UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

|

|

|

Date of Report (Date of Earliest Event Reported):

|

|

January 5, 2016

|

Financial Institutions, Inc.

__________________________________________

(Exact name of registrant as specified in its charter)

|

|

|

|

|

New York

|

0-26481

|

16-0816610

|

_____________________

(State or other jurisdiction

|

_____________

(Commission

|

______________

(I.R.S. Employer

|

|

of incorporation)

|

File Number)

|

Identification No.)

|

|

|

|

|

|

220 Liberty Street, Warsaw, New York

|

|

14569

|

_________________________________

(Address of principal executive offices)

|

|

___________

(Zip Code)

|

|

|

|

|

|

Registrant’s telephone number, including area code:

|

|

585-786-1100

|

Not Applicable

______________________________________________

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any

of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 3.02 Unregistered Sales of Equity Securities.

On January 5, 2016, Financial Institutions, Inc. (the "Company"), completed its previously announced acquisition of Courier Capital Corporation ("Courier"), a leading SEC-registered investment advisory and wealth management firm based in Western New York, with operations in Buffalo and Jamestown. In connection with the closing of the acquisition, the Company issued a total of 294,705 shares of the Company’s common stock, par value $0.01 (the "Issuance"), to the four shareholders of Courier as partial consideration for the merger of Courier into a wholly owned subsidiary of the Company. The Issuance was completed in reliance upon the exemption from registration set forth in Section 4(a)(2) of the Securities Act of 1933 because the Issuance did not involve a public offering. The Company reached this conclusion based on the offering being limited to the four shareholders of Courier who are each accredited investors, financially sophisticated and were given access to information about the Company relevant to their potential investment in the Company. Additionally, the Issuance did not involve any form of general solicitation or general advertising and the four shareholders of Courier represented to the Company their intention to acquire the common stock for investment purposes and not with a view to, or in connection with, any distribution thereof.

Item 8.01 Other Events.

On January 6, 2016, the Company announced that it completed its acquisition of Courier. A copy of the press release is filed as Exhibit 99.1 to this Form 8-K.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

Exhibit 99.1 Press Release issued by Financial Institutions, Inc. on January 6, 2016

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

Financial Institutions, Inc.

|

|

|

|

|

|

|

|

January 6, 2016

|

|

By:

|

|

/s/ Kevin B. Klotzbach

|

|

|

|

|

|

|

|

|

|

|

|

Name: Kevin B. Klotzbach

|

|

|

|

|

|

Title: Executive Vice President, Chief Financial Officer and Treasurer

|

Exhibit Index

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

99.1

|

|

Press Release issued by Financial Institutions, Inc. on January 6, 2016

|

| |

|

|

|

|

NEWS RELEASE |

|

220 Liberty Street |

For Immediate Release |

|

Warsaw, NY 14569 |

Financial Institutions, Inc. Completes Acquisition of Courier Capital

Financial Services Company Expands Presence in Western New York

WARSAW, N.Y., January 6, 2016 – Financial Institutions, Inc. (Nasdaq: FISI), a leading Western

New York diversified financial holding company, announced today that it has closed on the

acquisition of Courier Capital Corporation, a prominent SEC-registered investment advisory and

wealth management firm based in Western New York, with offices in Buffalo and Jamestown. Courier

now operates as a subsidiary of Financial Institutions, Inc. and as an affiliate of Five Star Bank

and Scott Danahy Naylon Insurance.

With $1.2 billion in assets under management, Courier Capital offers customized investment

management, investment consulting and retirement plan services to over 1,100 individuals,

businesses and institutions.

“The acquisition of Courier Capital reflects our commitment to an expanded revenue base and

increased noninterest income,” said Martin K. Birmingham, president and chief executive officer of

Financial Institutions, Inc. “In one step we meet the growing needs of our customers, raise our

profile in key markets, and acquire a platform to support future growth in investment advisory and

wealth management.”

The acquisition of Courier Capital, which is expected to be an EPS accretive transaction with an

expected internal rate of return of 15%, aligns with Financial Institutions’ plan to capitalize on

opportunistic situations that drive increased market share and grow revenue opportunities, while

continuing to strengthen brand value and achieve operational efficiencies.

“Through our strategic growth initiatives, we are a fast growing and highly respected independent

provider of diversified financial services in Western New York,” Birmingham said. “We are a

relationship-oriented community bank whose retail and business customers value the personal

attention we deliver. At a time when other financial services providers are leaving upstate New

York or divesting their upstate New York assets, Financial Institutions is expanding. Courier

Capital is a premier wealth manager in the region, and its addition to our family of companies is

fundamental to our long-term goals.”

About Financial Institutions, Inc.

Financial Institutions, Inc. provides diversified financial services through its subsidiaries, Five

Star Bank, Scott Danahy Naylon and Courier Capital. Five Star Bank provides a wide range of

consumer and commercial banking services to individuals, municipalities and businesses through a

network of over 50 offices and more than 60 ATMs throughout Western and Central New York State.

Scott Danahy Naylon provides a broad range of insurance services to personal and business clients

across 44 states. Courier Capital provides customized investment management, investment consulting

and retirement plan services to individuals, businesses, institutions, foundations and retirement

plans. Financial Institutions, Inc. and its subsidiaries employ approximately 650 individuals.

The Company’s stock is listed on the Nasdaq Global Select Market under the symbol FISI and is a

member of the NASDAQ OMX ABA Community Bank Index. Additional information is available at the

Company’s website: www.fiiwarsaw.com.

Safe Harbor Statement

This press release may contain forward-looking statements as defined by Section 21E of the

Securities Exchange Act of 1934, as amended, that involve significant risks and uncertainties.

Statements herein are based on certain assumptions and analyses by Financial Institutions, Inc.

(the “Company”) and are factors it believes are appropriate in the circumstances. Actual results

could differ materially from those contained in or implied by such statements for a variety of

reasons including, but not limited to: Courier’s financial results after the acquisition being

significantly different than its historical results or the Company’s internal projections;

Courier’s historical financial results being inaccurate or materially different once prepared in

accordance with GAAP; changes in interest rates; changes in accounting principles, policies, or

guidelines; changes in the Company’s dividend policy; significant changes in the economy in the

markets the Company serves; significant changes in regulatory requirements; Courier’s compliance

with regulatory requirements; unforeseen difficulties in integrating Courier with the Company; and

significant changes in securities markets. Consequently, all forward-looking statements made herein

are qualified by these cautionary statements and the cautionary language in the Company’s Annual

Report on Form 10-K, its Quarterly Reports on Form 10-Q and other documents filed with the SEC.

Except as required by law, the Company undertakes no obligation to revise these statements

following the date of this press release.

# # #

| |

|

|

For additional information:

|

|

|

Investors:

|

|

|

|

|

|

Kevin B. Klotzbach

|

|

Jordan Darrow |

Executive Vice President, Chief Financial Officer & Treasurer

|

|

Darrow Associates |

Phone: 585.786.1130

|

|

Phone: 631.367.1866 |

Email: KBKlotzbach@five-starbank.com

|

|

Email: jdarrow@darrowir.com |

|

|

|

News Media:

|

|

|

|

|

|

Brandonne Rankin

|

|

|

McDougall Communications

|

|

|

Phone: 585.313.3683

|

|

|

Email: brankin@mcdougallpr.com

|

|

|

|

|

|

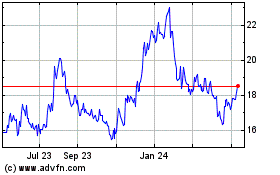

Financial Institutions (NASDAQ:FISI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Financial Institutions (NASDAQ:FISI)

Historical Stock Chart

From Apr 2023 to Apr 2024