Ericsson Shares Plunge on Profit Warning -- 3rd Update

October 12 2016 - 6:26AM

Dow Jones News

By Matthias Verbergt and Dominic Chopping

STOCKHOLM-- Ericsson AB, one of the world's largest makers of

telecom equipment and Sweden's flagship tech company, Wednesday

capped a series of management shake-up and job-cut announcements

with a profit warning that sent its share price tumbling and laid

bare how the rise of Asian rivals has wounded Western

suppliers.

The company said its third-quarter earnings will be

"significantly lower" than expected, citing a 19% sales decline in

its core mobile-network equipment business.

The news sent the company's share price down as much as 18%

Wednesday morning.

Ericsson is being hit hard as spending by mobile-service

providers on latest-generation, or 4G, networks has largely dried

up, with most mobile-broadband projects having been completed last

year. At the same time, competition has risen, with Huawei

Technologies Co. of China expanding aggressively on the traditional

European turf of Ericsson and Finland's Nokia Corp.

The company has also been hurt by economic weakness in

developing markets such as Brazil, Russia and the Middle East.

Ericsson said it expected to post third-quarter sales of 51.1

billion Swedish kronor ($5.79 billion), down 14% from 59.2 billion

kronor last year, with operating profit falling 93% to 300 million

kronor from 5.1 billion kronor, partly on restructuring charges of

1.3 billion kronor.

Jan Frykhammar--who took over as interim chief executive in July

after CEO Hans Vestberg was ousted --offered no prospect for a

quick turnaround, warning that additional cost-cutting measures may

be necessary.

"Continued progress in our cost reduction programs did not

offset the lower sales and gross margin," Mr. Frykhammar said. "We

will continue to drive the ongoing cost program and implement

further reductions in cost of sales to meet the lower sales

volumes."

"Ericsson's profit warning is troublesome and underlines how

very weak business climate is within radio and mobile broadband,"

said Mathias Lundberg, an analyst at Swedbank. He added that the

slowdown in global mobile-phone sales was also denting Ericsson's

lucrative patent business.

Ericsson is now betting on the development of faster wireless

networks, called 5G, and software-based services such as the

so-called "internet of things" and cloud computing. But the first

revenue from 5G is several years away and take-up has been slow,

analysts say.

Ericsson's said the shift to services sales contributed to a

decline of its third-quarter gross margin to 28%, compared with 34%

in the same period last year.

Last week, Ericsson announced plans to lay off nearly 20% of its

16,000-strong home-country workforce. The job cuts were a first

step in a wider restructuring program in which Ericsson plans to

significantly reduce its global staff of 115,000.

Mr. Frykhammar said he expects the current trends to continue in

the next two to three quarters. Ericsson said it will provide more

details on Oct. 21, when it publishes its full third-quarter

report.

Write to Matthias Verbergt at Matthias.Verbergt@wsj.com and

Dominic Chopping at dominic.chopping@wsj.com

(END) Dow Jones Newswires

October 12, 2016 06:11 ET (10:11 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

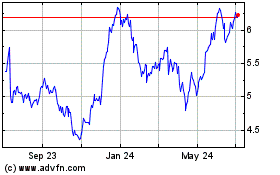

Ericsson (NASDAQ:ERIC)

Historical Stock Chart

From Mar 2024 to Apr 2024

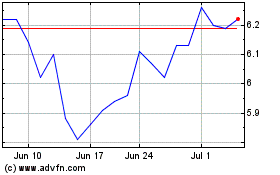

Ericsson (NASDAQ:ERIC)

Historical Stock Chart

From Apr 2023 to Apr 2024