Toyota Unit Enters $21.9 Million Settlement Over Alleged Auto Loan Racial Bias

February 02 2016 - 7:10PM

Dow Jones News

WASHINGTON—Federal regulators have reached a $21.9 million

settlement with Toyota Motor Corp.'s U.S. financing unit over

policies that allegedly overcharged minority borrowers for auto

loans.

It is the fourth settlement that regulators have drawn from auto

lenders over the past two years about suspected racial

discrimination, part of an expanding federal scrutiny of that

issue.

Under the agreement with the Consumer Financial Protection

Bureau and the Justice Department announced Tuesday, Toyota Motor

Credit Corp. will also change its pricing and compensation system

to reduce the discretion of dealers to charge extra interest for

certain loans, and will cut their compensation associated with such

action, the regulators said.

In a statement, the Toyota unit denied any wrongdoing and noted

that the voluntary agreement didn't include an assessment of civil

money penalties. Instead, the settlement will go into a fund

reimbursing borrowers who allegedly faced discrimination.

In a separate high-profile auto lending discrimination case,

Ally Financial Inc. on Jan. 29 mailed checks worth a combined $80

million to 235,000 customers allegedly harmed by its pricing

practices. In that case, the CFPB's methodology for determining

racial bias was questioned by companies and lawmakers.

Last year, American Honda Finance Corp. and Fifth Third Bancorp

signed settlements similar to Toyota's.

"As an indirect lender, TMCC has no visibility into the race or

ethnicity of its customers or credit applicants, and these factors

have no bearing on the company's credit or pricing decisions," the

company said in a news release. The company added that it

"respectfully disagrees" with the methodologies used by the federal

agencies to determine whether the industry's practices have been

discriminatory.

But the CFPB asserted that, even if Toyota wasn't intentionally

discriminating, it has a responsibility to reduce incentives that

could lead to that outcome. "Toyota Motor Credit is among the

largest indirect auto lenders, and we commend its industry

leadership in shifting to reduced discretion to address the

significant fair lending risks," CFPB Director Richard Cordray said

in a statement.

Under the latest agreement, Toyota will pay up to $21.9 million

into a settlement fund that will go to affected African-American

and Asian and Pacific Island borrowers whose auto loans were

financed by the company between January 2011 and the time of the

implementation of the new pricing structure.

The agreement won't fully eliminate the dealer's ability to mark

up interest rates for some loans. Instead, dealers now must limit

the extra charges to up to 1.25 percentage points for loans with

terms of five years or less, down from 2.5% previously.

Write to Yuka Hayashi at yuka.hayashi@wsj.com

(END) Dow Jones Newswires

February 02, 2016 18:55 ET (23:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

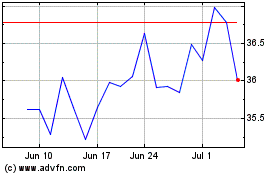

Fifth Third Bancorp (NASDAQ:FITB)

Historical Stock Chart

From Mar 2024 to Apr 2024

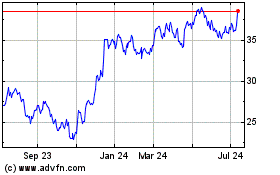

Fifth Third Bancorp (NASDAQ:FITB)

Historical Stock Chart

From Apr 2023 to Apr 2024