- 2Q15 net income available to common

shareholders of $292 million, or $0.36 per diluted common share

- Includes a $97 million pre-tax (~$63

million after tax) non-cash impairment charge related to previously

announced changes in the branch network and a $14 million pre-tax

(~$9 million after tax) positive valuation adjustment on the

warrant Fifth Third holds in Vantiv, resulting in a net $0.07

impact on earnings per share

- 2Q15 return on average assets (ROA) of

0.90%; return on average common equity of 8.1%; return on average

tangible common equity** of 9.70%

- Pre-provision net revenue (PPNR)** of

$496 million in 2Q15

- Net interest income (FTE) of $892

million, up 5 percent sequentially and down 1 percent from 2Q14;

net interest margin of 2.90%, up 4 basis points sequentially

- Average portfolio loans of $92.2

billion, up $1.7 billion sequentially and up $1.6 billion from

2Q14; both increases primarily driven by increases in C&I

loans

- Noninterest income of $556 million

compared with $630 million in the prior quarter; impacted by the

impairment charge related to announced changes in the branch

network in the current quarter, increased corporate banking revenue

and mortgage banking net revenue, and valuations on the Vantiv

warrant in both quarters; prior quarter comparisons were also

impacted by the gain on sale of residential mortgage TDRs and the

impairment associated with aircraft leases in 1Q15

- Noninterest expense of $947 million, up

3 percent from prior quarter primarily driven by higher

incentive-based compensation expenses, partially offset by

seasonally lower benefits expense; prior quarter comparisons were

also impacted by the benefit from a settlement of a tax liability

related to prior years recognized in 1Q15

- Credit trends

- Net charge-offs declined 15 percent

year-over-year; 2Q15 net charge-offs of $86 million (0.37% of loans

and leases) vs. 1Q15 NCOs of $91 million (0.41% of loans and

leases) and 2Q14 NCOs of $101 million (0.45% of loans and

leases)

- Portfolio NPA ratio of 0.67% down 9 bps

from 1Q15, NPL ratio of 0.51% down 6 bps from 1Q15; total

nonperforming assets (NPAs) of $627 million, including loans

held-for-sale (HFS), declined $66 million sequentially

- 2Q15 provision expense of $79 million;

$69 million in 1Q15 and $76 million in 2Q14

- Strong capital ratios*

- Common equity Tier 1 (CET1) ratio

9.41%; fully phased-in CET1 ratio of 9.3%

- Tier 1 risk-based capital ratio 10.49%,

Total risk-based capital ratio 13.67%, Leverage ratio 9.44%

- Tangible common equity ratio** of

8.51%; 8.33% excluding securities portfolio unrealized

gains/losses

- 8 million reduction in average diluted

share count

- Book value per share of $17.62 down 1

percent from 1Q15 and up 5 percent from 2Q14; tangible book value

per share** of $14.62

* Capital ratios estimated; presented under current U.S. capital

regulations.** Non-GAAP measure; see Reg. G reconciliation on page

33 in Exhibit 99.1 of 8-k filing dated 7/21/15.

Fifth Third Bancorp (Nasdaq: FITB) today reported second quarter

2015 net income of $315 million versus net income of $361 million

in the first quarter of 2015 and $439 million in the second quarter

of 2014. After preferred dividends, net income available to common

shareholders was $292 million, or $0.36 per diluted share, in the

second quarter of 2015, compared with $346 million, or $0.42 per

diluted share, in the first quarter of 2015, and $416 million, or

$0.49 per diluted share, in the second quarter of 2014.

Second quarter 2015

included:Income

- $14 million positive valuation

adjustment on the Vantiv warrant

- ($2 million) charge related to the

valuation of the Visa total return swap

- ($97 million) non-cash impairment

charge related to previously announced changes in the branch

network

First quarter 2015

included:Income

- $70 million positive valuation

adjustment on the Vantiv warrant

- $37 million gain on the sale of

residential mortgage loans classified as troubled debt

restructurings

- ($17 million) charge related to the

valuation of the Visa total return swap

- ($30 million) impairment associated

with aircraft leases

Second quarter 2014

included:Income

- $125 million gain on the sale of Vantiv

shares

- $63 million positive valuation

adjustment on the Vantiv warrant

- ($17 million) negative valuation

adjustments for branches and land

- ($16 million) charge related to the

valuation of the Visa total return swap

- ($12 million) negative impact to the

equity method income from the Bancorp’s interest in Vantiv related

to certain charges recognized by Vantiv as a result of their

acquisition of Mercury Payment Systems

Expenses

- ($61 million) in litigation reserve

charges

Earnings Highlights

For the Three Months Ended % Change

June March December September June 2015 2015 2014

2014 2014 Seq Yr/Yr

Earnings ($ in millions)

Net income attributable to Bancorp $ 315 $ 361 $ 385 $ 340 $ 439

(13 %) (28 %) Net income available to common shareholders $ 292 $

346 $ 362 $ 328 $ 416 (16 %) (30 %)

Common Share Data

Earnings per share, basic 0.36 0.42 0.44 0.39 0.49 (14 %) (27 %)

Earnings per share, diluted 0.36 0.42 0.43 0.39 0.49 (14 %) (27 %)

Cash dividends per common share 0.13 0.13 0.13 0.13 0.13 - -

Financial Ratios Return on average assets 0.90 % 1.06 % 1.13

% 1.02 % 1.34 % (15 %) (33 %) Return on average common equity 8.1

9.7 10.0 9.2 11.9 (16 %) (32 %) Return on average tangible common

equity(b) 9.7 11.7 12.1 11.1 14.4 (17 %) (33 %)

CET1 capital(c)

9.41 9.52 N/A N/A N/A (1 %) N/A Tier I risk-based capital(c) 10.49

10.62 10.83 10.83 10.80 (1 %) (3 %) Tier I common equity(b) N/A N/A

9.65 9.64 9.61 N/A N/A CET1 capital (fully-phased in)(b)(c) 9.30

9.41 N/A N/A N/A (1 %) N/A Net interest margin(a) 2.90 2.86 2.96

3.10 3.15 1 % (8 %) Efficiency(a) 65.4 62.3 59.6 62.1 58.2 5 % 12 %

Common shares outstanding (in thousands) 810,054 815,190

824,047 834,262 844,489 (1 %) (4 %) Average common shares

outstanding (in thousands): Basic 803,965 810,210 819,057 829,392

838,492 (1 %) (4 %) Diluted 812,843 818,672 827,831 838,324 848,245

(1 %) (4 %)

(a) Presented on a fully taxable

equivalent basis.

(b) These ratios have been included herein

to facilitate a greater understanding of the Bancorp's capital

structure and financial condition. See the Regulation G Non-GAAP

Reconciliation table for a reconciliation of these ratios to U.S.

GAAP.

(c) Under the banking agencies' Basel III

Final Rule, assets and credit equivalent amounts of off-balance

sheet exposures are calculated according to the standardized

approach for risk-weighted assets. The resulting values are added

together resulting in the Bancorp's total risk-weighted assets used

in the calculation of the tier I risk-based capital and common

equity tier 1 ratios beginning January 1, 2015. Current period

regulatory capital ratios are estimated.

NA: Not applicable.

“We are very pleased with our core business trends. The

strategic and tactical decisions that we have made over the past

year are producing the intended results, and reflect our focus on

revenue generation and balance sheet management in this low rate

environment. Net interest income was up 5 percent sequentially,

reflecting solid growth in our commercial business, particularly in

C&I lending, which was up 3 percent sequentially. Core deposits

were up 8 percent over last year and crossed $100 billion for the

first time in our history, which contributed to our core funding

ratio of 108% in the quarter,” said Kevin Kabat, CEO of Fifth Third

Bancorp. “Credit performance metrics continue to reflect the

underlying positive trends in our portfolio as net charge-offs

declined to 37 basis points and non-performing assets improved to

67 basis points. Our balance sheet is not only positioned to

generate good returns in this environment, but also in the upcoming

rate cycle that we expect to operate in once the Fed decides to

raise short-term rates.”

“Fee income results for the quarter showed sequential growth,

highlighted by corporate banking revenue growth of 79 percent, and

mortgage banking revenue up 36 percent. Expenses were in line with

our expectations and reflected our investment in our business as we

continue to make adjustments to the company in the current

operating environment and the heightened focus on risk and

compliance infrastructure,” added Kabat.

“While we are very focused on our current operating results we

continue to take long-term strategic actions to maximize our

company’s performance in the changing banking environment. Our

decision to close approximately 105 branches not only shows our

management team’s intense focus on expense management, but also

aligns our customer service quality and product delivery strategies

with our customers’ preferences,” said Greg Carmichael, who will

become the Chief Executive Officer in November. “I am very excited

to have the opportunity to lead this great company and continue

Kevin’s successful track record in building long-term shareholder

value. Our industry is undergoing important fundamental changes and

my goal is to maintain the momentum that we have in our core

businesses as I look to achieve our revenue growth targets and look

for further opportunities to improve operational efficiencies.”

Income Statement Highlights

For the Three Months Ended % Change June March

December September June 2015 2015 2014 2014

2014 Seq Yr/Yr

Condensed Statements of Income ($ in

millions)

Net interest income (taxable equivalent) $892 $852 $888 $908 $905 5

% (1 %) Provision for loan and lease losses 79 69 99 71 76 14 % 4 %

Total noninterest income 556 630 653 520 736 (12 %) (24 %) Total

noninterest expense 947 923 918

888 954 3 % (1 %) Income before income

taxes (taxable equivalent) 422 490

524 469 611 (14 %) (31 %)

Taxable equivalent adjustment 5 5 5 5 5 - - Applicable income taxes

108 124 134 124

167 (13 %) (35 %) Net income 309 361 385 340 439 (14

%) (30 %) Less: Net income attributable to noncontrolling interests

(6 ) - - - -

(100 %) (100 %) Net income attributable to Bancorp

315 361 385 340 439 (13 %) (28 %) Dividends on preferred stock

23 15 23 12 23

53 % - Net income available to common

shareholders 292 346 362

328 416 (16 %) (30 %) Earnings per share,

diluted $ 0.36 $ 0.42 $ 0.43

$ 0.39 $ 0.49 (14 %) (27 %)

Net

Interest Income

For the Three Months

Ended % Change June March December September June 2015

2015 2014 2014 2014 Seq

Yr/Yr

Interest Income ($ in millions) Total interest income

(taxable equivalent) $ 1,008 $ 975 $ 1,016 $ 1,023 $ 1,013 3 % -

Total interest expense 116

123 128

115 108

(6 %) 7 % Net interest income (taxable equivalent)

$ 892 $ 852

$ 888 $ 908 $ 905

5 % (1 %)

Average Yield Yield on

interest-earning assets (taxable equivalent) 3.28 % 3.28 % 3.38 %

3.49 % 3.53 % - (7 %) Rate paid on interest-bearing liabilities

0.56 % 0.60 %

0.61 % 0.56 %

0.54 % (7 %) 4 % Net interest rate

spread (taxable equivalent) 2.72 %

2.68 % 2.77 %

2.93 % 2.99 % 1 %

(9 %) Net interest margin (taxable equivalent) 2.90 % 2.86 % 2.96 %

3.10 % 3.15 % 1 % (8 %)

Average Balances ($ in

millions) Loans and leases, including held for sale $ 92,739 $

91,659 $ 91,581 $ 91,428 $ 91,241 1 % 2 % Total securities and

other short-term investments 30,563 29,038 27,604 24,927 23,940 5 %

28 % Total interest-earning assets 123,302 120,697 119,185 116,355

115,181 2 % 7 % Total interest-bearing liabilities 83,512 83,339

82,544 81,157 80,770 - 3 % Bancorp shareholders' equity

15,841 15,820

15,644 15,486

15,157 -

5 %

Net interest income of $892 million on a fully taxable

equivalent basis increased $40 million from the first quarter,

driven by earning asset growth and lower deposit costs.

Additionally, net interest income was positively impacted by $7

million due to an extra day in the quarter. These benefits were

partially offset by continued repricing in our loan portfolio and

the effect of the TDR sale in the first quarter of 2015.

The net interest margin was 2.90 percent, an increase of 4 bps

from the previous quarter primarily driven by a 6 basis point

benefit due to deployment of cash balances into investment

securities, 3 basis points due to better funding rates including

the continued rationalization of deposit rates, partially offset by

4 basis points of loan yield compression and a 1 basis point

decrease primarily due to day count.

Compared with the second quarter of 2014, net interest income

decreased $13 million and the net interest margin decreased 25 bps.

The decline in net interest income was driven by the impact of

changes to the Bancorp’s deposit advance product that were

effective January 1, 2015, higher interest expense due to increased

long-term debt balances, as well as continued loan repricing,

partially offset by the impact of higher investment securities

balances. The decline in the net interest margin from the prior

year was primarily driven by the impact of the changes to the

deposit advance product and loan repricing.

SecuritiesAverage securities and other short-term

investments were $30.6 billion in the second quarter of 2015

compared with $29.0 billion in the previous quarter and $23.9

billion in the second quarter of 2014. Other short-term investments

average balances of $3.2 billion decreased $2.7 billion

sequentially reflecting lower cash balances held at the Federal

Reserve. On an end of period basis, securities balances of $28.5

billion increased $1.5 billion driven by purchases of securities

that were funded with cash balances at the Federal Reserve held in

other short-term investments.

Loans

For the Three Months Ended

% Change June March December September June 2015 2015

2014 2014 2014 Seq Yr/Yr

Average Portfolio Loans and Leases ($

in millions)

Commercial: Commercial and industrial loans $ 42,550 $ 41,426 $

41,277 $ 41,477 $ 41,374 3 % 3 % Commercial mortgage loans 7,148

7,241 7,480 7,633 7,885 (1 %) (9 %) Commercial construction loans

2,549 2,197 1,909 1,563 1,362 16 % 87 % Commercial leases

3,776 3,715

3,600 3,571 3,555

2 % 6 % Subtotal - commercial loans and leases

56,023 54,579

54,266 54,244

54,176 3 % 3 % Consumer: Residential mortgage

loans 12,831 12,433 13,046 12,785 12,611 3 % 2 % Home equity 8,654

8,802 8,937 9,009 9,101 (2 %) (5 %) Automobile loans 11,902 11,933

12,073 12,105 12,070 - (1 %) Credit card 2,296 2,321 2,324 2,295

2,232 (1 %) 3 % Other consumer loans and leases

467 440 395

361 359 6 %

30 % Subtotal - consumer loans and leases

36,150 35,929 36,775

36,555 36,373

1 % (1 %) Total average loans and leases (excluding

held for sale) $ 92,173 $ 90,508 $ 91,041 $ 90,799 $ 90,549 2 % 2 %

Average loans held for sale 566

1,151 540

629 692 (51 %) (18 %)

Average loan and lease balances (excluding loans held-for-sale)

increased $1.7 billion, or 2 percent, sequentially and increased

$1.6 billion, or 2 percent, from the second quarter of 2014. The

sequential and prior year increases in average loans and leases

were driven by increased commercial and industrial (C&I),

commercial construction, and residential mortgage balances,

partially offset by decreased home equity balances. Period end

loans and leases (excluding loans held-for-sale) of $92.7 billion

increased $1.5 billion, or 2 percent, sequentially and increased

$2.2 billion, or 2 percent, from a year ago.

Average commercial portfolio loan and lease balances increased

$1.4 billion, or 3 percent, sequentially and increased $1.8

billion, or 3 percent, from the second quarter of 2014. Average

C&I loans increased $1.1 billion from the prior quarter and

increased $1.2 billion from the second quarter of 2014. Within

commercial real estate, average commercial mortgage balances

continued to decline and average commercial construction balances

increased due to continued focus on that business. Commercial line

usage, on an end of period basis, was 33 percent of committed lines

in the second quarter of 2015 compared with 32 percent in the first

quarter of 2015 and 32 percent in the second quarter of 2014.

Average consumer portfolio loan and lease balances increased

$221 million, or 1 percent, sequentially and decreased $223

million, or 1 percent, year-over-year. Average residential mortgage

loans increased 3 percent sequentially and 2 percent from a year

ago. Average auto loans were flat sequentially and down 1 percent

from the previous year. Average home equity loans declined 2

percent sequentially and 5 percent from the second quarter of 2014.

Average credit card loans decreased 1 percent sequentially and

increased 3 percent from the second quarter of 2014.

Average loans held-for-sale balances of $566 million decreased

$585 million sequentially primarily due to the full quarter impact

from the sale of certain residential mortgage loans classified as

troubled debt restructurings sold in the first quarter and

decreased $126 million compared with the second quarter of 2014.

Period end loans held-for-sale of $995 million increased $271

million from the previous quarter and $313 million from the second

quarter of 2014.

Deposits

For the Three Months Ended

% Change June March December September June 2015 2015

2014 2014 2014 Seq Yr/Yr

Average Deposits ($ in

millions)

Demand $ 35,384 $ 33,760 $ 33,301 $ 31,790 $ 31,275 5 % 13 %

Interest checking 26,894 26,885 25,478 24,926 25,222 - 7 % Savings

15,156 15,174 15,173 15,759 16,509 - (8 %) Money market 18,071

17,492 17,023 15,222 13,942 3 % 30 %

Foreign office(a)

955 861

1,439 1,663 2,200

11 % (57 %) Subtotal - Transaction deposits

96,460 94,172 92,414 89,360 89,148 2 % 8 % Other time

4,074 4,022 3,936

3,800 3,693

1 % 10 % Subtotal - Core deposits 100,534 98,194 96,350

93,160 92,841 2 % 8 % Certificates - $100,000 and over

2,558 2,683

2,998 3,339 3,840

(5 %) (33 %) Total deposits $ 103,092

$ 100,877 $ 99,348 $

96,499 $ 96,681 2 % 7 %

(a) Includes commercial customer

Eurodollar sweep balances for which the Bancorp pays rates

comparable to other commercial deposit accounts.

Average core deposits increased $2.3 billion, or 2 percent,

sequentially and increased $7.7 billion, or 8 percent, from the

second quarter of 2014. Average transaction deposits increased $2.3

billion, or 2 percent, from the first quarter of 2015 primarily

driven by higher demand deposit and money market account balances.

Year-over-year transaction deposits increased $7.3 billion, or 8

percent, driven by higher money market account, demand deposit, and

interest checking balances, partially offset by lower savings and

foreign office balances. Other time deposits increased 1 percent

sequentially and 10 percent compared with the second quarter of

2014.

Average commercial transaction deposits increased 4 percent

sequentially and 12 percent from the previous year. Sequential

performance was primarily driven by higher demand and money market

account balances. Year-over-year growth reflected higher demand

deposit, interest checking, and money market balances, partially

offset by lower foreign office balances.

Average consumer transaction deposits increased 1 percent

sequentially and increased 5 percent from the second quarter of

2014. The sequential performance reflected higher demand deposit

balances. Year-over-year growth was driven by increased money

market account balances, partially offset by lower savings

balances.

Wholesale Funding

For the

Three Months Ended % Change June March December September

June 2015 2015 2014 2014 2014

Seq Yr/Yr

Average Wholesale Funding ($ in

millions)

Certificates - $100,000 and over $ 2,558 $ 2,683 $ 2,998 $ 3,339 $

3,840 (5 %) (33 %) Federal funds purchased 326 172 161 520 606 90 %

(46 %) Other short-term borrowings 1,705 1,602 1,481 1,973 2,234 6

% (24 %) Long-term debt 13,773

14,448 14,855

13,955 12,524 (5 %) 10 %

Total wholesale funding $ 18,362 $

18,905 $ 19,495 $ 19,787

$ 19,204 (3 %) (4 %)

Average wholesale funding of $18.4 billion decreased $543

million, or 3 percent, sequentially and decreased $842 million, or

4 percent, compared with the second quarter of 2014. The sequential

decrease was driven by a decline in long-term debt due to pay-downs

from securitizations and the maturation of $500 million of

bank-level subordinated debt in the middle of the first quarter, as

well as a decrease in certificates $100,000 and over, partially

offset by an increase in short-term borrowings. The year-over-year

decrease in average wholesale funding reflected an increase in

long-term debt due to issuances during 2014, partially offset by a

decrease in certificates $100,000 and over and short-term

borrowings.

Noninterest Income

For the Three

Months Ended % Change June March December September June

2015 2015 2014 2014 2014 Seq

Yr/Yr

Noninterest Income ($ in

millions)

Service charges on deposits $ 139 $ 135 $ 142 $ 145 $ 139 3 % -

Corporate banking revenue 113 63 120 100 107 79 % 6 % Mortgage

banking net revenue 117 86 61 61 78 36 % 50 % Investment advisory

revenue 105 108 100 103 102 (3 %) 3 % Card and processing revenue

77 71 76 75 76 8 % 1 % Other noninterest income 1 163 150 33 226

(99 %) (100 %) Securities gains, net 4

4 4 3 8 -

(50 %) Total noninterest income $ 556

$ 630 $ 653 $ 520 $ 736 (12 %)

(24 %)

Noninterest income of $556 million decreased $74 million

sequentially and decreased $180 million compared with prior year

results. The second quarter of 2015 included a $97 million non-cash

impairment charge related to previously announced changes in the

branch network, which was slightly higher than the original

estimate due to the receipt of updated third party appraisals and

the inclusion of five additional branches. These actions are

expected to be complete by mid-2016, and the expected annualized

reduction in operating expenses associated with these actions is

now expected to be $65 million, higher by $5 million as a result of

the additions. In addition to the impairment, the sequential and

year-over-year comparisons also reflect the impacts described

below.

Noninterest Income excluding certain items

For the Three Months Ended

% Change June March June 2015

2015 2014 Seq Yr/Yr

Noninterest income (as reported)

$ 556 $ 630 $ 736 Vantiv warrant valuation (14 ) (70 ) (63 )

Valuation of Visa total return swap 2 17 16 Branch / land valuation

adjustments 97 - 17 Gain on sale of TDRs - (37 ) - Impairment from

aircraft leases - 30 - Gain on sale of Vantiv shares - - (125 )

Other Vantiv-related items - - 12 Securities (gains) / losses

(4 ) (4 )

(8 ) Noninterest income excluding

certain items $ 637 $ 566

$ 585 13 % 9 %

Excluding the items in the table above, noninterest income of

$637 million increased $71 million, or 13 percent, from the

previous quarter and increased $52 million, or 9 percent, from the

second quarter of 2014. The sequential increase was primarily due

to increases in corporate banking revenue and mortgage banking net

revenue. The year-over-year increase was primarily due to higher

mortgage banking net revenue.

Service charges on deposits of $139 million increased 3 percent

from the first quarter and were flat compared with the same quarter

last year. The sequential increase was due to a 5 percent increase

in retail service charges due to higher overdraft occurrences as

well as a 1 percent increase in commercial service charges.

Corporate banking revenue of $113 million increased $50 million

from the first quarter of 2015 and increased $6 million from the

second quarter of 2014. First quarter of 2015 results included a

$30 million impairment associated with aircraft leases and

excluding this charge, the sequential increase was primarily due to

improvement in institutional sales revenue and higher syndication

fees. The year-over-year increase was driven by higher

institutional sales revenue and business lending fees, partially

offset by lower syndication fees.

Mortgage banking net revenue was $117 million in the second

quarter of 2015, up 36 percent from the first quarter of 2015 and

up 50 percent from the second quarter of 2014. Second quarter 2015

originations were seasonally strong at $2.5 billion, compared with

$1.8 billion in the previous quarter and $2.0 billion in the second

quarter of 2014. Second quarter 2015 originations resulted in gains

of $43 million on mortgages sold, compared with gains of $44

million during the previous quarter and $42 million during the

second quarter of 2014. Mortgage servicing fees were $56 million

this quarter, $59 million in the first quarter of 2015, and $62

million in the second quarter of 2014. Mortgage banking net revenue

is also affected by net servicing asset valuation adjustments,

which include mortgage servicing rights (MSR) amortization and MSR

valuation adjustments (including mark-to-market adjustments on

free-standing derivatives used to economically hedge the MSR

portfolio). These net servicing asset valuation adjustments were

positive $18 million in the second quarter of 2015 (reflecting MSR

amortization of $39 million and MSR valuation adjustments of

positive $57 million); negative $17 million in the first quarter of

2015 (MSR amortization of $34 million and MSR valuation adjustments

of positive $17 million); and negative $26 million in the second

quarter of 2014 (MSR amortization of $32 million and MSR valuation

adjustments of positive $6 million). The mortgage servicing asset,

net of the valuation reserve, was $854 million at quarter end on a

servicing portfolio of $62 billion.

Investment advisory revenue of $105 million decreased 3 percent

from the first quarter and increased 3 percent year-over-year. The

sequential decrease was attributable to seasonally lower

tax-related private client services revenue, partially offset by an

increase in securities and brokerage fees due to a continued shift

from transaction-based fees to recurring revenue streams. The

year-over-year increase reflected an increase in securities and

brokerage fees and an increase in personal asset management fees

due to market-related growth.

Card and processing revenue of $77 million in the second quarter

of 2015 increased 8 percent sequentially and increased 1 percent

from the second quarter of 2014. The sequential increase reflected

higher transaction volumes compared with seasonally weak first

quarter volumes. The year-over-year increase reflects an increase

in the number of actively used cards and an increase in customer

spend volume.

Other noninterest income totaled $1 million in the second

quarter of 2015, compared with $163 million in the previous quarter

and $226 million in the second quarter of 2014. As previously

described, the results included the adjustments in the table above

with the exception of securities gains in all comparable periods

and the impairment of aircraft leases in the first quarter of 2015,

which is recorded in corporate banking revenue. Excluding these

items, other noninterest income of $86 million increased

approximately $13 million, or 18 percent, from the first quarter of

2015 and increased approximately $3 million, or 4 percent, from the

second quarter of 2014.

Net gains on investment securities were $4 million in the second

quarter of 2015, compared with $4 million in the previous quarter

and $8 million in the second quarter of 2014.

Noninterest Expense

For the Three

Months Ended % Change June March December September June

2015 2015 2014 2014 2014 Seq

Yr/Yr

Noninterest Expense ($ in

millions)

Salaries, wages and incentives $ 383 $ 369 $ 366 $ 357 $ 368 4 % 4

% Employee benefits 78 99 79 75 79 (21 %) (1 %) Net occupancy

expense 83 79 77 78 79 5 % 5 % Technology and communications 54 55

54 53 52 (2 %) 4 % Equipment expense 31 31 30 30 30 - 3 % Card and

processing expense 38 36 36 37 37 6 % 3 % Other noninterest expense

280 254 276

258 309 10 % (9 %) Total

noninterest expense $ 947 $ 923 $ 918

$ 888 $ 954 3 % (1 %)

Noninterest expense of $947 million increased 3 percent compared

with the first quarter of 2015 and decreased 1 percent compared

with the second quarter of 2014. The sequential increase was

primarily due to higher incentive-based compensation expenses,

partially offset by a decrease in FICA and unemployment tax expense

recorded in employee benefits. Additionally, the sequential

comparison reflected the first quarter benefit from a settlement of

a tax liability related to prior years recorded in other

noninterest expense. The year-over-year decrease reflected lower

charges to litigation reserves, partially offset by higher

compensation expense.

Credit Quality

For

the Three Months Ended June March December September June 2015

2015 2014 2014 2014

Total net losses charged-off ($ in

millions)

Commercial and industrial loans ($34 ) ($38 ) ($44 ) ($50 ) ($31 )

Commercial mortgage loans (11 ) (1 ) (10 ) (5 ) (9 ) Commercial

construction loans - - - - (8 ) Commercial leases - - (1 ) - -

Residential mortgage loans (5 ) (6 ) (94 ) (9 ) (8 ) Home equity (9

) (14 ) (11 ) (14 ) (18 ) Automobile loans (4 ) (8 ) (7 ) (7 ) (5 )

Credit card (21 ) (21 ) (20 ) (23 ) (21 ) Other consumer

loans and leases (2 ) (3 )

(4 ) (7 ) (1 ) Total net losses

charged-off (86 ) (91 ) (191 ) (115 ) (101 ) Total losses

(112 ) (115 ) (215 ) (146 ) (127 ) Total recoveries

26 24 24

31 26 Total net losses

charged-off ($86 ) ($91 ) ($191 ) ($115 ) ($101 )

Ratios

(annualized) Net losses charged-off as a percent of average

loans and leases (excluding held for sale) 0.37 % 0.41 % 0.83 %

0.50 % 0.45 % Commercial 0.32 % 0.29 % 0.40 % 0.40 % 0.35 %

Consumer 0.46 % 0.59 %

1.47 % 0.66 % 0.60 %

Net charge-offs were $86 million, or 37 bps of average loans on

an annualized basis, in the second quarter of 2015 compared with

net charge-offs of $91 million, or 41 bps, in the first quarter of

2015 and $101 million, or 45 bps, in the second quarter of

2014.

Commercial net charge-offs were $45 million, or 32 bps, and were

up $6 million sequentially. C&I net charge-offs of $34 million

decreased $4 million from the previous quarter and commercial real

estate net charge-offs increased $10 million from the previous

quarter.

Consumer net charge-offs were $41 million, or 46 bps, down $11

million sequentially. Net charge-offs on residential mortgage loans

in the portfolio were $5 million, down $1 million from the previous

quarter. Home equity net charge-offs were $9 million, down $5

million from the first quarter of 2015, and net charge-offs in the

auto portfolio of $4 million were down $4 million compared with the

prior quarter. Net charge-offs on consumer credit card loans were

$21 million, flat from the first quarter. Net charge-offs on other

consumer loans were $2 million, down $1 million compared with the

previous quarter.

For the Three Months Ended June March

December September June 2015 2015 2014

2014 2014

Allowance for Credit Losses ($ in

millions)

Allowance for loan and lease losses, beginning $ 1,300 $ 1,322 $

1,414 $ 1,458 $ 1,483 Total net losses charged-off (86 ) (91 ) (191

) (115 ) (101 ) Provision for loan and lease losses

79 69

99 71

76 Allowance for loan and lease losses, ending 1,293

1,300 1,322 1,414 1,458 Reserve for unfunded commitments,

beginning 130 135 134 142 153 Provision (benefit) for unfunded

commitments 2 (4 ) 1 (8 ) (11 ) Charge-offs -

(1 ) -

- - Reserve

for unfunded commitments, ending 132 130 135 134 142

Components of allowance for credit losses: Allowance for loan and

lease losses 1,293 1,300 1,322 1,414 1,458 Reserve for unfunded

commitments 132

130 135 134

142 Total allowance for credit

losses $ 1,425 $ 1,430 $ 1,457 $ 1,548 $ 1,600

Allowance for loan and lease losses

ratio

As a percent of portfolio loans and leases 1.39 % 1.42 % 1.47 %

1.56 % 1.61 % As a percent of nonperforming loans and leases(a) 272

% 247 % 228 % 228 % 228 % As a percent of nonperforming assets(a)

206 % 188 % 178 % 178 % 175 %

(a) Excludes nonaccrual loans and leases

in loans held for sale.

Provision for loan and lease losses totaled $79 million in the

second quarter of 2015 and increased $10 million from the first

quarter of 2015 and increased $3 million from the second quarter of

2014. The allowance for loan and lease losses declined $7 million

sequentially reflecting the portfolio’s overall risk profile and

charges to the allowance. The allowance represented 1.39 percent of

total portfolio loans and leases outstanding as of quarter end,

compared with 1.42 percent last quarter, and represented 272

percent of nonperforming loans and leases, and 206 percent of

nonperforming assets.

As of June March December

September June

Nonperforming Assets and Delinquent

Loans ($ in millions)

2015 2015 2014 2014 2014 Nonaccrual

portfolio loans and leases: Commercial and industrial loans $ 61 $

61 $ 86 $ 102 $ 103 Commercial mortgage loans 49 57 64 77 86

Commercial construction loans - - - 2 3 Commercial leases 2 2 3 3 2

Residential mortgage loans 35 40 44 52 56 Home equity

70 71 72

69 73

Total nonaccrual portfolio loans and

leases (excludes restructured loans)

$ 217 $ 231 $ 269 $ 305 $ 323

Restructured loans - commercial

(nonaccrual)(c)

175 205 214 201 202 Restructured loans - consumer

(nonaccrual) 83 90

96 114 115

Total nonaccrual portfolio loans and leases $ 475 $ 526 $

579 $ 620 $ 640 Repossessed personal property 16 20 18 19 18

OREO(a) 135 145

147

157

174

Total nonperforming assets(b)

$ 626 $ 691 $ 744 $ 796 $ 832 Nonaccrual loans held for sale 1 2 24

4 5 Restructured loans - (nonaccrual) held for sale

- - 15

3 - Total nonperforming

assets including loans held for sale $ 627

$ 693 $ 783 $ 803

$ 837 Restructured Consumer loans and leases

(accrual) $ 970 $ 943 $ 905 $ 1,610 $ 1,623 Restructured Commercial

loans and leases (accrual)(c) $ 769 $ 774 $ 844 $ 885 $ 914

Total loans and leases 90 days past due $ 70 $ 78 $ 87 $ 87 $ 94

Nonperforming loans and leases as a percent of portfolio loans,

leases and other assets, including OREO(b) 0.51 % 0.57 % 0.64 %

0.68 % 0.70 % Nonperforming assets as a percent of portfolio loans,

leases and other assets, including OREO(b) 0.67 % 0.76 % 0.82 %

0.88 % 0.92 %

(a) Excludes OREO related to government

insured loans. The Bancorp has historically excluded government

guaranteed loans classified in OREO from its nonperforming asset

disclosures. Upon the prospective adoption on January 1, 2015 of

ASU 2014-14 “Classification of Certain Government-Guaranteed

Mortgage Loans Upon Foreclosure,” government guaranteed loans

meeting certain criteria will be reclassified to other receivables

rather than OREO upon foreclosure.

(b) Does not include nonaccrual loans held

for sale.

(c) Excludes $21 million of restructured

nonaccrual loans and $7 million of restructured accruing loans as

of June 30, 2015, March 31, 2015, December 31, 2014, September 30,

2014 and June 30, 2014.

Total nonperforming assets, including loans held-for-sale, were

$627 million, a decline of $66 million, or 10 percent, from the

previous quarter. Nonperforming loans (NPLs) at quarter-end were

$475 million or 0.51 percent of total loans, leases and OREO, and

decreased $51 million, or 10 percent, from the previous

quarter.

Commercial NPAs were $376 million, or 0.66 percent of commercial

loans, leases and OREO, and decreased $45 million, or 11 percent,

from the first quarter. Commercial NPLs were $287 million, or 0.51

percent of commercial loans and leases, and decreased $38 million

from last quarter. C&I NPAs of $193 million decreased $23

million from the prior quarter. Commercial mortgage NPAs were $166

million, down $20 million from the previous quarter. Commercial

construction NPAs were $14 million, down $2 million from the

previous quarter. Commercial lease NPAs were $3 million, flat from

the previous quarter. Commercial NPAs included $175 million of

nonaccrual troubled debt restructurings (TDRs), compared with $205

million last quarter.

Consumer NPAs of $250 million, or 0.69 percent of consumer

loans, leases and OREO, decreased $20 million from the first

quarter. Consumer NPLs were $188 million, or 0.52 percent of

consumer loans and leases and decreased $13 million from last

quarter. Residential mortgage NPAs were $101 million, $12 million

lower than last quarter. Home equity NPAs of $106 million decreased

$5 million sequentially and credit card NPAs of $36 million were

down $2 million compared with the previous quarter. Consumer

nonaccrual TDRs were $83 million in the second quarter of 2015,

compared with $90 million in the first quarter of 2015.

Second quarter OREO balances included in NPA balances were $135

million, down $10 million from the first quarter, and included $78

million in commercial OREO and $57 million in consumer OREO.

Repossessed personal property of $16 million decreased $4 million

from the prior quarter.

Loans over 90 days past due and still accruing were $70 million,

down $8 million from the first quarter of 2015. Commercial balances

over 90 days past due were $2 million compared with $3 million in

the prior quarter, and consumer balances 90 days past due of $68

million were down $7 million from the previous quarter. Loans 30-89

days past due of $213 million were up $10 million from the previous

quarter. Commercial balances 30-89 days past due of $24 million

were down $1 million sequentially and consumer balances 30-89 days

past due of $189 million increased $11 million from the first

quarter. The above delinquencies figures exclude nonaccruals

described previously.

Capital Position

For the Three Months

Ended June March December September June 2015 2015

2014 2014 2014

Capital Position

Average shareholders' equity to average assets 11.32 % 11.49 %

11.54 % 11.71 % 11.57 %

Tangible equity(a)

9.28 % 9.37 % 9.41 % 9.65 % 9.77 %

Tangible common equity (excluding

unrealized gains/losses)(a)

8.33 % 8.40 % 8.43 % 8.64 % 8.74 % Tangible common equity

(including unrealized gains/losses)(a) 8.51 % 8.77 % 8.71 % 8.84 %

9.00 % Tangible common equity as a percent of risk-weighted assets

(excluding unrealized gains/losses) 9.38 %(b) 9.49 %(b) 9.70 %(d)

9.70 %(d) 9.67 %(d)

Regulatory capital

ratios:

Basel III

Transitional(c)

Basel I(d)

CET1 capital 9.41

%(b)

9.52

%(b)

N/A N/A N/A Tier I risk-based capital 10.49 %(b) 10.62 %(b) 10.83 %

10.83 % 10.80 % Total risk-based capital 13.67 %(b) 14.01 %(b)

14.33 % 14.34 % 14.30 % Tier I leverage 9.44 % 9.59 % 9.66 % 9.82 %

9.86 % Tier I common equity N/A N/A 9.65

%(a)

9.64

%(a)

9.61

%(a)

CET1 capital (fully-phased in)

9.30

(a)(b)

9.41

(a)(b)

N/A N/A N/A Book value per share 17.62 17.83 17.35 16.87

16.74

Tangible book value per share(a)

14.62 14.85 14.40 13.95 13.86

(a)

These ratios have been included herein to

facilitate a greater understanding of the Bancorp's capital

structure and financial condition. See the Regulation G Non-GAAP

Reconciliation table for a reconciliation of these ratios to U.S.

GAAP.

(b)

Under the banking agencies Basel III Final

Rule, assets and credit equivalent amounts of off-balance sheet

exposures are calculated based upon the standardized approach for

risk-weighted assets. The resulting values are added together

resulting in the Bancorp's total risk-weighted assets.

(c)

Current period regulatory capital ratios

are estimated.

(d)

These capital ratios were calculated under

the Supervisory Agencies general risk-based capital rules (Basel I)

which was in effect prior to January 1, 2015.

Capital ratios remained strong during the quarter, reflecting

growth in retained earnings, the payment of preferred dividends,

and share repurchase activity. The common equity Tier 1 ratio was

9.41 percent, the tangible common equity to tangible assets ratio*

was 8.33 percent (excluding unrealized gains/losses), and 8.51

percent (including unrealized gains/losses). The Tier 1 risk-based

capital ratio was 10.49 percent, the total risk-based capital ratio

was 13.67 percent, and the Leverage ratio was 9.44 percent.

Book value per share at June 30, 2015 was $17.62 and tangible

book value per share* was $14.62, compared with the March 31, 2015

book value per share of $17.83 and tangible book value per share*

of $14.85.

As previously announced, Fifth Third entered into a share

repurchase agreement with a counterparty on April 27, 2015, whereby

Fifth Third would purchase approximately $155 million of its

outstanding common stock. This transaction reduced Fifth Third’s

second quarter share count by 6.7 million shares on April 30, 2015.

Settlement of the forward contract related to this agreement is

expected to occur on or before July 28, 2015. In addition, the

settlement of the forward contract related to the January 22, 2015

$180 million share repurchase agreement occurred on April 23, 2015.

An additional 1.1 million shares were repurchased upon completion

of the agreement. In total, the incremental impact to the average

diluted share count in the second quarter of 2015 was approximately

7.96 million shares due to share repurchase transactions in the

second quarter and first quarter of 2015.

* Non-GAAP measure; see Reg. G reconciliation on page 33 in

Exhibit 99.1 of 8-k filing dated 7/21/15.

Tax RateThe effective tax rate was 26.1 percent this

quarter compared with 25.6 percent in the first quarter of 2015 and

27.6 percent in the second quarter of 2014.

OtherFifth Third Bank owns 43 million units representing

a 22.8 percent interest in Vantiv Holding, LLC, convertible into

shares of Vantiv, Inc., a publicly traded firm (NYSE: VNTV). Based

upon Vantiv’s closing price of $38.19 on June 30, 2015, our

interest in Vantiv was valued at approximately $1.6 billion. Next

month in our 10-Q, we will update our disclosure of the carrying

value of our interest in Vantiv stock, which was $402 million as of

March 31, 2015. The difference between the market value and the

book value of Fifth Third’s interest in Vantiv’s shares is not

recognized in Fifth Third’s equity or capital. Additionally, Fifth

Third has a warrant to purchase additional shares in Vantiv which

is carried as a derivative asset at a fair value of $500 million as

of June 30, 2015.

Conference CallFifth Third will host a conference call to

discuss these financial results at 9:00 a.m. (Eastern Time) today.

This conference call will be webcast live by Thomson Financial and

may be accessed through the Fifth Third Investor Relations website

at www.53.com (click on “About Fifth Third” then “Investor

Relations”). Institutional investors can access the call via

Thomson Financial’s password-protected event management site,

StreetEvents (www.streetevents.com).

Those unable to listen to the live webcast may access a webcast

replay through the Fifth Third Investor Relations website at the

same web address. Additionally, a telephone replay of the

conference call will be available beginning approximately two hours

after the conference call until Tuesday, August 4, 2015 by dialing

800-585-8367 for domestic access or 404-537-3406 for international

access (passcode 57890508#).

Corporate ProfileFifth Third Bancorp is a diversified

financial services company headquartered in Cincinnati, Ohio. As of

June 30, 2015, the Company had $142 billion in assets and operated

15 affiliates with 1,299 full-service Banking Centers, including

101 Bank Mart® locations, most open seven days a week, inside

select grocery stores and 2,630 ATMs in Ohio, Kentucky, Indiana,

Michigan, Illinois, Florida, Tennessee, West Virginia,

Pennsylvania, Missouri, Georgia and North Carolina. Fifth Third

operates four main businesses: Commercial Banking, Branch Banking,

Consumer Lending, and Investment Advisors. Fifth Third also has a

22.8% interest in Vantiv Holding, LLC. Fifth Third is among the

largest money managers in the Midwest and, as of June 30, 2015, had

$304 billion in assets under care, of which it managed $27 billion

for individuals, corporations and not-for-profit organizations.

Investor information and press releases can be viewed at

www.53.com. Fifth Third’s common stock is traded on the NASDAQ®

Global Select Market under the symbol “FITB.”

FORWARD-LOOKING STATEMENTS

This release contains statements that we believe are

“forward-looking statements” within the meaning of Section 27A of

the Securities Act of 1933, as amended, and Rule 175 promulgated

thereunder, and Section 21E of the Securities Exchange Act of 1934,

as amended, and Rule 3b-6 promulgated thereunder. These statements

relate to our financial condition, results of operations, plans,

objectives, future performance or business. They usually can be

identified by the use of forward-looking language such as “will

likely result,” “may,” “are expected to,” “anticipates,”

“potential,” “estimate,” “forecast,” “projected,” “intends to,” or

may include other similar words or phrases such as “believes,”

“plans,” “trend,” “objective,” “continue,” “remain,” or similar

expressions, or future or conditional verbs such as “will,”

“would,” “should,” “could,” “might,” “can,” or similar verbs. You

should not place undue reliance on these statements, as they are

subject to risks and uncertainties, including but not limited to

the risk factors set forth in our most recent Annual Report on Form

10-K as updated from time to time by our Quarterly Reports on Form

10-Q. When considering these forward-looking statements, you should

keep in mind these risks and uncertainties, as well as any

cautionary statements we may make. Moreover, you should treat these

statements as speaking only as of the date they are made and based

only on information then actually known to us. There is a risk that

additional information may arise during the company’s close process

or as a result of subsequent events that would require the company

to make adjustments to the financial information contained

herein.

There are a number of important factors that could cause future

results to differ materially from historical performance and these

forward-looking statements. Factors that might cause such a

difference include, but are not limited to: (1) general economic

conditions and weakening in the economy, specifically the real

estate market, either nationally or in the states in which Fifth

Third, one or more acquired entities and/or the combined company do

business, are less favorable than expected; (2) deteriorating

credit quality; (3) political developments, wars or other

hostilities may disrupt or increase volatility in securities

markets or other economic conditions; (4) changes in the interest

rate environment reduce interest margins; (5) prepayment speeds,

loan origination and sale volumes, charge-offs and loan loss

provisions; (6) Fifth Third’s ability to maintain required capital

levels and adequate sources of funding and liquidity; (7)

maintaining capital requirements and adequate sources of funding

and liquidity may limit Fifth Third’s operations and potential

growth; (8) changes and trends in capital markets; (9) problems

encountered by larger or similar financial institutions may

adversely affect the banking industry and/or Fifth Third; (10)

competitive pressures among depository institutions increase

significantly; (11) effects of critical accounting policies and

judgments; (12) changes in accounting policies or procedures as may

be required by the Financial Accounting Standards Board (FASB) or

other regulatory agencies; (13) legislative or regulatory changes

or actions, or significant litigation, adversely affect Fifth

Third, one or more acquired entities and/or the combined company or

the businesses in which Fifth Third, one or more acquired entities

and/or the combined company are engaged, including the Dodd-Frank

Wall Street Reform and Consumer Protection Act; (14) ability to

maintain favorable ratings from rating agencies; (15) fluctuation

of Fifth Third’s stock price; (16) ability to attract and retain

key personnel; (17) ability to receive dividends from its

subsidiaries; (18) potentially dilutive effect of future

acquisitions on current shareholders’ ownership of Fifth Third;

(19) effects of accounting or financial results of one or more

acquired entities; (20) difficulties from Fifth Third’s investment

in, relationship with, and nature of the operations of Vantiv, LLC;

(21) loss of income from any sale or potential sale of businesses

that could have an adverse effect on Fifth Third’s earnings and

future growth; (22) difficulties in separating the operations of

any branches or other assets divested; (23) inability to achieve

expected benefits from branch consolidations and planned sales

within desired timeframes, if at all; (24) ability to secure

confidential information and deliver products and services through

the use of computer systems and telecommunications networks; and

(25) the impact of reputational risk created by these developments

on such matters as business generation and retention, funding and

liquidity.

You should refer to our periodic and current reports filed with

the Securities and Exchange Commission, or “SEC,” for further

information on other factors, which could cause actual results to

be significantly different from those expressed or implied by these

forward-looking statements.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150721005482/en/

Fifth Third BancorpInvestors:Jim Eglseder,

513-534-8424orMedia:Larry Magnesen, 513-534-8055

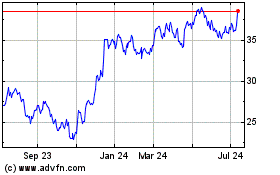

Fifth Third Bancorp (NASDAQ:FITB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Fifth Third Bancorp (NASDAQ:FITB)

Historical Stock Chart

From Apr 2023 to Apr 2024