DXP Enterprises, Inc. (NASDAQ:DXPE) today announced

financial results for the first quarter ended March 31, 2016. The

following are results for the three months ended March 31, 2016

compared to the three months ended March 31, 2015 and December 31,

2015, where appropriate. A reconciliation of the non-GAAP financial

measures is in the back of this press release.

DXP Enterprises 2016 First Quarter Financial

Highlights:

- Sales were $253.6 million for the first

quarter of 2016, compared to $278.7 million for the fourth quarter

of 2015 and $341.6 million for the first quarter of 2015, a

decrease of 9.0 percent from the fourth quarter and a decrease of

25.8 percent compared to the first quarter of 2015.

- Adjusted EBITDA was $6.8 million for

the current quarter versus $14.7 million in the fourth quarter and

$27.4 million for the first quarter of 2015. Adjusted EBITDA as a

percentage of sales was 2.7 percent versus 5.3 percent for the

fourth quarter of 2015 and 8.0 percent in the first quarter of

2015.

- Loss per diluted share for the first

quarter was $0.35, based on 14.5 million diluted shares, compared

to a loss of $0.20 per share in the fourth quarter of 2015, also

based on 14.5 million diluted shares.

David R. Little, Chairman and CEO remarked, “Completing the

first quarter, I am pleased with the collective effort to win new

business and aggressively cut costs in an effort to try and keep

pace with continued sales declines. Total DXP revenue of $253.6

million for the first quarter was down 9.0 percent sequentially. We

appreciate the continued hard work, perseverance and sacrifices

from our DXPeople as we work through the prolonged oil and gas

downturn and industrial softness. DXP’s industrial end markets,

which is 60 percent of our business today, appears to have bottomed

and shows signs of positive upward movement. Oil and gas, which

today is 40 percent of DXP, is attempting to find a bottom as

declines are decreasing. During the first quarter sales were $167.5

million for Service Centers, $47.4 million for Innovative Pumping

Solutions and $38.6 million for Supply Chain Services. The

continued sequential declines reflect the ongoing challenges in oil

and gas and the mining markets and the associated cut in spending

and activity by these customers. These declines were mitigated by

stability in the food & beverage and chemical markets.

In such a prolonged and difficult environment, we are taking

substantial steps to reorganize DXP without hurting sales efforts

and our ability to capitalize on the eventual turnaround of the oil

and gas market. Should conditions improve, the combination of

strong early feedback on DXP’s pump offering, a gradual return of

project work and continued improvements to our cost structure will

result in strong earnings growth. We will maintain strong focus on

those areas that we control, continue to right size and align our

businesses and optimize cost structures. We remain steadfast in our

ability to manage through the current cycle, maintaining our

customer focus while creating long-term stakeholder value.”

Mac McConnell, CFO added, "Our first quarter results reflect the

continued sales decline we experienced during the first half of the

first quarter. During the second half of the first quarter we took

steps to cut costs with an effort to optimize costs and sustain

earnings going forward. Our first quarter adjusted EBITDA for bank

purposes was $6.8 million. Also, in May, we were able to negotiate

an amendment to DXP’s credit facility providing a waiver of key

financial covenant ratios as of March 31, 2016."

We will host a conference call regarding 2016 first quarter

financial results on the Company’s website (www.dxpe.com) Friday,

May 13, 2016 at 10am CST. Web participants are encouraged to go to

the Company’s website at least 15 minutes prior to the start of the

call to register, download and install any necessary audio

software. The online archived replay will be available immediately

after the conference call at www.dxpe.com and at

www.viavid.net.

DXP Enterprises 2016 First Quarter Business Segment

Results:

- Service

Centers’ revenue for the first quarter was $167.5 million, a

decline of 10.6 percent sequentially with a 5.7 percent operating

income margin.

- Innovative

Pumping Solutions’ revenue for the first quarter was $47.4

million, a decline of 9.1 sequentially with a 0.6 percent operating

income margin.

- Supply Chain

Services’ revenue for the first quarter was $38.6 million, a

decline of 1.2 percent sequentially with a 9.0 percent operating

margin or 112 basis points improvement over the first quarter of

2015.

Non-GAAP Financial Measures

DXP supplements reporting of net income (loss) with non-GAAP

measurements, including Adjusted EBITDA and free cash flow. This

supplemental information should not be considered in isolation or

as a substitute for the unaudited GAAP

measurements. Additional information regarding Adjusted EBITDA

referred to in this press release is included below under

"--Reconciliation of Non-GAAP Measures."

About DXP Enterprises, Inc.

DXP Enterprises, Inc. is a leading products and service

distributor that adds value and total cost savings solutions to

industrial customers throughout the United States, Canada, Mexico

and Dubai. DXP provides innovative pumping solutions, supply chain

services and maintenance, repair, operating and production ("MROP")

services that emphasize and utilize DXP’s vast product knowledge

and technical expertise in rotating equipment, bearings, power

transmission, metal working, industrial supplies and safety

products and services. DXP's breadth of MROP products and service

solutions allows DXP to be flexible and customer-driven, creating

competitive advantages for our customers. DXP’s business segments

include Service Centers, Innovative Pumping Solutions and Supply

Chain Services. For more information, go to www.dxpe.com.

The Private Securities Litigation Reform Act of 1995 provides a

“safe-harbor” for forward-looking statements. Certain information

included in this press release (as well as information included in

oral statements or other written statements made by or to be made

by the Company) contains statements that are forward-looking. Such

forward-looking information involves important risks and

uncertainties that could significantly affect anticipated results

in the future; and accordingly, such results may differ from those

expressed in any forward-looking statement made by or on behalf of

the Company. These risks and uncertainties include, but are not

limited to; ability to obtain needed capital, dependence on

existing management, leverage and debt service, domestic or global

economic conditions, and changes in customer preferences and

attitudes. For more information, review the Company’s filings with

the Securities and Exchange Commission.

DXP ENTERPRISES, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS ($ thousands,

except per share amounts) (unaudited)

Three Months Ended March 31, 2016

2015 Sales $ 253,561 $ 341,594 Cost of sales

184,743 243,545 Gross profit 68,818 98,049

Selling, general and administrative expenses 70,820

79,950 Operating income (loss) (2,002 ) 18,099 Other

expense (income), net (155 ) (249 ) Interest expense 3,409

2,683 Income (loss) before income taxes (5,256

) 15,665 Provision (benefit) for income taxes (8 )

6,014 Net income (loss) (5,248 ) 9,651 Less: Net income

(loss) attributable to non-controlling interest (136 )

- Net income (loss) attributable to DXP Enterprises,

Inc. (5,112 ) 9,651 Preferred stock dividend 23

23 Net income (loss) attributable to common

shareholders

$

(5,135

)

$

9,628

Diluted earnings (loss) per share attributable to DXP

Enterprises, Inc. $ (0.35 ) $ 0.63

Weighted average common shares and common

equivalent shares outstanding

14,486

15,231

SEGMENT DATA ($ thousands,

unaudited) Sales Operating

Income by Segment by Segment Three Months

Ended Three Months Ended March 31, March

31,

2016

2015

2016

2015

Service Centers $ 167,502 $ 225,792 $ 9,536 $ 22,866 Innovative

Pumping Solutions 47,431 74,263 306 8,626 Supply Chain Services

38,628 41,539 3,480 3,279 Total $

253,561 $ 341,594 $ 13,322 $ 34,771

Reconciliation

of Operating Income for Reportable Segments ($ thousands,

unaudited) Three Months Ended March

31,

2016

2015

Operating income for reportable segments $ 13,322 $ 34,771

Adjustment for: Amortization of intangibles 4,528 5,358 Corporate

expense 10,796 11,314 Total operating

income (loss) (2,002 ) 18,099 Interest expense 3,409 2,683 Other

expense (income), net (155 ) (249 ) Income (loss)

before income taxes $ (5,256 ) $ 15,665

Unaudited Reconciliation of Non-GAAP

Financial Information

The following table is a reconciliation of

Adjusted EBITDA**, a non-GAAP financial measure, to income before

income taxes, calculated and reported in accordance with U.S. GAAP

($ thousands)

Three Months

Three Months

Ended

Ended

March 31,

December 31,

2016 2015 2015 Income (loss)

before income taxes $ (5,256 ) $ 15,665 $ (7,564 ) Plus: impairment

expense - - 9,847 Plus: interest expense 3,409 2,683 3,027 Plus:

depreciation and amortization 7,546 8,259 8,328

EBITDA $ 5,699 $ 26,607 $ 13,638 Plus:

NCI before tax 219 - 433 Plus: Stock compensation expense 848 834

669 Adjusted EBITDA $ 6,766 $ 27,441 $

14,740 **Adjusted EBITDA – earnings before

impairments, interest, taxes, depreciation and amortization

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160512006668/en/

DXP Enterprises, Inc.Mac McConnell, 713-996-4700Senior Vice

President, Finance & CFOwww.dxpe.com

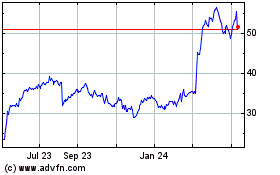

DXP Enterprises (NASDAQ:DXPE)

Historical Stock Chart

From Mar 2024 to Apr 2024

DXP Enterprises (NASDAQ:DXPE)

Historical Stock Chart

From Apr 2023 to Apr 2024