Fifth Third's Profit Jumps on Fees and Commercial Growth -- Update

October 20 2015 - 7:27PM

Dow Jones News

By Lisa Beilfuss

Fifth Third Bancorp became the latest bank to take a charge

related to tumult in the secondary market for student loans.

The Cincinnati-based bank on Tuesday said it charged off $102

million when it restructured a commercial loan that is backed by

private student loans. Fifth Third attributed the move to the

changing economics of student lending.

Fifth Third said the write-down was on a $500 million loan the

bank gave an unspecified student lender in 2007. The bank expected

the borrower to securitize the loans and use the proceeds to repay

Fifth Third, but that didn't happen.

The bank blamed problems in the secondary market for these loans

when explaining the markdown on an earnings call.

"This credit is backed by private student loans. And as you

know, during the quarter, volatility in the student-loan markets

caused significant stress on the valuation of underlying student

loans," Fifth Third Chief Financial Officer Tayfun Tuzun said on a

call with investors.

Student lending has grown rapidly in recent years but is now

largely done by the government. Meanwhile the markets for student

loans originated by banks or other private lenders have faced

hiccups since the financial crisis.

This summer, the issuance of bonds backed by older federal

student loans that were originally given out by private lenders

came to a halt on worries about possible downgrades. Those issues

are now rippling out into other types of loans.

In the market for private student loans--like those mentioned by

Fifth Third--it has become more expensive for companies to issue

bonds in recent months.

Since late July, the average spread--defined as the yield

investors are demanding to buy the bonds over the London interbank

offered rate benchmark--has widened by 0.28 percentage point on

private student-loan bonds with the highest credit ratings,

according to Interactive Data, a New York-based firm that provides

fixed-income evaluations.

At the time when Fifth Third made this loan, it was common for

private student lenders to take out large commercial loans from

banks to finance the loans they made, said Mark Kantrowitz, a

student-lending expert. While this secondary market for private

loans froze during the financial crisis, it isn't entirely clear

why the unnamed student lender wouldn't have securitized the loans

when markets rebounded, he said.

"We don't control whether the loans are securitized," a Fifth

Third spokesman said. "The decision to continue to service this

portfolio, or to pursue securitization, would be the decision of

our borrower."

The bank had already set aside some money for the write-off, but

took a $35 million pretax provision for the student-loan-related

restructuring in the third quarter, dragging down Fifth Third's

profit.

The bank reported a profit of $381 million for the quarter, up

from $340 million a year earlier but falling short of Wall Street

projections.

Analysts were surprised by Fifth Third's disclosure and said

questions remained about the situation.

"I was sort of caught off guard by the exposure," said Scott

Siefers, a bank analyst at Sandler O'Neill. "This is an issue that

is almost a decade old. The fact it's rearing its head again in

this indirect way is certainly a surprise."

U.S. Bancorp recently faced a similar issue with the

student-loan market. In September, U.S. Bancorp said it dropped an

effort to sell a $3 billion portfolio of student loans because the

bids were too low. It took a write-down of $58 million, reflecting

the diminished value of those assets.

U.S. Bancorp stopped making new student loan originations in

2012, but continues to own student loans made under the Federal

Family Education Loan Program, or FFELP.

The bank was seeking to free up capital for other purposes in

its recent sales effort. "The market broke," U.S. Bancorp Chief

Executive Richard Davis said at an investor conference last

month.

Federal student-loan bonds are at risk of defaulting because a

rising number of borrowers are either delaying payments or entering

programs to lower their monthly payments. This lessens the chances

that the loans will be paid in full by the time the bonds

mature.

Though these options are not as widely available with private

student loans, investor concern about liquidity has toppled over to

private student-loan bonds, said David Varano, a fixed-income

analyst with Interactive Data. Concerns over the Chinese economy

and stock market volatility in the U.S. during the summer also

contributed to the spike in spreads for many asset-backed

securities, he said.

Unlike federal student loan securitizations, the private

student-loan bond market remains active. There were $4.25 billion

in private student loan securitizations so far this year, up 48%

from the same period a year prior, according to Moody's Investors

Service. "Issuance in the private student loan [securitization]

market is not generally affected by the [federal securitization]

market," said Nicky Dang, a vice president at Moody's. "We expect

more issuance this year."

Write to Lisa Beilfuss at lisa.beilfuss@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 20, 2015 19:12 ET (23:12 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

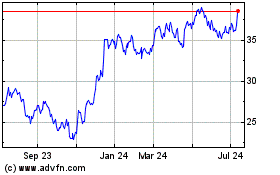

Fifth Third Bancorp (NASDAQ:FITB)

Historical Stock Chart

From Mar 2024 to Apr 2024

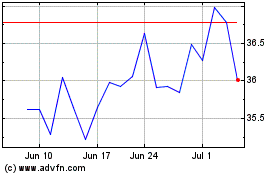

Fifth Third Bancorp (NASDAQ:FITB)

Historical Stock Chart

From Apr 2023 to Apr 2024