By Telis Demos

PayPal Holdings Inc. said it is expanding newer services such as

Xoom and Venmo as it seeks more ways to stand out from a bevy of

emerging mobile payments tools.

The San Jose, Calif., company's shares rose about 2% in

after-hours trading, after it announced that its total payments

volumes were $81 billion for the quarter, up 29% from a year ago,

and ahead of analyst expectations of $79 billion for the

quarter.

PayPal revenues also grew, but more slowly. Revenue in the first

quarter was $2.54 billion, up 19% from a year ago, and just ahead

of analyst forecasts of $2.5 billion.

The payment company's businesses contain its core online and

mobile e-commerce payments tools, and newer businesses like Xoom

and Venmo that it has acquired in recent years.

Excluding certain items, PayPal posted per-share earnings of 37

cents, up from 29 cents a year earlier, on a pro forma basis, and

above the average analyst estimate of 35 cents, according to

Thomson Reuters.

Since its separation from eBay Inc. last year, PayPal has sought

to find new ways to both expand its overall usage and defend its

pricing power as it faces off against an expanding array of

payments options for consumers, such as from Apple Inc.'s Apple Pay

to online checkout tools from Visa Inc. and MasterCard Inc.

"Larger merchants have much more volume, and therefore get a

lower price, " said PayPal's chief executive, Dan Schulman, in an

interview. But, he said, "every one of those dollars is

[profitable], and consumers can shop in more places."

Another factor is the rapid growth of Venmo, the

person-to-person payments app that PayPal acquired in 2013 that is

popular with young users who also make social-media postings about

their payments.

Venmo transaction volume grew 154% in the quarter from a year

ago, to $3.2 billion, but PayPal is still in the early stages of

making money from the free service.

Last quarter, PayPal said that Venmo would start a pilot to

allow users to use the service to pay for goods at some online

merchants, who would then pay fees to PayPal. It said that program

has grown to 550,000 users, and would be launched to all of Venmo

in the second half.

"The Venmo usage is pretty incredible," said Josh Olson, analyst

at Edward Jones. He said that "finding a way to monetize and

integrate [Venmo]" with PayPal's merchant customers was critical.

"Checkout with Venmo will be very important," he said.

PayPal in April led a venture fundraising round for Acorns Grow

Inc., which operates an investment app aimed at millennials opening

their first small accounts. PayPal said it was exploring possible

linkages with Venmo.

It also aims to win more big merchant business by showing it can

help convert shoppers, who often abandon purchases in online carts,

into buyers.

That includes expanding its One Touch product, in which users

sign up once and then port their payments options across multiple

websites and apps. PayPal said 21 million people had signed up for

One Touch, and that merchants in 144 markets were now using it.

PayPal also said it had launched contactless mobile payments in

Spain, via a partnership with carrier Vodafone Group PLC, ahead of

a broader Europe rollout.

Its Xoom service will expand to 53 countries, up from 30 before

it closed the acquisition of the international money transfer

business last November, PayPal said.

That includes a link with M-Pesa, a fast-growing digital

payments service in Kenya, which can then link Xoom payments to

things like paying bills. PayPal said that net new activations of

Xoom's app were up 70% from a year ago, reflecting its expanded

link with PayPal customers.

"We're creating a presence in emerging markets where there

hasn't been a presence for PayPal," said John Kunze, vice president

for Xoom, in an interview.

PayPal is increasingly facing some upstarts in international

payments. Xoom initially competed digitally with established money

transfer networks such as Western Union Co. and MoneyGram

International Inc. Now there are venture-funded firms such as

TransferWise, Circle Internet Financial Ltd., and Remitly, which

this week said it raised $38.5 million in fresh capital.

Mr. Kunze said that Xoom, which both digitally links with banks

and delivers cash via retail partners, focuses primarily on people

who are working in developed countries like the U.S. and sending

money home to their families in developing countries.

Some upstarts are "serving mass-affluent users," he said.

"They're not in the family remittances business."

Ezequiel Minaya contributed to this article.

Write to Telis Demos at telis.demos@wsj.com

(END) Dow Jones Newswires

April 27, 2016 20:06 ET (00:06 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

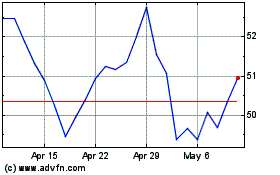

eBay (NASDAQ:EBAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

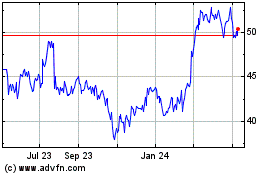

eBay (NASDAQ:EBAY)

Historical Stock Chart

From Apr 2023 to Apr 2024