SECOND QUARTER HIGHLIGHTS

-

Reported sales increased by 11% YoY. Sales,

adjusted for comparable units and currency, decreased by -6%

YoY.

-

The mobile broadband business in North America

stabilized in the quarter, but remained at a lower level than a

year ago.

-

Professional Services continued to deliver

strong sales growth YoY.

-

Sales in segment Networks recovered and showed a

growth QoQ of 18%.

-

Gross margin decreased YoY to 33.2% (36.4%).

Excluding restructuring charges, gross margin was 35.1% (36.6%) due

to lower capacity business in North America and continued 4G

coverage deployments in Mainland China, lower IPR revenues and

higher share of services sales.

-

The global cost and efficiency program is

progressing according to plan and restructuring charges in the

quarter were SEK 2.7 (0.2) b., mainly related to the reductions in

Sweden.

-

Operating income, excluding restructuring

charges, improved in all segments YoY to SEK 6.3 (4.2) b. and

segment Networks operating margin recovered from last

quarter.

-

Cash flow from operating activities recovered to

SEK 3.1 (2.1) b., after a weak first quarter.

| SEK b. |

Q2

2015 |

Q2

2014 |

YoY

change |

Q1

2015 |

QoQ

change |

Six months

2015 |

Six months

2014 |

| Net sales |

60.7 |

54.8 |

11% |

53.5 |

13% |

114.2 |

102.4 |

| Sales growth adj. for comparable

units and currency |

- |

- |

-6% |

- |

12% |

-6% |

-4% |

| Gross margin |

33.2% |

36.4% |

- |

35.4% |

- |

34.2% |

36.4% |

| Gross margin excluding

restructuring charges |

35.1% |

36.6% |

- |

36.3% |

- |

35.7% |

36.6% |

| Operating income |

3.6 |

4.0 |

-11% |

2.1 |

67% |

5.7 |

6.6 |

| Operating income excluding

restructuring charges |

6.3 |

4.2 |

49% |

2.7 |

129% |

9.1 |

7.0 |

| Operating margin |

5.9% |

7.3% |

- |

4.0% |

- |

5.0% |

6.5% |

| Operating margin excluding

restructuring charges |

10.4% |

7.7% |

- |

5.1% |

- |

7.9% |

6.8% |

| Net income |

2.1 |

2.7 |

-20% |

1.5 |

46% |

3.6 |

4.4 |

| EPS diluted, SEK |

0.64 |

0.79 |

-19% |

0.40 |

60% |

1.04 |

1.44 |

| EPS (Non-IFRS), SEK 1) |

1.45 |

1.07 |

36% |

0.77 |

88% |

2.22 |

1.98 |

| Cash flow from operating activities |

3.1 |

2.1 |

50% |

-5.9 |

-152% |

-2.8 |

11.5 |

| Net cash, end of period |

3.5 |

32.5 |

-89% |

15.6 |

-78% |

3.5 |

32.5 |

| 1) EPS, diluted, excl. amortizations and write-downs of

acquired intangible assets, and restructuring. |

Comments from Hans Vestberg,

President and CEO of Ericsson (NASDAQ:ERIC)

Reported sales increased by 11%. Sales, adjusted

for comparable units and currency, decreased by -6% YoY, mainly

impacted by less capacity business in North America. Profitability

improved sequentially, driven by a strong development in segment

Networks.

Business

The mobile broadband business in North America stabilized in the

quarter, but remained at a lower level than a year ago. The YoY

decline in North America was partly offset by an increased pace of

4G deployments in Mainland China. Sales growth was strong in the

Middle East, India and South East Asia, while it continued to be

weak in Japan. Professional Services sales increased YoY with

continued strong global demand and growth in all ten regions.

The OSS & BSS business had a favorable

development YoY, contributing to sales both in Professional

Services and segment Support Solutions.

Segment Networks sales increased by 18%

sequentially, supported by the stabilized mobile broadband sales in

North America.

Profitability

Operating income, excluding restructuring charges,

increased YoY by almost 50%, with improvements in all segments.

After a weak first quarter, segment Networks profitability

recovered, driven by increased sales and a positive currency hedge

effect.

IPR revenues

Reported IPR revenues were slightly down YoY despite a positive

currency effect as a majority of the licenses contracts are in USD.

The decline was primarily due to the ongoing dispute with a major

customer.

Cost and efficiency

program

The global cost and efficiency program is progressing according to

plan. The target, to achieve savings of approximately SEK 9 b.

during 2017 relative to 2014, remains. During the quarter, numerous

activities were implemented globally including a reduction of 2,100

positions in Sweden, resulting in higher than normal restructuring

charges. Savings related to the activities will start to impact

results towards the end of this year.

Cash flow

After a weak first quarter, cash flow from operating activities was

positive in the quarter. As cash flow is volatile between quarters

it should be viewed on a full-year basis. Our full-year cash

conversion target of more than 70% remains.

Targeted growth

areas

Our growth strategy builds on a combination of excelling in our

core business and establishing leadership in targeted growth areas.

We see good progress in the targeted areas and sales continued its

strong development from the first quarter. This was mainly driven

by a solid sales development in OSS & BSS.

The consolidation in the industry continues, both

among vendors and customers, creating opportunities and challenges.

Therefore we have, during the first half of 2015, accelerated our

transformation journey towards becoming a true ICT company. With

our ongoing strategic initiatives we are well positioned to

continue to create value for our customers in a transforming

market.

NOTES TO EDITORS

You find the complete report with tables in the

attached PDF or by following this link

www.ericsson.com/res/investors/docs/q-reports/2015/06month15-en.pdf

or on www.ericsson.com/investors

Ericsson invites media, investors and analysts to

a briefing at the Ericsson Studio, Grönlandsgången 4, Stockholm, at

09.00 (CET), July 17, 2015.

A conference call for analysts, investors and media will begin at

14.00 (CET).

Live webcast of the briefing and conference call

details, as well as supporting slides, will be available at

www.ericsson.com/press and www.ericsson.com/investors

Video material will be published during the day on

www.ericsson.com/press

FOR FURTHER INFORMATION, PLEASE CONTACT

Helena Norrman, Senior Vice President, Marketing

and Communications

Phone: +46 10 719 34 72

E-mail: media.relations@ericsson.com

Investors

Peter Nyquist, Head of Investor

Relations

Phone: +46 10 714 64 49

E-mail: peter.nyquist@ericsson.com

Åsa Konnbjer, Director, Investor

Relations

Phone: +46 10 713 39 28

E-mail: asa.konnbjer@ericsson.com

Stefan Jelvin, Director, Investor

Relations

Phone: +46 10 714 20 39

E-mail: stefan.jelvin@ericsson.com

Rikard Tunedal, Director, Investor

Relations

Phone: +46 10 714 54 00

E-mail: rikard.tunedal@ericsson.com

Media

Ola Rembe, Vice President, Head of External

Communications

Phone: +46 10 719 97 27

E-mail: media.relations@ericsson.com

Corporate Communications

Phone: +46 10 719 69 92

E-mail: media.relations@ericsson.com

Ericsson discloses the information provided herein

pursuant to the Securities Markets Act. The information was

submitted for publication at 07.30 CET, on July 17, 2015.

Ericsson second quarter report

2015

This

announcement is distributed by NASDAQ OMX Corporate Solutions on

behalf of NASDAQ OMX Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Ericsson via Globenewswire

HUG#1939509

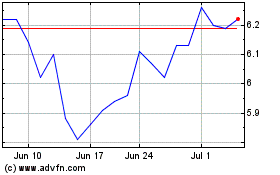

Ericsson (NASDAQ:ERIC)

Historical Stock Chart

From Mar 2024 to Apr 2024

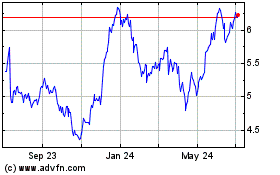

Ericsson (NASDAQ:ERIC)

Historical Stock Chart

From Apr 2023 to Apr 2024