PayPal Strikes Partnership With Visa, Posts 15% Rise in Revenue

July 21 2016 - 5:34PM

Dow Jones News

By Ezequiel Minaya

PayPal Holdings Inc., which has worked to extend its reach since

splitting with eBay Inc. last year, said Thursday it had forged a

new partnership with credit-card issuer Visa Inc.

The money-moving service also posted a 15% rise in quarterly

revenue and an increase in profit, with payment transactions

climbing during the three-month period.

Shares of the company, up 27% over the past six months, rose 2%

to $41 in after-hours trading.

PayPal has one of the largest market values of any

financial-technology company. At the end of its first quarter,

PayPal's customers had more than $13 billion in accounts at the

online-commerce company.

And since breaking off from its former parent company, PayPal

has worked to build its reach. In addition to linking to a credit

or debit card or bank account, there are some 66,000 partner stores

in which consumers add cash into their PayPal accounts. PayPal

accounts allows customers to buy things on the web or transfer

money.

With the Visa deal, PayPal will join Visa's commercial framework

for mobile payments. "This will enhance transaction security and

expand acceptance for PayPal's digital wallet to all physical

retail locations where Visa contactless transactions are enabled,"

the companies said in a statement.

Consumers will be able to move money from their PayPal and Venmo

accounts to their bank accounts via their Visa debit card. The pact

also installs economic incentives, including Visa incentives for

increased volume, among other facets.

"We want to democratize financial services and become an

everyday, essential service for underserved consumers," said Dan

Schulman, chief executive of PayPal, in a statement.

PayPal also raised its annual revenue guidance to between $10.75

billion and $10.85 billion, from $10.5 billion to $10.7 billion

previously. The company now expects adjusted earnings on a

per-share basis between $1.47 and $1.50, up from $1.45 to $1.50

previously.

For the third quarter, PayPal expects adjusted earnings between

33 cents and 35 cents, compared with analysts' expectations of 33

cents.

In the June quarter, the company processed 1.4 billion payment

transactions, which translates to 29 payment transactions per

active account, an increase from 26 transactions per active account

a year earlier.

For the quarter, PayPal's earnings rose to $323 million, or 27

cents a share, from $305 million, or 25 cents a share, a year

earlier. Excluding certain items, the company posted per-share

earnings of 36 cents, up from 33 cents a year earlier, on a pro

forma basis, in line with the average analyst estimate of 36 cents,

according to Thomson Reuters. The company had forecast adjusted

earnings between 34 cents and 36 cents.

The San Jose, Calif., company said revenue rose 15% to $2.65

billion, above the average analyst estimate of $2.6 billion. The

company had projected quarterly revenue of $2.57 billion to $2.62

billion.

Write to Ezequiel Minaya at ezequiel.minaya@wsj.com

(END) Dow Jones Newswires

July 21, 2016 17:19 ET (21:19 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

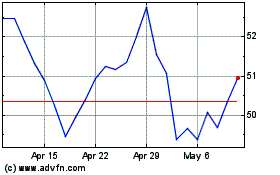

eBay (NASDAQ:EBAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

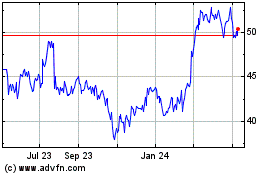

eBay (NASDAQ:EBAY)

Historical Stock Chart

From Apr 2023 to Apr 2024