PayPal Strikes Deal with MasterCard to Allow Payments in Stores

September 06 2016 - 7:30AM

Dow Jones News

PayPal Holdings Inc. has struck another deal with a payments

network, this time MasterCard Inc., as it seeks to carve out a

foothold in stores, according to the company.

This follows its big deal with Visa Inc. earlier this year. The

two deals in quick succession are among the biggest moves so far in

the online-payments pioneer's post-independence strategy after

splitting off from eBay Inc. last year.

The aim is to end bitter fights with the big card issuers and

make PayPal a universally accepted method of payment. This would

include in stores at the checkout counter, with MasterCard and

Visa's mobile-tap tools, the big new frontier for payments

companies.

But some analysts have argued that this comes at the expense of

profitability in the short term. The moves shift PayPal away from

promoting free bank transfers to fund customers' transactions and

toward the networks, which charge a fee.

There is also fierce competition from tech firms such as Apple

Inc., and young payments providers such as Stripe Inc., to win over

merchants and consumers in big numbers in the mobile and one-click

online payments realms.

PayPal's stock tumbled as much as 9% after the Visa deal was

announced in July, putting the company on the defensive about its

strategy. Its shares are still down 8% from the highest close that

month, though overall they remain up 7% from the company's debut in

July 2015.

The company has said the network deals, which will see PayPal

place debit and credit cards on par with other ways to pay, make

PayPal a "ubiquitous" payment tool. It argues that volume growth

would outpace declines in revenue per transaction, and that

merchants would want to pay for PayPal because it works seamlessly

for every customer.

The deals would also help its relatively newer services, such as

Braintree, which processes payments for big merchants, and Venmo, a

social peer-to-peer payments app popular with millennials.

"Customer choice and partnership are fundamental principles for

PayPal," Chief Executive Dan Schulman said in a statement. "With

each partnership agreement that we sign, we further expand the

ubiquity and value of the PayPal brand and improve our own

economics."

The company is in discussions with banks that issue cards to

potentially create new products and promote PayPal via those

partnerships, people familiar with the talks said.

Those deals could be crucial as well. Apple already offers a

mobile wallet and will soon be rolling out an online payment tool,

PayPal's bread-and-butter. Big banks are also preparing to roll out

their new Venmo competitor app, set to be called Zelle.

The terms of the MasterCard deal have PayPal enabling users to

set the credit or debit card as a default payment method. PayPal

will also share data on any transactions that use the MasterCard

mobile tap.

"Whether paying in the physical or digital world, consumers want

to see the familiar MasterCard brand," said MasterCard CEO Ajay

Banga in a statement.

In exchange, MasterCard will drop the digital wallet fee it

charges PayPal. It will also give PayPal volume discounts, as Visa

did.

MasterCard will further enable PayPal's Braintree to offer

Masterpass, a one-click online checkout tool, and enable Venmo

users to make instant transfers via MasterCard Send, rather than

waiting up to three days to get money into their bank accounts.

That in particular is key to competing with banks' real-time

payments apps.

Write to Telis Demos at telis.demos@wsj.com

(END) Dow Jones Newswires

September 06, 2016 07:15 ET (11:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

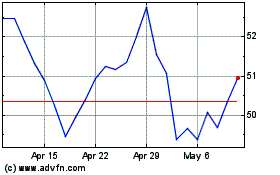

eBay (NASDAQ:EBAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

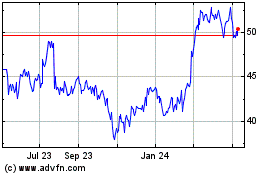

eBay (NASDAQ:EBAY)

Historical Stock Chart

From Apr 2023 to Apr 2024