BUSINESS Watch -- WSJ

December 03 2016 - 3:02AM

Dow Jones News

Lexmark International

High Court to Hear Patent-Rights Case

The Supreme Court said Friday it would review Lexmark

International Inc.'s power to prevent third-party companies from

refilling and reselling patented toner cartridges initially sold by

the Lexington, Ky., manufacturer.

The case pits Lexmark against Impression Products Inc., a

Charleston, W.Va., printer store that acquired used cartridges and

refilled them for resale.

Lexmark sold cartridges under different conditions. Consumers

could buy a "regular cartridge" at full price without limits on

future use, or a "return program cartridge" for about 20% less,

under a "single-use/no-resale" restriction requiring them to return

the product to the manufacturer.

The U.S. Court of Appeals for the Federal Circuit, a specialized

court that hears patent appeals, sided with Lexmark. But that court

frequently has been reversed by the Supreme Court, which has found

that its rulings have tended to give more market power to patent

holders than Congress or the U.S. Constitution intended.

Separately, the high court agreed to review whether hospital

chains with religious affiliations must comply with federal law

protecting employee pensions, the Employee Retirement Income

Security Act. Both cases will be heard in early 2017.

--Jess Bravin

Whitechapel Bell Foundry

Liberty Bell Maker To Close Its Doors

The British foundry that made the Liberty Bell, London's Big Ben

and the clock bells for the city's St. Paul's Cathedral is closing

its doors, citing shrinking demand for large church bells.

Whitechapel Bell Foundry Ltd., which calls itself Britain's

oldest manufacturing company, plans to cease operations in East

London by May. The foundry's owner plans to retire and sell the

site and won't take on any new contracts in the interim.

The foundry has moved several times since being established in

1570 but has been at its present site for more than 250 years.

--Saabira Chaudhuri

BIG LOTS

Revenue Declines; Outlook Improves

Big Lots Inc. reported flat comparable-store sales and an

unexpected revenue decline in its third quarter but raised its

profit forecast for the year.

The retailer reported a profit of $1.4 million, or 3 cents a

share, up from a loss of $1.5 million, or 3 cents a share, a year

earlier. Revenue declined 1% to $1.11 billion. For the year, Big

Lots expects adjusted per-share earnings of $3.55 to $3.60, up from

its previous forecast of between $3.45 and $3.55 a share. Analysts

polled by Thomson Reuters had expected earnings of $3.53.

--Austen Hufford

(END) Dow Jones Newswires

December 03, 2016 02:47 ET (07:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

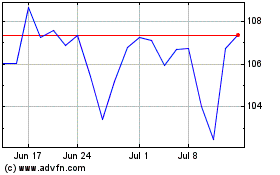

Dollar Tree (NASDAQ:DLTR)

Historical Stock Chart

From Mar 2024 to Apr 2024

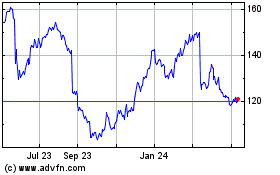

Dollar Tree (NASDAQ:DLTR)

Historical Stock Chart

From Apr 2023 to Apr 2024