UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 1, 2015

eBay Inc.

(Exact name of registrant as specified in its charter)

|

| | |

Delaware | 000-24821 | 77-0430924 |

(State or other jurisdiction | (Commission File Number) | (I.R.S. Employer |

of incorporation) | | Identification No.) |

2065 Hamilton Avenue

San Jose, CA 95125

(Address of principal executive offices)

(408) 376-7400

(Registrant’s telephone number, including area code)

Not Applicable.

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

At the Annual Meeting of Stockholders of eBay Inc. (“eBay” or the “Company”) held on May 1, 2015 (the “2015 Annual Meeting”), the Company’s stockholders, upon the recommendation of the Company’s Board of Directors (the “Board of Directors”), approved the material terms, including the performance goals, of the amendment and restatement of the eBay Incentive Plan (the “eBay Incentive Plan”), for purposes of satisfying the requirements of Section 162(m) of the Internal Revenue Code.

A brief summary of the eBay Incentive Plan was included as part of Proposal 3 in the Company’s definitive proxy statement filed with the Securities and Exchange Commission on March 23, 2015 (the “Proxy Statement”). The summary of the eBay Incentive Plan contained in the Proxy Statement is qualified by and subject to the full text of the eBay Incentive Plan, which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated by reference herein.

Item 5.07. Submission of Matters to a Vote of Security Holders.

At the 2015 Annual Meeting, the Company’s stockholders voted on the following seven proposals:

| |

1. | The election of 15 director nominees to serve as members of the Board of Directors until eBay’s 2016 Annual Meeting of Stockholders or until his or her respective successor has been elected and qualified (Proposal 1); |

| |

2. | The approval, on an advisory basis, of the compensation of the Company’s named executive officers (Proposal 2); |

| |

3. | The approval of the material terms, including the performance goals, of the amendment and restatement of the eBay Incentive Plan, for purposes of satisfying the requirements of Section 162(m) of the Internal Revenue Code (Proposal 3); |

| |

4. | The ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent auditors for its fiscal year ending December 31, 2015 (Proposal 4); |

| |

5. | A stockholder proposal regarding stockholder action by written consent without a meeting (Proposal 5); |

| |

6. | A stockholder proposal regarding stockholder proxy access (Proposal 6); and |

| |

7. | A stockholder proposal regarding gender pay (Proposal 7). |

The following is a summary of the matters voted on at the meeting.

| |

1. | Proposal 1 – Election of Directors. Each of the 15 director nominees proposed by eBay was elected to serve until eBay’s 2016 Annual Meeting of Stockholders or until his or her respective successor has been elected and qualified. The voting results were as follows: |

|

| | |

Director Name | Votes For | Votes Against |

Fred D. Anderson | 907,378,256 | 7,999,096 |

Anthony J. Bates | 906,554,164 | 8,790,359 |

Edward W. Barnholt | 906,717,597 | 8,578,940 |

Jonathan Christodoro | 889,972,318 | 25,216,124 |

Scott D. Cook | 901,138,550 | 14,204,950 |

John J. Donahoe | 901,266,415 | 14,121,372 |

David W. Dorman | 901,475,239 | 13,892,624 |

Bonnie S. Hammer | 910,334,062 | 5,037,276 |

Gail J. McGovern | 911,297,849 | 4,049,880 |

Kathleen C. Mitic | 904,264,958 | 11,097,071 |

David M. Moffett | 910,876,655 | 4,483,710 |

Pierre M. Omidyar | 908,071,950 | 7,327,073 |

Thomas J. Tierney | 899,663,944 | 15,676,749 |

Perry M. Traquina | 910,532,185 | 4,804,011 |

Frank D. Yeary | 910,344,742 | 4,993,521 |

| |

2. | Proposal 2 – Advisory Vote on Executive Compensation. Stockholders approved, on an advisory basis, the compensation of eBay’s named executive officers. The voting results were as follows: |

|

| | | |

Votes For | Votes Against | Abstensions | Broker Non-Votes |

867,461,864 | 48,292,962 | 2,646,383 | 78,304,878 |

| |

3. | Proposal 3 – Material Terms of eBay Incentive Plan. Stockholders approved the material terms, including the performance goals, of the amendment and restatement of the eBay Incentive Plan, for purposes of satisfying the requirements of Section 162(m) of the Internal Revenue Code. The voting results were as follows: |

|

| | | |

Votes For | Votes Against | Abstensions | Broker Non-Votes |

895,952,333 | 20,048,518 | 2,400,358 | 78,304,878 |

| |

4. | Proposal 4 – Ratification of Independent Auditors. Stockholders ratified the appointment of PricewaterhouseCoopers LLP as eBay’s independent auditors for eBay’s fiscal year ending December 31, 2015. The voting results were as follows: |

|

| | |

Votes For | Votes Against | Abstensions |

986,743,249 | 7,630,365 | 2,332,473 |

| |

5. | Proposal 5 – Stockholder Proposal Regarding Stockholder Action by Written Consent Without a Meeting. Stockholders did not approve the stockholder proposal regarding stockholder action by written consent without a meeting. The voting results were as follows: |

|

| | | |

Votes For | Votes Against | Abstensions | Broker Non-Votes |

393,474,913 | 514,448,110 | 10,478,186 | 78,304,878 |

| |

6. | Proposal 6 – Stockholder Proposal Regarding Stockholder Proxy Access. Stockholders approved the stockholder proposal regarding stockholder proxy access. The voting results were as follows: |

|

| | | |

Votes For | Votes Against | Abstensions | Broker Non-Votes |

544,459,733 | 371,585,696 | 2,355,780 | 78,304,878 |

7. Proposal 7 – Stockholder Proposal Regarding Gender Pay. Stockholders did not approve the stockholder proposal regarding stockholder proxy access. The voting results were as follows:

|

| | | |

Votes For | Votes Against | Abstensions | Broker Non-Votes |

67,915,263 | 735,069,693 | 115,416,253 | 78,304,878 |

Item 9.01. Financial Statements and Exhibits

|

| |

Exhibit Number | Description |

10.1 | Amended and Restated eBay Incentive Plan |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| |

| eBay Inc. |

| (Registrant) |

| |

Date: May 5, 2015 | /s/ Russell S. Elmer |

| Name: Russell S. Elmer |

| Title: Vice President, Deputy General Counsel, and Assistant Secretary |

INDEX TO EXHIBITS

|

| |

Exhibit Number | Description |

10.1 | Amended and Restated eBay Incentive Plan |

EXHIBIT 10.1

EBAY INCENTIVE PLAN

Initial Stockholder Approval on June 23, 2005

Amendment and Restatement adopted by the Compensation Committee of the

Board of Directors on February 19, 2015

Stockholder Approval of Amendment and Restatement on May 1, 2015

1. Purpose.

The eBay Incentive Plan is an element of eBay’s overall compensation strategy to align employee compensation with eBay’s business objectives, strategy, and performance. The Plan is designed to reward eBay’s employees for delivering measurable results. The purpose of the Plan is to align compensation with quarterly and annual performance and to enable eBay to attract, retain, and reward highly qualified individuals who contribute to eBay’s success and motivate them to enhance the value of the Company.

2. Definitions.

(a) “Board” means eBay’s Board of Directors.

(b) “Code” means the Internal Revenue Code of 1986, as amended, or the corresponding provisions of any subsequent federal internal revenue law.

(c) “Committee” means the Compensation Committee of eBay’s Board of Directors (and any committee to which the Compensation Committee has delegated its authority as set forth in Section 3(b) hereof); in any event the Committee shall be comprised of not less than two directors of the Company, each of whom shall qualify in all respects as an “outside director” for purposes of Section 162(m) of the Code.

(d) “eBay” or “Company” means eBay Inc. or any corporation or business entity of which eBay (i) directly or indirectly has an ownership interest of 50% or more, or (ii) has a right to elect or appoint 50% or more of the board of directors or other governing body.

(e) “Eligible Employee” means all active regular full-time and part-time employees who are notified by the Company are eligible to participate in the Plan.

(f) “Incentive Award” means any cash or equity incentive payment made under the Plan.

(g) “Performance Period” means the period in which performance is measured for which Incentive Awards are paid, as determined by the Committee.

(h) “Plan” means this plan, which shall be known as the eBay Incentive Plan or eIP.

(i) “Plan Year” means the calendar year.

3. Administration.

(a) The Plan shall be administered by the Committee. The Committee shall have full power and authority to:

(i) interpret, construe, and administer all questions of policy and expediency pertaining to the Plan;

(ii) adopt such rules, regulations, agreements, and instruments as it deems necessary for its proper administration;

(iii) select Eligible Employees to receive Incentive Awards;

(iv) determine the terms of the Incentive Awards;

(v) determine the amounts subject to Incentive Awards, including the exclusive right to establish, adjust, pay or decline to pay the Incentive Award for each Eligible Employee, provided that the exercise of such discretion shall not have the effect of increasing any Incentive Award that is intended to qualify as “performance-based compensation” under Section 162(m) of the Code;

(vi) determine whether Incentive Awards will be granted in replacement of, or alternatives to, any other incentive or compensation plan of eBay or an acquired business unit;

(vii) grant waivers of Plan or Incentive Award conditions;

(viii) determine the form of payment of an Incentive Award, which may be in cash, stock or other property as determined by the Committee;

(ix) correct any defect, supply any omission, or reconcile any inconsistency in the Plan, or any Incentive Award or notice;

(x) take any and all actions it deems necessary or advisable for the proper administration of the Plan;

(xi) adopt such Plan procedures, regulations, subplans and the like as deemed necessary to enable Eligible Employees to receive awards; and

(xii) amend the Plan at any time and from time to time, provided that no amendment to the Plan shall be effective unless approved by eBay’s stockholders to the extent that such stockholder approval is required under Section 162(m) of the Code with respect to Incentive Awards that are intended to qualify under that Section.

(b) The Committee may delegate its authority to grant and administer Incentive Awards to a separate committee or officer of the Company; however, only the Committee may grant and administer Incentive Awards with are intended to qualify as “performance-based compensation” under Section 162(m) of the Code.

4. Eligibility.

All active regular full-time and part-time employees who are notified by the Company that they are eligible to participate in the Plan are eligible to participate in the Plan. Except as otherwise provided by the Committee, Participation begins January 1 or the first full Performance Period of employment for newly hired employees. Employees joining eBay via an acquisition during the Plan Year will generally be eligible as of the first full Performance Period of employment unless otherwise notified by the Company. Employees who participate in other bonus programs, such as any sales incentive plan, are not eligible to participate in the Plan unless they are specifically made eligible in writing by an executive officer of the Company. In addition, the Company may, in its sole discretion, provide for a payout under the Plan for any employee who has changed positions and, as a result, may have been eligible to participate in the Plan and another bonus program during a Performance Period.

5. Performance Measures and Goals.

(a) The Compensation Committee shall establish performance measures and goals applicable to a particular Performance Period, provided that the outcome of the performance goals are substantially uncertain at the time such goals are established. Under ordinary circumstances, these performance measures shall be established within 90 days of the commencement of an annual Performance Period, or within the period that is the first 25% of any Performance Period that is shorter than twelve (12) months in duration.

(b) Each performance measure applicable to a Performance Period shall identify one or more of the following criteria that are to be monitored for eBay or any business unit during the Performance Period:

(i) trading volume;

(ii) users;

(iii) gross merchandise volume;

(iv) total payment volume;

(v) revenue;

(vi) operating income;

(vii) EBITDA and/or net earnings (either before or after interest, taxes, depreciation and amortization);

(viii) net income (either before or after taxes);

(ix) earnings per share;

(x) earnings as determined other than pursuant to United States generally accepted accounting principles (“GAAP”);

(xi) multiples of price to earnings;

(xii) multiples of price/earnings to growth;

(xiii) return on net assets;

(xiv) return on gross assets;

(xv) return on equity;

(xvi) return on invested capital;

(xvii) cash flow (including, but not limited to, operating cash flow and free cash flow);

(xviii) net or operating margin;

(xix) economic profit;

(xx) stock price appreciation;

(xxi) total stockholder return;

(xxii) employee productivity;

(xxiii) market share;

(xxiv) volume;

(xxv) customer satisfaction metrics; and

(xxvi) employee engagement/satisfaction metrics.

The measures may be described in terms of growth, an absolute number, or relative to an external group, and may be calculated on a pro forma basis or in accordance with Generally Accepted Accounting Principles. The Compensation Committee may set Performance Periods and performance goals that differ among Eligible Employees.

(c) The Committee may base performance measures and goals on one or more of the foregoing business criteria.

6. Establishment of Target Bonuses.

The Compensation Committee will designate those Eligible Employees who are to be participants in the eIP for that year and will specify the terms and conditions for the determination and payment of an Incentive Award to each Eligible Employee. The Compensation Committee may condition the payment of an Incentive Award upon the satisfaction of such objective or subjective standards as it deems appropriate. Under ordinary circumstances, these performance measures shall be established within 90 days of the commencement of a Performance Period, or within the period that is the first 25% of any Performance Period that is shorter than twelve (12) months in duration.

7. Incentive Awards.

(a) Incentive Awards may be made on the basis of eBay and/or business unit performance measures, goals, and formulas determined by the Committee.

(b) No Eligible Employee may receive an Incentive Award of more than $8,000,000 or an equivalent amount of equity based on the fair market value of the Company’s common stock on the date of grant in any Plan Year.

(c) As soon as practicable after the end of each Performance Period, the Compensation Committee will certify in writing whether the stated performance goals have been met and will determine the amount, if any, of the Incentive Award to be paid to each Eligible Employee.

(d) In determining the Incentive Award, the Compensation Committee will consider the target goals established at the beginning of the Plan Year or applicable Performance Period, the degree to which the established goals were satisfied and any other objective or subjective factors it deems appropriate. The Committee may reduce the amount of, or eliminate altogether, any Incentive Award that would otherwise be payable. Individuals who enter the eIP during the Plan Year may have their awards prorated.

8. Payment of Incentive Awards.

Subject to any election duly and validly made by an Eligible Employee with respect to the deferral of all or a portion of his or her Incentive Award, Incentive Awards shall be paid in cash or equity pursuant to an eBay equity-based award plan under which securities have been registered on Form S-8 at such times and on such terms as are determined by the Committee in its sole and absolute discretion.

9. No Right to Bonus or Continued Employment.

(a) Neither the establishment of the Plan, the provision for or payment of any amounts hereunder nor any action of the Company, the Board or the Committee with respect to the Plan shall be held or construed to confer upon any person:

(i) any legal right to receive, or any interest in, an Incentive Award or any other benefit under the Plan, or

(ii) any legal right to continue to serve as an officer or employee of the Company or any subsidiary or affiliate of the Company.

(b) The Company expressly reserves any and all rights to discharge any Eligible Employee without incurring liability to any person under the Plan or otherwise. Upon such discharge and notwithstanding any other provision hereof and regardless of whether or not specified performance goals have been achieved or the amount of an Incentive Award has been determined, the Company shall have no obligation to pay any Incentive Award, unless the Committee otherwise expressly provides by written contract or other written commitment.

10. Withholding.

The Company shall have the right to withhold, or require an Eligible Employee to remit to the Company, an amount sufficient to satisfy any applicable federal, state, local or foreign withholding tax requirements imposed with respect to the payment of any Incentive Award.

11. Nontransferability.

Except as expressly provided by the Committee, the rights and benefits under the Plan are personal to an Eligible Employee and shall not be subject to any voluntary or involuntary alienation, assignment, pledge, transfer or other disposition.

12. Unfunded Plan.

The Company shall have no obligation to reserve or otherwise fund in advance any amounts that are or may in the future become payable under the Plan. Any funds that the Company, acting in its sole and absolute discretion, determines to reserve for future payments under the Plan may be commingled with other funds of the Company and need not in any way be segregated from other assets or funds held by the Company. An Eligible Employee’s rights to payment under the Plan shall be limited to those of a general creditor of the Company.

13. The Incentive Awards and any cash payment, stock or other property delivered pursuant to an Incentive Award are subject to forfeiture, recovery by the Company or other action pursuant to any agreement evidencing an Incentive Award or any clawback or recoupment policy which the Company may adopt from time to time, including without limitation any such policy which the Company may be required to adopt under the Dodd-Frank Wall Street Reform and Consumer Protection Act and implementing rules and regulations thereunder, or as otherwise required by law.

14. Adoption, Amendment, Suspension and Termination of the Plan.

(a) Subject to the approval of the Plan by the holders of a majority of the Company common stock represented and voting on the proposal at the annual meeting of Company stockholders to be held on April 29, 2010 May 1, 2015 (or any adjournment thereof), the Plan shall be effective for Performance Periods beginning on or after January 1, 20102015, and shall continue in effect until the fifth anniversary of the date of such stockholder approval, unless earlier terminated as provided below. Upon such approval of the Plan by the Company’s stockholders, all Incentive Awards awarded under the Plan on or after January 1, 20102015 shall be fully effective as if the stockholders had approved the Plan on or before January 1, 20102015.

(b) Subject to the limitations set forth in this subsection, the Board may at any time suspend or terminate the Plan and may amend it from time to time in such respects as the Board may deem advisable; provided, however, that the Board shall not amend the Plan in any of the following respects without the approval of stockholders then sufficient to approve the Plan in the first instance:

(i) To increase the maximum amount of Incentive Award that may be paid under the Plan or otherwise materially increase the benefits accruing to any Eligible Employee under the Plan;

(ii) To materially modify the requirements as to eligibility for participation in the Plan; or

(iii) To change the material terms of the stated performance goals.

(c) No Incentive Award may be awarded during any suspension or after termination of the Plan, and no amendment, suspension or termination of the Plan shall, without the consent of the person affected thereby, alter or impair any rights or obligations under any Incentive Award previously awarded under the Plan.

15. Governing Law.

The validity, interpretation and effect of the Plan, and the rights of all persons hereunder, shall be governed by and determined in accordance with the laws of Delaware without regard to principles of conflict of laws.

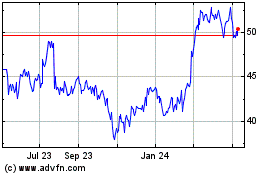

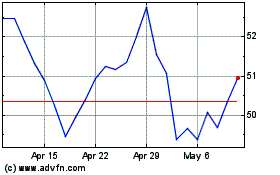

eBay (NASDAQ:EBAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

eBay (NASDAQ:EBAY)

Historical Stock Chart

From Apr 2023 to Apr 2024