UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant

x

Filed by a Party other than the Registrant

¨

Check the appropriate box:

|

|

|

|

|

x

|

|

Preliminary Proxy Statement

|

|

¨

|

|

Confidential, for Use of the Commission Only (as permitted by Rule

14a-6(e)(2))

|

|

¨

|

|

Definitive Proxy Statement

|

|

¨

|

|

Definitive Additional Materials

|

|

¨

|

|

Soliciting Material Pursuant to

§240.14a-12

|

FINANCIAL INSTITUTIONS, INC.

(Name of Registrant as Specified In Its

Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Copies to:

|

|

|

|

|

Craig S. Wittlin, Esq.

Harter Secrest & Emery LLP

1600

Bausch & Lomb Place

Rochester, NY 14604-2711

(585) 231-1260

|

|

Keith E. Gottfried, Esq.

Morgan, Lewis & Bockius LLP

1111 Pennsylvania Avenue, N.W.

Washington, DC 20004-2541

(202)

739-5947

|

|

|

|

|

|

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

x

|

|

No fee required.

|

|

¨

|

|

Fee computed on table below per Exchange Act Rules

14a-6(i)(1)

and 0-11.

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule

0-11

(set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

(5)

|

|

Total fee paid:

|

|

¨

|

|

Fee paid previously with preliminary materials.

|

|

¨

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration

statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

(4)

|

|

Date Filed:

|

PRELIMINARY PROXY STATEMENT

SUBJECT TO COMPLETION DATED APRIL 8, 2016

FINANCIAL INSTITUTIONS, INC.

220 Liberty Street

Warsaw, New York 14569

(585) 786-1100

NOTICE OF

ANNUAL MEETING OF SHAREHOLDERS

To be held on June 3, 2016

The Annual Meeting of Shareholders of Financial Institutions, Inc. will be held at the Company’s corporate headquarters located at 220

Liberty Street, Warsaw, New York 14569 on Friday, June 3, 2016, at 10:00 a.m. (the “Annual Meeting”) for the following purposes:

|

|

1.

|

Election of Directors.

To elect four directors, each to serve until the Company’s 2019 Annual Meeting of Shareholders and until their respective successors are duly elected and qualified;

|

|

|

2.

|

Advisory Vote on Executive Compensation.

To vote on a non-binding, advisory resolution to approve the compensation paid to our named executive officers for the fiscal year ended December 31, 2015, as

described in the “Compensation Discussion and Analysis,” executive compensation tables and enclosed narrative disclosures in this proxy statement (commonly referred to as a “say on pay” vote);

|

|

|

3.

|

Ratification of Independent Registered Public Accounting Firm

. To vote on a proposal to ratify the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending

December 31, 2016; and

|

|

|

4.

|

Other Business.

To transact such other business as may properly come before the meeting or any adjournment or postponements thereof.

|

The record date for the Annual Meeting is April 11, 2016. Only our shareholders of record at the close of business on that date may vote

at the meeting or at any adjournment or postponement of the meeting. A copy of our Annual Report to Shareholders, including our Annual Report on Form 10-K, for the fiscal year ended December 31, 2015 (“annual report”) is being mailed

with this Proxy Statement.

As you may be aware, we have received notice from MHC Mutual Conversion Fund, L.P., a Texas limited

partnership (“MHC Mutual”) and an affiliate of Clover Partners, L.P., a Texas limited partnership (“Clover Partners”), which owns approximately 5.5% of the Company’s common stock, expressing the intention of MHC Mutual to

nominate two director candidates for election to our Board of Directors at the 2016 Annual Meeting. We do not endorse the election of any such MHC Mutual candidates as director. You may receive proxy solicitation materials from MHC Mutual, Clover

Partners and/or other participants in their proxy solicitation (collectively, the “Clover Group”) or other persons or entities affiliated with the Clover Group, including an opposition proxy statement and proxy card. Please be advised that

we are not responsible for the accuracy of any information provided by or relating to the Clover Group contained in any proxy solicitation materials filed or disseminated by the Clover Group or any other statements that they may otherwise make.

Our Board of Directors does not endorse any of the Clover Group’s director candidates and unanimously recommends that you vote

“FOR” each of the nominees proposed by our Board of Directors using only the

BLUE

proxy card

or by following the instructions to vote your shares over the Internet, by telephone or in person at the Annual Meeting.

Your Board of Directors strongly urges you NOT to sign or return any white proxy card or voting

instruction form that the Clover Group may send to you, even as a protest vote against the Clover Group or any of the Clover Group’s director candidates. Even a “

WITHHOLD

” vote with respect to Clover’s director candidates

on its white proxy card will cancel any previously submitted

BLUE

proxy card vote. If you do sign a proxy card sent to you by the Clover Group, however, you have the right to change your vote by using the enclosed

BLUE

proxy card. Only the latest dated proxy card you vote will be counted.

It is important that your shares be represented and voted at

the Annual Meeting whether or not you plan to attend. You may vote by mail, telephone or Internet. Instructions for voting by Internet or telephone are provided on the enclosed

BLUE

proxy card or the voting instructions provided by your

broker.

Please read the attached proxy statement in its entirety, as it contains important information you need to know to vote at

the Annual Meeting.

If you have any questions or require any assistance with voting your shares, please contact our proxy solicitor:

Morrow & Co., LLC, toll free at (800) 662-5200 or (203) 658-9400.

|

|

|

By Order of the Board of Directors

|

|

|

|

|

Sonia M. Dumbleton

|

|

Corporate Secretary

|

Warsaw, New York

April [•], 2016

Important Notice Regarding the Availability of

Proxy Materials for the Annual Meeting of Shareholders to be held on June 3, 2016

Our Proxy Statement is attached. Financial and other information concerning our company is contained in our Annual Report to Shareholders for the year ended

December 31, 2015. Pursuant to rules promulgated by the U.S. Securities and Exchange Commission, we have elected to provide access to our proxy materials both by sending you this full set of proxy materials, including the Proxy Statement,

annual report and a

BLUE

proxy card, and by notifying you of the availability of these proxy materials on the Internet. This Proxy Statement and our annual report are available at

.

April [•], 2016

Dear

Fellow Shareholders:

I am privileged to serve as Chairman of the Board of Directors of Financial Institutions, Inc. It is the responsibility of the Board

to ensure good governance of the company and to oversee its strategic and operational initiatives in a manner that both creates and protects long-term shareholder value.

The Board focused on a number of key initiatives in 2015:

Strategy and Risk Management

In 2015, the Board remained

highly engaged in overseeing the implementation of the company’s strategic plan. We approved the company’s rolling three-year strategic plan in November of 2014 at the conclusion of a rigorous and collaborative planning process between the

Board and management with input from external industry experts. The strategic plan is regularly reviewed by the Board and was last updated and reaffirmed in August 2015.

The purpose of the strategic plan is to define a clear path and decision-making framework for achieving enhanced shareholder value, as measured by total

shareholder return. We are focused on:

|

|

•

|

|

Dynamic and Scalable Foundation

|

|

|

•

|

|

Strong Regulatory Relationships

|

Each focus area has related goals and initiatives that form the basis for

both long-term strategic decisions and annual business plans.

During the past year, the Board devoted significant time and discussion to a review of the

execution of the plan and analysis of investments for driving future growth. The acquisition of Courier Capital represents a key strategic milestone that will contribute to increasing non-interest revenues, reducing reliance on net interest income

while raising the company’s profile in a larger organic growth market that supports the further development of our core banking franchise.

The Board

also devoted substantial time to the enterprise risk management process in 2015. Enterprise risk management is a disciplined methodology for assessing, measuring and balancing both risk and reward in pursuit of our strategy and objectives and the

Board’s participation in the process assures alignment with our shareholders. The Board actively participated in the assessment and approval of an overall risk framework for the company which is designed to link the strategic and risk

management processes and addresses the types and magnitude of risk related to the achievement of the strategic, financial and value creation objectives.

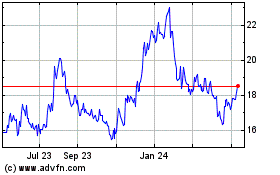

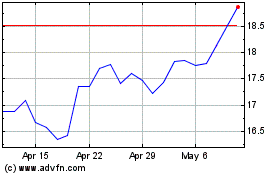

Importantly, we are proud of the progress that we have made – and continue to make – in growing our core business. Over the past three years, under

Marty Birmingham’s leadership, we have witnessed solid market cap growth of over $150 million or 59%; and we have generated a 3-year total shareholder return of 67%, which is in the top quartile of our peer group.

Engagement

The Board is committed to open and constructive dialogue with shareholders and other key constituents. Feedback from our shareholders allows us to more

effectively understand shareholder input and priorities. We routinely receive feedback from a broad cross-section of our investor base through a combination of formal Board and Management presentations and informal conversations.

The Board also takes an active role in the company’s relationship with its regulators through both meetings and conferences. It is critical for the Board

to understand the focus and perspective of our regulators given the importance of the regulatory environment in which we operate. Finally, we interact with customers and key community leaders in the markets we serve to gain further insights on our

performance and underlying opportunities.

Executive Compensation

The Board remains committed to establishing effective and transparent executive compensation programs that align the interests of our executive leadership team

with shareholders. Our programs are designed to incentivize both annual and longer-term performance that aligns to company strategy and generation of shareholder value. We regularly review best practices and solicit feedback from our shareholders,

which resulted in several changes to the design of key elements of our compensation program in 2015, including decreasing the weighting of the annual cash incentive and increasing the weighting of long-term equity incentives in an equivalent total

compensation opportunity for executives.

Talent Development and Succession Planning

Oversight of talent development and succession planning has been – and continues to be – an important component of the Board’s governance

responsibilities. We routinely discussed key talent indicators with management, met with high-potential leaders and executed against our succession plan. In 2015, we actively monitored the conclusion of a disciplined, multi-year management

succession process associated with the planned retirement of our Chief Operating Officer resulting in the expansion of our Executive Management Committee to include the Commercial and Retail Banking Executives and the Chief Information Officer. This

action deepens the executive talent pool and expands succession opportunities across the organization.

Board Effectiveness and Composition

We meet and speak frequently, both in formal meetings and in informal discussions between directors and management. We are also keenly aware that our

shareholders, regulators and other constituents are focused on the composition of our Board. Our review of our Board’s composition is an ongoing process, focused on ensuring that the Board combines the right mix of skills and qualifications.

The Board implements a thorough and thoughtful evaluation process in line with our duty to be effective stewards of shareholder capital. In fact, over the past three years we’ve nominated three new independent directors, underscoring our

efforts to attract talented, experienced and diverse professionals to our Board.

Our two newest directors, Bob Glaser and Andy Dorn have brought deep

market knowledge in addition to banking and financial expertise to the Board.

We are pleased to include Kim VanGelder in the slate of director nominees

this year as well. As the Chief Information Officer for Eastman Kodak, the Rochester-headquartered global technology company focused on imaging, Kim’s expertise in cyber security and information technology will add a unique and important

perspective as we continue to strengthen our regulatory compliance procedures, and ensure that our technology security systems and standards are best-in-class.

I also want to note that after nine years of distinguished service, Jim Robinson will not stand for re-election to the Board. Jim’s extensive business and

market knowledge, judgment and leadership made him an invaluable voice on our Board. His deep understanding of our business and culture has benefitted the company enormously. We thank him for his dedication and leadership to the company.

Conclusion

We are pleased with the performance of our company and the progress that has been made in support of sustained long-term shareholder value since the change in

management three years ago. I look forward to the opportunity to continue serving as your Chairman and contributing to the bright future of the company. Thank you for your support.

|

|

|

Sincerely,

|

|

|

|

|

|

|

Robert N. Latella

Chairman of the

Board

|

IMPORTANT

Your vote at this year’s Annual Meeting is especially important, no matter how many or how few shares you own. Please sign and date the

enclosed

BLUE

proxy card and return it in the enclosed postage-paid envelope promptly.

All shareholders are invited to

attend the Annual Meeting in person. Whether or not you expect to attend the Annual Meeting, we respectfully urge you to sign, date and return the enclosed

BLUE

proxy card as promptly as possible. Shareholders who execute a proxy card

may nevertheless attend the Annual Meeting, revoke their proxy and vote their shares in person. “Street name” shareholders who wish to vote their shares in person will need to obtain a legal proxy from the bank, broker or other nominee in

whose name their shares are registered. The instructions for voting by Internet or telephone are provided on your proxy card.

THE BOARD

STRONGLY URGES YOU

NOT

TO SIGN OR RETURN ANY

white

PROXY CARD OR VOTING INSTRUCTION FORM THAT YOU MAY RECEIVE FROM THE CLOVER GROUP OR ANY PERSON OTHER THAN THE COMPANY EVEN AS A PROTEST VOTE AGAINST THE CLOVER GROUP OR ANY OF

CLOVER’S NOMINEES.

Any white proxy card you sign and return from the Clover Group for any reason could invalidate previous

BLUE

proxy cards sent by you to support the Company’s Board of Directors.

Only your latest dated, signed proxy card or voting instruction form will be counted. Any proxy may be revoked at any time prior to its

exercise at the 2016 Annual Meeting as described in this proxy statement.

IMPORTANT!

PLEASE VOTE THE

BLUE

PROXY CARD TODAY!

WE URGE YOU

NOT

TO SIGN ANY

white

PROXY CARD OR VOTING

INSTRUCTION FORM SENT TO YOU BY THE CLOVER GROUP

Remember, you can vote your shares by telephone or

via

the Internet. Please follow the easy instructions on the

enclosed

BLUE

proxy card.

If you have any questions or need assistance in voting

your shares, please contact our proxy solicitor:

Morrow & Co., LLC

470 West Avenue

Stamford, CT 06902

Shareholders Call Toll Free: (800) 662-5200 Banks and Brokers Call Collect: (203) 658-9400

TABLE OF CONTENTS

- 2 -

PRELIMINARY PROXY STATEMENT

SUBJECT TO COMPLETION DATED APRIL 8, 2016

FINANCIAL INSTITUTIONS, INC.

220 Liberty Street

Warsaw, New York 14569

(585) 786-1100

PROXY

STATEMENT

INTRODUCTION

The Financial Institutions, Inc. Board of Directors (the “Board”) is using this Proxy Statement to solicit proxies from the holders

of its common stock for use at the Financial Institutions, Inc. 2016 Annual Meeting of Shareholders and any adjournments or postponements thereof (the “meeting” or the “Annual Meeting”). The notice of meeting, this Proxy

Statement and the

enclosed

form of

BLUE

proxy card are first being mailed to our shareholders on or about April [•], 2016. In this Proxy Statement, we may also refer to Financial Institutions, Inc. and its subsidiaries as

“Financial Institutions,” the “Company,” “we,” “our” or “us”.

Financial Institutions is

the holding company for Five Star Bank, Scott Danahy Naylon, LLC and Courier Capital, LLC. In this Proxy Statement, we may also refer to Five Star Bank as the “Bank”.

INFORMATION ABOUT THE MEETING, VOTING AND PROXIES

What are the date, time and place of the meeting?

|

|

|

|

|

Date:

|

|

June 3, 2016

|

|

Time:

|

|

10:00 a.m., local time

|

|

Place:

|

|

Corporate Headquarters of Financial Institutions, Inc.

|

|

|

|

220 Liberty Street

|

|

|

|

Warsaw, New York 14569

|

What matters are to be voted upon at the meeting?

At the meeting, record holders of our common stock as of April 11, 2016 will consider and vote on proposals to:

|

|

¡

|

Elect four directors, each to serve for a term expiring at the Company’s 2019 Annual Meeting of Shareholders and until their respective successors are duly elected and qualified (see “Proposal

1 – Election of Directors” on page 16);

|

|

|

¡

|

Approve a non-binding, advisory resolution to approve the compensation paid to our named executive officers for the fiscal year ended December 31, 2015, as described in the “Compensation Discussion and

Analysis,” executive compensation tables and enclosed narrative disclosures in this proxy statement (see “Proposal 2 - Advisory Vote to Approve the Compensation of Our Named Executive Officers” on page 55);

|

|

|

¡

|

Ratify the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2016 (see “Proposal 3 - Ratification of Appointment of Independent Registered

Public Accounting Firm” on page 58).

|

As of the date of this Proxy Statement, these three proposals are the only matters

that our Board of Directors intends to present at the Annual Meeting. Our Board does not know of any other business to be presented at the

- 3 -

meeting. If other business is properly brought before the Annual Meeting, the persons named on the enclosed

BLUE

proxy card will vote on these other matters in their discretion,

subject to compliance with Rule 14a-4(c) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Will there be a proxy

contest at the Annual Meeting?

We have received notice from MHC Mutual Conversion Fund, L.P., a Texas limited partnership (“MHC

Mutual”) and an affiliate of Clover Partners, L.P., a Texas limited partnership (“Clover Partners”), which owns approximately 5.5% of the Company’s common stock, expressing the intention of MHC Mutual to nominate two director

candidates for election to our Board of Directors at the 2016 Annual Meeting. We do not endorse the election of any such MHC Mutual candidates as director. You may receive proxy solicitation materials from MHC Mutual, Clover Partners and/or other

participants in its proxy solicitation (collectively, the “Clover Group”) or other persons or entities affiliated with the Clover Group, including an opposition proxy statement and proxy card. Please be advised that we are not responsible

for the accuracy of any information provided by or relating to the Clover Group contained in any proxy solicitation materials filed or disseminated by the Clover Group or any other statements that they may otherwise make.

You may receive multiple mailings from the Clover Group. You will also likely receive multiple mailings from the Company prior to the date of

the Annual Meeting, so that our shareholders have our latest proxy information and materials to vote. Proxy cards provided by the Company will be

BLUE

. Please see “What should I do if I receive a proxy card from the Clover

Group?” and “What does it mean if I receive more than one

BLUE

proxy card or voting instruction form?” below for more information.

Our Board does not endorse any of the Clover Group’s director candidates and unanimously recommends that you vote “FOR” each of

the nominees proposed by the Board using the

BLUE

proxy card or by following the instructions for voting over the Internet, by telephone or in person at the Annual Meeting. Our Board strongly urges you NOT to sign or return any white

proxy card sent to you by the Clover Group. If you have previously submitted a white proxy card sent to you by the Clover Group, you can revoke that proxy and vote for our Board’s nominees and on the other matters to be voted on at the Annual

Meeting by casting a later-dated vote using the enclosed

BLUE

proxy card or voting over the Internet, by telephone or in person at the Annual Meeting. Only the latest dated, valid proxy you submit will be counted.

What should I do if I receive a proxy card from the Clover Group?

Our Board does not endorse any of the Clover Group’s director candidates and strongly urges you NOT to sign or return any proxy card or

voting instruction form that you may receive from the Clover Group or any person other than the Company, even as a protest vote against the Clover Group or any of the Clover Group’s director candidates. Voting to “WITHHOLD” with

respect to any of the Clover Group’s director candidates on its proxy card is not the same as voting for our Board’s nominees because a vote to “WITHHOLD” with respect to any of the Clover Group’s director candidates on its

proxy card will revoke any proxy you previously submitted

How does the Board recommend that I vote?

The Board recommends that you vote:

|

|

¡

|

FOR the election of each of the four nominees for director named in this Proxy Statement (

Martin K. Birmingham, Samuel M. Gullo, Kim E. VanGelder, and James H. Wyckoff

), each to serve for a term expiring at the

Company’s 2019 Annual Meeting of Shareholders and until their respective successors are duly elected and qualified;

|

|

|

¡

|

FOR the proposal to approve a non-binding, advisory resolution to approve the compensation paid to our named executive officers for the fiscal year ended December 31, 2015, as described in the “Compensation

Discussion and Analysis,” executive compensation tables and enclosed narrative disclosures in this proxy statement; and

|

- 4 -

|

|

¡

|

FOR the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2016.

|

Our Board strongly urges you NOT to sign or return any white proxy card sent to you by the Clover Group.

Who can vote at the meeting?

Our

shareholders of record as of the close of business on April 11, 2016 are entitled to vote (in person or by proxy) at the Annual Meeting and at any postponement or adjournment thereof. On that date, there were [•] shares of our common stock

(each, a share) outstanding and entitled to vote. No securities other than our common stock are entitled to be voted at the Annual Meeting.

How many

shares must be present to conduct the meeting?

We must have a “quorum” present in person or by proxy to hold the meeting. A

quorum is a majority of the shares entitled to vote. For purposes of determining whether a quorum exists, we count as present any shares that are voted over the Internet, by telephone, by mail or that are represented in person at the Annual Meeting.

Proxies received but marked as abstentions and broker non-votes, which are described below, will be counted for the purpose of determining the existence of a quorum. An inspector of elections appointed for the meeting will determine whether a quorum

is present and will tabulate votes cast by proxy or in person at the meeting. If a quorum is not present, we expect to adjourn the Annual Meeting until we obtain a quorum.

What is the difference between a “record holder” and a “beneficial owner”?

If your shares are registered directly in your name, you are considered the “record holder” of your shares. If, on the other hand,

your shares are held in a brokerage account or by a bank or other intermediary, you are considered the “beneficial owner” of shares held in street name. As a beneficial owner, you have the right to direct your broker or other intermediary

on how to vote and you are also invited to attend the meeting. Since a beneficial owner is not the record holder, you may not vote these shares in person at the meeting unless you obtain a “legal proxy” from your broker or other

intermediary that holds your shares, giving you the right to vote your shares at the meeting. Your broker or other intermediary has provided you with instructions regarding how to direct the voting of your shares.

How do I vote before the meeting?

If you

are a record holder, you may vote your shares by mail by completing, signing and returning the enclosed

BLUE

proxy card. For your convenience, you may also vote your shares by telephone or via the internet by following the instructions

on the enclosed

BLUE

proxy card. If you vote by telephone or via the Internet, you do not need to return your

BLUE

proxy card.

If you hold shares beneficially in street name, you may vote by submitting voting instructions to your broker. For directions on how to vote

shares held beneficially in street name, please refer to the voting instruction form provided by your broker.

By completing and returning

a

BLUE

instruction card, participants in the Financial Institutions, Inc. 401(k) Retirement Savings Plan (which we refer to as the “Plan”) who hold shares of our common stock in their Plan accounts, direct the trustee of

the Plan to vote these shares as indicated on the

BLUE

instruction card. Any shares in a Plan account for which no instruction is received will not be voted. With respect to the election of directors (Proposal 1), you may either vote

for all four of the nominees to the Board of Directors named on the enclosed

BLUE

proxy card, withhold authority to vote for any of the Board’s nominee(s) you specify or you may withhold authority to vote for all of the

Board’s nominees as a group. For the proposal to approve a non-binding, advisory resolution to approve the compensation paid to our named executive officers for the fiscal year ended December 31, 2015 (Proposal 2) and the proposal to

ratify the appointment of our independent registered public accounting firm for the fiscal year ending December 31, 2016 (Proposal 3) you may vote for, against or abstain from voting.

- 5 -

If you have any questions or need assistance in voting your shares or authorizing your proxy,

please call Morrow & Co., which is the firm assisting the Company in the solicitation of proxies:

Morrow & Co., LLC

470 West Avenue

Stamford,

Connecticut 06902

Shareholders Call Toll Free: (800) 662-5200

Banks and Brokers Call Collect: (203) 658-9400

May I vote at the meeting?

Yes, you may

vote your shares at the meeting if you attend in person. If your shares are held by a broker, bank, or other nominee and you wish to vote at the meeting, you must bring to the meeting a letter from the broker, bank, or other nominee confirming

(1) your beneficial ownership of the shares, (2) that the broker, bank, or other nominee is not voting the shares at the meeting, and (3) granting you a legal proxy to vote the shares in person or at the meeting.

You will not be

able to vote shares you hold in street name through a bank, broker or other nominee in person at the Annual Meeting unless you have a legal proxy from that bank, broker or other nominee issued in your name giving you the right to vote your

shares.

For information on how to obtain directions to the Annual Meeting, please contact us at (585) 786-1100. Even if you plan to attend the meeting in person, we recommend that you also submit your

BLUE

proxy card or voting

instructions as described above so that your vote will be counted if you later decide not to attend the meeting in person.

What does it mean if I

receive more than one

BLUE

proxy card or voting instruction form?

You may receive more than one set of these proxy materials,

including multiple copies of this Proxy Statement and multiple

BLUE

proxy cards or voting instruction forms. For example, if you hold your shares in more than one brokerage account, you may receive a separate voting instruction form

for each brokerage account in which you hold shares. If you are a shareholder of record and your shares are registered in more than one name, you will receive more than one

BLUE

proxy card. To ensure that all of your shares are voted,

please vote using each

BLUE

proxy card or voting instruction form you receive or, if you vote by Internet or telephone, you will need to enter each of your Control Numbers. Remember, you may vote by telephone, Internet or by signing,

dating and returning the

BLUE

proxy card in the postage-paid envelope provided, or by voting by ballot at the Annual Meeting.

As previously noted, MHC Mutual, an affiliate of Clover Partners and a member of the Clover Group, has provided us with a notice indicating

that it intends to nominate two director candidates for election as directors at the 2016 Annual Meeting. As a result, you may receive proxy cards from both the Company and the Clover Group. To ensure that shareholders have the Company’s latest

proxy information and materials to vote, the Board may conduct multiple mailings prior to the date of the Annual Meeting, each of which will include a

BLUE

proxy card. The Board encourages you to vote each

BLUE

proxy card

you receive.

THE BOARD STRONGLY URGES YOU TO REVOKE ANY PROXY CARD YOU MAY HAVE RETURNED WHICH YOU RECEIVED FROM THE CLOVER GROUP. Even a

“WITHHOLD” vote with respect to the Clover Group’s director candidates on their proxy card will cancel any previously submitted

BLUE

proxy card.

THE BOARD STRONGLY URGES YOU NOT TO SIGN OR RETURN ANY white PROXY CARD OR VOTING INSTRUCTION FORM THAT YOU MAY RECEIVE FROM THE CLOVER GROUP,

EVEN AS A PROTEST VOTE AGAINST THE CLOVER GROUP OR THE CLOVER GROUP’S DIRECTOR CANDIDATES.

How many votes do I have?

Each share that you own as of the close of business on April 11, 2016 entitles you to one vote on each matter voted upon at the meeting.

As of the close of business on April 11, 2016, there were [•] shares of our common stock outstanding. Holders of our common stock do not have cumulative voting rights.

- 6 -

Can I change my vote or revoke my proxy?

Yes, you may change your vote or revoke your proxy at any time before the vote at the meeting. If you are a record holder, you may revoke your

proxy and change your vote at any time before the polls close at the meeting by:

|

|

¡

|

Properly submitting a later dated proxy;

|

|

|

¡

|

Notifying the Corporate Secretary of Financial Institutions in writing before the meeting that you have revoked your proxy; or

|

|

|

¡

|

Voting in person at the meeting.

|

If you have instructed a broker, bank or other nominee to

vote your shares, you may submit a new, later-dated voting instruction form or contact your bank, broker or other nominee. You may also vote in person at the Annual Meeting if you obtain a legal proxy as described in the answer to the question above

entitled “May I vote at the meeting?.”

If you have previously signed a proxy card sent to you by the Clover Group, you may

change your vote by marking, signing, dating and returning the

BLUE

proxy card or by voting by telephone, via the Internet or in person at the Annual Meeting. Only the latest dated, valid proxy that you submit will be counted.

Submitting a proxy card sent to you by the Clover Group will revoke votes you have previously made via the Company’s

BLUE

proxy card.

How are my shares voted if I submit a proxy but do not specify how I want to vote?

If you submit a properly executed

BLUE

proxy card and specify how you want to vote, the persons named on the proxy card (or, if

applicable, their substitutes) will vote your shares as you instruct. If you sign your proxy card and return it without indicating how you would like to vote your shares, your shares will be voted as the Board of Directors recommends, which is:

|

|

¡

|

FOR the election of each of the four nominees for director named in this Proxy Statement (

Martin K. Birmingham, Samuel M. Gullo, Kim E. VanGelder, and James H. Wyckoff

), each to serve for a term expiring at the

Company’s 2019 Annual Meeting of Shareholders and until their respective successors are duly elected and qualified;

|

|

|

¡

|

FOR the proposal to approve a non-binding, advisory resolution to approve the compensation paid to our named executive officers for the fiscal year ended December 31, 2015, as described in the “Compensation

Discussion and Analysis,” executive compensation tables and enclosed narrative disclosures in this proxy statement; and

|

|

|

¡

|

FOR the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2016.

|

With respect to the transaction of such other business as may properly come before the meeting and any adjournments or postponements thereof,

subject to compliance with Rule 14a-4(c) of the Exchange Act, each proxy received will be voted in accordance with the best judgment of the persons named on the enclosed

BLUE

proxy card. At this time, except as otherwise disclosed in

this proxy statement, the Board of Directors knows of no such other business.

What is a broker non-vote?

If you are a beneficial owner whose shares of record are held by a broker, you may instruct your broker how to vote your shares. If you do not

give instructions to your broker, the broker will determine if it has the discretionary authority to vote on the particular matter. Under the rules of the New York Stock Exchange (“NYSE”), which are also applicable to NASDAQ-listed

companies, brokers have the discretion to vote on routine matters, but do not have discretion to vote on non-routine matters. Because the Annual Meeting is expected to be the subject of a contested solicitation all proposals at the Annual Meeting

are considered “non-

- 7 -

routine” and therefore your bank, broker or other nominee does not have the authority to vote on a proposal at the Annual Meeting if you do not provide voting instructions with respect to

such proposal.

A broker non-vote occurs when a broker has not received voting instructions from the beneficial owner of the shares and the

broker cannot vote the shares because the matter is not considered a routine matter under NYSE rules. Broker non-votes, if any, will be counted for purposes of calculating whether a quorum is present at the meeting, but will not be counted for

purposes of determining the number of votes cast with respect to a particular proposal.

Your vote is important and we strongly encourage

you to vote your shares by following the instructions provided on the

BLUE

voting instruction form you receive from your broker. Please return your

BLUE

voting instruction form to your broker and contact the person

responsible for your account to ensure that a proxy is voted on your behalf. Because the Annual Meeting is expected to be the subject of a contested solicitation, if you do not provide timely instructions, your broker does not have the authority to

vote on any proposals at the Annual Meeting.

What vote is required to elect directors?

Our shareholders elect directors by a plurality vote, which means that the four director nominees for election who receive the highest number

of “FOR” votes will be elected as directors.

If your shares are held by a bank, broker or other nominee in street name and you

do not vote your shares, the bank, broker or other nominee cannot vote such shares for the election of directors. If you do not vote for the election of directors because the authority to vote is withheld, because a proxy is not returned, because

the broker holding the shares does not vote, or because of some other reason, the shares will not count in determining the total number of votes for each nominee.

BLUE

proxy cards signed and returned to the Company unmarked will be

voted FOR the Board’s four (4) highly qualified and very experienced nominees (

Martin K. Birmingham, Samuel M. Gullo, Kim E. VanGelder, and James H. Wyckoff

).

What vote is required to approve the non-binding, advisory resolution to approve the compensation paid to our named executive officers?

This matter is being submitted to enable our shareholders to approve, on an advisory and non-binding basis, the compensation of our named

executive officers for the year ended December 31, 2015. In order to be approved on an advisory, non-binding basis, this proposal must receive the “FOR” vote of a majority of the votes cast on the matter. Abstentions will have no

effect on the proposal. Broker non-votes will also have no effect on this proposal as brokers are not entitled to vote on such proposals in the absence of voting instructions from the beneficial owner. Although the advisory vote on the compensation

of our named executive officers is non-binding, our Management Development & Compensation Committee values the opinions expressed by our shareholders in their vote on this proposal and will review the results of the vote and evaluate

whether any actions are necessary to address such results.

What vote is required to ratify the appointment of KPMG LLP as our independent registered

public accounting firm?

In order for the ratification of the appointment of KPMG LLP as our independent registered public accounting

firm for the fiscal year ending December 31, 2016 to be approved, this proposal must receive the “FOR” vote of a majority of the votes cast on the matter. If your shares are held by a bank, broker or other nominee in street name and

you do not vote your shares, your bank, broker or other nominee cannot vote your shares on this proposal. Shares held in street name by banks, brokers or other nominees who indicate on their proxies that they do not have authority to vote the shares

on this proposal will not be counted as votes FOR or AGAINST this Proposal and will be treated as broker non-votes. Broker non-votes will have no effect on the voting on this proposal. If you vote to ABSTAIN on this proposal, your shares will not be

voted FOR or AGAINST the proposal, will not be counted as votes cast or shares withheld on this proposal and, accordingly, abstentions will have no effect on this proposal.

- 8 -

Although shareholder ratification of the appointment of KPMG LLP as the Company’s

independent registered public accounting firm for the fiscal year ending December 31, 2016 is not required, we believe that it is advisable to give shareholders an opportunity to ratify this appointment. If such ratification is not approved at

the Annual Meeting, the Board’s Audit Committee may reconsider its appointment of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2016 and reserves the discretion to

appoint KPMG LLP or another independent registered public accounting firm.

Who will solicit proxies on behalf of the Board?

Proxies may be solicited on behalf of the Board, without additional compensation, by the Company’s directors, director nominees and

certain executive officers and other employees of the Company. Such persons are listed in Appendix A to this proxy statement. Additionally, the Company has retained Morrow & Co, LLC, a proxy solicitation firm, who may solicit proxies on the

Board’s behalf.

The original solicitation of proxies by mail may be supplemented by telephone, telegram, facsimile, electronic mail,

internet and personal solicitation by our directors, director nominees and certain of our executive officers and other employees (who will receive no additional compensation for such solicitation activities), or by Morrow & Co., LLC. You

may also be solicited by advertisements in periodicals, press releases issued by us and postings on our corporate website or other websites. Unless expressly indicated otherwise, information contained on our corporate website is not part of this

proxy statement. In addition, none of the information on the other websites listed in this proxy statement is part of this proxy statement. These website addresses are intended to be inactive textual references only.

What are the costs of soliciting the proxies?

The entire cost of soliciting proxies on behalf of the Board, including the costs of preparing, assembling, printing and mailing this proxy

statement, the

BLUE

proxy card and any additional soliciting materials furnished to shareholders by or on behalf of the Company, will be borne by the Company. Copies of solicitation material will be furnished to banks, brokerage

houses, dealers, voting trustees, their respective nominees and other agents holding shares in their names, which are beneficially owned by others, so that they may forward such solicitation material, together with our 2015 Annual Report, which

includes our Annual Report on Form 10-K for the year ended December 31, 2015, to beneficial owners. In addition, if asked, the Company will reimburse these persons for their reasonable expenses in forwarding these materials to the beneficial

owners.

Due to the possibility of a proxy contest, we have engaged Morrow & Co., LLC to solicit proxies from shareholders in

connection with the Annual Meeting. Morrow & Co., LLC expects that approximately 25 of its employees will assist in the solicitation of proxies. We will pay Morrow & Co., LLC a fee of $[•] plus costs and expenses. In addition,

Morrow & Co., LLC and certain related persons will be indemnified against certain liabilities arising out of or in connection with the engagement.

The Company estimates that its additional out-of-pocket expenses beyond those normally associated with soliciting proxies for the Annual

Meeting as a result of the potential proxy contest will be $[•] in the aggregate, of which approximately $[•] has been spent to date. Such additional solicitation costs are expected to include the fees incurred to retain Morrow &

Co., LLC as the Company’s proxy solicitor, as discussed above, fees of outside counsel, investment bankers and public relation advisors to advise the Company in connection with a possible contested solicitation of proxies, increased mailing

costs, such as the costs of additional mailings of solicitation materials to shareholders, including printing costs, mailing costs and the reimbursement of reasonable expenses of banks, brokerage houses and other agents incurred in forwarding

solicitation materials to beneficial owners, as described above, and the costs of retaining an independent inspector of election.

How can I find out

the results of the voting at the meeting?

We will report the voting results in a filing with the U.S. Securities and Exchange

Commission (“SEC”) on a Current Report on Form 8-K within four business days following the conclusion of the Annual Meeting. If the

- 9 -

official results are not available at that time, we will provide preliminary voting results in the Form 8-K and will provide the final results in an amendment to the Form 8-K as soon as

practicable after they become available.

What is the deadline to propose actions for consideration at next year’s annual meeting of shareholders?

You may submit proposals for consideration at our 2017 annual meeting of shareholders. For a shareholder proposal to be considered for

inclusion in our proxy statement for the annual meeting next year pursuant to Rule 14a-8 of the Exchange Act, our Corporate Secretary must receive the written proposal at our corporate headquarters no later than [•]. Such proposals also must

comply with Rule 14a-8 of the Exchange Act. Such proposals should be addressed to:

Corporate Secretary

Financial Institutions, Inc.

220

Liberty Street

Warsaw, New York 14569

For a shareholder to bring business before the annual meeting of shareholders that is not intended to be included in our proxy statement

pursuant to Rule 14a-8 of the Exchange Act, the shareholder must give timely notice to our Corporate Secretary in accordance with our By-laws and include in such notice the information required by our By-laws. In general, our By-laws require that

the notice be received by our Corporate Secretary no later than 60 days and not more than 90 days prior to the scheduled date of the 2017 annual meeting of shareholders.

In addition, in order for any shareholder proposals submitted outside of Rule 14a-8 of the Exchange Act to be considered “timely” for

purposes of Rule 14a-4(c) of the Exchange Act, the proposal must be received at our principal executive offices not later than 60 days prior to the scheduled date of the 2017 annual meeting of shareholders.

Who can answer my questions?

Your vote

at this year’s meeting is especially important, no matter how many or how few shares you own. Please sign and date the enclosed

BLUE

proxy card and return it in the enclosed postage-paid envelope promptly or vote by Internet or

telephone. If you have questions or require assistance in the voting of your shares, please call Morrow & Co., LLC, the firm assisting the Company in its solicitation of proxies:

Morrow & Co., LLC

470

West Avenue

Stamford, Connecticut 06902

Shareholders Call Toll Free: (800) 662-5200

Banks and Brokers Call Collect: (203) 658-9400

How can I obtain additional copies of these materials or copies of other documents?

Complete copies of this proxy statement and the 2015 Annual Report, which includes our Annual Report on Form 10-K for the year ended

December 31, 2015, are also available on our website at

http://www.fiiwarsaw.com

. You may also contact Morrow & Co., LLC for additional copies.

- 10 -

IMPORTANT

The Clover Group may send you solicitation materials in an effort to solicit your vote to elect up to two of the Clover Group’s proposed

director candidates to the Board.

THE BOARD STRONGLY URGES YOU

NOT

TO SIGN OR RETURN ANY PROXY CARD OR VOTING INSTRUCTION FORM THAT YOU MAY RECEIVE FROM THE CLOVER GROUP OR ANY PERSON OTHER THAN THE COMPANY, EVEN AS A PROTEST VOTE AGAINST

THE CLOVER GROUP OR THE CLOVER GROUP’S DIRECTOR CANDIDATES.

Any proxy you sign from the Clover Group for any reason could invalidate previous

BLUE

proxy cards sent by you to support the Board.

Your vote at this year’s Annual Meeting is especially important, no matter how many or how few shares you own. Please sign and date the

enclosed

BLUE

proxy card and return it in the enclosed postage-paid envelope promptly.

Only your latest dated, signed proxy

card or voting instruction form will be counted. Any proxy may be revoked at any time prior to its exercise at the Annual Meeting as described in this proxy statement.

- 11 -

BACKGROUND OF THE EXPECTED CONTESTED SOLICITATION

The following is a chronology of the material contacts and events in our relationship with the Clover Group leading up to the filing of this

proxy statement:

|

|

•

|

|

On August 11, 2015, Clover began accumulating shares of the Company’s common stock with its acquisition of 10,000 shares of the Company’s common stock.

|

|

|

•

|

|

On November 11, 2015, Martin K. Birmingham, the Company’s President and Chief Executive Officer, and Kevin B. Klotzbach, the Company’s Executive Vice President and Chief Financial Officer participated in

the Sandler O’Neill + Partners 2015 East Coast Financial Services Conference in Palm Beach, Florida at which they conducted one-on-one meetings with institutional investors and analysts throughout the day to discuss the Company’s

strategies for continuing to grow shareholder value and its financial performance. As part of these one-on-one meetings, Messrs. Birmingham and Klotzbach met with representatives of Clover, Johnny Guerry, the Managing Partner of Clover Partners,

L.P., and Mike Shafir, an analyst at Clover Partners, L.P. During the course of this meeting, Messrs. Birmingham and Klotzbach discussed with Messrs. Guerry and Shafir the Company’s business and its strategy.

|

|

|

•

|

|

On November 30, 2015, Mr. Klotzbach had a telephone conversation with Mr. Shafir after the Company had issued a press release announcing that it was acquiring Courier Capital, a leading western New York

investment management firm.

|

|

|

•

|

|

On December 16, 2015, the members of the Clover Group jointly filed a Schedule 13D (the “

Schedule 13D

”) with the SEC to report that, as of December 16, 2015, Clover and its affiliates had

together become the beneficial owners of approximately five and two tenths percent (5.2%) of the issued and outstanding shares of the Company’s common stock.

|

|

|

•

|

|

Also, on December 16, 2015, the Clover Group sent a letter to the Board of Directors of the Company expressing its desire that the Company be sold to a larger bank.

|

|

|

•

|

|

On January 28, 2016, Messrs. Birmingham and Klotzbach, William L. Kreienberg, the Company’s EVP, Chief Risk Officer & General Counsel, and Richard J. Harrison, the Company’s former Executive Vice

President and Chief Operating Officer met with Mr. Guerry and Michael Mewhinney, Senior Partner and Founding Member at Clover Partners, L.P., to further discuss the Company’s business and strategy. At this meeting, Mr. Guerry

expressed his interest in being appointed or nominated to the Company’s Board.

|

|

|

•

|

|

On February 10, 2016, Messrs. Birmingham and Kreienberg had a telephone conversation with Mr. Guerry and communicated to Mr. Guerry that the Board’s Nominating and Governance Committee would consider

Mr. Guerry as a director candidate under the Company’s standard process for evaluating director candidates.

|

|

|

•

|

|

On March 4, 2016, members of the Nominating and Governance Committee conducted an in-person interview of Mr. Guerry. During the course of the interview, among other issues discussed relating to the

qualifications of Mr. Guerry to be appointed to the Board or to serve as a nominee for election to the Board, Mr. Guerry confirmed that he had no experience working for a bank or other operating company and that he had limited public

company board and corporate governance experience.

|

|

|

•

|

|

On March 23, 2016, the Company publicly announced that the 2016 Annual Meeting would be held on Friday, June 3, 2016 at 10:00 a.m., local time, at the Company’s corporate headquarters in Warsaw, New York.

|

|

|

•

|

|

On March 25, 2016, representatives of the Company and the Board’s Nominating and Governance Committee reached out to Mr. Guerry to inform him that the Nominating and Governance Committee had decided not

to appoint or nominate Mr. Guerry as a member of the Company’s Board as the Board believes that Mr. Guerry does not possess the qualifications, experience, and skills that would enhance the depth and breadth of the Company’s

Board.

|

- 12 -

|

|

•

|

|

On April 1, 2016, the Clover Group delivered a letter to the Company to provide notice of its intention to nominate two director candidates, including Mr. Guerry, for election to the Board at the 2016 Annual

Meeting.

|

|

|

•

|

|

On April 5, 2016, the Company issued a press release acknowledging receipt of Clover’s notice of nomination of its two director candidates.

|

|

|

•

|

|

On April 6, 2016, the Company sent a letter to the Clover Group acknowledging receipt of Clover’s notice of nomination of its two director candidates and indicating that the Company remains receptive to

working constructively with the Clover Group to pursue an amicable resolution that would avoid a proxy contest at the Annual Meeting. In the letter, the Company indicated that it is prepared to discuss with the Clover Group a resolution that

contemplates the addition to the Board of one mutually agreeable director candidate who has no prior relationship with the Company, any current member of our Board or management team, Mr. Guerry or any other member of the Clover Group, would

qualify as an independent director for purposes of NASDAQ’s listing standards and has skill sets and relevant industry expertise that would complement the strengths of the Board and management’s focus on building on the Company’s

demonstrated record of creating long-term value for the Company’s shareholders. As of the date of this proxy statement, the Company has received no response to its settlement offer from the Clover Group.

|

|

|

•

|

|

On April 8, 2016, the Company filed this preliminary proxy statement with the SEC with respect to the Annual Meeting.

|

OUR BOARD STRONGLY URGES YOU

NOT

TO SIGN OR RETURN ANY PROXY CARD OR VOTING INSTRUCTION FORM THAT YOU MAY RECEIVE FROM THE CLOVER GROUP, EVEN AS A

PROTEST VOTE AGAINST THE CLOVER GROUP OR ANY OF THE CLOVER GROUP’S DIRECTOR CANDIDATES, AS DOING SO WILL INVALIDATE ANY PRIOR VOTE YOU SUBMITTED ON THE

BLUE

PROXY CARD IN SUPPORT OF THE COMPANY’S DIRECTOR NOMINEES.

- 13 -

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

MANAGEMENT

The following table shows, as of April 7, 2016, the beneficial ownership of shares of Financial Institutions, Inc. common and preferred

stock by (a) all current directors and nominees, (b) all named executive officers, and (c) all of our current directors, nominees and executive officers as a group. Beneficial ownership means that the individual has or shares voting

power or investment power with respect to the shares of stock or the individual has the right to acquire the shares of stock within 60 days of April 7, 2016.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name

|

|

Title of class

|

|

Number of

shares

beneficially

owned

|

|

|

Number of shares

included in the

previous column

which the

individual or

group has the

right to

acquire

within 60 days of

April 7, 2016

|

|

|

Percent of

class

outstanding

(1)

|

|

Directors

(2)

:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Karl V. Anderson, Jr.

|

|

Common

|

|

|

17,183

|

|

|

|

6,000

|

|

|

*

|

|

John E. Benjamin

|

|

Common

|

|

|

22,675

|

|

|

|

4,000

|

|

|

*

|

|

Martin K. Birmingham

|

|

Common

|

|

|

96,535

|

|

|

|

-

|

|

|

*

|

|

Andrew W. Dorn, Jr.

|

|

Common

|

|

|

9,674

|

|

|

|

-

|

|

|

*

|

|

Robert M. Glaser

|

|

Common

|

|

|

9,276

|

|

|

|

-

|

|

|

*

|

|

Samuel M. Gullo

|

|

Common

|

|

|

20,856

|

|

|

|

6,000

|

|

|

*

|

|

Susan R. Holliday

|

|

Common

|

|

|

22,407

|

|

|

|

4,000

|

|

|

*

|

|

Erland E. Kailbourne

|

|

Common

|

|

|

40,978

|

|

|

|

6,000

|

|

|

*

|

|

Robert N. Latella

|

|

Common

|

|

|

19,371

|

|

|

|

6,000

|

|

|

*

|

|

James L. Robinson

|

|

Common

|

|

|

18,582

|

|

|

|

4,000

|

|

|

*

|

|

James H. Wyckoff

|

|

Common

|

|

|

426,660

|

(3)

|

|

|

6,000

|

|

|

2.94%

|

|

|

|

Class A Preferred

|

|

|

69

|

(4)

|

|

|

-

|

|

|

4.62%

|

|

|

|

Class B Preferred

|

|

|

8,565

|

(5)

|

|

|

-

|

|

|

4.98%

|

|

Nominee:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Kim E. VanGelder

|

|

Common

|

|

|

-

|

|

|

|

-

|

|

|

*

|

|

Named executive officers who are not

Directors

(2)

:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Richard J. Harrison

|

|

Common

|

|

|

40,536

|

|

|

|

3,150

|

|

|

*

|

|

Jeffrey P. Kenefick

|

|

Common

|

|

|

19,651

|

|

|

|

5,000

|

|

|

*

|

|

Kevin B. Klotzbach

|

|

Common

|

|

|

29,089

|

|

|

|

-

|

|

|

*

|

|

William L. Kreienberg

|

|

Common

|

|

|

19,943

|

|

|

|

-

|

|

|

*

|

|

All current directors , nominees and executive officers as a group

(21 persons)

|

|

Common

|

|

|

846,091

|

|

|

|

53,150

|

|

|

5.82%

|

|

|

Class A Preferred

|

|

|

69

|

|

|

|

-

|

|

|

4.62%

|

|

|

Class B Preferred

|

|

|

8,565

|

|

|

|

-

|

|

|

4.98%

|

* Denotes

less than 1%

|

(1)

|

As reported by such persons as of April 7, 2016 with percentages based on shares of the respective class of stock outstanding on April 7, 2016, including shares the individual or group has a right to acquire

within 60 days of April 7, 2016 (as indicated in the column above), which increases both the number of shares owned by such individual or group and the number of shares outstanding.

|

- 14 -

|

(2)

|

Except as set forth in the footnotes below, each person has sole investment and voting power with respect to the stock beneficially owned by such person.

|

|

(3)

|

Includes 66,995 shares held by Mr. Wyckoff’s spouse.

|

|

(4)

|

Includes 8 shares held by Mr. Wyckoff’s spouse and 19 shares held in trust.

|

|

(5)

|

Includes 855 shares held by Mr. Wyckoff’s spouse.

|

PRINCIPAL

SHAREHOLDERS

To our knowledge, the following persons were the beneficial owners of more than 5% of the outstanding shares of common

stock of the Company as of April 7, 2016.

|

|

|

|

|

|

|

Name and Address of Beneficial

Owner

|

|

Number of

shares

beneficially

owned

|

|

Percent of

outstanding

common

stock

(1)

|

|

Wellington Management Group LLP

280 Congress

Street

Boston, Massachusetts 02210

|

|

1,055,321

(2)

|

|

7.28%

|

|

BlackRock, Inc.

55 East 52nd Street

New York,

New York 10055

|

|

902,194

(3)

|

|

6.22%

|

|

Dimensional Fund Advisors LP

Palisades West, Building

One

6300 Bee Cave Road

Austin, Texas 78746

|

|

738,689

(4)

|

|

5.10%

|

|

Clover Partners L.P.

100 Crescent Court, Suite

575

Dallas, Texas 75201

|

|

738,636

(5)

|

|

5.10%

|

* Denotes

less than 1%

|

(1)

|

Based on common shares outstanding as of April 7, 2016.

|

|

(2)

|

Based on information set forth in Amendment number 3 to Schedule 13G filed with the SEC on February 11, 2016 by Wellington Management Group LLP and certain related entities, reporting beneficial ownership in the

following manner: shared voting power, 901,289 shares; and shared dispositive power, 1,055,321 shares. Wellington Management Group LLP reports beneficial ownership of shares held by clients of its investment adviser subsidiaries listed on Exhibit A

to its Schedule 13G filing.

|

|

(3)

|

Based on information set forth in Amendment number 6 to Schedule 13G filed with the SEC on January 26, 2016 by BlackRock, Inc. reporting beneficial ownership in the following manner: sole voting power, 879,103

shares; and sole dispositive power, 902,194 shares. Blackrock, Inc. is reporting beneficial ownership for the following subsidiaries: BlackRock Advisors, LLC, BlackRock Asset Management Canada Limited, BlackRock Fund Advisors, BlackRock

Institutional Trust Company, N.A., and BlackRock Investment Management, LLC.

|

|

(4)

|

Based on information set forth in Schedule 13G filed with the SEC on February 9, 2016 by Dimensional Fund Advisors LP (“Dimensional”) reporting beneficial ownership in the following manner: sole voting

power, 704,405 shares; and sole dispositive power, 738,689 shares. Dimensional reports beneficial ownership for four investment companies it advises and certain comingled funds, group trusts and separate accounts it advises. Dimensional disclaims

beneficial ownership of all such shares.

|

- 15 -

|

(5)

|

Based solely on a Schedule 13D filed by Clover Partners, L.P. on December 16, 2015 on behalf of MHC Mutual Conversion Fund, L.P., a Texas limited partnership (the “Fund”), Clover Partners, L.P., a Texas

limited partnership and the general partner of the Fund (the “GP”), Clover Partners Management, L.L.C., a Texas limited liability company and the general partner of the GP (“Clover”), and Johnny Guerry, the managing partner of

Clover. The Fund may direct the vote and disposition of 738,636 shares it holds directly. The GP serves as the investment adviser and general partner to the Fund and may direct the vote and disposition of 738,636 shares held by the Fund. Clover

serves as the general partner of the GP and may direct the GP to direct the vote and disposition of 738,636 shares held by the Fund. As the managing partner of Clover, Mr. Guerry may direct the vote and disposition of the 738,636 shares held by

the Fund.

|

- 16 -

|

|

|

PROPOSAL 1 – ELECTION OF DIRECTORS

|

Our By-laws provide for a classified Board of Directors, with directors divided into three classes of

approximately equal number. One class of directors is elected at each annual meeting of shareholders for a term expiring at the third successive annual meeting and until their respective successors have been duly elected and qualified. The Board of

Directors is authorized by our By-laws to fix, from time to time, the number of directors that constitute the whole Board of Directors. The Board size is currently set at eleven members. James L. Robinson, whose term expires in 2016, has elected to

retire as a Director and is not standing for re-election. Accordingly, Mr. Robinson’s term as a director will expire at the Annual Meeting. The nominees for director at the 2016 Annual Meeting are:

Martin K. Birmingham, Samuel M. Gullo,

Kim E. VanGelder, and James H. Wyckoff

. Each of these individuals has been nominated by the Board of Directors, upon the recommendation of its Nominating and Governance Committee, to stand for election for a term expiring at the Company’s

annual meeting to be held in 2019 and until his or her respective successors are duly elected and qualified.

The nominees recommended by

the Board of Directors have consented to serving as nominees for election to the Board, to being named in this proxy statement and to serving as members of the Board if elected by the Company’s shareholders. As of the date of this proxy

statement, the Company has no reason to believe that any nominee will be unable or unwilling to serve if elected as a director. However, if for any reason a nominee becomes unable to serve or for good cause will not serve if elected, the Board upon

the recommendation of its Nominating and Governance Committee may designate substitute nominees, in which event the shares represented by proxies returned to us will be voted for such substitute nominees. If any substitute nominees are so

designated, the Company will file an amended proxy statement that, as applicable, identifies the substitute nominees, discloses that such nominees have consented to being named in the amended proxy statement and to serve as directors if elected, and

includes certain biographical and other information about such nominees required by the applicable rules promulgated by the SEC.

We have

received notice from MHC Mutual, an affiliate of Clover Partners, which owns approximately 5.5% of the Company’s common stock, expressing the intention of MHC Mutual to nominate two director candidates for election to our Board of Directors at

the 2016 Annual Meeting. We do not endorse the election of any such MHC Mutual candidates as director. The affirmative vote of the holders of shares representing a plurality of the votes cast by the holders of shares of our common stock, voting in

person or by proxy, at the Annual Meeting is required to elect each nominee as a director. Accordingly, the four nominees receiving the highest number of “FOR” votes will be elected. A withhold vote for a director nominee and broker

non-votes, if any, will be counted as present for purposes of determining the presence of a quorum at the meeting but will not counted as a vote cast. Banks, brokers and other nominees holding shares in “street name” are not entitled to

vote on the proposal unless instructed by the beneficial owner.

Our Board does not endorse any of the Clover Group nominees and urges you

NOT to sign or return any white proxy card that may be sent to you by the Clover Group. Voting to “WITHHOLD” with respect to any of the Clover Group’s director candidates on its proxy card is not the same as voting for the

Company’s nominees because a vote to “WITHHOLD” with respect to any of the Clover Group’s nominees on its proxy card will revoke any

BLUE

proxy you previously submitted. If you have already voted using the Clover

Group’s white proxy card, you have every right to change your vote by using the

BLUE

proxy card or by voting over the Internet, by telephone or in person at the Annual Meeting. Only the latest dated, valid proxy that you submit

will be counted—any proxy may be revoked at any time prior to its exercise at the Annual Meeting by following the instructions under “Can I change my vote or revoke my proxy?” If you have any questions or require any assistance with

voting your shares, please contact our proxy solicitor, Morrow & Co., LLC toll free at

(800) 662-5200.

The enclosed

BLUE

proxy card will not be voted for more than four candidates or for anyone other than the Board’s nominees

or designated substitutes. Unless otherwise instructed, the persons named in the enclosed proxy will vote to elect

Martin K. Birmingham, Samuel M. Gullo, Kim E. VanGelder, and James H. Wyckoff

to the Board, unless, by marking the appropriate

space on the

BLUE

proxy card, the shareholder instructs that he, she or it withholds authority from the proxy holder to vote with respect to a specified candidate(s).

- 17 -

The Board believes that its director nominees bring or will bring special skills, experience and

expertise to the Board as a result of their other business activities and associations.

|

|

|

|

|

|

|

|

|

|

|

Core Qualifications and Experiences All of our Director Nominees Possess

|

|

|

|

Diversity of Skills and Experiences Represented on our Board

|

|

|

|

|

|

|

|

|

|

|

ü

Integrity, business judgment and

commitment

ü

Demonstrated management ability

ü

Extensive experience in the public,

private or not-for-profit sectors

ü

Leadership and expertise in their respective fields

ü

Financial literacy

ü

Active involvement in educational,

charitable and community organizations in the communities we serve

|

|

|

ü

Financial industry

ü

Complex regulated industries

ü

Risk management

ü

Reputational considerations

ü

Corporate governance

ü

Technology and cyber security

ü

Accounting & preparation of

financial statements

ü

Compliance

ü

In-market experience

|

|

|

|

ü

Business ethics

ü

Strategic thinking

ü

Operations

ü

Knowledge of growth markets

ü

Credit evaluation

ü

Environmental, social &

governance

ü

Human capital management

ü

Academia

ü

Government, public policy &

regulatory affairs

|

The business experience of each Director or director nominee of the Company for at least the past five years,

and the experience, qualifications, attributes, skills and areas of expertise of each Director or director nominee that supports his or her service as a Director or director nominee are set forth below. The ages shown are as of December 31,

2015.

|

|

|

|

|

|

|

|

|

|

|

|

|

Name

|

|

Age

|

|

Position(s) Held

|

|

|

|

Director

Since

|

|

Term

Expires

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DIRECTOR

NOMINEES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Martin K. Birmingham

|

|

49

|

|

Director, President and Chief Executive Officer

|

|

|

|

2013

|

|

2016

|

|

Samuel M. Gullo

|

|

67

|

|

Director

|

|

|

|

2000

|

|

2016

|

|

Kim E. VanGelder

|

|

51

|

|

Nominee

|

|

|

|

-

|

|

-

|

|

James H. Wyckoff

|

|

64

|

|

Director

|

|

|

|

1985

|

|

2016

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DIRECTORS CONTINUING IN OFFICE

|

|

|

|

|

|

|

|

|

|

|

|

|

|