kentucky, Indiana, Michigan,

Illinois, Florida, Tennessee, West Virginia, Pennsylvania,

Missouri, Georgia and North Carolina. Fifth Third operates four

main businesses: Commercial Banking, Branch Banking, Consumer

Lending, and Investment Advisors. Fifth Third also has an 18.3%

interest in Vantiv Holding, LLC. Fifth Third is among the largest

money managers in the Midwest and, as of December 31, 2015, had

$297 billion in assets under care, of which it managed $26 billion

for individuals, corporations and not-for-profit organizations.

Investor information and press releases can be viewed at

www.53.com. Fifth Third’s common stock is traded on the NASDAQ®

Global Select Market under the symbol “FITB.” Fifth Third Bank was

established in 1858. Member FDIC.

Fifth Third Securities is the trade name used by Fifth Third

Securities, Inc., member FINRA/SIPC, a registered broker-dealer and

registered investment advisor registered with the U.S. Securities

and Exchange Commission (SEC). Registration does not imply a

certain level of skill or training. Securities and investments

offered through Fifth Third Securities, Inc. and insurance

products:

Are Not FDIC Insured Offer No Bank Guarantee May Lose

Value Are Not Insured By Any Federal Government Agency Are

Not A Deposit

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160407006300/en/

For Fifth Third Securities, Inc.Sean Parker (Media),

513-534-6791orRob Bohn (Customers), 404-279-4542

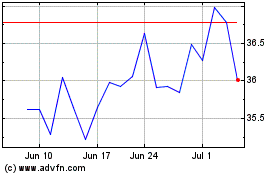

Fifth Third Bancorp (NASDAQ:FITB)

Historical Stock Chart

From Mar 2024 to Apr 2024

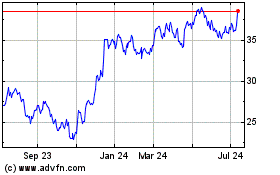

Fifth Third Bancorp (NASDAQ:FITB)

Historical Stock Chart

From Apr 2023 to Apr 2024