Google Accuses EU of Antitrust About Face

November 02 2015 - 1:40PM

Dow Jones News

BRUSSELS—Google owner Alphabet Inc. accused European Union

regulators of making an unexplained about-face in their decision to

file antitrust charges against the U.S. search giant, and warned

that there was "no basis" for imposing fines, according to a

redacted copy of Google's response seen by The Wall Street

Journal.

The response, which runs to almost 130 pages and leans heavily

on legal opinions and case law, suggests that Google is gearing up

for a protracted legal battle against the charges brought by the

European Commission.

"The theory on which the [EU's] preliminary conclusions rest is

so ambiguous that the Commission itself concluded three times that

the concern had been resolved," Google's lawyers wrote in the

document. The document was recently sent to complainants in the

case following heavy editing to remove commercially sensitive

material.

The EU's demands, Google argues, amount "to a demand that we

sacrifice quality to subsidize competitors."

EU regulators in April became the first globally to file formal

antitrust charges against Google, accusing the search giant of

skewing search results to favor its own comparison-shopping

service. The move followed a five-year investigation during which

the EU sought, and failed, three times to settle with Google.

The EU warned that Google could face substantial fines and

called on the company to use the "same underlying processes and

methods" when presenting rival comparison-shopping services on its

search page, according to people who have seen the EU's charge

sheet. Fines could theoretically amount to 10% of the company's

revenue, which in 2014 amounted to $66 billion.

In its response, Google rebuffed those demands and claimed that

the EU had no basis to impose fines.

"The Commission itself previously found that a requirement that

Google should apply the same algorithm to rank all search results

including its own would not be indispensable to remedy the

competition concerns," the document says, citing a note sent by the

EU's former antitrust chief Joaquí n Almunia to his fellow

commissioners.

The document highlights Mr. Almunia's announcement in January

2014 that a third settlement proposal from Google was "capable of

addressing [the EU's] competition concerns," as well as the EU's

decision to send letters to complainants later that year to reject

their concerns about the settlement.

The EU changed tack in September 2014, warning Google that its

proposed settlement wasn't sufficient and the company must offer

more.

"If the Commission decides to end the commitment process it must

therefore provide reasons for the change in position," the document

says. It argues that the EU "has not provided substantiated reasons

as to why it found the January 2014 commitments insufficient."

Google also questions the EU's legal justification for demanding

that Google change its algorithms to treat comparison-shopping

rivals equally in search results. To do so, Google argues, the EU

would need to show that its results are as essential as a public

utility.

"The only legal framework that could apply here for a finding of

abuse is the framework for a duty to supply," the document says.

"But the [charge sheet] does not (and cannot) establish the legal

conditions for such a duty."

The EU shouldn't impose a fine, the document argues, because the

case rests on a novel legal theory, and Google participated in

settlement negotiations in good faith.

"There is no precedent for characterizing Google's conduct as an

illegal abuse," the document says. "The rules must be knowable in

advance."

The document expands on Google's earlier arguments that the EU

erred in its analysis of the fast-changing online-shopping business

and failed to account for the fast growth of companies like

Amazon.com Inc. and eBay Inc.

"Users have a huge—and expanding—array of options when searching

for products," the document says. "The [EU's charge sheet] misses

hundreds of other aggregators and ignores the remarkable success of

merchant platforms like Amazon and eBay."

It cites a legal opinion from Professor Carl Shapiro, a former

senior economist in the Justice Department's antitrust division,

that "merchant platforms are a powerful competitive threat to

aggregation only comparison shopping sites."

It could be another year or more until the EU makes a decision

in the case, and that could be challenged in the EU's appeals

courts in Brussels, a process that could take more than five

years.

A Google spokesman declined to comment.

Write to Tom Fairless at tom.fairless@wsj.com and Natalia

Drozdiak at natalia.drozdiak@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 02, 2015 13:25 ET (18:25 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

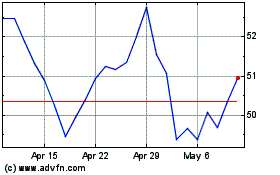

eBay (NASDAQ:EBAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

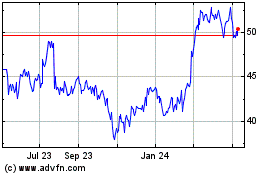

eBay (NASDAQ:EBAY)

Historical Stock Chart

From Apr 2023 to Apr 2024