- Fiscal year 2014 sales grew 20.8%,

or $258.2 million with organic growth of 3.8%

- Earnings Before Interest, Taxes,

Depreciation and Amortization (“EBITDA”) of $139.9 million, or 9.3%

of sales

- Free Cash Flow of $87.6

million

- $4.0 million increase in B27

amortization

- $117.6 million pretax goodwill

impairment

- Adjusted EPS of $3.83, excluding

impairment charges and B27 amortization increase

DXP Enterprises, Inc. (NASDAQ: DXPE) today announced

financial results for the fourth quarter and fiscal year ending

December 31, 2014. A reconciliation of the non-GAAP financial

measures is in the back of this press release.

Fourth Quarter 2014 financial highlights:

- Sales were $382.5 million for the

fourth quarter of 2014, compared to $313.8 million for the fourth

quarter of 2013, an increase of 21.9%. Organic sales increased

5.6%, acquisitions positively impacted sales by $51.1 million.

- Gross profit was $106.7 million, or

27.9% of sales for the fourth quarter of 2014, compared to $94.6

million, or 30.2% of sales for the fourth quarter of 2013.

- Amortization expense for 2014 was

increased by $4.0 million ($1.0 million per quarter) due to DXP

finalizing its purchase accounting for customer relationships for

the B27 acquisition and amortizing the customer relationships on an

accelerated basis. The first three quarters of 2014 have been

revised to reflect the increased amortization.

- Selling, general & administrative

(SG&A) expenses were $81.1 million, or 21.2% of sales for the

fourth quarter of 2014, compared to $66.5 million, or 21.2% of

sales for the fourth quarter of 2013.

- EBITDA was $34.2 million for the

current quarter, compared to $33.6 million for the fourth quarter

of 2013. EBITDA as a percentage of sales was 9.0% and 10.7% in 2014

and 2013, respectively.

- Fourth quarter 2014 net loss includes a

non-cash pre-tax goodwill impairment charge of $117.6 million.

Excluding this non-cash impairment charge and the $1.0 million

increased amortization charge for B27, fourth quarter 2014 adjusted

diluted earnings per share was $0.95.

- Free cash flow (cash flow from

operating activities less capital expenditures) for the fourth

quarter of 2014 was $32.8 million, or 95.7% of EBITDA compared to

$13.2 million, or 39.3% of EBITDA for the fourth quarter of

2013.

Fiscal Year 2014 financial highlights:

- Sales were $1.5 billion for fiscal year

2014, compared to $1.2 billion for the fiscal year 2013, an

increase of 20.8%. Organic sales increased 3.8%, acquisitions

positively impacted sales by $211.5 million for 2014.

- Gross profit was $432.8 million, or

28.9% of sales for the fiscal year 2014, compared to $372.3

million, or 30.0% of sales for the fiscal year 2013.

- Selling, general & administrative

(SG&A) expenses were $327.9 million, or 21.9% of sales for

fiscal 2014, compared to $271.4 million, or 21.9% of sales for

fiscal 2013.

- EBITDA was $139.9 million for the year,

compared to $122.7 million for 2013. EBITDA as a percentage of

sales was 9.3% and 9.9% in 2014 and 2013, respectively.

- Income before taxes, before a non-cash

goodwill impairment charge of $117.6 million and a $4.0 million

amortization charge resulting from finalization of B27 purchase

accounting for customer relationships and amortizing customer

relationships on an accelerated basis, was $96.0 million for 2014

which was up 1.4% compared to $94.7 million for fiscal 2013.

- Earnings per diluted share for the

fiscal year 2014 was a loss of $2.99, excluding a non-cash

impairment charge of $117.6 million and the $4.0 amortization

charge for B27, earnings per diluted share was $3.83 per share,

based on 15.5 million diluted shares, compared to $3.94 per share

in fiscal 2013, based on 15.3 million diluted shares.

- Free cash flow (cash flow from

operating activities less capital expenditures) for 2014 was $87.6

million, or 62.6% of EBITDA compared to $74.5 million, or 60.7% of

EBITDA for the fiscal year 2013.

David R. Little, Chairman and Chief Executive Officer, remarked,

“DXP accomplished a lot in 2014 and we would like to thank all our

'DXPeople' for their efforts this year. We were focused on

improving and managing our growth, culture, expenses, working

capital, and ease of doing business with our business segments and

product divisions. We made meaningful progress at Natpro and

positioned ourselves at B27 for success in 2015 and beyond.

Additionally, during the last quarter of the year, we were faced

with increased volatility in the upstream oil and gas market and

the large drop in oil prices. That said, we remain focused on

executing our strategy, achieving our goals of growing sales and

EBITDA, efficient working capital management and strong cash flow

generation.

“DXP’s fiscal year 2014 sales grew 20.8%. Innovative Pumping

Solutions lead the way with 66.4% sales growth driven primarily

from the acquisition of B27. DXP’s Service Centers sales grew

11.6%, followed by Supply Chain Services which grew 11.2%.

Operating margins for Innovative Pumping Solutions, DXP Service

Centers and Supply Chain Services were 14.2%, 10.9% and 8.4%,

respectively. With acquisitions fueling a majority of our sales

growth in 2014, similar to 2013, DXP’s ability to gain operating

leverage remained dampened with EBITDA margins for the full year of

9.3%. We completed two strategic acquisitions in 2014, B27 and

Machinery Tooling & Supply, which helped grow our Rotating

Equipment and Metal Working divisions. Total employees for the

fiscal year increased 16% from approximately 3,207 to 3,715.

“As we enter 2015, we face a challenging market environment on

the oil and gas front. The recent decline in crude oil prices has

and will challenge certain aspects of our business. DXP reviewed

its 2014 end-market exposure and believes that an estimated 19% of

our business is tied to upstream drilling, development and

completion. Obviously, this segment will be impacted the most by

the recent decline in oil prices and drilling activity and as such,

DXP expects a sales decline with these customers. In contrast,

however, the remaining pieces of our business are tied to various

end markets that we believe will experience differing levels of

organic growth. Specifically, DXP’s oil and gas production and

midstream exposure is an estimated 41% and DXP expects this

business to be steady for 2015. The lower spending on upstream

activity will inevitably affect midstream activity at some point in

the future but more modestly. The remaining 40% of our business is

tied to markets DXP believes will see organic growth in 2015.

“For fiscal 2015, we will focus on driving sales and operating

leverage in those markets that should give us growth while managing

the challenges in upstream oil and gas drilling, development and

completion. We will continue to expect to get operating leverage

within our business model and make acquisitions opportunistically.

We remain excited about our prospects and entering the year with

strong financial resources and our experienced group of expert

employees.”

Mac McConnell, Chief Financial Officer added, "Our annual

financial results reflect year-over-year sales growth driven by

acquisitions and organic growth. Supply Chain Services led DXP’s

business segments with 11.2% organic growth, followed by Innovative

Pumping Solutions with 3.9% and Service Centers with 2.5% organic

growth. Overall, we grew sales organically by 3.8% over 2013 and

achieved stronger EBITDA margins during the second half of the year

versus the first half driven by a strong third quarter. EBITDA for

fiscal 2014 was $139.9 million and grew 14% over 2013. Throughout

the year we saw a continual sequential decline of SG&A expense

as a percentage of sales with our continued focus on expense

control as we moved from a lackluster oil and gas market to high

volatility towards the end of the year. DXP generated over $87

million in free cash flow, which was primarily used to fund

acquisitions and pay down debt, up 18% over 2013. Fiscal 2014

includes a non-cash after-tax goodwill impairment charge of $102.0

million, or $6.66 per share, relating to B27 and Natpro, two

acquisitions which we have discussed throughout the year. Excluding

the impact of this non-cash goodwill impairment charge and a $4.0

million amortization charge for B27, net income was $59.4 million

or $3.83 per share for the fiscal year 2014. Finally, DXP continued

to deleverage by reducing debt by $38.1 million during the fourth

quarter, and ended the fiscal year with total debt to EBITDA of

2.9:1."

We will host a conference call regarding 2014 fourth quarter and

year end results to be web cast live on the Company’s website

(www.dxpe.com) today at 5:00 P.M. Eastern time. Web participants

are encouraged to go to the Company’s website at least 15 minutes

prior to the start of the call to register, download and install

any necessary audio software. The online archived replay will be

available immediately after the conference call at www.dxpe.com and

at www.viavid.net.

Fiscal 2014 and fourth quarter business segment

results:

- Service

Centers revenue for the fiscal year was up 11.6% year over

year with a 10.9% operating income margin. Organic revenue was up

2.5% year over year.

- For the fourth quarter, revenue was up

12.6% with a 11.2% operating income margin

- Innovative

Pumping Solutions revenue for the fiscal year was up 66.4%

year over year with a 14.7% operating income margin. Organic

revenue was up 3.9% year over year.

- For the fourth quarter, revenue was up

66.2% with a 12.2% operating income margin.

- Supply Chain

Services revenue for the fiscal year was up 11.2% year over

year with an 8.4% operating margin.

- For the fourth quarter, revenue was up

14.2% with a 8.2% operating income margin

About DXP Enterprises, Inc.

DXP Enterprises, Inc. is a leading products and service

distributor that adds value and total cost savings solutions to

industrial customers throughout the United States, Canada, Mexico

and Dubai. DXP provides innovative pumping solutions, supply chain

services and maintenance, repair, operating and production ("MROP")

services that emphasize and utilize DXP’s vast product knowledge

and technical expertise in rotating equipment, bearings, power

transmission, industrial supplies and safety products and services.

DXP's breadth of MROP products and service solutions allows DXP to

be flexible and customer driven, creating competitive advantages

for our customers. DXP’s business segments include Service Centers,

Innovative Pumping Solutions and Supply Chain Services. For more

information, go to www.dxpe.com.

The Private Securities Litigation Reform Act of 1995 provides a

“safe-harbor” for forward-looking statements. Certain information

included in this press release (as well as information included in

oral statements or other written statements made by or to be made

by the Company) contains statements that are forward-looking. Such

forward-looking information involves important risks and

uncertainties that could significantly affect anticipated results

in the future; and accordingly, such results may differ from those

expressed in any forward-looking statement made by or on behalf of

the Company. These risks and uncertainties include, but are not

limited to; ability to obtain needed capital, dependence on

existing management, leverage and debt service, domestic or global

economic conditions, and changes in customer preferences and

attitudes. For more information, review the Company’s filings with

the Securities and Exchange Commission.

DXP ENTERPRISES, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

OPERATIONS

(in thousands, except per share

amounts)

Years ending

December 31,

Three Months Ending

December 31,

2014* 2013

2014* 2013 Sales $ 1,499,662

$ 1,241,510 $ 382,502 $

313,752 Cost of sales 1,066,822

869,165 275,824

219,150 Gross profit 432,840

372,345 106,678

94,602 Selling, general and administrative expense

327,899 271,421

81,081 66,545 Impairment expense

117,569 - 117,569

- Operating income (loss)

(12,628 ) 100,924 (91,972 )

28,057 Other income (expense)

(131 ) 75 (130 )

59 Interest expense 12,797

6,282 2,929 1,352

Income (loss) before provision for income taxes

(25,556 ) 94,717 (95,031

) 26,764 Provision for income taxes

19,682 34,480

6,956 9,860 Net income (loss)

(45,238 ) 60,237 (88,075

) 16,904

Diluted earnings (loss) per

share $ (2.99 ) $ 3.94 $ (5.75 )

$ 1.10 Common and common equivalent shares

outstanding

15,479 15,279

15,311

15,303

*During the fourth quarter of 2014 DXP finalized the purchase

accounting for customer relationships for the acquisition of B27

and is amortizing customer relationships on an accelerated basis.

This revision resulted in increasing amortization of intangibles by

$4,027,000 for the year and $1,007,000 per quarter. The first three

quarters of 2014 have been revised to reflect this increased

amortization.

SEGMENT DATA

(in thousands)

Year Ended December 31,

Three Months Ended December 31,

ServiceCenters

IPS

SCS

Total

ServiceCenters

IPS

SCS

Total

2014

Sales $ 987,561 $ 348,134 $

163,967 $ 1,499,662 $ 252,456 $ 89,064

$ 40,982 $ 382,502 Operating income for reportable

segments $ 107,699 $ 51,162 $ 13,794

$ 172,655 $ 28,344 $ 10,833 $

3,370 $ 42,547

2013

Sales $ 884,821

$ 209,175 $ 147,514 $ 1,241,510

$ 224,269 $ 53,603 $ 35,880 $ 313,752

Operating income for reportable segments $ 107,142

$ 33,766 $ 12,490 $ 153,398 $

31,166 $ 9,499 $ 2,940 $ 43,605

Unaudited Reconciliation of Non-GAAP

Financial Information

The following table is a reconciliation of

EBITDA**, a non-GAAP financial measure, to income before income

taxes, calculated and reported in accordance with U.S. GAAP (in

thousands)

Years EndedDecember 31,

Three Months EndedDecember

31,

2014 2013 2014

2013 Income (loss) before income taxes $ (25,556 ) $

94,717 $ (95,031 ) $ 26,764 Impairment expense 117,569 - 117,569 -

Plus interest expense 12,797 6,282 2,929 1,352 Plus depreciation

and amortization 35,078 21,660 8,765

5,505 EBITDA $ 139,888 $ 122,659 $ 34,232

$ 33,621 **EBITDA – earnings before impairments,

interest, taxes, depreciation and amortization

DXP Enterprises, Inc.Mac McConnell, 713-996-4700Senior Vice

President, Finance & CFOwww.dxpe.com

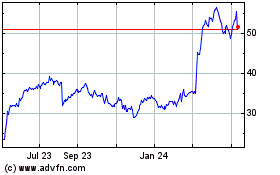

DXP Enterprises (NASDAQ:DXPE)

Historical Stock Chart

From Mar 2024 to Apr 2024

DXP Enterprises (NASDAQ:DXPE)

Historical Stock Chart

From Apr 2023 to Apr 2024