UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 27, 2016

eBay Inc.

(Exact name of registrant as specified in its charter)

|

| | |

Delaware | 000-24821 | 77-0430924 |

(State or other jurisdiction | (Commission File Number) | (I.R.S. Employer |

of incorporation) | | Identification No.) |

2065 Hamilton Avenue

San Jose, California 95125

(Address of principal executive offices)

(408) 376-7400

(Registrant's telephone number, including area code)

Not Applicable.

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02. Results of Operations and Financial Condition

The information in this report is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, or the Exchange Act, and is not to be incorporated by reference into any filing by eBay Inc., or the company, under the Securities Act of 1933 or the Exchange Act, regardless of any general incorporation language contained in such filing, unless otherwise expressly stated in such filing.

On January 27, 2016, the company announced its financial results for the quarter and year ended December 31, 2015. A copy of the company's press release announcing its financial results and certain other information is attached as Exhibit 99.1 to this report.

The attached press release includes the following financial measures defined as “non-GAAP financial measures” by the Securities and Exchange Commission, or the SEC: non-GAAP net income, non-GAAP earnings per diluted share, non-GAAP operating margin, non-GAAP effective tax rate, and free cash flow. These non-GAAP measures are presented on a continuing operations basis. These measures may be different from non-GAAP financial measures used by other companies. The presentation of this financial information, which is not prepared under any comprehensive set of accounting rules or principles, is not intended to be considered in isolation of, or as a substitute for, the financial information prepared and presented in accordance with generally accepted accounting principles. See “Business Outlook,” “Non-GAAP Measures of Financial Performance,” “Reconciliation of GAAP Operating Margin to Non-GAAP Operating Margin,” “Reconciliation of GAAP Net Income to Non-GAAP Net Income and GAAP Effective Tax Rate to Non-GAAP Effective Tax Rate,” and “Reconciliation of Operating Cash Flow to Free Cash Flow” included in the attached press release for further information regarding these non-GAAP financial measures, including a reconciliation of these measures to the nearest comparable GAAP measures and an explanation of why the company includes these non-GAAP measures.

The attached press release also contains forward-looking statements relating to, among other things, the company's future performance. A more thorough discussion of certain factors that may affect the company's actual results is included under the captions “Risk Factors” and “Management's Discussion and Analysis of Financial Condition and Results of Operations” in the company's most recent annual report on Form 10-K and subsequent quarterly reports on Form 10-Q, copies of which may be obtained by visiting the company's investor relations web site at http://investor.ebayinc.com or the SEC's web site at www.sec.gov. Undue reliance should not be placed on the forward-looking statements in the attached press release, which are based on information available to the company on the date hereof. The company assumes no obligation to update such statements.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits.

The following exhibit is furnished with this report:

|

| |

99.1 | Press release dated January 27, 2016 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

| eBay Inc. |

| (Registrant) |

| | |

Date: January 27, 2016 | /s/ Kathryn W. Hall |

| Name: Kathryn W. Hall |

| Title: Vice President, Legal, Deputy General Counsel |

| | & Assistant Secretary |

INDEX TO EXHIBITS

|

| |

Exhibit Number | Description |

99.1 | Press release dated January 27, 2016 |

Exhibit 99.1

eBay Inc. Reports Fourth Quarter and Full Year 2015 Results

Q4 2015 Highlights:

| |

• | Gross Merchandise Volume of $21.9 billion |

| |

• | Active buyer base grew 5% to 162 million |

| |

• | Non-GAAP and GAAP EPS per diluted share of $0.50 and $0.43, respectively, on a continuing operations basis |

| |

• | Repurchased $550 million of common stock |

San Jose, California, January 27, 2016 - eBay Inc. (NASDAQ: EBAY), a global commerce leader, today reported that gross merchandise volume (GMV) for the quarter ended December 31, 2015 was $21.9 billion, increasing 5% on a foreign exchange (FX) neutral basis and was flat year over year on an as-reported basis, reflecting the continued impact of a strong U.S. dollar. Revenue for the quarter was $2.3 billion, up 5% on an FX-Neutral basis and flat year over year on an as-reported basis, driving non-GAAP net income from continuing operations of $600 million, or $0.50 per diluted share, and GAAP net income from continuing operations of $523 million, or $0.43 per diluted share. During the quarter, the company generated $1.1 billion of operating cash flow from continuing operations and $1.0 billion of free cash flow from continuing operations. eBay also repurchased $550 million of its common stock and completed the divestiture of its Enterprise business on November 2, 2015.

"We delivered solid fourth quarter results and continued to make progress against our key priorities,” said Devin Wenig, President and CEO of eBay Inc. “The quarter also marked the end of an extraordinary year during which we completed the spin-off of PayPal. We continue to grow our business and customer base while executing our plan to reposition eBay for long-term success.”

Underlying total eBay Inc. performance, the Marketplace platform delivered $20.7 billion of GMV, resulting in $1.9 billion in revenue for the fourth quarter, up 1% on an FX-Neutral basis and down 3% on an as-reported basis. During the 2015 holiday shopping season, the Marketplace platform saw over 265 million transactions across 190 markets, as consumers around the world shopped for great deals and sought-after gifts. StubHub ended the year with strong momentum, driving GMV of $1.2 billion in the fourth quarter and $232 million of revenue, up 34%, aided by strength in the sports and concerts categories. Classifieds delivered another quarter of accelerating growth with revenue of $183 million, up 15% on an FX-Neutral basis and up 2% on an as-reported basis with strong performance in Germany and the United Kingdom.

For the full year 2015, eBay Inc.’s commerce platforms continued to connect buyers and sellers around the world, with an active buyer base that grew by 8 million, to 162 million total active buyers, representing 5% growth. Total GMV was $82 billion, up 5% on an FX-Neutral basis and down 1% on an as-reported basis, reflecting the impact of a strong U.S. dollar. Revenue was $8.6 billion, growing 5% on an FX-Neutral basis and down 2% on an as-reported basis. The company delivered strong operating and free cash flow on a continuing operations basis, generating $2.9 billion and $2.2 billion, respectively, during 2015.

The results of eBay Enterprise and PayPal are presented as discontinued operations, appearing net of tax in a single line in the company's statement of income.

Fourth Quarter and Full Year 2015 Financial Highlights (presented in millions, except per share data and percentages)

|

| | | | | | | | |

| Fourth Quarter | | | Full Year | | |

| 2015 | 2014 | Change | 2015 | 2014 | Change |

eBay Inc. | | | | | | | | |

Net revenues | $2,322 | $2,323 | $(1) | —% | $8,592 | $8,790 | $(198) | (2)% |

GAAP - Continuing Operations | | | | | | | | |

Income (loss) from continuing operations | $523 | $729 | $(206) | (28)% | $1,947 | $(865) | $2,812 | ** |

Earnings (loss) per diluted share from continuing operations | $0.43 | $0.59 | $(0.16) | (26)% | $1.60 | $(0.69) | $2.29 | ** |

Non-GAAP - Continuing Operations | | | | | | | | |

Net income (loss) | $600 | $685 | $(85) | (12)% | $2,232 | $2,386 | $(154) | (6)% |

Earnings (loss) per diluted share | $0.50 | $0.55 | $(0.05) | (10)% | $1.83 | $1.89 | $(0.06) | (3)% |

**Not meaningful

Other Selected Financial and Operational Results

| |

• | Operating margin — GAAP operating margin decreased to 28.5% for the fourth quarter of 2015, compared to 31.5% for the same period last year. Non-GAAP operating margin decreased to 34.4% in the fourth quarter, compared to 36.7% for the same period last year. |

| |

• | Taxes — The GAAP effective tax rate for continuing operations for the fourth quarter of 2015 was 19.5%, compared to 1.2% for the fourth quarter of 2014. The non-GAAP effective tax rate for continuing operations for the fourth quarter of 2015 was 23.8%, compared to 20.3% for the fourth quarter of 2014. |

| |

• | Cash flow — The company generated $1.1 billion of operating cash flow from continuing operations and $1.0 billion of free cash flow from continuing operations during the fourth quarter of 2015. |

| |

• | Stock repurchase program — The company repurchased approximately $550 million of its common stock, or 19.9 million shares, in the fourth quarter of 2015. The company's total repurchase authorization remaining as of December 31, 2015 was $1.8 billion. |

| |

• | Cash and cash equivalents and non-equity investments — The company's cash and cash equivalents and non-equity investments portfolio totaled $8.5 billion as of December 31, 2015. |

Business Outlook

| |

• | First quarter 2016 — The company expects net revenue between $2.05 billion and $2.10 billion, representing FX-Neutral growth of 3% - 5%, with non-GAAP earnings per diluted share from continuing operations in the range of $0.43 - $0.45 and GAAP earnings per diluted share from continuing operations in the range of $0.37 - $0.39. |

| |

• | Full year 2016 — The company expects net revenue between $8.5 billion and $8.8 billion, representing FX-Neutral growth of 2% - 5%, with non-GAAP earnings per diluted share from continuing operations in the range of $1.82 - $1.87 and GAAP earnings per diluted share from continuing operations in the range of $1.55 - $1.60. |

Quarterly Conference Call and Webcast

eBay Inc. will host a conference call to discuss fourth quarter 2015 results at 1:30 p.m. Pacific Time today. A live webcast of the conference call, together with a slide presentation that includes supplemental financial information and reconciliations of certain non-GAAP measures to their nearest comparable GAAP measures, can be accessed through the company's Investor Relations website at https://investors.ebayinc.com. In addition, an archive of the webcast will be accessible for 90 days through the same link.

eBay Inc. uses its Investor Relations website at https://investors.ebayinc.com as a means of disclosing material non-public information and for complying with its disclosure obligations under Regulation FD. Accordingly, investors should monitor, in addition to following press releases, SEC filings, public conference calls and webcasts.

About eBay

eBay Inc. (NASDAQ: EBAY) is a global commerce leader including the Marketplace, StubHub and Classifieds platforms. Collectively, we connect millions of buyers and sellers around the world, empowering people and creating opportunity through Connected Commerce. Founded in 1995 in San Jose, Calif., eBay is one of the world’s largest and most vibrant marketplaces for discovering great value and unique selection. In 2015, eBay enabled $82 billion of gross merchandise volume. For more information about the company and its global portfolio of online brands, visit www.ebayinc.com.

Presentation

All growth rates represent year over year comparisons, except as otherwise noted. All amounts in tables are presented in U.S. dollars, rounded to the nearest millions, except as otherwise noted. As a result, certain amounts may not sum or recalculate using the rounded dollar amounts provided.

Non-GAAP Financial Measures

This press release includes the following financial measures defined as “non-GAAP financial measures” by the Securities and Exchange Commission (SEC): non-GAAP net income, non-GAAP earnings per diluted share, non-GAAP operating margin, non-GAAP effective tax rate and free cash flow. These non-GAAP financial measures are presented on a continuing operations basis. These measures may be different from non-GAAP financial measures used by other companies. The presentation of this financial information, which is not prepared under any comprehensive set of accounting rules or principles, is not intended to be considered in isolation of, or as a substitute for, the financial information prepared and presented in accordance with generally accepted accounting principles (GAAP). For a reconciliation of these non-GAAP financial measures to the nearest comparable GAAP measures, see “Business Outlook,” “Non-GAAP Measures of Financial Performance,” “Reconciliation of GAAP Operating Margin to Non-GAAP Operating Margin,” “Reconciliation of GAAP Net Income to Non-GAAP Net Income and Reconciliation of GAAP Effective Tax Rate to Non-GAAP Effective Tax Rate” and “Reconciliation of Operating Cash Flow to Free Cash Flow” included in this press release.

Forward-Looking Statements

This press release contains forward-looking statements relating to, among other things, the future performance of eBay Inc. and its consolidated subsidiaries that are based on the company's current expectations, forecasts and assumptions and involve risks and uncertainties. These statements include, but are not limited to, statements regarding the future performance of eBay Inc. and its consolidated subsidiaries, including expected financial results for the first quarter and full year 2016 and the future growth in our business. Actual results could differ materially from those predicted or implied and reported results should not be considered as an indication of future performance. Other factors that could cause or contribute to such differences include, but are not limited to: changes in political, business and economic conditions, any regional or general economic downturn or crisis and any conditions that affect ecommerce growth or cross-border trade; fluctuations in foreign currency exchange rates; the company’s need to successfully react to the increasing importance of mobile commerce and the increasing social aspect of commerce; an increasingly competitive environment for our business; changes to the company’s capital allocation or management of operating cash the company’s ability to manage its indebtedness, including managing exposure to interest rates and maintaining its credit ratings; the company’s need to manage an increasingly large enterprise with a broad range of businesses of varying degrees of maturity and in many different geographies; the company’s need and ability to manage regulatory, tax, data security and litigation risks; whether the operational, marketing and strategic benefits of the separation of the eBay and PayPal businesses can be achieved; the company’s ability to timely upgrade and develop its technology systems, infrastructure and customer service capabilities at reasonable cost while maintaining site stability and performance and adding new products and features; and the company’s ability to integrate, manage and grow businesses that have been acquired or may be acquired in the future.

The forward-looking statements in this release do not include the potential impact of any acquisitions or divestitures that may be announced and/or completed after the date hereof.

More information about factors that could affect the company's operating results is included under the captions “Risk Factors” and “Management's Discussion and Analysis of Financial Condition and Results of Operations” in the company's most recent annual report on Form 10-K and subsequent quarterly reports on Form 10-Q, copies of which may be obtained by visiting the company's Investor Relations website at https://investors.ebayinc.com or the SEC's website at www.sec.gov. All information in this release is as of January 27, 2016. Undue

reliance should not be placed on the forward-looking statements in this press release, which are based on information available to the company on the date hereof. The company assumes no obligation to update such statements.

|

| | |

| | |

Investor Relations Contact: | Selim Freiha; Tina Todasco | ir@ebay.com |

Media Relations Contact: | Abby Smith | press@ebay.com |

Company News: | https://www.ebayinc.com/stories/news/ | |

Investor Relations website: | https://investors.ebayinc.com | |

eBay Inc.

Unaudited Condensed Consolidated Balance Sheet

|

| | | | | | | |

| December 31,

2015 | | December 31,

2014 |

| (In millions, except par value amounts) |

| |

ASSETS | | | |

Current assets: | | | |

Cash and cash equivalents | $ | 1,832 |

| | $ | 4,105 |

|

Short-term investments | 4,299 |

| | 3,730 |

|

Accounts receivable, net | 619 |

| | 600 |

|

Other current assets | 1,154 |

| | 1,048 |

|

Current assets of discontinued operations | — |

| | 17,048 |

|

Total current assets | 7,904 |

| | 26,531 |

|

Long-term investments | 3,391 |

| | 5,736 |

|

Property and equipment, net | 1,554 |

| | 1,486 |

|

Goodwill | 4,451 |

| | 4,671 |

|

Intangible assets, net | 90 |

| | 133 |

|

Other assets | 395 |

| | 207 |

|

Long-term assets of discontinued operations | — |

| | 6,368 |

|

Total assets | $ | 17,785 |

| | $ | 45,132 |

|

LIABILITIES AND STOCKHOLDERS' EQUITY | | | |

Current liabilities: | |

| | |

|

Short-term debt | $ | — |

| | $ | 850 |

|

Accounts payable | 349 |

| | 107 |

|

Accrued expenses and other current liabilities | 1,736 |

| | 3,830 |

|

Deferred revenue | 106 |

| | 108 |

|

Income taxes payable | 72 |

| | 125 |

|

Current liabilities of discontinued operations | — |

| | 12,511 |

|

Total current liabilities | 2,263 |

| | 17,531 |

|

Deferred and other tax liabilities, net | 2,092 |

| | 522 |

|

Long-term debt | 6,779 |

| | 6,777 |

|

Other liabilities | 75 |

| | 79 |

|

Long-term liabilities of discontinued operations | — |

| | 317 |

|

Total liabilities | 11,209 |

| | 25,226 |

|

| | | |

Total stockholders' equity | 6,576 |

| | 19,906 |

|

Total liabilities and stockholders' equity | $ | 17,785 |

| | $ | 45,132 |

|

eBay Inc.

Unaudited Condensed Consolidated Statement of Income

|

| | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Year Ended

December 31, |

| 2015 | | 2014 | | 2015 | | 2014 |

| (In millions, except per share amounts) |

| | | | | | | |

Net revenues | $ | 2,322 |

| | $ | 2,323 |

| | $ | 8,592 |

| | $ | 8,790 |

|

Cost of net revenues (1) | 493 |

| | 442 |

| | 1,771 |

| | 1,663 |

|

Gross profit | 1,829 |

| | 1,881 |

| | 6,821 |

| | 7,127 |

|

Operating expenses: | | | | | | | |

Sales and marketing (1) | 595 |

| | 627 |

| | 2,267 |

| | 2,442 |

|

Product development (1) | 229 |

| | 236 |

| | 923 |

| | 983 |

|

General and administrative (1) | 260 |

| | 211 |

| | 1,122 |

| | 889 |

|

Provision for transaction losses | 72 |

| | 66 |

| | 271 |

| | 262 |

|

Amortization of acquired intangible assets | 11 |

| | 10 |

| | 41 |

| | 75 |

|

Total operating expenses | 1,167 |

| | 1,150 |

| | 4,624 |

| | 4,651 |

|

Income from operations | 662 |

| | 731 |

| | 2,197 |

| | 2,476 |

|

Interest and other, net | (12 | ) | | 7 |

| | 209 |

| | 39 |

|

Income from continuing operations before income taxes | 650 |

| | 738 |

| | 2,406 |

| | 2,515 |

|

Provision for income taxes | (127 | ) | | (9 | ) | | (459 | ) | | (3,380 | ) |

Income (loss) from continuing operations | $ | 523 |

| | $ | 729 |

| | $ | 1,947 |

| | $ | (865 | ) |

Income (loss) from discontinued operations, net of income taxes (2) | (46 | ) | | 294 |

| | (222 | ) | | 911 |

|

Net income | $ | 477 |

| | $ | 1,023 |

| | $ | 1,725 |

| | $ | 46 |

|

| | | | | | | |

Income (loss) per share - basic: | | | | | | | |

Continuing operations | $ | 0.44 |

| | $ | 0.59 |

| | $ | 1.61 |

| | $ | (0.69 | ) |

Discontinued operations | $ | (0.04 | ) | | $ | 0.24 |

| | $ | (0.18 | ) | | $ | 0.73 |

|

Net income per share - basic | $ | 0.40 |

| | $ | 0.83 |

| | $ | 1.43 |

| | $ | 0.04 |

|

| | | | | | | |

Income (loss) per share - diluted: | | | | | | | |

Continuing operations | $ | 0.43 |

| | $ | 0.59 |

| | $ | 1.60 |

| | $ | (0.69 | ) |

Discontinued operations | $ | (0.04 | ) | | $ | 0.23 |

| | $ | (0.18 | ) | | $ | 0.73 |

|

Net income per share - diluted | $ | 0.39 |

| | $ | 0.82 |

| | $ | 1.42 |

| | $ | 0.04 |

|

| | | | | | | |

Weighted average shares: | | | | | | | |

Basic | 1,191 |

| | 1,230 |

| | 1,208 |

| | 1,251 |

|

Diluted | 1,204 |

| | 1,241 |

| | 1,220 |

| | 1,251 |

|

| | | | | | | |

(1) Includes stock-based compensation as follows: | | | | | | | |

Cost of net revenues | $ | 10 |

| | $ | 10 |

| | $ | 38 |

| | $ | 33 |

|

Sales and marketing | 19 |

| | 22 |

| | 94 |

| | 93 |

|

Product development | 25 |

| | 26 |

| | 108 |

| | 116 |

|

General and administrative | 24 |

| | 35 |

| | 139 |

| | 102 |

|

| $ | 78 |

| | $ | 93 |

| | $ | 379 |

| | $ | 344 |

|

(2) Includes PayPal financial results from October 1, 2014 to December 31, 2014 for Fourth Quarter; January 1, 2015 to July 17, 2015 and January 1, 2014 to December 31, 2014 for Full Year; also includes the eBay Enterprise financial results from October 1, 2015 to November 2, 2015 and October 1, 2014 to December 31, 2014 for Fourth Quarter; January 1, 2015 to November 2, 2015 and January 1, 2014 to December 31, 2014 for Full Year.

eBay Inc.

Unaudited Condensed Consolidated Statement of Cash Flows

|

| | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Year Ended

December 31, |

| 2015 | | 2014 | | 2015 | | 2014 |

| (In millions) |

Cash flows from operating activities: | | | | | | | |

Net income | $ | 477 |

| | $ | 1,023 |

| | $ | 1,725 |

| | $ | 46 |

|

(Income) loss from discontinued operations, net of income taxes | 46 |

| | (294 | ) | | 222 |

| | (911 | ) |

Adjustments: | | | | | | | |

Provision for transaction losses | 72 |

| | 66 |

| | 271 |

| | 262 |

|

Depreciation and amortization | 171 |

| | 164 |

| | 687 |

| | 682 |

|

Stock-based compensation | 78 |

| | 93 |

| | 379 |

| | 344 |

|

Gain on sale of investments | 17 |

| | (9 | ) | | (195 | ) | | (12 | ) |

Deferred income taxes | 83 |

| | (235 | ) | | (32 | ) | | 2,744 |

|

Changes in assets and liabilities, net of acquisition effects | 182 |

| | 30 |

| | (180 | ) | | 73 |

|

Net cash provided by continuing operating activities | 1,126 |

| | 838 |

| | 2,877 |

| | 3,228 |

|

Net cash provided by (used in) discontinued operating activities(1) | (86 | ) | | 803 |

| | 1,156 |

| | 2,449 |

|

Net cash provided by operating activities | 1,040 |

| | 1,641 |

| | 4,033 |

| | 5,677 |

|

Cash flows from investing activities: | | | | | |

| | |

|

Purchases of property and equipment | (129 | ) | | (200 | ) | | (668 | ) | | (622 | ) |

Purchases of investments | (2,292 | ) | | (1,944 | ) | | (6,744 | ) | | (8,752 | ) |

Maturities and sales of investments | 1,202 |

| | 3,910 |

| | 6,781 |

| | 8,115 |

|

Acquisitions, net of cash acquired | — |

| | — |

| | (24 | ) | | (55 | ) |

Other | (3 | ) | | (6 | ) | | (18 | ) | | (11 | ) |

Net cash provided by (used in) continuing investing activities | (1,222 | ) | | 1,760 |

| | (673 | ) | | (1,325 | ) |

Net cash provided by (used in) discontinued investing activities(1) | 899 |

| | (688 | ) | | (2,938 | ) | | (1,348 | ) |

Net cash provided by (used in) investing activities | (323 | ) | | 1,072 |

| | (3,611 | ) | | (2,673 | ) |

Cash flows from financing activities: | | | | | |

| | |

|

Proceeds from issuance of common stock | 48 |

| | 122 |

| | 221 |

| | 300 |

|

Repurchases of common stock | (637 | ) | | (1,182 | ) | | (2,149 | ) | | (4,658 | ) |

Excess tax benefits from stock-based compensation | 2 |

| | 19 |

| | 74 |

| | 75 |

|

Tax withholdings related to net share settlements of restricted stock units and awards | (19 | ) | | (28 | ) | | (245 | ) | | (252 | ) |

Proceeds from issuance of long-term debt, net | — |

| | — |

| | — |

| | 3,482 |

|

Repayment of debt | (600 | ) | | — |

| | (850 | ) | | — |

|

Other | (21 | ) | | (2 | ) | | (11 | ) | | 6 |

|

Net cash used in continuing financing activities | (1,227 | ) | | (1,071 | ) | | (2,960 | ) | | (1,047 | ) |

Net cash provided by (used in) discontinued financing activities(1) | 5 |

| | 6 |

| | (1,594 | ) | | 25 |

|

Net cash used in financing activities | (1,222 | ) | | (1,065 | ) | | (4,554 | ) | | (1,022 | ) |

Effect of exchange rate changes on cash and cash equivalents | (78 | ) | | (110 | ) | | (364 | ) | | (148 | ) |

Net (decrease) increase in cash and cash equivalents | (583 | ) | | 1,538 |

| | (4,496 | ) | | 1,834 |

|

Cash and cash equivalents at beginning of period | 2,415 |

| | 4,790 |

| | 6,328 |

| | 4,494 |

|

Cash and cash equivalents at end of period | 1,832 |

| | 6,328 |

| | 1,832 |

| | 6,328 |

|

Less: Cash and cash equivalents of discontinued operations - Enterprise | — |

| | 29 |

| | — |

| | 29 |

|

Less: Cash and cash equivalents of discontinued operations - PayPal | — |

| | 2,194 |

| | — |

| | 2,194 |

|

Cash and cash equivalents of continuing operations at end of period | $ | 1,832 |

| | $ | 4,105 |

| | $ | 1,832 |

| | $ | 4,105 |

|

(1) Includes PayPal financial results from October 1, 2014 to December 31, 2014 for Fourth Quarter; January 1, 2015 to July 17, 2015 and January 1, 2014 to December 31, 2014 for Full Year; also includes the eBay Enterprise financial results from October 1, 2015 to November 2, 2015 and October 1, 2014 to December 31, 2014 for Fourth Quarter; January 1, 2015 to November 2, 2015 and January 1, 2014 to December 31, 2014 for Full Year.

eBay Inc.

Unaudited Summary of Consolidated Net Revenues

|

| | | | | | | | | | | | | | | | | | | |

Net Revenues by Type | Three Months Ended |

| December 31,

2015 | | September 30,

2015 | | June 30,

2015 | | March 31,

2015 | | December 31,

2014 |

| (In millions, except percentages) |

Net Revenues by Type: | | | | | | | | | |

Net transaction revenues: | | | | | | | | | |

Marketplace | $ | 1,584 |

| | $ | 1,459 |

| | $ | 1,524 |

| | $ | 1,536 |

| | $ | 1,662 |

|

Current quarter vs prior year quarter | (5 | )% | | (5 | )% | | (3 | )% | | (3 | )% | | N/A |

|

Percent from international | 63 | % | | 62 | % | | 62 | % | | 60 | % | | 63 | % |

StubHub | 232 |

| | 200 |

| | 161 |

| | 132 |

| | 174 |

|

Current quarter vs prior year quarter | 34 | % | | 17 | % | | 8 | % | | (2 | )% | | N/A |

|

Percent from international | 1 | % | | 2 | % | | 2 | % | | 2 | % | | 1 | % |

Total net transaction revenues | 1,816 |

| | 1,659 |

| | 1,685 |

| | 1,668 |

| | 1,836 |

|

Current quarter vs prior year quarter | (1 | )% | | (3 | )% | | (2 | )% | | (3 | )% | | N/A |

|

Percent from international | 55 | % | | 54 | % | | 56 | % | | 55 | % | | 57 | % |

| | | | | | | | | |

Marketing services and other revenues: | | | | | | | | | |

Marketplace | 326 |

| | 266 |

| | 251 |

| | 235 |

| | 312 |

|

Current quarter vs prior year quarter | 4 | % | | — | % | | (5 | )% | | (10 | )% | | N/A |

|

Percent from international | 47 | % | | 44 | % | | 47 | % | | 49 | % | | 48 | % |

Classifieds | 183 |

| | 178 |

| | 180 |

| | 162 |

| | 180 |

|

Current quarter vs prior year quarter | 2 | % | | (3 | )% | | (4 | )% | | (2 | )% | | N/A |

|

Percent from international | 100 | % | | 100 | % | | 100 | % | | 100 | % | | 100 | % |

Corporate and other | (3 | ) | | (4 | ) | | (6 | ) | | (4 | ) | | (5 | ) |

Total marketing services and other revenues | 506 |

| | 440 |

| | 425 |

| | 393 |

| | 487 |

|

Current quarter vs prior year quarter | 4 | % | | (2 | )% | | (5 | )% | | (8 | )% | | N/A |

|

Percent from international | 66 | % | | 67 | % | | 70 | % | | 70 | % | | 67 | % |

| | | | | | | | | |

Total net revenues | $ | 2,322 |

| | $ | 2,099 |

| | $ | 2,110 |

| | $ | 2,061 |

| | $ | 2,323 |

|

Current quarter vs prior year quarter | — | % | | (2 | )% | | (3 | )% | | (4 | )% | | N/A |

|

eBay Inc.

Unaudited Supplemental Operating Data

|

| | | | | | | | | | | | | | | | | | | |

| Three Months Ended |

| December 31,

2015 | | September 30,

2015 | | June 30,

2015 | | March 31,

2015 | | December 31,

2014 |

| (In millions, except percentages) |

Active Buyers (1) | 162 |

| | 159 |

| | 157 |

| | 156 |

| | 154 |

|

Current quarter vs prior year quarter | 5 | % | | 5 | % | | 6 | % | | 8 | % | | 10 | % |

| | | | | | | | | |

Gross Merchandise Volume (2) | | | | | | | | | |

Marketplace |

| $20,676 |

| |

| $18,674 |

| |

| $19,273 |

| |

| $19,476 |

| |

| $20,883 |

|

Current quarter vs prior year quarter | (1 | )% | | (3 | )% | | (2 | )% | | (2 | )% | | 1 | % |

StubHub |

| $1,184 |

| |

| $927 |

| |

| $788 |

| |

| $675 |

| |

| $911 |

|

Current quarter vs prior year quarter | 30 | % | | 10 | % | | 1 | % | | 6 | % | | 2 | % |

Total GMV |

| $21,860 |

| |

| $19,601 |

| |

| $20,061 |

| |

| $20,151 |

| |

| $21,794 |

|

Current quarter vs prior year quarter | — | % | | (2 | )% | | (2 | )% | | (2 | )% | | 1 | % |

| |

(1) | All buyers who successfully closed a transaction on our Marketplace and StubHub platforms within the previous 12-month period. Buyers may register more than once, and as a result, may have more than one account. |

| |

(2) | Total value of all successfully closed transactions between users on our Marketplace and StubHub platforms during the period regardless of whether the buyer and seller actually consummated the transaction. We believe that GMV provides a useful measure of the overall volume of closed transactions that flow through our platforms in a given period, notwithstanding the inclusion in GMV of closed transactions that are not ultimately consummated. |

eBay Inc.

Business Outlook

(In Millions, Except Per Share Amounts)

The guidance figures provided below and elsewhere in this press release are forward-looking statements, reflect a number of estimates, assumptions and other uncertainties, and are approximate in nature because the company's future performance is difficult to predict. Such guidance is based on information available on the date of this press release, and the company assumes no obligation to update it.

The company's future performance involves risks and uncertainties, and the company's actual results could differ materially from the information below and elsewhere in this press release. Some of the factors that could affect the company's operating results are set forth under the caption “Forward-Looking Statements” above in this press release. More information about factors that could affect the company's operating results is included under the captions “Risk Factors” and “Management's Discussion and Analysis of Financial Condition and Results of Operations” in its most recent annual report on Form 10-K and subsequent quarterly reports on Form 10-Q, copies of which may be obtained by visiting eBay's investor relations website at https://investors.ebayinc.com or the SEC's website at www.sec.gov.

eBay Inc.

|

| | | |

| Three Months Ending |

| March 31, 2016 |

(In millions, except per share amounts) | GAAP | | Non-GAAP (a) |

Diluted EPS from continuing operations | $0.37 - $0.39 | | $0.43 - $0.45 |

| | | |

| Twelve Months Ending |

| December 31, 2016 |

| GAAP | | Non-GAAP (b) |

(In millions, except per share amounts) | | | |

Diluted EPS from continuing operations | $1.55 - $1.60 | | $1.82 - $1.87 |

| | | |

(a) Estimated non-GAAP amounts above for the three months ending March 31, 2016, reflect adjustments that exclude the estimated amortization of acquired intangible assets of approximately $10 - $15 million and estimated stock-based compensation expense and employer payroll taxes on stock-based compensation expense of approximately $85 - $95 million as well as the related tax impact. |

(b) Estimated non-GAAP amounts above for the twelve months ending December 31, 2016, reflect adjustments that exclude the estimated amortization of acquired intangible assets of approximately $35 - $45 million and estimated stock-based compensation expense and employer payroll taxes on stock-based compensation expense of approximately $410 - $430 million. |

eBay Inc.

Non-GAAP Measures of Financial Performance

To supplement the company's condensed consolidated financial statements presented in accordance with generally accepted accounting principles, or GAAP, the company uses non-GAAP measures of certain components of financial performance. These non-GAAP measures include non-GAAP net income, non-GAAP earnings per diluted share, non-GAAP operating margin, non-GAAP effective tax rate, and free cash flow. These non-GAAP financial measures are presented on a continuing operations basis.

These non-GAAP measures are not in accordance with, or an alternative to, measures prepared in accordance with GAAP and may be different from non-GAAP measures used by other companies. In addition, these non-GAAP measures are not based on any comprehensive set of accounting rules or principles. Non-GAAP measures have limitations in that they do not reflect all of the amounts associated with the company's results of operations as determined in accordance with GAAP. These measures should only be used to evaluate the company's results of operations in conjunction with the corresponding GAAP measures.

Reconciliation to the nearest GAAP measure of all non-GAAP measures included in this press release can be found in the tables included in this press release.

These non-GAAP measures are provided to enhance investors' overall understanding of the company's current financial performance and its prospects for the future. Specifically, the company believes the non-GAAP measures provide useful information to both management and investors by excluding certain expenses, gains and losses, or net purchases of property and equipment, as the case may be, that may not be indicative of its core operating results and business outlook. In addition, because the company has historically reported certain non-GAAP results to investors, the company believes that the inclusion of non-GAAP measures provides consistency in the company's financial reporting.

For its internal budgeting process, and as discussed further below, the company's management uses financial measures that do not include stock-based compensation expense, employer payroll taxes on stock-based compensation, amortization or impairment of acquired intangible assets, impairment of goodwill, significant gains or losses from the disposal/acquisition of a business, certain effects of the planned separation of our eBay and PayPal business, certain gains and losses on investments, restructuring-related charges and the income taxes associated with the foregoing. In addition to the corresponding GAAP measures, the company's management also uses the foregoing non-GAAP measures in reviewing the financial results of the company.

The company excludes the following items from non-GAAP net income, non-GAAP earnings per diluted share, non-GAAP operating margin and non-GAAP effective tax rate:

Stock-based compensation expense and related employer payroll taxes. This expense consists of expenses for stock options, restricted stock and employee stock purchases. The company excludes stock-based compensation expense from its non-GAAP measures primarily because they are non-cash expenses that management does not believe are reflective of ongoing operating results. The related employer payroll taxes is dependent on the company's stock price and the timing and size of exercises by employees of their stock options and the vesting of their restricted stock, over which management has limited to no control, and as such management does not believe it correlates to the company's operation of the business.

Amortization or impairment of acquired intangible assets, impairment of goodwill, significant gains or losses and transaction expenses from the acquisition or disposal of a business and certain gains or losses on investments. The company incurs amortization or impairment of acquired intangible assets and goodwill in connection with acquisitions and may incur significant gains or losses from the acquisition or disposal of a business and therefore excludes these amounts from its non-GAAP measures. The company also excludes certain gains and losses on investments. The company excludes the impact of the accretion of a note receivable associated with the disposal of certain businesses. The company excludes these items because management does not believe they correlate to the ongoing operating results of the company's business.

Restructuring. These charges consist of expenses for employee severance and other exit and disposal costs. The company excludes significant restructuring charges primarily because management does not believe they are reflective of ongoing operating results.

Other certain significant gains, losses, or charges that are not indicative of the Company’s core operating results. These are significant gains, losses, or charges during a period that are the result of isolated events or transactions which have not occurred frequently in the past and are not expected to occur regularly or be repeated in the future. The company excludes these amounts from its results primarily because management does not believe they are indicative of its current or ongoing operating results.

Separation. These are significant expenses that are related to the separation of our eBay and PayPal businesses into separate publicly traded companies. These consist primarily of third-party consulting fees, legal fees, employee retention payments, tax indemnifications and other expenses related to the separation.

Tax effect of non-GAAP adjustments. This amount is used to present stock-based compensation and the other amounts described above on an after-tax basis consistent with the presentation of non-GAAP net income.

In addition to the non-GAAP measures discussed above, the company also uses free cash flow. Free cash flow represents operating cash flows less purchases of property and equipment. The company considers free cash flow to be a liquidity measure that provides useful information to management and investors about the amount of cash generated by the business after the purchases of property, buildings, and equipment, which can then be used to, among other things, invest in the company's business, make strategic acquisitions, and repurchase stock. A limitation of the utility of free cash flow as a measure of financial performance is that it does not represent the total increase or decrease in the company's cash balance for the period.

eBay Inc.

Reconciliation of GAAP Operating Margin to Non-GAAP Operating Margin

|

| | | | | | | | | | | | | | | |

| Three Months Ended | | Year Ended |

| December 31,

2015 | | December 31,

2014 | | December 31,

2015 | | December 31,

2014 |

| (In millions, except percentages) |

GAAP operating income | $ | 662 |

| | $ | 731 |

| | $ | 2,197 |

| | $ | 2,476 |

|

Stock-based compensation expense and related employer payroll taxes | 78 |

| | 96 |

| | 396 |

| | 373 |

|

Amortization of acquired intangible assets within cost of net revenues | 5 |

| | 8 |

| | 25 |

| | 34 |

|

Amortization of acquired intangible assets within operating expenses | 11 |

| | 10 |

| | 41 |

| | 75 |

|

Separation | 43 |

| | 7 |

| | 160 |

| | 7 |

|

Restructuring and acquisition related | — |

| | — |

| | 62 |

| | — |

|

Total non-GAAP operating income adjustments | 137 |

| | 121 |

| | 684 |

| | 489 |

|

Non-GAAP operating income | $ | 799 |

| | $ | 852 |

| | $ | 2,881 |

| | $ | 2,965 |

|

Non-GAAP operating margin | 34.4 | % | | 36.7 | % | | 33.5 | % | | 33.7 | % |

Reconciliation of GAAP Net Income to Non-GAAP Net Income and

GAAP Effective Tax Rate to Non-GAAP Effective Tax Rate*

|

| | | | | | | | | | | | | | | |

| Three Months Ended | | Year Ended |

| December 31,

2015 | | December 31,

2014 | | December 31,

2015 | | December 31,

2014 |

| (In millions, except percentages) |

GAAP income from continuing operations before income taxes | $ | 650 |

| | $ | 738 |

| | $ | 2,406 |

| | $ | 2,515 |

|

GAAP provision for income taxes | (127 | ) | | (9 | ) | | (459 | ) | | (3,380 | ) |

GAAP net income from continuing operations | $ | 523 |

| | $ | 729 |

| | $ | 1,947 |

| | $ | (865 | ) |

Non-GAAP adjustments to net income from continuing operations: | | | | | | | |

Non-GAAP operating income from continuing operations adjustments (see table above) | 137 |

| | 121 |

| | 684 |

| | 489 |

|

Gains or losses on investments | — |

| | — |

| | (264 | ) | | — |

|

Tax effect of non-GAAP adjustments | (60 | ) | | (165 | ) | | (135 | ) | | 2,762 |

|

Non-GAAP net income from continuing operations | $ | 600 |

| | $ | 685 |

| | $ | 2,232 |

| | $ | 2,386 |

|

| | | | | | | |

Diluted net income from continuing operations per share: | | | | | | | |

GAAP | $ | 0.43 |

| | $ | 0.59 |

| | $ | 1.60 |

| | $ | (0.69 | ) |

Non-GAAP | $ | 0.50 |

| | $ | 0.55 |

| | $ | 1.83 |

| | $ | 1.89 |

|

Shares used in GAAP diluted net income (loss) per-share calculation | 1,204 |

| | 1,241 |

| | 1,220 |

| | 1,251 |

|

Shares used in non-GAAP diluted net income per-share calculation | 1,204 |

| | 1,241 |

| | 1,220 |

| | 1,262 |

|

| | | | | | | |

GAAP effective tax rate - Continuing operations | 20 | % | | 1 | % | | 19 | % | | 134 | % |

Tax effect of non-GAAP adjustments to net income (loss) from continuing operations | 4 | % | | 19 | % | | 2 | % | | (113 | )% |

Non-GAAP effective tax rate - Continuing Operations | 24 | % | | 20 | % | | 21 | % | | 21 | % |

*Presented on a continuing operations basis

Reconciliation of Operating Cash Flow to Free Cash Flow*

|

| | | | | | | | | | | | | | | |

| Three Months Ended | | Year Ended |

| December 31,

2015 | | December 31,

2014 | | December 31,

2015 | | December 31,

2014 |

| (In millions) | | (In millions) |

Net cash provided by continuing operating activities | $ | 1,126 |

| | $ | 838 |

| | $ | 2,877 |

| | $ | 3,228 |

|

Less: Purchases of property and equipment | (129 | ) | | (200 | ) | | (668 | ) | | (622 | ) |

Free cash flow from continuing operations | $ | 997 |

| | $ | 638 |

| | $ | 2,209 |

| | $ | 2,606 |

|

*Presented on a continuing operations basis

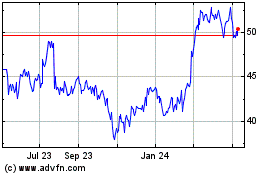

eBay (NASDAQ:EBAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

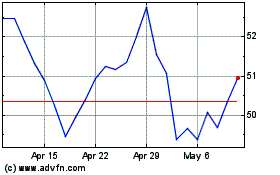

eBay (NASDAQ:EBAY)

Historical Stock Chart

From Apr 2023 to Apr 2024