Current Report Filing (8-k)

May 13 2016 - 3:10PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT PURSUANT TO SECTION 13 OR

15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

|

Date of Report (Date of earliest event reported):

|

|

May 12, 2016

|

First Bancorp

(Exact Name of Registrant as Specified in its

Charter)

|

|

|

|

|

|

|

North Carolina

|

|

0-15572

|

|

56-1421916

|

|

(State or Other Jurisdiction

|

|

(Commission

|

|

(I.R.S. Employer

|

|

of Incorporation)

|

|

File Number)

|

|

Identification Number)

|

|

|

|

|

|

|

|

300 SW Broad Street,

Southern Pines, NC

|

|

|

|

28387

|

|

(Address of Principal Executive Offices)

|

|

|

|

(Zip Code)

|

(910) 246-2500

(Registrant’s telephone number, including

area code)

Not Applicable

(Former Name or Former Address, if changed since

last report)

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

o

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

First Bancorp

INDEX

|

|

|

|

|

|

|

|

|

Page

|

|

|

|

|

|

|

|

|

|

|

|

Item 5.07 – Submission of Matters to a Vote of Security Holders

|

|

|

3

|

|

|

|

|

|

|

|

|

Signatures

|

|

|

5

|

|

|

|

|

|

|

|

|

|

|

|

|

2

Item 5.07 – Submission of Matters to a Vote of Security

Holders

On May 12, 2016, First Bancorp held its

annual meeting of shareholders. At the meeting, the Company’s shareholders: (i) elected each of the nine persons listed below

under Proposal 1 to serve as a director of the Company until the 2017 annual meeting; (ii) ratified the appointment of Elliott

Davis Decosimo, PLLC as the independent auditors of the Company for 2016; and (iii) approved, on a non-binding advisory basis,

the Company’s named executive officer compensation (“Say on Pay”).

The following table describes the results of the voting at the

annual meeting.

|

Proposal or Name of Nominee

|

|

Shares

Voted “For”

|

|

Shares

Voted

“Against”

|

|

Shares

Withheld

|

|

Shares

Abstained

|

|

Broker

Non-

Votes

|

|

Proposal 1: To elect nine nominees to the Board of Directors to serve until the 2017 annual meeting of shareholders, or until their successors are elected and qualified

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Daniel T. Blue, Jr.

|

|

|

14,193,434

|

|

|

|

—

|

|

|

|

83,948

|

|

|

|

—

|

|

|

|

3,071,578

|

|

|

Mary Clara Capel

|

|

|

14,139,779

|

|

|

|

—

|

|

|

|

137,603

|

|

|

|

—

|

|

|

|

3,071,578

|

|

|

James C. Crawford, III

|

|

|

14,240,278

|

|

|

|

—

|

|

|

|

37,104

|

|

|

|

—

|

|

|

|

3,071,578

|

|

|

Richard H. Moore

|

|

|

14,183,904

|

|

|

|

—

|

|

|

|

93,478

|

|

|

|

—

|

|

|

|

3,071,578

|

|

|

Thomas F. Phillips

|

|

|

14,192,549

|

|

|

|

—

|

|

|

|

84,833

|

|

|

|

—

|

|

|

|

3,071,578

|

|

|

O. Temple Sloan, III

|

|

|

14,197,742

|

|

|

|

—

|

|

|

|

79,640

|

|

|

|

—

|

|

|

|

3,071,578

|

|

|

Frederick L. Taylor II

|

|

|

14,168,383

|

|

|

|

—

|

|

|

|

108,999

|

|

|

|

—

|

|

|

|

3,071,578

|

|

|

Virginia C. Thomasson

|

|

|

14,241,317

|

|

|

|

—

|

|

|

|

36,065

|

|

|

|

—

|

|

|

|

3,071,578

|

|

|

Dennis A. Wicker

|

|

|

10,016,388

|

|

|

|

—

|

|

|

|

4,260,994

|

|

|

|

—

|

|

|

|

3,071,578

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proposal 2: To ratify the appointment of Elliott Davis Decosimo, PLLC as the independent auditors of the Company for 2016.

|

|

|

17,217,317

|

|

|

|

63,603

|

|

|

|

—

|

|

|

|

68,040

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proposal 3: To approve, on a non-binding advisory basis, the Company’s named executive officer compensation (“Say on Pay”).

|

|

|

13,928,417

|

|

|

|

275,925

|

|

|

|

—

|

|

|

|

73,040

|

|

|

|

3,071,578

|

|

3

Disclosures About Forward Looking Statements

The discussions included in this document and its exhibits

may contain forward looking statements within the meaning of the Private Securities Litigation Act of 1995, including Section 21E

of the Securities Exchange Act of 1934 and Section 27A of the Securities Act of 1933. Such statements involve known and unknown

risks, uncertainties and other factors that may cause actual results to differ materially. For the purposes of these discussions,

any statements that are not statements of historical fact may be deemed to be forward looking statements. Such statements are

often characterized by the use of qualifying words such as “expects,” “anticipates,” “believes,”

“estimates,” “plans,” “projects,” or other statements concerning opinions or judgments of

the Company and its management about future events. The accuracy of such forward looking statements could be affected by such

factors as, including but not limited to, the financial success or changing conditions or strategies of the Company’s customers

or vendors, fluctuations in interest rates, actions of government regulators, the availability of capital and personnel or general

economic conditions.

4

Signatures

Pursuant to

the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First Bancorp

|

|

|

|

|

|

|

|

|

|

|

|

May 13, 2016

|

|

By:

|

|

/s/ Richard H. Moore

|

|

|

|

|

|

|

|

Richard H. Moore

|

|

|

|

|

|

|

|

Chief Executive Officer

|

5

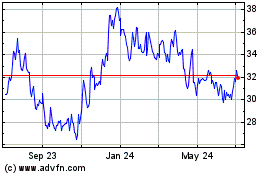

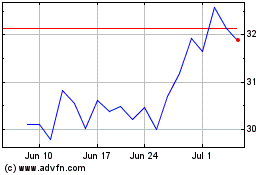

First Bancorp (NASDAQ:FBNC)

Historical Stock Chart

From Mar 2024 to Apr 2024

First Bancorp (NASDAQ:FBNC)

Historical Stock Chart

From Apr 2023 to Apr 2024