US Treasury Earns Net $2.86 Billion Via Sterling Bancshares Warrant Auction

June 10 2010 - 9:00AM

Dow Jones News

The U.S. will earn a net $2.86 million from its sale of 2.6

million warrants to purchase shares of Sterling Bancshares Inc.

(SBIB) stock, Treasury said Thursday.

A secondary offering priced at $1.15 per warrant, above the

minimum bid of 85 cents.

The deal, scheduled to close around June 15, "represents

Treasury's sale of its remaining investment in the company,"

Treasury said.

Treasury received the warrants in exchange for providing the

Houston-based bank with $125.2 million in funds from the Troubled

Asset Relief Program in December 2008.

Sterling shares closed Wednesday at $5, up 22 cents.

Sterling was the last warrant auction among six Treasury had

planned, with sales already conducted for First Financial Bancorp

(FFBC), Wells Fargo & Co. (WFC), PNC Financial Services Group

Inc. (PNC), Valley National Bancorp. (VLY) and Comerica Inc.

(CMA).

-By Tom Barkley, Dow Jones Newswires; 202-862-9275;

tom.barkley@dowjones.com

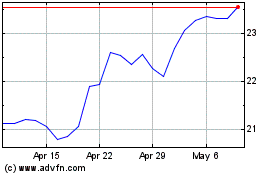

First Financial Bancorp (NASDAQ:FFBC)

Historical Stock Chart

From Mar 2024 to Apr 2024

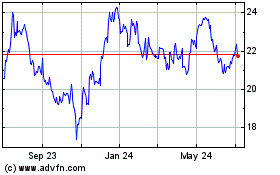

First Financial Bancorp (NASDAQ:FFBC)

Historical Stock Chart

From Apr 2023 to Apr 2024