|

CUSIP No. 317585404

|

Page 1 of 12 Pages

|

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 13D/A

(Amendment No. 2)

(Rule 13d-101)

Under the Securities Exchange Act of 1934

Financial Institutions, Inc.

Common Stock, par value $.01 per share

(Title of Class of Securities)

(CUSIP Number)

Clover Partners, L.P.

100 Crescent Court, Suite 575

Dallas, TX 75201

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

-with copies to-

| |

Phillip M. Goldberg

Foley & Lardner LLP

321 North Clark Street

Suite 2800

Chicago, IL 60654-5313

(312) 832-4549

|

Peter D. Fetzer

Foley & Larder LLP

777 East Wisconsin Avenue

Suite 3800

Milwaukee, WI 53202-5306

(414) 297-5596

|

|

(Date of event which requires filing of this statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition which is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(b)(3) or (4), check the following box £.

The information required in the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934, as amended (the “Act”), or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act.

|

CUSIP No. 317585404

|

Page 2 of 12 Pages

|

|

1

|

NAME OF REPORTING PERSON

MHC Mutual Conversion Fund, L.P.

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) £

(b) £

|

|

3

|

SEC USE ONLY

|

|

|

4

|

SOURCE OF FUNDS

WC

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

|

£

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Texas

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

795,799

|

|

|

8

|

SHARED VOTING POWER

0

|

|

|

9

|

SOLE DISPOSITIVE POWER

795,799

|

|

|

10

|

SHARED DISPOSITIVE POWER

0

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

795,799

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

£

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

5.5%

|

|

|

14

|

TYPE OF REPORTING PERSON

PN

|

|

|

CUSIP No. 317585404

|

Page 3 of 12 Pages

|

|

1

|

NAME OF REPORTING PERSON

Clover Partners, L.P.

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) £

(b) £

|

|

3

|

SEC USE ONLY

|

|

|

4

|

SOURCE OF FUNDS

OO/AF

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

|

£

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Texas

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

0

|

|

|

8

|

SHARED VOTING POWER

795,799

|

|

|

9

|

SOLE DISPOSITIVE POWER

0

|

|

|

10

|

SHARED DISPOSITIVE POWER

795,799

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

795,799

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

£

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

5.5%

|

|

|

14

|

TYPE OF REPORTING PERSON

PN, IA

|

|

|

CUSIP No. 317585404

|

Page 4 of 12 Pages

|

|

1

|

NAME OF REPORTING PERSON

Clover Partners Management, L.L.C.

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) £

(b) £

|

|

3

|

SEC USE ONLY

|

|

|

4

|

SOURCE OF FUNDS

OO/AF

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

|

£

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Texas

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

0

|

|

|

8

|

SHARED VOTING POWER

795,799

|

|

|

9

|

SOLE DISPOSITIVE POWER

0

|

|

|

10

|

SHARED DISPOSITIVE POWER

795,799

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

795,799

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

£

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

5.5%

|

|

|

14

|

TYPE OF REPORTING PERSON

CO

|

|

|

CUSIP No. 317585404

|

Page 5 of 12 Pages

|

|

1

|

NAME OF REPORTING PERSON

Johnny Guerry

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) £

(b) £

|

|

3

|

SEC USE ONLY

|

|

|

4

|

SOURCE OF FUNDS

OO/AF

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

|

£

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

USA

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

0

|

|

|

8

|

SHARED VOTING POWER

795,799

|

|

|

9

|

SOLE DISPOSITIVE POWER

0

|

|

|

10

|

SHARED DISPOSITIVE POWER

795,799

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

795,799

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

£

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

5.5%

|

|

|

14

|

TYPE OF REPORTING PERSON

IN

|

|

|

CUSIP No. 317585404

|

Page 6 of 12 Pages

|

|

1

|

NAME OF REPORTING PERSON

Terry Philen

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) £

(b) £

|

|

3

|

SEC USE ONLY

|

|

|

4

|

SOURCE OF FUNDS

OO/AF

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

|

£

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

USA

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

0

|

|

|

8

|

SHARED VOTING POWER

0

|

|

|

9

|

SOLE DISPOSITIVE POWER

0

|

|

|

10

|

SHARED DISPOSITIVE POWER

0

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

0

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

T

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

0%

|

|

|

14

|

TYPE OF REPORTING PERSON

IN

|

|

|

CUSIP No. 317585404

|

Page 7 of 12 Pages

|

SCHEDULE 13D

This Schedule 13D (this “Schedule 13D”) is being filed on behalf of MHC Mutual Conversion Fund, L.P., a Texas limited partnership (the “Fund”), Clover Partners, L.P., a Texas limited partnership and the general partner of the Fund (the “GP”), Clover Partners Management, L.L.C., a Texas limited liability company and the general partner of the GP (“Clover”), and Johnny Guerry, the managing partner of Clover (collectively, the “MHC Mutual Conversion Fund Group”), relating to common stock ($.01 par value) (the “Common Stock”) of Financial Institutions, Inc., a New York corporation (the “Company” or “Issuer”).

Specifically, this Schedule 13D relates to Common Stock of the Issuer purchased by the GP through the account of the Fund. The Fund may direct the vote and disposition of the 795,799 shares of Common Stock it holds directly. The GP serves as the investment adviser and general partner to the Fund and may direct the vote and disposition of the 795,799 shares of Common Stock held by the Fund. Clover serves as the general partner of the GP and may direct the GP to direct the vote and disposition of the 795,799 shares of Common Stock held by the Fund. As the managing partner of Clover, Mr. Guerry may direct the vote and disposition of the 795,799 shares of Common Stock held by the Fund.

On April 1, 2016, the MHC Mutual Conversion Fund Group submitted notice to the Company of its intent to nominate Johnny Guerry and Terry Philen for election to the Board of Directors of the Company at the 2016 Annual Meeting of Shareholders, on the WHITE proxy card.

|

Item 1.

|

Security and Issuer

|

| |

Securities acquired:

|

Common Stock

|

| |

|

|

| |

Issuer:

|

Financial Institutions, Inc.

220 Liberty Street

Warsaw, New York 14569

|

|

Item 2.

|

Identity and Background

|

(a)-(b) This Schedule 13D is jointly filed by the parties identified below.

By virtue of Terry Philen agreeing to serve as a nominee for election to the Company’s Board of Directors in connection with the nomination of a director candidate by the MHC Mutual Conversion Fund Group, Terry Philen may be deemed to constitute a “group” with the MHC Mutual Conversion Fund Group for purposes of Section 13(d)(3) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Mr. Philen expressly disclaims beneficial ownership of Common Stock held by the MHC Mutual Conversion Fund Group. The Common Stock reported herein as being beneficially owned by Mr. Philen, if any, does not include any Common Stock held by any member of the MHC Mutual Conversion Fund Group.

The MHC Mutual Conversion Fund Group expressly disclaims beneficial ownership of Common Stock held by Mr. Philen, if any. The Common Stock reported herein as being beneficially owned by the MHC Mutual Conversion Fund Group does not include any Common Stock held by Mr. Philen.

|

CUSIP No. 317585404

|

Page 8 of 12 Pages

|

The MHC Mutual Conversion Fund Group consists of the Fund, the GP, Clover and Mr. Guerry. Because Mr. Guerry is the managing partner of Clover, which is the general partner of the GP (with Mr. Guerry, the Fund and Clover hereinafter referred to as the “Controlling Persons”), the Controlling Persons may be deemed, pursuant to Rule 13d-3 of the Exchange Act, to be the beneficial owners of all of the Common Stock held by the Fund.

Each of the persons identified in this Schedule 13D is sometimes referred to as a “Reporting Person” and, collectively, as the “Reporting Persons.” Each of the Reporting Persons is a party to that certain Joint Filing Agreement attached hereto as Exhibit 99.1 to Amendment No. 1 to this Schedule 13D, as filed with the Securities and Exchange Commission on April 5, 2016.

The principal place of business for each member of the MHC Mutual Conversion Fund Group is 100 Crescent Court, Suite 575, Dallas, TX 75201.

The principal place of business of Mr. Philen is 12001 N. Central Expressway, Suite 1120, Dallas, Texas 75243.

(c) The principal occupation of Mr. Guerry is serving as the managing partner of Clover. The principal business of Clover is acting as the general partner of the GP. The principal business of the GP is investment management. The principal business of the Fund is investing in securities.

Mr. Philen serves as the Chief Financial Officer of Custom Extrusions Holdings, LLC.

(d) During the last five years, none of the Reporting Persons have been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors).

(e) During the last five years, none of the Reporting Persons have been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and, as a result of such proceeding, were or are subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

(f) The Fund, the GP and Clover are organized under the laws of the State of Texas. Mr. Guerry and Mr. Philen are each a citizen of the United States of America.

|

Item 3.

|

Source and Amount of Funds

|

As of the date of this Schedule 13D, the Fund had invested $20,205,119 (inclusive of brokerage commissions) in Common Stock of the Issuer. The source of these funds was the working capital of the Fund.

|

Item 4.

|

Purpose of the Transaction

|

The MHC Mutual Conversion Fund Group purchased the Common Stock for investment purposes. The MHC Mutual Conversion Fund Group’s intent is to influence the policies of the Issuer and assert shareholder rights, with a goal of maximizing the value of the Common Stock.

|

CUSIP No. 317585404

|

Page 9 of 12 Pages

|

Consistent with its investment purpose, the MHC Mutual Conversion Fund Group has engaged and will continue to engage in communications with one or more officers of the Issuer and/or one or more members of the board of directors of the Issuer (the “Board”), and/or one or more representatives of the Issuer regarding the Issuer, including, but not limited to its business, management, operations, assets, capitalization, financial condition, governance, strategy and future plans. The MHC Mutual Conversion Fund Group has discussed and will continue to discuss ideas that, if effectuated, may result in any of the following: a sale or transfer of a material amount of assets of the Issuer and/or changes in the Board or management of the Issuer.

The Reporting Persons may purchase, sell or transfer Common Stock beneficially owned by them from time to time in public transactions depending on economic considerations and, subject to the below, the results of such communications. Any such transactions may be effected at any time or from time to time subject to any applicable limitations imposed on the sale of the Common Stock by applicable law.

The Reporting Persons may purchase, sell or transfer Common Stock beneficially owned by them from time to time in public transactions depending on economic considerations and, subject to the below, the results of such communications. Any such transactions may be effected at any time or from time to time subject to any applicable limitations imposed on the sale of the Common Stock by applicable law.

On December 16, 2015, Clover Partners, L.P. sent a letter to the Board addressing, among other things, ways in which it believes shareholder value may be maximized. A copy of the letter is attached as Exhibit 99.2 to the original Schedule 13D, as filed with the Securities and Exchange Commission on December 16, 2015.

On April 1, 2016, the MHC Mutual Conversion Fund Group submitted notice to the Company of its intent to nominate Johnny Guerry and Terry Philen for election to the Board of Directors of the Company at the 2016 Annual Meeting of Shareholders, on the WHITE proxy card. A copy of the nomination letter is attached as Exhibit 99.3 to Amendment No. 1 to this Schedule 13D, as filed with the Securities and Exchange Commission on April 5, 2016.

On April 13, 2016, the MHC Mutual Conversion Fund Group sent a letter to the Board addressing matters related to the election of directors. A copy of the letter is attached as Exhibit 99.4 hereto.

Except to the extent the foregoing may be deemed a plan or proposal, the Reporting Persons have no plans or proposals which relate to, or could result in, any of the matters referred to in paragraphs (a) through (j), inclusive, of the instructions to Item 4 of the Schedule 13D. The Reporting Persons may, at any time and from time to time, review or reconsider their position and/or change their purpose and/or formulate plans or proposals with respect thereto.

|

Item 5.

|

Interest in Securities of the Issuer

|

(a) - (b) The MHC Mutual Conversion Fund Group beneficially owns 795,799 shares of Common Stock, which represents 5.5% of the Issuer’s outstanding shares of Common Stock. Mr. Philen does not own any shares of Common Stock.

|

CUSIP No. 317585404

|

Page 10 of 12 Pages

|

The percentage of beneficial ownership of the MHC Mutual Conversion Fund Group, as reported in this Schedule 13D, was calculated by dividing (i) the total number of shares of Common Stock beneficially owned by the MHC Mutual Conversion Fund Group as set forth in this Schedule 13D, by (ii) the 14,485,883, shares of Common Stock outstanding as of February 29, 2016, according to the Issuer’s Form 10-K filed with the Securities and Exchange Commission on March 8, 2016.

The GP, in its capacity as investment manager and general partner to the Fund has power to vote the 795,799 shares of Common Stock and the power to dispose of the 795,799 shares of Common Stock held in the Fund. Clover, in its capacity as general partner of the GP and Mr. Guerry, as the managing partner of Clover, may each be deemed to beneficially own the Common Stock held in the Fund.

(c) Within the past sixty days, the Fund has not effected any transactions in the Common Stock.

The filing of this Schedule 13D shall not be construed as admission that the GP, Clover, or Mr. Guerry is for the purposes of Section 13(d) or 13(g) of the Exchange Act the beneficial owner of any of the 795,799 shares of Common Stock owned by the Fund. Pursuant to Rule 13d-4, the GP, Clover, and Mr. Guerry disclaim all such beneficial ownership.

(d) No person other than the Reporting Persons is known to have the right to receive, or the power to direct the receipt of dividends from, or proceeds from the sale of, the Common Stock.

(e) Not applicable.

|

Item 6.

|

Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer

|

With respect to the Fund, GP is entitled to (1) an allocation of a portion of profits, if any, and (2) a management fee based upon a percentage of total capital.

Mr. Guerry and Mr. Philen will be indemnified by the MHC Mutual Conversion Fund Group for any liabilities they may incur in connection with the intended solicitation of proxies for use at the 2016 Annual Meeting of Shareholders of the Company. The MHC Mutual Conversion Fund Group will reimburse Mr. Guerry and Mr. Philen for any expenses that they reasonably incur in connection with the intended solicitation of proxies for use at the 2016 Annual Meeting of Shareholders of the Company. Mr. Guerry has no arrangement or understandings with any other person pursuant to which he was or is to be selected as a Director or nominee for election as a Director of the Company. Mr. Philen has no arrangement or understandings with any other person pursuant to which he was or is to be selected as a Director or nominee for election as a Director of the Company. Neither Mr. Guerry nor Mr. Philen is, and will not become, a party to any agreement, arrangement or understanding with, and has not given any commitment or assurance to, the MHC Mutual Conversion Fund Group as to how he will act or vote on any issue or question as a member of the Company’s Board of Directors or its Committees.

|

CUSIP No. 317585404

|

Page 11 of 12 Pages

|

Other than the foregoing agreements and arrangements, and the Joint Filing Agreement, there are no contracts, arrangements, understandings or relationships among the persons named in Item 2 hereof and between such persons and any person with respect to any securities of the Issuer.

|

Item 7.

|

Material to be Filed as Exhibits

|

|

Exhibit No.

|

Description

|

| |

|

|

Exhibit 99.1

|

Joint Filing Agreement by and among the Reporting Persons.*

|

| |

|

|

Exhibit 99.2

|

Board Letter dated December 16, 2015.*

|

| |

|

|

Exhibit 99.3

|

Nomination Letter to Financial Institutions, Inc. dated April 1, 2016.*

|

| |

|

| Exhibit 99.4 |

Board Letter dated April 13, 2016. |

* Previously filed.

|

CUSIP No. 317585404

|

Page 12 of 12 Pages

|

SIGNATURES

After reasonable inquiry and to the best of their knowledge and belief, each of the undersigned certifies that the information set forth in this statement is true, complete and correct.

| |

MHC Mutual Conversion Fund, L.P.

By: Clover Partners, L.P.

By: Clover Partners Management, L.L.C., general partner

By: /s/ John Guerry

Name: John Guerry

Title: Managing Partner

|

| |

Clover Partners, L.P.

By: Clover Partners Management, L.L.C., general partner

By: /s/ John Guerry

Name: John Guerry

Title: Managing Partner

|

| |

Clover Partners Management, L.L.C.

By: /s/ John Guerry

Name: John Guerry

Title: Managing Partner

|

| |

/s/ Johnny Guerry

Johnny Guerry

|

| |

/s/ Terry Philen

Terry Philen

|

See attached pdf for Letter from MHC Mutual Conversion Fund, L.P.

to the Board of Directors of Financial Institutions, Inc. dated April 13, 2016

This regulatory filing also includes additional resources:

cg723994.pdf

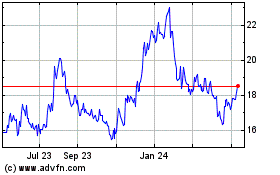

Financial Institutions (NASDAQ:FISI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Financial Institutions (NASDAQ:FISI)

Historical Stock Chart

From Apr 2023 to Apr 2024