Filed Pursuant to Rule 424(b)(5)

Registration No. 333-200294

The information in this preliminary prospectus supplement is not complete and may be changed. This preliminary prospectus supplement is not an

offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to completion, dated November 16, 2015

Preliminary prospectus supplement

Equinix, Inc.

$750,000,000

Common stock

We are offering shares (the “firm shares”) of our common stock, par value $0.001

per share (our “common stock”), with an aggregate public offering price of $750,000,000. At an assumed public offering price of $291.07 per share, the closing price of our common stock on the NASDAQ Global Select Market (the

“NASDAQ”) on November 13, 2015, we would expect to issue and sell 2,576,699 shares. We will receive all of the net proceeds from this offering.

We intend to use the net proceeds of this offering, together with the net proceeds of an anticipated offering of senior unsecured notes in an aggregate principal amount of up to approximately $1 billion (the

“Proposed New Notes”), the net proceeds of a senior secured term loan in an aggregate principal amount of up to approximately $700 million that we propose to obtain (the “Proposed Term Loan”) and cash on hand, for merger and

acquisition activities and repayment of indebtedness (including the funding of the cash portion of the purchase price for the cash and share offer we announced in May 2015 (the “Telecity Acquisition”) for the entire issued and to be issued

share capital of TelecityGroup plc (“TelecityGroup”) and repayment of existing TelecityGroup indebtedness in connection therewith) and for general corporate purposes. If for any reason the Telecity Acquisition is not completed, then we

intend to use all of the net proceeds from this offering for general corporate purposes. The completion of this common stock offering is not contingent upon the completion of the issuance of the Proposed New Notes, the Proposed Term Loan or the

Telecity Acquisition. See “Prospectus summary—Recent developments” and “Use of proceeds.” This prospectus supplement is not an offer to sell or a solicitation of an offer to buy any securities being offered in the offering

of the Proposed New Notes.

Our common stock is listed on the NASDAQ under the symbol “EQIX”. On November 13, 2015, the last reported sale

price of our common stock on the NASDAQ was $291.07 per share.

Investing in our common stock involves risks. See “Risk factors

” beginning on page S-15 of this prospectus supplement as well as the risks described in “Risk Factors” in our Quarterly Report on Form 10-Q for the quarter ended September 30, 2015.

|

|

|

|

|

|

|

|

|

| |

|

Per share |

|

|

Total |

|

|

|

|

| Public offering price(1) |

|

$ |

|

|

|

$ |

|

|

|

|

|

| Underwriting discounts and commissions(1) |

|

$ |

|

|

|

$ |

|

|

|

|

|

| Proceeds to Equinix, Inc. (before expenses)(1) |

|

$ |

|

|

|

$ |

|

|

| (1) |

|

Assumes no exercise of the underwriters’ option to purchase additional shares as described below. |

We have granted the underwriters an option exercisable within a 30-day period beginning on, and including, the date of this prospectus supplement, to purchase up

to additional shares of our common stock, representing an aggregate amount of approximately $112,500,000 (the “additional

shares” and, together with the firm shares, the “shares”) from us at the public offering price, less the underwriting discounts and commissions, and less an amount per share equal to any per share dividends that are paid or payable by

us on the firm shares but that are not payable on the additional shares. See “Underwriting”.

Neither the U.S. Securities and Exchange

Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the

contrary is a criminal offense.

The underwriters expect to deliver the shares on or about

, 2015.

Joint Book-Running

Managers

|

|

|

|

|

| J.P. Morgan |

|

BofA Merrill Lynch |

|

Citigroup |

|

|

|

|

|

| RBC Capital Markets |

|

Barclays |

|

TD Securities |

Co-Managers

|

|

|

|

|

| ING |

|

MUFG |

|

HSBC |

|

|

|

| Evercore ISI |

|

|

|

BTIG |

, 2015

We and the underwriters have not authorized anyone to provide any information other than that contained or

incorporated by reference into this prospectus supplement or the accompanying prospectus or any relevant free writing prospectus prepared by or on behalf of us or to which we have referred you. We and the underwriters take no responsibility for, and

can provide no assurance as to the reliability of, any other information that others may give you. We are not, and the underwriters are not, making an offer or sale of shares of common stock in any jurisdiction where the offer or sale is not

permitted. You should assume that the information contained in or incorporated by reference into this prospectus supplement and the accompanying prospectus is accurate only as of the date appearing on the front cover of this prospectus supplement or

the date of the accompanying prospectus or the applicable incorporated document, regardless of the time of delivery of such document. Our business, financial condition, results of operations and prospects may have changed since that date. It is

important that you read and consider all of the information contained in or incorporated by reference into this prospectus supplement and the information contained in or incorporated by reference into the accompanying prospectus in making your

investment decision.

Table of contents

S-i

S-ii

About the prospectus supplement

This document consists of two parts. The first part is this prospectus supplement, which describes the specific terms of this common stock offering and also adds to

and updates the information contained or incorporated by reference in the accompanying prospectus. The second part is the prospectus, which describes more general information regarding our securities, some of which does not apply to this offering.

You should read both this prospectus supplement and the accompanying prospectus, together with additional information described under the heading “Incorporation by reference” and “Where you can find more information” in this

prospectus supplement and the accompanying prospectus.

If the information set forth in this prospectus supplement differs in any way from the

information set forth in the accompanying prospectus or the information contained in any document incorporated by reference therein, the information contained in the most recently dated document shall control.

This prospectus supplement and the accompanying prospectus incorporate important business and financial information about us and our subsidiaries that is not

included in or delivered with this prospectus supplement or the accompanying prospectus. Information incorporated by reference is available without charge to prospective investors upon written request to us at One Lagoon Drive, Fourth Floor, Redwood

City, CA 94065, Attention: Investor Relations, or by telephone at (650) 598-6000.

Neither we nor the underwriters are making an offer to sell these

securities in any jurisdiction where the offer or sale is not permitted. You must comply with all applicable laws and regulations in force in any applicable jurisdiction and you must obtain any consent, approval or permission required by you for the

purchase, offer or sale of the common stock under the laws and regulations in force in the jurisdiction to which you are subject or in which you make your purchase, offer or sale, and neither we nor the underwriters will have any responsibility

therefor.

We reserve the right to withdraw this offering of our common stock at any time. We and the underwriters also reserve the right to reject any

offer to purchase, in whole or in part, for any reason, or to sell less than the amount of common stock offered hereby.

Certain persons participating in

this offering may engage in transactions that stabilize, maintain or otherwise affect the price of the common stock. Such transactions may include stabilization and the purchase of common stock to cover short positions. For a description of these

activities, see “Underwriting” in this prospectus supplement.

References to “Equinix,” the “Company,” “we,”

“our” and “us” and similar terms mean Equinix, Inc., a Delaware corporation, and its consolidated subsidiaries, unless the context otherwise requires.

S-1

Forward-looking statements

This prospectus supplement and the accompanying prospectus, including the documents incorporated by reference herein and therein, contain forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Such statements contained in

this prospectus supplement and the accompanying prospectus or incorporated by reference herein or therein are based upon current expectations that involve risks and uncertainties. Any statements contained in this prospectus supplement or the

accompanying prospectus or incorporated by reference herein or therein that are not statements of historical fact may be deemed to be forward-looking statements. For example, the words “believes,” “anticipates,”

“plans,” “expects,” “intends” and similar expressions are intended to identify forward-looking statements. Our actual results and the timing of certain events may differ significantly from the results discussed in the

forward-looking statements. Factors that might cause such a discrepancy include, but are not limited to, those discussed in the “Risk factors” section of this prospectus supplement and under the heading “Risk Factors” in the

documents incorporated by reference herein. We claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 for all forward-looking statements. All forward-looking

statements contained in this prospectus supplement and the accompanying prospectus or incorporated by reference herein or therein are based on information available to us as of the date of such statements and we assume no obligation to update any

such forward-looking statements.

Where you can find more information

We have filed with the U.S. Securities and Exchange Commission (the “SEC”) a registration statement on Form S-3 under the Securities Act relating to

the common stock offered by this prospectus supplement. This prospectus supplement and the accompanying prospectus are a part of that registration statement, which includes additional information not contained in this prospectus supplement or the

accompanying prospectus.

We file annual, quarterly and current reports, proxy statements and other information with the SEC. You may read and copy any

document we file with the SEC (including exhibits to such documents) at the SEC’s Public Reference Room at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the Public Reference Room. Our SEC filings are also available to the public at the SEC’s website at www.sec.gov.

Incorporation by reference

The SEC allows us to “incorporate by reference” the information we file with them, which means that we can disclose important information to you by referring you to those documents. The information

incorporated by reference is considered to be part of this prospectus supplement and the accompanying prospectus, and information that we file later with the SEC will automatically update and supersede this information. We incorporate by reference

the documents listed below and any future filings we make with the SEC under Section 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934 prior to the termination of the offering under this prospectus:

| • |

|

Current Reports on Form 8-K filed on February 17, 2015, April 30, 2015, May 20, 2015 (only with respect to

Item 8.01), May 26, 2015, May 29, 2015, June 1, 2015, September 28, 2015, October 1, 2015, October 9, 2015, and November 10, 2015 and our Current Report on Form 8-K/A filed on

November 16, 2015; |

| • |

|

Quarterly Reports on Form 10-Q for the quarters ended March 31, 2015, June 30, 2015 and September 30, 2015; and |

S-2

| • |

|

Annual Report on Form 10-K for the year ended December 31, 2014, including portions of our Definitive Proxy Statement on Schedule 14A filed on

April 24, 2015, to the extent specifically incorporated by reference in such Annual Report on Form 10-K. |

We are not, however,

incorporating by reference any documents or portions thereof, whether specifically listed above or filed in the future, that are not deemed “filed” with the SEC, including any information furnished pursuant to Items 2.02 or 7.01 of Form

8-K or certain exhibits furnished pursuant to Item 9.01 of Form 8-K.

You may request, and we will provide you with, a copy of these filings, at no

cost, by calling us at (650) 598-6000 or by writing to us at the following address:

Equinix,

Inc.

One Lagoon Drive, Fourth Floor

Redwood City, CA 94065

Attn: Investor Relations

S-3

Prospectus summary

This summary highlights information contained in or incorporated by reference into this prospectus supplement or the accompanying prospectus. Because this is only a summary, it does not contain all of the

information that may be important to you. For a more complete understanding of our business and financial affairs, we encourage you to read this entire prospectus supplement, the accompanying prospectus, any related free writing prospectuses, the

sections titled “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” together with our consolidated financial statements and the related notes thereto in our Annual

Report on Form 10-K for the year ended December 31, 2014 and in Quarterly Reports on Form 10-Q for the quarters ended March 31, 2015, June 30, 2015 and September 30, 2015, each of which is incorporated by reference in this

prospectus supplement and the accompanying prospectus, and the other documents incorporated by reference in this prospectus supplement and the accompanying prospectus, before making a decision whether to invest in our common stock. References herein

to “we”, “us”, “Equinix”, or the Company refer to Equinix, Inc. and, where appropriate, Equinix Inc.’s consolidated subsidiaries.

Overview

We connect more than 6,300 companies directly to their customers and partners inside the world’s

most networked data centers. Today, businesses leverage the Equinix interconnection platform in 33 strategic markets across the Americas, Asia-Pacific, and Europe, Middle East and Africa (EMEA).

Platform

Equinix® combines a global footprint of state-of-the-art International Business Exchange™ (IBX®) data centers, a variety of interconnection opportunities and unique ecosystems. Together these components accelerate business

growth and opportunity for our customers by safekeeping their infrastructure and applications closer to users, enabling them to improve performance with cost-effective and scalable interconnections, work with vendors to deploy new technologies such

as cloud computing and to collaborate with the widest variety of partners and customers to achieve their ambitions.

We generate revenue by providing

colocation and related interconnection and managed IT infrastructure offerings on a global platform of 105 IBX data centers. For the year ended December 31, 2014 and the nine months ended September 30, 2015, we had revenue of $2,443.8

million and $1,995.4 million, net income (loss) attributable to Equinix of $(259.5) million and $177.0 million and adjusted EBITDA of $1,113.9 million and $938.5 million, respectively. For a discussion of our primary non-GAAP metric, adjusted

EBITDA, including a reconciliation to GAAP financial measures, see our non-GAAP financial measures discussion in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K

for the year ended December 31, 2014 and subsequent Quarterly Reports on Form 10-Q which are incorporated by reference in this prospectus supplement and the accompanying prospectus.

We have been organized and have been operating as a real estate investment trust for U.S. federal income tax purposes (a “REIT”) effective for our taxable year that began on January 1, 2015.

Recent developments

Acquisition of

Telecity Group plc

In May 2015, we announced a cash and share offer (the “Telecity Acquisition”) for the entire issued and to be

issued share capital of Telecity Group plc (“TelecityGroup”). TelecityGroup operates 42 data center facilities in

S-4

strategic internet hub cities across Europe. For the year ended December 31, 2014 and the nine months ended September 30, 2015, TelecityGroup had revenues of $574.6 million and $398.3

million and net income of $91.7 million and $24.4 million, respectively, in each case converted into U.S. GAAP and U.S. dollars.

The Telecity

Acquisition is expected to have a purchase price of approximately £1,176 million in cash (or $1,786 million at September 30, 2015 exchange rates) and 6,905,645 shares of our common stock to be issued to shareholders of TelecityGroup.

The closing of the Telecity Acquisition is subject to certain conditions, including (i) receipt of regulatory clearances from the European Commission or certain national authorities, (ii) approval of a court sanctioned scheme of arrangement and

related resolutions by the holders of at least a majority in number representing at least 75% of the issued share capital of TelecityGroup and (iii) the sanction of the High Court of England and Wales.

On November 13, 2015, we announced that we obtained clearance from the European Commission for the Telecity Acquisition satisfying condition (i) described in the

paragraph above. In connection with obtaining the approval of the European Commission for the Telecity Acquisition, we and TelecityGroup agreed to divest certain data centers owned by TelecityGroup and one data

center owned by Equinix (the “Disposal Group”). The Disposal Group consists of the following facilities: TelecityGroup’s Bonnington House, Sovereign House, Meridian Gate and Oliver’s Yard data centers and Equinix’s West

Drayton data center in London; TelecityGroup’s Science Park and Amstel Business Park I in Amsterdam; and TelecityGroup’s Lyonerstrasse data center in Frankfurt. These assets contributed approximately 4% of revenues for the nine months

ended September 30, 2015 of the pro forma combined company. There is no agreement with any buyer or buyers to acquire all or any portion of these data centers and any such agreement will be subject to the approval of the European Commission.

The unaudited pro forma condensed combined financial statements contained in this prospectus supplement reflect the Disposal Group as held for sale in the accompanying unaudited pro forma condensed combined balance sheet as of September 30,

2015 and the results of operations related to revenue, costs of revenues and selling, marketing and administrative costs from the Disposal Group are removed from the accompanying unaudited pro forma condensed combined statements of operations for

the year ended December 31, 2014 and the nine months ended September 30, 2015. There can be no assurance as to the amount of proceeds to be received in connection with the sale of all or any part of the Disposal Group.

We expect to close the Telecity Acquisition early in the first half of 2016. For more information about the Telecity Acquisition, see our Current Report on Form 8-K

filed with the SEC on May 29, 2015 and Form 8-K/A filed with the SEC on November 16, 2015, which are incorporated by reference herein.

Telecity Bridge Loan Commitment

In connection with

the Telecity Acquisition, in May 2015 we also entered into a bridge credit agreement among J.P. Morgan Chase Bank, N.A., as lender and as administrative agent, and Bank of America, N.A., Citibank, N.A., Royal Bank of Canada, Toronto Dominion (Texas)

LLC, ING Bank N.V., HSBC Bank USA, NA and the Bank of Tokyo-Mitsubishi UFJ, Ltd., as lenders, for a principal amount of £875.0 million (or approximately $1.3 billion at September 30, 2015 exchange rates) (the “Telecity Bridge

Loan Commitment”). The lenders under the Telecity Bridge Loan Commitment are affiliates of certain of the underwriters. The Telecity Bridge Loan Commitment contains negative covenants that are typical for facilities of this type and that are

generally consistent with our existing outstanding senior notes, including limitations on incurrence of additional indebtedness, liens, restricted payments, fundamental changes, dividend and payment restrictions affecting restricted subsidiaries,

transactions with affiliates, asset sales, and issuance of preferred stock by domestic restricted subsidiaries. The Telecity Bridge Loan Commitment is dedicated solely to the Telecity Acquisition and to satisfy applicable funds certainty

requirements under the U.K. City Code on Takeovers and Mergers. No amounts have been drawn

S-5

under the Telecity Bridge Loan Commitment. As of September 30, 2015, we had accrued commitment fees of approximately $5.0 million associated with the Telecity Bridge Loan Commitment, which

are reflected as interest expense in our condensed consolidated statement of operations.

Financing of the Telecity Acquisition

We intend to obtain or otherwise incur up to approximately $1,700 million of indebtedness to fund a portion of the Telecity Acquisition,

including related fees and expenses, which we refer to in this prospectus supplement as the “Proposed Debt Financings.” We currently expect that the Proposed Debt Financings will include:

| • |

|

an anticipated offering of senior unsecured notes in an aggregate principal amount of up to approximately $1,000 million, which we refer to in this prospectus

supplement as the “Proposed New Notes”; and |

| • |

|

a senior secured term loan in an aggregate principal amount of up to approximately $700 million, which we refer to in this prospectus supplement as the

“Proposed Term Loan.” |

The foregoing description and any other information regarding the Proposed Debt Financings is included

herein solely for informational purposes. There can be no assurance that we will commence or complete the Proposed Debt Financings, or as to the amount and terms and conditions of the Proposed Debt Financings. The Proposed Debt Financings, if

commenced, will not be contingent on the completion of this offering. Our ability to obtain the Proposed Debt Financings will depend on many factors, including investor and lender demand, market conditions and other factors, and we cannot assure you

that the Proposed Debt Financings or other additional financing will be available to us on favorable terms, or at all.

In connection with this offering

and each of the Proposed Debt Financings, we intend to terminate the Telecity Bridge Loan Commitment. However, to the extent that we are unable to obtain the Proposed Debt Financings or obtain other permanent financing, we may be required to draw

under the Telecity Bridge Loan Commitment to fund the cash portion of the purchase price for the Telecity Acquisition. The completion of this common stock offering is not contingent upon the completion of the Proposed Debt Financings or the Telecity

Acquisition. If the Telecity Acquisition does not occur, the proceeds of this offering will be used for general corporate purposes, which may include repayment of indebtedness, capital expenditures, working capital and acquisitions from time to

time.

Acquisition of Bit-isle Inc.

In

September 2015, we announced that our Japanese subsidiary QAON G.K. commenced a cash tender offer for all issued and outstanding shares of Bit-isle Inc. (the “Bit-isle Acquisition”), valued at approximately ¥33.3 billion (or

approximately $277.2 million at September 30, 2015 exchange rates). Bit-isle Inc. is a leading provider of data centers in Japan, with five data centers in Tokyo and one data center in Osaka. The tender offer period ended on October 26,

2015 and we acquired approximately 97% of the outstanding equity interests (including stock options) of Bit-isle Inc. We will acquire the remaining equity interests pursuant to a process permitted under Japanese law by the end of 2015.

In connection with the Bit-isle Acquisition, QAON G.K. and certain of our other direct and indirect subsidiaries entered into a bridge credit agreement with The

Bank of Tokyo-Mitsubishi UFJ, Ltd., for a principal amount of ¥47.5 billion (or approximately $395.8 million at September 30, 2015 exchange rates) (the “Bit-isle Bridge Loan Commitment”). Equinix, Inc. is a guarantor under the

Bit-isle Bridge Loan Commitment. The Bit-isle Bridge Loan Commitment was entered into to provide a temporary source of funding for the cash consideration payable to shareholders and holders of stock acquisition rights in the Bit-isle Acquisition,

repayment of indebtedness of

S-6

Bit-isle Inc. and its wholly-owned subsidiaries, and the transaction costs incurred in connection with the closing of the Bit-isle Bridge Loan Commitment and the Bit-isle Acquisition. In October

2015, we made the first draw-down of approximately ¥27.3 billion (or approximately $226.9 million at September 30, 2015 exchange rates) on the Bit-isle Bridge Loan Commitment in preparation for closing the Bit-isle Acquisition. We expect to

draw down an additional approximate ¥15 billion on the Bit-isle Bridge Loan Commitment (or approximately $120 million at September 30, 2015 exchange rates) in the fourth quarter of 2015 in connection with the Bit-isle Acquisition. We intend

to seek permanent financing to replace and terminate the Bit-isle Bridge Loan Commitment in the first half of 2016.

Special Distribution and

Dividend

On September 28, 2015, we declared a special distribution of $627.0 million (the “2015 Special Distribution”),

encompassing various items of taxable income that we expect to recognize in 2015, including depreciation recapture in respect of accounting method changes commenced in our pre-REIT period, foreign earnings and profits recognized as dividend income

and certain other items of taxable income. The 2015 Special Distribution was paid on November 10, 2015 to our common stockholders of record as of the close of business on October 8, 2015 in the form of an aggregate of approximately $125.5

million in cash and 1.69 million shares of our common stock. As a result of the 2015 Special Distribution, the conversion rate relating to our 4.75% convertible subordinated notes due 2016 (the “2016 Convertible Notes”) was adjusted

to 12.9913 shares of common stock per $1,000 principal amount of 2016 Convertible Notes, and the approximately $157.9 million principal amount of 2016 Convertible Notes that are currently outstanding are now convertible, in the aggregate, into

approximately 2.05 million shares of our common stock. As a result of the adjustment to the conversion rate, the conversion price of the 2016 Convertible Notes decreased from approximately $79.87 per share of common stock to approximately

$76.98 per share of our common stock.

On October 28, 2015, we declared a quarterly cash dividend of $1.69 per share, which is payable on

December 16, 2015 to our common stockholders of record as of the close of business on December 9, 2015. Purchasers of shares of common stock in this offering who continue to hold such shares through the record date will receive this

dividend.

Sources and uses

The following table

outlines the sources and uses of funds for the cash consideration payable in connection with the Telecity Acquisition. The table assumes that the Telecity Acquisition and the Proposed Debt Financings are completed simultaneously, but this offering

is expected to occur before the completion of the Proposed Debt Financings and the Telecity Acquisition. Amounts in the table are in millions of dollars and are estimated. Actual amounts may vary from the estimated amounts. See “Use of

proceeds.”

|

|

|

|

|

|

|

|

|

|

|

| Sources of funds |

|

|

Uses of funds |

|

| Cash(1) |

|

$ |

490.4 |

|

|

Total cash consideration payable in Telecity Acquisition(5) |

|

$ |

1,786.2 |

|

| Common stock offered hereby(2) |

|

$ |

750.0 |

|

|

Transaction fees and expenses(6) |

|

$ |

179.7 |

|

| Proposed New Notes(3) |

|

$ |

1,000.0 |

|

|

Refinance existing TelecityGroup indebtedness(7) |

|

$ |

508.7 |

|

| Proposed Term Loan(4) |

|

$ |

700.0 |

|

|

General corporate purposes |

|

$ |

465.8 |

|

| Total |

|

$ |

2,940.4 |

|

|

Total |

|

$ |

2,940.4 |

|

| |

|

| (1) |

|

Reflects restricted cash of Equinix placed into a restricted cash account in connection with the Telecity Acquisition. |

S-7

| (2) |

|

Before discounts, commissions and expenses and assumes no exercise of the underwriters’ option to purchase additional shares. |

| (3) |

|

Before discounts, commissions and expenses. |

| (4) |

|

No lenders have committed to fund any portion of the Proposed Term Loan. |

| (5) |

|

Assuming an exchange rate of 1.5189 as of September 30, 2015. Does not include an estimated 6,905,645 shares of our common stock to be issued to shareholders of

TelecityGroup. |

| (6) |

|

Includes estimated transaction costs in connection with the Telecity Acquisition, Equity Offering and Proposed Debt Financings. Assumes an exchange rate of 1.5355 as of September

30, 2015. |

| (7) |

|

Includes repayment of TelecityGroup’s existing debt, accrued interest, and settlement of associated interest rate swap derivative liabilities. Assumes an exchange rate of

1.5189 as of September 30, 2015. |

Company information

Our principal executive offices are located at One Lagoon Drive, Fourth Floor, Redwood City, CA 94065 and our telephone number is (650) 598-6000. Our website is located at www.equinix.com. Information

contained on or accessible through our website is not part of this prospectus supplement.

S-8

The offering

The following is a brief summary of certain terms of this offering. For a more complete description of the terms of the common stock offered hereby, see the “Description of capital stock” section of

this prospectus supplement and the “Description of Capital Stock” section of the accompanying prospectus.

| Issuer |

Equinix, Inc., a Delaware corporation. |

| Common stock offered by us |

shares |

| Common stock to be outstanding after this offering |

shares |

| Option to purchase additional shares of common stock from us |

shares |

| Use of proceeds |

We estimate that the net proceeds from this offering, after deducting underwriting discounts and commissions and estimated offering expenses, will be approximately $721.2 million (or approximately $829.5

million if the underwriters exercise their option to purchase additional shares in full). We intend to use the net proceeds from this offering, together with the net proceeds of the Proposed Debt Financings and cash on hand, for merger and

acquisition activities and repayment of indebtedness (including the funding of the cash portion of the Telecity Acquisition purchase price and repayment of existing TelecityGroup indebtedness in connection therewith) and for general corporate

purposes. In connection with this offering and the Proposed Debt Financings, we intend to terminate the Telecity Bridge Loan Commitment. In order to satisfy requirements under the U.K. City Code on Takeovers and Mergers, prior to terminating the

Telecity Bridge Loan Commitment, we intend to place approximately £875.0 million, or approximately $1.3 billion based on an exchange rate as of September 30, 2015, in a restricted cash account in the U.K. pending the completion of the

Telecity Acquisition. If for any reason the Telecity Acquisition is not completed, then we intend to use all of the net proceeds from this offering for general corporate purposes, which may include repayment of indebtedness, capital expenditures,

working capital and acquisitions from time to time. See “Prospectus summary—Recent developments” and “Prospectus summary—Sources and uses.” |

| |

The completion of this common stock offering is not contingent upon the completion of the Proposed Debt Financings or the Telecity Acquisition and if the Telecity Acquisition

does not occur, the proceeds of this offering will be used for general corporate purposes, which may include repayment of indebtedness, capital expenditures, working capital and acquisitions from time to time. |

| |

Certain of the underwriters have acted as underwriters for our existing senior notes and are expected to act as underwriters for the Proposed New Notes.

|

S-9

| |

Certain affiliates of the underwriters act as lenders and/or agents under our existing credit facilities and/or are expected to act as lenders and/or agents under the Proposed Term Loan.

Affiliates of the underwriters have made commitments to us with respect to a Telecity Bridge Loan Commitment to finance a portion of the Telecity Acquisition under certain circumstances in the event this offering and the Proposed Debt Financings are

not consummated, for which the underwriters and/or their affiliates will be paid customary fees. See “Prospectus summary—Recent developments—Acquisition of Telecity Group plc.” Certain of the underwriters or their affiliates may

hold equity of TelecityGroup and/or positions in the existing TelecityGroup indebtedness to be refinanced and may be repaid with a portion of the net proceeds of this offering. See “Use of proceeds.” |

| NASDAQ Global Select Market symbol for our common stock |

“EQIX”. |

| Risk factors |

Investing in our common stock involves risk. See “Risk factors” in this prospectus supplement and “Risk Factors” in our Quarterly Report on Form 10-Q for the quarter ended September

30, 2015 and the other information included or incorporated by reference in this prospectus supplement and the accompanying prospectus for a discussion of factors you should carefully consider before deciding to invest in our common stock.

|

| REIT status and transfer restrictions |

We began operating as a REIT for our taxable year that began on January 1, 2015. To assist us in maintaining our qualification as a REIT, our certificate of incorporation includes various restrictions on

the ownership and transfer of our stock, including among others, a restriction that, subject to certain exceptions, prohibits any person from owning more than 9.8% (in value or in number, whichever is more restrictive) of our outstanding shares of

common stock or 9.8% in value of our outstanding shares of capital stock. |

| Transfer agent and registrar |

Computershare Trust Company, N.A. |

The number of shares of our common stock to be outstanding

after this offering is based on 57,285,666 of our common shares outstanding as of September 30, 2015. Unless the context requires otherwise, the number of shares of our common stock to be outstanding after this offering excludes:

| • |

|

an estimated 6,905,645 shares of our common stock to be issued to shareholders of TelecityGroup; |

| • |

|

1,688,411 shares of our common stock that were issued to our stockholders on November 10, 2015 in the 2015 Special Distribution;

|

| • |

|

1,448,188 shares of common stock issuable upon the exercise of outstanding options and restricted stock units as of September 30, 2015;

|

| • |

|

2,051,131 shares reserved for issuance upon the conversion of our 2016 Convertible Notes as of September 30, 2015 (after giving effect to the adjustment to

the conversion rate for our 2016 Convertible Notes for the 2015 Special Distribution); |

S-10

| • |

|

4,371,308 shares reserved for future issuances under our 2000 Equity Incentive Plan, 2000 Director Option Plan and 2001 Supplemental Stock Plan, and 3,568,891

shares reserved for future issuances under our 2004 Employee Stock Purchase Plan; and |

| • |

|

shares issuable upon the exercise of the underwriters’ option to purchase additional shares in this offering. |

S-11

Summary consolidated financial data

The following tables summarize our consolidated financial data for the periods presented. You should read this summary consolidated financial data in conjunction with “Management’s Discussion and Analysis

of Financial Condition and Results of Operations” and our consolidated financial statements and related notes incorporated by reference in this prospectus supplement and the accompanying prospectus. The consolidated statements of operations and

consolidated statements of cash flow data for the years ended December 31, 2012, 2013 and 2014 were derived from our audited consolidated financial statements incorporated by reference in this prospectus supplement and the accompanying

prospectus. The consolidated statements of operations and consolidated statements of cash flow data for the nine months ended September 30, 2014 and 2015 and the consolidated balance sheet data as of September 30, 2015 were derived from

our unaudited interim condensed consolidated financial statements incorporated by reference in this prospectus supplement and the accompanying prospectus. Pro forma financial information presented herein were derived from the historical consolidated

financial statements of Equinix and TelecityGroup and certain adjustments and assumptions have been made regarding Equinix after giving effect to the Telecity Acquisition and are therefore not necessarily indicative of actual results had the

companies been combined for the periods presented. You should read the pro forma financial information in conjunction with the section “Unaudited pro forma condensed combined financial information” included in this prospectus

supplement. Our historical results are not necessarily indicative of the results to be expected in the future and our interim results are not necessarily indicative of the results to be expected for the full year or any future period.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Years ended December 31, |

|

|

Nine months

ended

September 30, |

|

| (in thousands) |

|

2012 |

|

|

2013 |

|

|

2014 |

|

|

2014 |

|

|

2015 |

|

|

|

|

|

|

|

| Consolidated statement of operations data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues |

|

$ |

1,887,376 |

|

|

$ |

2,152,766 |

|

|

$ |

2,443,776 |

|

|

$ |

1,805,655 |

|

|

$ |

1,995,405 |

|

|

|

|

|

|

|

|

|

|

|

|

| Costs and operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of revenues |

|

|

944,617 |

|

|

|

1,064,403 |

|

|

|

1,197,885 |

|

|

|

884,436 |

|

|

|

939,538 |

|

| Sales and marketing |

|

|

202,914 |

|

|

|

246,623 |

|

|

|

296,103 |

|

|

|

214,867 |

|

|

|

243,573 |

|

| General and administrative |

|

|

328,266 |

|

|

|

374,790 |

|

|

|

438,016 |

|

|

|

324,332 |

|

|

|

356,455 |

|

| Restructuring reversals |

|

|

— |

|

|

|

(4,837 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Impairment charges |

|

|

9,861 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Acquisition costs |

|

|

8,822 |

|

|

|

10,855 |

|

|

|

2,506 |

|

|

|

580 |

|

|

|

24,374 |

|

|

|

|

|

|

| Total costs and operating expenses |

|

|

1,494,480 |

|

|

|

1,691,834 |

|

|

|

1,934,510 |

|

|

|

1,424,215 |

|

|

|

1,563,940 |

|

|

|

|

|

|

| Income from continuing operations |

|

|

392,896 |

|

|

|

460,932 |

|

|

|

509,266 |

|

|

|

381,440 |

|

|

|

431,465 |

|

| Interest income |

|

|

3,466 |

|

|

|

3,387 |

|

|

|

2,891 |

|

|

|

2,534 |

|

|

|

2,375 |

|

| Interest expense |

|

|

(200,328 |

) |

|

|

(248,792 |

) |

|

|

(270,553 |

) |

|

|

(199,450 |

) |

|

|

(219,556 |

) |

| Other income (expense) |

|

|

(2,208 |

) |

|

|

5,253 |

|

|

|

119 |

|

|

|

3,170 |

|

|

|

(11,964 |

) |

| Loss on debt extinguishment |

|

|

(5,204 |

) |

|

|

(108,501 |

) |

|

|

(156,990 |

) |

|

|

(51,183 |

) |

|

|

— |

|

|

|

|

|

|

| Income from continuing operations before income taxes |

|

|

188,622 |

|

|

|

112,279 |

|

|

|

84,733 |

|

|

|

136,511 |

|

|

|

202,320 |

|

| Income tax expense |

|

|

(58,564 |

) |

|

|

(16,156 |

) |

|

|

(345,459 |

) |

|

|

(42,134 |

) |

|

|

(25,277 |

) |

|

|

|

|

|

| Net income (loss) from continuing operations |

|

|

130,058 |

|

|

|

96,123 |

|

|

|

(260,726 |

) |

|

|

94,377 |

|

|

|

177,043 |

|

| Net income from discontinued operations, net of tax |

|

|

13,086 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

| Net income (loss) |

|

|

143,144 |

|

|

|

96,123 |

|

|

|

(260,726 |

) |

|

|

94,377 |

|

|

|

177,043 |

|

|

|

|

|

|

| Net (income) loss attributable to redeemable non-controlling interests |

|

|

(3,116 |

) |

|

|

(1,438 |

) |

|

|

1,179 |

|

|

|

1,179 |

|

|

|

— |

|

|

|

|

|

|

| Net income (loss) attributable to Equinix |

|

$ |

140,028 |

|

|

$ |

94,685 |

|

|

$ |

(259,547 |

) |

|

$ |

95,556 |

|

|

$ |

177,043 |

|

|

|

|

|

|

S-12

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Years ended December 31, |

|

|

Nine months

ended

September 30, |

|

| (in thousands) |

|

2012 |

|

|

2013 |

|

|

2014 |

|

|

2014 |

|

|

2015 |

|

|

|

|

|

|

|

| Other financial data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash provided by operating activities |

|

$ |

632,026 |

|

|

$ |

604,608 |

|

|

$ |

689,420 |

|

|

$ |

487,123 |

|

|

$ |

659,675 |

|

| Net cash provided by (used in) investing activities |

|

|

(442,873 |

) |

|

|

(1,169,313 |

) |

|

|

(435,839 |

) |

|

|

184,072 |

|

|

|

(605,931 |

) |

| Net cash provided by (used in) financing activities |

|

|

(222,721 |

) |

|

|

574,907 |

|

|

|

107,401 |

|

|

|

(572,449 |

) |

|

|

(319,768 |

) |

| Adjusted EBITDA(1) |

|

|

887,857 |

|

|

|

1,000,898 |

|

|

|

1,113,891 |

|

|

|

819,526 |

|

|

|

938,482 |

|

| Pro forma adjusted EBITDA(2)(3) |

|

|

|

|

|

|

|

|

|

|

1,296,878 |

|

|

|

|

|

|

|

1,071,104 |

|

| |

|

|

|

|

|

|

| (in thousands) |

|

As of

September 30, 2015 |

|

|

|

| Balance sheet data: |

|

|

|

|

| Cash, cash equivalents and short-term and long-term investments |

|

$ |

339,546 |

|

| Accounts receivable, net |

|

|

293,125 |

|

| Property, plant and equipment, net |

|

|

5,218,595 |

|

| Total assets |

|

|

7,705,666 |

|

| Current portion of capital lease and other financing obligations |

|

|

26,775 |

|

| Current portion of mortgage and loans payable |

|

|

55,024 |

|

| Current portion of convertible debt |

|

|

151,535 |

|

| Capital lease and other financing obligations, excluding current portion |

|

|

1,198,581 |

|

| Mortgage and loans payable, excluding current portion |

|

|

484,049 |

|

| Senior notes |

|

|

2,720,448 |

|

| Total debt |

|

|

3,411,056 |

|

| Total liabilities |

|

|

6,217,013 |

|

| Total stockholders’ equity |

|

|

1,488,653 |

|

|

|

| Selected financial data and annualized credit statistics:

|

|

|

|

|

| (in thousands) |

|

Nine months ended

September 30, 2015 |

|

| Pro forma annualized adjusted EBITDA(2)(3)(4) |

|

$ |

1,428,139 |

|

|

|

|

|

|

| |

|

As of

September 30, 2015 |

|

| Pro forma senior debt to pro forma annualized adjusted EBITDA ratio(2)(3)(4)(5) |

|

|

4.5x |

|

| Pro forma total debt to pro forma annualized adjusted EBITDA ratio(2)(3)(4)(6) |

|

|

4.6x |

|

| Pro forma net debt to pro forma annualized adjusted EBITDA ratio(2)(3)(4)(7) |

|

|

4.0x |

|

| |

|

| (1) |

|

For a discussion of our primary non-GAAP metric, adjusted EBITDA, and a reconciliation to income from continuing operations, see our non-GAAP financial measures discussion in

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” incorporated by reference in this prospectus supplement and the accompany prospectus from our Annual Report on Form 10-K for the year ended

December 31, 2014 and from our Quarterly Report on Form 10-Q for the quarter ended September 30, 2015. |

| (2) |

|

References to “pro forma financial information” refer to the financial information for the applicable period that gives effect to the Telecity

Acquisition and the exclusion of the Disposal Group, based upon the historical financial information of Equinix and TelecityGroup after giving effect to the pro forma adjustments as set forth in “Unaudited pro forma condensed combined financial

information” and the accompanying |

S-13

| |

notes. “Pro forma financial information” does not give effect to the consummation of the Bit-isle Acquisition for ¥ 33.3 billion in cash (or approximately $277.2 million at

September 30, 2015 exchange rates) and the expected borrowing by our wholly owned Japanese subsidiary of an aggregate of ¥42.3 billion (or $346.9 million at September 30, 2015 exchange rates) under the Bit-isle Bridge Loan Commitment in the

fourth quarter of 2015 to finance the cost of that acquisition, repayment of certain Bit-isle Inc. indebtedness and related costs. See “Risk Factors –The pro forma financial information in this prospectus supplement is presented for

illustrative purposes only, does not give effect to the Bit-isle |

| |

Acquisition (including expected borrowings in connection therewith) and may not be an indication of our financial condition or results of operations following the Telecity

Acquisition.” |

| (3) |

|

Pro forma adjusted EBITDA gives effect to the adjustments and assumptions described in the section “Unaudited pro forma condensed combined financial information” of

this prospectus supplement. Pro forma adjusted EBITDA does not give effect to the consummation of the Bit-isle Acquisition for ¥33.3 billion in cash (or $277.2 million at September 30, 2015 exchange rates) and the expected borrowing by our

wholly-owned Japanese subsidiary of an aggregate of ¥42.3 billion (or $346.9 million at September 30 exchange rates) in connection therewith. A reconciliation of pro forma adjusted EBITDA to the most comparable GAAP financial measure

is presented below (in thousands): |

|

|

|

|

|

|

|

|

|

| |

|

Year ended

December 31, 2014 |

|

|

Nine months ended

September 30, 2015 |

|

| Pro forma income from operations |

|

$ |

540,091 |

|

|

$ |

477,596 |

|

| Depreciation, amortization, and accretion expense |

|

|

606,369 |

|

|

|

469,257 |

|

| Stock-based compensation expense |

|

|

123,073 |

|

|

|

101,691 |

|

| Restructuring charges (reversal) |

|

|

5,129 |

|

|

|

(1,641 |

) |

| Impairment charges |

|

|

19,710 |

|

|

|

— |

|

| Acquisition costs |

|

|

2,506 |

|

|

|

24,201 |

|

|

|

|

|

|

| Pro forma adjusted EBITDA |

|

$ |

1,296,878 |

|

|

$ |

1,071,104 |

|

|

|

|

|

|

| (4) |

|

Pro forma annualized adjusted EBITDA for the period ended September 30, 2015 is calculated by dividing our pro forma adjusted EBITDA for the nine months ended

September 30, 2015 by nine and then multiplying by twelve. See footnote (2) above. A number of factors, such as changes in our results of operations, seasonal fluctuations (including fluctuations in the cost of electricity and other

utilities), fluctuations in exchange rates and other factors may cause adjusted EBITDA generated in a particular nine-month period to not be comparable to adjusted EBITDA generated in a twelve-month period. As a result, our pro forma annualized

adjusted EBITDA for the nine months ended September 30, 2015 is not necessarily indicative of the adjusted EBITDA that was generated by Equinix and TelecityGroup on a pro forma basis for that period or that we will earn following the Telecity

Acquisition. Our pro forma annualized adjusted EBITDA may be different from our actual results for such twelve month period and such differences could be material. Pro forma annualized adjusted EBITDA is included herein solely for illustrative

purposes because a calculation of pro forma adjusted EBITDA for the twelve months ended September 30, 2015 is not available. Pro forma annualized adjusted EBITDA is not necessarily indicative of our ability to meet our obligations.

|

| (5) |

|

Pro forma senior debt to pro forma annualized adjusted EBITDA ratio is presented as pro forma senior debt (which is pro forma total debt less pro forma convertible debt) divided

by pro forma annualized adjusted EBITDA for the nine months ended September 30, 2015. |

| (6) |

|

Pro forma total debt to pro forma annualized adjusted EBITDA ratio is presented as pro forma total debt, gross of discounts, divided by pro forma annualized adjusted EBITDA for

the nine months ended September 30, 2015. |

| (7) |

|

Pro forma net debt to pro forma annualized adjusted EBITDA ratio is presented as pro forma total debt, gross of discounts, less pro forma cash, cash equivalents and short-term

and long-term investments divided by pro forma annualized adjusted EBITDA for the nine months ended September 30, 2015. |

S-14

Risk factors

An investment in our common stock involves certain risks. You should carefully consider the risk factors described under “Risk Factors” in our Quarterly Report on Form 10-Q for the quarter ended

September 30, 2015, as well as the other information included or incorporated by reference in this prospectus supplement and the accompanying prospectus, before making an investment decision. Additional risks and uncertainties not now known to

us or that we now deem immaterial may also adversely affect our business or financial performance. Our business, financial condition, results of operations or cash flows could be materially adversely affected by any of these risks. The market or

trading price of the common stock could decline and our ability to pay dividends may be negatively affected due to any of these risks or other factors, and you may lose all or part of your investment.

In connection with the Telecity Acquisition, we have agreed to divest certain data centers owned by TelecityGroup and one data center owned by Equinix.

On November 13, 2015, we announced that we obtained clearance from the European Commission for the Telecity Acquisition. In connection with

obtaining the approval of the European Commission for the Telecity Acquisition, we and TelecityGroup agreed to divest certain data centers owned by TelecityGroup and one data center owned by Equinix. These assets contributed approximately 4% of

revenues for the nine months ended September 30, 2015 of the pro forma combined company. There is no agreement with any buyer or buyers to acquire all or any portion of these data centers and any such agreement will be subject to the approval

of the European Commission. There can be no assurance as to the amount of proceeds that we will receive in connection with the required sale of the data centers. In addition, there is a regulatory time period (which can be extended with the

agreement of the European Commission) within which we are required to complete these sales. Due in part to the time period in which we must complete the sales, we may not receive the value we would have received if we could choose not to sell them

or had more control over the timing of their sale.

Risks relating to the common stock

The market price of our stock may continue to be highly volatile, and the value of an investment in our common stock may decline.

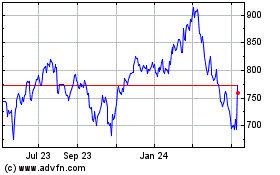

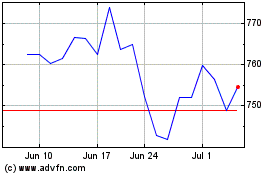

The market price of our common stock has been and may continue to be highly volatile. From January 1, 2014 to November 13, 2015, our stock has had low and high closing sales prices in the range of $303.58 to

$170.48 per share. General economic and market conditions, and market conditions for telecommunications stocks in particular, may affect the market price of our common stock.

Announcements by us or others, or speculations about our future plans, may also have a significant impact on the market price of our common stock.

Factors that may affect the market price of our common stock include:

| • |

|

our operating results or forecasts; |

| • |

|

new issuances of equity, debt or convertible debt by us; |

| • |

|

changes to our capital allocation, tax planning or business strategy; |

| • |

|

our continued qualification for taxation as a REIT and our declaration of distributions to our stockholders; |

| • |

|

a stock repurchase program; |

| • |

|

developments in our relationships with corporate customers; |

| • |

|

announcements by our customers or competitors; |

| • |

|

changes in regulatory policy or interpretation; |

| • |

|

governmental investigations; |

| • |

|

changes in the ratings of our debt or stock by rating agencies or securities analysts; |

S-15

| • |

|

our purchase or development of real estate and/or additional data centers; |

| • |

|

our acquisitions of complementary businesses; |

| • |

|

the operational performance of our data centers; |

| • |

|

global acts of terrorism or other natural or man-made acts or events; or |

| • |

|

other factors described in “Risk factors” in this prospectus supplement and in our Quarterly Report on Form 10-Q for the quarter ended

September 30, 2015. |

The stock market has from time to time experienced extreme price and volume fluctuations, which have

particularly affected the market prices for telecommunications companies, and which have often been unrelated to their operating performance. These broad market fluctuations may adversely affect the market price of our common stock. Furthermore,

companies that have experienced volatility in the market price of their stock have been subject to securities class action litigation. We may be the target of this type of litigation in the future. Securities litigation against us could result in

substantial costs and/or damages, and divert management’s attention from other business concerns, which could seriously harm our business.

The pro forma financial information in this prospectus supplement is presented for illustrative purposes only, does not give effect to the Bit-isle

Acquisition (including expected borrowings in connection therewith) and may not be an indication of our financial condition or results of operations following the Telecity Acquisition.

The unaudited pro forma condensed combined financial information included in this prospectus supplement is presented for illustrative purposes only and may not be an indication of our financial condition or results

of operations following the Telecity Acquisition. The unaudited pro forma condensed combined financial information has been derived from the historical consolidated financial statements of Equinix and TelecityGroup and certain adjustments and

assumptions have been made regarding Equinix after giving effect to the Telecity Acquisition. The information upon which these adjustments and assumptions have been made is preliminary, and these kinds of adjustments and assumptions are difficult to

make with complete accuracy. Before the acquisition is completed, there are limitations regarding what we can learn about TelecityGroup. The final allocation of the purchase price will be determined after the completion of the acquisition, and could

differ materially from the pro forma condensed combined financial statements incorporated by reference. Moreover, the unaudited pro forma condensed combined financial information does not reflect all costs that are expected to be incurred by us in

connection with the Telecity Acquisition. For example, the impact of any incremental costs incurred in integrating Equinix and TelecityGroup is not reflected in the unaudited pro forma condensed combined financial information. As a result, our

actual financial condition and results of operations following the Telecity Acquisition may not be consistent with, or evident from, the unaudited pro forma condensed combined financial information. Additionally, the purchase price used in preparing

the pro forma financial information is based on the closing market price of our common stock, as well as the exchange rate between the U.S. dollar and the British pound, as of September 30, 2015, which may be materially different from the

closing price of our common stock and the exchange rate between the U.S. dollar and the British pound on the completion date of the Telecity Acquisition. The assumptions used in preparing the unaudited pro forma condensed combined financial

information may not prove to be accurate, and other factors may affect our financial condition or results of operations following the Telecity Acquisition. Furthermore, the unaudited pro forma condensed combined balance sheet as of

September 30, 2015 included in this prospectus supplement reflects the Disposal Group as held for sale. However, there can be no assurance as to the timing or amount of proceeds to be received in connection with the sale of all or any part of

the Disposal Group. Our common stock price may be adversely affected if our actual results fall short of the historical results reflected in the unaudited pro forma condensed combined financial information incorporated by reference in this

prospectus supplement. Moreover, the unaudited pro forma condensed combined financial information does not give effect to the Bit-isle Acquisition or the expected borrowings in connection therewith, as described under “Prospectus

summary—Recent developments—Acquisition of Bit-isle Inc.”

S-16

This offering and the issuance of additional stock, in connection with acquisitions or otherwise, will dilute

all other shareholdings.

Upon issuance of the shares of common stock in this offering, holders of our common stock will incur immediate and

substantial net tangible book value dilution on a per share basis. After giving effect to this offering assuming an offering of 2,576,699 shares, as of September 30, 2015, we would have had an aggregate of approximately 240.1 million authorized but

unissued shares of common stock, excluding an estimated 6,905,645 shares of our common stock to be issued to shareholders of TelecityGroup; 1,688,411 shares of our common stock that were issued to our stockholders on November 10, 2015 in the

2015 Special Distribution; 1,448,188 shares of common stock issuable upon the exercise of outstanding options and restricted stock units as of September 30, 2015; 2,051,131 shares reserved for the conversion of our 2016 Convertible Notes as of

September 30, 2015 (after giving effect to the adjustment to the conversion rate for our 2016 Convertible Notes for the 2015 Special Distribution); 4,371,308 shares reserved for future issuances under our 2000 Equity Incentive Plan, 2000

Director Option Plan and 2001 Supplemental Stock Plan; 3,568,891 shares reserved for future issuances under our 2004 Employee Stock Purchase Plan; and any shares issuable upon the exercise of the underwriters’ option to purchase additional

shares in this offering. Subject to certain volume limitations imposed by the NASDAQ Global Select Market, we may issue all of these shares without any action or approval by our stockholders, including, without limitation, in connection with the

Telecity Acquisition. We may issue additional common stock in the future in connection with raising capital, acquisitions, strategic transactions, or for other purposes. Any shares issued either in connection with the foregoing activities, the

exercise of stock options or otherwise would dilute the percentage ownership held by investors who purchase our shares in this offering and would reduce our earnings per share.

We may invest or spend the net proceeds of this offering in ways with which you may not agree and in ways that may not earn a profit.

We intend to use the net proceeds of this offering, together with the proceeds from the Proposed Debt Financings, to finance the Telecity Acquisition, as described under “Use of proceeds.” However, the

completion of this common stock offering is not contingent upon the completion of the Telecity Acquisition. Accordingly, if the Telecity Acquisition were not to be consummated for any reason, the net proceeds from this offering would be used for

general corporate purposes, which may include repayment of indebtedness, capital expenditures, working capital and acquisitions from time to time. See “Use of proceeds.” You may not agree with the ways we decide to use these proceeds, and

our use of the proceeds may not yield any profits.

This offering is not conditioned on the consummation of any other financing.

We intend to use the net proceeds of this offering, together with the net proceeds from the Proposed Debt Financings, for merger and acquisition

activities and repayment of indebtedness (including the funding of the cash portion of the Telecity Acquisition purchase price and repayment of existing TelecityGroup indebtedness in connection therewith) and for general corporate purposes as

described in “Use of proceeds.” However, the completion of this common stock offering is not contingent upon the completion of the Proposed Debt Financings or the Telecity Acquisition. As of the date of this prospectus supplement, the

offering of the Proposed New Notes has not begun, and there can be no assurance as to whether it will be completed on attractive terms or at all. Furthermore, there are no lenders committed to providing the Proposed Term Loan. Our ability to

obtain the Proposed Debt Financings will depend on investor and lender demand, the condition of the capital markets, customary closing conditions and other factors, and we cannot assure you that we will be able to obtain or close the Proposed Debt

Financings or that other additional financing will be available to us on favorable terms, or at all. If we are unable to obtain permanent financing for the Telecity Acquisition, we may be required to draw

S-17

under the Telecity Bridge Loan Commitment to fund the cash portion of the purchase price for the Telecity Acquisition. In that event, our financing costs would be substantially higher than

anticipated and higher than described under “Unaudited pro forma condensed combined financial information.”

We have various mechanisms

in place that may discourage takeover attempts.

Certain provisions of our certificate of incorporation and bylaws may discourage, delay or

prevent a third party from acquiring control of us in a merger, acquisition or similar transaction that a stockholder may consider favorable. Such provisions include:

| • |

|

ownership limitations and transfer restrictions relating to our stock that are intended to facilitate our compliance with certain REIT rules relating to share

ownership; |

| • |

|

authorization for the issuance of “blank check” preferred stock; |

| • |

|

the prohibition of cumulative voting in the election of directors; |

| • |

|

limits on the persons who may call special meetings of stockholders; |

| • |

|

limits on stockholder action by written consent; and |

| • |

|

advance notice requirements for nominations to our board of directors or for proposing matters that can be acted on by stockholders at stockholder meetings.

|

In addition, Section 203 of the Delaware General Corporation Law, which restricts certain business combinations with interested

stockholders in certain situations, may also discourage, delay or prevent someone from acquiring or merging with us.

S-18

Use of proceeds

We estimate that the net proceeds from this offering, after deducting underwriting discounts and commissions and estimated offering expenses, will be approximately $721.2 million (or approximately $829.5 million if

the underwriters exercise their option to purchase additional shares in full).

We intend to use the net proceeds from this offering, together with the

net proceeds of the Proposed Debt Financings and cash on hand, for merger and acquisition activities and repayment of indebtedness (including the funding of the cash portion of the Telecity Acquisition purchase price and repayment of existing

TelecityGroup indebtedness in connection therewith) and for general corporate purposes. In connection with this offering and the completion of the Proposed Debt Financings, we intend to terminate the Telecity Bridge Loan Commitment. In order to

satisfy requirements under the U.K. City Code on Takeovers and Mergers, prior to terminating the Telecity Bridge Loan Commitment, we intend to place approximately £875 million, or approximately $1.3 billion, in a restricted cash account in the

U.K. pending the completion of the Telecity Acquisition. If for any reason the Telecity Acquisition is not completed, then we intend to use all of the net proceeds from this offering for general corporate purposes, which may include repayment of

indebtedness, capital expenditures, working capital and acquisitions from time to time. See “Prospectus summary—Recent developments” and the sources of funds and uses of funds table below.

The completion of this common stock offering is not contingent upon the completion of the Proposed Debt Financings or the Telecity Acquisition. Accordingly, even if

the Telecity Acquisition or the Proposed Debt Financings do not occur, the shares of our common stock sold in this offering will remain outstanding, and we will not have any obligation to offer to repurchase any of the shares of common stock sold in

this offering.

The following table outlines the sources and uses of funds for the cash consideration payable in connection with the Telecity

Acquisition. The table assumes that the Telecity Acquisition and the Proposed Debt Financings are completed simultaneously, but this offering is expected to occur before the completion of the Proposed Debt Financings and the Telecity Acquisition.

Amounts in the table are in millions of dollars and are estimated. Actual amounts may vary from the estimated amounts.

|

|

|

|

|

|

|

|

|

|

|

| Sources of funds |

|

|

Uses of funds |

|

| Cash(1) |

|

$ |

490.4 |

|

|

Total cash consideration payable in Telecity Acquisition(5) |

|

$ |

1,786.2 |

|

| Common stock offered hereby(2) |

|

$ |

750.0 |

|

|

Transaction fees and expenses(6) |

|

$ |

179.7 |

|

| Proposed New Notes(3) |

|

$ |

1,000.0 |

|

|

Refinance existing TelecityGroup indebtedness(7) |

|

$ |

508.7 |

|

| Proposed Term Loan(4) |

|

$ |

700.0 |

|

|

General corporate purposes |

|

$ |

465.8 |

|

| Total |

|

$ |

2,940.4 |

|

|

Total |

|

$ |

2,940.4 |

|

| |

|

| (1) |

|

Reflects restricted cash of Equinix placed into a restricted cash account in connection with the Telecity Acquisition. |

| (2) |

|

Before discounts, commissions and expenses and assumes no exercise of the underwriters’ option to purchase additional shares. |

| (3) |

|

Before discounts, commissions and expenses. |

| (4) |

|

No lenders have committed to fund any portion of the Proposed Term Loan. |

| (5) |

|

Assuming an exchange rate of 1.5189 as of September 30, 2015. Does not include an estimated 6,905,645 shares of our common stock to be issued to shareholders of

TelecityGroup. |

| (6) |

|

Includes estimated transaction costs in connection with the Telecity Acquisition, Equity Offering and Proposed Debt Financings. Assumes an exchange rate of 1.5355 as of September

30, 2015. |

| (7) |

|

Includes repayment of TelecityGroup’s existing debt, accrued interest, and settlement of associated interest rate swap derivative liabilities. Assumes an exchange rate of

1.5189 as of September 30, 2015. |

S-19

Certain of the underwriters have acted as underwriters for our existing senior notes and are expected to act as

underwriters for the Proposed New Notes. Certain affiliates of the underwriters act as lenders and/or agents under our existing credit facilities and/or are expected to act as lenders and/or agents under the Proposed Term Loan. Affiliates of the

underwriters have made commitments to us with respect to a Telecity Bridge Loan Commitment to finance a portion of the Telecity Acquisition under certain circumstances in the event this offering and the Proposed Debt Financings are not consummated,

for which the underwriters and/or their affiliates will be paid customary fees. See “Prospectus summary—Recent developments—Acquisition of Telecity Group plc”. Certain of the underwriters or their affiliates may hold equity of

TelecityGroup and/or positions in the existing TelecityGroup indebtedness to be refinanced and may be repaid with a portion of the net proceeds of this offering.

S-20

Capitalization

The following table sets forth our cash, cash equivalents and short-term and long-term investments and current portion of our indebtedness and our capitalization as of September 30, 2015:

| • |

|

on an as adjusted basis to give effect to this offering (but not the application of the net proceeds therefrom), assuming a public offering price of $294.74 per

share of our common stock, which is equal to the last reported sale price of our common stock on the NASDAQ Global Select Market on November 12, 2015, after deducting underwriting discounts and commissions and estimated offering expenses (assuming

no exercise of the underwriters’ option to purchase additional shares of our common stock); and |

| • |

|

on a pro forma as adjusted basis to give further effect to: (1) the Proposed Debt Financings and the payment of related fees and expenses; (2) the