UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 25, 2015

FIRST FINANCIAL BANCORP.

(Exact name of registrant as specified in its charter)

|

| | |

Ohio | | 31-1042001 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. employer identification number) |

Commission file number: 001-34762

255 East Fifth Street, Suite 700, Cincinnati, Ohio 45202

(Address of principal executive offices and zip code)

Registrant's telephone number, including area code: (877) 322-9530

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Form 8-K First Financial Bancorp.

Item 4.01 Changes in Registrant's Certifying Accountant.

The Audit Committee (the “Committee”) of the Board of Directors of First Financial Bancorp. (the “Company”) recently conducted a competitive selection process to determine the Company’s independent registered public accounting firm. As a result of this process, on August 25, 2015 the Committee approved the appointment of Crowe Horwath LLP (“Crowe Horwath”) as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2016, subject to completion by Crowe Horwath of its standard client acceptance procedures. Ernst & Young LLP (“EY”) served as the Company’s independent registered public accounting firm for the years ended December 31, 2014 and 2013, and has been engaged to serve for the year ending December 31, 2015. The decisions of the Committee were also approved by the Company’s Board of Directors.

The reports of EY on the Company’s consolidated financial statements for the years ended December 31, 2014 and 2013 did not contain any adverse opinion or disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principles. In connection with the audits of the Company's consolidated financial statements for the fiscal years ended December 31, 2014 and 2013, and in the subsequent period through August 25, 2015, there were no disagreements between the Company and EY on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedures, which, if not resolved to the satisfaction of EY, would have caused EY to make reference to the matter in their report. None of the “reportable events” described in Item 304(a)(1)(v) of Regulation S-K of the Security and Exchange Commission (SEC) occurred during the fiscal years ended December 31, 2014 or 2013 or through August 25, 2015.

The Company requested EY to furnish it with a letter addressed to the SEC stating whether EY agrees with the above statements. A copy of EY’s letter, dated August 26, 2015, is attached as Exhibit 16.1 to this Form 8-K.

During the fiscal years ended December 31, 2014 and 2013 and through the appointment of Crowe Horwath on August 25, 2015 for purposes of the 2016 audit, neither the Company nor anyone acting on its behalf consulted Crowe Horwath regarding (1) either the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company’s financial statements, or (2) any matter that was either the subject of a disagreement with EY on accounting principles or practices, financial statement disclosure or auditing scope or procedures, which, if not resolved to the satisfaction of EY, would have caused EY to make reference to the matter in their report, or a “reportable event” as described in Item 304(a)(1)(v) of Regulation S-K of the SEC’s rules and regulations.

Item 9.01 Financial Statements and Exhibits.

The following exhibit is furnished with this report pursuant to Item 4.01.

|

| | |

| (d) | Exhibits: |

| | |

| 16.1 | Letter to the Securities and Exchange Commission from Ernst & Young LLP dated August 26, 2015 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

FIRST FINANCIAL BANCORP.

|

| | |

| | |

| | By: /s/ John M. Gavigan |

| | John M. Gavigan |

| | Senior Vice President and Chief Financial Officer |

| | |

Date: | August 26, 2015 | |

Form 8-K First Financial Bancorp.

Exhibit Index

|

| |

Exhibit No. | Description |

| |

16.1 | Letter to the Securities and Exchange Commission from Ernst & Young LLP dated August 26, 2015 |

EXHIBIT 16.1

August 26, 2015

Securities and Exchange Commission

100 F Street, N.E.

Washington, DC 20549

Ladies and Gentlemen:

We have read Item 4.01 of Form 8-K dated August 25, 2015, of First Financial Bancorp. and are in agreement with the statements contained in the first two paragraphs on page 2 therein. We have no basis to agree or disagree with other statements of the registrant contained therein.

/s/ Ernst & Young LLP

About First Financial Bancorp

First Financial Bancorp is a Cincinnati, Ohio based bank holding company. As of March 31, 2014, the Company had $6.5 billion in assets, $4.0 billion in loans, $4.8 billion in deposits and $691 million in shareholders’ equity. The Company’s subsidiary, First Financial Bank, N.A., founded in 1863, provides banking and financial services products through its four lines of business: commercial, consumer, wealth management and mortgage. The commercial, consumer and mortgage units provide traditional banking services to business and retail clients. First Financial Wealth Management provides wealth planning, portfolio management, trust and estate, brokerage and retirement plan services and had approximately $2.5 billion in assets under management as of March 31, 2014. The Company’s strategic operating markets are located in Ohio, Indiana and Kentucky where it operates 106 banking centers. Additional information about the Company, including its products, services and banking locations is available at www.bankatfirst.com.

About Guernsey Bancorp, Inc.

Guernsey Bancorp, through its wholly-owned subsidiary, The Guernsey Bank, provides banking and financial services to individuals and commercial customers in Franklin County and its surrounding areas in Central Ohio from its three full-service banking locations. As of December 31, 2013, The Guernsey Bank had total assets of $122.9 million, total loans of $74.5 million and total deposits of $100.5 million. Additional information about The Guernsey Bank can be found on its website at www.guernseybank.com.

Forward-Looking Statement

Certain statements contained in this release which are not statements of historical fact constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act. Examples of forward-looking statements include, but are not limited to, projections of revenues, income or loss, earnings or loss per share, the payment or non-payment of dividends, capital structure and other financial items, statements of plans and objectives of First Financial or its management or board of directors and statements of future economic performances and statements of assumptions underlying such statements. Words such as ‘‘believes,’’ ‘‘anticipates,’’ “likely,” “expected,” ‘‘intends,’’ and other similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. Management’s analysis contains forward-looking statements that are provided to assist in the understanding of anticipated future financial performance. However, such performance involves risks and uncertainties that may cause actual results to differ materially. These factors include, but are not limited to: economic, market, liquidity, credit, interest rate, operational and technological risks associated with the Company’s business; the effect of and changes in policies and laws or regulatory agencies (notably the recently enacted Dodd-Frank Wall Street Reform and Consumer Protection Act); management’s ability to effectively execute its business plan; mergers and acquisitions, including costs or difficulties related to the integration of acquired companies, including the recently announced proposed acquisitions of The First Bexley Bank, Insight Bank and Guernsey Bancorp; the Company’s ability to comply with the terms of loss sharing agreements with the FDIC; the effect of changes in accounting policies and practices; and the costs and effects of litigation and of unexpected or adverse outcomes in such litigation. Please refer to the Company’s Annual Report on Form 10-K for the year ended December 31, 2013, as well as its other filings with the SEC, for a more detailed discussion of these risks, uncertainties and other factors that could cause actual results to differ from those discussed in the forward-looking statements. Such forward-looking statements are meaningful only on the date when such statements are made, and the Company undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such a statement is made to reflect the occurrence of unanticipated events. All forward-looking statements included in this news release are based on information available at the time of the release. Neither First Financial nor Guernsey assumes any obligation to update any forward-looking statement.

First Financial Bancorp Contact Information

Investors/Analysts Media

Kenneth Lovik Jenny Keighley

Senior Vice President, Investor Relations and Assistant Vice President, Media Relations Manager

Corporate Development (513) 979-5852

(513) 979-5837 jennifer.keighley@bankatfirst.com

kenneth.lovik@bankatfirst.com

Guernsey Bancorp, Inc. Contact Information

Robert D. Patrella

President & CEO

(614) 854-0400

rpatrella@guernseybank.com

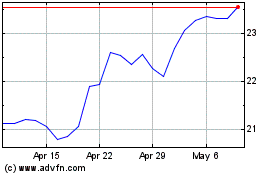

First Financial Bancorp (NASDAQ:FFBC)

Historical Stock Chart

From Mar 2024 to Apr 2024

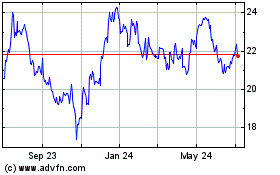

First Financial Bancorp (NASDAQ:FFBC)

Historical Stock Chart

From Apr 2023 to Apr 2024