UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): May 28, 2015

EQUINIX, INC.

(Exact

Name of Registrant as Specified in Its Charter)

|

|

|

|

|

| Delaware |

|

000-31293 |

|

77-0487526 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| One Lagoon Drive, 4th Floor

Redwood City, California |

|

94065 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(650) 598-6000

(Registrant’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 1.01. |

Entry into a Material Definitive Agreement |

On May 29, 2015, Equinix, Inc. (“Equinix”)

issued an announcement under Rule 2.7 of the United Kingdom City Code on Takeovers and Mergers (the “Rule 2.7 Announcement”) disclosing the terms of a recommended cash and share offer for the entire issued and to be issued share capital of

Telecity Group plc, a public company organized under the laws of England and Wales (“TelecityGroup”) (the “Transaction”). In connection with the Transaction, (i) Equinix and TelecityGroup entered into a cooperation agreement

(the “Cooperation Agreement”), and (ii) Equinix, as borrower, and JPMorgan Chase Bank, N.A. (“JPMCB”), as administrative agent and lender, entered into a Bridge Credit Agreement, dated as of May 28, 2015 (the

“Bridge Credit Agreement”).

Rule 2.7 Announcement

On May 29, 2015, Equinix issued the Rule 2.7 Announcement disclosing the terms of the Transaction. For each TelecityGroup share, TelecityGroup

shareholders will receive 572.5 pence in cash and 0.0327 new shares of Equinix common stock by means of a court sanctioned scheme of arrangement (the “Scheme”).

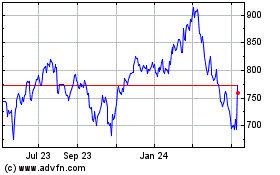

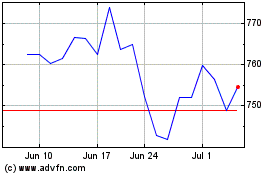

The Transaction values each TelecityGroup share at approximately 1,145.0 pence per TelecityGroup share and a value of approximately

£2,351.9 million for TelecityGroup’s entire issued and to be issued share capital based on the volume-weighted average share price of $267.74 per Equinix share for the 5 day period to 28 May 2015 (being the last business day

before the date of the Rule 2.7 Announcement).

The Transaction will be pre-conditional upon the receipt of competition authority clearances and also is

conditional upon (i) approval of the Scheme by the holders of at least a majority in number representing at least 75% of the issued share capital of TelecityGroup present at a shareholder meeting and approval of related resolutions by at least

a 75% majority of the issued share capital of TelecityGroup present at a further shareholder meeting and (ii) the sanction of the High Court of England and Wales.

The conditions to the Transaction are set out in full in the Rule 2.7 Announcement. It is expected that the Scheme will become effective in the first half of

2016, subject to the satisfaction or waiver of the pre-condition and other relevant conditions.

Equinix reserves the right, subject to the Cooperation

Agreement, to elect to implement the Transaction by way of a takeover offer (as such term is defined in the Companies Act 2006).

Co-operation

Agreement

On May 29, 2015, Equinix and TelecityGroup entered into the Cooperation Agreement pursuant to which each of Equinix and TelecityGroup

has agreed to cooperate to secure the clearances and authorizations necessary to satisfy the regulatory pre-condition to the Transaction (the “Clearances”). TelecityGroup also has agreed to certain undertakings to cooperate and provide

Equinix with information and assistance in relation to the Clearances.

The Cooperation Agreement will terminate (i) if Equinix and TelecityGroup so

agree, (ii) if the Scheme has not become effective by the Long Stop Date, (iii) where a competing proposal is recommended by the Board of TelecityGroup and announced, (iv) if the Scheme is withdrawn or lapses (other than pursuant to

Equinix’s right to switch to a takeover offer), (v) if the Scheme is not approved by the requisite majorities of TelecityGroup shareholders, (vi) if the Scheme is not sanctioned by the Scheme Court Hearing, (vii) if the

recommendation of the Board of TelecityGroup is withdrawn, qualified or adversely modified, or (viii) a Break Payment Event occurs.

By way of

compensation for any loss suffered by TelecityGroup in connection with the preparation and negotiation of the Transaction, Equinix has agreed to pay to TelecityGroup £50 million if: (i) on or prior to the Long Stop Date, Equinix

invokes the pre-condition, or (ii) on the Long Stop Date, the pre-condition is not satisfied or waived by Equinix (a “Break Payment Event”).

The Cooperation Agreement also records Equinix’s and TelecityGroup’s intention to implement the Transaction by way of the Scheme, subject to the

ability of Equinix to proceed by way of a takeover offer in the certain circumstances. The Cooperation Agreement also contains provisions that will apply in respect of the TelecityGroup share option schemes.

Bridge Credit Facility

In order to provide financing in connection with the Transaction, on May 28, 2015 (the “Effective Date”), Equinix entered into the Bridge Credit

Agreement with JPMCB as the initial lender and as administrative agent for the lenders from time to time party thereto (the “Lenders”), for a principal amount of £875 million (the “Bridge Loan”). The Bridge Loan has an

initial maturity of 12 months from the date of the first drawdown and, at the initial maturity date (if not repaid prior to that time), will be converted into seven-year extended bridge loans that will be exchangeable by the Lenders at any time

(subject to certain minimum exchange amounts) into fixed-rate exchange notes with registration rights. The Bridge Loan bears interest during the first three months at an initial annual rate of LIBOR plus 5.00%. Thereafter, the rate for each

subsequent three-month period increases by 0.5% over the applicable margin in effect for the immediately preceding three-month period (subject to a cap (the “Total Cap”) on the rate equal to (x)(i) prior to February 28, 2016, 1.50%

and (ii) on and after February 28, 2016, 1.75%, plus (y) the greatest of (i) the yield on Equinix’s 5.750% Senior Notes due 2025, (ii) the yield on the J.P. Morgan US Dollar Global High Yield Index minus 1.21% and

(iii) 4.875%). Under certain circumstances the loans will bear interest at the Total Cap as determined weekly. The Bridge Loan is not secured.

The

Bridge Credit Agreement requires mandatory prepayment of the Bridge Loan in the event of certain asset sales (subject to certain reinvestment rights) and from the proceeds of subsequent equity or debt offerings and certain debt financings. In

addition, the Bridge Credit Agreement contains standard affirmative covenants for facilities of this type, including requirements to effect a change of control repurchase offer and to effect take-out financings at the request of J.P. Morgan

Securities LLC. The Bridge Credit Agreement also contains standard negative covenants for facilities of this type and generally consistent with Equinix’s existing outstanding senior notes, including restrictions on incurrence of additional

debt; liens; restricted payments; fundamental changes; dividend and payment restrictions from subsidiaries; transactions with affiliates; business activities; asset sales; issuance of preferred stock by restricted subsidiaries; and additional

guarantees.

Equinix intends to obtain permanent financing prior to the closing of the Transaction to replace the Bridge Loan.

The foregoing summary of the Transaction, the Rule 2.7 Announcement and the Co-operation Agreement do not purport to be complete and are subject to, and

qualified in their entirety by, the full text of the Rule 2.7 Announcement, which is attached as Exhibit 2.1 hereto and incorporated by reference herein and the full text of the Co-operation Agreement, which is attached as Exhibit 2.2 hereto and

incorporated by reference herein.

The foregoing summary of the Bridge Credit Agreement is only a summary and is qualified in its entirety by reference to

the Bridge Credit Agreement, a copy of which will be filed as an exhibit to our Quarterly Report on Form 10-Q for the quarter ended June 30, 2015.

The Rule 2.7 Announcement, Co-operation Agreement and Bridge Credit Agreement and the above descriptions have been included solely to provide investors and

security holders with information regarding the terms of such documents. They are not intended to be a source of financial, business or operational information about Equinix, TelecityGroup or their respective subsidiaries or affiliates. The

representations, warranties and covenants contained in such documents were made only for purposes of those agreements and as of specific dates; were solely for the benefit of the parties to such documents, as applicable; and may be subject to

limitations agreed upon by the parties, including being qualified by confidential disclosures made by each contracting party to the other for the purposes of allocating contractual risk between them instead of establishing matters of fact; and may

be subject to standards of materiality applicable to the contracting parties that differ from those applicable to investors or security holders. Investors and security holders should not rely on the representations, warranties and covenants or any

description thereof as characterizations of the actual state of facts or condition of Equinix, TelecityGroup or their respective subsidiaries or affiliates. Moreover, information concerning the subject matter of the representations, warranties and

covenants may change after the date of such documents, as applicable, which subsequent information may or may not be fully reflected in public disclosures. As to factual matters concerning Equinix and TelecityGroup, you should not rely upon the

representations and warranties in such documents, as applicable.

JPMCB and/or its affiliates have provided in the past, and may provide in the future,

investment banking services to Equinix. In addition, J.P. Morgan Securities LLC together with its affiliate J.P. Morgan Limited is acting as financial advisor to Equinix in connection with the Transaction and J.P. Morgan Securities LLC has provided

a fairness opinion to Equinix that the aggregate cash consideration to be paid by Equinix in the Transaction is fair, from a financial point of view, to Equinix.

| Item 2.03. |

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

On May 28, 2015, Equinix entered into the Bridge Credit Agreement as described under Item 1.01 above. The description of the Bridge Credit Agreement

set forth in Item 1.01 above is incorporated into this Item 2.03 by reference.

On May 29, 2015, Equinix issued an announcement in relation to the terms of a

recommended cash and share offer by Equinix for all of the issued and to be issued share capital of TelecityGroup.

| Item 9.01. |

Financial Statements and Exhibits |

Equinix hereby furnishes the following exhibits described above in Item 1.01,

Item 2.03 and Item 8.01:

|

|

|

|

|

| 2.1 |

|

Rule 2.7 Announcement, dated as May 29, 2015. |

|

|

| 2.2 |

|

Cooperation Agreement, dated as of May 29, 2015, by and between Equinix, Inc. and Telecity Group plc. |

FURTHER INFORMATION

This Current Report

is not intended to and does not constitute or form part of any offer to sell or subscribe for or any invitation to purchase or subscribe for any securities or the solicitation of any vote or approval in any jurisdiction pursuant to the Transaction

or otherwise nor will there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable laws. The Transaction will be implemented solely pursuant to the terms of the Scheme document, which will contain the full

terms and conditions of the Transaction, including details of how to vote in respect of the Transaction. Any decision in respect of, or other response to, the Transaction should be made only on the basis of the information contained in the Scheme

Document.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Current Report on Form 8-K (the “Current Report”) contains forward-looking statements within the meaning of the Private Securities Litigation

Reform Act of 1995 and other securities laws. The forward-looking statements involve risks and uncertainties. Actual results may differ materially from expectations discussed in such forward-looking statements. Although Equinix believes that its

forward-looking statements are based on reasonable assumptions, expected results may not be achieved, and actual results may differ materially from its expectations.

Equinix’s forward-looking statements should not be relied upon except as statements of Equinix’s present intentions and of Equinix’s present

expectations, which may or may not occur. Cautionary statements should be read as being applicable to all forward-looking statements wherever they appear. Except as required by law, Equinix undertakes no obligation to release publicly the result of

any revision to these forward-looking statements that may be made to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. Readers are also urged to carefully review and consider the various

disclosures Equinix has made in this Current Report, as well as Equinix’s other filings with the Securities and Exchange Commission (the “SEC”). In particular, see Equinix’s Quarterly Report on Form 10-Q, filed with the SEC on

May 1, 2015, and Equinix’s Annual Report on Form 10-K, filed with the SEC on March 2, 2015, copies of which are available upon request from Equinix. Equinix does not assume any obligation to update the forwardlooking information

contained in this Current Report.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

| EQUINIX, INC. |

|

|

| By: |

|

/s/ Brandi Galvin Morandi |

| Name: |

|

Brandi Galvin Morandi |

| Title: |

|

Chief Legal Officer and Secretary |

Date: May 29, 2015

Exhibit Index

|

|

|

| Exhibit Number |

|

Description |

|

|

| 2.1 |

|

Rule 2.7 Announcement, dated as May 29, 2015. |

|

|

| 2.2 |

|

Cooperation Agreement, dated as of May 29, 2015, by and between Equinix, Inc. and Telecity Group plc. |

Exhibit 2.1

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART, IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE

RELEVANT LAWS OF SUCH JURISDICTION

29 May 2015

RECOMMENDED CASH AND SHARE OFFER

FOR

TELECITY GROUP PLC

BY

EQUINIX,

INC.

Summary

| |

• |

|

The Boards of Equinix and TelecityGroup are pleased to announce that they have reached agreement on the terms of a recommended cash and share offer for the entire issued and to be issued share capital of TelecityGroup.

|

| |

• |

|

The merger and implementation agreement that TelecityGroup entered into with Interxion on 9 March 2015 has been terminated. |

| |

• |

|

Under the terms of the Transaction, each TelecityGroup Shareholder will be entitled to receive: |

|

|

|

| for each TelecityGroup Share: |

|

572.5 pence in cash; and |

|

|

|

|

0.0327 New Equinix Shares |

| |

• |

|

The Transaction represents a value of approximately 1,145.0 pence per TelecityGroup Share and a value of approximately £2,351.9 million for TelecityGroup’s entire issued and to be issued share capital

based on the volume-weighted average share price of $267.74 per Equinix Share for the 5 day period to 28 May 2015 (being the last Business Day before the date of this Announcement) and an exchange rate on 28 May 2015 of 1.5283.

|

| |

• |

|

Based on the value of approximately 1,145.0 pence per TelecityGroup Share, the terms of the Transaction represent: |

| |

• |

|

a premium of approximately 34.9 per cent. to the Closing Price of 848.5 pence per TelecityGroup Share on 10 February 2015 (being the last Business Day before TelecityGroup announced its proposed merger with

Interxion); |

| |

• |

|

a premium of approximately 56.5 per cent. to the volume-weighted average share price of 731.8 pence per TelecityGroup Share for the 12-month period to 10 February 2015 (being the last Business Day before

TelecityGroup announced its proposed merger with Interxion); and |

| |

• |

|

a premium of approximately 27.3 per cent. to the Closing Price of 899.5 pence per TelecityGroup Share on 6 May 2015 (being the last Business Day before TelecityGroup announced that it was in discussions with

Equinix). |

| |

• |

|

The current value of the Transaction at Equinix’s Closing Price of $269.19 on 28 May 2015 (being the last Business Day before the date of this Announcement) and an exchange rate on 28 May 2015 of 1.5283

is 1,148.5 pence per TelecityGroup Share and implies a premium of approximately 27.7 per cent. to TelecityGroup’s Closing Price of 899.5 pence per TelecityGroup Share on 6 May 2015. |

| |

• |

|

Following completion of the Transaction, TelecityGroup Shareholders will hold approximately 10.1 per cent. of the Combined Group. |

| |

• |

|

Equinix has agreed that John Hughes, Executive Chairman of the Board of TelecityGroup, will join the Board of Equinix on completion of the Transaction. |

| |

• |

|

The directors of TelecityGroup, who have been so advised by Goldman Sachs International and Oakley Capital Limited as to the financial terms of the Transaction, consider the terms of the Transaction to be fair and

reasonable. In providing their advice Goldman Sachs International and Oakley Capital Limited have taken into account the commercial assessments of the directors of TelecityGroup. |

| |

• |

|

Accordingly, the directors of TelecityGroup intend unanimously to recommend that TelecityGroup Shareholders vote in favour of the Scheme at the Court Meeting and the resolutions relating to the Transaction at the

TelecityGroup General Meeting, as the directors of TelecityGroup have irrevocably undertaken to do in respect of their own beneficial holdings of 128,318 TelecityGroup Shares in aggregate representing approximately 0.0632 per cent. of

TelecityGroup’s issued share capital on 28 May 2015 (being the last Business Day before this Announcement). Further details of these irrevocable undertakings are set out in Appendix 4. |

| |

• |

|

The Board of Equinix believes that the Transaction will deliver significant value for the shareholders of both TelecityGroup and Equinix. The Board of Equinix believes that the premium offered, which includes a

significant cash component and the opportunity for TelecityGroup Shareholders to participate in combined value creation through the Transaction’s equity component, represents a highly attractive opportunity for TelecityGroup Shareholders.

|

| |

• |

|

The Board of Equinix believes that this Transaction will provide the opportunity for increased network and cloud density to better serve customers. The combined footprint of Equinix and TelecityGroup will create a

stronger platform to attract customers and pursue the emerging enterprise opportunity. Equinix expects the Transaction to enable accelerated deployment of cloud service provider nodes and to further the execution of Equinix’s cloud ecosystem

strategy for EMEA. |

| |

• |

|

Equinix will provide a Mix and Match Facility, which will allow TelecityGroup Shareholders to elect, subject to off-setting elections, to vary the proportions in which they receive New Equinix Shares and cash. The Mix

and Match Facility will not change the total number of New Equinix Shares to be issued or the maximum amount of cash that will be paid under the terms of the Transaction. |

| |

• |

|

In the event that the record date for a Special Equinix Dividend falls between the date of this Announcement and the Effective Date, then the number

of New Equinix Shares that each TelecityGroup Shareholder will be entitled to receive under the terms of the Transaction will be subject to a pro rata adjustment upwards to reflect the equity component of that Special Equinix Dividend and to ensure

that the percentage of the Combined Group owned by TelecityGroup Shareholders is not changed by that Special Equinix Dividend. |

2

| |

• |

|

TelecityGroup Shareholders will be entitled to an interim dividend in respect of the six-month period ended 30 June 2015, provided that such dividend will not exceed 5 pence per TelecityGroup Share. This dividend

will be paid only if the Transaction completes after the record date for the Special Equinix Dividend to be paid or declared during or before the fourth quarter of 2015. If any other dividend is declared, made or paid in respect of the TelecityGroup

Shares on or after the date of this Announcement or an interim dividend in respect of the six-month period ended 30 June 2015 is declared, made or paid in excess of 5 pence, Equinix reserves the right to reduce the Consideration by the amount

of all or part of any such dividend or all or part of any such excess. |

| |

• |

|

It is intended that the Transaction will be implemented by way of a court-sanctioned scheme of arrangement under Part 26 of the Companies Act 2006. |

| |

• |

|

The Transaction will be subject to the Pre-Condition relating to regulatory clearances from the European Commission or certain national authorities as set out in Appendix 1, the Conditions and certain further terms set

out in Appendix 2 and to the full terms and conditions which will be set out in the Scheme Document, including the sanction of the Scheme by the Court. |

| |

• |

|

The Scheme Document will include full details of the Scheme, together with notices of the Court Meeting and the TelecityGroup General Meeting and the expected timetable, and will specify the action to be taken by Scheme

Shareholders. It is expected that the Scheme Document will be despatched to TelecityGroup Shareholders after satisfaction or waiver of the Pre-Condition. |

| |

• |

|

Equinix expects the Effective Date to occur in the first half of 2016, subject to the satisfaction or waiver of the Pre-Condition set out in Appendix 1 and the Conditions and certain further terms set out in Appendix 2.

|

| |

• |

|

In order for Equinix to be in a position to satisfy the REIT requirements which apply to it and ensure compliance with the REIT tests which must be satisfied by Equinix quarterly in order to maintain qualification as a

REIT, during 2015, it is intended that the Effective Date will be within the first 15 days of commencement of the calendar quarter immediately following satisfaction or waiver of the Pre-Condition set out in Appendix 1 and satisfaction of the

Conditions set out in paragraphs 1.1 and 1.2 of Appendix 2 (the “Trigger Conditions”) provided that, if the Trigger Conditions are satisfied or waived (as the case may be) after 1 October 2015, then the Effective Date will be

within the first 30 days of the calendar quarter immediately following satisfaction or waiver of the Trigger Conditions unless Equinix notifies TelecityGroup that the Effective Date can occur at any other time in that quarter. |

3

Commenting on today’s Announcement, Stephen Smith, Chief Executive Officer & President of Equinix

said:

“We are delighted to announce the combination of TelecityGroup and Equinix in what is an exciting day for the stakeholders of both

companies. The addition of TelecityGroup’s businesses will considerably strengthen Equinix’s offering to customers in Europe and beyond, reinforcing us as a global leader in global interconnection and data centres, as well as bringing the

benefits of greater cloud and network density to our customers.

The transaction will allow Equinix to benefit from increased scale and extend the

global reach of our platform. We believe our offer is compelling to TelecityGroup Shareholders who will realise significant value for their holdings while having the opportunity to participate in the future strengths of the combined business. We are

especially pleased to be welcoming John Hughes onto the Board of the combined business and will greatly benefit from his experience in the technology space. “

Commenting on today’s Announcement, John Hughes, Executive Chairman of TelecityGroup said:

“On behalf of the Board of TelecityGroup, I am very pleased to recommend the combination of TelecityGroup and Equinix to our shareholders today.

Having carefully considered all our options, the Board believes this is a compelling offer and an excellent outcome for shareholders, employees and customers.

TelecityGroup has become a leading player in the European datacentre industry, consistently delivering an outstanding performance and high quality returns

to shareholders. This is testament to the hard work of all TelecityGroup’s employees. I am delighted that they now have the opportunity to be part of a global technology leader, led by Equinix’s exceptional management team.

Through this transaction, our customers will have new global opportunities for their connected datacentre requirements. The combination of Equinix and

TelecityGroup services and people will ensure the expanded business leads the way in the provision of highly-connected data centre services for customers in Europe and all over the world.”

This summary should be read in conjunction with, and is subject to, the full text of this Announcement (including the Appendices). The Transaction will be

subject to the Pre-Condition set out in Appendix 1, the Conditions and certain further terms set out in Appendix 2 and to the full terms and conditions which will be set out in the Scheme Document, including the sanction of the Scheme by the Court.

Appendix 3 contains sources and bases of certain information contained in this Announcement. Details of irrevocable undertakings received by Equinix are set out in Appendix 4. Certain terms used in this Announcement are defined in Appendix 5.

A copy of this Announcement is available, subject to certain restrictions relating to persons resident in Restricted Jurisdictions, for inspection on

Equinix’s website at www.equinix.com and on TelecityGroup’s website at www.telecitygroup.com.

4

Analyst and investor call

Equinix will hold a conference call on Friday 29 May 2015 at 8:30 a.m. EDT / 1.30 p.m. BST to discuss this Announcement.

To hear the conference call live, please dial +1 (210) 234-8004 (domestic and international) and use the passcode EQIX. A simultaneous live webcast of

the call will be available at http://investor.equinix.com.

A replay of the call will be available one hour after the call until Sunday 30 August

2015 by dialling +1 (203) 369-0257 and entering passcode 2015.

|

|

|

| Enquiries: |

|

|

|

|

| Equinix |

|

|

|

|

| Media contacts |

|

|

|

|

| Ian Bain |

|

+1 650 598 6447 |

|

|

| Claire Macland |

|

+44 750 783 4784 |

|

|

| Investor relations |

|

|

|

|

| Katrina Rymill |

|

+1 650 598 6583 |

|

|

| J.P. Morgan – Financial Adviser |

|

|

|

|

| Fred Turpin Marco Caggiano |

|

New York: +1 212 270 6000 |

|

|

| Laurence Hollingworth Dwayne Lysaght |

|

London: +44 207 742 4000 |

|

|

| Tulchan Communications – Communications Adviser |

|

+44 207 353 4200 |

|

|

| Andrew Grant Stephen Malthouse

Tom Murray |

|

|

5

|

|

|

| TelecityGroup |

|

|

|

|

| Media |

|

|

|

|

| James Tyler |

|

+44 207 001 0076 |

|

|

| Investor relations |

|

|

|

|

| Rosie Wilkins |

|

+44 203 229 1138 |

|

|

| Goldman Sachs International—Lead Financial Adviser, Rule 3 Adviser and Joint Corporate Broker |

|

+44 207 774 1000 |

|

|

| Anthony Gutman Richard Cormack

Nicholas van den Arend Alex Garner |

|

|

|

|

| Oakley Capital Limited – Financial Adviser and Rule 3 Adviser |

|

+44 207 766 6933 |

|

|

| Christian Maher Anthony Yaneza

David Rogers |

|

|

|

|

| Barclays Bank PLC, acting through its Investment Bank – Financial Adviser and Joint Corporate Broker |

|

+44 207 623 2323 |

|

|

| Matthew Smith Jim Renwick

Joe Valenti |

|

|

|

|

| Greenhill & Co International LLP – Financial Adviser |

|

+44 207 198 7400 |

|

|

| David Wyles Pieter-Jan Bouten |

|

|

|

|

| Brunswick – Public relations adviser |

|

+44 207 404 5959 |

|

|

| Sarah West Aideen Lee

Chris Buscombe Helen Smith |

|

|

6

Important notices relating to financial advisers

J.P. Morgan Securities LLC (“J.P. Morgan”), together with its affiliate J.P. Morgan Limited (which is authorised and

regulated in the United Kingdom by the FCA) is acting as financial adviser exclusively for Equinix and no one else in connection with the matters set out in this Announcement and will not regard any other person as its client in relation to the

matters in this Announcement and will not be responsible to anyone other than Equinix for providing the protections afforded to clients of J.P. Morgan or its affiliates, nor for providing advice in relation to any matter referred to in this

Announcement.

Goldman Sachs International, which is authorised by the PRA and regulated by the FCA and the PRA in the United Kingdom, is acting

for TelecityGroup and no one else in connection with the proposed transaction and the matters referred to in this Announcement and will not be responsible to anyone other than TelecityGroup for providing the protections afforded to clients of

Goldman Sachs International, or for giving advice in connection with the proposed transaction or any matter referred to herein.

Oakley Capital

Limited is authorised and regulated by the FCA. Oakley Capital Limited is acting as financial adviser for TelecityGroup and no one else in connection with the matters set out in this Announcement and will not regard any other person as its client

nor be responsible to anyone other than those persons for providing the protections afforded to clients of Oakley Capital Limited nor for providing advice in relation to the matters referred to in this Announcement.

Barclays Bank PLC, acting through its Investment Bank (“Barclays”), which is authorised by the PRA and regulated by the FCA

and the PRA, is acting exclusively for TelecityGroup and no one else in connection with the proposed transaction and the matters set out in this Announcement and will not be responsible to anyone other than TelecityGroup for providing the

protections afforded to clients of Barclays, or for giving advice in connection with the proposed transaction or any matter referred to in this Announcement.

Greenhill & Co. International LLP, which is authorised and regulated in the United Kingdom by the FCA, is acting for TelecityGroup and no one else

in connection with the proposed transaction and will not be responsible to anyone other than TelecityGroup for providing the protections afforded to clients of Greenhill & Co International LLP, or for giving advice in connection with the

proposed transaction or any matter referred to herein.

7

Further information

This Announcement is not intended to and does not constitute or form part of any offer to sell or subscribe for or any invitation to purchase or subscribe

for any securities or the solicitation of any vote or approval in any jurisdiction pursuant to the Transaction or otherwise nor will there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable laws. The

Transaction will be implemented solely pursuant to the terms of the Scheme Document, which will contain the full terms and conditions of the Transaction, including details of how to vote in respect of the Transaction. Any decision in respect of, or

other response to, the Transaction should be made only on the basis of the information contained in the Scheme Document.

Overseas jurisdictions

The release, publication or distribution of this Announcement in jurisdictions other than the United Kingdom may be restricted by law and

therefore any persons who are subject to the laws of any jurisdiction other than the United Kingdom should inform themselves about, and observe, any applicable requirements.

In particular, the ability of persons who are not resident in the United Kingdom to vote their TelecityGroup Shares with respect to the Scheme at the Court

Meeting, or to execute and deliver forms of proxy appointing another to vote at the Court Meeting on their behalf, may be affected by the laws of the relevant jurisdictions in which they are located. This Announcement has been prepared for the

purpose of complying with English law and the City Code and the information disclosed may not be the same as that which would have been disclosed if this Announcement had been prepared in accordance with the laws of jurisdictions outside the United

Kingdom.

No person may vote in favour of the Transaction by any use, means, instrumentality or form within a Restricted Jurisdiction or any other

jurisdiction if to do so would constitute a violation of the laws of that jurisdiction. Accordingly, copies of this Announcement and any formal documentation relating to the Transaction are not being, and must not be, directly or indirectly, mailed

or otherwise forwarded, distributed or sent in or into or from any Restricted Jurisdiction and persons receiving such documents (including custodians, nominees and trustees) must not mail or otherwise forward, distribute or send it in or into or

from any Restricted Jurisdiction. If the Transaction is implemented by way of an Offer (unless otherwise permitted by applicable law and regulation), the Offer may not be made, directly or indirectly, in or into, or by the use of mails or any means

or instrumentality (including, but not limited to, facsimile, email or other electronic transmission, telex or telephone) of interstate or foreign commerce of, or of any facility of a national, state or other securities exchange of, any Restricted

Jurisdiction and the Offer may not be capable of acceptance by any such use, means, instrumentality or facilities.

The availability of New Equinix

Shares under the Transaction to TelecityGroup Shareholders who are not resident in the United Kingdom may be affected by the laws of the relevant jurisdictions in which they are resident. Persons who are not resident in the United Kingdom should

inform themselves of, and observe, any applicable legal or regulatory requirements.

Further details in relation to TelecityGroup Shareholders in

overseas jurisdictions will be contained in the Scheme Document.

8

Additional information for US investors

The Transaction relates to the shares of an English company and will be subject to United Kingdom procedural and disclosure requirements that are different

from those of the US. Any financial statements or other financial information included in this Announcement may have been prepared in accordance with non-US accounting standards that may not be comparable to the financial statements of US companies

or companies whose financial statements are prepared in accordance with generally accepted accounting principles in the US. It may be difficult for US holders of shares to enforce their rights and any claims they may have arising under the US

federal securities laws in connection with the Transaction, since TelecityGroup is located in a country other than the US, and some or all of its officers and directors may be residents of countries other than the US. US holders of shares in

TelecityGroup may not be able to sue TelecityGroup or their respective officers or directors in a non-US court for violations of US securities laws. Further, it may be difficult to compel TelecityGroup and its affiliates to subject themselves to the

jurisdiction or judgment of a US court.

The Transaction is expected to be implemented by means of a scheme of arrangement provided for under

English company law.

As a result, any securities to be issued under the Transaction would be issued in reliance upon the exemption from the

registration requirements of the US Securities Act of 1933 (as amended), pursuant to the exemption from registration set forth in Section 3(a)(10) thereof, and also would not be subject to the tender offer rules promulgated under the US

Securities Exchange Act of 1934 (as amended).

If, in the future, Equinix exercises the right to implement the Transaction by way of an Offer in

accordance with the Co-operation Agreement, any securities to be issued under the Transaction may be issued in reliance upon the exemption from the registration requirements of the US Securities Act of 1933 (as amended) pursuant to Rule 802

thereunder, if such exemption is available. Alternatively, any securities to be issued under the Transaction may be registered under the US Securities Act of 1933 (as amended). If the Transaction is implemented by way of an Offer, it will be done in

compliance with the applicable tender offer rules under the US Securities Exchange Act of 1934 (as amended), including any applicable exemptions provided under Rules 14d-1(c) and 14d-1(d) thereunder.

TelecityGroup Shareholders are urged to read any documents related to the Transaction filed, furnished or to be filed or furnished with the SEC because

they will contain important information regarding the Transaction and any related offer of securities. Such documents will be available free of charge at the SEC’s website at www.sec.gov. Nothing in this Announcement shall be deemed an

acknowledgement that any SEC filing is required or that an offer requiring registration under the US Securities Act of 1933 may ever occur in connection with the Transaction.

Cautionary note regarding forward-looking statements

This Announcement contains certain forward-looking statements with respect to the financial condition, results of operations and businesses of TelecityGroup

and Equinix and certain plans and objectives of Equinix with respect to the Combined Group. These forward-looking statements can be identified by the fact that they do not relate only to historical or current facts. Forward-looking statements often

use words such as “anticipate”, “believe”, “expect”, “estimate”,

9

“intend”, “plan”, “goal”, “hope”, “aims”, “continue”, “will”, “may”, “should”, “would”,

“could” or other words of similar meaning. These statements are based on assumptions and assessments made by TelecityGroup and/or Equinix in light of their experience and their perception of historical trends, current conditions, future

developments and other factors they believe appropriate. By their nature, forward-looking statements involve risk and uncertainty, because they relate to events and depend on circumstances that will occur in the future and the factors described in

the context of such forward-looking statements in this Announcement could cause actual results and developments to differ materially from those expressed in or implied by such forward-looking statements. Although it is believed that the expectations

reflected in such forward-looking statements are reasonable, no assurance can be given that such expectations will prove to have been correct and you are therefore cautioned not to place undue reliance on these forward-looking statements, which

speak only as at the date of this Announcement. Neither TelecityGroup nor Equinix assumes any obligation to update or correct the information contained in this Announcement (whether as a result of new information, future events or otherwise), except

as required by applicable law.

There are a number of factors which could cause actual results to differ materially from those expressed or implied

in forward-looking statements. Among the factors that could cause actual results to differ materially from those described in the forward-looking statements are changes in the global, political, economic, business, competitive, market and regulatory

forces, future exchange and interest rates, changes in tax rates, and future business combinations or dispositions.

No profit forecasts or

estimates

No statement in this Announcement (including any statement of estimated synergies) is intended as a profit forecast or estimate for

any period.

Dealing and Opening Position Disclosure requirements

Under Rule 8.3(a) of the Code, any person who is interested in one per cent. or more of any class of relevant securities of an offeree company or of any

securities exchange offeror (being any offeror other than an offeror in respect of which it has been announced that its offer is, or is likely to be, solely in cash) must make an Opening Position Disclosure following the commencement of the Offer

Period and, if later, following the announcement in which any securities exchange offeror is first identified. An Opening Position Disclosure must contain details of the person’s interests and short positions in, and rights to subscribe for,

any relevant securities of each of (i) the offeree company and (ii) any securities exchange offeror(s). An Opening Position Disclosure by a person to whom Rule 8.3(a) applies must be made by no later than 3.30 pm (London time) on the tenth

Business Day following the commencement of the Offer Period and, if appropriate, by no later than 3.30 pm (London time) on the tenth Business Day following the announcement in which any securities exchange offeror is first identified. Relevant

persons who deal in the relevant securities of the offeree company or of a securities exchange offeror prior to the deadline for making an Opening Position Disclosure must instead make a dealing disclosure.

Under Rule 8.3(b) of the Code, any person who is, or becomes, interested in 1% or more of any class of relevant securities of the offeree company or of any

securities exchange offeror must make a dealing disclosure if the person deals in any relevant securities of the offeree company or of any securities exchange offeror. A dealing disclosure must contain details of the dealing

10

concerned and of the person’s interests and short positions in, and rights to subscribe for, any relevant securities of each of (i) the offeree company and (ii) any securities

exchange offeror, save to the extent that these details have previously been disclosed under Rule 8. A dealing disclosure by a person to whom Rule 8.3(b) applies must be made by no later than 3.30 pm (London time) on the Business Day following the

date of the relevant dealing.

If two or more persons act together pursuant to an agreement or understanding, whether formal or informal, to

acquire or control an interest in relevant securities of an offeree company or a securities exchange offeror, they will be deemed to be a single person for the purpose of Rule 8.3.

Opening Position Disclosures must also be made by the offeree company and by any offeror and dealing disclosures must also be made by the offeree company,

by any offeror and by any persons acting in concert with any of them (see Rules 8.1, 8.2 and 8.4).

Details of the offeree and offeror companies in

respect of whose relevant securities Opening Position Disclosures and dealing disclosures must be made can be found in the Disclosure Table on the Takeover Panel’s website at www.thetakeoverpanel.org.uk, including details of the number of

relevant securities in issue, when the Offer Period commenced and when any offeror was first identified. You should contact the Panel’s Market Surveillance Unit on +44 (0)207 638 0129 if you are in any doubt as to whether you are required to

make an Opening Position Disclosure or a dealing disclosure.

Rounding

Certain figures included in this Announcement have been subjected to rounding adjustments. Accordingly, figures shown for the same category presented in

different tables may vary slightly and figures shown as totals in certain tables may not be an arithmetic aggregation of the figures that precede them.

Information relating to TelecityGroup Shareholders

Please be aware that addresses, electronic addresses and certain other information provided by TelecityGroup Shareholders, persons with information rights

and other relevant persons for the receipt of communications from TelecityGroup may be provided to Equinix during the Offer Period as required under Section 4 of Appendix 4 to the City Code.

Publication on website and availability of hard copies

A copy of this Announcement will be available, subject to certain restrictions relating to persons resident in Restricted Jurisdictions, for inspection on

Equinix’s website www.equinix.com and on TelecityGroup’s website www.telecitygroup.com by no later than 12 noon (London time) on the Business Day following this Announcement. For the avoidance of doubt, the contents of the websites

referred to in this Announcement are not incorporated into and do not form part of this Announcement.

Equinix Shareholders and TelecityGroup

Shareholders may request a hard copy of this Announcement by submitting a request in writing to 80 Cheapside, London, EC2V 6EE.

11

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART, IN, INTO OR FROM ANY JURISDICTION WHERE TO

DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OF SUCH JURISDICTION

RECOMMENDED CASH AND SHARE OFFER

FOR

TELECITY GROUP PLC

BY

EQUINIX,

INC.

The Boards of Equinix and TelecityGroup are pleased to announce that they have reached

agreement on the terms of a recommended cash and share offer for the entire issued and to be issued share capital of TelecityGroup. The merger and implementation agreement that TelecityGroup entered into with Interxion on 9 March 2015 has been

terminated.

It is intended that the Transaction will be implemented by way of a court-sanctioned scheme of arrangement under Part 26 of the Companies Act

2006.

Under the terms of the Transaction, which will be subject to the Pre-Condition set out

in Appendix 1, the Conditions and certain further terms set out in Appendix 2 and to the full terms and conditions which will be set out in the Scheme Document, each TelecityGroup Shareholder will be entitled to receive:

|

|

|

| for each TelecityGroup Share: |

|

572.5 pence in cash; and |

|

|

|

|

0.0327 New Equinix Shares |

The Transaction represents a value of approximately 1,145.0 pence per TelecityGroup Share and a value of approximately

£2,351.9 million for TelecityGroup’s entire issued and to be issued share capital based on the volume-weighted average share price of $267.74 per Equinix Share for the 5 day period to 28 May 2015 (being the last Business Day

before the date of this Announcement) and an exchange rate on 28 May 2015 of 1.5283.

Based on the value of approximately 1,145.0 pence per

TelecityGroup Share, the terms of the Transaction represent:

| |

• |

|

a premium of approximately 34.9 per cent. to the Closing Price of 848.5 pence per TelecityGroup Share on 10 February 2015 (being the last Business Day before TelecityGroup announced its proposed merger with

Interxion); |

| |

• |

|

a premium of approximately 56.5 per cent. to the volume-weighted average share price of 731.8 pence per TelecityGroup Share for the 12-month period to 10 February 2015 (being the last Business Day before

TelecityGroup announced its proposed merger with Interxion); and |

12

| |

• |

|

a premium of approximately 27.3 per cent. to the Closing Price of 899.5 pence per TelecityGroup Share on 6 May 2015 (being the last Business Day before TelecityGroup announced that it was in discussions with

Equinix). |

The current value of the Transaction at Equinix’s Closing Price of $269.19 on 28 May 2015 (being the last Business Day

before the date of this Announcement) and an exchange rate on 28 May 2015 of 1.5283 is 1,148.5 pence per TelecityGroup Share and implies a premium of approximately 27.7 per cent. to TelecityGroup’s Closing Price of 899.5 pence per

TelecityGroup Share on 6 May 2015.

Following completion of the Transaction, TelecityGroup Shareholders will hold approximately 10.1 per cent.

of the Combined Group.

Equinix expects the Effective Date to occur in the first half of 2016, subject to the satisfaction or waiver of the Pre-Condition

set out in Appendix 1 and the Conditions and certain further terms set out in Appendix 2.

Equinix has agreed that John Hughes, Executive Chairman of the

Board of TelecityGroup, will join the Board of Equinix on completion of the Transaction.

Equinix will provide a Mix and Match Facility, which will allow

TelecityGroup Shareholders to elect, subject to off-setting elections, to vary the proportions in which they receive New Equinix Shares and cash. The Mix and Match Facility will not change the total number of New Equinix Shares to be issued or the

maximum amount of cash that will be paid under the terms of the Transaction.

In the event that the record date for a Special Equinix Dividend falls

between the date of this Announcement and the Effective Date, then the number of New Equinix Shares that each TelecityGroup Shareholder will be entitled to receive under the terms of the Transaction will be subject to a pro rata adjustment upwards

to reflect the equity component of that Special Equinix Dividend and to ensure that the percentage of the Combined Group owned by TelecityGroup Shareholders is not changed by that Special Equinix Dividend.

TelecityGroup Shareholders will be entitled to an interim dividend in respect of the six-month period ended 30 June 2015, provided that such dividend

will not exceed 5 pence per TelecityGroup Share. This dividend will be paid only if the Transaction completes after the record date for the Special Equinix Dividend to be paid or declared during or before the fourth quarter of 2015. If any other

dividend is declared, made or paid in respect of the TelecityGroup Shares on or after the date of this Announcement or an interim dividend in respect of the six-month period ended 30 June 2015 is declared, made or paid in excess of 5 pence,

Equinix reserves the right to reduce the Consideration by the amount of all or part of any such dividend or all or part of any such excess.

TelecityGroup

Shares acquired under the Transaction will be acquired fully paid and free from all liens, equities, charges, encumbrances, options, rights of pre-emption and any other third party rights and interests of any nature and together with all rights now

or hereafter attaching or accruing to them, including voting rights and the right to receive and retain in full all dividends and other distributions (if any) declared, made or paid on or after the Effective Date.

13

| 3. |

Background to and reasons for the Transaction |

The Board of Equinix believes that the Transaction will

deliver significant value for the shareholders of both TelecityGroup and Equinix.

The Board of Equinix believes that the premium offered, which includes

a significant cash component and the opportunity for TelecityGroup Shareholders to participate in combined value creation through the Transaction’s equity component, represents a highly attractive opportunity for TelecityGroup Shareholders.

The Transaction is consistent with a number of Equinix’s previously stated strategic priorities, namely: to increase both network and cloud density

in EMEA, to expand the Equinix platform by prioritising growth capital in core and new markets and to drive global consistency, alignment and focus across the business.

Acquiring TelecityGroup will broaden Equinix’s reach, complementing and extending Equinix’s geographic footprint in Europe in support of its

strategy. Specifically:

| |

• |

|

it will enhance Equinix’s core EMEA business through the addition of capacity in Amsterdam, London, Frankfurt and Paris; |

| |

• |

|

it will extend Equinix’s EMEA business through the addition of capacity in Dublin, Manchester, Stockholm, Helsinki and Milan, which are new locations for Equinix that will benefit from additional cloud services and

increased interconnection; and |

| |

• |

|

it will add new capacity in Warsaw, Sofia and Istanbul, which will establish for Equinix foundations for future growth in Eastern Europe and Turkey, and which are expected to be growth areas for cloud services and

interconnection in the coming years. |

Demand for data centre services is growing rapidly in Western Europe. Data centre traffic will grow

2.5-fold by 2018, at a compound annual growth rate (CAGR) of 20 per cent. from 2013 to 2018 (Source: Cisco, 2014).

The Board of Equinix believes

that this Transaction will provide the opportunity for increased network and cloud density to better serve customers. The combined footprint of Equinix and TelecityGroup will create a stronger platform to attract customers and pursue the emerging

enterprise opportunity. Equinix expects the Transaction to enable accelerated deployment of cloud service provider nodes of existing and new customers and to further the execution of Equinix’s cloud ecosystem strategy for EMEA. Equinix expects

the Transaction will expand network and cloud service provider choice, enabling customers to seamlessly leverage the benefits of cloud.

Equinix expects

the Transaction to drive cross-selling opportunities with expanded metros, products and services, allowing Equinix and TelecityGroup to sell each other’s data centre locations as well as to introduce their respective product suites to the

combined customer base. Equinix believes that this will enable accelerated deployment of cloud service provider nodes, creating incremental interconnection opportunities and growing Equinix’s relevance to enterprise CIOs looking to re-architect

their IT platforms for the digital age.

14

Equinix expects that the Transaction will position Equinix to continue to attract global data centre demand, and

that the Transaction will enable customers to take advantage of a wider selection of locations, increased capacity in core markets and differentiated offers. Equinix also expects that TelecityGroup customers will benefit from access to

Equinix’s global footprint for colocation, from opportunities to expand deployments into multiple metros, and from expanded product and service offerings inside Equinix.

The Board of Equinix expects revenue synergies from increased demand, improved sales coverage for TelecityGroup markets where Equinix is not currently

present, and broader deployment of Equinix’s interconnection services such as Cloud Exchange. The Board of Equinix also expects the Transaction to generate significant cost synergies from the streamlining of operations. Further benefits are

expected from the combined companies’ ability to better allocate investment capital. As Equinix invests capital in expansion, the Board of Equinix anticipates that the combined companies will have better access to investment capital at lower

cost.

Equinix expects the Transaction to be adjusted funds from operations (AFFO) breakeven to Equinix within twelve months of the Effective Date.

| 4. |

Background to and reasons for the recommendation |

TelecityGroup is a European carrier-neutral data

centre and co-location provider. TelecityGroup has a strong track record of building and operating data centres in key internet cities across Europe. TelecityGroup has expanded organically and through strategic acquisitions over the last decade and

currently operates 39 data centres across 12 cities providing over 110MW of power. TelecityGroup’s strategy is to build and operate data centres in strategic internet hub cities across Europe, located in facilities in areas with high

concentration of telecommunication networks and available power. These locations offer customers resilient and secure data centre services, low latency environments and connectivity choice. This enables the creation of customer ecosystems, as the

highly connected environments attract more customers through the multiple internet connectivity and cloud service providers that are co-locating in TelecityGroup’s data centres.

TelecityGroup has made substantial development in 2014 with strong gross order wins and a solid set of results, while expanding the TelecityGroup’s

footprint in existing markets. The company also made good progress with the delivery of Cloud-IX and the Strategic Accounts Programme, demonstrating commitment to the ongoing evolution of the business.

TelecityGroup’s standalone strategy would deliver, and the merger with Interxion would have delivered, value for TelecityGroup’s shareholders.

However, the Board of TelecityGroup also believes that the Transaction accelerates the delivery of value for TelecityGroup Shareholders through the headline premium offered. Furthermore, the share component of the Transaction provides TelecityGroup

Shareholders with the opportunity for continued investment in the data centre industry, underpinned by the strong industrial logic of the Transaction.

In

light of these factors, and having received advice from Goldman Sachs International and Oakley Capital Limited, the directors of TelecityGroup consider the financial terms of the Transaction to be fair and reasonable and intend unanimously to

recommend that TelecityGroup Shareholders vote in favour of the Scheme at the Court Meeting and the resolutions relating to the Transaction at the TelecityGroup General Meeting.

15

The directors of TelecityGroup, who have been so advised by Goldman Sachs International

and Oakley Capital Limited as to the financial terms of the Transaction, consider the terms of the Transaction to be fair and reasonable. In providing their advice Goldman Sachs International and Oakley Capital Limited have taken into account the

commercial assessments of the directors of TelecityGroup.

Accordingly, the directors of TelecityGroup intend unanimously to recommend that TelecityGroup

Shareholders vote in favour of the Scheme at the Court Meeting and the resolutions relating to the Transaction at the TelecityGroup General Meeting, as the directors of TelecityGroup have irrevocably undertaken to do in respect of their own

beneficial holdings of TelecityGroup Shares. Further details of these irrevocable undertakings are set out in Appendix 4.

| 6. |

Irrevocable undertakings |

Equinix has received irrevocable undertakings from each of the directors of

TelecityGroup to vote in favour of the Scheme at the Court Meeting and the resolutions relating to the Transaction at the TelecityGroup General Meeting in respect of their own beneficial holdings of 128,318 TelecityGroup Shares in aggregate

representing approximately 0.0632 per cent. of TelecityGroup’s issued share capital on 28 May 2015 (being the last Business Day before this Announcement). These irrevocable undertakings will cease to be binding on and from the earlier

of (i) the Long Stop Date; and (ii) the date on which the Scheme is withdrawn or lapses in accordance with its terms.

Further details of these

irrevocable undertakings are set out in Appendix 4.

| 7. |

Pre-Condition and Conditions |

The Transaction is subject to the Pre-Condition set out in Appendix 1, the

Conditions and further terms set out in Appendix 2 and further terms to be set out in the Scheme Document.

In addition to the Pre-Condition, the

Transaction is conditional, among other things, on: (i) the approval by the requisite majorities of TelecityGroup Shareholders at the Meetings; (ii) the sanction of the Scheme by the Court and the registration of the Scheme Court Order

with the Registrar of Companies; and (iii) the Scheme becoming effective no later than the Long Stop Date.

| 8. |

Information relating to TelecityGroup |

TelecityGroup is a pan-European operator of network independent

data centres offering a range of highly flexible, scalable data centre and related managed services to a wide range of organisations. TelecityGroup builds and operates data centre infrastructure in strategic internet hub cities across Europe,

offering customers resilient and secure data centre services (including cloud services), low latency environments and connectivity choice which enables the creation of customer ecosystems and drives the attraction of TelecityGroup data centres to

other prospective customers. TelecityGroup’s data centres act as content and connectivity hubs facilitating a wide range of connectivity and access to cloud platforms.

16

Headquartered in London, TelecityGroup operates 39 network independent data centres across 11 European countries.

The data centres are located in prime positions for commerce and connectivity in Amsterdam, Dublin, Frankfurt, Helsinki, Istanbul, London, Manchester, Milan, Paris, Sofia, Stockholm and Warsaw. TelecityGroup creates its data centres by leasing

suitable premises which it designs and fits out in accordance with industry best practice in terms of technical and operational specifications. TelecityGroup has a diverse customer base and currently has approximately 2,500 customer contracts,

including many with well-known corporations. In particular, TelecityGroup hosts many network service providers across its network of data centres, including over 100 in London Docklands. Customers are charged primarily for locating their IT

equipment within TelecityGroup data centres. These charges are supplemented by additional fees for power usage, engineering support, connectivity and other IT services. As at the end of 2014, TelecityGroup had approximately 1.2 million gross

square feet of capacity (based on methodology equivalent to Equinix’s definition).

Further information about TelecityGroup will be included in the

Scheme Document.

| 9. |

Information relating to Equinix |

Equinix is a leading global data centre provider, with more than 100

facilities in 15 countries across five continents. Equinix’s global platform provides interconnection opportunities to more than 6,300 companies in key markets across the globe. Equinix’s operations are organised into three regions and, in

FY2014, 57 per cent. of Equinix’s revenue was derived from the Americas (including Brazil and Canada), 25 per cent. from EMEA and 18 per cent. from Asia Pacific. In EMEA, Equinix has 30 data centres in 10 metros across the UK,

The Netherlands, Germany, France, Switzerland, and the UAE.

Equinix has a unique portfolio of data centre assets providing secure, reliable facilities

for servers, data storage and networking equipment. Equinix serves more than 1,900 customers in the EMEA region across the cloud and IT services, network, financial services, content and digital media and enterprise sectors. Equinix’s data

centres have a reputation for operational excellence with world-leading average uptime metrics.

Equinix has invested over $7.6 billion in capacity, new

markets and acquisitions since its inception, including the purchase of AIM-listed IXEurope Plc in 2007 for £271 million. In the last five years, Equinix has invested $1,059 million in the EMEA region, creating 675 net jobs.

Equinix’s objective to be the leading global interconnection platform is supported by three priorities: to drive differentiated growth by deepening cloud

density and investing in innovation; to broaden reach by further strengthening go-to-market capabilities and the global data centre platform; and to optimise capital allocation through balancing profitable growth with dividend distributions to

create long term value.

In the financial year ended 31 December 2014, Equinix reported revenues of $2,444 million and adjusted EBITDA of $1,114

million, increases of 14 per cent. and 11 per cent. respectively over FY 2013. In the first quarter of 2015, Equinix paid its first quarterly dividend, which was $1.69 per share. Equinix has experienced 49 quarters of consecutive revenue

growth and has a five-year revenue compound annual growth rate of over 20 per cent. Equinix has a conservative approach to its capital structure, with significant cash on balance sheet. As at Q4 2014, Equinix has net debt to LQA Adjusted EBITDA

of 3.0x.

17

Equinix was founded in 1998 and is headquartered in Redwood City, California, with over 4,000 employees around

the globe. Equinix is led by Steve Smith, Chief Executive Officer and President, who joined the company in 2007, and in EMEA is led by Eric Schwartz, President, Equinix EMEA, who joined the company in 2006. Equinix is listed on NASDAQ with a market

capitalisation in excess of $15 billion. With effect from 1 January 2015, Equinix changed its corporate structure to qualify as a real estate investment trust in the United States and joined the S&P500 in March 2015.

Further information about Equinix will be included in the Scheme Document.

| 10. |

Information about Bidco |

Equinix intends to acquire the TelecityGroup Shares through Equinix (EMEA)

Acquisition Enterprises B.V. (the “Bidco”), an indirect wholly-owned subsidiary of Equinix. Bidco is a newly-incorporated Dutch private limited company which has been formed at the direction of Equinix for the purposes of the

Transaction. Bidco has not traded since its date of incorporation, nor has it entered into any obligations other than in connection with the Transaction.

| 11. |

Management, employees and locations |

Although Equinix is listed and headquartered in the United States,

Equinix’s EMEA region accounts for roughly a quarter of its employee base, and it continues to grow a strong and permanent presence in Europe.

Equinix is an organisation which takes pride in being able to attract, develop and retain its most talented people, including those employees who have joined

us over the years as a result of various acquisitions.

It is Equinix’s firm belief that its combined future organisation will create broader and

more numerous career opportunities than before for employees of both entities, and its track record of investing in career development and global mobility for its employees supports this commitment. Equinix values and respects the skills of

employees in TelecityGroup and intends to work to build an organisation which deploys and develops these skills as fully as possible. Equinix confirms that the existing employment rights and pension rights of all TelecityGroup employees will be

fully safeguarded.

Equinix has agreed that John Hughes, Executive Chairman of the Board of TelecityGroup, will join the Board of Equinix on completion of

the Transaction.

Although there have been preliminary discussions between Equinix and senior management of TelecityGroup regarding their potential

involvement in the on-going business of Equinix after the Effective Date, there are no agreements or arrangements between Equinix and senior management of TelecityGroup and no such agreements or arrangements will be entered into at the current time.

The Transaction is accordingly not conditional on reaching agreement with senior management.

18

| 12. |

Mix and Match Facility |

TelecityGroup Shareholders (other than certain Overseas Shareholders) may submit

an election seeking to vary the proportions of New Equinix Shares and cash they receive in respect of their holding of TelecityGroup Shares.

However, the

maximum number of New Equinix Shares that will be issued and the maximum amount of cash that will be paid under the Transaction will not be varied as a result of elections made under the Mix and Match Facility. Accordingly, Equinix’s ability to

satisfy Mix and Match Facility elections made by TelecityGroup Shareholders will depend on other TelecityGroup Shareholders making off-setting elections. To the extent that elections cannot be satisfied in full, they will be scaled down on a pro

rata basis.

As a result, TelecityGroup Shareholders who make elections under the Mix and Match Facility may not know the exact number of New Equinix

Shares, or the amount of cash, which they will receive until settlement of the Consideration under the Transaction, although an announcement will be made of the approximate extent to which elections under the Mix and Match Facility will be

satisfied.

The Mix and Match Facility will not affect the entitlement of those TelecityGroup Shareholders who do not make an election under the Mix and

Match Facility. Details and further terms of the Mix and Match Facility will be set out in the Scheme Document.

Further details of the Mix and Match

Facility (including the action to take in order to make a valid election, the deadline for making elections, and the basis on which entitlement to receive cash may be exchanged for an entitlement to additional New Equinix Shares (or vice versa)) for

TelecityGroup Shareholders will be included in the Scheme Document.

The Mix and Match Facility is conditional upon the Transaction becoming effective.

Participants in any TelecityGroup Share Option Schemes will be contacted regarding the

effect of the Transaction on their rights under these schemes and provided with further details concerning the proposals which will be made to them in due course. Details of the proposals will be set out in the Scheme Document and in separate

letters to be sent to participants in the share schemes.

The Co-operation Agreement also contains provisions that will apply in respect of the

TelecityGroup Share Option Schemes.

In the event that the record date for a Special Equinix Dividend falls between the date of

this Announcement and the Effective Date, then the number of New Equinix Shares that each TelecityGroup Shareholder will be entitled to receive under the terms of the Transaction will be subject to a pro rata adjustment upwards to reflect the equity

component of that Special Equinix Dividend and to ensure that the percentage of the Combined Group owned by TelecityGroup Shareholders is not changed by that Special Equinix Dividend.

19

TelecityGroup Shareholders will be entitled to an interim dividend in respect of the six-month period ended

30 June 2015, provided that such dividend will not exceed 5 pence per TelecityGroup Share. This dividend will be paid only if the Transaction completes after the record date for the Special Equinix Dividend to be paid or declared in the fourth

quarter of 2015. If any other dividend is declared, made or paid in respect of the TelecityGroup Shares on or after the date of this Announcement or an interim dividend in respect of the six-month period ended 30 June 2015 is declared, made or

paid in excess of 5 pence, Equinix reserves the right to reduce the Consideration by the amount of all or part of any such dividend or all or part of any such excess.

TelecityGroup Shareholders will be entitled to receive all Equinix dividends for which the record date falls after the Effective Date.

| 15. |

Financing of the Transaction |

Equinix intends to finance the cash consideration payable to TelecityGroup

Shareholders pursuant to the Transaction from existing cash resources and/or third party debt.

Equinix has entered into a bridge loan facility with J.P.

Morgan Securities LLC as sole arranger and bookrunner and JPMorgan Chase Bank, N.A. as lender and administrative agent in connection with the financing of the cash consideration payable to TelecityGroup Shareholders pursuant to the Transaction.

J.P. Morgan is satisfied that sufficient resources are available to Equinix to satisfy in full the cash consideration payable pursuant to the Transaction.

As a result of the cash consideration being funded through third party debt, the total leverage of the Combined Group will increase significantly

compared to Equinix’s current leverage. However, Equinix expects that the credit ratings of the Combined Group will not be negatively impacted despite the increased leverage.

Further information on the financing of the Transaction will be set out in the Scheme Document.

| 16. |

Offer-related arrangements |

Confidentiality Agreement

Equinix and TelecityGroup entered into a mutual confidentiality agreement dated 27 April 2015 pursuant to which each of Equinix and TelecityGroup has

undertaken, among other things, to keep certain information relating to the Transaction and the other party confidential and not to disclose it to third parties (other than certain permitted parties) unless required by law or regulation.

Co-operation Agreement

Equinix and TelecityGroup have

entered into the Co-operation Agreement pursuant to which each of Equinix and TelecityGroup has agreed to co-operate to secure the regulatory clearances and authorisations necessary to satisfy the Pre-Condition. TelecityGroup has agreed to certain

undertakings to co-operate and provide Equinix with information and assistance in relation to the filings, submissions and notifications to be made in relation to such regulatory clearances and authorisations.

20

The Co-operation Agreement will terminate (i) if Equinix and TelecityGroup so agree, (ii) if the Scheme

has not become effective by the Long Stop Date, (iii) where a competing proposal is recommended by the Board of TelecityGroup and announced, (iv) if the Scheme is withdrawn or lapses (other than pursuant to Equinix’s right to switch

to an Offer), (v) if the Scheme is not approved by the requisite majorities of TelecityGroup Shareholders, (vi) if the Scheme is not sanctioned at the Scheme Court Hearing, (vii) if the recommendation of the Board of TelecityGroup is

withdrawn, qualified or adversely modified, or (viii) a Break Payment Event occurs.

By way of compensation for any loss suffered by TelecityGroup in

connection with the preparation and negotiation of the Transaction, Equinix has agreed to pay to TelecityGroup £50 million if: (i) on or prior to the Long Stop Date, Equinix invokes the Pre-Condition, or (ii) on the Long Stop

Date, the Pre-Condition is not satisfied or waived by Equinix (a “Break Payment Event”).

The Co-operation Agreement records

Equinix’s and TelecityGroup’s intention to implement the Transaction by way of the Scheme, subject to the ability of Equinix to proceed by way of a Takeover Offer in the certain circumstances. The Co-operation Agreement also contains

provisions that will apply in respect of the TelecityGroup Share Option Schemes.

| 17. |

Disclosure of interests in TelecityGroup |

Equinix made a public Opening Position Disclosure setting out

details of its interests or short positions in, or rights to subscribe for, any relevant securities of TelecityGroup on 21 May 2015.

As at the close

of business on 28 May 2015 (being the last Business Day prior to the publication of this Announcement), save for the irrevocable undertakings referred to in paragraph 6, none of Equinix nor, so far as Equinix is aware, any person acting in