Additional Proxy Soliciting Materials (definitive) (defa14a)

April 05 2016 - 5:17PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the

Registrant

x

Filed by

a Party other than the Registrant

¨

Check the appropriate box:

|

|

|

|

|

¨

|

|

Preliminary Proxy Statement

|

|

|

|

|

¨

|

|

Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

¨

|

|

Definitive Proxy Statement

|

|

|

|

|

¨

|

|

Definitive Additional Materials

|

|

|

|

|

x

|

|

Soliciting Material Pursuant to §240.14a-12

|

Financial

Institutions, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Copies to:

|

|

|

|

|

Craig S. Wittlin, Esq.

|

|

Keith E. Gottfried, Esq.

|

|

Harter Secrest & Emery LLP

|

|

Morgan, Lewis & Bockius LLP

|

|

1600 Bausch & Lomb Place

|

|

1111 Pennsylvania Avenue, N.W.

|

|

Rochester, NY 14604-2711

|

|

Washington, DC 20004-2541

|

|

(585) 231-1260

|

|

(202) 739-5947

|

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

|

|

|

x

|

|

No fee required.

|

|

|

|

|

¨

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing

fee is calculated and state how it was determined):

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

(5)

|

|

Total fee paid:

|

|

|

|

|

¨

|

|

Fee paid previously with preliminary materials:

|

|

|

|

|

¨

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

(1)

|

|

Amount previously paid:

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

(4)

|

|

Date Filed:

|

Financial Institutions, Inc., a New York corporation (“

FII

” or the “

Company

”),

is filing materials contained in this Schedule 14A with the U.S. Securities and Exchange Commission (“

SEC

”) in connection with the solicitation of proxies from its shareholders in connection with its 2016 Annual Meeting of

Shareholders to be held on Friday, June 3, 2016, at 10:00 a.m., local time, at the Company’s corporate headquarters in Warsaw, New York and at any and all adjournments or postponements thereof (the “

2016 Annual Meeting

”).

FII has not yet filed a preliminary or definitive proxy statement with the SEC in connection with its solicitation of proxies to be used at the 2016 Annual Meeting.

Press Release Issued on April 5, 2016

Attached

hereto is FII’s press release issued on April 5, 2016 confirming that it had received a notice from MHC Mutual Conversion Fund, L.P., an affiliate of Clover Partners, L.P., of its intention to nominate two candidates to stand for election

to FII’s Board of Directors at the Company’s 2016 Annual Meeting of Shareholders.

Important Additional Information and Where to Find It

FII, its directors and/or its director nominees and certain of its executive officers and employees are deemed to be participants in the solicitation

of proxies from FII’s shareholders in connection with the 2016 Annual Meeting. FII plans to file a proxy statement and accompanying form of

BLUE

proxy card with the U.S. Securities and Exchange Commission (the “

SEC

”) in

connection with the solicitation of proxies for the 2016 Annual Meeting (the “

2016 Proxy Statement

”).

SHAREHOLDERS ARE URGED TO READ THE

2016 PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO), THE ACCOMPANYING

BLUE

PROXY CARD AND ANY OTHER RELEVANT DOCUMENTS THAT FII WILL FILE WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION. Additional information regarding the identity of these potential participants and their direct or indirect interests, by security holdings or otherwise, will be set forth in the 2016 Proxy Statement and other materials to be filed with

the SEC in connection with the 2016 Annual Meeting. Such information can also be found in FII’s proxy statement for its 2015 Annual Meeting of Shareholders, filed with the SEC on March 25, 2015. To the extent holdings of FII’s

securities have changed since the amounts shown in the definitive proxy statement for the 2015 Annual Meeting of Shareholders, such changes have been or will be reflected on Initial Statements of Beneficial Ownership on Form 3 or

Statements of Change in Ownership on Form 4 filed with the SEC.

Shareholders will be able to obtain, free of charge, copies of the 2016 Proxy Statement

(including any amendments or supplements thereto), the

BLUE

proxy card and any other documents filed by FII with the SEC in connection with the 2016 Annual Meeting at the SEC’s website (www.sec.gov), at FII’s website

(www.fiiwarsaw.com) or by writing to the Company’s Corporate Secretary at Financial Institutions, Inc., 220 Liberty Street, Warsaw, New York 14569, or by calling FII’s Corporate Secretary at (585) 786-1100.

|

|

|

|

|

NEWS RELEASE

For Immediate

Release

|

|

220 Liberty Street

Warsaw, NY 14569

|

Financial Institutions Confirms Receipt of Clover Partners’ Director Nominations

WARSAW, N.Y., April 5, 2016 –

Financial Institutions, Inc. (Nasdaq: FISI), the parent company of Five Star Bank, Scott Danahy Naylon and

Courier Capital, today confirmed that it has received a notice from Clover Partners, L.P. nominating Johnny Guerry and Terrell T. Philen, Jr. for election to the Financial Institutions, Inc. (the “Company”) Board of Directors at the 2016

Annual Meeting of Shareholders. The Company’s Annual Meeting is scheduled to be held on Friday, June 3, 2016 at 10:00 a.m. at the Company’s corporate headquarters in Warsaw, New York. Financial Institutions’ shareholders are not

required to take any action at this time.

Financial Institutions welcomes constructive feedback from its shareholders. Financial Institutions regularly

meets with and engages in constructive dialog with its shareholders to understand their perspectives on the Company’s long-term strategic growth plan. Management of Financial Institutions met with Clover on several occasions since it initiated

its investment in Financial Institutions. Taking into account that the Company’s stock price has grown by approximately 50% over the past three years and its total shareholder return

1

was in

excess of 66% over the same period, the Board and management team are confident that they are pursuing the right strategy to enhance value for all shareholders. As always, Financial Institutions is committed to acting in the best interest of all

shareholders and remains focused on growing its core business and building long-term shareholder value.

Credit Suisse is serving as financial advisor to

Financial Institutions. Morgan, Lewis & Bockius LLP and Harter Secrest & Emery LLP are serving as legal advisors to Financial Institutions.

About Financial Institutions, Inc.

Financial

Institutions, Inc. provides diversified financial services through its subsidiaries, Five Star Bank, Scott Danahy Naylon and Courier Capital. Five Star Bank provides a wide range of consumer and commercial banking services to individuals,

municipalities and businesses through a network of over 50 offices and more than 60 ATMs throughout Western and Central New York State. Scott Danahy Naylon provides a broad range of insurance services to personal and business clients across 44

states. Courier Capital provides customized investment management, investment consulting and retirement plan services to individuals, businesses, institutions, foundations and retirement plans. Financial Institutions, Inc. and its subsidiaries

employ approximately 700 individuals. The Company’s stock is listed on the Nasdaq Global Select Market under the symbol FISI and is a member of the NASDAQ OMX ABA Community Bank Index. Additional information is available at the Company’s

website:

www.fiiwarsaw.com

.

Safe Harbor Statement

This press release may contain forward-looking statements as defined by Section 21E of the Securities Exchange Act of 1934, as amended, and is subject

to the safe harbors created by such laws. Such forward-looking statements are not guarantees of future operational or financial performance and are based on current expectations that involve a number of significant risks and uncertainties.

Statements herein are based on certain assumptions and analyses by the Company and are factors it believes are appropriate in the circumstances. Actual results could differ materially from those contained in or implied by such statements for a

variety of reasons including, but not limited to: the Company’s ability to implement its strategic plan, the Company’s ability to redeploy investment assets into loan assets, whether the Company experiences greater credit losses than

expected, whether the Company experiences breaches of its, or third party, information systems, the attitudes and

|

1

|

Total return of FISI common stock over the three year period ending December 31, 2015, including price appreciation and the reinvestment of

dividends. Dividends are assumed to be reinvested at the closing price of FISI common stock on the ex-date of the dividend. Our industry peers may provide similar measures of total shareholder return, although they may calculate the measure

differently and may use different terminology.

|

preferences of the Company’s customers, the Company’s ability to successfully integrate and profitably operate SDN and Courier Capital, the competitive environment, fluctuations in the

fair value of securities in its investment portfolio, changes in the regulatory environment and the Company’s compliance with regulatory requirements, changes in interest rates, general economic and credit market conditions nationally and

regionally and the actions of activist investors, including the amount of related costs incurred by Financial Institutions and the disruption caused to Financial Institutions’ business activities by these actions. Consequently, all

forward-looking statements made herein are qualified by these cautionary statements and the cautionary language in the Company’s Annual Report on Form 10-K, its Quarterly Reports on Form 10-Q and other documents filed with the SEC. Except

as required by law, the Company undertakes no obligation to revise these statements, whether to reflect new information or the occurrence of unanticipated events or otherwise, following the date of this press release.

Important Additional Information And Where To Find It

Financial Institutions, its directors and certain of its executive officers are deemed to be participants in the solicitation of proxies from the

Company’s shareholders in connection with the matters to be considered at the Company’s 2016 Annual Meeting of Shareholders. Information regarding the names of the Company’s directors and executive officers and their respective

interests in the Company by security holdings or otherwise can be found in the Company’s proxy statement for its 2015 Annual Meeting of Shareholders, filed with the SEC on March 25, 2015. To the extent holdings of the Company’s

securities have changed since the amounts set forth in the Company’s proxy statement for the 2015 Annual Meeting of Shareholders, such changes have been reflected on Statements of Change in Ownership on Form 4 filed with the SEC. These

documents are available free of charge at the SEC’s website at

www.sec.gov

. Financial Institutions intends to file a proxy statement and accompanying

BLUE

proxy card with the SEC in connection with the solicitation of

proxies from Financial Institutions shareholders in connection with the matters to be considered at the Company’s 2016 Annual Meeting of Shareholders. Additional information regarding the identity of participants, and their direct or indirect

interests, by security holdings or otherwise, will be set forth in the Company’s proxy statement for its 2016 Annual Meeting, including the schedules and appendices thereto. INVESTORS AND SHAREHOLDERS ARE STRONGLY ENCOURAGED TO READ ANY SUCH

PROXY STATEMENT AND THE ACCOMPANYING

BLUE

PROXY CARD AND OTHER DOCUMENTS FILED BY FINANCIAL INSTITUTIONS WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE AS THEY WILL CONTAIN IMPORTANT INFORMATION. Shareholders

will be able to obtain the Proxy Statement, any amendments or supplements to the Proxy Statement, the accompanying

BLUE

proxy card, and other documents filed by Financial Institutions with the SEC for no charge at the SEC’s

website at

www.sec.gov

. Copies will also be available at no charge at the Investor Relations section of the Company’s corporate website at

www.fiiwarsaw.com

, by writing to the Company’s Corporate Secretary at Financial

Institutions, Inc., 220 Liberty Street, Warsaw, New York 14569, or by calling the Company’s Corporate Secretary at (585) 786-1100.

*****

|

|

|

|

|

For additional information:

|

|

|

|

Investors:

|

|

News Media:

|

|

Kevin B. Klotzbach

|

|

Brandonne Rankin

|

|

Executive Vice President, Chief Financial Officer & Treasurer

|

|

McDougall Communications

|

|

Phone: 585.786.1130

|

|

Phone: 585.313.3683

|

|

Email:

KBKlotzbach@five-starbank.com

|

|

Email:

brankin@mcdougallpr.com

|

|

|

|

|

Jordan Darrow

|

|

|

|

Darrow Associates

|

|

|

|

Phone: 631.766.4528

|

|

|

|

Email:

jdarrow@darrowir.com

|

|

|

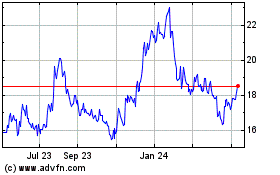

Financial Institutions (NASDAQ:FISI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Financial Institutions (NASDAQ:FISI)

Historical Stock Chart

From Apr 2023 to Apr 2024