Dollar Tree Gives Upbeat Guidance

November 22 2016 - 10:10AM

Dow Jones News

Dollar Tree Inc. provided upbeat top- and bottom-line guidance

for the current quarter, and same-store sales fared better than

expected in the latest period.

Shares, down 14% over the past three months, shot up 8.7%

premarket to $89.11.

The company estimates sales for the fourth quarter in the range

of $5.59 billion to $5.69 billion, based on low single-digit

increases in same-store sales for the Dollar Tree and Family Dollar

segments. Per-share earnings are expected in the range of $1.24 to

$1.33, an increase from the prior implied guidance of $1.21 to

$1.30. Analysts are expecting $1.29 a share.

Sales for the year are now expected to be between $20.67 billion

and $20.77 billion compared with the company's previous range of

$20.69 billion to $20.87 billion. The company now anticipates

per-share earnings will range between $3.67 and $3.76 a share,

bringing down the top end of its guidance from $3.82 a share, which

didn't include 9 cents a share of expenses related to debt

refinancing incurred in the third quarter.

"I am encouraged by our continued progress in building the

foundation for a larger, stronger and more profitable Family Dollar

business," Chief Executive Bob Sasser. He said the integration of

that business, for which Dollar Tree signed a deal last year,

continues to progress.

"The stores are cleaner, the values are greater and our customer

feedback scores regarding merchandise assortments and in-stocks

have improved," he said.

Mr. Sasser said the company is well-positioned and prepared for

the holiday selling season.

Like rival Dollar General Corp., Dollar Tree has generally

benefited over the past year from rising wages among core

customers. Sales and traffic have been up in the sector, in

contrast to trends across the larger retail space.

Weaker results in the previous quarter, dragged by declining

traffic, had stoked fears that discount retailers are also

vulnerable to the trend of dwindling consumer spending in

brick-and-mortar stores. But same-store sales increased 1.7% in the

October period, compared with a 2.1% increase a year ago. Analysts,

on average, had expected 1.2% growth in the latest quarter.

In all, Dollar Tree reported a third quarter profit of $171.6

million, or 72 cents a share, up from 81.9 million, or 35 cents a

share, a year earlier. The quarter included 9-cent per-share dent

for debt refinancing. Adjusted earnings were 81 cents a share, in

line with the company's guidance range of 76 cents to 82 cents a

share.

Revenue edged 1.1% higher to $5 billion. Analysts were looking

for $5.07 billion in sales, according to Thomson Reuters.

Gross margin improved to 30.4% from 28.3%, helped by lower

merchandise and freight costs.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

November 22, 2016 09:55 ET (14:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

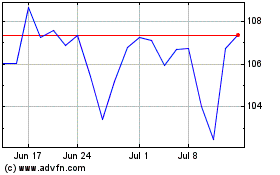

Dollar Tree (NASDAQ:DLTR)

Historical Stock Chart

From Mar 2024 to Apr 2024

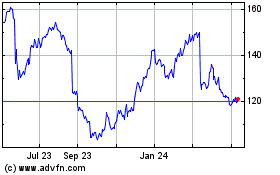

Dollar Tree (NASDAQ:DLTR)

Historical Stock Chart

From Apr 2023 to Apr 2024