Amended Statement of Beneficial Ownership (sc 13d/a)

May 16 2016 - 4:03PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 3)

Enstar Group

Limited

(Name of Issuer)

Ordinary Shares, par value $1.00 per share

(Title of Class of Securities)

G3075 P101

(CUSIP

Number)

Patrice Walch-Watson

Canada Pension Plan Investment Board

One Queen Street East, Suite 2500

Toronto, ON M5C 2W5 Canada

(416) 868-1171

Poul

Winslow

One Queen Street East, Suite 2500

Toronto, ON M5C 2W5 Canada

(416) 868-5052

(Name,

Address and Telephone Number of Person Authorized to Receive Notices and Communications)

March 4, 2016

(Date of Event Which Requires Filing of this Statement)

If the filing

person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following

box.

¨

The information required on the remainder of this cover page shall not

be deemed to be “filed” for the purpose of section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act.

|

|

|

|

|

|

|

|

|

1

|

|

Name of

reporting person.

Canada Pension Plan Investment Board

|

|

2

|

|

Check the appropriate box if a member

of a group (see instructions)

(a)

x

(b)

¨

|

|

3

|

|

SEC use only

|

|

4

|

|

Source of funds (see instructions)

OO

|

|

5

|

|

Check if disclosure of legal

proceedings is required pursuant to items 2(d) or 2(e)

¨

|

|

6

|

|

Citizenship or place of

organization

Canada

|

|

Number of

shares

beneficially

owned by

each

reporting

person

with

|

|

7

|

|

Sole voting power

1,501,211 shares

|

|

|

8

|

|

Shared voting power

0 shares

|

|

|

9

|

|

Sole dispositive power

1,501,211 shares

|

|

|

10

|

|

Shared dispositive power

0 shares

|

|

11

|

|

Aggregate amount beneficially owned by each reporting person

1,501,211 shares (excluding 741,735 shares held indirectly through CPPIB Epsilon Ontario Limited Partnership and 404,771 of Series E

Non-Voting Convertible shares held directly by Canada Pension Plan Investment Board)

|

|

12

|

|

Check if the aggregate amount in Row

(11) excludes certain shares (see instructions)

¨

|

|

13

|

|

Percent of class represented by amount

in Row (11)

9.3% (excluding 4.6% of the class held indirectly

through CPPIB Epsilon Ontario Limited Partnership)

(1)

|

|

14

|

|

Type of reporting person (see

instructions)

CO

|

|

(1)

|

Calculated based on the 16,151,293 Ordinary Shares outstanding as of February 25, 2016, as reported in the Issuer’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015, filed on February 29,

2016.

|

|

|

|

|

|

|

|

|

|

1

|

|

Name of

reporting person.

CPPIB Epsilon Ontario Limited Partnership

|

|

2

|

|

Check the appropriate box if a member

of a group (see instructions)

(a)

x

(b)

¨

|

|

3

|

|

SEC use only

|

|

4

|

|

Source of funds (see instructions)

OO

|

|

5

|

|

Check if disclosure of legal

proceedings is required pursuant to items 2(d) or 2(e)

¨

|

|

6

|

|

Citizenship or place of

organization

Canada

|

|

Number of

shares

beneficially

owned by

each

reporting

person

with

|

|

7

|

|

Sole voting power

741,735

|

|

|

8

|

|

Shared voting power

0 shares

|

|

|

9

|

|

Sole dispositive power

741,735 shares

|

|

|

10

|

|

Shared dispositive power

0 shares

|

|

11

|

|

Aggregate amount beneficially owned by each reporting person

741,735 shares

|

|

12

|

|

Check if the aggregate amount in Row

(11) excludes certain shares (see instructions)

¨

|

|

13

|

|

Percent of class represented by amount

in Row (11)

4.6%

(2)

|

|

14

|

|

Type of reporting person (see

instructions)

PN

|

|

(2)

|

Calculated based on the 16,151,293 Ordinary Shares outstanding as of February 25, 2016, as reported in the Issuer’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015, filed on February 29,

2016.

|

|

|

|

|

|

|

|

|

|

1

|

|

Name of

reporting person.

CPPIB Epsilon Ontario Trust

|

|

2

|

|

Check the appropriate box if a member

of a group (see instructions)

(a)

x

(b)

¨

|

|

3

|

|

SEC use only

|

|

4

|

|

Source of funds (see instructions)

OO

|

|

5

|

|

Check if disclosure of legal

proceedings is required pursuant to items 2(d) or 2(e)

¨

|

|

6

|

|

Citizenship or place of

organization

Canada

|

|

Number of

shares

beneficially

owned by

each

reporting

person

with

|

|

7

|

|

Sole voting power

741,735 shares held indirectly through CPPIB Epsilon Ontario

Limited Partnership

|

|

|

8

|

|

Shared voting power

0 shares

|

|

|

9

|

|

Sole dispositive power

741,735 shares held indirectly through CPPIB Epsilon Ontario

Limited Partnership

|

|

|

10

|

|

Shared dispositive power

0 shares

|

|

11

|

|

Aggregate amount beneficially owned by each reporting person

741,735 shares held indirectly through CPPIB Epsilon Ontario Limited Partnership

|

|

12

|

|

Check if the aggregate amount in Row

(11) excludes certain shares (see instructions)

¨

|

|

13

|

|

Percent of class represented by amount

in Row (11)

4.6%

(3)

|

|

14

|

|

Type of reporting person (see

instructions)

OO

|

|

(3)

|

Calculated based on the 16,151,293 Ordinary Shares outstanding as of February 25, 2016, as reported in the Issuer’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015, filed on February 29,

2016.

|

|

|

|

|

|

|

|

|

|

1

|

|

Name of

reporting person.

Poul Winslow

|

|

2

|

|

Check the appropriate box if a member

of a group (see instructions)

(a)

x

(b)

¨

|

|

3

|

|

SEC use only

|

|

4

|

|

Source of funds (see instructions)

OO

|

|

5

|

|

Check if disclosure of legal

proceedings is required pursuant to items 2(d) or 2(e)

¨

|

|

6

|

|

Citizenship or place of

organization

Denmark

|

|

Number of

shares

beneficially

owned by

each

reporting

person

with

|

|

7

|

|

Sole voting power

741,735 shares held indirectly through CPPIB Epsilon Ontario

Limited Partnership

|

|

|

8

|

|

Shared voting power

0 shares

|

|

|

9

|

|

Sole dispositive power

741,735 shares held indirectly through CPPIB Epsilon Ontario

Limited Partnership

|

|

|

10

|

|

Shared dispositive power

0 shares

|

|

11

|

|

Aggregate amount beneficially owned by each reporting person

741,735 shares held indirectly through CPPIB Epsilon Ontario Limited Partnership

|

|

12

|

|

Check if the aggregate amount in Row

(11) excludes certain shares (see instructions)

¨

|

|

13

|

|

Percent of class represented by amount

in Row (11)

4.6%

(4)

|

|

14

|

|

Type of reporting person (see

instructions)

IN

|

|

(4)

|

Calculated based on the 16,151,293 Ordinary Shares outstanding as of February 25, 2016, as reported in the Issuer’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015, filed on February 29,

2016.

|

Explanatory Note

This Amendment No. 3 to Schedule 13D (this “

Amendment

”) amends and supplements the Schedule 13D originally

filed with the United States Securities and Exchange Commission (the “

SEC

”) on June 3, 2015, amended on August 28, 2015 and amended again on March 4, 2016 (together, the “

Statement

”). This Amendment is being filed

in order to correct an inadvertent clerical error that misstated the number of Series E Non-Voting Convertible shares held by Canada Pension Plan Investment Board (“CPPIB”) as 404,711. The correct number of shares should have been reported

as 404,771. This Amendment is being filed on behalf of CPPIB, CPPIB Epsilon Ontario Limited Partnership (the “

Partnership

”), the CPPIB Epsilon Ontario Trust (the “

Trust

”) and Poul Winslow (together, the

“

Reporting Persons

”) identified on the cover pages of this Amendment.

Item 5. Interest in Securities of the Issuer

Item 5 is amended and restated in its entirety as follows:

(a)-(b) The aggregate number and percentage of Ordinary Shares beneficially owned by the Reporting Persons are as follows:

|

|

(a)

|

Amount beneficially owned:

|

1,501,211 shares held directly by CPPIB representing 9.3% of the

class of shares

(5)

(excluding 741,735 shares held indirectly through the Partnership and 404,771 of Series E Non-Voting Convertible shares held directly by CPPIB)

741,735 shares held directly by the Partnership representing 4.6% of the class of shares

741,735 shares held indirectly by the Trust as general partner to the Partnership representing 4.6% of the class of shares

741,735 shares held indirectly by Poul Winslow as trustee to the Trust representing 4.6% of the class of shares

(b) Number of shares to which the Reporting Persons has:

i. Sole power to vote or to direct the vote:

1,501,211 shares held directly by CPPIB

741,735 shares held directly by the Partnership

741,735 shares held indirectly by the Trust as general partner to the Partnership

741,735 shares held indirectly by Poul Winslow as trustee to the Trust

ii. Shared power to vote or to direct the vote: 0 shares

iii. Sole power to dispose or to direct the disposition of:

1,501,211 shares held directly by CPPIB

741,735 shares held directly by the Partnership

741,735 shares held indirectly by the Trust as general partner to the Partnership

741,735 shares held indirectly by Poul Winslow as trustee to the Trust

iv. Shared power to dispose or to direct the disposition of: 0 shares

|

(5)

|

Calculated based on the 16,151,293 Ordinary Shares outstanding as of February 25, 2016, as reported in the Issuer’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015, filed on February 29,

2016.

|

(c) Except as described in Item 3 above or elsewhere in this Schedule 13D, none of the

Reporting Persons or, to the Reporting Persons’ knowledge, the Covered Persons has effected any transactions in the Ordinary Shares during the past 60 days.

(d) None.

(e) Not applicable.

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

|

|

|

May 16, 2016

|

|

Date

|

|

|

CANADA PENSION PLAN INVESTMENT

BOARD

|

|

|

|

/s/ Patrice

Walch-Watson

|

|

Signature

|

|

|

|

Patrice Walch-Watson, Senior Managing Director,

General Counsel & Corporate Secretary

|

|

Name/Title

|

ATTENTION

Intentional misstatements or omissions of fact constitute Federal Criminal Violations (See 18 U.S.C. 1001)

[

Signature Page to Schedule 13D Amendment

]

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

|

|

|

May 16, 2016

|

|

Date

|

|

|

CPPIB EPSILON ONTARIO LIMITED

PARTNERSHIP

|

|

|

|

/s/ Poul

Winslow

|

|

Signature

|

|

|

|

Poul Winslow, Trustee of

CPPIB Epsilon Ontario Trust (the General Partner)

|

|

Name/Title

|

ATTENTION

Intentional misstatements or omissions of fact constitute Federal Criminal Violations (See 18 U.S.C. 1001).

[

Signature Page to Schedule 13D Amendment

]

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

|

|

|

May 16, 2016

|

|

Date

|

|

|

|

CPPIB EPSILON ONTARIO TRUST

|

|

|

|

/s/ Poul

Winslow

|

|

Signature

|

|

|

|

Poul Winslow, Trustee

|

|

Name/Title

|

ATTENTION

Intentional misstatements or omissions of fact constitute Federal Criminal Violations (See 18 U.S.C. 1001).

[

Signature Page to Schedule 13D Amendment

]

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

|

|

|

May 16, 2016

|

|

Date

POUL WINSLOW

|

|

|

|

/s/ Poul

Winslow

|

|

Signature

|

|

|

|

Poul Winslow

|

|

Name/Title

|

ATTENTION

Intentional misstatements or omissions of fact constitute Federal Criminal Violations (See 18 U.S.C. 1001)

[

Signature Page to Schedule 13D Amendment

]

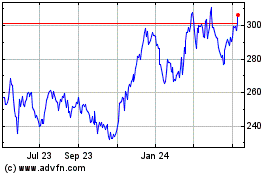

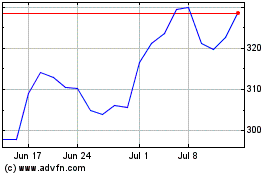

Enstar (NASDAQ:ESGR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Enstar (NASDAQ:ESGR)

Historical Stock Chart

From Apr 2023 to Apr 2024