CAPE TOWN, South Africa—Africa's biggest company also is one of

its least well-known outside the continent, and it owes its fortune

to one great investment: China.

Naspers Ltd., which has transformed itself from a local

publisher to a media juggernaut valued at $76.5 billion, invested

$34 million in 2001 to take a stake in Tencent Holdings Ltd., now

China's largest and most popular internet-service portal with

nearly a billion instant-messenger active users every month and a

market capitalization of $256.7 billion. Naspers's 34% stake

currently is worth more than Naspers itself.

Now, the media company is pushing into the U.S. and hoping to

topple a household name, Craigslist Inc.

In May, Naspers opened a venture-capital outfit in San Francisco

to be closer to the tech-innovation hub of Silicon Valley and get

early access to technology and internet companies it can help to

scale on a global basis. That followed a $100 million investment

last year in a mobile-classifieds app called Letgo.

The company wants to replicate successes in online classified

platforms in Russia as well as with OLX, the biggest classifieds

site in India and Brazil, by dethroning Craigslist, which remains

the industry's most recognizable brand.

"The U.S. as a market is obviously extremely interesting; it's

also very crowded," Naspers Chief Executive Bob van Dijk said in a

rare interview for the tight-lipped company.

"[Craigslist] is actually executed in quite a suboptimal way,"

said the 43-year-old, who took over as CEO in April 2014 after

working on the group's e-commerce side and previously heading up

eBay Inc.'s German operations. "A mobile-oriented generation

doesn't really want to interact with a clunky '90s website…That

market I think is ripe for disruption." Craigslist didn't respond

to a request for comment.

Analysts say Naspers is undervalued, given that its market

capitalization is less than the value of its Tencent stake, despite

having additional profitable businesses. Naspers—which oversees

more than 40 businesses, including pay television and online

retail, spread across more than 130 countries—also has a 29% stake

in Mail.ru Group, a Russian internet company that runs two of the

country's three-largest social-networking sites.

In December, Naspers raised $2.5 billion to allow flexibility to

invest in attractive growth opportunities during the next few

years, including a controlling stake valued at $1.2 billion in

Avito, an online classifieds platform in Russia. That business has

been booming as Russians hit by an economic downturn buy and sell

secondhand items on the site.

Founded in Stellenbosch, South Africa, in 1915, Naspers was

established as De Nationale Pers Beperkt, or the National Press

Ltd., to produce a Dutch-language newspaper for the country's

Afrikaner population. The company and its publications became

mouthpieces for the National Party, which came into power in 1948

and instituted the system of racial segregation known as

apartheid.

But Naspers has moved far beyond its roots as a publisher in

apartheid-era South Africa. Although the company is still domiciled

here, 77% of its revenue now comes from abroad and its media

segment, which includes the print business, is by far its smallest.

The emerging-markets-focused company also has set its sights on a

lucrative new target: the U.S.

"Even though they were focused on emerging markets, ultimately

they needed to be where the birth of ideas and home of tech really

is," said Philip Short, an analyst at Old Mutual Equities in Cape

Town. "Just because you're in emerging markets doesn't mean you

have to be last to the party."

Naspers's U.S. play is the latest in a series of bold moves for

a company trying to prove that its success goes beyond one landmark

investment. But Naspers's e-commerce division, which includes

classifieds and online retail, operates at a loss despite some

profitable assets, such as Avito.

The video-entertainment business, including sub-Saharan Africa's

biggest pay-TV provider, also has suffered after the global

commodities crash weakened African currencies and consumer

sentiment across the continent.

For the year ended March 31, Naspers said the video business

lost 288,000 customers and took a significant currency hit, because

while it earns revenue in local currencies, it incurs a large

portion of costs, such as sports rights and Hollywood films, in

U.S. dollars.

"That problem is not a fixable problem within a year," Mr. van

Dijk said.

The poor performance in the pay-TV business prompted S&P

Global Ratings to revise its outlook on Naspers's triple-B-minus

rating—one notch above the so-called junk status eschewed by many

investors—to negative.

"In terms of our creditworthiness, I violently disagree," Mr.

van Dijk said. "There is no risk in our bonds. Even if we would be

downgraded…it's neither here nor there."

In June, Naspers said its net profit for the year ended March 31

dropped 21% to $994 million. Still, core headline earnings, which

are adjusted for nonrecurring and nonoperational items and are the

company's preferred measure of performance, were up 17% at $2.98 a

share, driven by growth from the company's internet and classifieds

businesses.

Naspers raised its full-year dividend 11% to 5.20 South African

rand (37 U.S. cents), which executives called a vote of confidence

in the long-term viability of the business.

(END) Dow Jones Newswires

September 18, 2016 21:15 ET (01:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

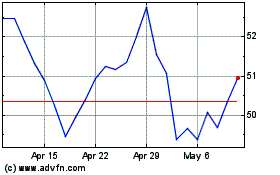

eBay (NASDAQ:EBAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

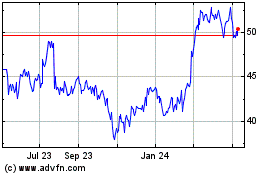

eBay (NASDAQ:EBAY)

Historical Stock Chart

From Apr 2023 to Apr 2024