Fifth Third's Profit Jumps on Fees

October 20 2015 - 8:30AM

Dow Jones News

Fifth Third Bancorp said profit in its third quarter rose as a

jump in fee revenue helped offset a higher loan-loss provision and

increased expenses.

Results beat Wall Street projections.

The Cincinnati-based regional bank reported a profit of $381

million, up from $340 million a year earlier. Per-share earnings

rose to 45 cents from 39 cents. Revenue, a combination of net

interest income and noninterest income, increased 13% to $1.62

billion.

Analysts estimated 40 cents in profit per share and $1.51

billion in revenue, according to Thomson Reuters.

Like other regional banks in recent weeks, Fifth Third credited

growth in its commercial business for improved results. Corporate

banking revenue rose 4% from a year ago, driven by a 17% jump in

capital markets fees. Total fee-based revenue surged 37% in the

period, also thanks to a 16% rise in mortgage banking fees.

Higher revenue from fees helped offset the effects of prolonged

low interest rates. Fifth Third's net interest margin—an important

measure of lending profitability that is tied to interest

rates—fell to 2.89% from 3.10% a year earlier. From the second

quarter, though, Fifth Third managed to keep the measure steady

amid a lightly lower short-term cash position.

In the face of low rates, Fifth Third, like other regional

banks, has worked to cut costs to support profit. The lender sold

29 retail locations during the quarter and Chief Executive Greg

Carmichael said the company is on track to complete its branch

consolidation effort by the middle of next year.

Noninterest expense in the quarter fell modestly from the

previous quarter, though expenses rose about 6% from a year earlier

as compensation expenses increased and as the bank set aside a

higher provision for loan losses. That provision more than doubled

to $156 million from the year-earlier period, due to the

restructuring of student-loan-backed commercial credit in addition

to a broadening economic slowdown, stress on capital markets and

the prolonged downturn in commodity prices, the bank said.

Shares, down about 7% this year, were inactive premarket.

Write to Lisa Beilfuss at lisa.beilfuss@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 20, 2015 08:15 ET (12:15 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

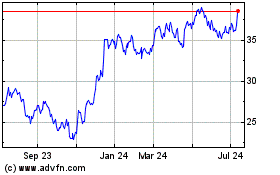

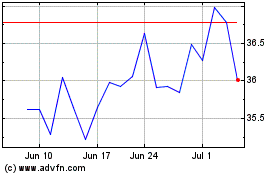

Fifth Third Bancorp (NASDAQ:FITB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Fifth Third Bancorp (NASDAQ:FITB)

Historical Stock Chart

From Apr 2023 to Apr 2024