UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 30, 2015

FINANCIAL INSTITUTIONS, INC.

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

| New York |

|

0-26481 |

|

16-0816610 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

| 220 Liberty Street, Warsaw, New York |

|

14569 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (585) 786-1100

Not Applicable

(Former

name or former address, if changed since last report.)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 7.01 |

Regulation FD Disclosure. |

Beginning on November 30, 2015, the Company intends to

distribute and make available to investors, and to post on its website, a written presentation regarding its agreement to acquire Courier Capital, as described below. The written presentation prepared by the Company is furnished as Exhibit 99.1

to this Current Report on Form 8-K. A copy of the written presentation is also available on the Company’s website at www.fiiwarsaw.com under “News & Events/Presentations.” Investors should note that the Company

announces material information in SEC filings and press releases. Based on guidance from the Securities and Exchange Commission, the Company may also use the Investor Relations section of its corporate website, www.fiiwarsaw.com, to

communicate with investors about the Company. It is possible that the information posted there could be deemed to be material information. The information on the Company’s website is not incorporated by reference into this Current Report on

Form 8-K.

In accordance with General Instruction B.2 of Form 8-K, Exhibit 99.1 hereto shall not be deemed to be “filed” for

purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and shall not be incorporated by reference into any registration statement or

other document filed under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

On November 30, 2015, Financial Institutions, Inc. (the

“Company”) announced that it had entered into a definitive agreement to acquire Courier Capital Corporation (“Courier Capital”), a leading SEC registered investment advisory and wealth management firm based in western New York

with operations in Buffalo and Jamestown. A copy of the press release is filed as Exhibit 99.2 to this Form 8-K.

| Item 9.01 |

Financial Statements and Exhibits. |

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 99.1 |

|

Written presentation to be distributed and made available to investors, and posted on the Company’s website, beginning on November 30, 2015. |

|

|

| 99.2 |

|

Press Release issued by Financial Institutions, Inc. on November 30, 2015 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

FINANCIAL INSTITUTIONS, INC. |

|

|

|

| Date: November 30, 2015 |

|

By: |

|

/s/ Kevin B. Klotzbach |

|

|

|

|

Kevin B. Klotzbach |

|

|

|

|

Executive Vice President, Chief Financial Officer and Treasurer |

| NASDAQ: FISI November 30, 2015 Courier Capital Wealth Management Acquisition Exhibit 99.1 |

| Forward Looking Statements 2 Statements contained in this presentation which are not historical facts and which pertain to future operating results of Financial Institutions, Inc. and its subsidiaries constitute forward-looking statements as defined by Section 21E of the Securities Exchange Act of 1934, as amended, that involve significant risks and uncertainties. Statements herein are based on certain assumptions and analyses by the Company and are factors it believes are appropriate in the circumstances. Actual results could differ materially from those contained in or implied by such statements for a variety of reasons including, but not limited to: Courier’s financial results after the acquisition being significantly different than its historical results or the Company’s internal projections; Courier’s historical financial results being inaccurate or materially different once prepared in accordance with GAAP; changes in interest rates; changes in accounting principles, policies, or guidelines; changes in the Company’s dividend policy; significant changes in the economic scenario: significant changes in regulatory requirements; unforeseen difficulties in integrating Courier with the Company; and significant changes in securities markets. Consequently, all forward-looking statements made herein are qualified by these cautionary statements and the cautionary language in the Company’s Annual Report on Form 10-K, its Quarterly Reports on Form 10-Q and other documents filed with the SEC. Except as required by law, the Company undertakes no obligation to update any information presented herein. |

| Growing and Diversifying Noninterest Income 3 Courier Capital Platform Acquisition – Wealth Management Services Acquisition (pending closing conditions) of leading SEC-registered investment advisory and wealth management

firm based in western New York with

operations in Buffalo and Jamestown Founded

in 1967; presently has over 1,100 individual, business, institutional, foundation, and retirement plan clients; more than $1.2 billion in assets under management and advisor to an additional $335 million of assets

Entire management and staff to remain; strong leadership

team with vast investment experience: Bruce Kaz (30 years), William Gurney (27 years), Randy Ordines (28 years) and Thomas Hanlon (27 years)

Named to the Financial Times FT 300 Top Financial

Advisers list in each of the past two years since the ranking established; ranking based on assets under management, asset growth rate, years in existence, compliance record,

industry certifications, and online

accessibility Raises profile of entire

Company in its markets and establishes another platform for expanded diversified financial services to further reduce reliance on our net interest margin business; potential for cross-selling activities and

bolt on acquisitions of other regional

firms Approximately $3.4 million in

revenues and $1.4 million in Earnings Before Interest, Taxes, Depreciation and Amortization (“EBITDA”)* for 2014, based on figures provided to the Company by Courier Capital. These financial

results were not audited and were compiled

on a cash accounting basis and not in compliance with GAAP. Acquisition of Platform Wealth Management Firm Aligned with FISI’s Growth Strategy

Diversifies non interest income with new fee-based

services Addition of commercial

customers/revenues Universal application

enhancing multiple business lines Enables

cross-selling and customer enhancement opportunities * See Appendix for the computation of this Non-GAAP measure. |

| Courier Capital – Financial Considerations Merger consideration worth $9.0 million (approximately 90% payable in FISI common

stock) at closing (subject to certain adjustments), with

additional contingent consideration (also

payable primarily in FISI common stock) expected between $2.3 million and $5.0 million based on achieving a three year compounded annual growth rate

in EBITDA* ranging between 9% and 14%,

respectively Purchase price of 8.3x 2014

EBITDA* compares favorably to other deals in sector Acquisition is expected to be moderately accretive to earnings in 2016 with an IRR in

excess of 15%

Estimated Tangible Common Book Value (“TCBV”)*

per share dilution of approximately 4.4%

at closing and expected earn-back of 7 years is within our acceptable range for the acquisition of a fee-based business platform

Deal is structured as a tax-free reorganization

which requires the recording of a deferred

tax liability on the separately identifiable intangible

assets and corresponding increase to

goodwill of approximately $1.3 million, resulting in a

relatively longer earn-back period

Inherently longer TCBV earn-back is balanced by a

reasonable level of expected TCBV

dilution, the positive impact on current and future

growth of earnings, and diversification of

our revenue 4

* See Appendix for the computation of this Non-GAAP

measure. |

| FISI’s Evolving Growth Profile 2013: Strategic growth plan developed and implemented by new Company leadership

Two key elements of plan: Diversify revenue base by increasing noninterest income through fee-based services; new services should be

aligned with core banking business and

mission to improve experience for customers

Leverage 200 years of rural NY banking to enter

opportunity rich markets of Rochester and Buffalo 2014: Insurance -- acquisition of Scott Danahy Naylon Co., Inc., a full service insurance agency based near Buffalo, as platform for entry into broad line insurance services. Integrate and develop

platform in 2015; focus on

organic/acquisition growth of business in 2016

2015:

Wealth

Management

--

acquisition

of

Courier

Capital,

a

leading

SEC-registered

investment advisory based bear Buffalo, as platform for

entry into wealth management. Integrate

and develop the platform in 2016; focus on

organic/acquisition growth in 2016 and beyond

2015/2016: Banking

--

core bank operations expanding in major regional MSAs

with 2 branch openings slated for

Rochester region (November 2015 and 1Q 2016); driving forward with new “Made for You: branch concept with cross-trained staff working closer with customers

Our

“DNA”

as

a

relationship

oriented

bank

that

values

personal

attention

for

retail

and

business

customers

is

a

competitive

advantage

in

a

rising

interest

rate

environment

and

within

a

region

experiencing consolidation; Growth complemented by

addition of fee-based services 5

|

| Non-GAAP to GAAP Reconciliation 7 September 30, 2015 Actual Adjustments Pro Forma Tangible Common Book Value: Common shareholders’ equity $ 278,094

$

8,100

$

286,194 Less: Goodwill and other

intangible assets, net 67,925

12,600

80,525

Tangible common equity (non-GAAP)

$ 210,169

$ 205,669

Common shares outstanding

14,189

311

14,500

Tangible common book value per share

(non-GAAP) (1)

$

14.81

$

14.18 (1)

Tangible common equity divided by common shares

outstanding. EBITDA:

2014 EBITDA for Courier Capital was calculated by adding

back $3 thousand of depreciation expense to net income. Courier Capital did not report any interest expense, income tax expense or amortization during 2014.

|

Exhibit 99.2

|

|

|

| NEWS RELEASE

For Immediate Release |

|

220 Liberty Street

Warsaw, NY 14569 |

Financial Institutions, Inc. Announces Agreement to Acquire Courier Capital, a Leading Western New York

Investment Management Firm

Acquisition Provides Platform to Support Future Growth in Wealth Management

WARSAW, N.Y. – November 30, 2015 – Financial Institutions, Inc. (the “Company”) (NASDAQ: FISI), the parent company of Five

Star Bank and Scott Danahy Naylon Insurance, announced today that it has entered into a definitive agreement to acquire Courier Capital, a leading SEC-registered investment advisory and wealth management firm based in western New York, with

operations in Buffalo and Jamestown. The acquisition is structured as a merger, with $9 million (approximately 90% payable in FISI common stock) payable at closing (subject to certain adjustments), with additional contingent consideration (also

payable primarily in FISI common stock) expected between $2.3 to $5.0 million and related post-closing payments based on Courier’s achievement of certain growth objectives during the three year period following the closing. The acquisition is

expected to be breakeven to moderately accretive to the earnings of Financial Institutions, Inc. in 2016.

Courier Capital offers customized investment

management, investment consulting and retirement plan services to over 1,100 individuals, businesses and institutions. Courier Capital has more than $1.2 billion in assets under management and is an advisor to an additional $335 million of assets.

Courier was named to the Financial Times 300 Top Registered Investment Advisers list* in each of the past two years since the ranking was established.

The Financial Times, a globally recognized leader in financial and investment media, launched its inaugural Financial Times 300 list to recognize the top registered investment adviser firms across the US. The rankings are based on a firm’s

assets under management, asset growth rate, years in existence, compliance record, industry certifications, and online accessibility.

“This

transaction continues our implementation of strategic initiatives designed to diversify our revenue beyond interest income and create value for our shareholders. We welcome the entire Courier Capital team, and its premier base of clients, to the

Financial Institutions, Inc. family,” stated Martin K. Birmingham, president and chief executive officer of Financial Institutions, Inc.

Mr. Birmingham continued, “This is the second key acquisition in as many years as part of our strategic growth plan. This growth plan centers on the

efficient deployment of capital and the diversification of our operations to better capitalize on market opportunities in the largest metropolitan areas of western New York. The Courier Capital acquisition is an integral component in the expansion

of our business lines, increasing our fee-based revenues and noninterest income, broadening our customer base, and providing increased value to our customers.

“The acquisition also is representative of how the regional financial services landscape has been evolving with, we believe, Financial Institutions, Inc.

at the forefront. With this trend in consolidation among all financial services industry constituents expected to continue for the foreseeable future, we are well positioned to offer our current and prospective customers a more comprehensive and

improved experience delivered by a strong and growing local company.”

“We are very pleased to be joining the Financial Institutions family,” said Bruce Kaz, president of

Courier Capital. “The impeccable reputation and integrity of Financial Institutions serves as a complement to the brand that has been built by Courier Capital, now in its third generation of owners/operators. In an increasingly complex and

competitive market for financial services, we believe the needs of our clients as well as those of Five Star Bank and Scott Danahy Naylon Insurance are best served by the combination of our operational disciplines. Our conviction is evidenced by our

management team becoming stakeholders in Financial Institutions, Inc., and our entire staff joining the growing Financial Institutions family.”

The

transaction is subject to typical conditions to closing, and is expected to be completed in January of 2016. Upon closing of the acquisition, Courier will operate as a subsidiary of Financial Institutions, Inc. and an affiliate of Five Star Bank and

Scott Danahy Naylon. Courier will serve as the Company’s platform for continued growth of the wealth management business, and further strengthens its position as a leading diversified financial services provider in western New York.

About Financial Institutions, Inc.

Financial

Institutions, Inc. (the “Company”) provides diversified financial services through its subsidiaries, Five Star Bank and Scott Danahy Naylon. Five Star Bank provides a wide range of consumer and commercial banking services to individuals,

municipalities and businesses through a network of over 50 offices and more than 60 ATMs throughout Western and Central New York State. Scott Danahy Naylon provides a broad range of insurance services to personal and business clients across 44

states. Financial Institutions, Inc. and its subsidiaries employ approximately 650 individuals. The Company’s stock is listed on the Nasdaq Global Select Market under the symbol FISI and is a member of the NASDAQ OMX ABA Community Bank Index.

Additional information is available at the Company’s website: www.fiiwarsaw.com.

About Courier Capital

Since 1967, Courier Capital has been a Western New York provider of choice for customized investment management, investment consulting and

retirement plan services. Clients include individuals, businesses, institutions, foundations, and retirement plans. The firm is dedicated to providing the broadest independent and objective investment solutions available. Courier’s team of

highly skilled professionals continues the tradition of comprehensive research, highly personalized service, and a dedication to providing clients with the best experience possible. Additional information is available at

www.couriercapital.com.

*The Financial Times Top 300 is an independent listing produced by the Financial Times. The list was

compiled using information prepared and submitted by the advisors, regulatory disclosures, and the FT’s research. The ranking is based on a firm’s assets under management, asset growth rate, years in existence, compliance record, industry

certifications, and online accessibility. A more thorough disclosure of the criteria used in making these rankings is available upon written request to the advisor. Neither the RIA firms nor their employees pay a fee to Financial Times in exchange

for inclusion in the FT 300. Third-party rankings from Financial Times and other publications are no guarantee of future investment success. Working with a highly-ranked advisor does not ensure that a client or prospective client will experience a

higher level of performance or results. These rankings should not be construed as an endorsement of the advisor by any client.

Safe Harbor Statement

This press release may contain forward-looking statements as defined by Section 21E of the Securities Exchange Act of 1934, as amended, that involve

significant risks and uncertainties. Statements herein are based on certain assumptions and analyses by the Company and are factors it believes are appropriate in the circumstances. Actual results could differ materially from those contained in or

implied by such statements for a variety of reasons including, but not limited to: Courier’s financial results after the acquisition being significantly different than its historical results or the Company’s internal projections;

Courier’s historical financial results being inaccurate or materially different once prepared in accordance with GAAP; changes in interest rates; changes in accounting principles, policies, or guidelines; changes in the Company’s dividend

policy; significant changes in the economic scenario: significant changes in regulatory requirements; unforeseen difficulties in integrating Courier with the Company; and significant changes in securities markets. Consequently, all forward-looking

statements made herein are qualified by these cautionary statements and the cautionary language in the Company’s Annual Report on Form 10-K, its Quarterly Reports on Form 10-Q and other documents filed with the SEC. Except as required by

law, the Company undertakes no obligation to revise these statements following the date of this press release.

*****

|

|

|

| For additional information: |

|

|

| Investors:

Kevin B. Klotzbach |

|

Jordan Darrow |

| Executive VP, Chief Financial Officer & Treasurer |

|

Darrow Associates |

| Phone: 585.786.1130 |

|

Phone: 631.367.1866 |

| Email: KBKlotzbach@five-starbank.com |

|

Email: jdarrow@darrowir.com |

News Media:

McDougall

Communications

Phone: 585.313.3683

Email:

brankin@mcdougallpr.com

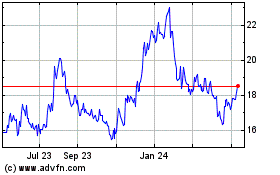

Financial Institutions (NASDAQ:FISI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Financial Institutions (NASDAQ:FISI)

Historical Stock Chart

From Apr 2023 to Apr 2024