UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

(Mark One)

|

o

|

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

|

OR

|

ý

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2014

|

OR

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to __________

|

OR

|

o

|

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report _____________

|

Commission file number 0-28996

_________________________________________

ELBIT IMAGING LTD.

(Exact name of registrant as specified in its charter)

N/A

(Translation of registrant’s name into English)

ISRAEL

(Jurisdiction of incorporation or organization)

5 KINNERET STREET, BNEI BRAK 51261, ISRAEL

(Address of principal executive offices)

RON HADASSI

Tel: +972-3-608-6000

Fax: +972-3-608-6050

5 KINNERET STREET, BNEI BRAK 51261, ISRAEL

(Name, Telephone, E-Mail and/or Facsimile Number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

|

Title of each class:

|

Name of each exchange on which registered:

|

|

ORDINARY SHARES, NO PAR VALUE

|

NASDAQ GLOBAL SELECT MARKET

|

Securities registered or to be registered pursuant to Section 12(g) of the Act:

NONE

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

NONE

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: 24,885,833 ordinary shares, par value NIS 1.00 per share, excluding 3,388,910 treasury shares as of December 31, 2013.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

YES o NO x

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

YES o NO x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

YES x NO o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

YES o NO o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 in the Exchange Act. (Check one):

Large Accelerated Filer o Accelerated Filer o Non-Accelerated Filer x

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

|

x

|

International Financial Reporting Standards as issued by the International Accounting Standards Board

|

If "Other" has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow:

o Item 17 o Item 18

If this is an annual report indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act:

YES o NO x

|

ITEM

|

DESCRIPTION

|

Page

|

| |

|

2

|

|

|

|

3

|

|

|

|

3

|

|

|

|

3

|

|

|

|

28

|

|

|

|

50

|

|

|

|

50

|

|

|

|

91

|

|

|

|

100

|

|

|

|

102

|

|

|

|

|

|

|

|

104

|

|

|

|

114

|

|

|

|

118

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

119

|

|

|

|

|

|

|

|

|

|

|

|

120

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

121

|

|

|

|

122

|

|

CERTIFICATIONS

|

|

|

INDEX TO FINANCIAL STATEMENTS

|

F-1

|

Special Explanatory Note

Share and share price information in this annual report have been adjusted to reflect the 1-for-20 reverse share split effected by us on August 21, 2014 (the “Reverse Split”).

THIS ANNUAL REPORT ON FORM 20-F CONTAINS "FORWARD-LOOKING STATEMENTS,” WITHIN THE MEANING OF SECTION 27A OF THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), AND SECTION 21E OF THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED (THE "EXCHANGE ACT"). FORWARD-LOOKING STATEMENTS INCLUDE STATEMENTS REGARDING THE INTENT, BELIEF OR CURRENT EXPECTATIONS OF THE COMPANY AND ITS MANAGEMENT ABOUT THE COMPANY’S BUSINESS, FINANCIAL CONDITION, RESULTS OF OPERATIONS, RELATIONSHIPS WITH EMPLOYEES, BUSINESS PARTNERS AND OTHER THIRD PARTIES, THE CONDITION OF ITS PROPERTIES, LOCAL AND GLOBAL MARKET TERMS AND TRENDS, AND THE LIKE. WORDS SUCH AS “BELIEVE,” “EXPECT,” “INTEND,” “ESTIMATE” AND SIMILAR EXPRESSIONS ARE INTENDED TO IDENTIFY FORWARD-LOOKING STATEMENTS BUT ARE NOT THE EXCLUSIVE MEANS OF IDENTIFYING SUCH STATEMENTS. ACTUAL RESULTS MAY DIFFER MATERIALLY FROM THOSE PROJECTED, EXPRESSED OR IMPLIED IN THE FORWARD-LOOKING STATEMENTS AS A RESULT OF VARIOUS FACTORS INCLUDING, WITHOUT LIMITATION, THE FACTORS SET FORTH BELOW UNDER THE CAPTION “RISK FACTORS.” ANY FORWARD-LOOKING STATEMENTS CONTAINED IN THIS ANNUAL REPORT SPEAK ONLY AS OF THE DATE HEREOF, AND WE CAUTION EXISTING AND PROSPECTIVE INVESTORS NOT TO PLACE UNDUE RELIANCE ON SUCH STATEMENTS. SUCH FORWARD-LOOKING STATEMENTS DO NOT PURPORT TO BE PREDICTIONS OF FUTURE EVENTS OR CIRCUMSTANCES, AND THEREFORE, THERE CAN BE NO ASSURANCE THAT ANY FORWARD-LOOKING STATEMENT CONTAINED HEREIN WILL PROVE TO BE ACCURATE. WE UNDERTAKE NO OBLIGATION TO UPDATE OR REVISE ANY FORWARD-LOOKING STATEMENTS.

CURRENCY TRANSLATION

For the reader’s convenience, financial information for 2014 has been translated from various foreign currencies to the U.S. dollar (“$” or "U.S. dollar"), as of December 31, 2014, in accordance with the following exchange rates:

|

Currency

|

$1.00 as of December 31, 2014

|

|

1 New Israeli Shekel (NIS)

|

|

|

1 Euro

|

|

|

1 Great British Pound (GBP)

|

|

|

1 Hungarian Forint (HUF)

|

|

|

1 Czech Republic Koruny (CZK)

|

|

|

1 Romanian LEI (RON)

|

|

|

1 Polish Zloty (PLN)

|

|

|

1 Indian Rupee (INR)

|

|

|

1 Crore (10 million INR)

|

|

The U.S. dollar amounts reflected in these convenience translations should not be construed as representing amounts that actually can be received or paid in U.S. dollars or convertible into U.S. dollars (unless otherwise indicated), nor do such convenience translations mean that the foreign currency amounts (i) actually represent the corresponding U.S. dollar amounts stated, or (ii) could be converted into U.S. dollars at the assumed rate. The Federal Reserve Bank of New York does not certify for customs purposes a buying rate for cable transfers in New Israeli Shekel (“NIS”). Therefore all information about exchange rates is based on the Bank of Israel rates.

EXCHANGE RATES

The exchange rate between the NIS and U.S. dollar published by the Bank of Israel was NIS 3.9430 to the U.S. dollar on April 12, 2015. The exchange rate has fluctuated during the six month period beginning October 2014 through April 12, 2015 from a high of NIS 4.053 to the U.S. dollar to a low of NIS 3.644 to the U.S. dollar. The monthly high and low exchange rates between the NIS and the U.S. dollar during the six month period beginning October 2014 through April 12, 2015, as published by the Bank of Israel, were as follows:

|

MONTH

|

HIGH

|

LOW

|

|

1 U.S. dollar =NIS

|

1 U.S. dollar =NIS

|

|

October 2014

|

|

|

|

November 2014

|

|

|

|

December 2014

|

|

|

|

January 2015

|

|

|

|

February 2015

|

|

|

|

March 2015

|

|

|

|

April 2015 (through April 12)

|

|

|

The average exchange rate between the NIS and U.S. dollar, using the average of the exchange rates on the last day of each month during the period, for each of the five most recent fiscal years was as follows:

|

PERIOD

|

AVERAGE EXCHANGE RATE

|

January 1, 2010 - December 31, 2010

|

|

January 1, 2011 - December 31, 2011

|

|

January 1, 2012 - December 31, 2012

|

|

January 1, 2013 - December 31, 2013

|

|

January 1, 2014 - December 31, 2014

|

|

PART I

|

|

IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS

|

Not Applicable.

|

|

OFFER STATISTICS AND EXPECTED TIMETABLE

|

Not Applicable.

A. SELECTED FINANCIAL DATA The following selected consolidated financial data of Elbit Imaging Ltd. and its subsidiaries (together, “EI,” "Elbit," the “Company,” “our,” “we” or “us”) are derived from our 2014 consolidated financial statements and are set forth below in table format. Our 2014 consolidated financial statements and notes included elsewhere in this report were prepared in accordance with International Financial Reporting Standards ("IFRS") as issued by the International Accounting Standards Board ("IASB").

The 2014 consolidated financial statements were audited by Brightman Almagor Zohar & Co., a firm of certified public accountants in Israel and a member of Deloitte Touche Tohmatsu. Our selected consolidated financial data are presented in NIS. A convenience translation to U.S. dollars is presented for 2014 only.

The selected financial data for the years ended December 31, 2014, 2013, 2012, 2011 and 2010 which are presented in the table below are derived from our consolidated financial statements prepared in accordance with IFRS and do not include consolidated financial data in accordance with U.S. GAAP.

CONSOLIDATED STATEMENTS OF OPERATIONS IN ACCORDANCE WITH IFRS

(in thousands, except share and per share data)

| |

|

|

|

| |

|

2014

|

|

|

2014

|

|

|

2013

|

|

|

2012

|

|

|

2011

|

|

|

2010

|

|

| |

|

Convenience translation

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

($'000)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income revenues and gains

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues from sale of commercial centers

|

|

|

51,831 |

|

|

|

201,571 |

|

|

|

8,614 |

|

|

|

67,594 |

|

|

|

3,525 |

|

|

|

4,345 |

|

|

Revenue from hotel operations and management

|

|

|

50,658 |

|

|

|

197,007 |

|

|

|

202,791 |

|

|

|

206,746 |

|

|

|

286,548 |

|

|

|

403,822 |

|

|

Total revenues

|

|

|

102,489 |

|

|

|

398,578 |

|

|

|

211,405 |

|

|

|

274,340 |

|

|

|

290,073 |

|

|

|

408,167 |

|

|

Gains and other

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rental income from commercial centers

|

|

|

29,226 |

|

|

|

113,661 |

|

|

|

129,748 |

|

|

|

147,185 |

|

|

|

111,745 |

|

|

|

98,550 |

|

|

Gain from sale of investees

|

|

|

2,906 |

|

|

|

11,301 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gains from sale of real estate assets

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

198,777 |

|

|

Gains from changes of shareholding in investees

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

53,875 |

|

|

|

- |

|

|

|

- |

|

|

Total gains

|

|

|

32,132 |

|

|

|

124,962 |

|

|

|

129,748 |

|

|

|

201,060 |

|

|

|

111,745 |

|

|

|

297,327 |

|

|

Total income revenues and gains

|

|

|

134,621 |

|

|

|

523,540 |

|

|

|

341,153 |

|

|

|

475,400 |

|

|

|

401,818 |

|

|

|

705,494 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses and losses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commercial centers

|

|

|

75,049 |

|

|

|

291,864 |

|

|

|

124,737 |

|

|

|

213,367 |

|

|

|

159,626 |

|

|

|

156,745 |

|

|

Hotel operations and management

|

|

|

44,721 |

|

|

|

173,918 |

|

|

|

179,137 |

|

|

|

186,760 |

|

|

|

240,784 |

|

|

|

341,291 |

|

|

General and administrative expenses

|

|

|

10,230 |

|

|

|

39,785 |

|

|

|

60,643 |

|

|

|

48,771 |

|

|

|

61,857 |

|

|

|

65,292 |

|

|

Share in losses of associates, net

|

|

|

4,450 |

|

|

|

17,298 |

|

|

|

339,030 |

|

|

|

102,127 |

|

|

|

7,568 |

|

|

|

8,275 |

|

|

Financial expenses

|

|

|

61,096 |

|

|

|

237,601 |

|

|

|

334,101 |

|

|

|

184,273 |

|

|

|

160,707 |

|

|

|

313,224 |

|

|

Financial income

|

|

|

(1,624 |

) |

|

|

(6,317 |

) |

|

|

(3,930 |

) |

|

|

(28,303 |

) |

|

|

(65,571 |

) |

|

|

(40,927 |

) |

|

Change in fair value of financial instruments measured at fair value through profit and loss

|

|

|

18,368 |

|

|

|

71,432 |

|

|

|

68,407 |

|

|

|

50,229 |

|

|

|

(273,020 |

) |

|

|

50,531 |

|

|

Financial gain from debt restructuring

|

|

|

(415,692 |

) |

|

|

(1,616,628 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Write-down, charges and other expenses, net

|

|

|

136,550 |

|

|

|

531,042 |

|

|

|

840,034 |

|

|

|

302,093 |

|

|

|

288,935 |

|

|

|

79,637 |

|

| |

|

|

(66,852 |

) |

|

|

(260,005 |

) |

|

|

1,942,159 |

|

|

|

1,059,317 |

|

|

|

580,886 |

|

|

|

974,068 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Profit (loss) before income taxes

|

|

|

201,473 |

|

|

|

783,545 |

|

|

|

(1,601,006 |

) |

|

|

(583,917 |

) |

|

|

(179,068 |

) |

|

|

(268,574 |

) |

|

Income taxes (tax benefits)

|

|

|

(588 |

) |

|

|

(2,287 |

) |

|

|

(30,937 |

) |

|

|

(9,212 |

) |

|

|

63,283 |

|

|

|

3,992 |

|

|

Profit (loss) from continuing operations

|

|

|

202,061 |

|

|

|

785,832 |

|

|

|

(1,570,069 |

) |

|

|

(574,705 |

) |

|

|

(242,351 |

) |

|

|

(272,566 |

) |

|

Profit(loss) from discontinued operations, net

|

|

|

(379 |

) |

|

|

(1,475 |

) |

|

|

5,059 |

|

|

|

90,721 |

|

|

|

(4,678 |

) |

|

|

346,091 |

|

|

Profit (loss) for the year

|

|

|

201,682 |

|

|

|

784,357 |

|

|

|

(1,565,010 |

) |

|

|

(483,984 |

) |

|

|

(247,029 |

) |

|

|

73,525 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Attributable to:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity holders of the Company

|

|

|

259,447 |

|

|

|

1,008,999 |

|

|

|

(1,155,645 |

) |

|

|

(315,746 |

) |

|

|

(264,919 |

) |

|

|

61,998 |

|

|

Non-controlling interest

|

|

|

(57,765 |

) |

|

|

(224,642 |

) |

|

|

(409,365 |

) |

|

|

(168,238 |

) |

|

|

17,890 |

|

|

|

11,527 |

|

| |

|

|

201,682 |

|

|

|

784,357 |

|

|

|

(1,565,010 |

) |

|

|

(483,984 |

) |

|

|

(247,029 |

) |

|

|

73,525 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per share - (in NIS)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings (loss) per share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

From continuing operations

|

|

|

10.94 |

|

|

|

42.55 |

|

|

|

(932.15 |

) |

|

|

(329.51 |

) |

|

|

(10.46 |

) |

|

|

(11.23 |

) |

|

From discontinued operations

|

|

|

(0.02 |

) |

|

|

(0.06 |

) |

|

|

3.84 |

|

|

|

75.75 |

|

|

|

(0.19 |

) |

|

|

13.68 |

|

| |

|

|

10.92 |

|

|

|

42.49 |

|

|

|

(928.31 |

) |

|

|

(253.76 |

) |

|

|

(10.65 |

) |

|

|

2.45 |

|

|

Diluted earnings (loss) per share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

From continuing operations

|

|

|

10.94 |

|

|

|

42.55 |

|

|

|

(932.15 |

) |

|

|

(329.51 |

) |

|

|

(10.46 |

) |

|

|

(11.23 |

) |

|

From discontinued operations

|

|

|

(0.02 |

) |

|

|

(0.06 |

) |

|

|

3.84 |

|

|

|

75.75 |

|

|

|

(0.19 |

) |

|

|

13.36 |

|

| |

|

|

10.92 |

|

|

|

42.49 |

|

|

|

(928.31 |

) |

|

|

(253.76 |

) |

|

|

(10.65 |

) |

|

|

2.13 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividend declared per share

|

|

|

0 |

|

|

|

0 |

|

|

|

0 |

|

|

|

0 |

|

|

|

0 |

|

|

|

0 |

|

SELECTED BALANCE SHEET DATA IN ACCORDANCE WITH IFRS

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

2014

|

|

|

2014

|

|

|

2013

|

|

|

2012

|

|

|

2011

|

|

|

2010

|

|

| |

|

Convenience translation

|

|

|

|

|

| |

|

($ '000)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Assets

|

|

|

125,662 |

|

|

|

488,702 |

|

|

|

694,348 |

|

|

|

1,042,069 |

|

|

|

1,258,227 |

|

|

|

2,123,961 |

|

|

Non-current Assets

|

|

|

815,791 |

|

|

|

3,172,611 |

|

|

|

3,870,096 |

|

|

|

5,700,578 |

|

|

|

9,112,840 |

|

|

|

8,578,752 |

|

|

Total

|

|

|

941,453 |

|

|

|

3,661,313 |

|

|

|

4,564,444 |

|

|

|

6,742,647 |

|

|

|

10,371,067 |

|

|

|

10,702,713 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Liabilities

|

|

|

92,306 |

|

|

|

358,985 |

|

|

|

4,794,477 |

|

|

|

1,721,661 |

|

|

|

2,226,971 |

|

|

|

2,799,122 |

|

|

Non-current Liabilities

|

|

|

665,748 |

|

|

|

2,589,091 |

|

|

|

178,597 |

|

|

|

3,631,878 |

|

|

|

6,605,226 |

|

|

|

5,726,070 |

|

|

Shareholders' equity Attributable to:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity holders of the company

|

|

|

59,650 |

|

|

|

231,979 |

|

|

|

(1,032,637 |

) |

|

|

288,630 |

|

|

|

359,630 |

|

|

|

760,740 |

|

|

Non-controlling interest

|

|

|

123,749 |

|

|

|

481,258 |

|

|

|

624,007 |

|

|

|

1,100,478 |

|

|

|

1,179,240 |

|

|

|

1,416,781 |

|

|

Total

|

|

|

941,453 |

|

|

|

3,661,313 |

|

|

|

4,564,444 |

|

|

|

6,742,647 |

|

|

|

10,371,067 |

|

|

|

10,702,713 |

|

B. CAPITALIZATION AND INDEBTEDNESS

Not Applicable.

C. REASONS FOR THE OFFER AND USE OF PROCEEDS

Not Applicable.

D. RISK FACTORS

The following is a list of the material risk factors that may affect our business, our financial condition, our results of operations and our cash flows. We cannot predict nor can we assess the impact, if any, of such risk factors on our business or the extent to which any factor, or a combination of factors, may cause actual results to differ materially from those projected in any forward-looking statement. Furthermore, we cannot assess the occurrence, probability or likelihood of any such risk factor, or a combination of factors, to materialize, nor can we provide assurance that we will not be subject to additional risk factors resulting from local and/or global changes and developments not under our control that might impact our businesses or the markets in which we operate.

GENERAL RISKS

Our debt restructuring resulted in severe constriction of our business development, which may have a material adverse effect on our operations.

As discussed below under "Our Debt Restructuring", on February 20, 2014, we completed a major debt restructuring pursuant to an arrangement under Section 350 of the Israeli Companies Law, 5759-1999 (the "Companies Law"). Following the Debt Restructuring, all non-external members of our board of directors were replaced on March 13, 2014, and to date no decisions have been made with respect to our business model as implemented in recent years. Such changes may be made with immediate effect, and may have a significant effect on our operations and cash flow. Furthermore, during the pendency of the Debt Restructuring from February 2013, we were severely constricted in our ability to develop our business, inter alia, as on March 19, 2013, we entered into a letter of undertakings (the "Letter of Undertakings") with the trustees of our Series 1, C, D, E, F and G note holders pursuant to which we undertook, among other things, that we and the entities under our control (excluding Plaza Centers N.V.) ("PC" or "Plaza") would not dispose of any material asset or enter into any transaction outside the ordinary course of business, without providing the trustees for those series of notes prior written notice and all relevant information. The Letter of Undertakings remained in effect until the election of our new board of directors on March 13, 2014 and as a result, we essentially ceased our business development activity. Since then, due to those constraints, as well as other circumstances, such as the change of control over the Company, the replacement of our board members, our participation in the rights offering of Plaza in the framework of its own debt restructuring at a significant amount which limited our available resources, lack of new financing and related matters, we did not initiate any new projects nor make any significant progress in projects that were under development. This adversely affected our operations, and may cause us to suffer adverse effects in the future, including our ability to generate future cash flow in order to meet our obligations, and our financing obligations may be limited.

In addition, as a result of the Debt Restructuring, we are no longer controlled by one shareholder, and seven new directors were elected to our board of directors (out of a total of nine directors) on March 13, 2014. This situation creates uncertainty with respect to our strategy and has resulted and may result in changes in our business plans. This situation may also result in delays in pursuing business opportunities. In addition, according to our amended articles of association, a decision to engage in a new field of business which is material to the Company, in which neither we nor any of our subsidiaries is engaged and which new field of business is not complementary to an existing business, would require the approval of all the members of our board of directors present and lawfully entitled to vote at the relevant meeting. This situation creates uncertainty and may result in material adverse effects on our operations.

We essentially ceased our business development activity in the fields of commercial centers, hotels and residential projects during recent years, which may have a material adverse effect on our operations.

Following consummation of the Debt Restructuring we have not initiated any new projects nor made any significant progress in projects that were under development, due to the reasons detailed above. As a result, we did not commence new cycles of entrepreneurship-development-improvement-realization, and focused only on our backlog projects with no new pipeline. This may adversely affect our operations and may significantly affect our ability to generate future cash flow in order to meet our obligations, and to synchronize between our business cycle and our maturities.

An appeal was filed against the court ruling approving the Debt Restructuring. The success of such appeal in whole or in part may result in material harm to our company, including its liquidation.

Following the approval of the Tel-Aviv Jaffa District Court (the “Court”) of the Debt Restructuring (the “Court Ruling”), a holder of our Series B Notes which holds less than 0.1% of the outstanding unsecured debt of the Company prior to the debt Restructuring and which had previously filed with the Court a purported class action lawsuit against us on April 11, 2013 (the “Previous Action”), filed an appeal with the Israeli Supreme Court arguing that the Court erred in approving the Debt Restructuring, with specific reference to the exemption from personal civil liability that could potentially have been accorded to our then-current officers and directors (other than Mr. Mordechai Zisser) and the rejection of the Previous Action. One of the alternative remedies requested by the appellant was the cancelation of the approval of the Debt Restructuring by the District Court. To date, the appeal is still pending. If the Supreme Court will award the alternative remedy of the cancellation of the Court Ruling, we may incur material harm and may be required to negotiate a new debt restructuring plan, the failure of which will likely result in our liquidation.

We have large shareholders who may be able to control us.

As a result of the Debt Refinancing, affiliates of York Capital Management Global Advisers LLC and affiliates of Davidson Kempner Capital Management LLC beneficially own an aggregate of approximately 19.7% and 14.3%, respectively, of our outstanding ordinary shares. In addition, as a result of the Debt Refinancing, as of January 8, 2015 and based on the information available to us as of such date, certain Israeli institutional investors held, in aggregate, approximately 17.5% of our outstanding ordinary shares. To our knowledge, these shareholders are not party to a shareholders’ agreement between them or with any other shareholders. However, if they act together or with other shareholders, together they may have the power to control the outcome of matters submitted for the vote of shareholders, including the approval of significant change in control transactions. To the extent they maintain at least such holding percentages, their equity interests may make certain transactions more difficult and result in delaying or preventing a change in control of us unless approved by them. Furthermore, should large shareholders take opposing approaches with respect to our company, our business and results of operations may materially suffer.

Following the Debt Restructuring, the market price for our ordinary shares may suffer from fluctuation and may decline significantly.

According to the terms of the Debt Restructuring, we issued 509,713,459 ordinary shares to our unsecured financial creditors, representing approximately 92% of our outstanding share capital at the closing of the Debt Restructuring, 16,594,036 ordinary shares to Bank Hapoalim B.M. (“Bank Hapoalim”), representing 3% of our outstanding share capital following the closing of the Debt Restructuring, and 1,914,215 ordinary shares as a result of the exercise of a warrant held by Eastgate Property LLC. All share amounts in this paragraph do not reflect the Reverse Split.

As a result, there may be an adverse effect on the market price of our shares as a result of a substantial number of shares being sold or available for sale. If our shareholders sell substantial amounts of our ordinary shares, the market price of our ordinary shares may fall. The ordinary shares issued pursuant to the Debt Restructuring are generally freely tradable, and the potential sales of such shares could cause the market price of our ordinary shares to decline significantly. They also might make it more difficult for us to sell equity or equity-related securities in the future at a time and price that we deem appropriate.

As a result of the Debt Restructuring, we have numerous liens on our assets and subsidiaries, which may result in material adverse effect on our operations.

In accordance with the terms of the Debt Restructuring, we created floating liens on all of our assets and fixed liens on our various holdings and rights in our subsidiaries Elbit Ultrasound (Luxembourg) B.V./S.ar.l (through which we hold a controlling stake in Plaza, of which we own approximately 44.9% of its share capital) and Elscint Holdings and Investments N.V. (through which we hold the entire share capital of BEA Hotels N.V. (“BEA Hotels”), which holds our hotels portfolio assets in Bucharest and Antwerp), including rights to receive compensation for a shareholder’s loan to each of such entities. In event that we default on the terms of such debt, such liens may be foreclosed, which may result in liquidation of our subsidiaries and material harm to our operations and cash flow. In addition, such liens limit our ability to sell our holdings and other rights in such subsidiaries (subject to certain exceptions included in the New Notes, as defined below) without making early prepayment of certain amounts to our note holders.

In addition, in accordance with the refinancing agreement with Bank Hapoalim which was consummated on February 20, 2014, for the restructuring of our secured loan from Bank Hapoalim pursuant to a refinancing agreement dated December 29, 2013 (the "Refinancing Agreement”), we placed fixed liens on BEA Hotels’ holdings and shareholder’s loan (subject to certain exceptions) in Bea Hotels Eastern Europe B.V. (through which we hold a hotel in Bucharest) and Astrid Hotel Holdings B.V. (through which we hold hotels in Antwerp). In event that we default on the terms of such debt, such liens may be foreclosed, which may result in the liquidation of our subsidiaries and material harm to our operations and cash flow. In addition, such liens limit our ability to sell our holdings and other rights in these subsidiaries without making early prepayment of certain amounts to Bank Hapoalim.

The grant of liens pursuant to the Debt Restructuring and the amended loan agreement with Bank Hapoalim resulted in most of our valuable assets being subject to liens and encumbrances. In the event that we need additional financing for our operations, we will not be able to provide adequate collateral, which may adversely affect our ability to raise the financing on favorable terms or at all. Such outcome may substantially limit our ability to further develop our assets.

As a result of the new notes that we issued pursuant to the Debt Restructuring, we have limited flexibility in making dividends due to prepayment obligations.

The new notes issued to our note holders pursuant to the Debt Restructuring (the “New Notes”) include mandatory prepayment provisions in the event we pay a dividend or make any other distribution before the full redemption of the New Notes, such that we will be obligated to prepay an amount equal to the amount distributed by us, in the following order: (i) first, towards all unpaid amounts under the Series H notes, and (ii) secondly, towards all unpaid amounts under the Series I notes. In addition, pursuant to the Refinancing Agreement, in the case of a distribution, including payment of a dividend in any manner to the Company's shareholders, we shall be required to prepay Bank Hapoalim an amount equal to the amount paid to the note holders on such date multiplied by the ratio between our debt to Bank Hapoalim and our total debt to Bank Hapoalim and to the note holders as of such date. Such provisions may substantially limit our ability to distribute dividends to our shareholders. In addition, such limitation could prove burdensome and limit our ability to raise equity investments due to the limited ability to avail our shareholders of the return of such investments by way of dividends or distributions.

We have significant capital needs and additional financing may not be available.

The sectors in which we compete are capital intensive. We require substantial up-front expenditures for land acquisition, development and construction costs, investments in research and development as well as for the ongoing maintenance of our hotels or operation of our commercial centers. In addition, following construction, additional financing is necessary to maintain the centers in good condition until they are almost fully leased to tenants and sold. Accordingly, we require substantial amounts of cash and financing for our operations. We cannot be certain that our own capital will be sufficient to support such future development or that such external financing would be available on favorable terms, on a timely basis or at all. Furthermore, any changes in the global economy, real estate or business environments in which we operate, any negative trend in the capital markets, any restrictions on the availability of credit and/or decrease the credit rating of PC, might have a material adverse effect on our ability to raise capital.

As a result of our recent financial difficulties, our suspension of payments in respect of our outstanding notes during the year leading up to the Debt Restructuring, the restructuring of our financial debt as part of the Debt Restructuring and the restructuring of PC's debt as part of the Amended PC Plan (as defined below), we may experience difficulties raising financing from investors, especially in Israel, at attractive terms or at all.

In 2008 the world markets experienced a financial crisis from which they have not yet fully recovered that, among other things, resulted in lower liquidity in the capital markets and lower liquidity in bank financing for real property projects (mainly for projects under development). The financial crisis also affected our ability to obtain financing in Central and Eastern Europe ("CEE") and India for our commercial shopping centers and residential projects in those countries. Lower liquidity may result in difficulties to raise additional debt or less favorable interest rates for such debt, which may impact the development of our projects as well as the ability of the potential purchasers thereof to finance such purchases. In addition, construction loan agreements generally permit the drawdown of the loan funds against the achievement of pre-determined construction and space leasing or selling milestones. If we fail to achieve these milestones (including as a result of the global financial crisis and the significant decrease in the number and volume of transactions in general), the availability of the loan funds may be delayed, thereby causing a further delay in the construction schedule. If we are not successful in obtaining financing to fund our planned projects and other expenditures, our ability to develop existing projects and to undertake additional development projects may be limited and our future profits and results of operations could be materially adversely affected. Our inability to obtain financing may cause delays in planned renovation or maintenance of our hotels and commercial centers, or in completion of the construction of our trading property that could have a material adverse effect on our results of operations. Our inability to obtain financing may also affect our ability to refinance our existing debt, if necessary, which may have a material adverse effect on our results of operations and cash flow. In addition, as discussed in the risk factor below "Our annual and quarterly results may fluctuate, which may cause the market price of our shares and New Notes to decline." our quarterly and annual operating results have fluctuated, and may in the future continue to fluctuate, significantly. If we were in need of cash and financing for our operations at a time when our results are poor, this may also have an impact on our ability to fund or successfully obtain financing to fund our planned projects and other expenditures.

In addition, under the terms of our outstanding notes, the net proceeds of any debt we raise must be used to repay the notes, unless raised to refinance the debt to Bank Hapoalim under the Refinancing Agreement. This further limits our ability to secure additional debt financing. In addition, as part of the Debt Restructuring and the Refinancing Agreement, most of our valuable assets are subject to liens and encumbrances. In the event we shall need additional financing for our operations, we will not be able to provide adequate collateral, which may adversely affect our ability to raise the financing on favorable terms or at all. Such outcome may substantially limit our ability to pursue our business plan and further develop our assets.

Furthermore, as part of PC's debt restructuring under the Amended PC Plan which is described more fully below, inter alia, PC is required to assign 75% of the net proceeds received from the sale or refinancing of any of its assets to early repayment of its debt to its note holders. PC will be permitted to make investments only if its cash reserves contain an amount equal to general and administrative expenses and interest payments for such debt for a six-month period, has placed a negative pledge on its assets and undertook certain limitations on distribution of dividends and incurring of new indebtedness, financial covenants and other undertakings with respect to the sale and financing of certain projects and investment in new projects, all together, imposing considerable limitations on obtaining new financing.

We are restricted from receiving dividends from PC and other subsidiaries.

The Amended PC Plan includes certain limitations on the distribution of dividends as well as subordination provisions, which would significantly limit our ability to generate cash flow from PC and may significantly affect our cash flow and operations. In addition, other subsidiaries of ours are subject to limitations on the payment of dividends by virtue of legal or regulatory restrictions in their respective jurisdictions. These limitations may have material adverse effects on our cash flow and in turn our ability to service our debts on timely manner.

Events of default under our debt arrangements may result in cross-defaults being triggered under our other credit facilities.

As indicated and more fully described under Item 4 hereof under the caption "PC Debt Restructuring", on December 19, 2014, PC completed its debt restructuring proceedings and the implementation of the Amended PC Plan as approved by the District Court of Amsterdam in the Netherlands (the “Dutch Court”) on July 10, 2014, with the Approval Date being July 18, 2014. Under such plan, inter alia, the maturities of PC's notes that were issued for trading at the Tel-Aviv Stock Exchange ("Israeli Notes") and notes that were issued to certain Polish noteholders ("Polish Notes") were postponed, as all principal payments of any unsecured debt due during 2013-2015 were deferred for three years from the date of approval of the Amended PC Plan by the Dutch Court (“Approval Date”), while determining that if within two years from the Approval Date PC manages to repay 50% of such unsecured debt, then the remaining principal payments shall be deferred for an additional one year.

If an event of default were to subsist under one or more of our debt arrangements, namely, either the Company's Debt Restructuring or the Amended PC Plan, that event of default may, in accordance with cross-default provisions, constitute an event of default under our other debt arrangements or credit facilities. Upon an event of default (whether due to cross-default or otherwise), the relevant lenders would have the right, subject to the terms of the relevant facility arrangements to, inter alia, declare the borrower’s outstanding debts under the relevant facilities to be due and payable and/or cancel their respective commitments under the facilities, enforce their security, take control of certain assets or make a demand on any guarantees given in respect of the relevant facility. Accordingly, in the event we do not fulfill our obligations under the Notes issued pursuant to our Debt Restructuring or if PC does not fulfill its obligations under the Israeli Notes or Polish Notes (including but not limited to payment obligations), as the case may be, the respective trustees representing holders of our Notes in case of the Company or the Israeli Notes in case of PC, may be able to claim an immediate settlement, and declare all or any part of the unsettled balance of our Notes or PC's Israeli Notes or Polish Notes, as the case may be, immediately due and payable. Such event of default will trigger cross-default provisions included in other credit facilities. The occurrence of one or more of these factors may have a material adverse effect on our business, financial condition or prospects and/or results of operations.

Our ability to satisfy our obligations under certain credit facilities depends on the value of our assets.

Although the use of borrowings is intended to enhance the returns on our invested capital when the value of our underlying assets is rising, it may have the opposite effect where the value of underlying assets is falling. Any fall in the value of any of our properties may significantly reduce the value of our equity investment in the entity which holds such property, meaning that we may not make a profit, may incur a loss on the sale or impairment of any such property and/or increase the likelihood of breaching certain financial covenants in our existing debt arrangements (namely, our Debt Restructuring or the Amended PC Plan) or credit facilities resulting in an event of default under such arrangements. The occurrence of one or more of these factors may have a material adverse effect on our business, financial condition, prospects and/or results of operations.

IF PC fails to comply with the provisions of the Amended PC Plan, than it might enter into liquidation or we may lose our control over PC or the value of our investment in PC.

As discussed below under Item 4 “Recent Events”, as part of the Amended PC Plan we and our affiliates participated in a rights offering of PC. Should PC default under the Amended PC Plan, there is no obligation or assurance that we will be able to further support PC, and such default may result in massive dilution of our holdings causing us to lose our control over PC or the liquidation of PC, where in such case, we will lose our investment in PC.

Conditions and changes in the local and global economic environments may adversely affect our business and financial results including our ability to comply with certain financial covenants.

Adverse economic conditions in markets in which we operate can harm our business. Such adverse economic conditions may result in diminished liquidity and tighter credit conditions, leading to decreased credit availability, as well as declines in economic growth, employment levels, purchasing power and the size and amount of transactions. In addition, recent concerns regarding the possibility of sovereign debt defaults by European Union member countries, such as Greece and Cyprus, each of which is facing possible default of its sovereign debt obligations, as well as Spain and Italy, the sovereign debt obligations of which were recently downgraded, has disrupted financial markets throughout the world, and may lead to weaker consumer demand in the European Union, the United States, and other parts of the world. These risks may be elevated with respect to our interactions with third parties with substantial operations in countries where current economic conditions are the most severe, particularly where such third parties are themselves exposed to sovereign risk from business interactions directly with fiscally-challenged government payers.

The credit crisis of recent years could have a number of follow-on effects on our business, including a possible: (i) decrease in asset values that are deemed to be other than temporary, which may result in impairment losses and possible noncompliance with certain financial covenants in credit and loan agreements to which we are a party, including but not limited to as a result of the decrease in the value of our collateral loan to value (LTV) (including the decrease in the value of real estate or securities which are pledged to banks), (ii) negative impact on our liquidity, financial condition and share price, which may impact our ability to raise capital in the market, obtain financing and other sources of funding in the future on terms favorable to us, which would harm our ability to finance the development of new projects and engage with co-investors, (iii) slowdown in our business resulting from potential buyers experiencing difficulties in raising capital from financial institutions in order to finance the purchase of our assets from us, which may significantly impact our cash flow and our ability to serve our debts in a timely manner and (iv) imposition of regulatory limitations on financial institutions with respect to their ability to provide financing to companies such as us and/or projects such as those in which we are engaged, while creating a credit crunch. If such financial and economic uncertainty shall occur, it may materially adversely affect our results of operations and cash flow and may increase the difficulty for us to accurately forecast and plan future business.

We are highly leveraged and our debts contain financial and operational covenants, which if breached could adversely affect our ability to operate our business.

We are highly leveraged and have significant debt service obligations. As of the balance sheet date our consolidated debt toward banks and note holders amount to NIS 2,633 million ($677 million), out of which a corporate -level debt (i.e.: debts of the Company on a standalone balance sheet) amounted to NIS 755 million (approximately $194 million).

In addition, we may incur additional debt from time to time to finance acquisitions or the development of projects, for capital expenditures or for other purposes.

As a result of our substantial indebtedness:

|

·

|

we could be more vulnerable to general adverse economic and industry conditions;

|

|

·

|

we may find it more difficult to obtain additional financing to fund future working capital, capital expenditures and other general corporate requirements;

|

|

·

|

we will be required to dedicate a substantial portion of our cash flow from operations to the payment of principal and interest on our debt, reducing the available cash flow to fund other projects;

|

|

·

|

we may have limited flexibility in planning for, or reacting to, changes in our business and in the industry;

|

|

·

|

we may have a competitive disadvantage relative to other companies in our business segments with less debt;

|

|

·

|

we may face difficulties in establishing strategic or other long-term business joint ventures; and

|

|

·

|

we may not be able to refinance our outstanding indebtedness.

|

We cannot guarantee that we will be able to generate enough cash flow from operations or that we will be able to obtain sufficient capital to service our debt or fund our planned capital expenditures. In addition, we may need to refinance some or all of our indebtedness on or before maturity. We cannot guarantee that we will be able to refinance our indebtedness on commercially reasonable terms or at all.

In addition, a significant part of our loans and notes include provisions with respect to maintaining and complying with certain financial and operational covenants. Our ability to comply with these covenants may be affected by events beyond our control. A breach of one or more of these covenants could result an event of default under the loan agreements and may give rise to an acceleration of our loans from the respective lenders. Such breach of covenants could have a material adverse effect on our operations and cash flows.

Delays in the realization of our assets could result in significant harm to our financial condition and our ability to serve our indebtedness in a timely manner.

Our business activity is characterized by cycles of entrepreneurship-development-improvement-realization, with the objective to create value with our assets and, as a result, to create value for our company. Our cash flow is dependent upon maintaining synchronization between the realization timetables to the payment schedules of our indebtedness. Delays in the realization of our assets could harm our cash flow and our ability to service our indebtedness. For example, at the beginning of 2013, we experienced a confluence of events not under our control that had an adverse effect on our cash flow and, due to market conditions and delays in projects, we experienced difficulties in realizing our assets at fair commercial values. Those difficulties were attributed to a number of factors, including delays in obtaining permits and licenses from municipal and planning authorities and the hardening of financing policies by banks and financial institutions for the financing of our projects (both for entrepreneurs and potential purchasers). In addition, the note holders of PC threatened to take legal action to prevent PC from distributing dividends, from which we had expected to receive an amount of NIS 100 million (approximately $27 million). As a result, the credit ratings of our notes were downgraded, which itself imposed more difficulties on our obtaining financing and, in addition, certain financing alternatives that we had been considering did not come to fruition. This led us to commence the process that resulted in the Debt Restructuring. We and PC require realizing a significant part of our assets in order to serve our debts in a timely manner, some of which require further development before placing them in the market. There is no assurance that we and PC will succeed in the realization of our assets in synchronization with the maturity date of our debts, which would prevent our ability to avoid a recurrence of such events. In addition, as during the pendency of the Debt Restructuring from February 2013 to February 2014 and the election of new board members on March 2014, we essentially ceased our business development activity, recommencing such activity at once would require substantial investment, without assurance that such synchronization will be achieved, and the failure of which would likely result in material adverse effects on our operations and cash flow and our ability to service our debt.

We have limited eligibility to use Form F-3 for primary offerings, which could impair our capital raising activities.

We have recently regained the ability to use the SEC's "short form" Form F-3 to register sales of our securities. However, our “public float” is currently below $75 million and may remain below $75 million for the foreseeable future. As a result, we are not fully eligible to use Form F-3 for primary offerings. Any such limitations may harm our ability to raise the capital we need. To the extent we are ineligible to use Form F-3 for primary offerings, we will be required to use a registration statement on Form F-1 or issue such securities in a private placement, which could increase the cost of raising capital and delay our financings.

Our financial instruments (mainly our loans and notes) and our derivative financial instruments are subject to fluctuation in interest rates, currency exchange rates, changes in the consumer price index and/or changes in fair value, which may have a negative impact on our earnings, balance sheet and cash flows.

Floating interest rates on most of our debt facilities expose us to increases in market interest rates and subsequent increases in interest costs. To the extent that at any time we do not have any hedges or our hedges are insufficient against interest rate fluctuations, our earnings and balance sheet position may be negatively impacted. Currently we do not have hedges for most of our loans against interest rate fluctuations. In addition, certain debt agreements may include default interest under certain circumstances, which may be higher than the original interest rate set out in the debt agreement. If a lender successfully asserts its right to invoke a default interest clause, this will increase our effective interest costs in respect of facilities with that lender.

We are impacted by exchange rates and fluctuations thereof. We are likely to face risks from fluctuations in the value of the functional currencies of our subsidiaries against the linkage currency of the applicable financial instruments. To the extent that at any time we do not have any hedges or our hedges are insufficient against currency exchange rates, our earnings and balance sheet position may be negatively impacted. In addition a significant part of our real estate assets and investments is managed in foreign currencies (mainly Euro, US Dollar and Rupee) while our debts in the corporate level are mainly in NIS and US Dollars. Therefore the proceeds from the realization of such real estate assets and investments may significantly fluctuate and we may be adversely effected by such exposure. Currently we do not have any material hedges against exchange rate fluctuations.

The principal and interest of most of our debt instruments is determined by reference to the Israeli consumer price index (the "CPI"), which may entail significant risks not associated with similar investments in a conventional fixed or floating rate debt security. The historical value of the CPI is not indicative of future CPI performance and its value is affected by, and sometimes depends on, a number of interrelated factors, including direct government intervention and economic, financial, regulatory, and political events, over which we have no control. An increase in the CPI will result in additional financing expenses to our profits and losses and will have a negative impact on our cash flows. Currently we do not have any material hedges against fluctuations in the CPI.

Certain of our financial instruments and derivative financial instruments are measured by fair value. Any change to the fair value of such instrument will affect our profits and losses and may have a material effect on our results. Changes in accounting standards or evaluation methods for the determination of fair value or for valuing and assessing the fair value of our assets might result in capital decreases in our financial statements, affect our profits and losses and have a material effect on our results. In addition, such decreases may result in failure to meet financial covenants under bank loans that include LTV ratio covenants.

The fair value of our real estate assets (including commercial shopping centers, hotels, residential projects and others) may be harmed by certain factors that may entail impairment losses not previously recorded, which would affect our financial results and the satisfaction of financial covenants.

Certain circumstances may affect the fair value of our real estate assets (whether operating or under construction), including, among other things, (i) the absence of or modifications to permits or approvals required for the construction and/or operation of any real estate asset; (ii) in commercial centers where a significant part of the rental areas is subject to long-term leases with a small group of retailers which is distinguished from other lessees, we may be exposed to a risk of rental fee rates being significantly lower than originally anticipated and a material long term decline in the business operations of such retailers may therefore have an adverse effect on the real estate assets recoverable amount and their final sale prices; (iii) delays in completion of works, beyond the anticipated target, may adversely affect the fair value of the assets and our results of operations and cash flow; (iv) costs overruns in the constructions of our real estate and higher operational costs than anticipated may affected the fair value of our real estate; (v) an increase in the applicable discounts rates in which we are discounting the anticipated operational cash flow of the real estate may have a material adverse affect on the fair value of the real estate (vi) lawsuits that are pending, whether or not we are a party thereto, may have a significant impact on our real estate assets and/or on certain of our shareholding rights in the companies owning such assets; (vii) full or partial eminent domain proceedings (with or without compensation) regarding such real estate assets; and (viii) findings indicating soil or water contamination or the existence of historical or geological antiquities may require the company to absorb significant cleaning, purification or preservation costs, and may limit the use or exploitation of the land, resulting in significant decrease in its fair value. In addition, certain laws and regulations applicable to our business in certain countries where the legislation process undergoes constant changes may be subject to frequent and substantially different interpretations, and agreements which may be interpreted by governmental authorities so as to shorten the term of use of real estate, which may be accompanied by a demolition or nationalization order with or without compensation, may significantly affect the value of such real estate asset. The fair value of our real estate assets may be significantly decreased thereby resulting in potential impairment losses not previously recorded in our financial results, which would impact our ability to satisfy financial covenants under our bank loans.

Since market conditions and other parameters (such as macroeconomic and microeconomic environment trends, and others) that affect the fair value of our real estate and investments vary from time to time, the fair value may not be adequate on a date other than the date the measurement was executed (in general, immediately after the balance sheet date). In the event the underlying assumptions included in the valuation of the real estate (mainly the projected forecasts regarding the future cash flows generated by those assets and the applicable discount rate) are not met, we may have to record an additional impairment loss not previously recorded.

The failure to comply with government regulation may adversely affect our business and results of operations.

Our business is subject to numerous national and local government regulations, including those relating to acquisition of real estate properties, building and zoning requirements, fire safety control, access for the disabled, environmental law and health board reviews and standards. In addition, we are subject to laws governing our relationships with employees, including minimum wage requirements, overtime, working conditions, and work permit requirements, and in some localities to collective labor agreements. A determination that we (or any of our tenants, where applicable) are not in compliance with these regulations could result in the imposition of fines, an award of damages to private litigants and significant expenses in bringing our operations into compliance with such laws and regulations. In addition, our ability to terminate the employment of workers whom we think we no longer need may be hampered by local labor laws and courts, which traditionally favor employees in disputes with former employers.

Operating globally exposes us to additional and unpredictable risks.

We conduct our businesses in multiple countries. Our future results could be materially adversely affected by a variety of factors relating to international transactions, including changes in exchange rates, general economic conditions, regulatory requirements, dividend restrictions, tax structures or changes in tax laws or practices, and longer payment cycles in the countries in our geographic areas of operations. International operations may be limited or disrupted by the imposition of governmental controls and regulations, political instability, hostilities, natural disasters and difficulties in managing international operations. In the CEE region and India, laws and regulations, particularly those involving taxation, foreign investment and trade, title to securities, and transfer of title that are applicable to our activities, can change quickly and in a far more volatile manner than in developed market economies. We cannot assure you that one or more of these factors will not have a material adverse effect on our international operations and, consequently, on our business, financial condition and results of operations. A failure to effectively manage the expansion of our business could have a negative impact on our business.

If we are characterized as a passive foreign investment company for U.S. federal income tax purposes, U.S. holders of ordinary shares may suffer adverse tax consequences.

Generally, if for any taxable year, 75% or more of our gross income is passive income, or at least 50% of the value of our assets, averaged quarterly, are held for the production of, or produce, passive income, we will be characterized as a passive foreign investment company ("PFIC"), for U.S. federal income tax purposes. Our PFIC status is determined based on several factors, including our market capitalization, the valuation of our assets, the assets of companies held by us in certain cases and certain assumptions and methodologies upon which we base our analysis. A determination that we are a PFIC could cause our U.S. shareholders to suffer adverse tax consequences, including having gains realized on the sale of our shares taxed at ordinary income rates, rather than capital gains rates, and being subject to an interest charge on such gain. Similar rules apply to certain "excess distributions" made with respect to our ordinary shares. A determination that we are a PFIC could also have an adverse effect on the price and marketability of our shares. If we are a PFIC for U.S. federal income tax purposes, highly complex rules would apply to U.S. holders owning our ordinary shares. Accordingly, you are urged to consult your tax advisors regarding the application of such rules. See "Item 10.E. Taxation - Tax consequences if we are a Passive Foreign Investment Company" in our Annual Report on Form 20-F.

We are subject to various legal proceedings that may have a material adverse effect on our results of operations.

In November 1999 a claim was initiated against us and certain other third parties, including former directors of the Company and Elscint Ltd., in connection with the change of control of us and our former subsidiary Elscint Ltd. ("Elscint," which was merged into us in 2010) in May 1999 and the acquisition of the hotel businesses and the Arena Commercial Center in Israel by Elscint in September 1999 from Europe Israel (our former controlling shareholder prior to the Debt Restructuring), as well as motions to certify certain of such claims as class actions (Gadish et al v. Elscint et al). On May 28, 2012, the Supreme Court certified the lawsuit as a class action with respect to the claim that the hotels and the Arena Commercial Center were allegedly sold to us at a price higher than the then-current fair value and that Elron Electronic Industries Ltd. (an unrelated third party) had breached certain minority rights in the framework of the sale of Elscint's shares to Europe Israel), and the case was remanded to the Court for hearing the case without prejudicing the parties' rights and arguments with respect to a derivative action. For additional details regarding the class action lawsuit filed against us, see "Note 17 in our 2014 annual financial statements”.

In addition certain other legal proceedings have been initiated against us, including the Appeal filed by former Series B holder to the Israeli Supreme Court in respect of the approval of the Debt Restructuring (as discussed above under “An appeal was filed against the court ruling approving the Debt Restructuring). A determination against us in some or all of these proceedings, mainly those related to class actions and the Appeal of the former Series B holder, may materially adversely affect our results of operations and cash flow.

Our results of operations fluctuate due to the seasonality of our various businesses.

Our annual revenues and earnings are substantially dependent upon general business activity, vacation and holiday seasons and the influence of weather conditions. As a result, changes in any of the above have a disproportionate effect on the annual results of operations of our hotels and fashion retail businesses (as well as on the consumer activity in our commercial and entertainment centers.

Our annual and quarterly results may fluctuate, which may cause the market price of our shares and notes to decline.

We have experienced at times in the past, and may in the future experience, significant fluctuations in our quarterly and annual operating results, which may cause the market price of our shares and notes to decline. These fluctuations may be caused by various factors including, among other things, significant sales of our properties, the frequency of such transactions. As a result of our disposition of our real estate assets and/or investments, we may experience significant fluctuations in our annual and quarterly results. As a result, we believe that period-to-period comparisons of our historical results of operations may not necessarily be meaningful and that investors should not rely on them as an indication of our future performance. It is likely that in some future periods, our operating results may be below expectations of public market analysts or investors.

Our business is subject to general business and macro and microeconomic risks.

In addition to risks that are relevant to a specific activity or relate to a specific territory, certain conditions and changes in the economic environment in the countries in which we operate may have an adverse effect on our business performance; changes in the global economy, in real estate and/or the business environment in which we operate, and/or a negative trend in the capital markets and/or a decrease in our capital and/or impairments in our real estate assets from the reasons described in this Item 3 under “The fair value of our real estate assets (including commercial shopping centers, hotels, residential projects and others) may be harmed by certain factors that may entail impairment losses not previously recorded, which would affect our financial results and the satisfaction of financial covenants” risk factor above, may have an adverse effect on our ability to raise funds; macroeconomic or microeconomic changes as described above may influence our compliance with financial covenants under certain bank loans and credit agreements, including but not limited to, as a result of the decrease in the LTV or Debt Service Cover Ratio ("DSCR") and/or a decrease in our capital. For details regarding our pledged assets, see Item 5B, under “Other Loans”.

If we do not satisfy the NASDAQ requirements for continued listing, our ordinary shares could be delisted from NASDAQ.

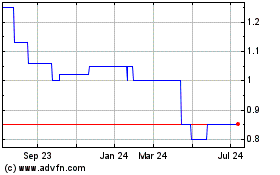

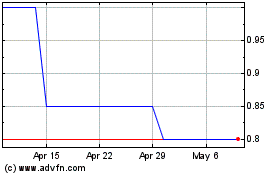

Our listing on the NASDAQ Stock Market is contingent on our compliance with the NASDAQ's conditions for continued listing. One of such conditions is maintaining a bid price for our ordinary shares of least $1.00 per share. In advance of the closing of the Debt Restructuring, the closing price of our ordinary shares dropped below $1.00 per share on January 28, 2014. On March 12, 2014, NASDAQ notified us of our noncompliance with the aforementioned condition and set a period of 180 days in order to regain compliance.