UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT PURSUANT TO SECTION 13 OR

15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

| |

|

|

| Date of Report (Date of earliest event reported): |

|

April 29, 2015 |

First Bancorp

(Exact Name of Registrant as Specified in its

Charter)

| |

|

|

|

|

| North Carolina |

|

0-15572 |

|

56-1421916 |

| (State or Other Jurisdiction |

|

(Commission |

|

(I.R.S. Employer |

| of Incorporation) |

|

File Number) |

|

Identification Number) |

| |

|

|

|

|

|

300 SW Main Street,

Southern Pines, North Carolina |

|

|

|

28387 |

| (Address of Principal Executive Offices) |

|

|

|

(Zip Code) |

(910) 246-2500

(Registrant’s telephone number, including

area code)

Not Applicable

(Former Name or Former Address, if changed since

last report)

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

First Bancorp

INDEX

| |

|

Page |

| |

|

|

|

|

| Item 2.02 – Results of Operations and Financial Condition |

|

|

3 |

|

| |

|

|

|

|

| Item 9.01 – Financial Statements and Exhibits |

|

|

3 |

|

| |

|

|

|

|

| Signatures |

|

|

4 |

|

| |

|

|

|

|

| Exhibit 99.1 News Release dated April 29, 2015 |

|

|

Exhibit |

|

2

Item 2.02 – Results of Operations and Financial Condition

On April 29, 2015, the Registrant issued

a news release to announce its financial results for the three months ended March 31, 2015. The news release is attached hereto

as Exhibit 99.1.

The news release includes disclosure of net

interest income on a tax-equivalent basis, which is a non-GAAP performance measure used by management in operating its business.

Management believes that analysis of net interest income on a tax-equivalent basis is useful and appropriate because it allows

a comparison of net interest income amounts in different periods without taking into account the different mix of taxable versus

non-taxable investments that may have existed during those periods.

The news release also includes disclosure of

tax-equivalent net interest margin, excluding the impact of loan discount accretion, which is a non-GAAP performance measure. Management

believes that it is useful to calculate and present the net interest margin without the impact of loan discount accretion, for

the reasons explained in the rest of this paragraph. Loan discount accretion is a non-cash interest income adjustment related to

the Registrant’s acquisition of two failed banks and represents the portion of the fair value discount that was initially

recorded on the acquired loans that is being recognized into income over the lives of the loans. At March 31, 2015, the Registrant

had a remaining loan discount balance of $19.1 million compared to $31.2 million at March 31, 2014. For the related loans that

perform and pay-down over time, the loan discount will also be reduced, with a corresponding increase to interest income. Therefore

management believes it is useful to also present this ratio to reflect net interest margin excluding this non-cash, temporary loan

discount accretion adjustment to aid investors in comparing financial results between periods.

The Registrant cautions that non-GAAP financial

measures should be considered in addition to, but not as a substitute for, the reported GAAP results. A reconciliation between

the non-GAAP financial measures presented and the most directly comparable financial measure calculated in accordance with GAAP

is included in the news release and financial summary attached hereto as Exhibit 99.1.

Item 9.01 – Financial Statements and Exhibits

| |

Exhibit No. |

Description |

| |

99.1 |

Press release issued on April 29, 2015 |

Disclosures About Forward Looking Statements

This press release contains forward-looking

statements within the meaning of Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform

Act of 1995, which statements are inherently subject to risks and uncertainties. Forward-looking statements are statements that

include projections, predictions, expectations or beliefs about future events or results or otherwise are not statements of historical

fact. Such statements are often characterized by the use of qualifying words (and their derivatives) such as “expect,”

“believe,” “estimate,” “plan,” “project,” “anticipate,” or other statements

concerning opinions or judgments of the Company and its management about future events. Factors that could influence the accuracy

of such forward-looking statements include, but are not limited to, the financial success or changing strategies of the Company’s

customers, the Company’s level of success in integrating acquisitions, actions of government regulators, the level of market

interest rates, and general economic conditions. For additional information about the factors that could affect the matters discussed

in this paragraph, see the “Risk Factors” section of the Company’s most recent annual report on Form 10-K. Forward-looking

statements speak only as of the date they are made, and the Company undertakes no obligation to update or revise forward-looking

statements. The Company is also not responsible for changes made to the press release by wire services, internet services or other

media.

3

Signatures

Pursuant to

the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned thereunto duly authorized.

| |

|

|

|

|

|

| |

|

|

|

|

First Bancorp |

| |

|

|

|

|

|

| |

|

April 29, 2015 |

|

By: |

/s/ Richard H. Moore |

| |

|

|

|

|

Richard H. Moore |

| |

|

|

|

|

President and Chief Executive Officer |

4

News Release

| For Immediate Release: |

For More Information, |

| April 29, 2015 |

Contact: Elaine Pozarycki |

| |

919-834-3090 |

First Bancorp Reports First Quarter Results

SOUTHERN PINES, N.C. – First Bancorp

(NASDAQ - FBNC), the parent company of First Bank, announced today net income available to common shareholders of $6.8 million,

or $0.33 per diluted common share, for the three months ended March 31, 2015, an increase of 24.0% compared to the $5.5 million,

or $0.27 per diluted common share, recorded in the first quarter of 2014. The higher earnings were primarily the result of a lower

provision for loan losses.

Net Interest Income and Net Interest Margin

Net interest income for the first quarter of

2015 amounted to $29.7 million, a 16.4% decrease from the $35.5 million recorded in the first quarter of 2014.

The Company’s net interest margin (tax-equivalent

net interest income divided by average earning assets) in the first quarter of 2015 was 4.19% compared to 5.13% for the first quarter

of 2014. The 4.19% net interest margin was a six basis point decrease from the 4.25% margin realized in the fourth quarter of 2014.

The lower margins are primarily due to lower amounts of discount accretion on loans purchased in failed-bank acquisitions and lower

average asset yields – see additional discussion below. As shown in the accompanying tables, loan discount accretion amounted

to $1.6 million in the first quarter of 2015, $2.2 million in the fourth quarter of 2014, and $6.4 million in the first quarter

of 2014. The lower amount of accretion is due to the unaccreted discount amount that resulted from prior acquisitions continuing

to wind down.

Excluding the effects of discount accretion

on purchased loans, the Company’s net interest margin amounted to 3.98% for the first quarter of 2015, 3.96% for the fourth

quarter of 2014, and 4.22% for the first quarter of 2014. The lower margin realized for the first quarter of 2015 compared to the

first quarter of 2014 was primarily the result of lower loan yields, which are being impacted by the prolonged low interest rate

environment. The two basis point increase in net interest margin compared to the fourth quarter of 2014 was primarily the result

of the Company investing approximately $125 million of excess cash balances into higher yielding investment securities late in

the fourth quarter of 2014. See the Financial Summary for a table that presents the impact of loan discount accretion, as well

as other purchase accounting adjustments affecting net interest income. Also see the Financial Summary for a reconciliation of

the Company’s net interest margin to the net interest margin excluding loan discount accretion, and other information regarding

this ratio.

The Company’s cost of funds has steadily

declined from 0.31% in the first quarter of 2014 to 0.26% in the first quarter of 2015, which has had a positive impact on the

Company’s net interest margin.

Provision for Loan Losses and Asset Quality

The Company recorded a negative

provision for loan losses (reduction of the allowance for loan losses) of $0.2 million in the first quarter of 2015 compared to

a provision for loan losses of $3.6 million in the first quarter of 2014. As discussed below, the Company records provisions for

loan losses related to both non-covered and covered loan portfolios – see explanation of the terms “non-covered”

and “covered” in the section below entitled “Note Regarding Components of Earnings.”

The provision for loan losses

on non-covered loans amounted to $0.1 million in the first quarter of 2015 compared to $3.4 million in the first quarter of 2014.

The lower provision recorded in 2015 was primarily a result of improved credit quality trends, minimal loan growth, and generally

improving economic trends.

The Company recorded a negative

provision for loan losses on covered loans of $0.3 million in the first quarter of 2015 compared to a $0.2 million in provision

for loan losses in the first quarter of 2014. The negative provision in 2015 primarily resulted from lower levels of covered nonperforming

loans, declining levels of total covered loans and net loan recoveries (recoveries, net of charge-offs) of $0.2 million realized

during the quarter.

Total non-covered nonperforming assets amounted

to $90.4 million at March 31, 2015 (2.92% of total non-covered assets), $95.3 million at December 31, 2014 (3.09% of total non-covered

assets), and $82.2 million at March 31, 2014 (2.65% of total non-covered assets). The increase in non-covered nonperforming assets

when comparing March 31, 2015 to March 31, 2014 was primarily due to the Company transferring $14.8 million in nonperforming assets

from covered status to non-covered status on July 1, 2014 upon the scheduled expiration of a loss share agreement with the FDIC

associated with those assets.

Total covered nonperforming

assets have declined in the past year, amounting to $14.5 million at March 31, 2015, $18.7 million at December 31, 2014 and $58.9

million at March 31, 2014. Over the past twelve months, the Company has resolved a significant amount of covered loans and has

experienced strong property sales along the North Carolina coast, which is where most of the Company’s covered assets are

located. Also, as discussed in the preceding paragraph, on July 1, 2014 the Company transferred $14.8 million in nonperforming

assets from covered status to non-covered status upon the expiration of a loss share agreement.

Noninterest Income

Total noninterest income for the three months

ended March 31, 2015 was $4.5 million compared to $0.3 million for the comparable period of 2014.

Core noninterest income for the first quarter

of 2015 was $7.2 million, a decrease of 3.9% from the $7.5 million reported for the first quarter of 2014. Core noninterest income

includes i) service charges on deposit accounts, ii) other service charges, commissions, and fees, iii) fees from presold mortgages,

iv) commissions from financial product sales, and v) bank-owned life insurance income. The primary reason for the decrease in core

noninterest income in 2015 was lower service charges on deposit accounts, which declined from $3.6 million in the first quarter

of 2014 to $2.9 million in the first quarter of 2015. After the elimination of free checking for most customers with low balances

in late 2013, monthly fees earned on deposit accounts have gradually declined over the past several quarters as a result of more

customers meeting the requirements to have the monthly service charge waived. Fewer instances of fees earned from customers overdrawing

their accounts have also impacted this line item.

Noncore components of noninterest income resulted

in net losses of $2.6 million in the first quarter of 2015 and net losses of $7.2 million in the first quarter of 2014. The largest

variances in noncore noninterest income related to gains (losses) on covered foreclosed properties and indemnification asset income

(expense) – see discussion below.

Gains on covered foreclosed properties were

$0.2 million for the three months ended March 31, 2015 compared to losses of $2.1 million recorded for the three months ended March

31, 2014. Losses on covered foreclosed properties have generally declined in recent quarters as a result of significantly lower

levels of covered foreclosed properties held by the Company and stabilization in property values.

Indemnification asset income (expense) is recorded

to reflect additional (decreased) amounts expected to be received from the FDIC during the period related to covered assets. The

three primary items that result in recording indemnification asset income (expense) are 1) income from loan discount accretion,

which results in indemnification expense, 2) provisions for loan losses on covered loans, which result in indemnification income

and 3) foreclosed property gains (losses) on covered assets, which also result in indemnification expense (income). In the first

quarter of 2015, the Company recorded $2.4 million in indemnification asset expense compared to $4.9 million in indemnification

asset expense in the first quarter of 2014. This variance is primarily due to lower indemnification asset expense associated with

the lower loan discount accretion income in the first quarter of 2015. See additional discussion related to this matter in the

section below entitled “Note Regarding Components of Earnings.”

Noninterest Expenses

Noninterest expenses amounted

to $23.7 million in the first quarter of 2015 compared to $23.6 million recorded in the first quarter of 2014. In 2015, a lower

level of salary expense, resulting from a decline in the number of employees, was offset by miscellaneous items of other operating

expense.

Balance Sheet and Capital

Total assets at March 31, 2015 amounted to

$3.2 billion, a 2.9% decrease from a year earlier. Total loans at March 31, 2015 amounted to $2.4 billion, a 2.1% decrease from

a year earlier, and total deposits amounted to $2.7 billion at March 31, 2015, a 3.3% decrease from a year earlier.

Investment securities totaled $349.0 million

at March 31, 2015 compared to $234.1 million at March 31, 2014. In the fourth quarter of 2014, the Company used a portion of its

excess cash balances to purchase approximately $125 million in investment securities.

Non-covered loans amounted

to $2.3 billion at March 31, 2015, an increase of $18.8 million from March 31, 2014. The increase was due to the reclassification

of $39.7 million in loans from covered status to non-covered status in connection with the July 1, 2014 expiration of a loss share

agreement. Non-covered loans increased $7 million during the first quarter of 2015 as a result of ongoing internal initiatives

to drive loan growth. Loans covered by FDIC loss share agreements are expected to continue to decline as those loans continue to

pay down.

The lower amount of deposits at March 31, 2015

compared to March 31, 2014 was primarily due to declines in retail time deposits (“other time deposits > $100,000”

and “other time deposits” in the accompanying tables) and brokered deposits, with increases in checking accounts offsetting

a large portion of the decline. Time deposits are generally one of the Company’s most expensive funding sources, and thus

the shift from this category has benefited the Company’s overall cost of funds.

The Company remains well-capitalized by all

regulatory standards, with a Total Risk-Based Capital Ratio at March 31, 2015 of 17.66% compared to the 10.00% minimum to be considered

well-capitalized. The Company’s tangible common equity to tangible assets ratio was 8.08% at March 31, 2015, an increase

of 78 basis points from a year earlier.

Comments of the President and Other Business Matters

Richard H. Moore, President and CEO of First

Bancorp, commented on today’s report, “I am pleased to report another quarter of strong earnings for the Company. We

have now reported eight consecutive quarters of earnings of more than $5 million. Asset quality continues to improve and we are

focused on strategic initiatives that we expect will result in future increases in profitability and market share.”

The following is a list of business development

and other miscellaneous matters affecting the Company:

| · | On March 16, 2015, the Company announced a quarterly cash dividend of $0.08 cents per share payable on April 24, 2015 to shareholders

of record on March 31, 2015. This is the same dividend rate as the Company declared in the first quarter of 2014. |

| · | The Company is currently constructing a new branch facility at 4110 Bradham Drive, Jacksonville, North Carolina. Upon completion,

the First Bank branch located on Western Boulevard will be closed and the accounts serviced at that branch will be reassigned to

the new and improved branch. This is expected to occur in the second quarter of 2015. |

Note Regarding Components of Earnings

The Company’s results of operation are

significantly affected by the on-going accounting for two FDIC-assisted failed bank acquisitions. In the discussion above, the

term “covered” is used to describe assets included as part of FDIC loss share agreements, which generally result in

the FDIC reimbursing the Company for 80% of losses incurred on those assets. The term “non-covered” refers to the Company’s

legacy assets, which are not included in any type of loss share arrangement.

For covered loans that deteriorate in terms

of repayment expectations, the Company records immediate allowances through the provision for loan losses. For covered loans that

experience favorable changes in credit quality compared to what was expected at the acquisition date, including loans that pay

off, the Company records positive adjustments to interest income over the life of the respective loan – also referred to

as loan discount accretion. For covered foreclosed properties that are sold at gains or losses or that are written down to lower

values, the Company records the gains/losses within noninterest income.

The adjustments discussed above are recorded

within the income statement line items noted without consideration of the FDIC loss share agreements. Because favorable changes

in covered assets result in lower expected FDIC claims, and unfavorable changes in covered assets result in higher expected FDIC

claims, the FDIC indemnification asset is adjusted to reflect those expectations. The net increase or decrease in the indemnification

asset is reflected within noninterest income.

The adjustments noted above can result in volatility

within individual income statement line items. Because of the FDIC loss share agreements and the associated indemnification asset,

pretax income resulting from amounts recorded as provisions for loan losses on covered loans, discount accretion, and losses from

covered foreclosed properties is generally only impacted by 20% of these amounts due to the corresponding adjustments made to the

indemnification asset.

First Bancorp is a bank holding company headquartered

in Southern Pines, North Carolina with total assets of approximately $3.2 billion. Its principal activity is the ownership and

operation of First Bank, a state-chartered community bank that operates 87 branches, with 73 branches operating in North Carolina,

6 branches in South Carolina (Cheraw, Dillon, Florence, and Latta), and 7 branches in Virginia (Abingdon, Blacksburg, Christiansburg,

Fort Chiswell, Radford, Salem and Wytheville), where First Bank does business as First Bank of Virginia. First Bank also has loan

production offices in Fayetteville, North Carolina, and Greenville, North Carolina. First Bancorp’s common stock is traded

on the NASDAQ Global Select Market under the symbol “FBNC.”

Please visit our website at www.LocalFirstBank.com.

This press release contains forward-looking

statements within the meaning of Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform

Act of 1995, which statements are inherently subject to risks and uncertainties. Forward-looking statements are statements that

include projections, predictions, expectations or beliefs about future events or results or otherwise are not statements of historical

fact. Such statements are often characterized by the use of qualifying words (and their derivatives) such as “expect,”

“believe,” “estimate,” “plan,” “project,” “anticipate,” or other statements

concerning opinions or judgments of the Company and its management about future events. Factors that could influence the accuracy

of such forward-looking statements include, but are not limited to, the financial success or changing strategies of the Company’s

customers, the Company’s level of success in integrating acquisitions, actions of government regulators, the level of market

interest rates, and general economic conditions. For additional information about the factors that could affect the matters discussed

in this paragraph, see the “Risk Factors” section of the Company’s most recent annual report on Form 10-K available

at www.sec.gov. Forward-looking statements speak only as of the date they are made, and the Company undertakes no obligation

to update or revise forward-looking statements. The Company is also not responsible for changes made to the press release by wire

services, internet services or other media.

|

First Bancorp and Subsidiaries

Financial Summary – Page 1 |

| |

Three Months Ended

March 31, | | |

Percent |

| ($ in thousands except per share data – unaudited) | |

2015 | | |

2014 | | |

Change |

| | |

| | |

| | |

| |

| INCOME STATEMENT | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | |

| Interest income | |

| | | |

| | | |

| | |

| Interest and fees on loans | |

$ | 29,441 | | |

| 36,086 | | |

| | |

| Interest on investment securities | |

| 1,822 | | |

| 1,471 | | |

| | |

| Other interest income | |

| 195 | | |

| 119 | | |

| | |

| Total interest income | |

| 31,458 | | |

| 37,676 | | |

| (16.5 | %) |

| Interest expense | |

| | | |

| | | |

| | |

| Interest on deposits | |

| 1,458 | | |

| 1,891 | | |

| | |

| Interest on borrowings | |

| 297 | | |

| 250 | | |

| | |

| Total interest expense | |

| 1,755 | | |

| 2,141 | | |

| (18.0 | %) |

| Net interest income | |

| 29,703 | | |

| 35,535 | | |

| (16.4 | %) |

| Provision for loan losses – non-covered loans | |

| 104 | | |

| 3,365 | | |

| (96.9 | %) |

| Provision (reversal) for loan losses – covered loans | |

| (268 | ) | |

| 210 | | |

| n/m | |

| Total provision for loan losses | |

| (164 | ) | |

| 3,575 | | |

| n/m | |

| Net interest income after provision for loan losses | |

| 29,867 | | |

| 31,960 | | |

| (6.5 | %) |

| Noninterest income | |

| | | |

| | | |

| | |

| Service charges on deposit accounts | |

| 2,892 | | |

| 3,573 | | |

| | |

| Other service charges, commissions, and fees | |

| 2,542 | | |

| 2,367 | | |

| | |

| Fees from presold mortgages | |

| 808 | | |

| 607 | | |

| | |

| Commissions from financial product sales | |

| 561 | | |

| 594 | | |

| | |

| Bank-owned life insurance income | |

| 371 | | |

| 327 | | |

| | |

| Foreclosed property gains (losses) – non-covered | |

| (494 | ) | |

| (156 | ) | |

| | |

| Foreclosed property gains (losses) – covered | |

| 237 | | |

| (2,117 | ) | |

| | |

| FDIC indemnification asset income (expense), net | |

| (2,392 | ) | |

| (4,916 | ) | |

| | |

| Other gains (losses) | |

| 4 | | |

| 19 | | |

| | |

| Total noninterest income | |

| 4,529 | | |

| 298 | | |

| 1,419.8 | % |

| Noninterest expenses | |

| | | |

| | | |

| | |

| Salaries expense | |

| 11,497 | | |

| 11,648 | | |

| | |

| Employee benefit expense | |

| 2,183 | | |

| 2,311 | | |

| | |

| Occupancy and equipment expense | |

| 2,825 | | |

| 2,808 | | |

| | |

| Intangibles amortization | |

| 180 | | |

| 194 | | |

| | |

| Other operating expenses | |

| 7,029 | | |

| 6,590 | | |

| | |

| Total noninterest expenses | |

| 23,714 | | |

| 23,551 | | |

| 0.7 | % |

| Income before income taxes | |

| 10,682 | | |

| 8,707 | | |

| 22.7 | % |

| Income taxes | |

| 3,694 | | |

| 3,031 | | |

| 21.9 | % |

| Net income | |

| 6,988 | | |

| 5,676 | | |

| 23.1 | % |

| | |

| | | |

| | | |

| | |

| Preferred stock dividends | |

| (217 | ) | |

| (217 | ) | |

| | |

| | |

| | | |

| | | |

| | |

| Net income available to common shareholders | |

$ | 6,771 | | |

| 5,459 | | |

| 24.0 | % |

| | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | |

| Earnings per common share – basic | |

$ | 0.34 | | |

| 0.28 | | |

| 21.4 | % |

| Earnings per common share – diluted | |

| 0.33 | | |

| 0.27 | | |

| 22.2 | % |

| | |

| | | |

| | | |

| | |

| ADDITIONAL INCOME STATEMENT INFORMATION | |

| | | |

| | | |

| | |

| Net interest income, as reported | |

$ | 29,703 | | |

| 35,535 | | |

| | |

| Tax-equivalent adjustment (1) | |

| 390 | | |

| 373 | | |

| | |

| Net interest income, tax-equivalent | |

$ | 30,093 | | |

| 35,908 | | |

| (16.2 | %) |

| | |

| | | |

| | | |

| | |

| (1) | This amount reflects the tax benefit that the Company receives related to its tax-exempt loans and securities, which carry

interest rates lower than similar taxable investments due to their tax-exempt status. This amount has been computed assuming a

39% tax rate and is reduced by the related nondeductible portion of interest expense. |

n/m = not meaningful

|

First Bancorp and Subsidiaries

Financial Summary – Page 2 |

| | |

Three Months Ended

March 31, | |

| PERFORMANCE RATIOS (annualized) | |

2015 | | |

2014 | |

| Return on average assets (1) | |

| 0.86% | | |

| 0.70% | |

| Return on average common equity (2) | |

| 8.54% | | |

| 7.24% | |

| Net interest margin – tax-equivalent (3) | |

| 4.19% | | |

| 5.13% | |

| Net charge-offs to average loans – non-covered | |

| 0.84% | | |

| 0.52% | |

| | |

| | | |

| | |

| COMMON SHARE DATA | |

| | | |

| | |

| Cash dividends declared – common | |

$ | 0.08 | | |

| 0.08 | |

| Stated book value – common | |

| 16.34 | | |

| 15.50 | |

| Tangible book value – common | |

| 12.90 | | |

| 12.02 | |

| Common shares outstanding at end of period | |

| 19,740,183 | | |

| 19,695,316 | |

| Weighted average shares outstanding – basic | |

| 19,721,992 | | |

| 19,688,183 | |

| Weighted average shares outstanding – diluted | |

| 20,454,614 | | |

| 20,424,475 | |

| | |

| | | |

| | |

| CAPITAL RATIOS | |

| | | |

| | |

| Tangible equity to tangible assets | |

| 10.33% | | |

| 9.48% | |

| Tangible common equity to tangible assets | |

| 8.08% | | |

| 7.30% | |

| Tier I leverage ratio | |

| 12.18% | | |

| 11.27% | |

| Tier I risk-based capital ratio | |

| 16.40% | | |

| 15.57% | |

| Total risk-based capital ratio | |

| 17.66% | | |

| 16.83% | |

| | |

| | | |

| | |

| AVERAGE BALANCES ($ in thousands) | |

| | | |

| | |

| Total assets | |

$ | 3,194,570 | | |

| 3,178,848 | |

| Loans | |

| 2,391,071 | | |

| 2,459,368 | |

| Earning assets | |

| 2,910,732 | | |

| 2,836,806 | |

| Deposits | |

| 2,688,973 | | |

| 2,739,194 | |

| Interest-bearing liabilities | |

| 2,210,302 | | |

| 2,294,138 | |

| Shareholders’ equity | |

| 392,173 | | |

| 376,418 | |

| | |

| | | |

| | |

(1) Calculated by dividing annualized

net income (loss) available to common shareholders by average assets.

(2) Calculated by dividing annualized

net income (loss) available to common shareholders by average common equity.

(3) See footnote 1 on page 1 of Financial

Summary for discussion of tax-equivalent adjustments.

TREND INFORMATION

| ($ in thousands except per share data) | |

For the Three Months Ended |

INCOME STATEMENT | |

March 31,

2015 | |

December 31,

2014 | |

September 30,

2014 | |

June 30,

2014 | |

March 31,

2014 |

| | |

| |

| |

| |

| |

|

| Net interest income – tax-equivalent (1) | |

$ | 30,093 | | |

| 31,299 | | |

| 31,721 | | |

| 34,183 | | |

| 35,908 | |

| Taxable equivalent adjustment (1) | |

| 390 | | |

| 376 | | |

| 378 | | |

| 375 | | |

| 373 | |

| Net interest income | |

| 29,703 | | |

| 30,923 | | |

| 31,343 | | |

| 33,808 | | |

| 35,535 | |

| Provision for loan losses – non-covered | |

| 104 | | |

| 1,285 | | |

| 1,279 | | |

| 1,158 | | |

| 3,365 | |

| Provision (reversal) for loan losses – covered | |

| (268 | ) | |

| 191 | | |

| 206 | | |

| 2,501 | | |

| 210 | |

| Noninterest income | |

| 4,529 | | |

| 4,492 | | |

| 4,608 | | |

| 4,970 | | |

| 298 | |

| Noninterest expense | |

| 23,714 | | |

| 22,989 | | |

| 25,931 | | |

| 24,780 | | |

| 23,551 | |

| Income before income taxes | |

| 10,682 | | |

| 10,950 | | |

| 8,535 | | |

| 10,339 | | |

| 8,707 | |

| Income tax expense | |

| 3,694 | | |

| 3,855 | | |

| 2,956 | | |

| 3,693 | | |

| 3,031 | |

| Net income | |

| 6,988 | | |

| 7,095 | | |

| 5,579 | | |

| 6,646 | | |

| 5,676 | |

| Preferred stock dividends | |

| (217 | ) | |

| (217 | ) | |

| (217 | ) | |

| (217 | ) | |

| (217 | ) |

| Net income available to common shareholders | |

| 6,771 | | |

| 6,878 | | |

| 5,362 | | |

| 6,429 | | |

| 5,459 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Earnings per common share – basic | |

| 0.34 | | |

| 0.35 | | |

| 0.27 | | |

| 0.33 | | |

| 0.28 | |

| Earnings per common share – diluted | |

| 0.33 | | |

| 0.34 | | |

| 0.27 | | |

| 0.32 | | |

| 0.27 | |

See footnote 1 on page 1 of Financial

Summary for discussion of tax-equivalent adjustments.

|

First Bancorp and Subsidiaries

Financial Summary – Page 3 |

CONSOLIDATED BALANCE SHEETS ($ in thousands - unaudited) | |

At March 31,

2015 | | |

At Dec. 31,

2014 | | |

At March 31,

2014 | | |

One Year

Change |

| Assets | |

| | | |

| | | |

| | | |

| | |

| Cash and due from banks | |

$ | 84,208 | | |

| 81,068 | | |

| 219,779 | | |

| (61.7 | %) |

| Interest bearing deposits with banks | |

| 160,279 | | |

| 172,016 | | |

| 164,310 | | |

| (2.5 | %) |

| Total cash and cash equivalents | |

| 244,487 | | |

| 253,084 | | |

| 384,089 | | |

| (36.3 | %) |

| | |

| | | |

| | | |

| | | |

| | |

| Investment securities | |

| 348,994 | | |

| 342,721 | | |

| 234,127 | | |

| 49.1 | % |

| Presold mortgages | |

| 8,273 | | |

| 6,019 | | |

| 4,587 | | |

| 80.4 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Loans – non-covered | |

| 2,275,570 | | |

| 2,268,580 | | |

| 2,256,726 | | |

| 0.8 | % |

| Loans – covered by FDIC loss share agreements | |

| 119,829 | | |

| 127,594 | | |

| 190,551 | | |

| (37.1 | %) |

| Total loans | |

| 2,395,399 | | |

| 2,396,174 | | |

| 2,447,277 | | |

| (2.1 | %) |

| Allowance for loan losses – non-covered | |

| (33,770 | ) | |

| (38,345 | ) | |

| (44,706 | ) | |

| (24.5 | %) |

| Allowance for loan losses – covered | |

| (2,226 | ) | |

| (2,281 | ) | |

| (3,421 | ) | |

| (34.9 | %) |

| Total allowance for loan losses | |

| (35,996 | ) | |

| (40,626 | ) | |

| (48,127 | ) | |

| (25.2 | %) |

| Net loans | |

| 2,359,403 | | |

| 2,355,548 | | |

| 2,399,150 | | |

| (1.7 | %) |

| | |

| | | |

| | | |

| | | |

| | |

| Premises and equipment | |

| 75,573 | | |

| 75,113 | | |

| 76,970 | | |

| (1.8 | %) |

| FDIC indemnification asset | |

| 18,452 | | |

| 22,569 | | |

| 35,504 | | |

| (48.0 | %) |

| Intangible assets | |

| 67,712 | | |

| 67,893 | | |

| 68,475 | | |

| (1.1 | %) |

| Foreclosed real estate – non-covered | |

| 8,978 | | |

| 9,771 | | |

| 11,740 | | |

| (23.5 | %) |

| Foreclosed real estate – covered | |

| 2,055 | | |

| 2,350 | | |

| 19,504 | | |

| (89.5 | %) |

| Bank-owned life insurance | |

| 55,793 | | |

| 55,421 | | |

| 44,367 | | |

| 25.8 | % |

| Other assets | |

| 29,868 | | |

| 27,894 | | |

| 36,310 | | |

| (17.7 | %) |

| Total assets | |

$ | 3,219,588 | | |

| 3,218,383 | | |

| 3,314,823 | | |

| (2.9 | %) |

| | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Liabilities | |

| | | |

| | | |

| | | |

| | |

| Deposits: | |

| | | |

| | | |

| | | |

| | |

| Non-interest bearing checking accounts | |

$ | 591,283 | | |

| 560,230 | | |

| 511,612 | | |

| 15.6 | % |

| Interest bearing checking accounts | |

| 578,784 | | |

| 583,903 | | |

| 550,702 | | |

| 5.1 | % |

| Money market accounts | |

| 568,752 | | |

| 548,255 | | |

| 553,935 | | |

| 2.7 | % |

| Savings accounts | |

| 183,036 | | |

| 180,317 | | |

| 177,744 | | |

| 3.0 | % |

| Brokered deposits | |

| 62,801 | | |

| 88,375 | | |

| 150,272 | | |

| (58.2 | %) |

| Internet time deposits | |

| 249 | | |

| 747 | | |

| 1,967 | | |

| (87.3 | %) |

| Other time deposits > $100,000 | |

| 373,599 | | |

| 384,127 | | |

| 436,245 | | |

| (14.4 | %) |

| Other time deposits | |

| 335,110 | | |

| 349,952 | | |

| 404,247 | | |

| (17.1 | %) |

| Total deposits | |

| 2,693,614 | | |

| 2,695,906 | | |

| 2,786,724 | | |

| (3.3 | %) |

| | |

| | | |

| | | |

| | | |

| | |

| Borrowings | |

| 116,394 | | |

| 116,394 | | |

| 136,394 | | |

| (14.7 | %) |

| Other liabilities | |

| 16,336 | | |

| 18,384 | | |

| 15,618 | | |

| 4.6 | % |

| Total liabilities | |

| 2,826,344 | | |

| 2,830,684 | | |

| 2,938,736 | | |

| (3.8 | %) |

| | |

| | | |

| | | |

| | | |

| | |

| Shareholders’ equity | |

| | | |

| | | |

| | | |

| | |

| Preferred stock | |

| 70,787 | | |

| 70,787 | | |

| 70,787 | | |

| 0.0 | % |

| Common stock | |

| 132,752 | | |

| 132,532 | | |

| 132,215 | | |

| 0.4 | % |

| Retained earnings | |

| 190,150 | | |

| 184,958 | | |

| 171,021 | | |

| 11.2 | % |

| Accumulated other comprehensive income (loss) | |

| (445 | ) | |

| (578 | ) | |

| 2,064 | | |

| n/m | |

| Total shareholders’ equity | |

| 393,244 | | |

| 387,699 | | |

| 376,087 | | |

| 4.6 | % |

| Total liabilities and shareholders’ equity | |

$ | 3,219,588 | | |

| 3,218,383 | | |

| 3,314,823 | | |

| (2.9 | %) |

| | |

| | | |

| | | |

| | | |

| | |

n/m = not meaningful

|

First Bancorp and Subsidiaries

Financial Summary - Page 4 |

| | |

For the Three Months Ended |

YIELD INFORMATION | |

March 31,

2015 | |

December 31,

2014 | |

September 30,

2014 | |

June 30,

2014 | |

March 31,

2014 |

| | |

| |

| |

| |

| |

|

| Yield on loans | |

| 4.99% | | |

| 5.13% | | |

| 5.23% | | |

| 5.65% | | |

| 5.95% | |

| Yield on securities – tax-equivalent (1) | |

| 2.67% | | |

| 2.95% | | |

| 3.25% | | |

| 3.00% | | |

| 3.19% | |

| Yield on other earning assets | |

| 0.43% | | |

| 0.38% | | |

| 0.30% | | |

| 0.33% | | |

| 0.34% | |

| Yield on all interest earning assets | |

| 4.44% | | |

| 4.51% | | |

| 4.58% | | |

| 4.95% | | |

| 5.44% | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Rate on interest bearing deposits | |

| 0.28% | | |

| 0.30% | | |

| 0.32% | | |

| 0.33% | | |

| 0.34% | |

| Rate on other interest bearing liabilities | |

| 1.03% | | |

| 1.03% | | |

| 1.03% | | |

| 1.02% | | |

| 2.14% | |

| Rate on all interest bearing liabilities | |

| 0.32% | | |

| 0.34% | | |

| 0.35% | | |

| 0.37% | | |

| 0.38% | |

| Total cost of funds | |

| 0.26% | | |

| 0.27% | | |

| 0.28% | | |

| 0.30% | | |

| 0.31% | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net interest margin – tax-equivalent (2) | |

| 4.19% | | |

| 4.25% | | |

| 4.30% | | |

| 4.65% | | |

| 5.13% | |

| Average prime rate | |

| 3.25% | | |

| 3.25% | | |

| 3.25% | | |

| 3.25% | | |

| 3.25% | |

| (1) |

See footnote 1 on page 1 of Financial Summary for discussion of tax-equivalent adjustments. |

| (2) |

Calculated by dividing annualized tax-equivalent net interest income by average earning assets for the period. See footnote 1

on page 1 of Financial Summary for discussion of tax-equivalent adjustments. |

| | |

For the Three Months Ended | |

NET INTEREST INCOME PURCHASE

ACCOUNTING ADJUSTMENTS ($ in thousands) | |

March 31,

2015 | | |

December 31,

2014 | | |

September 30,

2014 | | |

June 30,

2014 | | |

March 31,

2014 | |

| | |

| | |

| | |

| | |

| | |

| |

| Interest income – reduced by premium amortization on loans | |

$ | — | | |

| — | | |

| — | | |

| (49 | ) | |

| (49 | ) |

| Interest income – increased by accretion of loan discount (1) | |

| 1,557 | | |

| 2,173 | | |

| 2,577 | | |

| 4,851 | | |

| 6,408 | |

| Interest expense – reduced by premium amortization of deposits | |

| — | | |

| — | | |

| — | | |

| 4 | | |

| 3 | |

| Impact on net interest income | |

$ | 1,557 | | |

| 2,173 | | |

| 2,577 | | |

| 4,806 | | |

| 6,362 | |

| (1) | Corresponding indemnification asset expense is recorded for approximately 80% of this amount, and therefore the net effect

is that pretax income is positively impacted by 20% of the amounts in this line item. |

|

First Bancorp and Subsidiaries

Financial Summary - Page 5 |

ASSET QUALITY DATA ($ in thousands) | |

March 31,

2015 | | |

Dec. 31,

2014 | | |

Sept. 30,

2014 | | |

June 30,

2014 | | |

March 31,

2014 | |

| | |

| | |

| | |

| | |

| | |

| |

| Non-covered nonperforming assets | |

| | | |

| | | |

| | | |

| | | |

| | |

| Nonaccrual loans | |

$ | 47,416 | | |

| 50,066 | | |

| 53,620 | | |

| 47,533 | | |

| 44,129 | |

| Troubled debt restructurings - accruing | |

| 33,997 | | |

| 35,493 | | |

| 31,501 | | |

| 27,250 | | |

| 26,335 | |

| Accruing loans > 90 days past due | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| Total non-covered nonperforming loans | |

| 81,413 | | |

| 85,559 | | |

| 85,121 | | |

| 74,783 | | |

| 70,464 | |

| Foreclosed real estate | |

| 8,978 | | |

| 9,771 | | |

| 11,705 | | |

| 9,346 | | |

| 11,740 | |

| Total non-covered nonperforming assets | |

$ | 90,391 | | |

| 95,330 | | |

| 96,826 | | |

| 84,129 | | |

| 82,204 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Covered nonperforming assets (1) | |

| | | |

| | | |

| | | |

| | | |

| | |

| Nonaccrual loans | |

$ | 8,596 | | |

| 10,508 | | |

| 10,478 | | |

| 20,938 | | |

| 31,986 | |

| Troubled debt restructurings - accruing | |

| 3,874 | | |

| 5,823 | | |

| 6,273 | | |

| 8,193 | | |

| 7,429 | |

| Accruing loans > 90 days past due | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| Total covered nonperforming loans | |

| 12,470 | | |

| 16,331 | | |

| 16,751 | | |

| 29,131 | | |

| 39,415 | |

| Foreclosed real estate | |

| 2,055 | | |

| 2,350 | | |

| 3,237 | | |

| 9,934 | | |

| 19,504 | |

| Total covered nonperforming assets | |

$ | 14,525 | | |

| 18,681 | | |

| 19,988 | | |

| 39,065 | | |

| 58,919 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total nonperforming assets | |

$ | 104,916 | | |

| 114,011 | | |

| 116,814 | | |

| 123,194 | | |

| 141,123 | |

Asset Quality Ratios – All Assets | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net quarterly charge-offs to average loans - annualized | |

| 0.76% | | |

| 0.82% | | |

| 0.51% | | |

| 0.99% | | |

| 0.65% | |

| Nonperforming loans to total loans | |

| 3.92% | | |

| 4.25% | | |

| 4.20% | | |

| 4.27% | | |

| 4.49% | |

| Nonperforming assets to total assets | |

| 3.26% | | |

| 3.54% | | |

| 3.66% | | |

| 3.77% | | |

| 4.26% | |

| Allowance for loan losses to total loans | |

| 1.50% | | |

| 1.70% | | |

| 1.82% | | |

| 1.88% | | |

| 1.97% | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Asset Quality Ratios – Based on Non-covered Assets only | |

| | | |

| | | |

| | | |

| | |

| Net quarterly charge-offs to average non-covered loans - annualized | |

| 0.84% | | |

| 0.78% | | |

| 0.60% | | |

| 0.69% | | |

| 0.52% | |

| Non-covered nonperforming loans to non-covered loans | |

| 3.58% | | |

| 3.77% | | |

| 3.71% | | |

| 3.31% | | |

| 3.12% | |

| Non-covered nonperforming assets to total non-covered assets | |

| 2.92% | | |

| 3.09% | | |

| 3.17% | | |

| 2.73% | | |

| 2.65% | |

| Allowance for loan losses to non-covered loans | |

| 1.48% | | |

| 1.69% | | |

| 1.81% | | |

| 1.86% | | |

| 1.98% | |

(1) Covered nonperforming

assets consist of assets that are included in loss-share agreements with the FDIC.

|

First Bancorp and Subsidiaries

Financial Summary - Page 6 |

| | |

For the Three Months Ended | |

NET INTEREST MARGIN, EXCLUDING LOAN DISCOUNT ACCRETION – RECONCILIATION ($ in thousands) | |

March 31,

2015 | | |

Dec. 31,

2014 | | |

Sept. 30,

2014 | | |

June 30,

2014 | | |

March 31,

2014 | |

| | |

| | |

| | |

| | |

| | |

| |

| Net interest income, as reported | |

$ | 29,703 | | |

| 30,923 | | |

| 31,343 | | |

| 33,808 | | |

| 35,535 | |

| Tax-equivalent adjustment | |

| 390 | | |

| 376 | | |

| 378 | | |

| 375 | | |

| 373 | |

| Net interest income, tax-equivalent (A) | |

$ | 30,093 | | |

| 31,299 | | |

| 31,721 | | |

| 34,183 | | |

| 35,908 | |

Average earning assets (B) | |

$ | 2,910,732 | | |

| 2,920,295 | | |

| 2,924,705 | | |

| 2,946,586 | | |

| 2,836,806 | |

| Tax-equivalent net interest

margin, annualized – as reported – (A)/(B) | |

| 4.19% | | |

| 4.25% | | |

| 4.30% | | |

| 4.65% | | |

| 5.13% | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net interest income, tax-equivalent | |

$ | 30,093 | | |

| 31,299 | | |

| 31,721 | | |

| 34,183 | | |

| 35,908 | |

| Loan discount accretion | |

| 1,557 | | |

| 2,173 | | |

| 2,577 | | |

| 4,851 | | |

| 6,408 | |

| Net interest income, tax-equivalent, excluding loan discount accretion (A) | |

$ | 28,536 | | |

| 29,126 | | |

| 29,144 | | |

| 29,332 | | |

| 29,500 | |

Average earnings assets (B) | |

$ | 2,910,732 | | |

| 2,920,295 | | |

| 2,924,705 | | |

| 2,946,586 | | |

| 2,836,806 | |

| Tax-equivalent net interest margin, excluding impact of loan discount accretion, annualized – (A) / (B) | |

| 3.98% | | |

| 3.96% | | |

| 3.95% | | |

| 3.99% | | |

| 4.22% | |

Note: The measure “tax-equivalent net interest margin, excluding

impact of loan discount accretion” is a non-GAAP performance measure. Management of the Company believes that it is useful

to calculate and present the Company’s net interest margin without the impact of loan discount accretion for the reasons

explained in the remainder of this paragraph. Loan discount accretion is a non-cash interest income adjustment related to the Company’s

acquisition of two failed banks and represents the portion of the fair value discount that was initially recorded on the acquired

loans that is being recognized into income over the lives of the loans. At March 31, 2015, the Company had a remaining loan discount

balance of $19.1 million compared to $31.2 million at March 31, 2014. For the related loans that perform and pay-down over time,

the loan discount will also be reduced, with a corresponding increase to interest income. Therefore management of the Company believes

it is useful to also present this ratio to reflect the Company’s net interest margin excluding this non-cash, temporary loan

discount accretion adjustment to aid investors in comparing financial results between periods. The Company cautions that non-GAAP

financial measures should be considered in addition to, but not as a substitute for, the Company’s reported GAAP results.

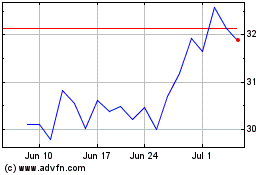

First Bancorp (NASDAQ:FBNC)

Historical Stock Chart

From Mar 2024 to Apr 2024

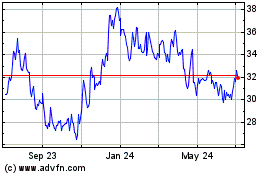

First Bancorp (NASDAQ:FBNC)

Historical Stock Chart

From Apr 2023 to Apr 2024