Fifth Third Bank Introduces Touch ID for its Mobile Banking App

February 04 2016 - 8:00AM

Business Wire

Customers Can Log In Without a Password to Pay

Bills, Deposit a Check, Transfer Money and More

Fifth Third Bank announced today the addition of Touch ID

biometric capabilities to its mobile banking app for the iPhone.

Touch ID allows fingerprint authentication for enabled devices,

letting customers log into their Fifth Third app with their fingers

or thumbs instead of a password.

The Bank’s fast mobile app allows people to:

- Access their balance without logging

in, using Now Balance.

- Make payments.

- Transfer money with a few taps.

- Deposit a check with just a hover.

- Set up alerts with the swipe of a

thumb.

- Check the past 24 months of

statements.

- Log in with Touch ID for iOS.

Customers want their banking to be quick and simple. Two years

ago Fifth Third was one of the first banks to create a system to

check balances without needing to log in.

“Our customers’ digital expectations continue to evolve – and

many of those expectations are being set by using non-bank apps

such as shopping and games," said Chad Borton, executive vice

president and head of the Consumer Bank for Fifth Third Bank.

"Fifth Third is continuing to evolve its digital experiences to do

the same, creating fast and simple banking.”

Fifth Third Bank added Touch ID as a response to its customers’

requests.

Mobile banking is outpacing online banking for Fifth Third

customers, with mobile banking increasing 43 percent from 2014 to

2015, with 19 million mobile banking logins last year.

Fifth Third consumers increasingly want the services mobile

banking can provide, such as alerts, which increased 144 percent

from 2014 to 2015, with 13.9 million alerts sent last year.

In December of 2015, nearly one-fifth of all Fifth Third

consumer deposits were made via mobile, an increase of 36 percent

over December of 2014.

“We know how important banking on the go is to our customers,”

Borton said. “Our banking app makes banking simple and fast.”

The most frequently used mobile services for Fifth Third Bank

are: checking balances and activity, transferring money and

depositing checks.

*Mobile Internet data charges may apply as well as text

messaging charges. Contact your mobile service provider for

details.

About Fifth Third:

Fifth Third Bancorp is a diversified financial services company

headquartered in Cincinnati, Ohio. The Company has $141 billion in

assets and operates 1,254 full-service Banking Centers, including

95 Bank Mart® locations, most open seven days a week, inside select

grocery stores and 2,593 ATMs in Ohio, Kentucky, Indiana, Michigan,

Illinois, Florida, Tennessee, West Virginia, Pennsylvania,

Missouri, Georgia and North Carolina. Fifth Third operates four

main businesses: Commercial Banking, Branch Banking, Consumer

Lending, and Investment Advisors. Fifth Third also has an 18.3%

interest in Vantiv Holding, LLC. Fifth Third is among the largest

money managers in the Midwest and, as of December 31, 2015, had

$297 billion in assets under care, of which it managed $26 billion

for individuals, corporations and not-for-profit organizations.

Investor information and press releases can be viewed at

www.53.com. Fifth Third’s common stock is traded on the NASDAQ®

Global Select Market under the symbol “FITB.” Fifth Third Bank was

established in 1858. Member FDIC

Copyright © 2015. Fifth Third Bank, Member

FDIC, Equal Housing Lender, All Rights Reserved.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160204005179/en/

Fifth Third BankLaura Trujillo,

513-534-4361Laura.Trujillo@53.com

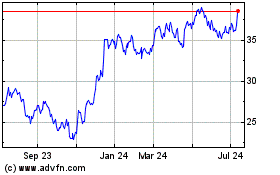

Fifth Third Bancorp (NASDAQ:FITB)

Historical Stock Chart

From Mar 2024 to Apr 2024

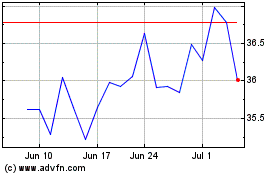

Fifth Third Bancorp (NASDAQ:FITB)

Historical Stock Chart

From Apr 2023 to Apr 2024