UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

Enstar Group

Limited

(Name of Issuer)

Ordinary Shares, par value $1.00 per share

(Title of Class of Securities)

G3075 P101

(CUSIP

Number)

Benita M. Warmbold

Canada Pension Plan Investment Board

One Queen Street East, Suite 2500

Toronto, ON M5C 2W5 Canada

(416) 868-1171

(Name,

Address and Telephone Number of Person Authorized to Receive Notices and Communications)

June 3, 2015

(Date of Event Which Requires Filing of this Statement)

If the filing person has

previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following

box. ¨

The information required on the remainder of this cover page shall not be deemed to be

“filed” for the purpose of section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act.

|

|

|

|

|

|

|

| 1 |

|

Name of

reporting person. Canada Pension Plan Investment Board |

| 2 |

|

Check the appropriate box if a member

of a group (see instructions)

(a) ¨ (b) ¨ |

| 3 |

|

SEC use only

|

| 4 |

|

Source of funds (see instructions)

OO |

| 5 |

|

Check if disclosure of legal

proceedings is required pursuant to items 2(d) or 2(e) ¨ |

| 6 |

|

Citizenship or place of

organization Canada |

| Number of

shares beneficially

owned by each

reporting person

with |

|

7 |

|

Sole voting power

1,501,211 shares |

|

8 |

|

Shared voting power

0 shares |

|

9 |

|

Sole dispositive power

1,501,211 shares |

|

10 |

|

Shared dispositive power

0 shares |

| 11 |

|

Aggregate amount beneficially owned by each reporting person

1,501,211 shares |

| 12 |

|

Check if the aggregate amount in Row

(11) excludes certain shares (see instructions)

¨ |

| 13 |

|

Percent of class represented by amount

in Row (11)

9.5%(1) |

| 14 |

|

Type of reporting person (see

instructions) CO |

| (1) |

Calculated based on 15,817,694 Ordinary Shares outstanding as of May 6, 2015, as reported in the Issuer’s Quarterly Report on Form 10-Q for the period ended

March 31, 2015, filed on May 11, 2015. |

| Item 1. |

Security and Issuer |

This Schedule 13D relates to the ordinary shares,

par value $1.00 per share (“Ordinary Shares”), of Enstar Group Limited, a Bermuda company (the “Issuer”), having its principal executive offices at 22 Queen Street, Windsor Place, 3rd Floor, P.O. Box HM 2267,

Hamilton, HM JX Bermuda.

| Item 2. |

Identity and Background |

(a) This Statement is filed by Canada Pension Plan Investment

Board (the “Reporting Person”).

All disclosures herein with respect to the Reporting Person are made

only by the Reporting Person. Any disclosures herein with respect to persons other than the Reporting Person are made on information and belief after making inquiry to the appropriate party.

(b) The business address of the Reporting Person is One Queen Street East, Suite 2500, Toronto, ON M5C 2W5 Canada.

(c) The principal business of the Reporting Person is investing the assets of the Canada Pension Plan.

(d) The Reporting Person has not, during the last five years, been convicted in a criminal proceeding (excluding traffic violations or similar

misdemeanors).

(e) The Reporting Person has not, during the last five years, been a party to a civil proceeding of a judicial

administrative body of competent jurisdiction and, as a result of such proceeding, was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities

laws or finding any violation with respect to such laws.

(f) Not applicable.

In accordance with the provisions of General Instruction C to Schedule 13D, information concerning the general partners,

executive officers, board of directors and each person controlling the Reporting Person (collectively, the “Covered Persons”), required by Item 2 of Schedule 13D, is provided on Schedule 1 and is incorporated by

reference herein. To the Reporting Person’s knowledge, none of the Covered Persons listed on Schedule 1 as a director or executive officer of the Reporting Person has been, during the last five years, (i) convicted in a criminal proceeding

(excluding traffic violations or similar misdemeanors), or (ii) a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final

order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

| Item 3. |

Source and Amount of Funds or Other Consideration |

The Reporting Person

purchased 1,501,211 Ordinary Shares and 404,771 shares of series E non-voting convertible ordinary shares, par value US $1.00 per share, of the Issuer for an aggregate purchase price of $266,837,480, pursuant to the Securities Purchase Agreement

(the “Securities Purchase Agreement”), dated May 29, 2015, by and among the Reporting Person and FR First Reserve Fund XII, L.P., FR XII-A Parallel Vehicle, L.P., FR XI Offshore AIV, L.P. and FR Torus Co-Investment, L.P.

(collectively, the “First Reserve Partnerships”). The Purchase Price was funded by the assets of the Reporting Person.

References to, and descriptions of, the Securities Purchase Agreement as set forth in this Item 3 are qualified in their

entirety by the terms of the Securities Purchase Agreement, a copy of which is attached hereto as Exhibit 99.1 and is incorporated in its entirety in this Item 3.

| Item 4. |

Purpose of Transaction |

The acquisition of Ordinary Shares by the

Reporting Person was undertaken for investment purposes. The Reporting Person also intends to participate in and influence the affairs of the Issuer through the nomination of a representative of the Reporting Person to the Board of Directors of the

Issuer (the “Board”) (pursuant to the Shareholder Rights Agreement, as defined and described in Item 4(d) below) and through its voting rights with respect to its Ordinary Shares.

The following describes plans or proposals that the Reporting Person may have with respect to the matters set forth in

Item 4(a)-(j) of Schedule 13D:

(a) None.

(b) None.

(c) None.

(d) Pursuant to Section 2.01 of the Shareholder Rights Agreement, dated as of June 3, 2015, by and between the

Issuer and the Reporting Person (the “Shareholder Rights Agreement”), the Reporting Person has the right to nominate for appointment or as a candidate for election one representative to the Issuer’s Board of Directors (the

“CPPIB Director Nominee”). The Issuer has agreed, pursuant to Section 2.01 of the Shareholder Rights Agreement, to use its commercially reasonable efforts to put forward such CPPIB Director Nominee for election at future

applicable annual meetings or take such other steps as are required to have such CPPIB Director Nominee elected or appointed to the Board. This designation right terminates if the Reporting Person ceases to beneficially own at least 75% of the total

number of Ordinary Shares and non-voting preferred shares it acquired under the Securities Purchase Agreement.

References

to, and descriptions of, the Shareholder Rights Agreement as set forth in this Item 4(d) are qualified in their entirety by the terms of the Shareholder Rights Agreement, a copy of which is attached hereto as Exhibit 99.2 and is

incorporated in its entirety in this Item 4(d).

(e) None.

(f) None.

(g) None.

(h) None.

(i) None.

(j) None.

| Item 5. |

Interest in Securities of the Issuer |

(a)-(b) The aggregate number and percentage

of Ordinary Shares beneficially owned by the Reporting Person are as follows:

| |

(a) |

Amount beneficially owned: 1,501,211 shares |

Percentage: 9.5%(2)

(b) Number of shares to which the Reporting Person has:

i. Sole power to vote or to direct the vote: 1,501,211 shares

ii. Shared power to vote or to direct the vote: 0 shares

iii. Sole power to dispose or to direct the disposition of: 1,501,211 shares

iv. Shared power to dispose or to direct the disposition of: 0 shares

(c) Except as described in Item 3 above or elsewhere in this Schedule 13D, none of the Reporting Person or, to the Reporting

Person’s knowledge, the Covered Persons has effected any transactions in the Ordinary Shares during the past 60 days.

(d) None.

(e) Not applicable.

| (2) |

Calculated based on 15,817,694 Ordinary Shares outstanding as of May 6, 2015, as reported in the Issuer’s Quarterly Report on Form 10-Q for the period ended March 31, 2015, filed on May 11, 2015.

|

| Item 6. |

Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer |

The information provided or incorporated by reference in Item 3 and Item 4 is hereby incorporated by reference

herein.

Shareholder Rights Agreement

The information in Item 4(d) with respect to the Shareholder Rights Agreement and the Reporting Person’s rights

regarding the appointment of directors to the Board is incorporated into this Item 6 by reference.

References to,

and descriptions of, the Shareholder Rights Agreement as set forth in this Item 6 are qualified in their entirety by the terms of the Shareholder Rights Agreement, a copy of which is attached hereto as Exhibit 99.2 and is

incorporated in its entirety in this Item 6.

Registration Rights Agreement and Registration Rights Assignment Agreement

The Issuer and each of the First Reserve Partnerships are parties to a Registration Rights Agreement, dated April 1, 2014

(the “Registration Rights Agreement”), which provides the First Reserve Partnerships with certain rights to cause Ordinary Shares to be registered under the Securities Act of 1933, as amended (the “Securities Act”),

in accordance with the terms and conditions of the Registration Rights Agreement. The First Reserve Partnerships are entitled to make three written requests for the Company to register all or any part of the Registrable Securities under the

Securities Act, subject to certain exceptions and conditions set forth in the Registration Rights Agreement. The First Reserve Partnerships were also granted “piggyback” registration rights with respect to the Company’s registration

of Ordinary Shares for its own account or for the account of one or more of its securityholders. References to, and descriptions of, the Registration Rights Agreement as set forth in this Item 6 are qualified in their entirety by the terms of

the Registration Rights Agreement, a copy of which is attached hereto as Exhibit 99.3, which is incorporated in its entirety in this Item 6.

The First Reserve Partnerships executed a Registration Rights Assignment Agreement, dated June 3, 2015 (the

“Registration Rights Assignment Agreement”), which provides for an assignment of all rights under the Registration Rights Agreement to the Reporting Person, other than certain rights regarding the existing shelf registration

statement that shall remain with the First Reserve Partnerships (collectively, the “CPPIB Registration Rights”). Pursuant to Section 3.01 of the Shareholder Rights Agreement, the Issuer consented to the assignment of the CPPIB

Registration Rights to the Reporting Person. References to, and descriptions of, the Registration Rights Assignment Agreement as set forth in this Item 6 are qualified in their entirety by the terms of the Registration Rights Assignment

Agreement, a copy of which is attached hereto as Exhibit 99.4 and is incorporated in its entirety in this Item 6.

| Item 7. |

Material to be Filed as Exhibits |

|

|

|

| Exhibit No. |

|

Description |

|

|

| 99.1 |

|

Securities Purchase Agreement, dated May 29, 2015, by and among First Reserve Fund XII, L.P., FR XII-A Parallel Vehicle L.P., FR XI Offshore AIV, L.P., FR Torus Co-Investment, L.P. and Canada Pension Plan Investment Board

(attached as Exhibit 99.1 to the Schedule 13D/A filed by the First Reserve Partnerships, First Reserve GP XII Limited, First Reserve GP XII, L.P., FR XI Offshore GP, L.P., FR XI Offshore GP Limited and William E. Macaulay (File

No. 005-83620) with the Securities and Exchange Commission on June 1, 2015 and incorporated herein by reference). |

|

|

| 99.2 |

|

Shareholder Rights Agreement, dated June 3, 2015, between Enstar Group Limited and Canada Pension Plan Investment Board (attached as Exhibit 10.1 to the Form 8-K filed by the

Issuer (File No. 001-33289) with the Securities and Exchange Commission on June 3, 2015 and incorporated herein by reference). |

|

|

| 99.3 |

|

Registration Rights Assignment Agreement, dated June 3, 2015, by and among First Reserve Fund XII, L.P., FR XII-A Parallel Vehicle L.P., FR XI Offshore AIV, L.P., FR Torus Co-Investment, L.P., Canada Pension Plan Investment

Board and Enstar Group Limited. |

|

|

| 99.4 |

|

Registration Rights Agreement, dated April 1, 2014, among Enstar Group Limited, FR XI Offshore AIV, L.P., First Reserve Fund XII, L.P., FR XII A Parallel Vehicle L.P., FR Torus Co-Investment, L.P. and Corsair Specialty

Investors, L.P. (attached as Exhibit 10.1 to the Form 8-K filed by the Issuer (File No. 001-33289) with the Securities and Exchange Commission on April 4, 2014 and incorporated herein by

reference). |

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

|

| June 3, 2015 |

| Date |

|

| CANADA PENSION PLAN INVESTMENT BOARD |

|

| /s/ Eric M. Wetlaufer |

| Signature |

|

| Eric M. Wetlaufer

Senior Managing Director & Global Head of Public Market Investments |

| Name/Title |

ATTENTION

Intentional misstatements or omissions of fact constitute Federal Criminal Violations (See 18 U.S.C. 1001).

Schedule 1

The following sets forth the name, business address, and present principal occupation and citizenship of each manager, executive officer and

controlling person of the Reporting Person.

Directors of the Reporting Person

Heather Munroe-Blum

c/o Canada Pension Plan Investment Board,

One Queen Street East, Suite 2500, Toronto, ON M5C 2W5

Principal Occupation: Director

Citizenship: Canada

Ian A. Bourne

c/o Canada Pension Plan Investment Board, One Queen Street East, Suite 2500, Toronto, ON M5C 2W5

Principal Occupation: Director

Citizenship: Canada

Robert L. Brooks

c/o Canada Pension Plan Investment Board, One

Queen Street East, Suite 2500, Toronto, ON M5C 2W5

Principal Occupation: Director

Citizenship: Canada, Ireland

Pierre Choquette

c/o Canada Pension Plan Investment Board, One Queen Street East, Suite 2500, Toronto, ON M5C 2W5

Principal Occupation: Director

Citizenship: Canada

Michael Goldberg

c/o Canada Pension Plan Investment Board, One

Queen Street East, Suite 2500, Toronto, ON M5C 2W5

Principal Occupation: Director

Citizenship: Canada, United States

Tahira Hassan

c/o Canada Pension Plan Investment Board, One Queen Street East, Suite 2500, Toronto, ON M5C 2W5

Principal Occupation: Director

Citizenship: Canada, Pakistan

Nancy Hopkins

c/o Canada Pension Plan Investment Board,

One Queen Street East, Suite 2500, Toronto, ON M5C 2W5

Principal Occupation: Director

Citizenship: Canada

Douglas W. Mahaffy

c/o Canada Pension Plan Investment Board, One Queen Street East, Suite 2500, Toronto, ON M5C 2W5

Principal Occupation: Director

Citizenship: Canada

Karen Sheriff

c/o Canada Pension Plan Investment Board, One

Queen Street East, Suite 2500, Toronto, ON M5C 2W5

Principal Occupation: Director

Citizenship: Canada, United States

Kathleen Taylor

c/o Canada Pension Plan Investment Board, One Queen Street East, Suite 2500, Toronto, ON M5C 2W5

Principal Occupation: Director

Citizenship: Canada

D. Murray Wallace

c/o Canada Pension Plan Investment Board, One Queen Street East, Suite 2500, Toronto, ON M5C 2W5

Principal Occupation: Director

Citizenship: Canada

Jo Mark Zurel

c/o Canada Pension Plan Investment Board, One

Queen Street East, Suite 2500, Toronto, ON M5C 2W5

Principal Occupation: Director

Citizenship: Canada, South Africa

Officers

of the Reporting Person

Mark Wiseman

c/o Canada

Pension Plan Investment Board, One Queen Street East, Suite 2500, Toronto, ON M5C 2W5

Principal Occupation: President & Chief Executive Officer

Citizenship: Canada

Edwin D. Cass

c/o Canada Pension Plan Investment Board, One Queen Street East, Suite 2500, Toronto, ON M5C 2W5

Principal Occupation: Senior Managing Director & Chief Investment Strategist

Citizenship: Canada

Graeme Eadie

c/o Canada Pension Plan Investment Board, One Queen Street East, Suite 2500, Toronto, ON M5C 2W5

Principal Occupation: Senior Managing Director & Global Head of Real Estate Investments

Citizenship: Canada

Mark Jenkins

c/o Canada Pension Plan Investment Board, One Queen Street East, Suite 2500, Toronto, ON M5C 2W5

Principal Occupation: Senior Managing Director & Global Head of Private Investments

Citizenship: Canada, United States

Pierre Lavallée

c/o Canada Pension Plan Investment Board, One Queen Street East, Suite 2500, Toronto, ON M5C 2W5

Principal Occupation: Senior Managing Director & Global Head of Investment Partnerships and Chief Talent Officer

Citizenship: Canada

Michel Leduc

c/o Canada Pension Plan Investment Board, One Queen Street East, Suite 2500, Toronto, ON M5C 2W5

Principal Occupation: Senior Managing Director & Global Head of Public Affairs and Communications

Citizenship: Canada

Mark Machin

c/o Canada Pension Plan Investment Board, One Queen Street East, Suite 2500, Toronto, ON M5C 2W5

Principal Occupation: Senior Managing Director & Head of International and President (CPPIB Asia Inc.)

Citizenship: Great Britain

Benita M. Warmbold

c/o Canada Pension Plan Investment Board, One Queen Street East, Suite 2500, Toronto, ON M5C 2W5

Principal Occupation: Senior Managing Director & Chief Financial Officer

Citizenship: Canada, Germany

Eric M. Wetlaufer

c/o Canada Pension Plan Investment Board, One Queen Street East, Suite 2500, Toronto, ON M5C 2W5

Principal Occupation: Senior Managing Director & Global Head of Public Market Investments

Citizenship: United States

Nicholas Zelenczuk

c/o Canada Pension Plan Investment Board, One Queen Street East, Suite 2500, Toronto, ON M5C 2W5

Principal Occupation: Senior Managing Director & Chief Operations Officer

Citizenship: Canada

Exhibit 99.3

Execution Version

REGISTRATION RIGHTS ASSIGNMENT AGREEMENT

THIS REGISTRATION RIGHTS ASSIGNMENT AGREEMENT (this “Agreement”) dated as of this 3rd day of June, 2015, by and among First Reserve Fund XII, L.P., a Cayman Islands limited partnership (“FRF”), FR XII-A Parallel Vehicle, L.P., a Cayman Islands limited

partnership (“FRA”), FR XI Offshore AIV, L.P., a Cayman Islands limited partnership (“FR AIV”), FR Torus Co-Investment, L.P., a Cayman Islands limited partnership, as assignors (“FRT” and together

with FRF, FRA and FR AIV, the “Assignors” and each a “Assignor”), CANADA PENSION PLAN INVESTMENT BOARD, a Canadian federal Crown corporation, as assignee (the “Assignee”) and ENSTAR GROUP LIMITED, a

Bermuda company (the “Company”). Capitalized terms used herein shall have meanings assigned to such terms in the Securities Purchase Agreement (as defined below) unless otherwise defined herein or the context clearly requires

otherwise.

W I T N E S S E T H:

WHEREAS, in connection with and pursuant to the Securities Purchase Agreement by and among the Assignee and the Assignors, dated May 29,

2015 (the “Securities Purchase Agreement”), Assignee will acquire from Assignors, subject to the conditions set forth therein, Ordinary Shares and Series E Shares of the Company;

WHEREAS, as a condition to Assignee’s obligations to the Securities Purchase Agreement, Assignors are entering into this Agreement for

the purpose of, among other things, (i) assigning to Assignee all of Assignors’ right and interest in the Registration Rights Agreement, dated as of April 1, 2014, among the Company, the Assignors and Corsair Specialty

Investor, L.P., other than as specified below (the “Registration Rights Agreement”) and (ii) delegating to Assignee all of the duties of the Assignors in and under the Registration Rights Agreement, in each case other

than as specified below; and

WHEREAS, the Company consents to the assignment described above as of the Effective Date (as defined in

Section 6 of this Agreement).

NOW, THEREFORE, in consideration of the premises and the mutual covenants herein contained, and other

good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the parties hereto do hereby agree as follows:

Section 1. Assignment. Assignors hereby assign unto Assignee and its successors and assigns all of their right and interest in and

to, and remedies under, the Registration Rights Agreement, including all rights exercisable by Assignors thereunder from and after such Effective Time, provided that Assignors shall retain all rights and related obligations under Section 1 of

the Registration Rights Agreement with respect to the Mandatory Shelf Registration Statement (as defined therein) and under Section 4, 5, 6, 8, 9, 10, 11 and 12 to the extent, and only to the extent, associated with such Mandatory Shelf

Registration Statement (and, in the case of Section 8, sales pursuant to Rule 144). Notwithstanding the foregoing, Assignors shall have no obligations under Section 9 of the Registration Rights Agreement after the earliest to occur of

clauses (A) through (E) in Section 1(b) of the Registration Rights Agreement. Assignors represent and warrant that the Assignors (i) are not in breach and have not previously been in breach of the Registration Rights

Agreement, (ii) have not exercised any of the three demand registration rights pursuant to Section 2 of the Registration Rights Agreement and (iii) have not assigned

or encumbered any of their rights under the Registration Rights Agreement, other than the assignment to the Assignee contemplated hereby.

Section 2. Assumption. Assignee hereby assumes all of Assignors’ obligations under the Registration Rights Agreement arising

from and after such Effective Time, other than to the extent retained by Assignors pursuant to Section 1 hereof.

Section 3.

Consent and Confirmation

(a) The Company hereby consents to the assignment of all of Assignors’ right and interest in the

Registration Rights Agreement, including all rights exercisable by the Assignors thereunder from and after such Effective Time, subject to the retention of rights pursuant to Section 1 hereof and recognizes Assignee as the Assignors’

successor-in-interest in and to the Registration Rights Agreement. For the avoidance of doubt, the Company agrees that from and after such assignment and assumption: (i) all references to “Parent Shares” or “Common

Shares” or “Series B Convertible Participating Non-Voting Perpetual Preferred Stock” of the Company or “Registrable Securities” acquired by Assignors under the Amalgamation Agreement (as defined in the Registration Rights

Agreement) shall be deemed to refer to the Common Shares and Non-Voting Shares acquired by Assignee under the Securities Purchase Agreement, (ii) the six-month waiting period referred to in Section 2(a) of the Registration Rights

Agreement has been satisfied and shall have no application to the Assignee, and (iii) notices to the Assignee pursuant to the Registration Rights Agreement shall be sent in accordance with the notice provisions of the Securities Purchase

Agreement. The Company further agrees that (i) no breach by Assignors or any of the rights or obligations retained by Assignors hereunder shall prejudice or limit any of the rights of Assignee under the Registration Rights Agreement and

(ii) no breach by Assignee of any of the rights or obligations assigned to Assignee hereunder, shall prejudice or limit any of the rights of Assignors retained by them hereunder in respect of the Registration Rights Agreement.

(b) The Company hereby confirms to Assignee that (i) the Registration Rights Agreement is in full force and effect and

(ii) to the best of its knowledge, there exists no actual, claimed or threatened breach, nor any actual, claimed or threatened event which, but for the passage of time, the giving of notice, or both, would constitute a breach under the

Registration Rights Agreement with respect to the performance of any of the terms, covenants or conditions to be performed thereunder.

Section 4. Securities Purchase Agreement. Assignee and the Assignors, by execution of this Agreement, each hereby acknowledge and

agree that neither the representations and warranties nor the rights, obligations or remedies of any party under the Securities Purchase Agreement shall be deemed to be abrogated, modified or altered in any way by execution or acceptance of this

Agreement.

Section 5. Effectiveness. This Agreement shall become effective as of and subject to the closing under the

Securities Purchase Agreement.

Section 6. Miscellaneous. Sections 8.3-8.19, other than Section 8.10, from the Securities

Purchase Agreement are incorporated herein mutatis mutandis, provided, notices to the Company shall be delivered to:

2

Enstar Group Limited

P.O. Box HM 2267

Windsor Place, 3rd Floor, 22 Queen Street

Hamilton HM JX

Bermuda

Attention: Paul J. O’Shea, Joint Chief Operating Officer

Facsimile: (441) 296-7319

E-mail:

paul.o’shea@enstargroup.com

with a copy (which shall not constitute notice to the Company) to:

Drinker Biddle & Reath LLP

One Logan Square, Suite

2000

Philadelphia, PA 19103

Attention: Robert C. Juelke

Facsimile: (215) 988-2757

E-mail:

robert.juelke@dbr.com

[Signature Pages Follow]

3

IN WITNESS WHEREOF, the parties hereto have each caused this Agreement to be duly executed as of

the date first written above.

|

|

|

|

|

| ASSIGNORS: |

|

| First Reserve Fund XII, L.P. |

|

|

| By: |

|

First Reserve GP XII, L.P., its general partner |

| By: |

|

First Reserve GP XII Limited, its general partner |

|

|

| By: |

|

/s/ Kenneth W. Moore |

|

|

Name: |

|

Kenneth W. Moore |

|

|

Title: |

|

Director |

|

| FR XII-A Parallel Vehicle, L.P. |

|

|

| By: |

|

First Reserve GP XII, L.P., its general partner |

| By: |

|

First Reserve GP XII Limited, its general partner |

|

|

| By: |

|

/s/ Kenneth W. Moore |

|

|

Name: |

|

Kenneth W. Moore |

|

|

Title: |

|

Director |

|

| FR XI Offshore AIV, L.P. |

|

|

| By: |

|

FR XI Offshore GP, L.P., its general partner |

| By: |

|

FR XI Offshore GP Limited, its general partner |

|

|

| By: |

|

/s/ Kenneth W. Moore |

|

|

Name: |

|

Kenneth W. Moore |

|

|

Title: |

|

Director |

|

|

|

|

|

| FR Torus Co-Investment, L.P. |

|

|

| By: |

|

First Reserve GP XII Limited, is general partner |

|

|

| By: |

|

/s/ Kenneth W. Moore |

|

|

Name: |

|

Kenneth W. Moore |

|

|

Title: |

|

Director |

|

| ASSIGNEE: |

|

| Canada Pension Plan Investment Board |

|

|

| By: |

|

/s/ R. Scott Lawrence |

|

|

Name: |

|

R. Scott Lawrence |

|

|

Title: |

|

Managing Director, Head of Relationship Investments |

|

|

| By: |

|

/s/ Eric M. Wetlaufer |

|

|

Name: |

|

Eric M. Wetlaufer |

|

|

Title: |

|

Senior Managing Director & Global Head of Public Market Investments |

|

| COMPANY: |

|

| Enstar Group Limited |

|

|

| By: |

|

/s/ Dominic F. Silvester |

|

|

Name: |

|

Dominic F. Silvester |

|

|

Title: |

|

Chief Executive Officer |

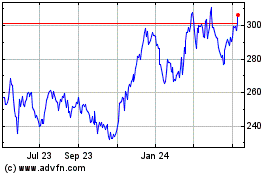

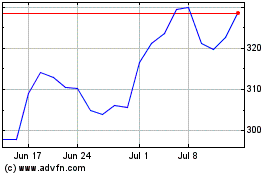

Enstar (NASDAQ:ESGR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Enstar (NASDAQ:ESGR)

Historical Stock Chart

From Apr 2023 to Apr 2024