Among the companies with shares expected to trade actively in

Thursday's session are Alibaba Group Holding Ltd. (BABA), Regeneron

Pharmaceuticals Inc. (REGN) and Merck & Co. (MRK).

Alibaba Group Holding Ltd. on Thursday reported a

better-than-expected surge in revenue in the final quarter of the

year as the Chinese e-commerce giant continued to add users and

drive mobile sales. Shares rose 5.32% to $79.89 in premarket

trading.

Regeneron Pharmaceuticals Inc. on Thursday said revenue

increased a better-than-expected 38% in its first quarter as sales

continued to surge for its key eye-disease treatment. Shares rose

4.2% to $375.79 premarket.

Merck & Co. posted a revenue decline as generic competition

and currency fluctuations hurt results. Shares rose 0.26% to $54.95

premarket.

Drug wholesaler AmerisourceBergen Corp. (ABC) swung to a profit

for the March quarter but cut its earnings guidance for the current

fiscal year amid continued generic-drug pricing pressures in the

sector. Shares fell 9.24% to $76.50 premarket.

AT&T (T) said Wednesday that it has awarded a contract to

host its Web and mobile portals to Synacor Inc. (SYNC). Shares of

Synacor rose 148.23% to $3.50 premarket.

Avon Products Inc. (AVP) on reported its loss worsened in the

most recent quarter, dented by foreign currency challenges,

restructuring and the deconsolidation of its Venezuela operations

as it works through a major rehaul of its business. Shares fell

4.42% to $4.11 premarket.

Occidental Petroleum Corp. (OXY) posted a profit in its latest

quarter, helped by a hefty tax benefit, as the company continues to

cut costs amid a low-energy-price environment.

Costco Wholesale Corp. (COST) said total sales in April rose 3%

to $8.98 billion, helped by strength in Canada. Shares fell 1.73%

to $148.89 premarket.

Kellogg Co. (K) said its first-quarter earnings fell 33% in the

latest quarter as lower revenue, dinged by currency translations,

and higher interest expense hurt the company's bottom line.

Cable networks powered revenue and adjusted profit growth for

21st Century Fox (FOXA) in the March quarter, as increases in

subscription fees and ad dollars offset higher programming

expenses.

Hail storms, market volatility and persistently low interest

rates stung more insurers in the first quarter, as four of the

biggest companies in the sector on Wednesday reported sharply lower

operating profits.

Equinix Inc. (EQIX) swung to a loss in the latest quarter as

expenses climbed in the wake of recent acquisitions.

Fitbit Inc. on Wednesday raised its financial projections for

the year as it reported sales surged in the first quarter. Higher

expenses, however, lowered profit and eroded margins.

GoDaddy Inc. (GDDY) on Wednesday reported an increase in

customers and average revenue per user during the first quarter as

total revenue slightly exceeded its guidance.

IAC/InterActiveCorp.(IAC), which last year spun off its dating

websites as Match Group Inc., on Wednesday reported a 6% increase

in revenue, though profit dropped sharply in the first quarter.

Kraft Heinz Co.(KHC), run by the Brazilian private-equity firm

3G Capital Partners LP, said Wednesday that sales fell 3.8% in the

first quarter. The company attributed the decline largely to

currency conversions.

Leucadia National Corp.(LUK), the parent of investment bank

Jefferies, swung to a first-quarter loss, driven by losses at the

investment bank. The New York holding company also booked a $53.2

million investment loss tied to its bailout of currency-trading

firm FXCM Inc. last year, when Switzerland's central bank lifted

its cap on the Swiss franc's exchange rate against the euro.

Marathon Oil Corp. on Wednesday said its quarterly revenue was

cut in half, year-over-year, and fell below $1 billion for the

first time since becoming a standalone company in 2002.

McKesson Corp.'s (MCK) profit rose in the fourth quarter, helped

by higher revenue and a reduction in operating expenses.

Plains All American Pipeline LP's (PAA) first-quarter profit

fell 29% as the master limited partnership said drilling and

completion activity has "meaningfully" declined in the last few

months.

Oil driller Transocean Ltd. (RIG) swung to a first-quarter

profit as it slashed spending to offset a 35% revenue drop brought

on by an oil rut amid a supply glut wreaking havoc through the

sector.

Tesla Motors Inc.'s (TSLA) first-quarter losses widened to $283

million as lower-than-expected deliveries hurt revenues.

TripAdvisor Inc.'s (TRIP) first-quarter profit dropped sharply

on higher expenses and lower revenue, driven by a drop in

click-based advertising.

WebMD Health Corp. (WBMD) on Wednesday posted quarterly revenue

and profit that beat market expectations, propelled by a 15% climb

in its advertising and sponsorship sales.

Weight Watchers International Inc. (WTW) on Wednesday raised its

annual projections as it reported a narrower-than-expected

first-quarter loss.

Whole Foods Market Inc. (WFM) on Wednesday cut its financial

projections for the year and projected a decline in a key sales

metric as the supermarket chain tries to revamp operations.

Williams Cos. (WMB) swung to a first-quarter loss and the

pipeline company's chief executive disclosed additional cost cuts,

including reducing its workforce by 10%. The Tulsa, Okla., company

is in the process of being acquired in a $32.6 billion deal by

Energy Transfer Equity LP (ETE), which along with affiliate Energy

Transfer Partners LP (ETP) posted lower revenue for the three-month

period ended in March.

Zynga Inc. (ZNGA) on Wednesday reported first-quarter results

that beat expectations, thanks to cost-cuts and increased

advertising revenue, but the videogame developer posted another

sharp decline in customers.

Write to Chris Wack at chris.wack@wsj.com or Maria Armental at

maria.armental@wsj.com

(END) Dow Jones Newswires

May 05, 2016 09:28 ET (13:28 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

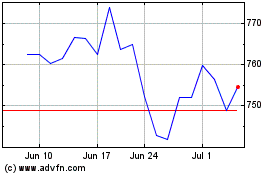

Equinix (NASDAQ:EQIX)

Historical Stock Chart

From Mar 2024 to Apr 2024

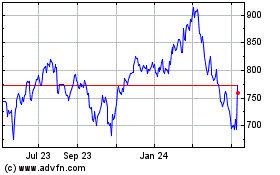

Equinix (NASDAQ:EQIX)

Historical Stock Chart

From Apr 2023 to Apr 2024