Carolina Bank Holdings, Inc. Shareholders Approve Merger with First Bancorp

December 22 2016 - 10:23AM

On December 20, 2016, the shareholders of Carolina Bank Holdings,

Inc. (Nasdaq:CLBH) voted at a special meeting of shareholders to

approve the previously announced Agreement and Plan of Merger and

Reorganization, dated as of June 21, 2016, providing for the merger

of Carolina Bank Holdings with First Bancorp (Nasdaq:FBNC). The

votes cast by Carolina Bank Holdings shareholders in favor of the

proposal to approve the merger represented approximately 73.43% of

the company’s issued and outstanding common stock entitled to vote

as of October 21, 2016, the record date for the special meeting. Of

the shares voted, approximately 99.62% voted to approve the merger.

First Bancorp and Carolina Bank Holdings have

received approval for the merger from the North Carolina

Commissioner of Banks. An application for approval of the merger is

also currently under review by the Board of Governors of the

Federal Reserve System. The merger is expected to close during the

first quarter of 2017, subject to receipt of all required

regulatory approvals.

About Carolina Bank Holdings,

Inc.

Carolina Bank, the banking subsidiary of Carolina Bank Holdings,

Inc., began banking operations on November 25, 1996. The parent

company is a North Carolina corporation organized in 2000. The bank

is engaged in lending and deposit gathering activities in the

Piedmont Triad of North Carolina, with operations in four counties:

Guilford, Alamance, Forsyth and Randolph. The bank has eight

full-service banking locations, three in Greensboro, one in

Asheboro, one in High Point, one in Burlington, and two in

Winston-Salem. Residential mortgage loan production offices are

located in Burlington, Chapel Hill and Sanford in addition to a

wholesale residential mortgage operation in Greensboro. Carolina

Bank Holdings, Inc.’s stock is listed on the Nasdaq Global Market

under the symbol CLBH. Further information is available on the

company’s web site: www.carolinabank.com.

Caution Regarding Forward-Looking

Statements

This press release, in particular statements regarding the

proposed transaction between Carolina Bank Holdings, Inc. and First

Bancorp, the expected timetable for completing the transaction, and

any other statements about Carolina Bank Holdings, Inc. or First

Bancorp managements’ future expectations, beliefs, goals, plans or

prospects, includes forward-looking statements that are based on

certain beliefs and assumptions and reflect the current

expectations of Carolina Bank Holdings, Inc., First Bancorp, and

their respective management. Statements that are predictive in

nature, that depend on or relate to future events or conditions, or

that include words such as “believes,” “anticipates,” “expects,”

“continues,” “predict,” “potential,” “contemplates,” “may,” “will,”

“likely,” “could,” “should,” “estimates,” “intends,” “plans” and

other similar expressions are forward-looking statements. All

statements other than statements of historical fact are statements

that could be deemed forward-looking statements. Forward-looking

statements involve known and unknown risks, assumptions and

uncertainties that may cause actual results in future periods to

differ materially from those projected or contemplated in the

forward-looking statements, and you should not place undue reliance

on these statements. Some of the factors that could cause actual

results to differ materially from current expectations are: the

ability to consummate the proposed transaction; any conditions

imposed on the parties in connection with the consummation of the

proposed transaction; the occurrence of any event, change or other

circumstances that could give rise to the termination of the

agreement relating to the proposed transaction; Carolina Bank

Holdings, Inc.’s ability to maintain relationships with employees

and third parties following announcement of the proposed

transaction; the ability of the parties to satisfy the conditions

to the closing of the proposed transaction; the risk that the

proposed transaction may not be completed in the time frame

expected by the parties or at all; and the risks that are described

from time to time in Carolina Bank Holdings Inc.’s reports filed

with the SEC, including Annual Reports on Form 10-K, Quarterly

Reports on Form 10-Q and Current Reports on Form 8-K, and on

general industry and economic conditions. Carolina Bank Holdings,

Inc. disclaims any intention or obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise.

FOR ADDITIONAL INFORMATION, PLEASE CONTACT:

Carolina Bank Holdings, Inc.

T. Allen Liles, EVP and CFO

Telephone: 336-286-8746

Email: a.liles@carolinabank.com

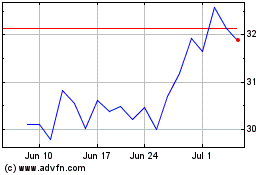

First Bancorp (NASDAQ:FBNC)

Historical Stock Chart

From Mar 2024 to Apr 2024

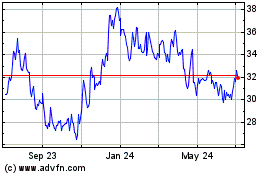

First Bancorp (NASDAQ:FBNC)

Historical Stock Chart

From Apr 2023 to Apr 2024