UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Amendment No. 1)

Under the Securities Exchange Act of 1934

Enstar Group

Limited

(Name of Issuer)

Ordinary Shares, par value $1.00 per share

(Title of Class of Securities)

G3075 P101

(CUSIP

Number)

Patrice Walch-Watson

Canada Pension Plan Investment Board

One Queen Street East, Suite 2500

Toronto, ON M5C 2W5 Canada

(416) 868-1171

(Name,

Address and Telephone Number of Person Authorized to Receive Notices and Communications)

August 28, 2015

(Date of Event Which Requires Filing of this Statement)

If the filing person has

previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following

box. ¨

The information required on the remainder of this cover page shall not be deemed to be

“filed” for the purpose of section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act.

|

|

|

|

|

|

|

| 1 |

|

Name of

reporting person. Canada Pension Plan Investment Board |

| 2 |

|

Check the appropriate box if a member

of a group (see instructions)

(a) ¨ (b) ¨ |

| 3 |

|

SEC use only

|

| 4 |

|

Source of funds (see instructions)

OO |

| 5 |

|

Check if disclosure of legal

proceedings is required pursuant to items 2(d) or 2(e) ¨ |

| 6 |

|

Citizenship or place of

organization Canada |

| Number of

shares beneficially

owned by each

reporting person

with |

|

7 |

|

Sole voting power

1,501,211 shares |

| |

8 |

|

Shared voting power

0 shares |

| |

9 |

|

Sole dispositive power

1,501,211 shares |

| |

10 |

|

Shared dispositive power

0 shares |

| 11 |

|

Aggregate amount beneficially owned by each reporting person

2,242,946 shares(1) |

| 12 |

|

Check if the aggregate amount in Row

(11) excludes certain shares (see instructions) ¨ |

| 13 |

|

Percent of class represented by amount

in Row (11)

14.1%(2) |

| 14 |

|

Type of reporting person (see

instructions) CO |

| (1) |

Gives effect to consummation of the transactions contemplated by the Securities Purchase Agreement described in Item 3 of this Amendment. |

| (2) |

Calculated based on the 15,939,972 Ordinary Shares outstanding as of August 3, 2015, as reported in the Issuer’s Quarterly Report on Form 10-Q for the period ended June 30, 2015, filed on August 7, 2015.

|

Explanatory Note

This Amendment No. 1 to Schedule 13D (this “Amendment”) amends and supplements the Schedule 13D

originally filed with the United States Securities and Exchange Commission (the “SEC”) on June 3, 2015 (the “Statement”). This Amendment is being filed on behalf of the reporting person (the “Reporting

Person”) identified on the cover page of this Amendment.

| Item 3. |

Source and Amount of Funds or Other Consideration |

Item 3 is hereby

amended and supplemented by adding the following:

On August 28, 2015, the Reporting Person entered into a Securities

Purchase Agreement (the “Securities Purchase Agreement”), by and among the Reporting Person and Dominic F. Silvester (“DFS”) and R&H Trust Co. (BVI) Ltd., as trustee of The Right Trust (the “Right

Trust”). Pursuant to the Securities Purchase Agreement, subject to the terms and conditions thereof, the Reporting Person will purchase 741,735 Ordinary Shares, par value US $1.00 per share, of the Issuer for an aggregate purchase price of

$111,260,250. The closing of the Securities Purchase Agreement is subject to customary conditions, including receipt of required regulatory approvals. The Reporting Person expects that the closing will occur in the 4th quarter of 2015 or 1st quarter of 2016.

References to, and descriptions of, the Securities Purchase Agreement as set forth in this Item 3 are qualified in their

entirety by the terms of the Securities Purchase Agreement, a copy of which is attached hereto as Exhibit 99.1 and is incorporated in its entirety in this Item 3.

| Item 5. |

Interest in Securities of the Issuer |

Item 5 is amended and

restated in its entirety as follows:

(a)-(b) The aggregate number and percentage of Ordinary Shares beneficially owned by the

Reporting Person are as follows:

| |

(a) |

Amount beneficially owned: 2,242,946 shares |

Percentage: 14.1%(3)

| |

(b) |

Number of shares to which the Reporting Person has: |

i. Sole power to vote or to direct the

vote: 1,501,211 shares

ii. Shared power to vote or to direct the vote: 0 shares

iii. Sole power to dispose or to direct the disposition of: 1,501,211 shares

iv. Shared power to dispose or to direct the disposition of: 0 shares

(c) Except as described in Item 3 above or elsewhere in this Schedule 13D, none of the Reporting Person or, to the Reporting

Person’s knowledge, the Covered Persons has effected any transactions in the Ordinary Shares during the past 60 days.

(d) None.

(e) Not applicable.

| (3) |

Gives effect to consummation of the transactions contemplated by the Securities Purchase Agreement described in Item 3 of this Amendment. Calculated based on the 15,939,972 Ordinary Shares outstanding as of

August 3, 2015, as reported in the Issuer’s Quarterly Report on Form 10-Q for the period ended June 30, 2015, filed on August 7, 2015. |

| Item 6. |

Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer |

Item 6 is hereby amended and supplemented by adding the following:

The information provided or incorporated by reference in Item 3 is hereby incorporated by reference herein.

Registration Rights Agreement and Registration Rights Assignment Agreement

The Issuer, DFS and the Right Trust are parties to a Registration Rights Agreement, dated January 31, 2007 (the

“Registration Rights Agreement”), which provides DFS and the Right Trust with certain rights to cause Ordinary Shares to be registered under the Securities Act of 1933, as amended (the “Securities Act”), in

accordance with the terms and conditions of the Registration Rights Agreement. DFS is entitled to make two written requests for the Company to register under the Securities Act all or any part of the Registrable Securities owned by him, subject to

certain exceptions and conditions set forth in the Registration Rights Agreement. References to, and descriptions of, the Registration Rights Agreement as set forth in this Item 6 are qualified in their entirety by the terms of the Registration

Rights Agreement, a copy of which is filed herewith as Exhibit 99.2, incorporated by reference to the Form 8-K filed by the Issuer (File No. 001-33289) with the Securities and Exchange Commission on January 31, 2007, and which is

incorporated in its entirety in this Item 6.

As a condition to closing under the Securities Purchase Agreement, the

Reporting Person, the Issuer, DFS and the Right Trust will execute a Registration Rights Assignment (the “Registration Rights Assignment”). The Registration Rights Assignment provides for an assignment to the Reporting Person of all

rights of the Right Trust, and one of DFS’ two demand registration rights, under the Registration Rights Agreement (collectively, the “CPPIB Registration Rights”). References to, and descriptions of, the Registration Rights

Assignment as set forth in this Item 6 are qualified in their entirety by the terms of the Registration Rights Assignment, a copy of which is attached hereto as Exhibit 99.3 and is incorporated in its entirety in this Item 6.

| Item 7. |

Material to be Filed as Exhibits |

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 99.1 |

|

Securities Purchase Agreement, dated August 28, 2015, by and among R&H Trust Co. (BVI) Ltd., as trustee of the Right Trust, Dominic F. Silvester and Canada Pension Plan Investment Board. |

|

|

| 99.2 |

|

Registration Rights Agreement, dated January 31, 2007, among Enstar Group Limited, Trident II, L.P., Marsh & McLennan Capital Professionals Fund, L.P., Marsh & McLennan Employee’s Securities Company, L.P., J.

Christopher Flowers, Dominic F. Silvester and the other parties thereto set forth on the Schedule of Shareholders attached thereto (attached as Exhibit 10.1 to the Form 8-K filed by the Issuer (File No. 001-33289) with the Securities and Exchange

Commission on January 31, 2007 and incorporated herein by reference). |

|

|

| 99.3 |

|

Form of Registration Rights Assignment, by and among Enstar Group Limited, R&H Trust Co. (BVI) Ltd., as trustee of the Right Trust, Dominic F. Silvester and Canada Pension Plan Investment Board. |

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

|

| August 31, 2015 |

| Date |

|

| CANADA PENSION PLAN INVESTMENT BOARD |

|

| /s/ Patrice Walch-Watson |

| Signature |

|

| Patrice Walch-Watson, Senior Managing Director,

General Counsel and Corporate Secretary |

| Name/Title |

ATTENTION

Intentional misstatements or omissions of fact constitute Federal Criminal Violations (See 18 U.S.C. 1001).

Exhibit 99.1

SECURITIES PURCHASE AGREEMENT

THIS SECURITIES PURCHASE AGREEMENT (this “Agreement”) is made and entered into as of this 28th day of August, 2015, by and

among R&H Trust Co. (BVI) Ltd., as trustee of The Right Trust (the “Seller”), Dominic F. Silvester (“DFS”) and Canada Pension Plan Investment Board, a Canadian federal Crown corporation (the

“Purchaser”).

RECITALS

WHEREAS, the Seller currently owns 741,735 ordinary shares par value $1.00 per share (the “Shares”) of Enstar Group Limited,

a Bermuda company (the “Company”);

WHEREAS, DFS currently owns 490,732 Shares of the Company directly in his own name

and DFS and his immediate family are the sole beneficiaries of The Right Trust; and

WHEREAS, on the terms and subject to the conditions

of this Agreement, the Seller desires to sell 741,735 Shares (the “Purchased Shares”), being all the Shares held in The Right Trust, to the Purchaser, and the Purchaser desires to purchase from the Seller all of the Purchased

Shares, on the terms and conditions set forth in this Agreement (the “Transaction”).

NOW, THEREFORE, in consideration of

the premises and the agreements set forth below, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties agree as follows:

ARTICLE I

SALE AND PURCHASE OF

PURCHASED SHARES

Section 1.1 Purchase. Subject to the terms and conditions of this Agreement, on the Closing Date (as defined

below), the Seller shall sell, assign, transfer, convey and deliver to the Purchaser, and the Purchaser shall purchase, acquire and accept from the Seller, free and clear of any and all Liens (as defined herein) other than Permitted Liens (as

defined herein) the Purchased Shares. The purchase price for each Purchased Share shall be $150.00 per share, resulting in an aggregate purchase price for all of the Purchased Shares of $111,260,250.00 (the “Purchase Price”).

Section 1.2 Closing.

(a) The closing of the Transaction (the “Closing”) shall occur as promptly as practicable (but in no event later than the

third business day) after the satisfaction or waiver of the conditions (excluding conditions that, by their nature, cannot be satisfied until the Closing, but subject to the satisfaction or waiver of those conditions as of the Closing) set forth in

Articles V, VI and VII unless this Agreement has been theretofore terminated pursuant to its terms or unless another time or date is agreed to in writing by the parties hereto (the date and time of the Closing being

referred to in this Agreement as the “Closing Date”).

(b) At the Closing:

(i) the Seller shall deliver or cause to be delivered to the Purchaser all of the Seller’s right, title and interest in

and to the Purchased Shares (x) by delivery of one or more certificates evidencing the Purchased Shares, endorsed to the Purchaser or accompanied by duly executed stock powers or other instrument of assignment and/or (y) to the extent any

Purchased Shares are to be delivered through the facilities of The Depository Trust Company that are credited to or otherwise held in a securities account maintained by the Seller, the Seller shall take such actions as are necessary to provide

appropriate instruction to the relevant financial institution or other entity with which the Seller’s account is maintained to effect the legally valid transfer of the Purchased Shares from the Seller’s account to an account designated by

the Purchaser for the receipt of the Purchased Shares so transferred;

(ii) the Seller shall deliver to the Purchaser

evidence from the transfer agent (such as a “screen shot”) of the recordation in the Purchaser’s name (or, if applicable, to an account of the Purchaser through the facilities of The Depository Trust Company) of the Purchased Shares;

(iii) the Purchaser shall pay to the Seller, as aggregate consideration for the Purchased Shares, the Purchase Price in

cash by wire transfer of immediately available funds in accordance with the wire transfer instructions to be provided by the Seller to the Purchaser at least three (3) business days prior to the Closing Date;

(iv) the Seller shall deliver to the Purchaser (with a copy to the Company) a duly executed counterpart of the complete

assignment of its rights under the Registration Rights Agreement, dated as of January 31, 2007, among the Company (f/k/a Castlewood Holdings Limited), Trident II, L.P., Marsh & McLennan Capital Professionals Fund, L.P.,

Marsh & McLennan Employees’ Securities Company, L.P., J. Christopher Flowers, DFS and other shareholders (the “Registration Rights Agreement,” and such assignment, the form of which is attached hereto as Exhibit

A, the “Registration Rights Assignment Agreement,” and such Registration Rights Assignment Agreement together with this Agreement, the “Transaction Agreements”); and

(v) the Purchaser shall deliver to the Seller (with a copy to the Company) a duly executed counterpart of the Registration

Rights Assignment Agreement.

ARTICLE II

REPRESENTATIONS AND WARRANTIES OF THE SELLER AND DFS

Section 2.1 Representations and Warranties of the Seller.

The Seller hereby represents and warrants to the Purchaser, as of the date hereof and as of the Closing Date, as follows:

(a) The Seller is a trust company and has the power, authority and capacity to execute and deliver this Agreement and each of the Transaction

Agreements to which it is a party, to perform its obligations hereunder and thereunder and to consummate the transactions contemplated hereby and thereby.

- 2 -

(b) The execution and delivery of this Agreement and each of the Transaction Agreements to which

it is a party by the Seller and the consummation by the Seller of the transactions contemplated hereby and thereby, (i) do not require Seller to obtain any consent, approval, authorization, order, registration or qualification of or (except for

filings pursuant to Regulation 13D under or Section 16 of the Securities Exchange Act of 1934) make any filing with any Governmental Authority (as defined herein) (each, a “Seller Governmental Approval”), except as set forth in

Schedule I; and (ii) except as would not have an adverse effect on the ability of the Seller to consummate the transactions contemplated by this Agreement and the Transaction Agreements on the terms set forth herein, do not and will not

constitute or result in a breach, violation or default under (A) any statute, law, ordinance, decree, order, injunction, rule, directive, judgment or regulation of any court, administrative or regulatory body, including any stock exchange or

self-regulatory organization, governmental authority, arbitrator, mediator or similar body (each, a “Governmental Authority) applicable to the Seller or (B) the terms of any agreements governing The Right Trust.

(c) This Agreement and each of the other Transaction Agreements to which it is a party have been duly executed and delivered by the Seller and

constitute a legal, valid and binding obligation of the Seller, enforceable against the Seller in accordance with their respective terms, except as such enforceability may be limited by applicable bankruptcy, insolvency, reorganization, moratorium,

fraudulent conveyance and other similar laws of general application affecting enforcement of creditors’ rights generally and by general principles of equity. The Seller has duly taken all necessary action to authorize the execution, delivery

and performance of this Agreement and each of the other Transaction Agreements to which it is a party and the transactions contemplated hereby and thereby.

(d) The Seller is the sole owner of the Purchased Shares. No person or entity has any beneficial ownership of the Purchased Shares other than

the beneficiaries of The Right Trust and the Seller. The Seller has good and valid title to the Purchased Shares, free and clear of any lien, encumbrance, pledge, charge, security interest, mortgage, title retention agreement, assessment, option,

proxy, agreement to vote, equitable or other adverse claim (collectively, “Liens”) other than Liens existing under applicable securities or insurance laws or Liens arising under the Registration Rights Agreement (collectively,

“Permitted Liens”), and the Seller has not, in whole or in part, (a) assigned, transferred, hypothecated, pledged or otherwise disposed of the Purchased Shares or its ownership rights in such Purchased Shares or (b) given

any person or entity any transfer order, power of attorney or other authority of any nature whatsoever with respect to such Purchased Shares. There are no contracts, commitments, agreements, understandings or arrangements of any kind (contingent or

otherwise) relating to, or granting rights in connection with, the issuance, sale, transfer or ownership of any of the Purchased Shares, other than as contemplated by this Agreement and the Registration Rights Agreement. The delivery and/or release,

as applicable, of the Purchased Shares to the Purchaser pursuant to this Agreement at the Closing will transfer and convey good, valid and marketable title thereto to the Purchaser, free and clear of all Liens other than Permitted Liens.

- 3 -

(e) Except for the representations and warranties contained in this Agreement, neither the Seller

nor any other person on behalf of the Seller makes any other express or implied representation or warranty with respect to the Seller or the Company or with respect to any other information provided by or on behalf of the Seller or the Company.

Section 2.2 Representations and Warranties of DFS.

DFS hereby represents and warrants to the Purchaser, as of the date hereof and (except for the representation and warranty set forth in clause

(d) below, which is made only as of the date hereof) as of the Closing Date, as follows:

(a) DFS is a natural person, and has the

power, authority and capacity to execute and deliver this Agreement and each of the Transaction Agreements to which he is a party, to perform his obligations hereunder and thereunder and to consummate the transactions contemplated hereby and

thereby.

(b) The execution and delivery of this Agreement and each of the Transaction Agreements to which he is a party by DFS and the

consummation by DFS of the transactions contemplated hereby and thereby (i) do not require DFS to obtain any consent, approval, authorization, order, registration or qualification of or (except for filings pursuant to Regulation 13D under or

Section 16 of the Securities Exchange Act of 1934) make any filing with any Governmental Authority (each, a “DFS Governmental Approval”), except as set forth in Schedule I; (ii) to the knowledge of DFS, do not give

rise to any rights or obligations pursuant to “key man,” required share ownership or other similar provisions under any contract or obligation to which the Company is a party; and (iii) except as would not have an adverse effect on

the ability of the Seller to consummate the transactions contemplated by this Agreement and the Transaction Agreements on the terms set forth herein, do not and will not constitute or result in a breach, violation or default, or cause the

acceleration or termination of any obligation or right of DFS or any other party thereto, under (A) any note, bond, mortgage, deed, indenture, lien, instrument, contract, agreement, lease or license, whether written or oral, express or implied,

to which DFS is a party or (B) any statute, law, ordinance, decree, order, injunction, rule, directive, judgment or regulation of any Governmental Authority applicable to DFS.

(c) This Agreement and each of the other Transaction Agreements to which he is a party have been duly executed and delivered by DFS and

constitute a legal, valid and binding obligation of DFS, enforceable against DFS in accordance with their respective terms, except as such enforceability may be limited by applicable bankruptcy, insolvency, reorganization, moratorium, fraudulent

conveyance and other similar laws of general application affecting enforcement of creditors’ rights generally and by general principles of equity. DFS has duly taken all necessary action to authorize the execution, delivery and performance of

this Agreement and each of the other Transaction Agreements to which he is a party and the transactions contemplated hereby and thereby.

(d) DFS is not aware of any Excluded Information (as defined herein) that would be reasonably likely to materially and adversely affect the

Company.

- 4 -

(e) Except for the representations and warranties contained in this Agreement, neither DFS nor

any other person on behalf of DFS makes any other express or implied representation or warranty with respect to the Seller, The Right Trust or the Company or with respect to any other information provided by or on behalf of the Seller, The Right

Trust or the Company.

ARTICLE III

REPRESENTATIONS AND WARRANTIES OF THE PURCHASER

The Purchaser hereby represents and warrants to the Seller and to DFS, as of the date hereof and as of the Closing Date, as follows:

Section 3.1 Existence and Power.

(a) The Purchaser is a Canadian federal Crown corporation duly organized, validly existing and in good standing under the laws of the province

of Ontario. The Purchaser has the power, authority and capacity to execute and deliver this Agreement and each of the Transaction Agreements, to perform the Purchaser’s obligations hereunder and thereunder and to consummate the transactions

contemplated hereby and thereby.

(b) The execution and delivery of this Agreement and each of the Transaction Agreements to which it is a

party by the Purchaser and the consummation by the Purchaser of the transactions contemplated hereby and thereby (i) do not require Purchaser to obtain any consent, approval, authorization, order, registration or qualification of or (except for

filings pursuant to Regulation 13D or Section 16 of the Securities Exchange Act of 1934) make any filing with any Governmental Authority, except as set forth in Schedule I (each a “Purchaser Governmental Approval” and,

together with the Seller Government Approvals and the DFS Governmental Approvals, the “Governmental Approvals”); and (ii) except as would not have an adverse effect on the ability of the Purchaser to consummate the transactions

contemplated by this Agreement and the Transaction Agreements on the terms set forth herein, do not and will not constitute or result in a breach, violation or default, or cause the acceleration or termination of any obligation or right of the

Purchaser, any of the Purchaser’s subsidiaries, or any other party thereto, under (A) any note, bond, mortgage, deed, indenture, lien, instrument, contract, agreement, lease or license, whether written or oral, express or implied, to which

the Purchaser or any of its subsidiaries is a party, (B) the Purchaser’s or any of its subsidiaries’ organizational documents or (C) any statute, law, ordinance, decree, order, injunction, rule, directive, judgment or regulation

of any Governmental Authority applicable to Purchaser. Purchaser is not aware of any facts or conditions related to it or any of its affiliates, including their identity, business, investments, directors, officers or regulatory relationships, that

are reasonably likely to materially and adversely affect its ability to consummate the Transaction in a reasonably timely manner.

Section 3.2 Valid and Enforceable Agreement; Authorization. This Agreement and each of the other Transaction Agreements have been

duly executed and delivered by the Purchaser and constitute a legal, valid and binding obligation of the Purchaser, enforceable against the Purchaser in accordance with their respective terms, except as such enforceability may be limited by

applicable bankruptcy, insolvency, reorganization, moratorium, fraudulent

- 5 -

conveyance and other similar laws of general application affecting enforcement of creditors’ rights generally and by general principles of equity. The Purchaser has duly taken all necessary

corporate action to authorize the execution, delivery and performance of this Agreement and the other Transaction Agreements and the transactions contemplated hereby and thereby.

Section 3.3 Sufficient Funds. The Purchaser has legally available funds sufficient to consummate the transactions contemplated by

this Agreement.

Section 3.4 Sophistication of the Purchaser; Purchase for Investment. Without limiting the representations

and warranties of DFS and the Seller in Article II, the Purchaser has such knowledge and experience in financial and business matters and in making investment decisions of this type that it is capable of evaluating the merits and risks of

making its investment decision regarding the Transaction and of making an informed investment decision. In entering into this Agreement, the Purchaser has consulted with its own advisors and has relied solely upon its own investigation and analysis,

without relying upon DFS, the Seller or the Company except to the extent specified in this Agreement and the Transaction Agreements. The Purchaser is acquiring the Purchased Shares for its own account, for investment only, and not with a view to, or

for sale in connection with, any distribution thereof, nor with any present intention of distributing or selling the Purchased Shares in violation of applicable law, and the Purchaser has no present or contemplated agreement, undertaking,

arrangement obligation, indebtedness, or commitment providing for the distribution or sale thereof. The Purchaser acknowledges and agrees that the Purchased Shares have not been registered under the Securities Act of 1933, as amended (the

“Securities Act”), and may not be sold, pledged or otherwise transferred by the Purchaser without compliance with the registration provisions of the Securities Act or an exemption therefrom.

Section 3.5 Access to Information. The Purchaser and its representatives have been provided with access to substantial

information, including non-public information, relevant to the Company and the Shares, and the Purchaser has reviewed such information as it considers necessary to evaluate the decision to purchase the Purchased Shares pursuant to this Agreement

(collectively, the “Provided Information”). Notwithstanding the access provided to the Purchaser and its representatives, the Purchaser acknowledges that the Seller or DFS may be in possession of material non-public information

about the Company not known to the Purchaser (“Excluded Information”). Except as provided in Section 2.2(d), the Purchaser hereby waives any and all claims and causes of action now or hereafter arising against the Seller or DFS

or any of their affiliates based upon or relating to any alleged non-disclosure of Excluded Information or the disclosure of the Provided Information and further covenants not to assert any claims against or to sue the Seller or DFS or any of their

directors, officers, employees, agents, representatives, dependents or heirs for any loss, damage or liability arising from or relating to its sale of the Purchased Shares pursuant to this Agreement based upon or relating to any alleged

non-disclosure of Excluded Information or the disclosure of the Provided Information.

Section 3.6 Acknowledgement; Value of

Shares. The Purchaser acknowledges and confirms that it is aware that neither DFS nor the Seller is making any representation or warranty to the Purchaser whatsoever with respect to the business, condition (financial or otherwise), properties,

prospects, creditworthiness, status or affairs of the Company, or with respect to the value of the Purchased Shares. The Purchaser acknowledges and confirms that it is

- 6 -

aware that the closing sale price of the Shares (the “Stock Price”) has fluctuated since the Seller acquired the Shares and is likely to continue to fluctuate both prior to and

after the Closing, including possible material decreases to the Stock Price.

Section 3.7 No Other Representations or

Warranties. Except for the representations and warranties contained in this Agreement, neither the Purchaser nor any other person on behalf of the Purchaser makes any other express or implied representation or warranty with respect to the

Purchaser or with respect to any other information provided by or on behalf of the Purchaser.

ARTICLE IV

COVENANTS

Section 4.1

No Transfer of Shares. From the date hereof through the date that is 18 months following the Closing Date, DFS agrees not to sell, assign, transfer, pledge, charge, hypothecate, encumber or otherwise dispose of any of the Shares owned by him

on the date hereof, whether owned directly or indirectly, other than the disposition contemplated by this Agreement. The foregoing restrictions shall not apply (a) in the event of DFS’s death or permanent disability (such that DFS is no

longer physically capable of performing the functions of an officer of the Company similar to those required of him on the date hereof) or (b) in the event that a third party acquires at least a majority of the Company’s ordinary shares,

provided that such acquisition (i) is recommended by the Board of Directors of the Company and (ii) has received all necessary Governmental Approvals and provided, further, that in such case the obligations of the

Purchaser, the Seller and DFS with respect to the purchase and sale of the Purchased Shares to the Purchaser pursuant to this Agreement shall remain unaltered.

Section 4.2 Filings and Approvals.

(a) The Seller, DFS and the Purchaser shall each use their reasonable best efforts, and shall cooperate fully with each other, to

(i) comply with all requirements of Governmental Authorities applicable to the transactions contemplated by this Agreement and the other Transaction Agreements and (ii) seek to obtain as promptly as practicable all Governmental Approvals

necessary or advisable in connection with the transactions contemplated by this Agreement and the other Transaction Agreements. The parties shall cooperate with the reasonable requests of each other in seeking to obtain as promptly as practicable

all such Governmental Approvals. In connection therewith, the parties shall make all filings required by applicable laws as promptly as practicable after the date hereof in order to facilitate prompt consummation of the transactions contemplated by

this Agreement and the other Transaction Agreements, and shall promptly provide such information and communications to Governmental Authorities as such Governmental Authorities may request. Without limiting the foregoing covenants, the Purchaser

(x) shall use its best efforts, subject to receiving any cooperation reasonably requested by the Purchaser from the Company, the Seller and DFS, to make the required filings with respect to Governmental Approvals not later than 20 business days

after the date of this Agreement and (y) agrees that it will accede to reasonable conditions that may be imposed by Governmental Authorities in connection with their review and approval of the transactions contemplated by this Agreement.

- 7 -

(b) Notwithstanding anything to the contrary in this Agreement, no party nor any of their

respective affiliates shall be required to disclose pursuant to this Section 4.2 (i) any information that in the reasonable judgment of such party would result in the disclosure of any trade secrets of such party or of any third

parties, (ii) any privileged information or confidential competitive information or (iii) any information to the other party or any of its representatives that in the reasonable judgment of such non-disclosing party would violate any of

its contractual obligations with respect to confidentiality; provided, that with respect to clause (iii), the non-disclosing party shall have first used its reasonable best efforts to obtain a waiver or consent necessary to allow it to

disclose such information; provided, further, that if such consent or waiver to disclose is not obtained, the non-disclosing party shall provide such information directly to the applicable Governmental Authority and may seek to have such

information treated confidentially.

Section 4.3 Notices of Certain Events. Prior to the Closing Date, each party shall

promptly notify the other of:

(a) any material communication received by it from any Governmental Authority in connection with any of the

transactions contemplated by this Agreement and the other Transaction Agreements;

(b) any actions, suits, claims, investigations or

proceedings commenced or, to its knowledge, threatened against it, relating to or involving or otherwise affecting the transactions contemplated by this Agreement or the other Transaction Agreements;

(c) any inaccuracy of any representation or warranty contained in this Agreement at any time during the term hereof that could reasonably be

expected to cause the conditions set forth in Article V, Article VI or Article VII not to be satisfied; and

(d) any failure to comply

with or satisfy any covenant, condition or agreement to be complied with or satisfied by it hereunder;

provided, however, that the delivery of any

notice pursuant to this Section 4.3 shall not limit or otherwise affect the remedies available hereunder to the party receiving such notice.

ARTICLE V

MUTUAL CONDITIONS

The respective obligations of the Purchaser and the Seller to consummate the transactions contemplated by this Agreement and the other

Transaction Agreements are subject to the satisfaction or waiver at or prior to the Closing of the following conditions:

Section 5.1

No Order. No Governmental Authority shall have enacted, issued, promulgated, enforced or entered any law, injunction, order, decree or ruling (whether temporary, preliminary or permanent) which is then in effect and has the effect of making

consummation of the transactions contemplated by this Agreement illegal or prohibiting consummation of the transactions contemplated by this Agreement.

- 8 -

Section 5.2 Board Approval. The parties shall have received confirmation from the

Company of the approval of the Registration Rights Assignment Agreement from both the Board of Directors and, as applicable, the Audit Committee of the Company.

Section 5.3 Governmental Approvals. Each of the Governmental Approvals set forth in Schedule I, in connection with the

consummation of the transactions contemplated by this Agreement and the other Transaction Agreements, shall have been made or obtained and no consent, approval, permit or authorization shall have been revoked; and, if applicable, any waiting period

in respect thereof (and any extensions thereof) shall have expired or otherwise been terminated without disapproval thereof.

ARTICLE VI

CONDITIONS OF THE SELLER’S OBLIGATIONS

The obligations of the Seller to consummate the transactions contemplated by this Agreement are subject to the satisfaction or waiver at or

prior to the Closing of the following condition:

Section 6.1 Assignment of Registration Rights Agreement. The Registration

Rights Assignment Agreement shall have been duly executed by the Company and the Purchaser.

Section 6.2 Representations and

Warranties; Covenants. The representations and warranties of the Purchaser set forth in Article III of this Agreement shall be true and correct at and as of the date of this Agreement and as of the Closing Date with the same effect as

though made at and as of such date (except to the extent expressly made at and as of a specific date, in which case as of such specific date). The Purchaser shall have in all material respects duly performed or complied with all agreements,

covenants and conditions required by this Agreement to be performed or complied with by the Purchaser on or prior to the Closing Date. The Purchaser shall have delivered to Seller a certificate dated the Closing Date and signed by the Purchaser to

the effect set forth above in this Section 6.2.

ARTICLE VII

CONDITIONS OF THE PURCHASER’S OBLIGATION

The obligations of the Purchaser to consummate the transactions contemplated by this Agreement are subject to the satisfaction or waiver at or

prior to the Closing of the following conditions:

Section 7.1 Assignment of Registration Rights Agreement. The Registration

Rights Assignment Agreement shall have been duly executed by the Company and the Seller.

Section 7.2 Representations and

Warranties; Covenants. The representations and warranties of the Seller and of DFS set forth in Article II of this Agreement shall be true and correct at and as of the date of this Agreement and as of the Closing Date with the same effect

as though made at and as of such date (except to the extent expressly made at and as of a specific

- 9 -

date, in which case as of such specific date). The Seller and DFS shall have in all material respects duly performed or complied with all agreements, covenants and conditions required by this

Agreement to be performed or complied with by each of them on or prior to the Closing Date. The Seller and DFS shall each have delivered to Purchaser a certificate dated the Closing Date and signed by the Seller or DFS, as the case may be, to the

effect set forth above in this Section 7.2.

ARTICLE VIII

MISCELLANEOUS PROVISIONS

Section 8.1 Termination.

(a) This Agreement may be terminated:

| |

(1) |

by mutual written consent of the Purchaser, DFS and the Seller; |

| |

(2) |

by the Purchaser, DFS or the Seller if the mutual conditions to Closing set forth in Section 5.1 and Section 5.2 are not fulfilled on the Closing Date; |

| |

(3) |

by the Purchaser, DFS or the Seller if the mutual condition to Closing set forth in Section 5.3 is not fulfilled on or prior to the one-year anniversary of the date hereof (the “Outside

Date”); |

| |

(4) |

by the Seller if the conditions to the Seller’s obligations hereunder set forth in Article VI are not fulfilled on or prior to the Outside Date; or |

| |

(5) |

by the Purchaser if the conditions to the Purchaser’s obligations hereunder set forth in Article VII are not fulfilled on or prior to the Outside Date. |

(b) The termination of this Agreement shall be effectuated by the delivery of written notice of such termination by the party terminating this

Agreement to the other parties.

(c) If this Agreement is terminated in accordance with this Section 8.1 and the transactions

contemplated hereby are not consummated, except as otherwise specifically provided herein, this Agreement shall be of no further force and effect, without any liability on the part of any party hereto, except for Sections 8.2 through

8.19, which shall survive the termination of this Agreement. Nothing herein shall relieve any party to this Agreement of liability for a willful breach of any representation, warranty, agreement, covenant or other provision of this Agreement

prior to the date of termination.

Section 8.2 Public Announcements. Except (i) as required by applicable law (including

U.S. federal securities laws) or (ii) with respect to disclosures that are consistent in all material respects with prior disclosures made in compliance with this Section 8.2, each party hereto shall consult with the other party

before issuing, and give the other party the opportunity to review and comment upon, any press release or other public statement with respect to this Agreement or the Transaction.

- 10 -

Section 8.3 Notices. All notices required or permitted hereunder shall be in writing

and shall be deemed effectively given (i) upon personal delivery to the party to be notified, (ii) when sent by confirmed facsimile if sent during normal business hours of the recipient, if not, then on the next business day or

(iii) one business day after deposit with a nationally recognized overnight courier, specifying next-day delivery, with written verification of receipt. All communications shall be sent to the addresses set forth below or such other address or

facsimile number as a party may from time to time specify by notice to the other parties hereto.

If to the Purchaser, to:

Canada Pension Plan Investment Board

One Queen Street East, Suite 2500

Toronto, ON M5C 2W5 Canada

Attention: R. Scott Lawrence, Managing Director, Head of Relationship Investments

Fax: (416) 868-8690

with a

copy to the address above to:

Attention: Patrice Walch-Watson, Senior Managing Director & General Counsel and Corporate Secretary

Fax: (416) 868-4760

with a copy (which shall not constitute notice) to:

Debevoise & Plimpton LLP

919 Third Avenue

New York, New

York 10022

Attention: Nicholas F. Potter

Fax: (212) 521-7178

If to

the Seller, to:

R&H Trust Co. (BVI) Limited

Woodbourne Hall

PO Box 3162

Road Town

Tortola

British Virgin Islands

Attention: Edith Steel

Fax:

(284) 494-5417

- 11 -

If to DFS, to:

Dominic F. Silvester

c/o Enstar

Group Limited

P.O. Box HM 2267

Windsor Place, 3rd Floor, 22 Queen Street

Hamilton HM JX

Bermuda

with a copy (which shall not constitute notice) to:

Drinker Biddle & Reath LLP

One Logan Square, Suite 2000

Philadelphia, PA 19103

Attention: Robert C. Juelke

Fax:

(215) 988-2757

Section 8.4 Entire Agreement. This Agreement and the other documents and agreements executed in

connection with the Transaction embody the entire agreement and understanding of the parties hereto with respect to the subject matter hereof and supersede all prior written and contemporaneous oral agreements, representations, warranties,

contracts, correspondence, conversations, memoranda and understandings between or among the parties or any of their agents, representatives or affiliates relative to such subject matter, including any term sheets, emails or draft documents.

Section 8.5 Assignment; Binding Agreement. No party may assign this Agreement or any of its rights and obligations hereunder

without the prior written consent of the other parties hereto. This Agreement and the various rights and obligations arising hereunder shall inure to the benefit of and be binding upon the parties hereto and their respective successors and assigns.

Section 8.6 Counterparts. This Agreement may be executed in counterparts, each of which shall be deemed an original, but both

of which taken together shall constitute one and the same instrument. Any counterpart or other signature hereupon delivered by facsimile or other electronic means shall be deemed for all purposes as constituting good and valid execution and delivery

of this Agreement by such party.

Section 8.7 Governing Law; Trial by Jury. This Agreement shall be governed by and construed

in accordance with the internal laws of the State of New York without regard to principles of conflicts of laws. Each party hereto waives, to the fullest extent permitted by applicable law, any right it may have to a trial by jury in respect of any

action, suit or proceeding arising out of or relating to this Agreement or any transaction contemplated hereby.

Section 8.8 No

Third Party Beneficiaries or Other Rights. Nothing herein shall grant to or create in any person not a party hereto, or any such person’s dependents or heirs, any right to any benefits hereunder, and no such party shall be entitled to sue

any party to this Agreement with respect thereto.

- 12 -

Section 8.9 Amendment; Waiver. This Agreement and its terms may not be changed,

amended, waived, terminated, augmented, rescinded or discharged, in whole or in part, except by a writing executed by the parties hereto.

Section 8.10 No Brokers. Except as previously disclosed to the other party in writing, no party has engaged any third party as

broker or finder or incurred or become obligated to pay any broker’s, commission or finder’s fee in connection with the transactions contemplated by this Agreement.

Section 8.11 Further Assurances. Each party hereto hereby agrees to execute and deliver, or cause to be executed and delivered,

such other documents, instruments and agreements, and take such other actions consistent with the terms of this Agreement as may be reasonably necessary in order to accomplish the transactions contemplated by this Agreement.

Section 8.12 Costs and Expenses. Each party hereto shall each pay its own costs and expenses, including any commission or

finder’s fee to any broker or finder, incurred in connection with the negotiation, drafting, execution and performance of this Agreement.

Section 8.13 Severability. Whenever possible, each provision of this Agreement will be interpreted in such manner as to be

effective and valid under applicable law, but if any provision of this Agreement is held to be invalid, illegal or unenforceable in any respect under any applicable law or rule in any jurisdiction, such invalidity, illegality or unenforceability

will not affect any other provision or any other jurisdiction, but this Agreement will be reformed, construed and enforced in such jurisdiction as if such invalid, illegal or unenforceable provision had never been contained herein.

Section 8.14 Time of Essence. Time is of the essence in the performance of each and every term of this Agreement.

Section 8.15 Headings. The article and section headings herein are for convenience of reference only, do not constitute part of

this Agreement and will not be deemed to limit or otherwise affect any of the provisions hereof.

Section 8.16 Construction.

The definitions given for terms in this Agreement shall apply equally to both the singular and plural forms of the terms defined. Whenever the context may require, any term shall include the corresponding masculine, feminine and neuter forms. The

word “including” shall be deemed to be followed by the phrase “without limitation”. All references to “$” are to the lawful currency of the United States of America. The term “business day” shall mean any day

other than a Saturday, Sunday or a day on which banking institutions in New York, New York, are authorized or obligated to close. The words “this Agreement”, “hereof”, “hereunder”, “herein”, “hereby”

or words of similar import shall refer to this Agreement as a whole and not to a particular section, subsection, clause or other subdivision of this Agreement, unless the context otherwise requires.

- 13 -

Section 8.17 Specific Performance. The parties acknowledge and agree that a party

could not be made whole by monetary damages in the event that any of the provisions of this Agreement are not performed by the other party in accordance with their specific terms or are otherwise breached. Accordingly, the parties agree that, in any

such event, the parties shall be entitled to seek an injunction or injunctions to specifically enforce the terms and provisions hereof in an action instituted in any court of the State of New York having subject matter jurisdiction in respect

thereof, and the parties further hereby agree to waive any requirement for the securing or posting of a bond in connection with the obtaining of such injunctive or other equitable relief.

Section 8.18 Survival. The representations and warranties (other than those in Section 2.1(d) and

Section 2.2(d)) contained in this Agreement shall survive the Closing for a period of one year from the Closing, provided that (a) the representations and warranties contained in Section 2.1(d) and the covenants and

agreements of the parties shall survive without expiration and (b) the representations and warranties contained in Section 2.2(d) shall survive the Closing until the later of June 30, 2016 and the date that is six months

following the Closing Date.

Section 8.19 Private Sale. It is the intention of the parties to this Agreement that the

Transaction be a private sale of securities that is exempt from the registration and prospectus delivery requirements of the Securities Act, pursuant to the satisfaction of the conditions for the so-called “Section 4 (1 1/2)” private

resale exemption.

Section 8.20 Currency. All dollar amounts contained herein refer to US dollars.

[Signature pages follow]

- 14 -

IN WITNESS WHEREOF, each of the parties hereto has caused this Agreement to be executed as of the

date first above written.

|

|

|

| PURCHASER |

|

| Canada Pension Plan Investment Board |

|

|

| By: |

|

/s/ Ed Cass for |

| Name: |

|

Eric M. Wetlaufer |

| Title: |

|

Senior Managing Director & Global |

|

|

Head of Public Market Investments |

|

|

| By: |

|

/s/ R. Scott Lawrence |

| Name: |

|

R. Scott Lawrence |

| Title: |

|

Managing Director, Head of |

|

|

Relationship Investments |

|

| SELLER |

|

| THE COMMON SEAL of R&H TRUST |

| CO. (BVI) LTD., as trustee of THE RIGHT TRUST was hereunto affixed in the presence of |

|

|

| By: |

|

/s/ Derek C. Rawlings |

| Name: |

|

Derek C. Rawlings |

| Title: |

|

Director of R&H Trust Co. (BVI) Limited |

|

|

| DFS |

|

|

|

| Dominic F. Silvester |

|

|

| By: |

|

/s/ Dominic F. Silvester |

[Signature Page to SPA]

Schedule I

Governmental Approvals

Seller Governmental Approvals

None

DFS Governmental

Approvals

None

Purchaser Governmental Approvals

| |

1. |

Form A Acquisition of Control filings with (and related approvals from) the Delaware Department of Insurance with respect to Torus Specialty Insurance Company, Torus National Insurance Company and Pavonia Life Insurance

Company of Delaware |

| |

2. |

Form A Acquisition of Control filings with (and related approvals from) the Illinois Department of Insurance with respect to Clarendon National Insurance Company, Clarendon America Insurance Company and SeaBright

Insurance Company |

| |

3. |

Form A Acquisition of Control filings with (and related approval from) the Michigan Department of Insurance and Financial Services with respect to Pavonia Life Insurance Company of Michigan |

| |

4. |

Form A Acquisition of Control filings with (and related approval from) the Rhode Island Department of Business Regulation with respect to Providence Washington Insurance Company |

| |

5. |

Form A Acquisition of Control filings with (and related approval from) the South Carolina Department of Insurance with respect to Sussex Insurance Company |

| |

6. |

Section 1506 filing and any related filings with (and related approval(s) from) the New York State Department of Financial Services with respect to Pavonia Life Insurance Company of New York |

| |

7. |

Form E filings to the extent required |

| |

8. |

Section 30E of the Insurance Act of 1978 filing with the Bermuda Monetary Authority with respect to Brittany Insurance Company Ltd., Fitzwilliam

Insurance |

| |

Limited, Overseas Reinsurance Corporation Limited, Hudson Reinsurance Company Limited, Rosemont Reinsurance Ltd, Electricity Producers Insurance Company (Bermuda) Limited, Inter-Ocean Reinsurance

Company Ltd., Arden Reinsurance Ltd, New Castle Reinsurance Company Ltd and Torus Insurance (Bermuda) Ltd. |

| |

9. |

Acquiring Transaction Notification Form with the Central Bank of Ireland with respect to Laguna Life Limited |

| |

10. |

Filing with the Swiss Financial Market Supervisory Authority with respect to Harper Insurance Limited |

| |

11. |

Section 178 notice to the Prudential Regulatory Authority, with a copy to the Financial Conduct Authority, with respect to River Thames Insurance Company, Mercantile Indemnity Company Limited, Goshawk Dedicated

Limited, Unionamerica Insurance Company Limited, Bosworth Run-Off Limited, Marlon Insurance Company Limited, The Copenhagen Reinsurance Company (UK) Limited, SGL No 1 Ltd., SGL No 3 Ltd., Atrium 5 Ltd, Knapton Insurance Limited, DLCM No. 1

Limited, DLCM No. 2 Limited, DLCM No. 3 Limited, Torus Corporate Capital 2 Ltd., Torus Corporate Capital 4 Ltd., Torus Corporate Capital 5 Ltd., Torus Insurance (UK) Ltd. and Brampton Insurance Company Limited |

| |

12. |

Change of control filings with Lloyd’s of London with respect to UK entities acting as managing agents |

Notwithstanding the foregoing:

| |

(a) |

If, following execution of this Agreement, a Governmental Authority in any jurisdiction determines that the Seller, DFS, the Purchaser, or any of their respective affiliates is required to provide, make or obtain a

notice, filing or approval or non-disapproval with respect to the Transaction prior to the Closing, the Seller, DFS, and the Purchaser shall, or shall cause their respective affiliates to, provide, make or

obtain such notice, filing or approval or non-disapproval in such jurisdiction prior to the Closing. |

| |

(b) |

If, following execution of this Agreement, the Company or any of its affiliates acquires an interest in additional operations in one or more jurisdictions other than those in which it currently operates or resides, or

there is a change in applicable law in any of the jurisdictions in which the Company or any of its affiliates currently operates or resides, the Seller, DFS, and the Purchaser shall, or shall cause their respective affiliates to, provide, make or

obtain all notices, filings or approvals or non-disapprovals required in such jurisdictions with respect to the Transaction on account of such acquisitions or changes in law prior to the Closing, including, without limitation, a Form B notification

to (and related approval from) the National Bank of Belgium with respect to Nationale Suisse S.A. |

2

| |

(c) |

If, following execution of this Agreement, a Governmental Authority in any jurisdiction described on this Schedule I determines and confirms in writing that a notice, filing or approval or non-disapproval is not

required by the Seller, DFS, the Purchaser, or any of their respective affiliates, as applicable, with respect to the Transaction, the Seller, DFS, the Purchaser, or such affiliate, as applicable, will not be required to provide, make or obtain such

notice, filing or approval or non-disapproval in such jurisdiction. |

3

Exhibit 99.3

ASSIGNMENT OF REGISTRATION RIGHTS

THIS ASSIGNMENT OF REGISTRATION RIGHTS (this “Assignment”) dated as of this [●] day of [●], 2015, is entered into

by each of R&H Trust Co. (BVI) Ltd. (the “Seller”), as trustee of The Right Trust (the “Right Trust”), and Dominic F. Silvester (“DFS” and together with the Seller, the “Assignors” and

each an “Assignor”), in favor of CANADA PENSION PLAN INVESTMENT BOARD, a Canadian federal Crown corporation, as assignee (the “Assignee”), and constitutes the prior written consent of ENSTAR GROUP LIMITED, a Bermuda

company (the “Company”), to the assignment of rights contemplated hereby. Capitalized terms used herein shall have meanings assigned to such terms in the Securities Purchase Agreement (as defined below) unless otherwise defined

herein or the context clearly requires otherwise.

W I T N E S S E T H:

WHEREAS, in connection with and pursuant to the Securities Purchase Agreement by and among the Assignee and the Assignors, dated

August 28, 2015 (the “Securities Purchase Agreement”), Assignee will acquire from the Seller, subject to the conditions set forth therein, Ordinary Shares of the Company;

WHEREAS, as a condition to Assignee’s obligations to the Securities Purchase Agreement, Assignors are entering into this Assignment for

the purpose of, among other things, (i) assigning to Assignee certain of the Assignors’ respective rights and interests in the Registration Rights Agreement, dated as of January 31, 2007, among the Company, DFS, Trident II,

L.P., Marsh & McLennan Capital Professionals Fund, L.P., Marsh & McLennan Employees’ Securities Company, L.P., J. Christopher Flowers and other shareholders of the Company (including the Seller) set forth on the schedule of

shareholders attached thereto (the “Registration Rights Agreement”) and (ii) delegating to Assignee certain of the duties of the Assignors in and under the Registration Rights Agreement, in each case to the extent

specified below; and

WHEREAS, the Company consents to the assignment described above, with effect from and after the Effective Time (as

defined in Section 5 of this Assignment).

NOW, THEREFORE, in consideration of the premises and the mutual covenants herein

contained, and other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the parties hereto do hereby agree as follows:

Section 1. Assignment.

(a) The Seller hereby, with effect from and after the Effective Time, assigns unto Assignee and its successors and assigns all of the

Seller’s right, title and interest in and to, and remedies under, the Registration Rights Agreement, including all rights exercisable by the Seller thereunder from and after the Effective Time. The Seller represents and warrants that it

(i) is not in breach and has not previously been in breach of the Registration Rights Agreement and (ii) has not assigned or encumbered any of its rights under the Registration Rights Agreement, other than the assignment to

the Assignee contemplated hereby.

(b) DFS hereby, with effect from and after the Effective Time, assigns unto Assignee and its

successors and assigns all of his right, title and interest in and to one of the two Registration Requests (as defined in the Registration Rights Agreement) granted to him pursuant to Section 1(a) of the Registration Rights Agreement, to the

full extent, and subject to all other rights and limitations, as specified in Section 1 of the Registration Rights Agreement. DFS represents and warrants that he (i) is not in breach and has not previously been in breach of the

Registration Rights Agreement, (ii) has not exercised any of his two Registration Requests pursuant to Section 1 of the Registration Rights Agreement and (iii) has not assigned or encumbered any of his rights under the

Registration Rights Agreement, other than the assignment to the Assignee contemplated hereby. From and after the Effective Time, DFS will retain all rights previously held by him with respect to one Registration Request, and the Assignee will have

the sole and exclusive right to exercise, for all purposes under the Registration Rights Agreement, the other Registration Request previously held by DFS.

Section 2. Assumption. Assignee hereby assumes, from and after the Effective Time, (i) all of the Seller’s

obligations under the Registration Rights Agreement arising from and after the Effective Time and (ii) all obligations of DFS with respect to the exercise of the one Registration Request assigned to Assignee under Section 1(b)

above, including all obligations of DFS derivative from the exercise of such Registration Request as if Assignee had been an original party to the Registration Rights Agreement holding such Registration Request. For the avoidance of doubt, except as

expressly stated in the preceding sentence, Assignee does not assume DFS’ obligations under the Registration Rights Agreement.

Section 3. Consent and Confirmation

(a) The Company hereby consents to the assignment of Assignors’ right, title and interest in the Registration Rights Agreement to the full

extent described in Section 1 above, including rights exercisable by the Assignors thereunder from and after the Effective Time, and recognizes Assignee as the Assignors’ successor-in-interest in and to the Registration Rights Agreement,

in each case to the extent described in Section 1 hereof. For the avoidance of doubt, the Company agrees that: (i) the one-year waiting period referred to in Section 1(a) of the Registration Rights Agreement has been satisfied

and shall have no application to the Assignee, (ii) notices previously required to be sent to the Seller pursuant to the Registration Rights Agreement shall instead be sent and delivered to Assignee in accordance with the notice

provisions of the Securities Purchase Agreement (which are incorporated herein by reference), and (iii) notices previously required to be sent to DFS with respect to Registration Requests under the Registration Rights Agreement shall be

sent and delivered to both DFS in accordance with the notice provisions of the Registration Rights Agreement and Assignee in accordance with the notice provisions of the Securities Purchase Agreement (which are incorporated herein by reference). The

Company further agrees that (i) no breach by DFS of any of the rights or obligations retained by him under the Registration Rights Agreement shall prejudice or limit any of the rights of Assignee under the Registration Rights Agreement

and (ii) no breach by Assignee of any of the rights or obligations assigned to Assignee hereunder shall prejudice or limit any of the rights of DFS retained by him under the Registration Rights Agreement.

(b) The Company hereby confirms to Assignee that (i) the Registration Rights Agreement is in full force and effect and

(ii) to the best of its knowledge, there exists no actual, claimed or threatened breach, nor any actual, claimed or threatened event which, but for the passage of time, the giving of notice, or both, would constitute a breach under the

Registration Rights Agreement with respect to the performance of any of the terms, covenants or conditions to be performed thereunder.

Section 4. Securities Purchase Agreement. Assignee and the Assignors, by execution of

this Assignment, each hereby acknowledge and agree that neither the representations and warranties nor the rights, obligations or remedies of any party under the Securities Purchase Agreement shall be deemed to be abrogated, modified or altered in

any way by execution or acceptance of this Assignment.

Section 5. Effectiveness. This Assignment shall become effective as of

and subject to the closing under the Securities Purchase Agreement (the “Effective Time”).

Section 6.

Miscellaneous. Sections 8.3-8.19, other than Section 8.10, from the Securities Purchase Agreement are incorporated herein mutatis mutandis, provided, notices to the Company shall be delivered to:

Enstar Group Limited

P.O. Box HM 2267

Windsor Place, 3rd Floor, 22 Queen Street

Hamilton HM JX

Bermuda

Attention: Paul J. O’Shea, Joint Chief Operating

Officer

Facsimile: (441) 296-7319

E-mail:

paul.o’shea@enstargroup.com

with a copy (which shall not constitute notice to the Company) to:

Drinker Biddle & Reath LLP

One Logan Square, Suite

2000

Philadelphia, PA 19103

Attention: Robert C. Juelke

Facsimile: (215) 988-2757

E-mail:

robert.juelke@dbr.com

[Signature Pages Follow]

IN WITNESS WHEREOF, the parties hereto have each caused this Assignment to be duly executed as of

the date first written above.

|

|

|

| ASSIGNORS: |

|

| THE COMMON SEAL of R&H TRUST |

| CO. (BVI) LTD., as trustee of THE RIGHT TRUST

was hereunto affixed in the presence of |

|

|

| By: |

|

|

| Name: |

|

Derek C. Rawlings |

| Title: |

|

Director of R&H Trust Co. (BVI) Limited |

|

| Dominic F. Silvester |

|

|

| By: |

|

|

|

| ASSIGNEE: |

|

| Canada Pension Plan Investment Board |

|

|

| By: |

|

|

| Name: |

|

Eric M. Wetlaufer |

| Title: |

|

Senior Managing Director & Global Head of

Public Market Investments |

|

|

| By: |

|

|

| Name: |

|

R. Scott Lawrence |

| Title: |

|

Managing Director, Head of Relationship

Investments |

|

| COMPANY: |

|

| Enstar Group Limited |

|

|

| By: |

|

|

| Name: |

|

|

| Title: |

|

|

[Signature Page]

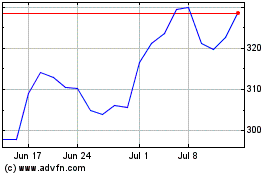

Enstar (NASDAQ:ESGR)

Historical Stock Chart

From Mar 2024 to Apr 2024

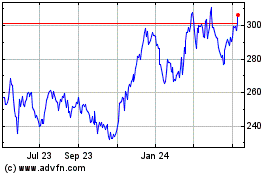

Enstar (NASDAQ:ESGR)

Historical Stock Chart

From Apr 2023 to Apr 2024