UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

|

Filed by the Registrant o

|

|

Filed by a Party other than the Registrant x

|

|

Check the appropriate box:

|

|

o

|

Preliminary Proxy Statement

|

|

o

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

o

|

Definitive Proxy Statement

|

|

o

|

Definitive Additional Materials

|

|

x

|

Soliciting Material Pursuant to §240.14a-12

|

| |

|

|

FINANCIAL INSTITUTIONS, INC.

|

|

(Name of Registrant as Specified In Its Charter)

|

|

CLOVER PARTNERS, L.P.

MHC MUTUAL CONVERSION FUND, L.P.

CLOVER INVESTMENTS, L.L.C.

TERRELL T. PHILEN, JR.

JOHNNY GUERRY

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

| |

|

Payment of Filing Fee (Check the appropriate box):

|

|

x

|

No fee required.

|

|

o

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

| |

(1)

|

Title of each class of securities to which transaction applies:

|

| |

|

|

| |

(2)

|

Aggregate number of securities to which transaction applies:

|

| |

|

|

| |

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| |

(4)

|

Proposed maximum aggregate value of transaction:

|

| |

|

|

| |

(5)

|

Total fee paid:

|

| |

|

|

|

o

|

Fee paid previously with preliminary materials.

|

|

o

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

| |

(1)

|

Amount Previously Paid:

|

| |

|

|

| |

(2)

|

Form, Schedule or Registration Statement No.:

|

| |

|

|

| |

(3)

|

Filing Party:

|

| |

|

|

| |

(4)

|

Date Filed:

|

Filed by Clover Partners, L.P.

A copy of a letter from MHC Mutual Conversion Fund, L.P. to the Board of Directors of Financial Institutions, Inc. is being filed herewith under Rule 14a-12 of the Securities Exchange Act of 1934, as amended.

Important Information

MHC Mutual Conversion Fund, L.P. has nominated Johnny Guerry and Terrell T. Philen, Jr. as nominees to the board of directors of Financial Institutions, Inc. (the “Company”) and intend to solicit votes for the election of Mr. Guerry and Mr. Philen as members of the board. MHC Mutual Conversion Fund, L.P. will send a definitive proxy statement, WHITE proxy card and related proxy materials to shareholders of the Company seeking their support of Mr. Guerry and Mr. Philen at the Company’s 2016 Annual Meeting of Shareholders. Shareholders are urged to read the definitive proxy statement and WHITE proxy card when they become available, because they will contain important information about the participants in the solicitation, Mr. Guerry and Mr. Philen, the Company and related matters. Shareholders may obtain a free copy of the definitive proxy statement and WHITE proxy card (when available) and other documents filed by MHC Mutual Conversion Fund, L.P. with the Securities and Exchange Commission (“SEC”) at the SEC’s web site at www.sec.gov. The definitive proxy statement (when available) and other related SEC documents filed by MHC Mutual Conversion Fund, L.P. with the SEC may also be obtained free of charge from the MHC Mutual Conversion Fund.

Participants in Solicitation

The participants in the solicitation by MHC Mutual Conversion Fund, L.P. consist of the following persons: MHC Mutual Conversion Fund, L.P., Clover Partners, L.P., Clover Investments, L.L.C., Johnny Guerry and Terrell T. Philen, Jr. Such participants may have interests in the solicitation, including as a result of holding shares of the Company’s common stock. Information regarding the participants and their interests may be found in the attached Notice of Intent to Nominate Directors and Submit Nominees for Election that MHC Mutual Conversion Fund, L.P. sent to the Company on April 1, 2016, which is attached hereto.

See attached pdf for Letter from MHC Mutual Conversion Fund, L.P.

to the Board of Directors of Financial Institutions, Inc. dated April 13, 2016

April 1, 2016

E-mail, Certified Mail Return Receipt Requested and Overnight Delivery

Attention: Corporate Secretary

Financial Institutions, Inc.

220 Liberty Street

Warsaw, New York 14569

Re: Notice of Intent to Nominate Directors

Ladies and Gentlemen:

This letter constitutes a notice of intent by MHC Mutual Conversion Fund, L.P. (the “Shareholder”) to nominate two persons for election as Directors of Financial Institutions, Inc. (the “Company”) at the 2016 Annual Meeting of Shareholders of the Company to be held on Friday, June 3, 2016 (the “2016 Annual Meeting”), including the submission of its nominees for election at the 2016 Annual Meeting. This notice is being provided to you in accordance with the Company’s Amended and Restated Bylaws, as publicly available (the “Bylaws”), and is being submitted on behalf of the Shareholder by Johnny Guerry, the managing partner of Clover Partners Management, L.L.C., which is the general partner to Clover Partners, L.P, the general partner of the Shareholder.

MHC Mutual Conversion Fund, L.P. hereby certifies that it is entitled to vote and beneficially owns 795,799 shares of the Company’s common stock, par value $0.01 per share (the “Common Stock”), which are held in record name by Cede & Co., the nominee of the Depository Trust Company (“DTC”). Clover Partners, L.P. is a Texas limited partnership and the general partner of the Shareholder (the “GP”). Clover Partners Management, L.L.C. is a Texas limited liability company and the general partner of the GP (“Clover”). Johnny Guerry is the managing partner of Clover. Attached hereto are a letter from Morgan Stanley & Co. LLC (“Morgan Stanley”) confirming the number of shares of the Company’s common stock beneficially owned by the Shareholder and held in Morgan Stanley’s DTC participant account as of the date hereof, and a letter from DTC asserting rights on behalf of MHC Mutual Conversion Fund, L.P. to nominate directors in accordance with the Bylaws (DTC is a record holder only, and is not a beneficial owner of shares of the Common Stock).

By the fact of the Shareholder’s submission of this notice of intent to nominate and submit its nominees for election, it is the Shareholder’s understanding the Company will now generally be obligated under the federal securities laws to file a preliminary proxy statement and form of proxy with the United States Securities and Exchange Commission (“SEC” or “Commission”) to allow the Commission to review and comment on such proxy materials.

The Shareholder hereby notifies the Company pursuant to Section 12 of Article II of the Bylaws that the Shareholder intends to nominate Johnny Guerry and Terry Philen for election to the Board of Directors of the Company at the 2016 Annual Meeting (each a “Nominee” and, collectively, the “Nominees”). Enclosed is the written consent of Mr. Guerry and Mr. Philen to be named in the proxy statement of the Shareholder and to serve as Directors of the Company if elected. The Shareholder represents that it is a shareholder of record at the time of this submission of the Nominees, and is entitled to vote at the 2016 Annual Meeting.

The Shareholder intends to appear (or will direct a qualified representative of the Shareholder to appear) in person or by proxy at the 2016 Annual Meeting to nominate Johnny Guerry and Terry Philen, and the Shareholder intends to deliver a proxy statement and form of WHITE proxy card to holders of at least the percentage of the Company’s outstanding capital stock required to elect the Nominees.

To the extent not prohibited under the Company’s Certificate of Incorporation, as amended to date, the Bylaws and applicable law, the Shareholder reserves the right to solicit proxies for the election of substitute nominees or additional nominees (1) if a Nominee is unable to serve or for good cause will not serve or (2) if the Company makes or announces any changes to its charter documents, including changes that increase the size of the Company’s Board of Directors, or takes or announces any other action that has, or if consummated would have, the effect of disqualifying a Nominee.

Provided below is the information required by Section 12 of Article II of the Bylaws in connection with the nomination of Mr. Guerry and Mr. Philen as directors.

(1) As to proposed Nominees:

A. Name, Age, Business Address and Residence Address

|

Name

|

Age

|

Business Address

|

Residence Address

|

| |

|

|

|

|

Johnny Guerry

|

34

|

Clover Partners, L.P.

100 Crescent Court

Suite 575

Dallas, Texas 75201

|

6138 Norway Rd

Dallas, Texas 75230

|

|

Terry Philen

|

61

|

12001 N. Central Expressway

Suite 1120

Dallas, Texas 75243

|

509 Twin Creeks Drive

Allen, Texas 75013

|

B. Principal Occupation or Employment and Qualifications

|

Johnny Guerry:

|

Since July 2007, Mr. Guerry has been a partner of Clover Partners L.P. He is the portfolio manager of the Stockholder.

|

|

Terry Philen:

|

Since September 2014, Mr. Philen has been the Chief Financial Officer of Custom Extrusions Holdings, LLC. From 2010 to July 2014, Mr. Philen worked at Alan Ritchey, Inc. & Affiliates, first from 2010 to 2013 as Chief Financial Officer and from June 2013 to July 2014 as President and Chief Executive Officer.

|

The combination of experience, skill sets, and qualifications disclosed above led to the conclusion that each of the Nominees should serve as a Director of the Company. The financial background of each Nominee, combined with each Nominee’s extensive experience reviewing and analyzing companies, qualify each Nominee to serve on the Company’s Board of Directors.

The Shareholder believes that Mr. Guerry and Mr. Philen would be deemed “independent” under the NASDAQ Marketplace Rules. [The Shareholder also believes that Mr. Philen would qualify as an “audit committee financial expert,” as that term is defined by the Securities and Exchange Commission (SEC) and the NASDAQ Marketplace Rules.]

Mr. Guerry’s financial background, combined with his extensive knowledge of the banking industry, qualify him to serve on the Company’s board of directors. Specifically, his extensive experience with, and understanding of, financial issues will allow him to provide the board with valuable recommendations and ideas. In addition, Mr. Guerry’s extensive knowledge of the banking industry makes him a valuable source of information, and will allow him to provide useful insight and advice.

Mr. Philen’s financial background, having served as a Chief Financial Officer for the past 30 years in a variety of industries, combined with his experience as a leader in the role of President and Chief Executive Officer qualify him to serve on the Company’s board of directors. Specifically, his extensive experience with and understanding of financial issues will allow him to provide the board with valuable recommendations and ideas. In addition, Mr. Philen’s extensive interactions with boards, having served on a publicly traded company’s board and multiple committees, combined with industry experience in banking and management experience in treasury operations, debt placement and risk management will allow him to provide useful insight and advice.

The role of an effective Director inherently requires certain personal qualities, such as integrity, as well as the ability to comprehend, discuss and critically analyze materials and issues that are presented so that the Director may exercise judgment and reach conclusions in fulfilling his duties and fiduciary obligations. The Shareholder believes that the background and expertise of each Nominee evidences those abilities and are appropriate to his serving on the Company’s Board of Directors.

C. Shares Owned Either Beneficially or Of Record

Name of Nominee Class Amount

Johnny Guerry Common 795,799*

Terry Philen Common 0

_______

* MHC Mutual Conversion Fund, L.P. is entitled to vote and beneficially owns 795,799 shares. The GP, in its capacity as investment manager and general partner to the Shareholder has power to vote the 795,799 shares of Common Stock and the power to dispose of the 795,799 shares of Common Stock held by the Shareholder. Clover, in its capacity as general partner of the GP and Mr. Guerry, as the managing partner of Clover, may each be deemed to beneficially own the Common Stock held by the Shareholder.

Except as otherwise set forth herein, no hedging or other transaction or series of transactions has been entered into by or on behalf of any of the Nominees, nor has any other agreement, arrangement or understanding (including any short position or any borrowing or lending of shares) been made, the effect or intent of which is to mitigate loss to or manage risk or benefit of share price changes for, or to increase or decrease the voting power of, any Nominee with respect to any share of stock of the Company. None of the Nominees has pledged any Shares as security.

D. Interest of Certain Persons in Matters to be Acted Upon

Except as otherwise set forth herein, none of the Nominees has been within the past year, a party to any contract, arrangement or understanding with any person with respect to any securities of the Company, including, but not limited to joint ventures, loan or option arrangements, puts or calls, guarantees against loss or guarantees of profit, division of losses or profits, or the giving or withholding of proxies.

Except as otherwise set forth herein, none of the Nominees has, nor do any of the Nominees’ associates have, any arrangement or understanding with any person with respect to any future employment with the Company or its affiliates or with respect to any future transactions to which the Company or any of its affiliates will or may be a party.

E. Other Information

Directorships of Other Publicly Owned Companies

None of the Nominees presently serve as, nor has such Nominee served within the past five years as, a director of any corporation, partnership or other entity that has a class of equity securities registered under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or is subject to the requirements of Section 15(d) of such Act, or any company registered as an investment company under the Investment Company Act of 1940, as amended.

Material Proceedings Adverse to the Company

There are no material proceedings to which the Nominees, or any of their associates, is a party adverse to the Company or any of its subsidiaries, and neither the Nominees nor any of their associates has a material interest adverse to the Company or any of its subsidiaries.

Transactions In Stock of the Company

The transactions identified on Appendix A are the Nominees’ only transactions in Shares during the past two years. The Nominees did not use margin account loans in connection with their transactions in Shares.

Arrangements or Understandings with Other Persons

The Nominees will be indemnified by the Shareholder for any liabilities they may incur in connection with the intended solicitation of proxies for use at the 2016 Annual Meeting of Shareholders of the Company. The Shareholder will reimburse the Nominees for any expenses that they reasonably incur in connection with the intended solicitation of proxies for use at the 2016 Annual Meeting of Shareholders of the Company. With respect to the Shareholder, GP is entitled to (1) an allocation of a portion of profits, if any, and (2) a management fee based upon a percentage of total capital. Mr. Guerry has no arrangement or understandings with any other person pursuant to which he was or is to be selected as a Director or nominee for election as a Director of the Company. Mr. Philen has no arrangement or understandings with any other person pursuant to which he was or is to be selected as a Director or nominee for election as a Director of the Company. Neither Mr. Guerry nor Mr. Philen is, and will not become, a party to any agreement, arrangement or understanding with, and has not given any commitment or assurance to, the Shareholder as to how he will act or vote on any issue or question as a member of the Company’s Board of Directors or its Committees.

As of the date of this letter, the Shareholder has not formally retained any person to make solicitations or recommendations to shareholders for the purpose of assisting in the election of the Nominees as Directors.

Absence of any Family Relationships

None of the Nominees has any family relationship with any Director or officer of the Company.

Absence of Involvement in Certain Legal Proceedings

During the past ten years:

a. No petition under the federal bankruptcy laws or any state insolvency law has been filed by or against any Nominee, and no receiver, fiscal agent or similar officer has been appointed by a court for the business or property of any Nominee. In addition, since January 1, 2006, no petition under the federal bankruptcy laws or any state insolvency law has been filed by or against, and no receiver, fiscal agent or similar officer has been appointed by a court for the business or property of any partnership in which any Nominee is or was a general partner, or any corporation or business association of which any Nominee is or was an executive officer at or within two years before the time of such filing.

b. No Nominee has been convicted in a criminal proceeding nor has any Nominee been the named subject of any criminal proceeding which is presently pending (excluding traffic violations or similar misdemeanors).

c. No Nominee has been the subject of any court order, judgment or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining (or otherwise limiting) such Nominee from (A) acting as a futures commission merchant, introducing broker, commodity trading advisor, commodity pool operator, floor broker, leverage transaction merchant, any other person regulated by the Commodity Futures Trading Commission (“CFTC”) or any associated person of any of the foregoing, or as an investment advisor, underwriter, broker or dealer in securities, or as an affiliated person, director or employee of any investment company, bank, savings and loan association or insurance company, or engaging in or continuing any conduct or practice in connection with any such activity; (B) engaging in any type of business practice; or (C) engaging in any activity in connection with the purchase or sale of any security or commodity or in connection with any violation of federal or state securities laws or federal commodities laws.

d. No Nominee has been the subject of any order, judgment or decree not subsequently reversed, suspended or vacated, of any federal or state authority barring, suspending or otherwise limiting for more than 60 days such Nominee’s right to be engaged in any activity described in clause c.(A) above, or such Nominee’s right to be associated with persons engaged in any such activity.

e. No Nominee has been found by a court of competent jurisdiction in a civil action or by the SEC or the CFTC to have violated any federal or state securities law or any federal commodities law, where such judgment or finding has not been subsequently reversed, suspended or vacated.

f. No Nominee has been the subject of, or a party to, any federal or state judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated, relating to an alleged violation of: (A) Any federal or state securities or commodities law or regulation; (B) any law or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist order, or removal or prohibition order; or (C) any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity.

g. No Nominee has been the subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization, and registered entity, or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member.

Absence of Certain Transactions

During the Company’s last two fiscal years, none of the Nominees, nor any member of any Nominee’s immediate family, has had any direct or indirect material interest in any transaction in which the Company was or is a participant, and none of the Nominees, nor any member of any Nominee’s immediate family, has any direct or indirect material interest in any currently proposed transaction in which the Company is to be a participant.

Section 16 Compliance

None of the Nominees is required to file reports under Section 16 of the Exchange Act, with respect to Shares of the Company.

(2) As to the Nominator:

A. Name and Address

|

Name

|

Age

|

Business Address

|

Residence Address

|

| |

|

|

|

|

Johnny Guerry

|

32

|

Clover Partners, L.P.

100 Crescent Court

Suite 575

Dallas, Texas 75201

|

6138 Norway Rd

Dallas, Texas 75230

|

The Shareholder is engaged in various interests, including investments.

Other than the parties named herein, no other shareholder is known to the Shareholder to be supporting the Shareholder’s Nominees.

B. Record and Beneficial Ownership

MHC Mutual Conversion Fund, L.P. is entitled to vote and beneficially owns 795,799 shares. The GP, in its capacity as investment manager and general partner to the Shareholder has power to vote the 795,799 shares of Common Stock and the power to dispose of the 795,799 shares of Common Stock held by the Shareholder. Clover, in its capacity as general partner of the GP and Mr. Guerry, as the managing partner of Clover, may each be deemed to beneficially own the Common Stock held by the Shareholder.

Except as otherwise set forth herein, no hedging or other transaction or series of transactions has been entered into by or on behalf of the Shareholder, nor has any other agreement, arrangement or understanding (including any short position or any borrowing or lending of shares) been made, the effect or intent of which is to mitigate loss to or manage risk or benefit of share price changes for, or to increase or decrease the voting power of, the Shareholder with respect to any share of stock of the Company. The Shareholder has not pledged any Shares as security.

C. Interest of Certain Persons in Company and Matters to Be Acted Upon

Except as otherwise set forth herein, the Shareholder is not, nor has the Shareholder been within the past year, a party to any contract, arrangement or understanding with any person with respect to any securities of the Company, including, but not limited to joint ventures, loan or option arrangements, puts or calls, guarantees against loss or guarantees of profit, division of losses or profits, or the giving or withholding of proxies.

The Shareholder does not have, nor do any of the Shareholder’s associates have, any arrangement or understanding with any person with respect to any future employment with the Company or its affiliates or with respect to any future transactions to which the Company or any of its affiliates will or may be a party.

The Shareholder has no material interest in the election of the Nominees other than in the Shareholder’s capacity as a shareholder of the Company.

D. Transactions in Stock of the Company

The transactions identified on Appendix A are the Shareholder’s only transactions in Shares during the past two years. The Shareholder did not use margin account loans in connection with its transactions in Shares.

E. Arrangements or Understandings with Other Persons

The Nominees will be indemnified by the Shareholder for any liabilities they may incur in connection with the intended solicitation of proxies for use at the 2016 Annual Meeting of Shareholders of the Company. The Shareholder will reimburse the Nominees for any expenses that they reasonably incur in connection with the intended solicitation of proxies for use at the 2016 Annual Meeting of Shareholders of the Company. With respect to the Shareholder, GP is entitled to (1) an allocation of a portion of profits, if any, and (2) a management fee based upon a percentage of total capital. Mr. Guerry has no arrangement or understandings with any other person pursuant to which he was or is to be selected as a Director or nominee for election as a Director of the Company. Mr. Philen has no arrangement or understandings with any other person pursuant to which he was or is to be selected as a Director or nominee for election as a Director of the Company. Neither Mr. Guerry nor Mr. Philen is, and will not become, a party to any agreement, arrangement or understanding with, and has not given any commitment or assurance to, the Shareholder as to how he will act or vote on any issue or question as a member of the Company’s Board of Directors or its Committees.

As of the date of this letter, the Shareholder has not formally retained any person to make solicitations or recommendations to shareholders for the purpose of assisting in the election of the Nominees as Directors.

F. Absence of Certain Proceedings and Transactions

There are no material proceedings to which the Shareholder, or any of its associates, is a party adverse to the Company or any of its subsidiaries, and neither the Shareholder nor any of its associates has a material interest adverse to the Company or any of its subsidiaries.

During the past ten years, the Shareholder has not been convicted in a criminal proceeding nor has the Shareholder been the named subject of any criminal proceeding which is presently pending.

During the Company’s last two fiscal years, neither the Shareholder, nor any member of the Shareholder’s immediate family (as it has none), has had any direct or indirect material interest in any transaction in which the Company was or is a participant, and neither the Shareholder, nor any member of the Shareholder’s immediate family (as it has none), has any direct or indirect material interest in any currently proposed transaction in which the Company is to be a participant.

* * *

If the Company’s Board of Directors or a committee thereof believes this notice is incomplete or otherwise deficient in any respect, please contact the Shareholder immediately so that the Shareholder may promptly address any alleged deficiencies.

Very truly yours,

/s/ Johnny Guerry

Johnny Guerry

Appendix A

Transactions by Shareholder during the past two years:

|

Date

|

Transaction Type

|

Number of Shares

|

|

8/11/2015

|

Buy

|

10,000.00

|

|

8/12/2015

|

Buy

|

56,535.00

|

|

8/14/2015

|

Buy

|

517.00

|

|

8/17/2015

|

Buy

|

102,616.00

|

|

8/18/2015

|

Buy

|

2,600.00

|

|

8/20/2015

|

Buy

|

31,125.00

|

|

8/21/2015

|

Buy

|

500.00

|

|

8/24/2015

|

Buy

|

6,300.00

|

|

8/25/2015

|

Buy

|

44,576.00

|

|

8/27/2015

|

Buy

|

54,000.00

|

|

8/31/2015

|

Buy

|

2,858.00

|

|

9/1/2015

|

Buy

|

23,773.00

|

|

9/8/2015

|

Buy

|

1,749.00

|

|

9/9/2015

|

Buy

|

14,000.00

|

|

9/10/2015

|

Buy

|

25,000.00

|

|

9/14/2015

|

Buy

|

20,000.00

|

|

9/14/2015

|

Buy

|

24,000.00

|

|

9/15/2015

|

Buy

|

21,031.00

|

|

9/17/2015

|

Buy

|

25,000.00

|

|

9/18/2015

|

Buy

|

54,000.00

|

|

9/25/2015

|

Buy

|

8,979.00

|

|

10/2/2015

|

Buy

|

20,200.00

|

|

10/6/2015

|

Buy

|

25,000.00

|

|

10/7/2015

|

Buy

|

1,300.00

|

|

10/13/2015

|

Buy

|

5,700.00

|

|

10/14/2015

|

Buy

|

15,000.00

|

|

10/15/2015

|

Buy

|

2.00

|

|

10/27/2015

|

Buy

|

10,000.00

|

|

10/28/2015

|

Sell

|

10,000.00

|

|

10/28/2015

|

Sell

|

7.00

|

|

10/29/2015

|

Sell

|

5,000.00

|

|

11/3/2015

|

Sell

|

693.00

|

|

11/3/2015

|

Sell

|

6,607.00

|

|

11/4/2015

|

Sell

|

8,393.00

|

|

11/4/2015

|

Sell

|

2.00

|

|

11/4/2015

|

Sell

|

500.00

|

|

11/4/2015

|

Sell

|

1,105.00

|

|

11/5/2015

|

Sell

|

7,874.00

|

|

11/5/2015

|

Sell

|

1,300.00

|

|

11/5/2015

|

Sell

|

12,362.00

|

|

11/6/2015

|

Sell

|

39,730.00

|

|

11/9/2015

|

Sell

|

1,500.00

|

|

11/10/2015

|

Sell

|

408.00

|

|

11/10/2015

|

Sell

|

4,592.00

|

|

11/10/2015

|

Sell

|

3,000.00

|

|

11/13/2015

|

Buy

|

5,000.00

|

|

11/16/2015

|

Buy

|

5,000.00

|

|

11/19/2015

|

Buy

|

10,000.00

|

|

11/20/2015

|

Buy

|

5,000.00

|

|

11/30/2015

|

Buy

|

21,000.00

|

|

12/1/2015

|

Buy

|

3,000.00

|

|

12/3/2015

|

Buy

|

35,000.00

|

|

12/8/2015

|

Buy

|

12,530.00

|

|

12/9/2015

|

Buy

|

25,566.00

|

|

12/10/2015

|

Buy

|

35,223.00

|

|

12/11/2015

|

Buy

|

30,990.00

|

|

12/14/2015

|

Buy

|

1,100.00

|

|

12/14/2015

|

Buy

|

25,000.00

|

|

12/15/2015

|

Buy

|

20,939.00

|

|

12/22/2015

|

Buy

|

3,454.00

|

|

12/23/2015

|

Buy

|

2,300.00

|

|

12/28/2015

|

Buy

|

8,967.00

|

|

1/4/2016

|

Buy

|

7,100.00

|

|

1/5/2016

|

Buy

|

1,500.00

|

|

1/13/2016

|

Buy

|

5,000.00

|

|

1/21/2016

|

Buy

|

5,000.00

|

|

1/25/2016

|

Buy

|

10,000.00

|

|

1/27/2016

|

Buy

|

13,842.00

|

There were no transactions by Terry Philen during the past two years.

CONSENT OF PROPOSED NOMINEE

I, Johnny Guerry, hereby consent to be named in my proxy statement to be used in connection with the solicitation of proxies by MHC Mutual Conversion Fund, L.P. from the Shareholders of Financial Institutions, Inc. for use in voting at the 2016 Annual Meeting of Shareholders of Financial Institutions, Inc., and I hereby consent and agree to serve as a director of Financial Institutions, Inc. if elected at such Annual Meeting.

/s/ Johnny Guerry

Johnny Guerry

Dated: April 1, 2016

CONSENT OF PROPOSED NOMINEE

I, Terry Philen, hereby consent to be named in my proxy statement to be used in connection with the solicitation of proxies by MHC Mutual Conversion Fund, L.P. from the Shareholders of Financial Institutions, Inc. for use in voting at the 2016 Annual Meeting of Shareholders of Financial Institutions, Inc., and I hereby consent and agree to serve as a director of Financial Institutions, Inc. if elected at such Annual Meeting.

/s/ Terry Philen

Terry Philen

Dated: April 1, 2016

This regulatory filing also includes additional resources:

cg724b.pdf

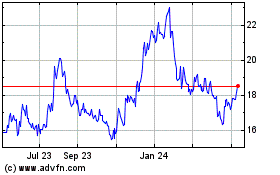

Financial Institutions (NASDAQ:FISI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Financial Institutions (NASDAQ:FISI)

Historical Stock Chart

From Apr 2023 to Apr 2024