CORRECT:US Treasury Expected To Earn $181 Million From Comerica Warrants Sale

May 07 2010 - 10:44AM

Dow Jones News

The U.S. Treasury Department announced Friday it stands to earn

about $181.10 million from its sale of warrants to purchase common

stock of Comerica Inc. (CMA).

Treasury sold roughly 11.5 million warrants at $16 each. The

closing is expected to occur on or about May 12.

The department announced plans Tuesday to sell the warrants to

purchase common stock of the Dallas bank for a minimum bid price of

$15 each.

"This offering represents Treasury's sale of its remaining

investment in the company," the department said in a statement.

The warrant auction is part of a U.S. effort to minimize losses

on a controversial $700 billion financial-sector bailout that

started in 2008. The Treasury announced plans last month to sell

warrants in six banks, including Comerica. The federal government

received the warrants in 2008 when it provided support to about 270

banks through Treasury's Troubled Asset Relief Program.

The other five banks are Wells Fargo & Co. (WFC), PNC

Financial Services Group Inc. (PNC), Valley National Bancorp (VLY),

Sterling Bancshares Inc. (SBIB) and First Financial Bancorp

(FFBC).

The Treasury previously said it would collect $320 million from

its auction of warrants to buy shares in PNC. Treasury has netted

about $3 billion from auctions so far and has deals in the pipeline

that could earn an additional $1.3 billion by the end of May.

-By Darrell A. Hughes, Dow Jones Newswires; 202-862-9255;

darrell.hughes@dowjones.com

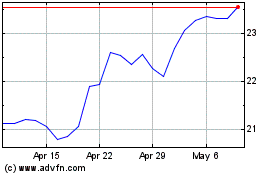

First Financial Bancorp (NASDAQ:FFBC)

Historical Stock Chart

From Mar 2024 to Apr 2024

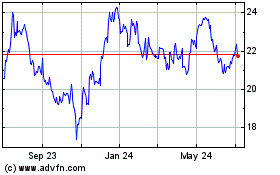

First Financial Bancorp (NASDAQ:FFBC)

Historical Stock Chart

From Apr 2023 to Apr 2024