(FROM THE WALL STREET JOURNAL 11/10/15)

By Don Clark and Jens Hansegard

STOCKHOLM -- Networking giants Ericsson AB and Cisco Systems

Inc. are forging an unusual alliance to better take on a rapidly

shifting global market and combat the rise of such rivals as

China's Huawei Technologies Co.

The pact, announced Monday, stops short of a full-blown merger

but has aspects of one: Ericsson, a leader in wireless equipment,

and Cisco, which dominates the market for Internet gear, will work

together to integrate existing equipment. They will combine some

sales and consulting efforts and, ultimately, may jointly develop

entirely new hardware and services.

Both companies are coping with challenges that include a

slowdown in the smartphone market, a longtime driver of revenues

for the telecom companies that are their biggest customers. They

also face heightened competition from Huawei, as well as a new

threat created by the pending 15.6 billion euros ($16.8 billion)

takeover of Alcatel-Lucent SA by Nokia Corp. Those rivals have

expertise in both wireless and Internet technologies, a combination

that Cisco and Ericsson hope to now match, said Pierre Ferragu, an

analyst at Sanford C. Bernstein.

At the same time, the deal underscores a widening recognition of

the downsides of large mergers, particularly cross-border

transactions that can face regulatory scrutiny in many

countries.

"Neither Ericsson or Cisco really believe that these large

mergers typically work," Chuck Robbins, Cisco's chief executive,

said in an interview.

Cisco and Ericsson, in negotiations for 13 months, said

alliances can bring benefits to companies and customers more

quickly. They projected their alliance would add $1 billion or more

in annual sales for each company by 2018.

"This is a much more agile and efficient choice," Hans Vestberg,

Ericsson's chief executive, said in an interview. "We can start

already tomorrow."

Analysts don't expect formal reviews by antitrust authorities,

but politicians on both sides of the Atlantic may take a close

look. Governments have been eager to closely monitor suppliers of

equipment regarded as highly sensitive for security and privacy

reasons. Huawei has been essentially shut out of the U.S. market

after a congressional report deemed it a risk to national

security.

Ericsson, a Swedish company that traces its history to 1876,

makes hardware that manages wireless connections, as well as

network operations and billing systems. Cisco, a Silicon Valley

company founded in 1984, is known for switches and routers that

connect computers together and to the Internet.

For Ericsson, the alliance could help retain its position as the

world's biggest telecom-equipment supplier by sales, just as its

Nordic rival Nokia regains strength. Nokia's takeover of

Alcatel-Lucent could create a powerful challenger to both Ericsson

and Cisco.

To find new revenues, analysts said, Cisco and Ericsson must

develop new products to cope with changes in the networks operated

by mobile and wireline carriers -- as well as exploit a trend

called the "Internet of Things," which will connect more everyday

devices to one another.

The other problem is Huawei, which recently overtook Ericsson in

the market for mobile infrastructure equipment, according to

analysts at Dell'Oro Group. Huawei received 30% of revenues in that

market during the first half of 2015, according to the research

firm, compared with 27% for Ericsson and 25% for the combination of

Nokia and Alcatel-Lucent.

Meantime, Ericsson's core business of supplying equipment has

suffered from price competition and from the relatively slow

rollout of broadband wireless networks, known by the acronym 4G, by

its carrier customers.

Cisco also faces pressure from Huawei. Dell'Oro estimates that

the Chinese company accounts for 13% of the global router business

-- Cisco has 49% -- but Huawei has displaced Cisco as No. 1 in

China.

Technology changes at telecom carriers are equally important.

"These service providers are looking to build their networks in a

different way," said Chris DePuy, a Dell'Oro analyst.

For one thing, telecom carriers are using computers equipped

with software for some of their key operations rather than buying

special-purpose equipment.

Those combinations, which Cisco is working to deliver, are

likely to be increasingly integrated with the kind of gear for

managing billing and operations that Ericsson specializes in, Mr.

DePuy said.

"That is one of the first things that is going to bring value to

the operators," Mr. Robbins said.

In the short term, one benefit of the alliance is for Ericsson

to resell Cisco networking gear. The Swedish company also has

65,000 service personnel that help advise carriers on how to build

networks. Cisco, which has 11,000 service workers, can take

advantage of the Ericsson staff, Mr. Robbins said.

Ericsson, which has around 116,240 employees, reported revenue

last year of 228 billion Swedish kronor ($26.3 billion). Cisco,

which employs 70,000 people, reported revenue of $49.2 billion in

its latest fiscal year, which ended in July.

The companies sell some competing equipment, but the overlap is

small. Cisco accounted for 1% of the wireless infrastructure market

in the first half, while Ericsson accounted for 1% of the routing

market, Dell'Oro estimates.

An added wrinkle of the partnership concerns patents. Ericsson,

a wireless pioneer, claims 37,000 patents to Cisco's 19,000. The

companies said they expected to complete a patent cross-license

agreement under which Cisco would pay an unspecified amount to

Ericsson for use of its patents.

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 10, 2015 02:48 ET (07:48 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

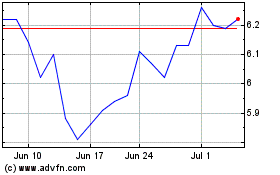

Ericsson (NASDAQ:ERIC)

Historical Stock Chart

From Mar 2024 to Apr 2024

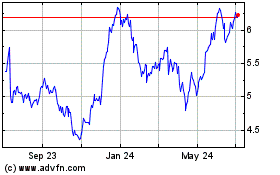

Ericsson (NASDAQ:ERIC)

Historical Stock Chart

From Apr 2023 to Apr 2024