UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the

Registrant

x

Filed by

a Party other than the Registrant

¨

Check the appropriate box:

|

|

|

|

|

¨

|

|

Preliminary Proxy Statement

|

|

|

|

|

¨

|

|

Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

¨

|

|

Definitive Proxy Statement

|

|

|

|

|

x

|

|

Definitive Additional Materials

|

|

|

|

|

¨

|

|

Soliciting Material Pursuant to §240.14a-12

|

Financial

Institutions, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Copies to:

|

|

|

|

|

Craig S. Wittlin, Esq.

Harter Secrest & Emery LLP

1600 Bausch & Lomb Place

Rochester, NY 14604-2711

(585) 231-1260

|

|

Keith E. Gottfried, Esq.

Morgan, Lewis & Bockius LLP

1111 Pennsylvania Avenue, N.W.

Washington, DC 20004-2541

(202) 739-5947

|

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

|

|

|

x

|

|

No fee required.

|

|

|

|

|

¨

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing

fee is calculated and state how it was determined):

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

(5)

|

|

Total fee paid:

|

|

|

|

|

¨

|

|

Fee paid previously with preliminary materials:

|

|

|

|

|

¨

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

(1)

|

|

Amount previously paid:

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

(4)

|

|

Date Filed:

|

Financial Institutions, Inc., a New York corporation (“

FISI

” or the “

Company

”),

is filing materials contained in this Schedule 14A with the U.S. Securities and Exchange Commission (“

SEC

”) in connection with the solicitation of proxies from its shareholders in connection with its 2016 Annual Meeting of

Shareholders to be held on Friday, June 3, 2016, at 10:00 a.m., local time, at the Company’s corporate headquarters in Warsaw, New York and at any and all adjournments or postponements thereof (the “

2016 Annual Meeting

”).

On April 19, 2016, FISI filed with the SEC its definitive proxy statement and accompanying definitive

BLUE

proxy card in connection with its solicitation of proxies to be used at the 2016 Annual Meeting.

Press Release Issued by FISI on May 26, 2016

Attached hereto is a press release issued by FISI on May 26, 2016 announcing that, on such date, FISI is first mailing to its shareholders a letter dated

May 26, 2016 (accompanied by a

BLUE

proxy card) in which FISI comments on the proxy contest by Clover Partners, L.P. (“

Clover

”) and the other participants in its solicitation with respect to the 2016

Annual Meeting and reports that the two leading independent, third-party proxy advisory firms, Institutional Shareholder Services Inc. (ISS) and Glass, Lewis & Co., LLC (Glass Lewis), whose clients include institutional investors,

mutual funds, pension funds and other fiduciaries, have each recommended to its clients that are FISI shareholders that they vote the

BLUE

proxy card

FOR ALL

four of FISI’s director nominees

–

Martin Birmingham, Samuel Gullo, Kim VanGelder and James Wyckoff

– standing for election at the 2016 Annual Meeting. As previously announced, Clover and the other participants in its solicitation have publicly

disclosed that they intend to pursue a proxy contest to elect two nominees to the FISI Board of Directors at the 2016 Annual Meeting. FISI strongly urges shareholders to follow the recommendations of both ISS and Glass Lewis and vote only the

BLUE

proxy card

FOR ALL

four of FISI’s director nominees recommended by the FISI Board of Directors.

Important Additional Information And Where To Find It

Financial Institutions, Inc. (“

FISI

”) its directors and certain of its executive officers are deemed to be participants in the solicitation of

proxies from FISI’s shareholders in connection with the matters to be considered at FISI’s 2016 Annual Meeting of Shareholders. On April 19, 2016, FISI filed a definitive proxy statement and accompanying definitive

BLUE

proxy card with the Securities and Exchange Commission (“

SEC

”) in connection with the solicitation of proxies from FISI’s shareholders in connection with the matters to be considered at FISI’s 2016

Annual Meeting of Shareholders. Information regarding the names of FISI’s directors and executive officers and their respective interests in FISI by security holdings or otherwise can be found in such definitive proxy statement, including the

schedules and appendices thereto. INVESTORS AND SHAREHOLDERS ARE STRONGLY ENCOURAGED TO READ ANY SUCH PROXY STATEMENT AND THE ACCOMPANYING

BLUE

PROXY CARD AND OTHER DOCUMENTS FILED BY FINANCIAL INSTITUTIONS WITH THE SEC CAREFULLY AND

IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE AS THEY WILL CONTAIN IMPORTANT INFORMATION. Shareholders may obtain the definitive proxy statement, any amendments or supplements to the proxy statement, the accompanying

BLUE

proxy card,

and other documents filed by FISI with the SEC for no charge at the SEC’s website at

www.sec.gov

. Copies will also be available at no charge at the Investor Relations section of FISI’s corporate website at www.fiiwarsaw.com, by

writing to FISI’s Corporate Secretary at Financial Institutions, Inc., 220 Liberty Street, Warsaw, New York 14569, or by calling FISI’s Corporate Secretary at (585) 786-1100.

|

|

|

|

|

NEWS RELEASE

|

|

220 Liberty Street

Warsaw, NY 14569

|

Financial Institutions Sends Letter to Shareholders

Letter Highlights that the Two Leading Independent Proxy Advisory Firms, ISS And Glass Lewis, Have Recommended that FISI Shareholders Vote

the

BLUE

Proxy Card

FOR ALL

of FISI’s Director Nominees

ISS and Glass

Lewis Recognize FISI’s Strong Financial Performance and Superior Shareholder Returns

WARSAW, N.Y., May 26, 2016 –

Financial

Institutions, Inc. (Nasdaq: FISI), the parent company of Five Star Bank, Scott Danahy Naylon and Courier Capital, today announced that it has sent a letter to shareholders, together with a

BLUE

proxy card, urging them to follow the

recommendations of the two leading, independent proxy advisory firms, Institutional Shareholder Services and Glass, Lewis & Co., and

VOTE

the

BLUE

proxy card

TODAY

FOR

the election of all four of the FISI

Board of Directors’ highly-qualified and very experienced director nominees,

Martin Birmingham, Samuel Gullo, Kim VanGelder

and

James Wyckoff,

at the 2016 Annual Meeting of Shareholders to be held on June 3, 2016. The letter

to FISI shareholders can be found at:

www.votefisi.com

.

The full text of the letter is as follows:

IMPORTANT RECENT DEVELOPMENTS!

THE TWO LEADING INDEPENDENT PROXY ADVISORY FIRMS, ISS AND GLASS LEWIS, RECOMMEND THAT FISI SHAREHOLDERS VOTE THE

BLUE

PROXY CARD

FOR ALL

OF FISI’S DIRECTOR NOMINEES

May 26, 2016

Dear Fellow Shareholder –

We are extremely pleased to

inform you that, over the past week, the two leading independent proxy advisory firms, Institutional Shareholder Services (“ISS”) and Glass Lewis & Co., LLC (“Glass Lewis”), issued reports recommending that FISI

shareholders vote the

BLUE

proxy card

FOR ALL

four of FISI’s highly-qualified and very experienced director nominees –

Martin Birmingham, Samuel Gullo, Kim VanGelder

and

James Wyckoff

–

standing for election at our upcoming 2016 Annual Meeting. In their reports, ISS and Glass Lewis recognized FISI’s clear strategic direction, strong financial performance and record of outperforming its peers in returning value to shareholders.

ISS and Glass Lewis also both came to the same conclusion that the dissident shareholder, Clover Partners, L.P., has not made a compelling case that additional change in FISI’s board composition is warranted.

FISI’S STRATEGIC DIRECTION, STRONG FINANCIAL PERFORMANCE AND SUPERIOR SHAREHOLDER RETURNS

ARE RECOGNIZED BY THE TWO LEADING INDEPENDENT PROXY ADVISORY FIRMS

|

|

|

|

|

|

|

|

|

ISS

|

|

Glass Lewis

|

|

|

|

|

|

Strength of

Strategic

Growth Plan

|

|

“FISI has delivered solid growth and profitability over the past five years.”

|

|

“We find no cause for concern with the Company’s strategic direction, which has been clearly communicated to investors and upon which management appears to be making progress, in our view.”

|

|

|

|

|

|

Superior Shareholder Returns

|

|

“On a five-year and three-year basis, the Company’s TSR [total shareholder return] appears to have handily outperformed peers through the date at which the dissident’s involvement first became public.”

|

|

“We find that the Company has generally outperformed peers and regional bank indices over the near-and longer-term, including over the one-year, three-year and 10-year periods reviewed in our analysis.”

|

|

|

|

|

|

Concerns

About Clover Partners

|

|

“Moreover, FISI’s outperformance was reduced after the dissident filed its 13D, which does not suggest the market believed the company was in need of an intervention.”

|

|

“We are concerned that the Dissident’s [Clover Partners] brief holding period and publicly stated interest in selling the Company could deny long-term shareholders the upside potential associated with the Company’s

stand-alone strategy.”

|

|

|

|

|

|

Conclusion

|

|

“As the dissident [Clover Partners] has not made a compelling case that additional change in the board level is warranted, votes FOR all management nominees – Birmingham, Gullo, VanGelder, and Wyckoff – are

warranted.”

|

|

“In conclusion, we do not believe the Dissident [Clover Partners] has made a compelling case that electing its nominees to the board is warranted or in the best interests of all shareholders at this time.”

|

We are very pleased that the two leading independent and highly reputable proxy advisory firms, ISS and Glass Lewis, carefully

reviewed the voting alternatives and came to the same conclusion in recommending that shareholders should vote

FOR ALL

four of FISI’s highly-qualified and very experienced director nominees on the

BLUE

proxy card. We

are also pleased that in making their recommendations, both ISS and Glass Lewis recognized that your Board’s strategic plan has been producing superior returns for shareholders over the last three years. Delivering value to our shareholders

remains our top priority. We believe that our strategic plan will continue to drive growth and profitability and create superior value for shareholders and its success has been demonstrated by numerous measures of FISI’s overall performance,

including the following:

|

|

•

|

|

66% in total shareholder returns

1

|

|

|

•

|

|

50% growth in FISI stock price

|

|

|

•

|

|

$32 million returned to shareholders through dividends

|

|

|

•

|

|

21% growth in net income; over 20% growth in loans, deposits and assets

|

|

|

•

|

|

21% growth in commercial business loans, 37% growth in commercial mortgages, and a 52% decrease in nonperforming loans

|

|

1

|

All calculations are based on three-year period ending December 31, 2015.

|

YOUR VOTE IS IMPORTANT FOR THE FUTURE OF FISI

Only the latest dated proxy card counts, so please vote the BLUE proxy card again TODAY!

The upcoming Annual Meeting, which is only days away on June 3

rd

, is a significant event that could

determine the future of FISI. We strongly urge all shareholders to follow the recommendations of the two leading, independent proxy advisory firms, ISS and Glass Lewis, and VOTE the

BLUE

proxy card

TODAY

FOR ALL

your

Board’s four highly-qualified and very experienced nominees:

Martin Birmingham, Samuel Gullo, Kim VanGelder

and

James Wyckoff

. Voting the

BLUE

proxy card will ensure that FISI is best positioned to

continue

executing on a strategic plan that has delivered increased growth, increased profitability, and achieved a 66% increase in total shareholder returns over the past three years.

We also urge you NOT to sign or return any white proxy card or voting instruction form that you may receive from Clover Partners. Even a WITHHOLD vote

with respect to Clover Partners’ proposed director nominees on its white proxy card or voting instruction form will cancel any

BLUE

proxy card or voting instruction form previously given to FISI. If you do sign a white proxy card

that is sent to you by Clover Partners, however, you have the right to change your vote by using the enclosed

BLUE

proxy card.

Only the latest dated proxy card or voting instruction form you vote will be counted.

We encourage you to visit

www.votefisi.com

for more information about the Annual Meeting.

Thank you for your continued support and patience as we strive to ensure that we are providing you with the information necessary to make a fully informed

voting decision.

Sincerely,

Board of Directors of

Financial Institutions, Inc.

About Financial Institutions, Inc.

Financial Institutions, Inc. provides diversified financial services through its subsidiaries, Five Star Bank, Scott Danahy Naylon and Courier Capital.

Five Star Bank provides a wide range of consumer and commercial banking services to individuals, municipalities and businesses through a network of over 50 offices and more than 60 ATMs throughout Western and Central New York State. Scott Danahy

Naylon provides a broad range of insurance services to personal and business clients across 44 states. Courier Capital provides customized investment management, investment consulting and retirement plan services to individuals, businesses,

institutions, foundations and retirement plans. Financial Institutions, Inc. and its subsidiaries employ approximately 700 individuals. The Company’s stock is listed on the Nasdaq Global Select Market under the symbol FISI and is a member of

the NASDAQ OMX ABA Community Bank Index. Additional information is available at the Company’s website:

www.fiiwarsaw.com

.

Safe

Harbor Statement

This press release may contain forward-looking statements as defined by Section 21E of the Securities Exchange Act of 1934, as

amended, and is subject to the safe harbors created by such laws. These forward-looking statements can generally be identified as such by the context of the statements, including words such as “believe,” “expect,”

“anticipate,” “plan,” “may,” “would,” “intend,” “estimate,” “guidance” and other similar expressions, whether in the negative or affirmative. Similarly, statements

that describe the objectives, plans or goals of Financial Institutions, Inc. (“FISI”) are forward-looking. Such forward-looking statements include, but are not limited to, statements

regarding the anticipated proxy contest by Clover Partners, L.P. and the other participants in its solicitation, FISI’s ability to continue to execute on and implement its strategic growth plan, FISI’s opportunities for continued growth,

FISI’s initiatives to improve its financial and operational performance and increase its growth and profitability, FISI’s future stock price and dividend growth, FISI’s future returns to shareholders, FISI’s ability to continue

to strengthen its balance sheet and grow its core business, FISI’s ability to continue to strengthen its regulatory compliance procedures, FISI’s ability to continue to profitably grow its commercial lending business, FISI’s ability

to enhance its competitive position through diversified income streams, FISI’s ability to leverage its client base to offer its clients additional fee-based products, FISI’s future returns from its existing fee-based platforms and the

effect of those platforms on overall shareholder value, FISI’s ability to continue to maintain expense discipline, FISI’s plans to continue to return cash to its shareholders through cash dividends and future increases that may be made

thereto, FISI’s actions taken or contemplated to enhance its long-term prospects and create and return value for its shareholders, FISI’s future operational and financial performance, FISI’s future growth and profitability, the effect

that the election of FISI’s nominees to the FISI Board will have on FISI’s execution of its long-term plan and long-term shareholder value, and the future effect of FISI’s strategic growth plan on FISI’s growth, profitability and

total shareholder returns. Such forward-looking statements are not guarantees of future operational or financial performance and are based on current expectations, estimates, forecasts and projections and management’s current beliefs and

assumptions, all of which involve a number of significant risks and uncertainties, any one or more of which could cause actual results to differ materially from those described in FISI’s forward-looking statements. There are a number of

important risks and uncertainties that could cause FISI’s actual events or results to differ materially from those indicated or implied by such forward-looking statements, including, but not limited to: FISI’s ability to implement its

strategic plan, FISI’s ability to redeploy investment assets into loan assets, whether FISI experiences greater credit losses than expected, whether FISI experiences breaches of its, or third party, information systems, the attitudes and

preferences of FISI’s customers, FISI’s ability to successfully integrate and profitably operate SDN and Courier Capital, the competitive environment, fluctuations in the fair value of securities in its investment portfolio, changes in the

regulatory environment and FISI’s compliance with regulatory requirements, changes in interest rates, general economic and credit market conditions nationally and regionally, and the actions of activist investors, including the amount of

related costs incurred by FISI and the disruption caused to FISI’s business activities by these actions. Consequently, all forward-looking statements made herein are qualified by these cautionary statements and the cautionary language in

FISI’s Annual Report on Form 10-K, its Quarterly Reports on Form 10-Q and other documents filed with the SEC. Except as required by law, FISI undertakes no obligation to revise these statements, whether to reflect new information or the

occurrence of unanticipated events or otherwise, following the date of this press release.

Important Additional Information And Where To Find It

Financial Institutions, Inc. (“FISI”) its directors and certain of its executive officers are deemed to be participants in the solicitation

of proxies from FISI’s shareholders in connection with the matters to be considered at FISI’s 2016 Annual Meeting of Shareholders. On April 19, 2016, FISI filed a definitive proxy statement and accompanying definitive

BLUE

proxy card with the Securities and Exchange Commission (“

SEC

”) in connection with the solicitation of proxies from FISI’s shareholders in connection with the matters to be considered at FISI’s 2016

Annual Meeting of Shareholders. Information regarding the names of FISI’s directors and executive officers and their respective interests in FISI by security holdings or otherwise can be found in such definitive proxy statement, including the

schedules and appendices thereto. INVESTORS AND SHAREHOLDERS ARE STRONGLY ENCOURAGED TO READ ANY SUCH PROXY STATEMENT AND THE ACCOMPANYING

BLUE

PROXY CARD AND OTHER DOCUMENTS FILED BY FINANCIAL INSTITUTIONS WITH THE SEC CAREFULLY AND

IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE AS THEY WILL CONTAIN IMPORTANT INFORMATION. Shareholders may obtain the definitive proxy statement, any amendments or supplements to the proxy statement, the accompanying

BLUE

proxy card, and other documents filed by FISI with the SEC for no charge at the SEC’s website at

www.sec.gov

. Copies will also be available at no charge at the

Investor Relations section of FISI’s corporate website at www.fiiwarsaw.com, by writing to FISI’s Corporate Secretary at Financial Institutions, Inc., 220 Liberty Street, Warsaw, New York 14569, or by calling FISI’s Corporate

Secretary at (585) 786-1100.

Disclaimer

Financial Institutions, Inc. has neither sought nor obtained the consent from any third party to use any statements or information contained in this press

release that have been obtained or derived from statements made or published by such third parties. Any such statements or information should not be viewed as indicating the support of such third parties for the views expressed herein.

*****

|

|

|

|

|

|

|

For additional information:

|

|

|

|

|

|

Investors:

|

|

|

|

News Media:

|

|

Kevin B. Klotzbach

|

|

|

|

Brandonne Rankin

|

|

Executive Vice President, Chief Financial Officer & Treasurer

|

|

|

|

McDougall Communications

|

|

Phone: 585.786.1130

|

|

|

|

Phone: 585.313.3683

|

|

Email:

KBKlotzbach@five-starbank.com

|

|

|

|

Email:

brankin@mcdougallpr.com

|

|

|

|

|

|

Jordan Darrow

|

|

|

|

|

|

Darrow Associates

|

|

|

|

|

|

Phone: 631.367.1866

|

|

|

|

|

|

Email:

jdarrow@darrowir.com

|

|

|

|

|

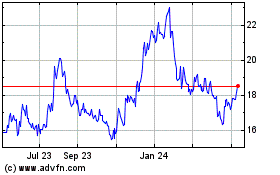

Financial Institutions (NASDAQ:FISI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Financial Institutions (NASDAQ:FISI)

Historical Stock Chart

From Apr 2023 to Apr 2024