Financial Institutions, Inc. (Nasdaq:FISI), today reported

financial results for the first quarter ended March 31, 2016.

Financial Institutions, Inc. (the “Company”) is the parent company

of Five Star Bank, Scott Danahy Naylon Insurance, LLC (“Scott

Danahy Naylon”) and Courier Capital, LLC (“Courier Capital”). The

Company’s financial results since January 5, 2016 include the

results of operations of Courier Capital, our wealth management

subsidiary whose business we acquired from Courier Capital

Corporation in January 2016.

First Quarter 2016 Highlights:

- Increased net interest income to a record $24.7 million in the

first quarter

- Increased noninterest income to $9.2 million in the first

quarter

- Strong performance resulted in return on average tangible

common equity of 13.54% for the quarter

- Growth strategy drives increase in fee-based services income

and market share, leading to record level of earnings assets and

deposits

- Total assets increased to over $3.5 billion, up $319.5 million

or 10% from a year ago

- Grew total loans $192.1 million or 10% from a year ago

- Increased total deposits by $255.5 million or 9% from a year

ago

- Quarterly cash dividend of $0.20 per common share represented a

2.77% dividend yield as of March 31, 2016 and a return of 40% of

first quarter net income to common shareholders

- Common and tangible common book value per share increased to

$20.46 and $15.18, respectively, at March 31, 2016

- Total risk-based capital increased to 13.39%, strengthening the

Company’s capital position to support future growth

- Completed the acquisition of Courier Capital, a prominent

SEC-registered investment advisory and wealth management firm with

offices in Buffalo and Jamestown

- Opened our second “Made For You” financial solution center in

Rochester; a unique customer service experience offered in one of

the Company’s targeted growth markets

Net income for the first quarter 2016 was $7.6 million, compared

to $6.6 million for the fourth quarter 2015, and $6.8 million for

the first quarter 2015. After preferred dividends, first quarter

2016 net income available to common shareholders was $7.3 million

or $0.50 per diluted share, compared with $6.3 million or $0.44 per

diluted share for the fourth quarter 2015, and $6.4 million or

$0.46 per diluted share for the first quarter 2015.

The Company’s President and Chief Executive Officer Martin K.

Birmingham stated, “Continued strength in banking operations,

successful implementation of our revenue diversification strategy

and diligent management of operating expenses were key drivers of

our core earnings growth this quarter. Consolidated revenues

of $33.9 million in the first quarter of 2016 reached the highest

level in the Company’s history. We remain focused on expense

control and implemented several initiatives designed to reduce

operating expenses late in the first quarter of 2016. We

expect those savings to be reflected beginning in the second

quarter.

“We continue to deliver balanced growth in our banking

operations. Deposits increased 8% from the fourth quarter of 2015

of this year, which we believe partially reflects the retrenchment

of larger competitors operating in the regions in which we operate.

In particular, the progress of our two new bank branches in

Rochester, one of the largest metro areas in our operating region,

is very encouraging. Our first branch office in Rochester, the

CityGate Financial Solution Center, opened in November and ended

the first quarter with $32 million in total deposits. We are

optimistic about further market share gains given the opening of

our Brighton office in late March 2016.

“The January 2016 acquisition of Courier Capital, our wealth

management platform, coupled with 4% growth in insurance revenues

through our Scott Danahy Naylon insurance subsidiary, contributed

to the growth in our noninterest income. Noninterest income

comprised 34% of total revenues in the quarter, up from 31% in the

first quarter of 2015. These new business lines combined with our

core community bank which has a 200 year tradition, positions us as

a leading western New York diversified financial services provider.

We believe this platform and our independence as a community bank

to respond to market needs in our region are key to our continued

growth.”

Kevin B. Klotzbach, the Company’s Chief Financial Officer added,

“We continue to deploy capital in a strategic manner that is

delivering results, while only beginning to benefit from the

leverage in our expanding platform. We ended the quarter with

record levels in a number of key business areas, including interest

income, noninterest income, total loans, total assets and total

deposits. Interest-earning assets reached a record at $3.2 billion,

as loan growth remained robust with demand from both consumer and

business customers, while rates on loan production and net interest

margin have held up well. We have also been able to effectively

control our cost of funds which has stabilized our margin. Net

interest margin has now increased for two consecutive quarters.

Meanwhile, our credit quality remained steady in the first quarter

and we have ample liquidity and a strong balance sheet to further

execute our growth strategies.

“The Company’s tangible common equity also ended the quarter at

a record level. Our return on tangible common equity of 13.54%

increased by 15% compared to last quarter due to earnings growth.

Contributing to our returns are the benefits from Company owned

life insurance policies which added $1.4 million to noninterest

income in the quarter. With over 60 policies remaining in force, we

expect continued contributions for many years, although the timing

and amounts will vary.

“Our strong first quarter performance led to tangible common

book value reaching $15.18 per share, an increase of nearly 3%

since the beginning of the year and up 7% in the last 12 months.

For the three months ended March 31, 2016, total shareholder return

of 4.6% far outpaced our peer group and the broader bank indexes,

many of which have experienced negative returns. We are gratified

that our operating strategies and financial results achieved have

enabled us to contribute to the communities we serve while

delivering value for our shareholders.”

Net Interest Income and Net Interest Margin

Net interest income was $24.7 million in the first quarter 2016

compared to $24.6 million in the fourth quarter 2015 and $23.1

million in the first quarter 2015. Average earning assets were up

$33.4 million, led by a $55.0 million increase in loans in the

first quarter of 2016 compared to the fourth quarter of 2015. When

comparing the first quarter 2016 to the same quarter in 2015,

average earning assets increased $313.1 million, including

increases of $119.7 million and $193.4 million in investment

securities and loans, respectively. First quarter 2016 net interest

margin was 3.27%, up slightly from 3.26% for the fourth quarter of

2015 and down 16 basis points from 3.43% for the first quarter of

2015.

Noninterest Income

Noninterest income was $9.2 million for the first quarter 2016

compared to $8.6 million for the fourth quarter 2015 and $8.3

million in the first quarter 2015. Included in company owned life

insurance income for the first quarter 2016 is $911 thousand of

death benefit proceeds. Included in fourth quarter 2015 other

noninterest income is $1.1 million related to the reduction in the

Company’s estimate of the fair value of the contingent

consideration liability recorded for Scott Danahy Naylon. Exclusive

of those items and gains realized from the sale of investment

securities, noninterest income was $7.7 million in the first

quarter 2016, $6.8 million in the fourth quarter 2015 and $7.2

million in the first quarter 2015. The main factors contributing to

the higher noninterest income during the first quarter 2016

compared to the fourth quarter 2015 were increases in insurance

income and investment advisory income. Insurance income increased

$436 thousand and investment advisory income increased $601

thousand, reflecting the contribution from Courier Capital which

was acquired during the first quarter 2016 as part of our strategy

to diversify our business lines and increase noninterest income

through additional fee-based services. The increase in insurance

income was largely due to contingent commission revenue from Scott

Danahy Naylon. Such commissions are seasonal in nature and are

generally received during the first quarter of each year. The

higher noninterest income in the first quarter 2016 compared to the

first quarter 2015 was primarily the result of a $756 thousand

increase in investment advisory income, reflecting the contribution

from Courier Capital, which was partially offset by a $418 thousand

decrease in limited partnership income. Income from the Company’s

equity method investments in limited partnerships, which are

primarily small business investment companies, fluctuates based on

the performance of the underlying investments.

Noninterest Expense

Noninterest expense was $21.2 million for the first quarter 2016

compared to $21.8 million for the fourth quarter 2015 and $19.0

million for the first quarter 2015. The decrease in noninterest

expense in first quarter 2016 compared to fourth quarter 2015 was

primarily due to the $751 thousand of goodwill impairment

recognized in the fourth quarter 2015.

The increase in noninterest expense during the first quarter

2016 compared to the first quarter 2015 was largely due to higher

salaries and employee benefits coupled with an increase in

professional services expense. Salaries and employee benefits

expense increased $1.4 million from the first quarter 2015,

reflecting the addition of Courier Capital and a combination of

additional personnel to support organic growth as part of the

Company’s expansion initiatives and higher medical expense as the

level of medical claims in the first quarter of 2015 were unusually

low. Professional services increased $479 thousand when comparing

the first quarter of 2016 to the same period in 2015. The first

quarter 2016 professional services expense included approximately

$360 thousand of professional services associated with responding

to the demands of an activist shareholder.

Income Taxes

Income tax expense was $2.7 million in the first quarter 2016,

compared to $2.2 million in the fourth quarter 2015 and $2.9

million in the first quarter 2015. Higher income tax expense during

the first quarter 2016 compared to the fourth quarter 2015 was

primarily driven by higher pre-tax income. The effective tax rate

was 26.4% for the first quarter 2016, compared with an effective

tax rate of 24.5% for the fourth quarter of 2015 and 29.8% in the

first quarter 2015. The lower effective tax rate in 2016 compared

to the same quarter a year ago is a result of the non-taxable life

insurance proceeds received in 2016.

Balance Sheet and Capital Management

Total assets were $3.52 billion at March 31, 2016, up $135.5

million from $3.38 billion at December 31, 2015 and up $319.5

million from $3.20 billion at March 31, 2015. The increases were

attributable to loan growth and higher investment security balances

funded by deposit growth.

Total loans were $2.12 billion at March 31, 2016, up $31.5

million from December 31, 2015 and up $192.4 million from March 31,

2015. The increases in loans are primarily attributable to organic

commercial loan growth. Commercial loans totaled $908.1 million as

of March 31, 2016, an increase of $28.2 million or 3% from December

31, 2015 and an increase of $151.4 million or 20% from March 31,

2015. Total investment securities were $1.09 billion at March 31,

2016, up $56.2 million or 5% from the end of the prior quarter and

up $140.8 million or 15% from March 31, 2015.

Total deposits were $2.96 billion at March 31, 2016, an increase

of $229.6 million from December 31, 2015 and an increase of $255.5

million from March 31, 2015. The increase during the first quarter

of 2016 was mainly due to seasonal inflows of municipal deposits,

while the year-over-year increase was due to higher municipal

deposits and successful business development efforts in retail

banking. Public deposit balances represented 30% of total deposits

at March 31, 2016 and 2015, compared to 25% at December 31,

2015.

Short-term borrowings were $179.2 million at March 31, 2016,

down $113.9 million from December 31, 2015 and up $3.6 million from

March 31, 2015. Short-term borrowings are typically utilized to

manage the seasonality of municipal deposits.

Shareholders’ equity was $314.0 million at March 31, 2016,

compared with $293.8 million at December 31, 2015 and $286.7

million at March 31, 2015. Common book value per share was $20.46

at March 31, 2016, an increase of $0.97 or 5% from $19.49 at

December 31, 2015 and $1.45 or 8% from $19.01 at March 31, 2015.

Tangible common book value per share was $15.18 at March 31, 2016,

compared to $14.77 at December 31, 2015 and $14.18 at March 31,

2015. The increases in shareholders’ equity and the book value per

share amounts are attributable to net income, stock issued for the

acquisition of Courier Capital and to higher net unrealized gains

on securities available for sale, a component of accumulated other

comprehensive income.

During the first quarter 2016, the Company declared a common

stock dividend of $0.20 per common share. The first quarter 2016

dividend returned 40% of first quarter net income to common

shareholders.

The Company’s leverage ratio was 7.46% at March 31, 2016,

compared to 7.41% at December 31, 2015 and 7.53% at March 31, 2015.

The increase in the leverage ratio from December 31, 2015 was due

to higher regulatory capital, which excludes changes in accumulated

other comprehensive income. The decrease in the leverage ratio from

March 31, 2015 was primarily due to an increase in average

quarterly assets.

Credit Quality

Non-performing loans were $8.6 million at March 31, 2016,

compared to $8.4 million at December 31, 2015 and $11.1 million at

March 31, 2015. The $2.5 million decrease from the first quarter

2015 was due to across the board improvement in each of the loan

portfolios. The ratio of non-performing loans to total loans was

0.41% at March 31, 2016 and December 31, 2015, and 0.58% at March

31, 2015.

The provision for loans losses for the first quarter 2016 was

$2.4 million, a decrease of $230 thousand from the prior quarter

and $373 thousand from the first quarter 2015. Net charge-offs were

$1.9 million during the first quarter 2016, an $83 thousand

decrease compared to the prior quarter and $1.3 million decrease

from the first quarter 2015. The ratio of annualized net

charge-offs to total average loans was 0.36% during the current

quarter, compared to 0.38% during the prior quarter and 0.68%

during the first quarter 2015.

The ratio of allowance for loans losses to total loans was 1.30%

at March 31, 2016 and December 31, 2015, and 1.41% at March 31,

2015. The ratio of allowance for loans losses to non-performing

loans was 322% at March 31, 2016, compared with 321% at December

31, 2015 and 246% at March 31, 2015.

About Financial Institutions,

Inc.

Financial Institutions, Inc. provides

diversified financial services through its subsidiaries, Five Star

Bank, Scott Danahy Naylon and Courier Capital. Five Star Bank

provides a wide range of consumer and commercial banking services

to individuals, municipalities and businesses through a network of

over 50 offices and more than 60 ATMs throughout Western and

Central New York State. Scott Danahy Naylon provides a broad range

of insurance services to personal and business clients across 44

states. Courier Capital provides customized investment management,

investment consulting and retirement plan services to individuals,

businesses, institutions, foundations and retirement plans.

Financial Institutions, Inc. and its subsidiaries employ

approximately 700 individuals. The Company’s stock is listed on the

Nasdaq Global Select Market under the symbol FISI and is a member

of the NASDAQ OMX ABA Community Bank Index. Additional information

is available at the Company’s website: www.fiiwarsaw.com.

Non-GAAP Financial

Information

This news release contains financial

information, such as tangible common equity, determined by methods

other than in accordance with U.S. generally accepted accounting

principles ("GAAP"). The Company believes that non-GAAP financial

measures provide a meaningful comparison of the underlying

operational performance of the Company, and facilitate investors'

assessments of its business and performance trends. In addition,

the Company believes the exclusion of these non-operating items

enables management to perform a more effective evaluation and

comparison of the Company's results and to assess performance in

relation to the Company's ongoing operations. These disclosures

should not be viewed as a substitute for financial measures

determined in accordance with GAAP, nor are they necessarily

comparable to non-GAAP financial measures that may be presented by

other companies. Where non-GAAP disclosures are used in this news

release, the comparable GAAP financial measure, as well as the

reconciliation to the comparable GAAP financial measure, can be

found in Appendix A to this document.

Safe Harbor Statement

This press release may contain forward-looking

statements as defined by Section 21E of the Securities Exchange Act

of 1934, as amended, that involve significant risks and

uncertainties. Statements herein are based on certain assumptions

and analyses by the Company and are factors it believes are

appropriate in the circumstances. Actual results could differ

materially from those contained in or implied by such statements

for a variety of reasons including, but not limited to: the

Company’s ability to implement its strategic plan, the Company’s

ability to redeploy investment assets into loan assets, whether the

Company experiences greater credit losses than expected, whether

the Company experiences breaches of its, or third party,

information systems, the attitudes and preferences of the Company’s

customers, the Company’s ability to successfully integrate and

profitably operate Scott Danahy Naylon and Courier Capital, the

competitive environment, fluctuations in the fair value of

securities in its investment portfolio, changes in the regulatory

environment and the Company’s compliance with regulatory

requirements, changes in interest rates, general economic and

credit market conditions nationally and regionally, and costs

associated with responding to the current proxy contest.

Consequently, all forward-looking statements made herein are

qualified by these cautionary statements and the cautionary

language in the Company’s Annual Report on Form 10-K, its Quarterly

Reports on Form 10-Q and other documents filed with the SEC.

Except as required by law, the Company undertakes no obligation to

revise these statements following the date of this press

release.

FINANCIAL INSTITUTIONS, INC.Selected

Financial Information (Unaudited)(Amounts in thousands,

except per share amounts)

|

|

|

2016 |

|

|

2015 |

|

|

March 31, |

|

December 31, |

|

September 30, |

|

June 30, |

|

March 31, |

| SELECTED

BALANCE SHEET DATA: |

|

|

|

|

|

|

|

|

|

| Cash and cash

equivalents |

$ |

110,944 |

|

|

60,121 |

|

51,334 |

|

|

52,554 |

|

|

135,972 |

| Investment

securities: |

|

|

|

|

|

|

|

|

|

| Available for sale |

|

610,013 |

|

|

544,395 |

|

577,509 |

|

|

772,639 |

|

|

639,275 |

| Held-to-maturity |

|

476,283 |

|

|

485,717 |

|

490,638 |

|

|

320,820 |

|

|

306,255 |

| Total investment securities |

|

1,086,296 |

|

|

1,030,112 |

|

1,068,147 |

|

|

1,093,459 |

|

|

945,530 |

| Loans held for

sale |

|

609 |

|

|

1,430 |

|

1,568 |

|

|

448 |

|

|

656 |

| Loans: |

|

|

|

|

|

|

|

|

|

| Commercial business |

|

317,776 |

|

|

313,758 |

|

297,876 |

|

|

292,791 |

|

|

277,464 |

| Commercial mortgage |

|

590,316 |

|

|

566,101 |

|

548,529 |

|

|

536,590 |

|

|

479,226 |

| Residential real estate loans |

|

382,504 |

|

|

381,074 |

|

376,552 |

|

|

365,172 |

|

|

355,495 |

| Residential real estate lines |

|

126,526 |

|

|

127,347 |

|

128,361 |

|

|

128,844 |

|

|

129,183 |

| Consumer indirect |

|

679,846 |

|

|

676,940 |

|

665,714 |

|

|

666,550 |

|

|

662,213 |

| Other consumer |

|

18,066 |

|

|

18,542 |

|

19,204 |

|

|

19,326 |

|

|

19,373 |

| Total loans |

|

2,115,034 |

|

|

2,083,762 |

|

2,036,236 |

|

|

2,009,273 |

|

|

1,922,954 |

| Allowance for loan losses |

|

27,568 |

|

|

27,085 |

|

26,455 |

|

|

27,500 |

|

|

27,191 |

| Total loans, net |

|

2,087,466 |

|

|

2,056,677 |

|

2,009,781 |

|

|

1,981,773 |

|

|

1,895,763 |

| Total interest-earning

assets |

|

3,189,582 |

|

|

3,114,530 |

|

3,097,315 |

|

|

3,104,631 |

|

|

2,860,605 |

| Goodwill and other

intangible assets, net |

|

76,567 |

|

|

66,946 |

|

67,925 |

|

|

68,158 |

|

|

68,396 |

| Total assets |

|

3,516,572 |

|

|

3,381,024 |

|

3,357,608 |

|

|

3,359,459 |

|

|

3,197,077 |

| Deposits: |

|

|

|

|

|

|

|

|

|

| Noninterest-bearing demand |

|

617,394 |

|

|

641,972 |

|

623,296 |

|

|

602,143 |

|

|

559,646 |

| Interest-bearing demand |

|

622,443 |

|

|

523,366 |

|

563,731 |

|

|

530,861 |

|

|

611,104 |

| Savings and money market |

|

1,042,910 |

|

|

928,175 |

|

942,673 |

|

|

910,215 |

|

|

922,093 |

| Certificates of deposit |

|

677,430 |

|

|

637,018 |

|

623,800 |

|

|

613,019 |

|

|

611,852 |

| Total deposits |

|

2,960,177 |

|

|

2,730,531 |

|

2,753,500 |

|

|

2,656,238 |

|

|

2,704,695 |

| Short-term

borrowings |

|

179,200 |

|

|

293,100 |

|

241,400 |

|

|

350,600 |

|

|

175,573 |

| Long-term borrowings,

net |

|

39,008 |

|

|

38,990 |

|

38,972 |

|

|

38,955 |

|

|

- |

| Total interest-bearing

liabilities |

|

2,560,991 |

|

|

2,420,649 |

|

2,410,576 |

|

|

2,443,650 |

|

|

2,320,622 |

| Shareholders’

equity |

|

313,953 |

|

|

293,844 |

|

295,434 |

|

|

284,435 |

|

|

286,689 |

| Common shareholders’

equity |

|

296,613 |

|

|

276,504 |

|

278,094 |

|

|

267,095 |

|

|

269,349 |

| Tangible common equity

(1) |

|

220,046 |

|

|

209,558 |

|

210,169 |

|

|

198,937 |

|

|

200,953 |

| Unrealized gain (loss)

on investment securities, net of tax |

$ |

7,555 |

|

|

443 |

|

5,270 |

|

|

(924 |

) |

|

5,241 |

| |

|

|

|

|

|

|

|

|

|

| Common shares

outstanding |

|

14,495 |

|

|

14,191 |

|

14,189 |

|

|

14,184 |

|

|

14,167 |

| Treasury shares |

|

197 |

|

|

207 |

|

209 |

|

|

214 |

|

|

231 |

| CAPITAL RATIOS

AND PER SHARE DATA: |

|

|

|

|

|

|

|

|

|

| Leverage ratio |

|

7.46 |

% |

|

7.41 |

|

7.29 |

|

|

7.31 |

|

|

7.53 |

| Common equity Tier 1

ratio |

|

9.83 |

% |

|

9.77 |

|

9.74 |

|

|

9.50 |

|

|

9.66 |

| Tier 1 risk-based

capital |

|

10.56 |

% |

|

10.50 |

|

10.49 |

|

|

10.25 |

|

|

10.45 |

| Total risk-based

capital |

|

13.39 |

% |

|

13.35 |

|

13.37 |

|

|

13.17 |

|

|

11.69 |

| Common equity to

assets |

|

8.43 |

% |

|

8.18 |

|

8.28 |

|

|

7.95 |

|

|

8.42 |

| Tangible common equity

to tangible assets (1) |

|

6.40 |

% |

|

6.32 |

|

6.39 |

|

|

6.04 |

|

|

6.42 |

| |

|

|

|

|

|

|

|

|

|

| Common book value per

share |

$ |

20.46 |

|

|

19.49 |

|

19.60 |

|

|

18.83 |

|

|

19.01 |

| Tangible common book

value per share (1) |

$ |

15.18 |

|

|

14.77 |

|

14.81 |

|

|

14.03 |

|

|

14.18 |

| Stock price (Nasdaq:

FISI): |

|

|

|

|

|

|

|

|

|

| High |

$ |

29.53 |

|

|

29.04 |

|

25.21 |

|

|

25.50 |

|

|

25.38 |

| Low |

$ |

25.38 |

|

|

24.05 |

|

23.54 |

|

|

22.50 |

|

|

21.67 |

| Close |

$ |

29.07 |

|

|

28.00 |

|

24.78 |

|

|

24.84 |

|

|

22.93 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

________(1) See Appendix A – Reconciliation to

Non-GAAP Financial Measures for the computation of this Non-GAAP

measure.

FINANCIAL INSTITUTIONS, INC.Selected

Financial Information (Unaudited)(Amounts in thousands,

except per share amounts)

| |

|

|

|

2016 |

|

|

2015 |

| |

|

|

First |

|

Year ended |

|

Fourth |

|

Third |

|

Second |

|

First |

| |

|

|

Quarter |

|

December 31, |

|

Quarter |

|

Quarter |

|

Quarter |

|

Quarter |

| SELECTED INCOME

STATEMENT DATA: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest income |

|

|

$ |

27,635 |

|

|

|

105,450 |

|

|

27,487 |

|

|

27,007 |

|

|

25,959 |

|

24,997 |

| Interest expense |

|

|

|

2,916 |

|

|

|

10,137 |

|

|

2,856 |

|

|

2,876 |

|

|

2,555 |

|

1,850 |

| Net interest income |

|

|

|

24,719 |

|

|

|

95,313 |

|

|

24,631 |

|

|

24,131 |

|

|

23,404 |

|

23,147 |

| Provision for loan

losses |

|

|

|

2,368 |

|

|

|

7,381 |

|

|

2,598 |

|

|

754 |

|

|

1,288 |

|

2,741 |

| Net interest income after provision

for loan losses |

|

|

|

22,351 |

|

|

|

87,932 |

|

|

22,033 |

|

|

23,377 |

|

|

22,116 |

|

20,406 |

| Noninterest

income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Service charges on deposits |

|

|

|

1,724 |

|

|

|

7,742 |

|

|

1,862 |

|

|

2,037 |

|

|

1,964 |

|

1,879 |

| Insurance income |

|

|

|

1,672 |

|

|

|

5,166 |

|

|

1,236 |

|

|

1,265 |

|

|

1,057 |

|

1,608 |

| ATM and debit card |

|

|

|

1,325 |

|

|

|

5,084 |

|

|

1,311 |

|

|

1,297 |

|

|

1,283 |

|

1,193 |

| Investment advisory |

|

|

|

1,243 |

|

|

|

2,193 |

|

|

642 |

|

|

523 |

|

|

541 |

|

487 |

| Company owned life insurance |

|

|

|

1,368 |

|

|

|

1,962 |

|

|

514 |

|

|

488 |

|

|

493 |

|

467 |

| Investments in limited

partnerships |

|

|

|

56 |

|

|

|

895 |

|

|

30 |

|

|

336 |

|

|

55 |

|

474 |

| Loan servicing |

|

|

|

116 |

|

|

|

503 |

|

|

87 |

|

|

153 |

|

|

96 |

|

167 |

| Net gain on sale of loans held for

sale |

|

|

|

78 |

|

|

|

249 |

|

|

88 |

|

|

53 |

|

|

39 |

|

69 |

| Net gain on investment

securities |

|

|

|

613 |

|

|

|

1,988 |

|

|

640 |

|

|

286 |

|

|

- |

|

1,062 |

| Net gain on sale of other

assets |

|

|

|

4 |

|

|

|

27 |

|

|

7 |

|

|

- |

|

|

16 |

|

4 |

| Amortization of tax credit

investment |

|

|

|

- |

|

|

|

(390 |

) |

|

- |

|

|

(390 |

) |

|

- |

|

- |

| Other |

|

|

|

1,018 |

|

|

|

4,918 |

|

|

2,163 |

|

|

957 |

|

|

911 |

|

887 |

| Total noninterest income |

|

|

|

9,217 |

|

|

|

30,337 |

|

|

8,580 |

|

|

7,005 |

|

|

6,455 |

|

8,297 |

| Noninterest

expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Salaries and employee benefits |

|

|

|

11,614 |

|

|

|

42,439 |

|

|

11,332 |

|

|

10,278 |

|

|

10,606 |

|

10,223 |

| Occupancy and equipment |

|

|

|

3,625 |

|

|

|

13,856 |

|

|

3,365 |

|

|

3,417 |

|

|

3,375 |

|

3,699 |

| Professional services |

|

|

|

1,447 |

|

|

|

4,502 |

|

|

1,604 |

|

|

1,064 |

|

|

866 |

|

968 |

| Computer and data processing |

|

|

|

804 |

|

|

|

3,186 |

|

|

895 |

|

|

779 |

|

|

810 |

|

702 |

| Supplies and postage |

|

|

|

594 |

|

|

|

2,155 |

|

|

544 |

|

|

540 |

|

|

508 |

|

563 |

| FDIC assessments |

|

|

|

436 |

|

|

|

1,719 |

|

|

442 |

|

|

444 |

|

|

415 |

|

418 |

| Advertising and promotions |

|

|

|

377 |

|

|

|

1,120 |

|

|

331 |

|

|

312 |

|

|

238 |

|

239 |

| Goodwill impairment charge |

|

|

|

- |

|

|

|

751 |

|

|

751 |

|

|

- |

|

|

- |

|

- |

| Other |

|

|

|

2,321 |

|

|

|

9,665 |

|

|

2,564 |

|

|

2,484 |

|

|

2,418 |

|

2,199 |

| Total noninterest expense |

|

|

|

21,218 |

|

|

|

79,393 |

|

|

21,828 |

|

|

19,318 |

|

|

19,236 |

|

19,011 |

| Income before income taxes |

|

|

|

10,350 |

|

|

|

38,876 |

|

|

8,785 |

|

|

11,064 |

|

|

9,335 |

|

9,692 |

| Income tax expense |

|

|

|

2,732 |

|

|

|

10,539 |

|

|

2,150 |

|

|

2,748 |

|

|

2,750 |

|

2,891 |

| Net income |

|

|

|

7,618 |

|

|

|

28,337 |

|

|

6,635 |

|

|

8,316 |

|

|

6,585 |

|

6,801 |

| Preferred stock

dividends |

|

|

|

365 |

|

|

|

1,462 |

|

|

365 |

|

|

366 |

|

|

366 |

|

365 |

| Net income available to

common shareholders |

|

|

$ |

7,253 |

|

|

|

26,875 |

|

|

6,270 |

|

|

7,950 |

|

|

6,219 |

|

6,436 |

| FINANCIAL

RATIOS: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per share –

basic |

|

|

$ |

0.50 |

|

|

|

1.91 |

|

|

0.44 |

|

|

0.56 |

|

|

0.44 |

|

0.46 |

| Earnings per share –

diluted |

|

|

$ |

0.50 |

|

|

|

1.90 |

|

|

0.44 |

|

|

0.56 |

|

|

0.44 |

|

0.46 |

| Cash dividends declared

on common stock |

|

|

$ |

0.20 |

|

|

|

0.80 |

|

|

0.20 |

|

|

0.20 |

|

|

0.20 |

|

0.20 |

| Common dividend payout

ratio |

|

|

|

40.00 |

% |

|

|

41.88 |

|

|

45.45 |

|

|

35.71 |

|

|

45.45 |

|

43.48 |

| Dividend yield

(annualized) |

|

|

|

2.77 |

% |

|

|

2.86 |

|

|

2.83 |

|

|

3.20 |

|

|

3.23 |

|

3.54 |

| Return on average

assets |

|

|

|

0.90 |

% |

|

|

0.87 |

|

|

0.78 |

|

|

0.99 |

|

|

0.81 |

|

0.89 |

| Return on average

tangible assets (1) |

|

|

|

0.88 |

% |

|

|

0.84 |

|

|

0.76 |

|

|

0.96 |

|

|

0.78 |

|

0.86 |

| Return on average

equity |

|

|

|

9.91 |

% |

|

|

9.78 |

|

|

8.86 |

|

|

11.41 |

|

|

9.19 |

|

9.68 |

| Return on average

common equity |

|

|

|

10.00 |

% |

|

|

9.87 |

|

|

8.89 |

|

|

11.60 |

|

|

9.24 |

|

9.75 |

| Return on average

tangible common equity (1) |

|

|

|

13.54 |

% |

|

|

13.16 |

|

|

11.73 |

|

|

15.47 |

|

|

12.37 |

|

13.11 |

| Efficiency ratio

(2) |

|

|

|

62.90 |

% |

|

|

61.58 |

|

|

64.55 |

|

|

59.46 |

|

|

62.00 |

|

60.27 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

________(1) See Appendix A – Reconciliation to

Non-GAAP Financial Measures for the computation of this Non-GAAP

measure.(2) Efficiency ratio equals noninterest expense less other

real estate expense and amortization and impairment of goodwill and

other intangible assets as a percentage of net revenue, defined as

the sum of tax-equivalent net interest income and noninterest

income before net gains on investment securities, proceeds from

company owned life insurance, adjustments to contingent liabilities

and amortizations of tax credit investment.

FINANCIAL INSTITUTIONS, INC.Selected

Financial Information

(Unaudited) (Amounts in

thousands)

|

|

|

|

|

2016 |

|

|

2015 |

|

|

|

|

First |

|

Year ended |

|

Fourth |

|

Third |

|

Second |

|

First |

|

|

|

|

Quarter |

|

December 31, |

|

Quarter |

|

Quarter |

|

Quarter |

|

Quarter |

| SELECTED

AVERAGE BALANCES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Federal funds sold and

interest-earning deposits |

|

|

$ |

70 |

|

|

37 |

|

- |

|

- |

|

26 |

|

124 |

| Investment securities

(1) |

|

|

|

1,027,602 |

|

|

1,014,171 |

|

1,049,217 |

|

1,067,815 |

|

1,029,640 |

|

907,871 |

| Loans: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Commercial business |

|

|

|

316,143 |

|

|

286,019 |

|

297,033 |

|

297,216 |

|

284,535 |

|

264,814 |

| Commercial mortgage |

|

|

|

582,142 |

|

|

522,328 |

|

554,327 |

|

545,875 |

|

509,317 |

|

478,705 |

| Residential real estate loans |

|

|

|

382,077 |

|

|

366,032 |

|

379,189 |

|

371,318 |

|

357,442 |

|

355,866 |

| Residential real estate lines |

|

|

|

127,317 |

|

|

128,525 |

|

127,688 |

|

127,826 |

|

129,167 |

|

129,444 |

| Consumer indirect |

|

|

|

678,133 |

|

|

665,454 |

|

671,888 |

|

663,884 |

|

664,222 |

|

661,727 |

| Other consumer |

|

|

|

17,926 |

|

|

18,969 |

|

18,626 |

|

18,680 |

|

18,848 |

|

19,736 |

| Total loans |

|

|

|

2,103,738 |

|

|

1,987,327 |

|

2,048,751 |

|

2,024,799 |

|

1,963,531 |

|

1,910,292 |

| Total interest-earning

assets |

|

|

|

3,131,410 |

|

|

3,001,535 |

|

3,097,968 |

|

3,092,614 |

|

2,993,197 |

|

2,818,287 |

| Goodwill and other

intangible assets, net |

|

|

|

76,324 |

|

|

68,138 |

|

67,692 |

|

68,050 |

|

68,294 |

|

68,527 |

| Total assets |

|

|

|

3,405,451 |

|

|

3,269,890 |

|

3,353,702 |

|

3,343,802 |

|

3,263,111 |

|

3,115,516 |

| Interest-bearing

liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest-bearing demand |

|

|

|

572,424 |

|

|

543,690 |

|

545,602 |

|

516,448 |

|

561,570 |

|

551,503 |

| Savings and money market |

|

|

|

965,629 |

|

|

908,614 |

|

960,768 |

|

903,491 |

|

929,701 |

|

839,218 |

| Certificates of deposit |

|

|

|

658,537 |

|

|

616,747 |

|

628,944 |

|

619,459 |

|

616,145 |

|

602,115 |

| Short-term borrowings |

|

|

|

221,326 |

|

|

262,494 |

|

241,957 |

|

329,050 |

|

226,577 |

|

251,768 |

| Long-term borrowings, net |

|

|

|

38,997 |

|

|

27,886 |

|

38,979 |

|

38,962 |

|

33,053 |

|

- |

| Total interest-bearing

liabilities |

|

|

|

2,456,913 |

|

|

2,359,431 |

|

2,416,250 |

|

2,407,410 |

|

2,367,046 |

|

2,244,604 |

| Noninterest-bearing

demand deposits |

|

|

|

617,590 |

|

|

599,334 |

|

619,423 |

|

625,131 |

|

587,396 |

|

564,500 |

| Total deposits |

|

|

|

2,814,180 |

|

|

2,668,385 |

|

2,754,737 |

|

2,664,529 |

|

2,694,812 |

|

2,557,336 |

| Total liabilities |

|

|

|

3,096,263 |

|

|

2,980,183 |

|

3,056,541 |

|

3,054,573 |

|

2,975,762 |

|

2,830,557 |

| Shareholders’

equity |

|

|

|

309,188 |

|

|

289,707 |

|

297,161 |

|

289,229 |

|

287,349 |

|

284,959 |

| Common equity |

|

|

|

291,848 |

|

|

272,367 |

|

279,821 |

|

271,889 |

|

270,009 |

|

267,619 |

| Tangible common equity

(2) |

|

|

$ |

215,524 |

|

|

204,229 |

|

212,129 |

|

203,839 |

|

201,715 |

|

199,092 |

| Common shares

outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

|

14,395 |

|

|

14,081 |

|

14,095 |

|

14,087 |

|

14,078 |

|

14,063 |

| Diluted |

|

|

|

14,465 |

|

|

14,135 |

|

14,163 |

|

14,139 |

|

14,121 |

|

14,113 |

| SELECTED

AVERAGE YIELDS: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Tax equivalent

basis) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Investment

securities |

|

|

|

2.48 |

% |

|

2.46 |

|

2.47 |

|

2.46 |

|

2.44 |

|

2.47 |

| Loans |

|

|

|

4.21 |

% |

|

4.21 |

|

4.22 |

|

4.16 |

|

4.18 |

|

4.27 |

| Total interest-earning

assets |

|

|

|

3.64 |

% |

|

3.62 |

|

3.63 |

|

3.57 |

|

3.58 |

|

3.69 |

| Interest-bearing

demand |

|

|

|

0.14 |

% |

|

0.14 |

|

0.15 |

|

0.15 |

|

0.14 |

|

0.11 |

| Savings and money

market |

|

|

|

0.13 |

% |

|

0.13 |

|

0.14 |

|

0.14 |

|

0.12 |

|

0.10 |

| Certificates of

deposit |

|

|

|

0.88 |

% |

|

0.87 |

|

0.88 |

|

0.89 |

|

0.87 |

|

0.84 |

| Short-term

borrowings |

|

|

|

0.62 |

% |

|

0.41 |

|

0.49 |

|

0.41 |

|

0.38 |

|

0.37 |

| Long-term borrowings,

net |

|

|

|

6.34 |

% |

|

6.28 |

|

6.34 |

|

6.34 |

|

6.23 |

|

- |

| Total interest-bearing

liabilities |

|

|

|

0.48 |

% |

|

0.43 |

|

0.47 |

|

0.47 |

|

0.43 |

|

0.33 |

| Net interest rate

spread |

|

|

|

3.16 |

% |

|

3.19 |

|

3.16 |

|

3.10 |

|

3.15 |

|

3.36 |

| Net interest rate

margin |

|

|

|

3.27 |

% |

|

3.28 |

|

3.26 |

|

3.20 |

|

3.24 |

|

3.43 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

________(1) Includes investment securities at

adjusted amortized cost.(2) See Appendix A – Reconciliation to

Non-GAAP Financial Measures for the computation of this Non-GAAP

measure.

FINANCIAL INSTITUTIONS, INC.Selected

Financial Information (Unaudited)(Amounts in

thousands)

|

|

|

2016 |

|

|

2015 |

|

|

First |

|

Fourth |

|

Third |

|

Second |

|

First |

|

|

Quarter |

|

Quarter |

|

Quarter |

|

Quarter |

|

Quarter |

| ASSET QUALITY

DATA: |

|

|

|

|

|

|

|

|

|

| Allowance for

Loan Losses |

|

|

|

|

|

|

|

|

|

| Beginning balance |

$ |

27,085 |

|

|

26,455 |

|

27,500 |

|

|

27,191 |

|

|

|

27,637 |

|

| Net loan charge-offs

(recoveries): |

|

|

|

|

|

|

|

|

|

| Commercial business |

|

502 |

|

|

133 |

|

68 |

|

|

(73 |

) |

|

|

1,093 |

|

| Commercial mortgage |

|

(1 |

) |

|

23 |

|

12 |

|

|

194 |

|

|

|

520 |

|

| Residential real estate loans |

|

21 |

|

|

110 |

|

37 |

|

|

38 |

|

|

|

98 |

|

| Residential real estate lines |

|

- |

|

|

24 |

|

30 |

|

|

116 |

|

|

|

(2 |

) |

| Consumer indirect |

|

1,328 |

|

|

1,519 |

|

1,475 |

|

|

645 |

|

|

|

1,317 |

|

| Other consumer |

|

35 |

|

|

159 |

|

177 |

|

|

59 |

|

|

|

161 |

|

| Total net charge-offs |

|

1,885 |

|

|

1,968 |

|

1,799 |

|

|

979 |

|

|

|

3,187 |

|

| Provision for loan

losses |

|

2,368 |

|

|

2,598 |

|

754 |

|

|

1,288 |

|

|

|

2,741 |

|

| Ending balance |

$ |

27,568 |

|

|

27,085 |

|

26,455 |

|

|

27,500 |

|

|

|

27,191 |

|

| |

|

|

|

|

|

|

|

|

|

| Net charge-offs

(recoveries) to average loans (annualized): |

|

|

|

|

|

|

|

|

|

| Commercial business |

|

0.64 |

% |

|

0.18 |

|

0.09 |

|

|

-0.10 |

|

|

|

1.67 |

|

| Commercial mortgage |

|

0.00 |

% |

|

0.02 |

|

0.01 |

|

|

0.15 |

|

|

|

0.44 |

|

| Residential real estate loans |

|

0.02 |

% |

|

0.12 |

|

0.04 |

|

|

0.04 |

|

|

|

0.11 |

|

| Residential real estate lines |

|

0.00 |

% |

|

0.07 |

|

0.09 |

|

|

0.36 |

|

|

|

-0.01 |

|

| Consumer indirect |

|

0.79 |

% |

|

0.90 |

|

0.88 |

|

|

0.39 |

|

|

|

0.81 |

|

| Other consumer |

|

0.79 |

% |

|

3.39 |

|

3.76 |

|

|

1.26 |

|

|

|

3.31 |

|

| Total loans |

|

0.36 |

% |

|

0.38 |

|

0.35 |

|

|

0.20 |

|

|

|

0.68 |

|

|

|

|

|

|

|

|

|

|

|

|

| Supplemental

information (1) |

|

|

|

|

|

|

|

|

|

| Non-performing

loans: |

|

|

|

|

|

|

|

|

|

| Commercial business |

$ |

4,056 |

|

|

3,922 |

|

3,064 |

|

|

4,643 |

|

|

|

4,587 |

|

| Commercial mortgage |

|

1,781 |

|

|

947 |

|

1,802 |

|

|

3,070 |

|

|

|

3,411 |

|

| Residential real estate loans |

|

1,601 |

|

|

1,848 |

|

2,092 |

|

|

2,028 |

|

|

|

1,829 |

|

| Residential real estate lines |

|

165 |

|

|

235 |

|

223 |

|

|

219 |

|

|

|

204 |

|

| Consumer indirect |

|

943 |

|

|

1,467 |

|

1,292 |

|

|

728 |

|

|

|

994 |

|

| Other consumer |

|

21 |

|

|

21 |

|

20 |

|

|

20 |

|

|

|

47 |

|

| Total non-performing loans |

|

8,567 |

|

|

8,440 |

|

8,493 |

|

|

10,708 |

|

|

|

11,072 |

|

| Foreclosed assets |

|

187 |

|

|

163 |

|

286 |

|

|

165 |

|

|

|

139 |

|

| Total non-performing assets |

$ |

8,754 |

|

|

8,603 |

|

8,779 |

|

|

10,873 |

|

|

|

11,211 |

|

| |

|

|

|

|

|

|

|

|

|

| Total non-performing

loans to total loans |

|

0.41 |

% |

|

0.41 |

|

0.42 |

|

|

0.53 |

|

|

|

0.58 |

|

| Total non-performing

assets to total assets |

|

0.25 |

% |

|

0.25 |

|

0.26 |

|

|

0.32 |

|

|

|

0.35 |

|

| Allowance for loan

losses to total loans |

|

1.30 |

% |

|

1.30 |

|

1.30 |

|

|

1.37 |

|

|

|

1.41 |

|

| Allowance for loan

losses to non-performing loans |

|

322 |

% |

|

321 |

|

311 |

|

|

257 |

|

|

|

246 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

________(1) At period end.

FINANCIAL INSTITUTIONS, INC.Appendix A

- Reconciliation to Non-GAAP Financial Measures

(Unaudited)(In thousands, except per share amounts)

|

|

|

|

2016 |

|

|

2015 |

|

|

|

First |

|

Year ended |

|

Fourth |

|

Third |

|

Second |

|

First |

|

|

|

Quarter |

|

December 31, |

|

Quarter |

|

Quarter |

|

Quarter |

|

Quarter |

| Ending tangible

assets: |

|

|

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

3,516,572 |

|

|

|

|

|

3,381,024 |

|

|

3,357,608 |

|

3,359,459 |

|

3,197,077 |

| Less: Goodwill and

other intangible assets, net |

|

|

76,567 |

|

|

|

|

|

66,946 |

|

|

67,925 |

|

68,158 |

|

68,396 |

| Tangible assets |

|

$ |

3,440,005 |

|

|

|

|

|

3,314,078 |

|

|

3,289,683 |

|

3,291,301 |

|

3,128,681 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ending tangible

common equity: |

|

|

|

|

|

|

|

|

|

|

|

|

| Common shareholders’

equity |

|

$ |

296,613 |

|

|

|

|

|

276,504 |

|

|

278,094 |

|

267,095 |

|

269,349 |

| Less: Goodwill and

other intangible assets, net |

|

|

76,567 |

|

|

|

|

|

66,946 |

|

|

67,925 |

|

68,158 |

|

68,396 |

| Tangible common

equity |

|

$ |

220,046 |

|

|

|

|

$ |

209,558 |

|

|

210,169 |

|

198,937 |

|

200,953 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Tangible common equity

to tangible assets (1) |

|

|

6.40 |

% |

|

|

|

|

6.32 |

|

|

6.39 |

|

6.04 |

|

6.42 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Common shares

outstanding |

|

|

14,495 |

|

|

|

|

|

14,191 |

|

|

14,189 |

|

14,184 |

|

14,167 |

| Tangible common book

value per share (2) |

|

$ |

15.18 |

|

|

|

|

|

14.77 |

|

|

14.81 |

|

14.03 |

|

14.18 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Average

tangible assets: |

|

|

|

|

|

|

|

|

|

|

|

|

| Average assets |

|

$ |

3,405,451 |

|

|

3,269,890 |

|

|

3,353,702 |

|

|

3,343,802 |

|

3,263,111 |

|

3,115,516 |

| Less: Average goodwill

and other intangible assets |

|

|

76,324 |

|

|

68,138 |

|

|

67,692 |

|

|

68,050 |

|

68,294 |

|

68,527 |

| Average tangible

assets |

|

$ |

3,329,127 |

|

|

3,210,752 |

|

|

3,286,010 |

|

|

3,275,752 |

|

3,194,817 |

|

3,046,989 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average

tangible common equity: |

|

|

|

|

|

|

|

|

|

|

|

|

| Average common

equity |

|

$ |

291,848 |

|

|

272,367 |

|

|

279,821 |

|

|

271,889 |

|

270,009 |

|

267,619 |

| Less: Average goodwill

and other intangible assets |

|

|

76,324 |

|

|

68,138 |

|

|

67,692 |

|

|

68,050 |

|

68,294 |

|

68,527 |

| Average tangible common

equity |

|

$ |

215,524 |

|

|

204,229 |

|

|

212,129 |

|

|

203,839 |

|

201,715 |

|

199,092 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net income available to

common shareholders |

|

$ |

7,253 |

|

|

26,875 |

|

|

6,270 |

|

|

7,950 |

|

6,219 |

|

6,436 |

| Return on average

tangible common equity (3) |

|

|

13.54 |

% |

|

13.16 |

|

|

11.73 |

|

|

15.47 |

|

12.37 |

|

13.11 |

| Return on average

tangible assets (4) |

|

|

0.88 |

% |

|

0.84 |

|

|

0.76 |

|

|

0.96 |

|

0.78 |

|

0.86 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

________(1) Tangible common equity divided by

tangible assets.(2) Tangible common equity divided by common shares

outstanding.(3) Net income available to common shareholders

(annualized) divided by average tangible common equity.(4) Net

income available to common shareholders (annualized) divided by

average tangible assets.

For additional information contact:

Kevin B. Klotzbach

Chief Financial Officer & Treasurer

Phone: 585.786.1130

Email: KBKlotzbach@five-starbank.com

Jordan Darrow

Darrow Associates

Phone: 512.551.9296

Email: jdarrow@darrowir.com

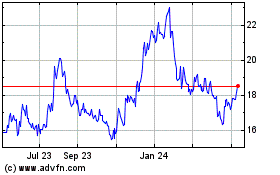

Financial Institutions (NASDAQ:FISI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Financial Institutions (NASDAQ:FISI)

Historical Stock Chart

From Apr 2023 to Apr 2024